ASIAN AUTOMOTIVE NEWSLETTER ISSUE 16, December 1999 a Bimonthly Newsletter of Developments in the Auto and Auto Components Markets

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2018 Laporan Tahunan 2018

Inovasi dan Digitalisasi: Menciptakan Nilai untuk Tumbuh Secara Berkelanjutan Innovation and Digitalization: Creating Value to Sustain Growth PT Astra International Tbk Laporan Tahunan 2018 Annual Report Laporan Tahunan 2018 Annual Report Innovation and Digitalization: Creating Value to Sustain Growth Amidst challenges in the economy and business throughout 2018, Astra Group maintained the sustainability of its business by continuing to build its capabilities focusing on four core areas: continuous innovation, developing globally oriented employees, being an agile organization, and being a partner of choice. Also, in the face of massive, rapid and unpredictable changes in the business landscape, Astra Group has stepped-up its digitalization initiatives to drive more effective business processes, optimize market penetration capability, and introduce various innovations and new services on digital platforms. By building digital capabilities while continuing to encourage the creation of added value for its customers, employees, business partners, shareholders and the people of Indonesia, Astra Group moves forward in its strategic journey towards the Pride of the Nation. Laporan Tahunan 2018 Annual Report ASTRA 1 Highlights Management Reports Company Profile Human Capital Management Discussion and Analysis Corporate Governance Corporate Social Responsibility Consolidated Financial Statements 2018 Inovasi dan Digitalisasi: Menciptakan Nilai untuk Tumbuh Secara Berkelanjutan Di tengah berbagai tantangan perekonomian dan bisnis sepanjang tahun -

11 an Top 100 FINAL Pages.Qxp

Global Cover-060712.qxp 6/7/2012 4:14 PM Page 1 Top 100 global OEM parts suppliers – Ranked on 2011 global OEM automotive parts sales Total global Total global OEM automotive OEM automotive Percent Percent parts sales parts sales North Percent Percent rest of 2011 (dollars in (dollars in America Europe Asia world 2010 rank Company Address Executive millions) 2011 millions) 2010 2011 2011 2011 2011 Products rank 1 Robert Bosch GmbH Postfach 106050 Franz Fehrenbach $39,753 e $34,565 e 14 54 26 6 Gasoline, diesel & steering systems, chassis system controls, electrical 1 (49) 711-811-0; bosch.com Stuttgart D-70049, Germany chairman drives, starter motors & generators, car multimedia & electronics, battery technology, exhaust gas turbochargers & treatment systems 2 Denso Corp. 1-1 Showo-cho Nobuaki Katoh 34,153 fe 32,850 fe 16 12 70 2 Thermal, powertrain control, electronic & electric systems; small 2 (81) 566-25-5511; globaldenso.com Kariya-Aichi 00448, Japan president & CEO motors, telecommunications 3 Continental AG Vahrenwalder Strasse 9 Elmar Degenhart 30,521 fe 24,819 fe 19 52 25 4 Electronic & foundation brakes, stability management systems, tires, 3 (49) 511-938-01; conti-online.com Hanover 30165, Germany CEO chassis systems, safety system electronics, telematics, powertrain electronics, interior modules, instrumentation, technical elastomers 4 Magna International Inc.† 337 Magna Drive Donald Walker 28,300 23,600 52 43 5 Complete vehicle engineering & assembly; body & chassis, 5 (905) 726-2462; magna.com Aurora, Ontario L4G7K1, Canada CEO closures, electronic, interior/exterior, powertrain, roof, seating, & vision systems; hybrid & electric vehicle systems 5 Aisin Seiki Co. -

