FBD Holdings Plc Annual Report 2011 Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Quarter 1, 2021

Corporate Finance Review of Irish Merger and Acquisition Activity Quarter 1, 2021 Prepared by Investec Corporate Finance Review of Irish M&A activity M&A Tracker Summary, Q1 2021 Quarterly Value and Volume Trend €12bn 120 €13.1bn €10bn €11.4bn 94 100 90 90 €10bn 80 98 71 72 80 66 €8bn 62 s 58 l 60 a e €6bn D €4.8bn €4.3bn 40 €4bn €2.3bn €2bn €1.7bn 20 €1.0bn €1.0bn €1.0bn €0.6bn - - Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Values Volumes Most Active Sectors (by volume) 21 13 13 IT & Telecoms Health & Pharmaceutical Industrials Transaction Type (by volume) 44 15 6 Foreign Acquisitions Irish Deals (In-market) UK Buyer Investec Commentary • There were 90 deals announced during the quarter, representing a 25% increase relative to Q4’20 • Total disclosed transaction value was €13,070m during the quarter – the highest ever quarterly value recorded. This is mainly due to the proposed €10.5bn acquisition of PRA Health Sciences by ICON. Of the 90 deals announced only 27 disclosed a deal value • Notable transactions which were announced during the quarter included the above mentioned acquisition of PRA Health Sciences by ICON as well as Norwegian energy company Aker Horizons acquiring a 75% stake in Mainstream Renewable Power Limited, an Irish renewable energy company for a reported €675m • Irish companies were active overseas during the quarter, with a total of 44 transactions (18 in Q4’20) • There were 15 in-market transactions during Q1’21 in addition to 6 transactions being announced involving a UK based buyer of an Irish business • The IT & Telecoms sector was the most active in the quarter, with 21 transactions announced. -

Morning Wrap

Morning Wrap Today ’s Newsflow Equity Research 26 May 2020 08:37 BST Upcoming Events Select headline to navigate to article ARYZTA COVID-19 challenges to the fore, though liquidity Company Events robust 26-May ARYZTA; Q320 Results 27-May Hibernia REIT; FY Results FBD Holdings Business update on BI cover; test case to 28-May Non-Standard Finance; FY19 Results Norwegian Air Shuttle; Q120 Results go to commercial courts Irish Banks EBA paper on first insights into Covid-19 impact on EU banks Mondi Ferguson CFO joins Mondi Economic Events Ireland 28-May Retail Sales Apr20 United Kingdom United States Europe This document is intended for the sole use of Goodbody Stockbrokers and its affiliates Goodbody Capital Markets Equity Research +353 1 6419221 Equity Sales +353 1 6670222 Bloomberg GDSE<GO> Goodbody Stockbrokers UC, trading as “Goodbody”, is regulated by the Central Bank of Ireland. In the UK, Goodbody is authorised and subject to limited regulation by the Financial Conduct Authority. Goodbody is a member of Euronext Dublin and the London Stock Exchange. Goodbody is a member of the FEXCO group of companies. For the attention of US clients of Goodbody Securities Inc, this third-party research report has been produced by our affiliate, Goodbody Stockbrokers Goodbody Morning Wrap ARYZTA COVID-19 challenges to the fore, though liquidity robust ARYZTA provided a Q3 update (end April) this morning with organic revenues down 21.5%. Recommendation: Hold ARYZTA now expects that COVID-19 will have a material impact on FY20 performance Closing Price: €0.44 though it is not possible to fully assess the consequences that will result from the short and longer-term impact. -

