29136013.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

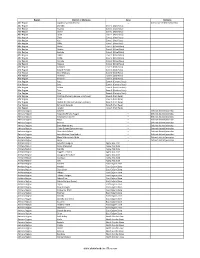

Districts of Ethiopia

Region District or Woredas Zone Remarks Afar Region Argobba Special Woreda -- Independent district/woredas Afar Region Afambo Zone 1 (Awsi Rasu) Afar Region Asayita Zone 1 (Awsi Rasu) Afar Region Chifra Zone 1 (Awsi Rasu) Afar Region Dubti Zone 1 (Awsi Rasu) Afar Region Elidar Zone 1 (Awsi Rasu) Afar Region Kori Zone 1 (Awsi Rasu) Afar Region Mille Zone 1 (Awsi Rasu) Afar Region Abala Zone 2 (Kilbet Rasu) Afar Region Afdera Zone 2 (Kilbet Rasu) Afar Region Berhale Zone 2 (Kilbet Rasu) Afar Region Dallol Zone 2 (Kilbet Rasu) Afar Region Erebti Zone 2 (Kilbet Rasu) Afar Region Koneba Zone 2 (Kilbet Rasu) Afar Region Megale Zone 2 (Kilbet Rasu) Afar Region Amibara Zone 3 (Gabi Rasu) Afar Region Awash Fentale Zone 3 (Gabi Rasu) Afar Region Bure Mudaytu Zone 3 (Gabi Rasu) Afar Region Dulecha Zone 3 (Gabi Rasu) Afar Region Gewane Zone 3 (Gabi Rasu) Afar Region Aura Zone 4 (Fantena Rasu) Afar Region Ewa Zone 4 (Fantena Rasu) Afar Region Gulina Zone 4 (Fantena Rasu) Afar Region Teru Zone 4 (Fantena Rasu) Afar Region Yalo Zone 4 (Fantena Rasu) Afar Region Dalifage (formerly known as Artuma) Zone 5 (Hari Rasu) Afar Region Dewe Zone 5 (Hari Rasu) Afar Region Hadele Ele (formerly known as Fursi) Zone 5 (Hari Rasu) Afar Region Simurobi Gele'alo Zone 5 (Hari Rasu) Afar Region Telalak Zone 5 (Hari Rasu) Amhara Region Achefer -- Defunct district/woredas Amhara Region Angolalla Terana Asagirt -- Defunct district/woredas Amhara Region Artuma Fursina Jile -- Defunct district/woredas Amhara Region Banja -- Defunct district/woredas Amhara Region Belessa -- -

Productive and Reproductive Performance of Local Cows Under Farmer’S Management in Central Tigray, Ethiopia

Nigerian J. Anim. Sci. 2020 Vol 22 (3): 70-74 (ISSN:1119-4308) © 2020 Animal Science Association of Nigeria (https://www.ajol.info/index.php/tjas) available under a Creative Commons Attribution 4.0 International License Productive and reproductive performance of local cows under farmer’s management in central Tigray, Ethiopia Abrha B. H., Niraj K.*, Berihu G., Kiros A. and Gebregiorgis A. G. College of Veterinary Medicine, Mekelle University, Mekelle, Ethiopia *Corresponding Author: [email protected] (Mob: +251.966675736) Target audience: Ministry of Agriculture, Researchers, Dairy Policy Makers Abstract The study was conducted on 408 indigenous cows maintained under farmer’s management in eight districts of central Tigray, Ethiopia. A total of 208 small-scale dairy farm owners were randomly selected and interviewed with structured questionnaire to obtain information on the productive and reproductive performance of indigenous cows. The results of the study showed that the mean age at first calving (AFC) was 43.3 ±2.7 months, number of services per conception (NSC) was 2.7±0.5, days open (DO) was 201.47±61.21 days, calving interval (CI) was 468.33±71.42 days, lactation length (LL) was 206.17±32.33 days, lactation milk yield (LMY) was 414.65±53.69 litres for indigenous cows. The estimated value for productive and reproductive traits had higher than normal range in indigenous cows. This calls for a planned technical and institutional intervention for improved support services for appropriate breeding programs, improved cows and adequate veterinary health services. Key words: Productive and Reproductive Performance, Local Cows. -

