Australia's Rail Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Full Year Report 12 Months to 30 June 2012

Full Year Report 12 months to 30 June 2012 Financial Performance $m FY121 FY111 Change (%) Total revenue2 8,524.6 6,960.9 22.5 EBITDA 593.7 502.7 18.1 EBIT 346.5 292.2 18.6 Net interest expense (69.0) (64.3) 7.3 Tax expense (82.1) (61.5) 33.5 Net profit after tax 195.3 166.4 17.4 ROFE3 17.7% 15.8% 1.9 1 Numbers are “underlying”, i.e. excluding Individually Significant Items 2 Total revenue is a non-statutory disclosure and includes revenue, other income and notional revenue from joint ventures and other alliances not proportionately consolidated. 3 ROFE = EBIT divided by average funds employed (AFE) (AFE = Average Opening and Closing Net Debt = Equity) Total Revenue2 ($m) EBIT1 ($m) 9000 360 8000 350 7000 340 330 6000 320 5000 310 4000 300 3000 290 2000 280 1000 270 0 260 FY10 FY11 FY12 FY10 FY11 FY12 EBITDA1 ($m) Work-in-hand ($b) 700 25 600 20 500 15 400 300 10 200 5 100 0 0 FY10 FY11 FY12 FY10 FY11 FY12 2 THE YEAR TO 30 JUNE 2012 Downer made significant progress during the 2012 financial year and the strength of the business is clear in the full year result. All Downer businesses continued to win new work and work-in-hand remains high at $20 billion. Downer’s portfolio structure is now well defined with the establishment of Downer Infrastructure in May 2012 (bringing together the Group’s infrastructure businesses in Australia and New Zealand) and the completion of the sale of CPG Asia for $147 million in April 2012. -

Rural and Regional Affairs and Transport References Committee

The Senate Rural and Regional Affairs and Transport References Committee Australia's rail industry October 2017 © Commonwealth of Australia 2017 ISBN 978-1-76010-667-6 This document was prepared by the Senate Standing Committee on Rural and Regional Affairs and Transport and printed by the Senate Printing Unit, Department of the Senate, Parliament House, Canberra. This work is licensed under the Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia License. The details of this licence are available on the Creative Commons website: http://creativecommons.org/licenses/by-nc-nd/3.0/au/. Membership of the committee Members Senator Glenn Sterle, Chair Western Australia, ALP Senator Barry O'Sullivan, Deputy Chair Queensland, NATS Senator Chris Back (to 22 June 2017) Western Australia, LP Senator Slade Brockman (from 17 August 2017) Western Australia, LP Senator David Bushby (from 22 June 2017 to 17 August 2017) Tasmania, LP Senator Anthony Chisholm Queensland, ALP Senator Malarndirri McCarthy Northern Territory, ALP Senator Janet Rice Victoria, AG Substitute members for this inquiry Senator Kim Carr Victoria, ALP to replace Senator Malarndirri McCarthy iii Secretariat Dr Jane Thomson, Secretary Ms Sarah Redden, Principal Research Officer Ms Trish Carling, Senior Research Officer Ms Erin Pynor, Senior Research Officer Ms Leonie Lam, Research Officer (to 1 June 2017, from 25 August 2017) Ms Helen Ulcoq, Research Officer (from 3 July 2017) Mr Michael Fisher, Administrative Officer PO Box 6100 Parliament House Canberra ACT 2600 Ph: 02 6277 3511 Fax: 02 6277 5811 E-mail: [email protected] Internet: www.aph.gov.au/senate_rrat iv Table of contents Membership of the committee ........................................................................ -