CDP Ireland Climate Change Report 2015

1 CDP Ireland climate change report 2015 Irish Companies Demonstrating Leadership on Climate Change ‘On behalf of 822 investors with assets of US$95 trillion’ Programme Sponsors Report Sponsor Ireland partner to CDP and report writer 2 3 Contents 04 Foreword by Paul Dickinson Executive Chairman CDP 06 CDP Ireland Network 2015 Review by Brian O’ Kennedy 08 Commentary from SEAI 09 Commentary from EPA 10 Irish Emissions Reporting 12 Ireland Overview 14 CDP Ireland Network initiative 16 The Investor Impact 17 The Climate A List 2015 19 Investor Perspective 20 Investor signatories and members 22 Appendix I: Ireland responding companies 23 Appendix II: Global responding companies with operation in Ireland 27 CDP 2015 climate change scoring partners Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP Worldwide (CDP). This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. Clearstream Solutions, and CDP have prepared the data and analysis in this report based on responses to the CDP 2015 information request. No represen- tation or warranty (express or implied) is given by Clearstream Solutions or CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, Clearstream Solutions and CDP do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

Euronext ® Europe 500

EU500 Factsheet 1/12 Euronext ® Europe 500 Objective The Euronext ® Europe 500 tracks the performance of a portfolio of 500 stocks in Europe, ranked by their free float market capitalization. Constituents are reviewed on a quarterly basis and their weights are reset to equal weight at the quarterly rebalances. The index serves as an underlying for structured products, funds and exchange traded funds. Investability Stocks are screened to ensure liquidity to ensure that the index is investable. Transparency The index rules are available on our website. Euronext acts as Supervisor. All our rulebooks can be found on the following webpage: www.euronext.com/en/indices/index-rules. Statistics June-2019 Market Capitalization EUR Bil Performance (%) Fundamentals Full not mkt cap Q2 2019 1,45% P/E Incl. Neg LTM 20,50 Free float weighted YTD 13,91% P/E Incl. Neg FY1 15,68 2018 -12,84% P/E excl. Neg LTM 22,19 2017 7,39% P/E excl. Neg FY1 16,05 Components (full) EUR Bil 2016 -1,23% Price/Book 4,83 Average 19,50 Price/Sales 3,27 Median 9,74 Annualized (%) Price/Cash Flow 13,15 Largest 270,87 2 Year 0,86% Dividend Yield (%) 3,47 Smallest 2,37 3 Years 5,39% 5 Years 2,51% Risk Component Weights (%) Since Base Date 31-Dec-2007 1,93% Sharpe Ratio 1 Year not calc. Largest #N/A Volatility 30 Day 10,28 Smallest #N/A Top ten 18,6 Performance of other versions EU5NR EU5GR WLENV Euronext Europe 500 NR Euronext Europe 500 GR (%) (%) Q2 2019 2,95% Q2 2019 3,40% YTD 16,36% YTD 17,05% 2018 -10,45% 2018 -9,93% 2017 10,19% 2017 10,81% 2016 1,62% 2016 2,25% This publication is for information purposes only and is not a recommendation to engage in investment activities. -