R E S T Relief Society of Tigray

R E S T Relief Society of Tigray Towards a food secure future WellWishers funded Rural WASH Development Program in Tigray Regional state, Ethiopia Completion Report (1 January, 2018 to 31 December, 2018) 15 January, 2019 i 1. Project Title Potable Water Supply Development, and Sanitation and Hygiene Program in five weredas of Tigray, Ethiopia Eastern and Central Zone, Tigray Regional state, Ethiopia 2. Project Location 3. Project Type Construction of 34 New Hand dug wells, rehabilitation of 6 hand dug wells and training on hygiene and sanitation activities of the 6 project districts. 4. Project Overall objective To contribute to the eradication of poverty and improve the quality of Objective life of the target population. Specific objective To enhance that all people have safe and equitable access to sufficient quality and quantity of water for drinking and domestic uses. To improve good personal and environmental hygiene To increase the health status of women and children and reduce the expenses for medications To increase child school enrolment 5. Estimated Number of Beneficiaries 8621 peoples 6. Anticipated Program Duration Starting date: 1 Jan 2018 Completion date: 31 Dec 2018 7. Budget Total Program Cost: ETB 5,741,677.93 WellWishers Contribution ETB 5,400,000.00 ii ACRONYMS CLTSH Community Led Total Sanitation & Hygiene GTP Growth and Transformation Plan HEWs Health Extension Workers HHs Households KAP Knowledge Attitude Practice NHDW New Hand Dug Well ODF Open Defecation Free RHDW Rehabilitation Hand dug well REST Relief Society of Tigray SLTSCH School Led Total Sanitation and Hygiene WASH Water, Hygiene and Sanitation WASHCO Water Hygiene and Sanitation Committee iii 1. -

Assessing the Potential of Geonetcast Earth Observation and In-Situ Data for Drought Early Warning and Monitoring in Tigray, Ethiopia

ASSESSING THE POTENTIAL OF GEONETCAST EARTH OBSERVATION AND IN-SITU DATA FOR DROUGHT EARLY WARNING AND MONITORING IN TIGRAY, ETHIOPIA TEWELDE YIDEG ATAKLTI March, 2012 SUPERVISORS: Dr. Ir. Chris Mannaerts Dr. Ing. Tom Rientjes ASSESSING THE POTENTIAL OF GEONETCAST EARTH OBSERVATION AND IN -SITU DATA FOR DROUGHT EARLY WARNING AND MONITORING IN TIGRAY, ETHIOPIA TEWELDE YIDEG ATAKLTI Enschede, The Netherlands, March, 2012 Thesis submitted to the Faculty of Geo-Information Science and Earth Observation of the University of Twente in partial fulfilment of the requirements for the degree of Master of Science in Geo-information Science and Earth Observation. Specialization: Water Resources and Environmental Management SUPERVISORS: Dr. Ir. Chris Mannaerts Dr. Ing. Tom Rientjes THESIS ASSESSMENT BOARD: Prof. Dr. Z. (Bob) Su (Chair) Dr. Muktar Reshid (External Examiner, UN-World Food Program, Ethiopia) Dr. Ir. Chris Mannaerts Dr. Ing. Tom Rientjes DISCLAIMER This document describes work undertaken as part of a programme of study at the Faculty of Geo-Information Science and Earth Observation of the University of Twente. All views and opinions expressed therein remain the sole responsibility of the author, and do not necessarily represent those of the Faculty. ASSESSING THE POTENTIAL OF GEONETCAST EARTH OBSERVATION AND IN-SITU DATA FOR DROUGHT EARLY WARNING AND MONITORING IN TIGRAY, ETHIOPIA ABSTRACT Rainfall is a one of the most dominant factors governing drought occurrences. Its representing at the global, regional as well as local scale is a major issue in drought assessment and early warning. Observing of rainfall in the Tigray region of Ethiopia requires a combination of satellite rainfall and rain gauge data. -

