Annual Report 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Morning Wrap

Morning Wrap Today ’s Newsflow Equity Research 26 May 2020 08:37 BST Upcoming Events Select headline to navigate to article ARYZTA COVID-19 challenges to the fore, though liquidity Company Events robust 26-May ARYZTA; Q320 Results 27-May Hibernia REIT; FY Results FBD Holdings Business update on BI cover; test case to 28-May Non-Standard Finance; FY19 Results Norwegian Air Shuttle; Q120 Results go to commercial courts Irish Banks EBA paper on first insights into Covid-19 impact on EU banks Mondi Ferguson CFO joins Mondi Economic Events Ireland 28-May Retail Sales Apr20 United Kingdom United States Europe This document is intended for the sole use of Goodbody Stockbrokers and its affiliates Goodbody Capital Markets Equity Research +353 1 6419221 Equity Sales +353 1 6670222 Bloomberg GDSE<GO> Goodbody Stockbrokers UC, trading as “Goodbody”, is regulated by the Central Bank of Ireland. In the UK, Goodbody is authorised and subject to limited regulation by the Financial Conduct Authority. Goodbody is a member of Euronext Dublin and the London Stock Exchange. Goodbody is a member of the FEXCO group of companies. For the attention of US clients of Goodbody Securities Inc, this third-party research report has been produced by our affiliate, Goodbody Stockbrokers Goodbody Morning Wrap ARYZTA COVID-19 challenges to the fore, though liquidity robust ARYZTA provided a Q3 update (end April) this morning with organic revenues down 21.5%. Recommendation: Hold ARYZTA now expects that COVID-19 will have a material impact on FY20 performance Closing Price: €0.44 though it is not possible to fully assess the consequences that will result from the short and longer-term impact. -

20100107 Trading Notice Functional 0221

Trading Notice - 0221 Date: 7th January 2010 Priority: Notification Bulletin Subject: Chi-X launches services in Irish stocks with EMCF N.V. on 22 nd January 2010 Sent from: Trading Operations Message: Chi-X Europe Ltd (Chi-X) is pleased to announce the addition of the Irish market segment to its EMCF cleared stock universe. The following ISEQ 20 stocks will be available to trade from Friday 22nd January 2010: Chi-X Bloomberg Name UMTF RIC Chi-X RIC Bloomberg Code ISIN Allied Irish Banks PLC AIBi ALBK.I ALBKi.CHI ALBK ID ALBK IX IE0000197834 Aryzta AG YZAi ARYN.I ARYNi.CHI YZA ID YZA IX CH0043238366 Bank of Ireland BIRi BKIR.I BKIRi.CHI BKIR ID BKIR IX IE0030606259 C&C Group PLC GCCi GCC.I GCCi.CHI GCC ID GCC IX IE00B010DT83 CRH PLC CRGi CRH.I CRHi.CHI CRH ID CRH IX IE0001827041 DCC PLC DCCi DCC.I DCCi.CHI DCC ID DCC IX IE0002424939 Dragon Oil PLC DRSi DGO.I DGOi.CHI DGO ID DGO IX IE0000590798 Elan Corporation PLC DRXi ELN.I ELNi.CHI ELN ID ELN IX IE0003072950 F.B.D Holdings PLC EG7i FBD.I FBDi.CHI FBD ID FBD IX IE0003290289 Glanbia PLC GL9i GL9.I GL9i.CHI GLB ID GLB IX IE0000669501 Grafton Group PLC GN5i GRF_u.I GRF_ui.CHI GN5 ID GN5 IX IE00B00MZ448 Greencore Group PLC GCGi GNC.I GNCi.CHI GNC ID GNC IX IE0003864109 Independent News & Media PLC IPDi INME.I INMEi.CHI INM ID INWS IX IE0004614818 Irish Life & Permanent PLC ILBi IPM.I IPMi.CHI IPM ID IPM IX IE0004678656 Kerry Group PLC KRZi KYGa.I KYGai.CHI KYG ID KYG IX IE0004906560 Kingspan Group PLC KRXi KSP.I KSPi.CHI KSP ID KSP IX IE0004927939 Paddy Power PLSi PAP.I PAPi.CHI PWL ID PWL IX IE0002588105 Ryanair Holdings PLC RY4Bi RYA.I RYAi.CHI RYA ID RYA IX IE00B1GKF381 Smurfit Kappa Group PLC SK3i SKG.I SKGi.CHI SKG ID SKG IX IE00B1RR8406 United Drug PLC UN6Ai UDG.I UDGi.CHI UDG ID UDG IX IE0033024807 Current Trading Participants who require access to the above market segment are required to complete, sign and return the Access to Markets form to Chi-X Compliance. -