Radical New Thoughts on Train Operation in Our Big

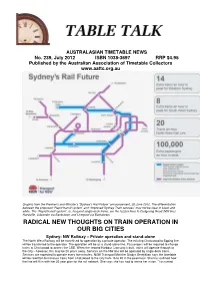

AUSTRALASIAN TIMETABLE NEWS No. 239, July 2012 ISBN 1038-3697 RRP $4.95 Published by the Australian Association of Timetable Collectors www.aattc.org.au Graphic from the Premier’s and Minister’s “Sydney’s Rail Future” announcement, 20 June 2012. The differentiation between the proposed “Rapid transit system” and “Improved Sydney Train services” may not be clear in black and white. The “Rapid transit system”, ie, frequent single-deck trains, are the fuzzier lines to Cudgeong Road (NW line) Hurstville, Lidcombe via Bankstown and Liverpool via Bankstown. RADICAL NEW THOUGHTS ON TRAIN OPERATION IN OUR BIG CITIES Sydney: NW Railway – Private operation and stand-alone The North West Railway will be franchised for operation by a private operator. The existing Chatswood to Epping line will be transferred to the operator. The operation will be as a stand-alone line. Passengers will be required to change trains at Chatswood to access the CBD. When the second Harbour Crossing is built, trains will operate through to the City – however, this may be 20 years away. Services on the NW line will be operated by single deck trains. Services are expected to operate every five minutes. NSW Transport Minister Gladys Berejiklian says the timetable will be rewritten to increase trains from Chatswood to the City from 16 to 20 in the peak hour. She has outlined how the line will fit in with her 20-year plan for the rail network. She says she has had to revise her vision. "I assumed when I became Transport Minister that double decks were the way to go but expert advice, community input, industry input, demonstrates to me and also looking at what happens around the world, the best way to go for the north-west rail line is single deck," she said. -

4 February 2016 Company Announcements Office ASX

Downer EDI Limited ABN 97 003 872 848 Triniti Business Campus 39 Delhi Road North Ryde NSW 2113 1800 DOWNER www.downergroup.com 4 February 2016 Company Announcements Office ASX Limited Exchange Centre Level 4, 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam Please find attached the following documents: 1. Appendix 4D – results for announcement to the market for the half-year ended 31 December 2015; 2. Condensed Consolidated Half-year Financial Report dated 31 December 2015; 3. Market release dated 4 February 2016; and 4. Investor Presentation. Yours sincerely, Downer EDI Limited Peter Tompkins Company Secretary Page 1 of 1 Results for announcement to the market for the half-year ended 31 December 2015 Appendix 4D 31 Dec 2015 31 Dec 2014 change $'m $'m % Revenue from ordinary activities 3,262.0 3,375.0 Other income 2.6 2.8 Total revenue and other income from ordinary activities 3,264.6 3,377.8 (3.4%) Total revenue including joint ventures and other income 3,543.4 3,586.0 (1.2%) Earnings before interest and tax 113.2 141.7 (20.1%) Profit from ordinary activities after tax attributable to members of the parent entity 72.1 94.7 (23.9%) 31 Dec 2015 31 Dec 2014 change cents cents % Basic earnings per share 15.8 20.8 (24.0%) Diluted earnings per share 15.1 20.1 (24.9%) Net tangible asset backing per ordinary share 254.2 253.5 0.3% Dividend 31 Dec 2015 31 Dec 2014 Interim Interim Dividend per share (cents) 12.0 12.0 Franked amount per share (cents) 12.0 12.0 Dividend record date 18/02/2016 19/02/2015 Dividend payable date 17/03/2016 19/03/2015 Redeemable Optionally Adjustable Distributing Securities (ROADS) Dividend per ROADS (in Australian cents) 2.40 2.65 New Zealand imputation credit percentage per ROADS 100% 100% ROADS payment date Quarter 1 Quarter 2 Instalment date FY2016 15/09/2015 15/12/2015 Instalment date FY2015 15/09/2014 15/12/2014 Downer EDI's Dividend Reinvestment Plan (DRP) has been suspended. -

Downer Group Business Profile (April 2014)