And Drought Tolerant

SORGHUM PRODUCTION IN TRANSITION Through Striga Management Taye Tessema and Gebisa Ejeta የኢትዮጵያ የግብርና ምርምር ኢንስቲትዩት Ethiopian Institute of Agricultural Research Taye SORGHUM PRODUCTION IN TRANSITION Through Striga Management ©EIAR, 2019 ኢግምኢ፤ 2011 Website: http://www.eiar.gov.et Tel: +251-11-6462633 Fax: +251-11-6461294 P.O. Box: 2003 Addis Ababa, Ethiopia Editor: Abebe Kirub ISBN: 9789994466634 Contents Preface 1 Foreword 3 Chapter 1 5 Introduction 5 Chapter 2 15 Seed System, Production and Distribution of Striga Resistant and Drought Tolerant Varieties 15 Chapter 3 31 Training on Sorghum Production and Integrated Sorghum Management 31 Chapter 4 49 Integrated Striga Management Demonstration 49 Chapter 5 61 Popularizing and Adopting Striga Resistant Varieties 61 Chapter 6 67 Strengthening Striga Research 67 Chapter 7 71 Combining Complementary Tactics and Research Results 71 Chapter 8 87 Project Administration, Monitoring and Evaluation 87 Chapter 9 95 Challenges, Lessons, and Looking Ahead 95 References 105 Index 109 Preface This book documents EIAR‟s and the respective bureaus of agriculture, seed agencies and regional research institutes of the four major regions in Ethiopia, i.e., Amhara, Oromia, SNNP and Tigray Regional States in scale up of integrated Striga management in sorghum in Ethiopia. The chapters are arranged in a logical progression. Chapter 1 introduces on sorghum and Striga species in Ethiopia. The second chapter pursues the discussion of seed system, seed production, and distribution of SRV. Chapter 3 deals with farmers‟ practices in sorghum production in Ethiopia and the trainings delivered on sorghum production and ISM technology along with the training impact and lessons. -

An Assessment of Road Network Optimality in Tigray, Ethiopia

AN ASSESSMENT OF ROAD NETWORK OPTIMALITY IN TIGRAY, ETHIOPIA Geographic remoteness and poverty connected INTERDISCIPLINARY PROJECT By Axel Hirschel (10656146), Wai Kee Man (10580514) & Claudia Schwennen (10655808) Date: 8 May 2016 Words: 6585 Supervisors: Koen van der Gaast & Crelis Rammelt Abstract In recent years major public investments have been made in infrastructure development in Ethiopia. The Ethiopian Roads Authority (ERA) has expressed its goal for this road development, which is mainly poverty alleviation. This study is focused on evaluating the optimality of the current road network regarding this goal by taking geographic remoteness and poverty per woreda, which is a part of a province, into consideration. There are just a few towns in Tigray that are not geographically remote. Poverty is also not evenly distributed throughout the province. The poverty rate is generally higher in areas with higher population density. With the use of Geographic Information System (GIS) data files and a self-made algorithm, it is concluded that the current network is not optimal yet. 1 Table of Contents 1. Introduction ............................................................................................................................................... 3 2. Theoretical framework .............................................................................................................................. 5 2.1 Impact of roads on poverty ................................................................................................................ -