FBD Insurance Plc Annual Report 2014

THROUGH FBD Insurance plc Annual Report 2014 Contents Financial Statements 2 Chairman’s Statement 14 Statement of Accounting Policies 5 Board of Directors and Other Information 17 Profit and Loss Account/Technical Account – General Business 6 Report of The Directors 18 Profit And Loss Account/Non-Technical Account 11 Corporate Governance Report 19 Balance Sheet 13 Independent Auditor’s Report 21 Cash Flow Statement 22 Statement of Reconciliation of Movement in Ordinary Shareholders’ Funds 23 Notes to the Financial Statements 44 Notice of Annual General Meeting FBD INSURANCE PLC Annual Report 2014 1 Chairman’s Statement OVERVIEW BUSINESS REVIEW 2014 was a very difficult year for the Irish insurance market Underwriting and FBD, with a significant market-wide deterioration in Premium Income the claims environment and severe weather experience. As a result, the Company recorded a loss before taxation FBD’s gross premium written increased by 3.6% to €363.7m of €5.9m. The Company’s first priority is to return to (2013: €351.2m), marginally increasing the Company’s profitability and, although significant progress was made in market share to 13.7%. FBD shifted emphasis during the 2014, it will be some time before the full benefits of the year so as to increase focus on risk selection and rate-led actions taken are reflected in profitability. price adequacy. This was necessary given that the industry is incurring losses, there is significant deterioration in the While it was known that the improving economy would claims environment and that the Company’s objective is to have an impact on the claims environment, the worsening of deliver only profitable growth. -

Introduction of a Central Counterparty at Irish Stock Exchange Information for Production Start

eurex circular 2 41/05 Date: Frankfurt, November 30, 2005 Recipients: All Eurex members, CCP members and vendors Authorized by: Daniel Gisler Introduction of a Central Counterparty at Irish Stock Exchange Information for Production Start Related Eurex Circulars: 057/05, 230/05 Contact: Customer Support, tel. +49-69-211-1 17 00 E-mail: [email protected] Content may be most important for: Attachment: Ü Front Office / Trading Updated List of CCP-eligible Securities for ISE Ü Middle + Back Office Ü Auditing / Security Coordination With this circular we complement information on the introduction of a Central Counterparty for the Irish stock market scheduled for next Monday, December 5, 2005. The Central Counterparty (CCP) for securities traded in the Xetra order book at Irish Stock Exchange (ISE) originated from a common initiative of Irish Stock Exchange, Euroclear/CRESTCo Limited and Deutsche Börse AG. Eurex Clearing AG, which already renders CCP services for other markets, acts as CCP. The product range for production start on December 5, 2005 comprises Irish stocks and Exchange Traded Funds (ETFs) traded in the Xetra order book at Irish Stock Exchange. Please find attached to this circular an updated list of securities which will be CCP-eligible for ISE effective December 5, 2005. Should you have any questions or require further information, please feel free to contact the Customer Support Team at tel. +49-69-211-1 17 00. Eurex Clearing AG Customer Support Chairman of the Executive Board: Aktiengesellschaft mit Sitz D-60485 Frankfurt/Main Tel. +49-69-211-1 17 00 Supervisory Board: Rudolf Ferscha (CEO), in Frankfurt/Main www.eurexchange.com Fax +49-69-211-1 17 01 Dr. -