State-Owned Enterprise Governance and Privatization Program

Completion Report Project Number: 32517 Loan Number: 1866 November 2008 Indonesia: State-Owned Enterprise Governance and Privatization Program CURRENCY EQUIVALENTS Currency Unit – rupiah (Rp) At Appraisal At Program Completion (28 February 2000) (7 October 2005) Rp1.00 = $0.000137 $0.000097 $1.00 = Rp7,305 Rp10,305 ABBREVIATIONS ADB – Asian Development Bank MOF – Ministry of Finance MSOE – Ministry of State-Owned Enterprises OECD – Organisation for Economic Co-operation and Development PPP – public-private partnership PSO – public service obligation SCI – statement of corporate intent SOE – state-owned enterprise TA – technical assistance NOTES (i) The fiscal year (FY) of the Government ends on 31 December. “FY” before a calendar year denotes the year in which the fiscal year ends. (ii) In this report, “$” refers to US dollars. Vice President C. Lawrence Greenwood, Jr., Operations Group 2 Director General A. Thapan, Southeast Asia Department (SERD) Director J. Ahmed, Governance, Finance, and Trade Division, SERD Team leader K.-P. Kriegsmann, Senior Financial Sector Specialist, SERD CONTENTS Page BASIC DATA i I. PROGRAM DESCRIPTION 1 II. EVALUATION OF DESIGN AND IMPLEMENTATION 2 A. Relevance of Design and Formulation 2 B. Program Outputs 3 C. Program Costs and Disbursements 10 D. Program Schedule 10 E. Implementation Arrangements 10 F. Conditions and Covenants 11 G. Related Technical Assistance 11 H. Consultant Recruitment and Procurement 12 I. Performance of Consultants, Contractors, and Suppliers 12 J. Performance of the Borrower and the Executing Agency 12 K. Performance of the Asian Development Bank 12 III. EVALUATION OF PERFORMANCE 13 A. Relevance 13 B. Effectiveness in Achieving Outcome 13 C. Efficiency in Achieving Outcome and Outputs 14 D. -

Akebono Report 2017

AKEBONO REPORT 2017 AKEBONO REPORT AKEBONO REPORT 2017 AKEBONO REPORT 2017 Issued August 2017 Corporate Communications Office 19-5 Nihonbashi Koami-cho, Chuo-ku, Tokyo 103-8534, Japan TEL +81 (0) 3-3668-5183 FAX +81 (0) 3-5695-7391 Akebono Brake Industry Co., Ltd. URL http://www.akebono-brake.com/english/ E-mail [email protected] Please send your opinions and impressions to the above office. This report was printed on Forest Stewardship Council-certified paper, sourced from well-managed forests and other controlled sources. In addition, the printing involved no volatile organic compounds (VOCs). akebono’s Through “Friction and Vibration, their Control and Analysis,” Corporate Mission we are determined to protect, grow and support every individual life We will continue to create value long into the 21st century as we pursue our Corporate Mission. We declare that we will: akebono’s Declaration for the 1. Recognize the real value of what we create and provide. 21st Century 2. Assure our own indispensability by continuously creating new value. 3. Accomplish our tasks with speed and the courage of our convictions without fear of failure. 4. Achieve our aspirations through the pride of each and every individual. 1. Customer needs first Corporate Goals 2. Technology realignment 3. Establishing a global network Brand Slogan Brand Statement Since 1929, akebono has brought assurance and peace of mind to our customers and end-users everywhere as a global industry leader in brake design and production. We take pride in our history of achieving safety without compromise, and continue to pursue new standards of perfection with Absolute safety; Unparalleled control innovation. -

Memberdayakan Keunggulan Internal Building up Our Natural Capabilities Building up Our Natural Capabilities

Laporan Tahunan Annual Report 2017 MEMBERDAYAKAN KEUNGGULAN INTERNAL BUILDING UP OUR NATURAL CAPABILITIES BUILDING UP OUR NATURAL CAPABILITIES The year 2017 is an important milestone as Astra commemorated the 60th year anniversary since it was first established in 1957. In Astra’s six decades of journey to aspire to “Prosper with the Nation”, Astra has transformed to become an Indonesian group company with more than 210,000 employees spread across more than 200 companies throughout Indonesia. Amid the various business challenges in 2017, Astra made breakthroughs by focusing on building our natural capabilities, such as our technical and non-technical competencies, solid company culture, established management system, wide network, strong customers’ trust and high value of Astra brand. The result was Astra generated outstanding operational and business performance in 2017. With this, Astra continue its course to reach its 2020 Goal, to be “Pride of the Nation”. 1 MEMBERDAYAKAN KEUNGGULAN INTERNAL Tahun 2017 merupakan tonggak penting perjalanan Astra yang telah mencapai usia 60 tahun sejak didirikan pada tahun 1957. Dalam perjalanan enam dasawarsa Astra dalam menginspirasi negeri sekaligus mewujudkan cita-cita “Sejahtera Bersama Bangsa”, Astra telah bertransformasi menjadi satu grup perusahaan di Indonesia yang menaungi lebih dari 210.000 karyawan yang tersebar di lebih dari 200 perusahaan di seluruh tanah air. Dalam menghadapi berbagai tantangan bisnis sepanjang tahun 2017, Astra melakukan terobosan-terobosan yang memfokuskan pada pendayagunaan kapabilitas internal berupa kompetensi teknikal dan non-teknikal yang mumpuni, budaya organisasi yang kokoh, sistem manajemen yang mapan, jaringan yang luas, kepercayaan pelanggan yang kuat dan brand value Astra yang tinggi. Hasilnya, Astra meraih kinerja operasional dan bisnis yang menggembirakan di tahun 2017. -