The Tigray War & Regional Implications

THE TIGRAY WAR & REGIONAL IMPLICATIONS (VOLUME 1) November 2020 to June 2021 1 CONTENTS 1. Foreword …………………………………………………………………………… 4 2. Introduction: war, offensives and atrocities 2.1 Overview …………………………………………………………………………… 7 2.2 Early attempts to halt the fighting ……………………………………………… 10 2.3 The war escalates …………………………………………………………………. 13 3. Ethiopia at war 3.1 The Federal Government v Tigray Regional State ……………………………. 16 3.2 Prime Minister Abiy’s short-lived whirlwind of reform ……………………... 30 3.3 An inexorable drive towards conflict 2018 – 2020 …………………………….. 49 3.4 President Isaias and Prime Minister Abiy – who is in the driving seat? ……. 60 4. Progress of the war 4.1 ENDF offensives along the southwestern front ……………………………….. 73 4.2 The northern fronts ………………………………………………………………. 76 4.3 The Southern Front ………………………………………………………………. 78 4.4 The ENDF’s strategy ……………………………………………………………... 78 4.5 Retreat and consolidation ……………………………………………………….. 80 4.6 TDF expansion and the start of semi-conventional warfare …………………. 82 4.7 Overall War Progress: November 2020 to May 2021 …………………………. 84 4.8 Conclusion ………………………………………………………………………… 88 5. The Ethiopian national context 5.1 Contextualising the war in Tigray ……………………………………………… 91 5.2 A threat to Ethiopia’s integrity? ………………………………………………… 92 5.3 Conflict and the rule of law ……………………………………………………... 94 5.4 Oromia politics and conflict - optimism and excitement ……………………. 95 5.5 Amhara politics and conflict …………………………………………………… 102 5.6 The south, east and west ……………………………………………………….. 112 5.7 Somali Region …………………………………………………………………… 113 5.8 Afar Region ……………………………………………………………………… 115 5.9 Benishangul Gumuz ……………………………………………………………. 116 5.10 Socio-economic stakes and the cost of the war ………………………………. 117 5.11 Concluding remarks ……………………………………………………………. 119 6. Diplomatic Efforts 6.1 UN Security Council and the African Union ………………………………… 122 6.2 The United States of America …………………………………………………. -

Summary of Key Findings DATE of PUBLICATION: 26 MARCH 2018 DISPLACEMENT TRACKING MATRIX (DTM) Tigray REGION ETHIOPIA ROUND 9: JANUARY/FEBRUARY 2018

DISPLACEMENT TRACKING MATRIX (DTM) TIGRAY REGION, ETHIOPIA ROUND 9: JANUARY - FEBRUARY 2018 Summary of key findings DATE OF PUBLICATION: 26 MARCH 2018 DISPLACEMENT TRACKING MATRIX (DTM) Tigray REGION ETHIOPIA ROUND 9: JANUARY/FEBRUARY 2018 DISPLACEMENT TRACKING MATRIX (DTM) TIGRAY REGION ETHIOPIA DTMETHIOPIA ROUND 9: JANUARY - FEBRUARY 2018 DISPLACEMENT TRACKING MATRIX (DTM) TIGRAY REGION ETHIOPIA DTMETHIOPIA ROUND 9: JANUARY - FEBRUARY 2018 TIGRAY REGION - KEY FINDINGS HEALTH: Malaria was the primary health concern in 7000 LOCATION AND CAUSE OF DISPLACEMENT: 22,488 this round of data collection with 23 sites reporting 6000 displaced individuals comprising 7,941 households this. 5000 in 60 displacement sites were identified in Tigray 4000 region. These figures represent an increase of EDUCATION: In 13% of sites 50% or less of the 3000 1,736 in the total individuals (+8.37%) an increase children on site are attending school. Formal 2000 primary school education is available at 60 sites. of 320 households(+4.20%) and a decrease of 1 1000 Alternative basic education (ABE) is not available at site (-1.64%) since round 8 (November/December 0 2017). 88.35% of sites opened before 2017 and any sites. Round 3 Round 4 Round 5 Round 6 Round 7 Round 8 Round 9 11.67% opened during 2017. Conflict was the Population in sites reporting new arrivals in 2018 primary cause of displacement for an estimated COMMUNICATION: 53% of sites reported that 95% of the displaced population. the authorities were IDPs primary source of Population in sites reporting new arrivals in 2017 information followed by local leaders at 42% of Total DEMOGRAPHICS: 46% of displaced individuals were sites. -

Assessment of Honey Marketing System and Its Value Chain in Three Selected Woredas of Tigray Region, Ethiopia