Shaping the Future of Railway Institute of Railway Technology 21st September 2016 Adams Williams Manufacturing Lead Major Bids Team Rail Relationships creating success Opportunities in Rail Page 2 Trains, Trams, Jobs 2015 – 2025 WHY WE NEED MORE TRAINS AND TRAMS SUPPORTING LOCAL JOBS Victoria’s train and tram building industry supports up to 10,000 jobs. TRANSFORMING THE RAIL NETWORK The Andrews Labor Government is expanding and growing our rail network. MEETING FUTURE NEEDS Our rail capacity needs to grow along with Melbourne’s growing population. AN AGEING TRAIN AND TRAM FLEET Our train and tram fleet is ageing and needs constant refreshing. A BETTER PASSENGER EXPERIENCE New trams and next-generation trains mean a better Reference: Extracts from Trains, Trams Jobs 2015 -2025. Victorian Rolling Stock Strategy. State Government passenger experience. Victoria. © Downer Group Limited All rights reserved Page 3 Strong pipeline of opportunities 300 252 237 237 237 237 236 234 250 220 212 212 208 15 30 48 61 NEW 200 74 87 100 METROPOLITAN 150 100 211 211 216 216 212 202 188 178 TRAINS 163 158 153 50 0 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Existing fleet in service HCMT Total train requirement 500 442 428 416 450 407 397 385 373 400 360 346 332 5 20 35 75 160 350 307 120 140 300 NEW 250 200 REGIONAL 331 352 361 361 361 361 333 150 309 295 284 284 TRAINS 100 50 0 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Total existing fleet Total new fleet Total carriage requirement © Downer Group Limited All rights reserved Page 4 HCMT Project © Downer Group Limited All rights reserved Page 5 Relationships creating success About Downer Page 6 Overall Business Profile Market Revenue Work-in-hand People capitalisation (FY 2016) approx. -

For Personal Use Only Use Personal For

6 August 2013 Company Announcements Office ASX Limited Exchange Centre Level 4, 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam Please find attached the following documents: 1. Appendix 4E – results for announcement to the market for the year ended 30 June 2013; 2. 2013 Annual Report; 3. Market release dated 6 August 2013; and 4. Investor Presentation. Should you require any further information, please do not hesitate to contact me. Yours sincerely Downer EDI Limited Peter Tompkins Company Secretary For personal use only Downer EDI Limited A Triniti Business Campus, 39 Delhi Road, North Ryde NSW 2113 ABN 97 003 872 848 P PO Box 1823, North Ryde NSW 2113 T +61 2 9468 9700 | F +61 2 9813 8915 | W downergroup.com Results for announcement to the market for the year ended 30 June 2013 Appendix 4E 2013 2012 % Continuing and discontinued operations: $'000 $'000 change Revenue from ordinary activities - continuing operations 8,370,151 7,915,413 Other income 4,863 5,053 Total revenue and other income from ordinary activities - continuing operations 8,375,014 7,920,466 5.7% Revenue from ordinary activities - discontinued operations - 150,867 Total revenue and other income from ordinary activities 8,375,014 8,071,333 3.8% Total revenue including joint ventures and other income 9,132,366 8,524,569 7.1% Earnings before interest and tax (after individually significant items) 358,877 264,204 35.8% Earnings before interest and tax (before individually significant items) 370,333 346,483 6.9% Profit from ordinary activities after tax attributable to members -

Annual Review 2 0 11 Contents

ANNUAL REVIEW 2 0 11 CONTENTS CEO’s report 02 Downer Australia 04 Downer New Zealand 06 Downer Mining 08 Downer Rail 10 Our people 12 Environmental sustainability 14 Safety 16 Company directory IBC DOWNER OVERVIEW DOWNER PROVIDES COMPREHENSIVE ENGINEERING AND INFRASTRUCTURE MANAGEMENT SERVICES TO ITS CUSTOMERS IN AUSTRALIA, NEW ZEALAND, THE ASIA-PACIFIC REGION, SOUTH AMERICA, SOUTH AFRICA AND THE UNITED KINGDOM. DOWNER DESIGNS, CONSTRUCTS AND MAINTAINS THE BEST SOLUTIONS FOR ITS CUSTOMERS WHILE FOCUSING ON THE SAFETY OF ITS EMPLOYEES AND THE SUSTAINABILITY OF THE ENVIRONMENT AND THE COMMUNITIES IN WHICH IT OPERATES. DOWNER EMPLOYS OVER 20,000 PEOPLE AND IS COMMITTED TO ITS GOAL OF ZERO HARM. Cover image: James Forrest Downer Mining at Christmas Creek DOWNER AUSTRALIA Downer Australia provides integrated solutions to support the critical infrastructure needs of customers in the core markets of Minerals & Metals, Oil & Gas, Power, Transport Infrastructure, Water, Communications and Property. 04 DOWNER NEW ZEALAND Downer is one of New Zealand’s largest transport, water, communications and renewable energy infrastructure service providers and is often referred to as the country’s fourth emergency service. 06 DOWNER MINING Downer is one of Australia’s leading diversified mining contractors, with over 3,500 employees working across more than 50 sites in Australia, DOWNER RAIL New Zealand, Papua New Guinea, South America and South Africa. 08 Downer is the leading provider and maintainer of freight and passenger rolling stock in Australia, operating three engineering design centres, four manufacturing plants and over 20 maintenance facilities. 10 OUR PEOPLE Downer employs over 20,000 people who deliver results for our customers, the communities in which we operate and each other. -