Akebono Report 2018

AKEBONO REPORT 2018 AKEBONO REPORT AKEBONO REPORT 2018 AKEBONO REPORT 2018 Issued August 2018 Corporate Planning Division, Corporate Communications Office 19-5 Nihonbashi Koami-cho, Chuo-ku, Tokyo 103-8534, Japan Akebono Brake Industry Co., Ltd. TEL +81 (0) 3-3668-5183 FAX +81 (0) 3-5695-7391 URL http://www.akebono-brake.com/english/ Please send your opinions and impressions to the above office. This report was printed on Forest Stewardship Council-certified paper, sourced from well-managed forests and other controlled sources. In addition, the printing involved no volatile organic compounds (VOCs). Contents Message Top Message ................................................................................................................... 03 Akebono’s Journey .......................................................................................................... 05 akebono’s Through “Friction and Vibration, their Control and Analysis,” Akebono 2018 ................................................................................................................. 07 we are determined to protect, grow and support every individual life About Akebono Product Introduction ........................................................................................................ 09 Corporate Mission Basic Principles of Brakes ............................................................................................... 11 Established 1999 Global Expansion ............................................................................................................ -

MNCS Compendium / III / September 2018 1

MNCS Compendium / III / September 2018 1 MNCS Compendium / III / September 2018 2 MNCS Compendium / III / September 2018 Contents 04 Kata Sambutan Direktur Utama Analisis Emiten MNC Group MNC Sekuritas 06 Analisis Makroekonomi 55 PT Adaro Energy Tbk 71 MNC College Wisnu Wardana 57 PT Astra International Tbk 99 PT MNC Land Tbk 10 Investment Strategy 59 PT Bank Central Asia Tbk 61 PT Bank Tabungan Negara Tbk 13 Bond Market Update 63 PT XL Axiata Tbk Appendixes 65 PT Gudang Garam Tbk 17 SGX Indonesia Equity Futures 67 PT Indofood CBP Sukses Makmur Tbk 103 MNCS Stock Universe 69 PT Japfa Comfeed Indonesia Tbk 104 Data Obligasi 75 PT Arwana Citramulia Tbk 105 Heat Map dan Nilai Tukar Analisis Sektoral 77 PT Blue Bird Tbk 106 Kalender Ekonomi 80 PT GMF Aero Asia Tbk 21 Sektor Consumer 107 Special Thanks 83 PT Buyung Poetra Sembada Tbk 24 Sektor Telecommunication 85 PT Hartadinata Abadi Tbk 27 Sektor Metal Mining 87 PT London Sumatra Indonesia Tbk 30 Sektor Automotive 89 PT Industri Jamu dan Farmasi 35 Sektor Banking Sidomuncul Tbk 38 Sektor Coal Mining 91 PT Waskita Beton Precast Tbk 41 Sektor Plantation 44 Sektor Construction 47 Sektor Cement 50 Sektor Property 53 HARA - Empowering Billions 94 Expert Talks Session Daniel Nainggolan 73 Expert Talks Session 97 Tips & Tricks from Investment Figure 102 Learn from Millenials Adrianto Djokosoetono Sukarto Bujung LastDay Production 3 MNCS Compendium / III / September 2018 Sambutan Direktur Utama MNCS Compendium Para nasabah MNC Sekuritas yang terhormat, Tidak terasa tahun 2018 akan segera berlalu. Semangat nasionalisme terasa semakin kental setelah Indonesia sukses menjadi tuan rumah dalam kompetisi olahraga Asian Games 2018. -