CORE Metadata, citation and similar papers at core.ac.uk Provided by International Institute for Science, Technology and Education (IISTE): E-Journals Journal of Marketing and Consumer Research www.iiste.org ISSN 2422-8451 An International Peer-reviewed Journal Vol.35, 2017 Assessment of Honey Marketing System and its Value Chain in Three Selected Woredas of Tigray Region, Ethiopia Atsbaha Hailemariam 1 Taye Tolemariam 2 1.Ethiopian Institute of Agricultural Research, Mehoni Agricultural Ressearch center, P.O.Box 71, Maichew, Ethiopia 2.Jimma University, College of Agriculture and Veterinary Medicine, Jimma, Ethiopia Abstract The study was conducted in three selected woredas of Tigray Region. The objectives of the study were to assess the honey marketing system and its value chain in the study areas. For this study three woredas were selected purposively based on beekeeping marketing potential and were further stratified in to three peasant associations based on altitude variation as high land (>2300), mid land (1500-2300) and low land (<1500) m.a.s.l. Thirty beekeepers involved in honey marketing were selected from each peasant association using systematic random sampling method to conduct formal honey market survey with semi structured questionnaire making a total of 270 respondents. There was significant difference among different honey colors collected from traditional hives and the survey result showed that the mean price of white honey (66.39 ETB) was significantly higher (P<0.001) than any other honey color types in traditional hive. White honey from traditional hive in Kolla-Temben was significantly higher in price (68.60 ETB) than white honey in Medebe-zana and Ray-azebo woredas of the same hive types. -

Ethiopia: Tigray Region Administrative Map (As of 05 Jan 2015)

Ethiopia: Tigray region administrative map (as of 05 Jan 2015) ERITREA ERITREA ! Dawuhan Town ! Gerihu Sernay Town ! Erob Adi Hageray Town ! Tahtay Adiyabo Rama Town ! Fatsi Town Shiraro Town Gulomekeda! ! Ahferom Laelay Adiyabo Mereb Leke Adi Daero Town ! Humera ! Chasa Town Inticho Town Bazet Town ! Diobdibo Town! ! Adi Girat ! ! Ganta Afeshum AdebayeTown ! ! EDEGA HAMUS TOWN Adwa Town ! SUDAN ! Feres May Town Adwa ! Saesie Tsaedaemba Wukro Marya Akisum Selekileha Town ! ! Shire Enida Silase ! Nebelat Town ! ! Eastern May Cadera Town North Western Tahtay Koraro Laelay Maychew ! FIREWEYINI TOWN Idagarbi Town ! Kafta Humera ! Tahtay Maychew TIGRAY Biher Town Werei Leke ! Hawzen Town Hawzen ! ! Asgede Tsimbila Zana Town Endaba Guna Town ! Maykinatil Town ! Central ! Semema Town Medebay Zana ! Atsbi Endasilasie Town ! Naeder Adet Atsbi Wenberta Western Mezega Town Wekero Town ! ! Welkait Adi Remets Town Hayka Mesahil Town ! Kelete Awelallo ! ! Kola Temben Hagere Selam Town Abiyi adi Town ! Tselemti ! Degua Temben Danisha Town ! May Tsebri Town ! Mekele P ! Tsegede ! Enderta Ketema Nigus Town ! Tanqua Abergele ! AFAR ! ! ! Gijet Town ! Mearay Town ! Adi Gudom Town ! Saharti Samre Samira Town ! ! Legend Hintalo Wejirat ! HiwaneTown ! P Regional capital ! ! Town ! ! ! Alaje Southern Adei Sheou International boundary ! ! Region boundary ! Lile Town Zone boundary AMHARA ! Mehoni Town Maychew ! ! ! ! Woreda boundary Endamehoni ! Meswaet Town All-weather road ! Raya Azebo Dry-weather road ! ! ZONENAME ! ! Ofla Chercher Town ! ! ! ! Korem Town Central ! ! Eastern ! ! Alamata Town ! ! ! North Western ! ! Alamata ! WAJA TEMUGA TOWN Southern ! ¯ Western ! 25 km The boundaries and names shown and the designations used on this map do not imply official endorsement or acceptance by the United Nations. Creation date: 05 Jan 2015 Ref. number: 21_ADM__TIG_010515_A0 Sources:CSA, UNCS, Field Survey Feedback: [email protected] www.humanitarianresponse.info/operations/ethiopia www.reliefweb.int. -