DOWNER HALF YEAR RESULTS Investor Presentation | 2 February 2017 OVERVIEW

Downer EDI Limited ABN 97 003 872 848 Triniti Business Campus 39 Delhi Road North Ryde NSW 2113 1800 DOWNER www.downergroup.com 2 February 2017 Company Announcements Office ASX Limited Exchange Centre Level 4, 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam Please find attached the following documents: 1. Appendix 4D – results for announcement to the market for the half-year ended 31 December 2016; 2. Condensed Consolidated Half-year Financial Report dated 31 December 2016; 3. Market release dated 2 February 2017; and 4. Investor Presentation. Yours sincerely, Downer EDI Limited Peter Tompkins Company Secretary For personal use only Page 1 of 1 Results for announcement to the market for the half-year ended 31 December 2016 Appendix 4D 31 Dec 2016 31 Dec 2015 change $'m $'m % Revenue from ordinary activities 3,333.6 3,262.0 Other income 1.0 2.6 Total revenue and other income from ordinary activities 3,334.6 3,264.6 2.1% Total revenue including joint ventures and other income 3,603.0 3,543.4 1.7% Earnings before interest and tax 120.8 113.2 6.7% Profit from ordinary activities after tax attributable to members of the parent entity 78.2 72.1 8.5% 31 Dec 2016 31 Dec 2015 change cents cents % Basic earnings per share 17.6 15.8 11.4% Diluted earnings per share 17.1 15.1 13.2% Net tangible asset backing per ordinary share 255.6 254.2 0.6% Dividend 31 Dec 2016 31 Dec 2015 Interim Interim Dividend per share (cents) 12.0 12.0 Franked amount per share (cents) 12.0 12.0 Dividend record date 16/02/2017 18/02/2016 Dividend payable date 16/03/2017 17/03/2016 Redeemable Optionally Adjustable Distributing Securities (ROADS) Dividend per ROADS (in Australian cents) 2.17 2.40 New Zealand imputation credit percentage per ROADS 100% 100% ROADS payment date Quarter 1 Quarter 2 Instalment date FY2017 15/09/2016 15/12/2016 Instalment date FY2016 15/09/2015 15/12/2015 Downer EDI's Dividend Reinvestment Plan (DRP) has been suspended. -

Half Year Report 2015

Results for announcement to the market for the half-year ended 31 December 2014 Appendix 4D 31 Dec 2014 31 Dec 2013 % $'000 $'000 change Revenue from ordinary activities 3,374,997 3,757,554 Other income 2,778 3,297 Total revenue and other income from ordinary activities 3,377,775 3,760,851 (10.2%) Total revenue including joint ventures and other income 3,585,983 3,931,119 (8.8%) Earnings before interest and tax 141,730 160,077 (11.5%) Profit from ordinary activities after tax attributable to members of the parent entity 94,715 99,109 (4.4%) 31 Dec 2014 31 Dec 2013 % cents cents change Basic earnings per share 20.8 21.8 Diluted earnings per share 20.1 20.8 Net tangible asset backing per ordinary share 253.5 303.4 (16.4%) 31 Dec 2014 31 Dec 2013 Dividends Interim dividend per share (cents) 12.0 11.0 Interim franked amount per share (cents) 12.0 7.7 Conduit foreign income (CFI) 0% 30% Interim dividend record date 19/02/2015 18/02/2014 Interim dividend payable date 19/03/2015 20/03/2014 Redeemable Optionally Adjustable Distributing Securities (ROADS) Dividend per ROADS (in Australian cents) 2.65 2.22 New Zealand imputation credit percentage per ROADS 100% 100% ROADS Quarter 1 instalment payment date 15/09/2014 16/09/2013 ROADS Quarter 2 instalment payment date 15/12/2014 16/12/2013 Downer EDI's Dividend Reinvestment Plan (DRP) has been suspended. For commentary on the results for the period and review of operations, refer to the Directors' Report and separate media release attached. -