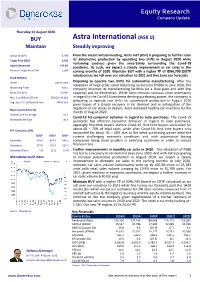

Astra International (ASII IJ) Maintain Steadily Improving

Equity Research Company Update Thursday,13 August 2020 BUY Astra International (ASII IJ) Maintain Steadily improving Last price (IDR) 5,400 From the recent virtual meeting, Astra Int’l (ASII) is preparing to further raise Target Price (IDR) 6,700 its automotive production by operating two shifts in August 2020 while remaining cautious given the uncertainty surrounding the Covid-19 Upside/Downside +24.1% pandemic. As such, we expect a steady improvement in car sales in the Previous Target Price (IDR) 5,600 coming months of 2020. Maintain BUY with a higher TP of IDR6,700 (SOTP valuation) as we roll over our valuation to 2021 and fine tune our forecasts. Stock Statistics Sector Automotive Preparing to operate two shifts for automotive manufacturing. After the relaxation of large-scale social distancing restrictions (PSBB) in June 2020, the Bloomberg Ticker ASII IJ company resumed its manufacturing facilities (at a slow pace and with low No of Shrs (mn) 40,484 capacity) and its dealerships. While Astra remains cautious amid uncertainty Mkt. Cap (IDRbn/USDmn) 218,611/14,811 in regard to the Covid-19 pandemic denting purchasing power, the company is preparing to operate two shifts for automotive production in August 2020 Avg. daily T/O (IDRbn/USDmn) 244.6/16.6 given hopes of a steady recovery in car demand and in anticipation of the Major shareholders (%) depletion of car stocks at dealers. Astra indicated healthy car inventory for the month of August 2020. Jardine Cycle & Carriage 50.1 Covid-19 hit consumer behavior in regard to auto purchases. The Covid-19 Estimated free float 49.9 pandemic has affected consumer behavior in regard to auto purchases, especially first-time buyers. -

Autodesk W Branży Motoryzacyjnej

Autodesk w Branży Motoryzacyjnej Name Surname Job Title Image courtesy of Local Motors Inc. Idea Koncepcja Wizualizacja Ergonomia Konstrukcja i optymalizacja Symulacja Organizacja procesu produkcyjnego Marketing 14 GENERAL MOTORS CORPORATION EXEDY CORPORATION IMABARI SHIPBUILDING CO.,LTD. WERNER BAIER UND GERHARD MEY TOYOTA MOTOR CORPORATION TSUNEISHI SHIPBUILDING COMPANY CENTRAL JAPAN RAILWAY COMPANY AMSTED INDUSTRIES INCORPORATED HONDA MOTOR CO., LTD. MAZDA MOTOR CORPORATION LINAMAR CORPORATION MITSUBISHI MOTORS AUSTRALIA LIMITED MITSUBISHI HEAVY INDUSTRIES, LTD. GENERAL ELECTRIC COMPANY CHINA SHIPBUILDING INDUSTRY CORPORATION CHINA STATE SHIPBUILDING CORPORATION MICHELIN ET CIE GM DAEWOO AUTO & TECHNOLOGY COMPANY NAMURA SHIPBUILDING CO.,LTD. KEIHIN CORPORATION NORTHROP GRUMMAN CORPORATION SIEMENS AG AUSTAL USA, LLC AKEBONO BRAKE INDUSTRY CO., LTD. FORD MOTOR COMPANY VALEO MAG IAS HOLDINGS, INC. COOPER-STANDARD HOLDINGS, INC. HYUNDAI HEAVY INDUSTRIES CO., LTD. L-3 COMMUNICATIONS HOLDINGS, INC. KOREA DELPHI AUTOMOTIVE SYSTEMS CENTRAL MOTOR CO.,LTD. ROBERT BOSCH GMBH DANA HOLDING CORPORATION STELLA VERM?GENSVERWALTUNGS GMBH L?RSSEN MARITIME BETEILIGUNGEN GMBH. VOLKSWAGEN AG SUZUKI MOTOR CORPORATION REPUBBLICA ITALIANA CHINA COMMUNICATIONS CONSTRUCTION KUBOTA CORPORATION SEMBCORP INDUSTRIES LTD THAI SUMMIT AUTOPARTS INDUSTRY COMPANY PARKER -HANNIFIN CORPORATION FIAT SPA ROLLS-ROYCE GROUP PLC NAVISTAR INTERNATIONAL CORPORATION DCNS MAGNA INTERNATIONAL INC AB VOLVO PRESCO, Y.K. JUNGHEINRICH AG BRIDGESTONE CORPORATION CKD CORPORATION UNITED TECHNOLOGIES CORPORATION MITSUBA CORPORATION CONTINENTAL AG NIENPAL EMPREENDIMENTOS E PARTICIPACOES YAZAKI CORPORATION YOKOHAMA RUBBER COMPANY, LIMITED, THE DAIMLER AG FUJI HEAVY INDUSTRIES LTD. BENTELER AG MUSASHI SEIMITSU INDUSTRY CO., LTD. STX OFFSHORE & SHIPBUILDING CO., LTD. SHANGHAI AUTOMOTIVE INDUSTRY CORP ABEKING & RASMUSSEN SCHIFFS- UND ALLISON TRANSMISSION, INC. NISSAN MOTOR CO., LTD. BROSE FAHRZEUGTEILE GMBH & CO. KG ODIM ASA STICHTING ADMINISTRATIEKANTOOR HUISMAN MITSUBISHI MOTORS CORPORATION HARLEY-DAVIDSON, INC. -

