Corporate Presentation 1Q20 Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BAB I PENDAHULUAN 1.1. Profil Perusahaan 1.1.1 Gambaran

BAB I PENDAHULUAN 1.1. Profil Perusahaan 1.1.1 Gambaran Umum Perusahaan PT.Telekomunikasi Indonesia, Tbk adalah Perusahaan Perseroan (Persero) yang memiliki jaringan terbesar di Indonesia. Layanan telekomunikasi dan jaringan Telkom sangat luas dan beragam meliputi layanan dasar telekomunikasi domestik dan internasional, baik menggunakan jaringan kabel, nirkabel tidak bergerak (Code Division Multiple Access atau CDMA maupun Global System for Mobile Communication atau GSM) serta layanan interkoneksi antar operator penyedia jaringan. Sebagai BUMN, pemerintah Republik Indonesia merupakan pemegang saham mayoritas yang menguasai sebagian besar saham biasa perusahaan sedangkan sisanya dimiliki oleh Telkom. Untuk menghadapi tantangan dengan semakin meningkatnya kebutuhan akan mobilitas dan konektivitas tanpa putus, Telkom telah memperluas portofolio bisnisnya yang mencakup telekomunikasi, informasi, media dan edutainment (TIME). Dengan meningkatkan infrastruktur, memperluas teknologi Next Generation Network (NGN) dan memobilisasi sinergi di seluruh jajaran TELKOMGroup, Telkom dapat mewujudkan dan memberdayakan pelanggan ritel dan korporasi dengan memberikan kualitas, kecepatan, kehandalan dan layanan pelanggan yang lebih baik. Konsistensi Telkom dalam berinovasi telah berhasil memposisikan perusahaan sebagai salah satu perusahaan yang berdaya saing tinggi dan unggul dalam bisnis telekomunikasi. Telkom meluncurkan slogan baru, yaitu “The World in Your Hand”. Slogan tersebut menandakan bahwa, dengan adanya Telkom masyarakat diharapkan dapat merasakan -

Nomor Surat Nama Perusahaan Kode Emiten Lampiran Perihal TEL.18/LP000/DCI-M20000004e11/2020 PT Telekomunikasi Indonesia (Persero

Go To English Page Nomor Surat TEL.18/LP000/DCI-M20000004e11/2020 Nama Perusahaan PT Telekomunikasi Indonesia (Persero) Tbk. Kode Emiten TLKM Lampiran 2 Laporan Informasi atau Fakta Material Keterbukaan Informasi atas Investasi PT Perihal Telekomunikasi Selular di PT Aplikasi Karya Anak Bangsa Dengan ini kami untuk dan atas nama perusahaan menyampaikan Laporan Informasi atau Fakta Material sebagai berikut: Nama Emiten atau Perusahaan Publik PT Telekomunikasi Indonesia (Persero) Tbk. Bidang Usaha Penyelenggara Jaringan dan Jasa Telekom Telepon (021) 5215109 Faksimili (021) 5220500 Alamat Surat Elektronik (email) [email protected] Tanggal Kejadian 16 November 2020 Jenis Informasi atau Fakta Material Keterbukaan Informasi atas Investasi PT Telekomunikasi Selular di PT Aplikasi Karya Anak Bangsa Uraian Informasi atau Fakta Material Pada tanggal 16 November 2020 di Jakarta PT Telekomunikasi Selular (“Telkomsel”) anak perusahaan dari PT Telkom Indonesia (Persero) Tbk (“Telkom”) dan PT Aplikasi Karya Anak Bangsa (“AKAB”) telah menandatangani perjanjian atas investasi senilai USD150 Juta. Investasi di AKAB dilakukan sebagai bentuk komitmen Telkomsel sebagai perusahaan telekomunikasi digital untuk memberikan layanan beyond connectivity. Telkom percaya kolaborasi ini dapat memberikan layanan dan solusi yang lebih baik kepada masyarakat dalam membangun ekosistem digital yang inklusif dan berkesinambungan. Dampak kejadian, informasi atau fakta Dengan Transaksi ini, terhitung sejak terpenuhinya segala material tersebut terhadap kegiatan syarat berdasarkan Perjanjian dan ditandatanganinya operasional, hukum, kondisi keuangan, dokumen terkait, maka Telkomsel akan memiliki investasi di atau kelangsungan usaha Emiten atau AKAB sebesar USD150 Juta. Perusahaan Publik Informasi Lain Telkomsel adalah anak perusahaan dari PT Telkom Indonesia (Persero) Tbk yang bergerak di bidang penyediaan layanan telekomunikasi selular dan produk-produk telekomunikasi digital. -