The Future of Transport

Downer News Issue 2 September-October 2015 4 The future of transport Community Awards Zero Harm 6 relationships 8 10 pivitol to success 2 Issue 2 September-October 2015 INNOVATION Future Box – Downer’s Downer supports inaugural innovation solar car innovation competition Downer is proud to be a Bronze sponsor of the 2015 Sunswift team as they compete in We have had a this year’s Bridgestone World Solar Challenge. tremendous response Sunswift is a team of undergraduate students from the University to our Future Box of New South Wales who build and race the world’s most advanced competition, with more solar cars. Their aim is to push the boundaries of technology in order than 100 ideas submitted so far. to inspire interest and action in sustainability. In 2013 the team’s car, eVe, achieved first place in the Bridgestone World Solar Challenge across Australia. In 2014, eVe broke a FIA* What type of ideas are we looking for? World Record for the fastest electric car over 500km on a single charge. There is no such thing as a bad idea. Your idea could: This year the team has completely rebuilt eVe to become Australia’s ■ enhance our service offering; first ever road legal solar sports car (pending government certification), ■ improve the safety of our people; making eVe the first solar car in the world to be manufactured to ■ reduce our environmental impact; commercial safety standards. ■ drive collaboration; ■ create new revenue; In October, the team will compete in the Bridgestone World Solar ■ lift our own productivity and efficiency; Challenge Cruiser Class against other solar vehicles from all over the ■ differentiate Downer from its competitors; or globe, racing 3000km from Darwin to Adelaide. -

RISSB Rail Safety Conference Tuesday 11 May 2021 DAY 1

PRESENTING THE 21ST ANNUAL RISSB Rail Safety New ideas, new perspectives Conference and new directions 11 – 12 May 2021 | Swissotel Sydney INTERNATIONAL KEYNOTES 2021 KEY FEATURES, BENEFITS AND TAKE-AWAYS Ian Jeffries, President and CEO, AAR (USA) OVER 50+ INDUSTRY LEADERS from – Safety and Technology Australia, USA, United Kingdom and George Bearfield, Director of Health, Safety New Zealand Networking Drinks and Cyber Security, Rock Rail Holdings (UK) Plenary sessions each morning 50% Discount rate for all young rail professionals (Under 35) Dan Basacik, Principal Human Factors including keynotes, thought provoking presentations and panels Specialist, RSSB (UK) The option to attend one of two Safety issues in focus with concurrent concurrent industry workshops: INDUSTRY KEYNOTES streams focusing on: Delivering Effective Solutions to Contractor Management Sue McCarrey, Chief Executive, ONRSR – Safety Innovation Delivering Effective Solutions to Dr Natalie Pelham, CEO & Chief Investigator, – Safety Harmonisation and Minimising Environmental Impacts of Rail Office of Transport Safety Investigations Interoperability (OTSI) A selection of three technical site visits: – Asset Management Metro Trains Sydney – Maintenance Greg Hood, Chief Commissioner and CEO, – Fatigue Australian Transport Safety Bureau (ATSB) Facility and Control Room – Safety Culture Central Station Metro – New Platforms Suzanne Holden, A/Deputy Chief Executive, Sydney Trains – Track Worker Safety UTS Data Arena Photo courtesy of Sydney Metro www.railsafetyconference.com.au -

Victorian Government Submission to the Senate Inquiry Into the State Of

Victorian Government submission to the Senate Inquiry into the State of Australia’s Rail Industry Department of Economic Development, Jobs, Transport and Resources March 2017 TABLE OF CONTENTS 1 Introduction ................................................................................................................................................. 2 2 Victorian rail industry ................................................................................................................................... 2 3 Rail as a regional employer and activity generator ...................................................................................... 3 3.1 Building a sustainable rail industry in Victoria ............................................................................................. 3 3.2 Why Victoria needs rolling stock ................................................................................................................. 5 4 Barriers to growth and improved productivity .............................................................................................. 6 4.1 Lack of supply chain development poses risk to growth ............................................................................. 6 4.2 Investment attraction requires a long term pipeline of procurement ............................................................ 6 5 Nationally coordinated approach to standards and procurement ................................................................ 7 5.1 Procurement smoothing, pipeline of projects and harmonisation