SAE 2009 Brake Colloquium and Exhibition Technical Session Schedule As of 10/17/2009 07:40 Pm

SAE 2009 Brake Colloquium and Exhibition Technical Session Schedule As of 10/17/2009 07:40 pm Sunday, October 11 Environmental Issues Session Code: BC109 Room Ballroom A/B Session Time: 3:30 p.m. The session provides the status and issues with the various worldwide environmental regulatory and legislative actions (i.e., REACH, ELV, IMDS, California Copper, Green Chemistry Initiative..) as well as the latest studies in wear debris analysis. Organizers - Stephen Brown, Samarium LLC; Kwangjin M. Lee, Delphi Corp. Time Paper No. Title 3:30 p.m. 2009-01-3005 Wear Mechanisms in Automotive Brake Materials Plus Characterization and Potential Environmental Impact of Wear Debris ORAL ONLY Jana Kukutschova, VSB Technical University Ostrava; Peter Filip, Southern Illinois Univ at Carbondale; Vaclav Roubicek , VSB - Technical University Ostrava; Donald MacCrimmon, Southern Illinois Univ 3:55 p.m. ORAL ONLY European Enviornmental Regulations in Friction Materials Nanty Hautus, Lapinus Fibres BV 4:20 p.m. ORAL ONLY California Copper SB346 Update William P. Hilbrandt, Akebono Corp. 4:40 p.m. ORAL ONLY Green Chemistry Initiative (written presentation will be made available by the California Dept. of Toxic Substances Control) Stephen Brown, Samarium LLC 4:45 p.m. ORAL ONLY Suppliers Partnership for the Environment (SP) - Material Assessment Strategy Pat Beattie, Arcalis Scientific, Suppliers Partnership for Environment Monday, October 12 OEM Brake Management Panel Discussion Session Code: BC200 Room Ballroom A/B Session Time: 8:00 a.m. Join the key leaders of the Brake activities within the major OEM¿s to learn what to expect for the future in terms of business activities and technical issues which will be encountered as we move forward. -

Vanguard FTSE International Index Funds Annual

Annual Report | October 31, 2020 Vanguard FTSE International Index Funds Vanguard FTSE All-World ex-US Index Fund Vanguard FTSE All-World ex-US Small-Cap Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. -

Indonesia Auto

Indonesia Sector Update 17 January 2020 Consumer Cyclical | Auto & Autoparts Indonesia Auto Neutral (Maintained) Stocks Covered 2 ASII’s Dec-19 Share Lowest In Last Six Months Ratings (Buy/Neutral/Sell): 1 / 1 / 0 Last 12m Earnings Neutral Revision Trend: Stay NEUTRAL. Dec 2019 4-wheeler (4W) national wholesales declined to Pecking Order Target Price 86.6k units (-4.6% MoM, -1.4% YoY), bringing FY19 wholesales to 1,026k Astra Otoparts (AUTO IJ) – BUY IDR2,100 units (-10.9% YoY). Astra International’s Dec 2019 market share declined to Astra International (ASII IJ) – NEUTRAL IDR6,700 47.4% (Nov 2019: 52.7%), the lowest in the past six months. Meanwhile, Mitsubishi and other small automotive brands’ market shares picked up. Key Analyst downside risk: Tougher competition in MPVs and SUVs. Key upside risk: Easier financing (from declining interest rates), which boosts auto sales. Andrey Wijaya +6221 5093 9846 Lower December 4W wholesales. FY19 4W domestic wholesales closed at [email protected] 1,026k units (-10.9% YoY, 2018: 1,151k units). Although the decline in sales persisted throughout the year, the result notched above Gaikindo’s revised target of 1,000k units (initial target was at 1,150k units). Dec 2019 4W national wholesales declined to 87,534 units (-4.6% MoM, -1.4% YoY). ASII’s market share declined to 47.4%, the lowest in last six months. This softening was mostly attributed to Daihatsu, whose market share narrowed to ASII’s market share 12.5% in Dec 2019 (Nov 2019: 17.5%). Toyota, ASII’s biggest contributor to Astra's market share (LHS) sales, saw its market share drop to 31.7% in Dec 2019 (Nov 2019: 32.0%).