Mami 2102 (Eng)

MANULIFE DANA EKUITAS USD FEB 2021 Investment Objective Risk Classification Providing the participants with superior investment growth over the long-term by Risk classification is based on type of fund. investing the assets in a diversified portfolio of publicly listed Indonesian equities. Low Mid High Money Market Fixed Income Balanced Equity Fund Information Allocation Portfolio Inception Date :16 Oct 13 Equity :80 - 100 % Equity : 96.46% Fund Size :USD 19,971,111.44 Money Market :0 - 20 % Money Market : 3.54% Fund Currency : USD Type of fund : Equity Valuation : Daily Custodian Bank : Standard Chartered Bank Top 5 Holdings Sector Allocation 3) Annual Management Fee : 2.50% 1 Bank Central Asia 4) :USD 1.0196 2 Bank Rakyat Indonesia Financials Net Asset Value/Unit 33.46% 39.94% Bloomberg Code : MANDEKU IJ 3 Telkom Indonesia Persero Materials 4 Astra International Communication Services Performance Since Inception 5 Unilever Indonesia 12.19% 14.40% Other 1.280 Fund Performance 1.150 Performance in USD per (26/02/21) Since 1.020 1 mo 3 mo 6 mo YTD 1 yr 1) 1) 3 yr 5 yr Inception 1) 0.890 MDE (in USD) 3.52% 10.21% 19.43% 1.76% 9.52% -5.03% 1.09% 0.26% BM 2) 4.07% 9.67% 21.21% 2.05% 14.50% -3.20% 3.97% 0.78% 0.760 Yearly Performance 0.630 Total Fund Grow th : 1.96% 2020 2019 2018 2017 2016 2015 2014 2013 0.500 Oct-13 Jan-15 Mar-16 Jun-17 Sep-18 Nov-19 Feb-21 MDE (in USD) -7.61% 6.47% -12.26% 14.99% 10.85% -17.77% 23.71% n/a BM 2) -5.92% 6.13% -8.80% 19.57% 18.09% -21.35% 20.47% n/a Monthly Performance Last 3 Years Note 16.00% 1) Annualized (1 year = 365 days) and using compound method (for products that have been more than one year old 8.00% since inception). -

Corporate Presentation FY20 Results

Corporate Presentation FY20 Results PT Telkom Indonesia (Persero) Tbk May 2021 Disclaimer This document may contain forward-looking statements within the meaning of safe- harbor. Actual results could differ materially from projections, estimations or expectations. These may involve risks and uncertainties, and may cause actual results and development to differ substantially from those expressed or implied in the statements. The company does not guarantee that any action, which may have been taken in reliance of this document will bring specific results as expected. 2 FY20 Results Telkom in Brief FY20 Financial and Operational Results 3 Board of Directors CEO TELKOM GROUP DIRECTOR DIRECTOR DIRECTOR DIRECTOR RIRIEK HERI SUPRIADI HERLAN DIAN EDI ADRIANSYAH WIJANARKO RACHMAWAN WITJARA DIRECTOR DIRECTOR DIRECTOR DIRECTOR FM VENUSIANA R BUDI SETYAWAN FAJRIN AFRIWANDI TELKOM TELKOM Group WIJAYA RASYID CEO TELKOMSEL DIRECTOR DIRECTOR DIRECTOR DIRECTOR SETYANTO LEONARDUS WONG RACHEL GOH NUGROHO HANTORO WAHYU SOON NAM WASONO DIRECTOR DIRECTOR DIRECTOR Telkomsel HENDRI MULYA R. MUHARAM BHARAT ALVA SYAM PERBAWAMUKTI 4 Share Ownership 52.1% 47.9% Government Public Telkom Indonesia is listed at Indonesia Stock Exchange (Bloomberg: TLKM IJ) and New York Stock Exchange (TLK US) Total Shares 99,062,216,600 shares Market Capitalization Rp311Tn (USD21.6 Bn)* *as of April 28, 2021 5 FY20 Results Telkom in Brief FY20 Financial and Operational Results 6 FY20 Performance Highlights In FY20, Telkom recorded Rp136.5 trillion in Revenue, increased by 0.7% YoY, with EBITDA and Net Income grew by 11.2% YoY and 11.5% YoY, respectively. The strong performance was achieved during challenging situation due to COVID-19 pandemic. -