FBD Holdings Annual Report 2018

Protection. It’s in our nature. FBD Holdings plc Annual Report 2018 In the years report Strategic Report 1 FBD at a Glance 1 Financial Highlights 2 2018 in Pictures 3 Chairman's Statement 4 Review of Operations 8 Our Business Model 14 Our Strategy 16 Risk & Uncertainties Report 18 Corporate Social Responsibility 25 Corporate Information 29 Governance 32 Board of Directors 32 Report of the Directors 34 Corporate Governance 40 Report on Directors’ Remuneration 50 Directors’ Responsibilities Statement 59 Independent Auditors’ Report 60 Financial Statements 70 Consolidated Income Statement 70 Consolidated Statement of Comprehensive Income 71 Consolidated Statement of Financial Position 72 Consolidated Statement of Cash Flows 74 Consolidated Statement of Changes in Equity 75 Company Statement of Financial Position 76 Company Statement of Cash Flows 77 Company Statement of Changes in Equity 78 Notes to the Financial Statements 79 Other Information 138 Alternative Performance Measures 138 Letter from the Chairman in relation to the Annual General Meeting 140 Notice of Annual General Meeting 142 STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS OTHER INFORMATION FBD at a Glance Established in the 1960s by farmers for farmers, FBD has built on those roots in agriculture to become a leading general insurer directly serving the needs of agricultural, small business and consumer customers throughout Ireland. 2018 Performance Highlights PROFIT BEFORE TAX COMBINED OPERATING RATIO GROSS WRITTEN PREMIUM €50m 81% €372m In line with €50m profit Improvement -

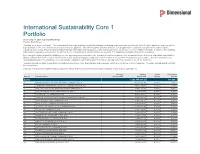

International Sustainability Core 1 Portfolio As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

International Sustainability Core 1 Portfolio As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions -

Dimensional International Core Equity Market ETF SCHEDULE of INVESTMENTS April 30, 2021 (Unaudited)

Dimensional International Core Equity Market ETF SCHEDULE OF INVESTMENTS April 30, 2021 (Unaudited) Security Description Shares Fair Value ($) COMMON STOCKS (98.4%) AUSTRALIA (6.7%) 5G Networks, Ltd. 40 37 *A2B Australia, Ltd. 92 91 Accent Group, Ltd. 272 618 Adairs, Ltd. 92 330 Adbri, Ltd. 288 716 *Advance NanoTek, Ltd. 16 48 *Aeris Resources, Ltd. 1,048 81 *Afterpay, Ltd. 1,438 130,684 AGL Energy, Ltd. 14,736 101,649 #*»Alkane Resources, Ltd. 276 157 *Alliance Aviation Services, Ltd. 368 1,194 ALS, Ltd. 11,346 92,375 Altium, Ltd. 1,925 44,089 Alumina, Ltd. 4,497 6,009 *AMA Group, Ltd. 1,351 579 Ampol, Ltd. 3,655 72,249 Ansell, Ltd. 2,657 86,735 APA Group 19,887 154,078 Appen, Ltd. 1,204 14,564 ARB Corp., Ltd. 40 1,209 *Ardent Leisure Group, Ltd. 420 281 Aristocrat Leisure, Ltd. 8,793 252,465 *Artemis Resources, Ltd. 496 44 Asaleo Care, Ltd. 260 283 ASX, Ltd. 2,886 162,694 Atlas Arteria, Ltd. 18,915 88,250 AUB Group, Ltd. 109 1,718 Aurelia Metals, Ltd. 8,745 2,837 Aurizon Holdings, Ltd. 41,513 120,250 AusNet services 1,164 1,704 Austal, Ltd. 264 492 Austin Engineering, Ltd. 396 44 Australia & New Zealand Banking Group, Ltd. 35,542 789,041 *Australian Agricultural Co., Ltd. 990 879 Australian Ethical Investment, Ltd. 56 378 Australian Finance Group, Ltd. 965 2,102 Australian Pharmaceutical Industries, Ltd. 1,902 1,741 Australian Vintage, Ltd. 136 78 Auswide Bank, Ltd. 45 223 #Ava Risk Group, Ltd. -