Qualitative Research and Analyses of the Economic Impacts of Cash Transfer Programmes in Sub-Saharan Africa

Qualitative research and analyses of the economic impacts of cash transfer programmes in sub-Saharan Africa Ethiopia country case study report Qualitative research and analyses of the economic impacts of cash transfer programmes in sub-Saharan Africa Ethiopia country case study report FOOD AND AGRICULTURE ORGANIZATION OF THE UNITED NATIONS Rome, 2014 i The From Protection to Production (PtoP) programme is, jointly with UNICEF, exploring the linkages and strengthening coordination between social protection, agriculture and rural development. PtoP is funded principally by the UK Department for International Development (DFID), the Food and Agriculture Organization of the UN (FAO) and the European Union. The programme is also part of a larger effort, the Transfer Project, together with UNICEF, Save the Children and the University of North Carolina, to support the implementation of impact evaluations of cash transfer programmes in sub-Saharan Africa. For more information, please visit PtoP website: www.fao.org/economic/ptop The designations employed and the presentation of material in this information product do not imply the expression of any opinion whatsoever on the part of the Food and Agriculture Organization of the United Nations (FAO) concerning the legal or development status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. The mention of specific companies or products of manufacturers, whether or not these have been patented, does not imply that these have been endorsed or recommended by FAO in preference to others of a similar nature that are not mentioned. The views expressed in this information product are those of the author(s) and do not necessarily reflect the views or policies of FAO. -

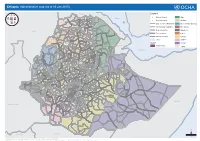

Ethiopia: Administrative Map (As of 05 Jan 2015)

Ethiopia: Administrative map (as of 05 Jan 2015) ERITREA Legend Ahferom Erob ^! Tahtay Adiyabo National Capital Gulomekeda Afar Laelay Adiyabo Mereb Leke Red Sea Dalul Ganta Afeshum P! Adwa SaesEiea Tsatedranemba Regional Capital Amhara North WesternTahtay KoraroLaelay Maychew Kafta Humera Tahtay Maychew Werei Leke Hawzen Asgede Tsimbila Central Koneba TIGRAY Medebay Zana Naeder Adet Berahile Western Atsbi Wenberta Undetermined boundary Beneshangul Gumuz Kelete Awelallo Welkait Kola Temben Tselemti Degua Temben Mekele P! Zone 2 International boundary Dire Dawa Tsegede Tselemt Enderta Tanqua Abergele Afdera Addi Arekay Ab Ala Tsegede Beyeda Mirab Armacho Afdera Region boundary Gambela Debark Saharti Samre Erebti Hintalo Wejirat SUDAN Abergele Tach Armacho Dabat Janamora Megale Bidu Alaje Sahla Southern Zone boundary Hareri Ziquala Raya Azebo Metema Lay Armacho Wegera Wag Himra Endamehoni North Gonder Sekota Teru Chilga Woreda boundary Oromia Yalo East Belesa Ofla West Belesa Kurri Dehana Dembia Gonder Zuria Alamata Zone 4 Elidar Gaz Gibla Lake SNNPR Quara Takusa Ebenat Gulina Libo Kemkem Bugna Awra Kobo Tana Gidan Region Lasta (Ayna) AFAR Somali Alfa Ewa Fogera Farta North Wollo Semera Lay Gayint Meket Guba Lafto P! Dubti Zone 1 DJIBOUTI Addis Ababa Jawi Semen Achefer South Gonder Tigray East Esite Chifra Bahir Dar Wadla Habru Aysaita AMHARA P! Dera Tach Gayint Delanta Guba Bahirdar Zuria Ambasel Debub Achefer Dawunt Worebabu Dangura Gulf of Aden Mecha West Esite Simada Thehulederie Adaa'r Mile Pawe Special Afambo Dangila Kutaber Yilmana