Annu Al Report 2019

ANNUAL REPORT 2019 ANNUAL 1 ANNUAL REPORT 2019 Building on the initiatives of previous years, Telkomsel continued to expand and to enrich its digital business to shape the future through internal collaboration, synergies, and partnerships within the digital ecosystem at large. Telkomsel continued to expand and to enrich its digital business At the same time, Telkomsel strove to improve customer experience and satisfaction as key drivers of long-term success. (in billion rupiah) (in million) DIGITAL BUSINESS DATA USERS REVENUE 58,237 110.3 23.1% 3.5% DATA 50,550 LTE USERS 88.3 22.3% (in million) 61.3% DIGITAL SERVICES 7,687 29.0% 2019 63.9% DIGITAL 2018 BUSINESS 53.0% CONTRIBUTION 2 PT TELEKOMUNIKASI SELULAR IMPROVED MOMENTUM Telkomsel has successfully delivered growth and revenue from data supported by solid digital products and services offerings, as shown by TOTAL BTS improved momentum in 2019. 212,235 (in gigabyte) 12.2% CONSUMPTION/ 2019 DATA USER 3G/4G BTS 54.7% 5.2 161,938 16.7% 2018 3.4 (in terabyte) PAYLOAD 6,715,227 53.6% 3 ANNUAL REPORT 2019 Highlights of the Year 6 Key Performance Company 8 Financial Highlights at a Glance 9 Operational Highlights 10 2019 Event Highlights 52 Telkomsel in Brief 18 Awards & Accolades 53 Share Ownership History 23 ISO Certification 54 Organization Structure 54 Key Products & Services 56 Milestones Business Review Remarks from 60 Vision and Mission the Management 61 Corporate Strategy in Brief 62 Transformation Program 65 Marketing 26 Remarks from the President Commissioner 72 Digital Services 30 -

Kata Pengantar

i KATA PENGANTAR Berdasarkan Undang-Undang Nomor 43 Tahun 2009 tentang Kearsipan, Arsip Nasional Republik Indonesia (ANRI) sebagai lembaga kearsipan nasional wajib melakukan pengolahan arsip statis berskala nasional agar dapat diakses dan dimanFaatkan untuk kepentingan publik/masyarakat pengguna arsip. Salah satu hasil pengolahan arsip statis yang telah diselesaikan pada 2017 adalah Inventaris Arsip PT Telekomunikasi Indonesia (Persero), Tbk 1966-2006. Substansi arsip yang dimuat dalam inventaris arsip ini adalah arsip tekstual terkait pelaksanaan tugas dan Fungsi PT Telekomunikasi Indonesia (Persero), Tbk yang tercipta pada periode 1966-2006. Dengan tersusunnya inventaris arsip ini diharapkan dapat meningkatkan akses masyarakat terhadap arsip statis PT Telekomunikasi Indonesia (Persero), Tbk yang tersimpan di ANRI. Kami menyadari inventaris arsip ini masih belum sempurna, namun inventaris arsip ini sudah dapat digunakan untuk mengakses arsip statis PT Telekomunikasi Indonesia (Persero), Tbk 1966-2006 yang tersimpan di ANRI. Akhirnya, kami menyampaikan terima kasih kepada pimpinan ANRI, tim, dan semua pihak yang telah membantu penyusunan inventaris arsip ini. Semoga Allah SWT, Tuhan Yang Maha Esa membalas amal baik yang telah Bapak/Ibu/Saudara berikan. Amin Jakarta, Maret 2018 Plt. Direktur Pengolahan Dr. Kandar, MAP ii DAFTAR ISI HALAMAN JUDUL ............................................................................... i KATA PENGANTAR ............................................................................ ii DAFTAR ISI ........................................................................................ -