FBD HOLDINGS PLC 26 February 2021 FBD HOLDINGS

FBD HOLDINGS PLC 26 February 2021 FBD HOLDINGS PLC PRELIMINARY ANNOUNCEMENT For the year ended 31 December 2020 KEY HIGHLIGHTS Profit Before Tax of €4.8m reflects a strong underlying business performance and includes positive prior year claims reserve development of €23m and an investment return of €10m. The Commercial Court judgement delivered on 5 February provides clarity around the liability for Covid-19 pandemic business interruption claims relating to our pub policies. Provision increased to €65m (best estimate net claims costs of €54m and €11m assumed for reinsurance reinstatement premium). Gross claims costs (including legal and other expenses) are currently estimated to be approximately €150m. The effects of the judgement are being considered with our reinsurance partners in order to finalise the reinsurance recovery position. Reported Combined Operating Ratio (COR) of 101.4% reflects the adverse business interruption impact of 20.3% (€65m) and positive prior year claims development of 7.4% (€23m). Excluding these the current year COR is 88.5% Gross Written Premium (GWP) of €358m is down 3% on 2019 (premium flat year on year excluding €12m Covid-19 pandemic related premium rebates). Increase of over 14,400 policy holders since the start of 2020 as partnership channels grow. Average premium down 3% across the portfolio. Private Motor down 5.7%, Farm down 1.5%, Home down 2.2% and Commercial up 2.8%. Our capital position remains strong with a Solvency Capital Ratio of 197% (unaudited) with the unpaid 2019 dividend no longer accrued. Given the continuing uncertainty prevailing, the Board continues to believe that capital preservation is paramount and therefore no dividend is being proposed at this time. -

Annual Report 2017

FBD Holdings plc Annual Report 2017 Protection. It’s in our nature. FBD Holdings plc Contents Financial Highlights 2 Chairman's Statement 4 Review of Operations 8 Corporate Information 14 Annual Report 2017 Report of the Directors 15 Corporate Governance 24 Report on Directors’ Remuneration 38 Directors’ Responsibilities Statement 47 Independent Auditors’ Report 48 Financial Statements Consolidated Income Statement 60 Consolidated Statement of Comprehensive Income 61 Consolidated Statement of Financial Position 62 Consolidated Statement of Cash Flows 64 Consolidated Statement of Changes in Equity 65 Company Statement of Financial Position 66 Company Statement of Cash Flows 67 Company Statement of Changes in Equity 68 Notes to the Financial Statements 69 Other Items (Not Forming Part of the Financial Statements) Alternative Performance Measures 130 Letter from Chairman in relation to Annual General Meeting 131 Notice of Annual General Meeting 135 1 Financial Highlights 2017 2016 €000s €000s Gross premium written 372,459 361,799 Net premium earned 325,932 308,226 Profit for the financial year 42,696 10,680 2017 2016 Cent Cent Basic earnings per share 123 31 Diluted earnings per share 991 31 Net asset value per share 784 651 Ordinary dividend per share - - 1Diluted earnings per share reflects the potential conversion of the convertible debt and share based payments Calendar Preliminary announcement 27 February 2018 Dividend record date 6 April 2018 Annual General Meeting 4 May 2018 Dividend payment date 11 May 2018 2 FBD Holdings plc FBD -

Download the Report

ANNUAL REPORT 1998 IRISH TAKEOVER PANEL Report for the period from April 29, 1997 to June 30, 1998 IRISH TAKEOVER PANEL Report for the period from April 29, 1997 to June 30, 1998 This first report of the Irish Takeover Panel is made to Ms. Mary Harney, T.D., Minister for Enterprise, Trade and Employment as required by section 19 of the Irish Takeover Panel Act, 1997 Irish Takeover Panel (Registration No. 265647), 8 Upper Mount Street, Dublin 2 Telephone: (01) 6789020 Facsimile: (01) 6789289 Contents Page Members of the Panel, Directors and Director General 3 Introduction 5 Chairperson’s Statement 7 Director General’s Report 11 Directors’ Report 19 Statement of Directors’ Responsibilities 21 Auditors’ Report 22 Financial Statements 24 Appendix 1 Administrative Appendix 31 Appendix 2 Takeovers supervised by Irish Takeover 34 Panel, July 1, 1997 to June 30, 1998 Appendix 3 List of Relevant Companies as 35 at June 30, 1998 2 Members of the Panel Irish Association of Investment Managers Irish Clearing House Limited Nominated by the Irish Bankers Federation Irish Stock Exchange Limited Law Society of Ireland Sean Dorgan Nominated by the Consultative Committee of Accountancy Bodies Ireland Directors of the Panel Chairperson Daniel O’Keeffe, S.C. } } Appointed by the Governor of the Central } Bank of Ireland Deputy Chairperson William M. McCann, FCA } Kenneth Beaton Appointed by the Irish Stock Exchange Limited (Alternate: Michael Dillon) Ann Fitzgerald Appointed by the Irish Association of Investment Managers Daniel J. Kitchen Appointed by the Consultative Committee of Accountancy Bodies Ireland Brian J. O’Connor Appointed by the Law Society of Ireland (Alternate: Alvin Price) Philip Sykes Appointed by the Irish Bankers Federation (Alternates: Richard Keatinge Hugh Cooney) Director General (and Secretary of the Panel) Leo Conway 3 4 Introduction The Irish Takeover Panel (“the Panel”) is the statutory body responsible for monitoring and supervising takeovers and other relevant transactions in Ireland. -

Draper Esprit

Morning Wrap Today ’s Newsflow Equity Research 06 Sep 2016 Upcoming Events Select headline to navigate to article Applegreen Robust H1 outcome Company Events 06-Sep Applegreen; Q2 2016 Results Dalata Hotel Group Reports solid H116 numbers Dalata Hotel Group; H116 Results easyJet Demand looks good but we don’t know at what DS Smith; Q1 2017 Results easyJet; August 2016 - Traffic Stats price 08-Sep Air France-KLM; August 2016 - Traffic Stats IAG Europe okay, long-haul weak 09-Sep Greene King; Q1 2017 Results J D Wetherspoon; FY16 Results DS Smith Robust statement but already at a premium to Lufthansa; August 2016 - Traffic Stats 12-Sep Associated British Foods; Q4 2016 Trading Update the sector Green REIT; FY16 results Draper Esprit Conditional offer for Movidius Commercial Property Regulator gears up for post Brexit world Economic View Irish housing starts highest since 2008, but still a long way to go Economic Events UK Builders Merchants UK housebuilders still to see any Ireland Brexit impact IFG Group Curtis Banks H1 show margin decline from United Kingdom investment, base rate headwinds 06-Sep BRC Retail Sales Aug 2016 07-Sep Industrial Production July 2016 FBD Holdings Updated book of quantum due by month Halifax House Price Aug 2016 end Manufacturing Production July 2016 08-Sep Construction Output July 2016 Trade Balance July 2016 13-Sep Retail Price Index Aug 2016 CPI Aug 2016 United States Europe 06-Sep GDP Q2 2016 Goodbody Capital Markets Equity Research +353 1 6419221 Equity Sales +353 1 6670222 Bloomberg GDSE<GO> Goodbody Stockbrokers (trading as Goodbody) is regulated by the Central Bank of Ireland. -

Morning Wrap

Morning Wrap Today ’s Newsflow Equity Research 18 Dec 2020 08:51 GMT Upcoming Events Select headline to navigate to article Hammerson Plan to list on Euronext Dublin Company Events Morses Club 1H20 Results; remains profitable despite Covid-19 challenges Irish Banks Lumbering to deal on Brexit over the weekend? UK Economic View November retail sales fall but outlook improves Economic Events Ireland 22-Dec PPI Nov20 Wholesale Price Indsx Nov20 United Kingdom 18-Dec Retail Sales Nov20 22-Dec GDP Q3 Exports Q3 Imports Q3 Current Account Q3 United States Europe This document is intended for the sole use of Goodbody Investment Banking and its affiliates Goodbody Capital Markets Equity Research +353 1 6419221 Equity Sales +353 1 6670222 Bloomberg GDSE<GO> Goodbody Stockbrokers UC, trading as “Goodbody”, is regulated by the Central Bank of Ireland. In the UK, Goodbody is authorised and subject to limited regulation by the Financial Conduct Authority. Goodbody is a member of Euronext Dublin and the London Stock Exchange. Goodbody is a member of the FEXCO group of companies. For the attention of US clients of Goodbody Securities Inc, this third-party research report has been produced by our affiliate, Goodbody Stockbrokers Goodbody Morning Wrap Hammerson Plan to list on Euronext Dublin Hammerson announced this morning that it is to seek admission of its entire issued share Recommendation: Hold capital to the secondary listing segment of the Irish Stock Exchange (Euronext Dublin) and Closing Price: £0.26 to trading on the main market for listed securities of Euronext Dublin. Colm Lauder +353-1-641 6042 Hammerson is seeking a secondary listing given the importance and scale of its investor base [email protected] and operations in continental Europe and Ireland.