Telkom Indonesia Is Nation's Most Valuable Brand Indosat Ooredoo

Press Release – For Immediate Release Telkom Indonesia is Nation’s Most Valuable Brand Indosat Ooredoo returns to the Top 10 after dropping out in 2014 Telkom Indonesia and Sampoerna also join the Global 500 brand rankings . Total value of Top 100 Indonesian brands in 2017 has increased to US$32.4 billion, up 44% from US$22.6 billion in 2016. Telkom Indonesia retains the #1 Most Valuable Indonesia Brand for 2017 however it’s brand strength remains stagnant. Bank BRI moves up to #3, overtaking Gudang Garam and Bank Mandiri. BCA is the strongest brand in Indonesia and the only brand with AAA rating. BCA also managed to graduate to the top 5, beating Mandiri by a hair's breadth. Indosat Ooredeoo is ranked #9 this year with brand value surging 51%. Garuda Indonesia drops out of the Top 10 with brand value of US$643m. Every year, leading brand valuation and strategy consultancy Brand Finance puts thousands of the world’s top brands to the test, evaluating which are the most powerful and valuable, publishing the Brand Finance Top 100 Indonesian Brands. Click here for the Brand Finance Indonesia 100 Table In terms of brand value, Telkom Indonesia retains its #1 position in the Brand Finance Top 100 Most Valuable Indonesian Brands in 2017. Telecom sector has increased its dominance in the top 10 by Indosat Ooredoo climbed into 9th place thereby pushing Garuda Indonesian out of the top 10. Telecom Indonesia also managed to retain the AAA- brand strength rating with 65% increase in brand value. Growing Big 4 The four largest Indonesian banks have been performing well for a number of years and in 2017 as BRI climbed to third, BCA fifth and BNI to seventh place. -

Avrist Indeks LQ45

Fund Fact Sheet Avrist Indeks LQ45 31 Agustus 2021 Informasi Reksadana Avrist Asset Management PT Avrist Asset Management ("Avram") adalah perusahaan manajer investasi yang berdiri tahun 2011 dan mendapatkan izin kegiatan usaha Tanggal Efektif Reksa Dana 15-Feb-19 berdasarkan Surat Keputusan Ketua Badan Pengawas Pasar Modal dan Lembaga Keuangan Nomor: KEP-07/BL/MI/2012 tanggal 18 Juni tahun 2012. Nomor Surat Pernyataan Avram merupakan anak perusahaan dari PT Avrist Assurance (“Avrist”) yang didukung oleh profesional berpengalaman di bidang investasi dan Efektif Reksadana S-254/PM.21/2019 menawarkan beragam solusi investasi yang disesuaikan dengan kondisi pasar dan tujuan investasi pemodal. Tanggal Peluncuran 12-Mar-19 Mata Uang Rupiah Tujuan Investasi Avrist Indeks LQ45 bertujuan untuk berinvestasi pada perusahaan dengan kapitalisasi saham besar, likuiditas tinggi, dan kondisi keuangan yang baik, Harga Unit (NAB per Unit) (Rp/Unit) 900.86 yang masuk ke dalam Indeks LQ45 serta memberikan hasil investasi yang setara dengan kinerja Indeks LQ45 Total Nilai Aktiva Bersih (Rp juta) 740,491.46 Minimum Investasi Awal (Rp) 10,000 Jumlah Unit Yang Ditawarkan (Maksimum) 2,000,000,000.00 Periode Penilaian Harian Biaya Pembelian Tidak ada Kebijakan Investasi 10 Kepemilikan Efek Terbesar dalam Portofolio Biaya Penjualan Kembali Tidak ada % Efek Biaya Pengalihan Tidak ada Ekuitas 80 - 100 Astra International Biaya Manajemen (Maksimum) 2.00% Pasar Uang 0 - 20 Bank BCA Biaya Kustodian (Maksimum) 0.25% Bank BNI Nama Bank Kustodian PT Bank DBS Indonesia Bank BRI Kode ISIN TP002IFCAVINLQ00 Bank Mandiri Risiko-Risiko Utama: Komposisi Portofolio Charoen Pokphand Indonesia 1. Risiko Berkurangnya Nilai Investasi % Merdeka Copper Gold 2. -

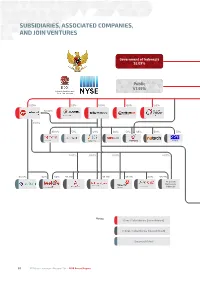

Subsidiaries, Associated Companies, and Join Ventures

SUBSIDIARIES, ASSOCIATED COMPANIES, AND JOIN VENTURES Government of Indonesia 52.09% Public 47.91% 100% 65% 100% 100% 100% 30.95% 0.01% 99.9% 51% 49% 60% 51% 49% 60% 51% 0.01% 0.01% 0.01% 0.01% 30.4% 52% 48% 99.9% 99.9% 99.9% 60% 99.9% PT. Satelit Multimedia Indonesia Notes: Direct Subsidiaries (consolidated) Indirect Subsidiaries (consolidated) Unconsolidated 80 PT Telkom Indonesia (Persero) Tbk | 2018 Annual Report 1 Telkom Highlights Telkom 2 and Directors of Commissioners of Report of The Board of Report 3 About Telkom 4 100% 100% 100% 100% 100% 100% Discussion Analysis and Analysis 5 24% 100% 100% 100% 100% 51% 100% 55% Corporate Governance 6 100% 70% 70% Responsibility Corporate Social USA MALAYSIA 7 15.67% 25% 4.33% Community Partnership and Development Program Development 8 Appendices 9 PT Telkom Indonesia (Persero) Tbk | 2018 Annual Report 81 Consolidated Financial Statements Financial As of December 31, 2018, Telkom consolidated the fnancial statements of all subsidiaries owned directly or indirectly as follows: SUBSIDIARIES WITH DIRECT OWNERSHIP Operational Total Asset Company Share Ownership Business Field Address Status (Rp billion) PT Telekomunikasi 65% Telecommunication Operating 82,650 Telkom Landmark Selular provides Tower 1st 20th foor, Jakarta, Indonesia telecommunication The Telkom Hub. facilities and mobile Jl. Jend Gatot celluler services Subroto Kav. 52 using Global Jakarta, 12710, Systems for Mobile Indonesia Communication (GSM) PT Dayamitra 100% Telecommunication Operating 13,053 Telkom Landmark Telekomunikasi Tower 25 th27th foor, Jakarta, Indonesia The Telkom Hub. Jl. Jend Gatot Subroto Kav. 52 Jakarta, 12710, Indonesia PT Multimedia 100% Network Operating 16,524 Telkom Landmark Nusantara telecommunication Tower 41st foor, Jakarta, Indonesia services and The Telkom Hub. -

Investor Newsletter March 2021

Investor NewsLetter March 2021 BRI is listed in the ESG Leaders (ESGL) Index Indonesia Stock Exchange (IDX) on March 9th, 2021 announced its List of Constituents of ESG Leaders Index (ESGL) for the period of March 17th to September 14, 2021. The list consists of 30 Indonesian public companies that become leaders in ESG (Environment, Social, Government) rating and do not have significant controversies selected from stocks with high trading liquidity and good financial performance assessed by Sustainalytics. BRI is listed as one of the member of the IDX ESG Leaders Index with Medium Risk ESG Rating and ESG Risk Score of 25.34, outperforming its peers in the banking sector. Being listed in the ESGL Index affirms BRI’s commitment in the implementation of ESG and sustainable finance. ESG Risk ESG Risk No. Constituent No. Constituent Score Score List of Constituents 1 Erajaya Swasembada 11,77 16 XL Axiata 25,65 of ESGL Index 2 Integra Indocabinet 13,21 17 HM Sampoerna 25,73 3 Jasa Marga 14,08 18 Bank Central Asia 26,08 4 Ace Hardware Indonesia 18,42 19 Puradelta Lestari 26,31 5 Unilever Indonesia 18,48 20 Bank Tabungan Negara 26,63 6 Media Nusantara Citra 18,49 21 Telkom Indonesia 26,76 7 Matahari Department Store 18,67 22 Pakuwon Jati 26,92 8 Sri Rejeki Isman 18,80 23 Ciputra Development 27,03 9 Surya Citra Media 19,73 24 Indocement Tunggal Prakarsa 27,22 10 Ramayana Lestari Sentosa 20,11 25 AKR Corporindo 27,44 11 Mitra Adiperkasa 20,50 26 Bank Negara Indonesia 27,51 12 Bumi Serpong Damai 22,76 27 Sarana Menara Nusantara 27,65 13 Bekasi Fajar Industrial Estate 23,38 28 Tower Bersama Infrastructure 27,71 14 Buana Lintas Lautan 24,73 29 Astra International 28,42 15 Bank Rakyat Indonesia 25,34 30 Bank Mandiri 29,71 Source: www.idx.co.id, modified General Selection Criteria of ESGL Index Companies with involvement in controversies category 4 and 5 (assessed by Sustainalytics) are excluded. -

Qlue-Enabling-Indonesians-To-Report-Neighbourhood-Conditions-To-City-Authorities-And

ECOSYSTEM ACCELERATOR COMPASS: INSIGHTS ON START-UPS AND MOBILE IN EMERGING MARKETS CASE STUDY Qlue Enabling Indonesians to report neighbourhood conditions to city authorities and businesses FOUNDING YEAR GEOGRAPHY 2016 Indonesia FOUNDING TEAM Raditya Maulana Rusdi | Co-founder and CEO Andre Hutagalung | Co-founder and CTO TWEET PITCH Qlue is a civic engagement mobile solution that allows users to report or share neighbourhood conditions with city authorities and businesses. WEBSITE www.qlue.co.id Indonesia’s bustling capital of Jakarta is home to The requests and complaints are compiled in actionable 10 million people. When the suburbs of the city are reports for city authorities to manage. The Qlue mobile included (often referred to as Jabodetabek), Jakarta’s app includes a city dashboard that enables city officials population swells to 30 million people, making it and service providers to track and resolve requests the largest urban area in the world after Tokyo.21 and complaints. These reports are also available to the The sheer scale of the metropolis and rapid rate of media and the public, making communication between urbanisation have made the maintenance of roads and city residents and local government more transparent. public infrastructure a complicated task, and the city In addition to reporting and sharing civic issues in government faces a variety of challenges providing a their neighbourhood with government or businesses, safe and orderly environment for residents. residents can also access real-time information on traffic and public transportation. In 2016, Qlue launched a mobile-enabled platform offering two-way communication between city Currently, Qlue is active in 15 cities across Indonesia. -

1 BAB I PENDAHULUAN 1.1 Sejarah Dan Perkembangan PT Telkom Indonesia, Tbk. Perusahaan Telekomunikasi Sudah Ada Sejak Masa Hindia

BAB I PENDAHULUAN 1.1 Sejarah dan Perkembangan PT Telkom Indonesia, Tbk. Perusahaan Telekomunikasi sudah ada sejak masa Hindia Belanda dan yang menyelenggarakan adalah pihak swasta. Sedangkan perusahaan Telekomunikasi Indonesia (PT. TELKOM) sendiri juga termasuk bagian dari perusaahaan tersebut yang mempunyai bentuk badan usaha Post-en Telegraaflent dengan Staats blaad No.52 tahun 1884. Dan sejak tahun 1905 perusahaan Telekomunikasi sudah berjumlah 38 peusahaan. Namun setelah itu pemerintah Hindia Belanda mengambil alih perusahaan tersebut yang berdasar kepada Staatsblaad tahun 1906. Dan sejak itu berdirilah Post, Telegraf en Telefoon Dients (PTT- Dients),dan perusahaan ini ditetapkan sebagai Perusahaan Negara berdasar Staats blaad No.419 tahun 1927 tentang Indonesia Bedrijven Weet (I.B.W Undang- Undang Perusahaan Negara). Perusahaan PTT tesebut bertahan sampai adanya Peraturan Pemerintah Pengganti Undang-Undang (Perpu) No.19 tahun 1960 oleh Pemerintah Republik Indonesia, tentang adanya persyaratan suatu Perusahaan Negara (PN). Tetapi pada tahun 1961 menurut Peraturan Pemerintah No.240 bahwa Perusahaan Negara dilebur menjadi Perusahaan Negara Pos dan Telekomunikasi yang dimuat dalam pasal 2 I.B. 1 2 Namun pada tahun 1965 pmemerintah membagi perusahaan Pos dan Telekomunikasi menjadi dua bagian yang berdiri sendiri yaitu Perusahaan Pos dan Giro (PN. Pos dan Giro) serta Perusahaan Negara Telekomunikasi (PN. Telekomunikasi) yang sudah diatur dalam Peraturan Pemerintah No.30 tahun 1965. Dan perusahaan tersebut berkembang menjadi Perusahaan Umum (Perum). Dalam Peraturan Pemerintah No.36 tahun 1974 dinyatakan bahwa Perum Telekomunikasi sebagai penyelenggara jasa Telekomunikasi untuk umum baik Telekomunikasi dalam negeri maupun luar negeri. Perusahaan Umum (PERUM) Telekomunikasi merupakan penyelenggara jasa telekomunikasi untuk umum, baik hubungan telekomunikasi dalam negeri maupun luar negeri.