20100107 Trading Notice Functional 0221

Trading Notice - 0221 Date: 7th January 2010 Priority: Notification Bulletin Subject: Chi-X launches services in Irish stocks with EMCF N.V. on 22 nd January 2010 Sent from: Trading Operations Message: Chi-X Europe Ltd (Chi-X) is pleased to announce the addition of the Irish market segment to its EMCF cleared stock universe. The following ISEQ 20 stocks will be available to trade from Friday 22nd January 2010: Chi-X Bloomberg Name UMTF RIC Chi-X RIC Bloomberg Code ISIN Allied Irish Banks PLC AIBi ALBK.I ALBKi.CHI ALBK ID ALBK IX IE0000197834 Aryzta AG YZAi ARYN.I ARYNi.CHI YZA ID YZA IX CH0043238366 Bank of Ireland BIRi BKIR.I BKIRi.CHI BKIR ID BKIR IX IE0030606259 C&C Group PLC GCCi GCC.I GCCi.CHI GCC ID GCC IX IE00B010DT83 CRH PLC CRGi CRH.I CRHi.CHI CRH ID CRH IX IE0001827041 DCC PLC DCCi DCC.I DCCi.CHI DCC ID DCC IX IE0002424939 Dragon Oil PLC DRSi DGO.I DGOi.CHI DGO ID DGO IX IE0000590798 Elan Corporation PLC DRXi ELN.I ELNi.CHI ELN ID ELN IX IE0003072950 F.B.D Holdings PLC EG7i FBD.I FBDi.CHI FBD ID FBD IX IE0003290289 Glanbia PLC GL9i GL9.I GL9i.CHI GLB ID GLB IX IE0000669501 Grafton Group PLC GN5i GRF_u.I GRF_ui.CHI GN5 ID GN5 IX IE00B00MZ448 Greencore Group PLC GCGi GNC.I GNCi.CHI GNC ID GNC IX IE0003864109 Independent News & Media PLC IPDi INME.I INMEi.CHI INM ID INWS IX IE0004614818 Irish Life & Permanent PLC ILBi IPM.I IPMi.CHI IPM ID IPM IX IE0004678656 Kerry Group PLC KRZi KYGa.I KYGai.CHI KYG ID KYG IX IE0004906560 Kingspan Group PLC KRXi KSP.I KSPi.CHI KSP ID KSP IX IE0004927939 Paddy Power PLSi PAP.I PAPi.CHI PWL ID PWL IX IE0002588105 Ryanair Holdings PLC RY4Bi RYA.I RYAi.CHI RYA ID RYA IX IE00B1GKF381 Smurfit Kappa Group PLC SK3i SKG.I SKGi.CHI SKG ID SKG IX IE00B1RR8406 United Drug PLC UN6Ai UDG.I UDGi.CHI UDG ID UDG IX IE0033024807 Current Trading Participants who require access to the above market segment are required to complete, sign and return the Access to Markets form to Chi-X Compliance. -

FBD Insurance Plc Annual Report 2014

THROUGH FBD Insurance plc Annual Report 2014 Contents Financial Statements 2 Chairman’s Statement 14 Statement of Accounting Policies 5 Board of Directors and Other Information 17 Profit and Loss Account/Technical Account – General Business 6 Report of The Directors 18 Profit And Loss Account/Non-Technical Account 11 Corporate Governance Report 19 Balance Sheet 13 Independent Auditor’s Report 21 Cash Flow Statement 22 Statement of Reconciliation of Movement in Ordinary Shareholders’ Funds 23 Notes to the Financial Statements 44 Notice of Annual General Meeting FBD INSURANCE PLC Annual Report 2014 1 Chairman’s Statement OVERVIEW BUSINESS REVIEW 2014 was a very difficult year for the Irish insurance market Underwriting and FBD, with a significant market-wide deterioration in Premium Income the claims environment and severe weather experience. As a result, the Company recorded a loss before taxation FBD’s gross premium written increased by 3.6% to €363.7m of €5.9m. The Company’s first priority is to return to (2013: €351.2m), marginally increasing the Company’s profitability and, although significant progress was made in market share to 13.7%. FBD shifted emphasis during the 2014, it will be some time before the full benefits of the year so as to increase focus on risk selection and rate-led actions taken are reflected in profitability. price adequacy. This was necessary given that the industry is incurring losses, there is significant deterioration in the While it was known that the improving economy would claims environment and that the Company’s objective is to have an impact on the claims environment, the worsening of deliver only profitable growth. -

Introduction of a Central Counterparty at Irish Stock Exchange Information for Production Start

eurex circular 2 41/05 Date: Frankfurt, November 30, 2005 Recipients: All Eurex members, CCP members and vendors Authorized by: Daniel Gisler Introduction of a Central Counterparty at Irish Stock Exchange Information for Production Start Related Eurex Circulars: 057/05, 230/05 Contact: Customer Support, tel. +49-69-211-1 17 00 E-mail: [email protected] Content may be most important for: Attachment: Ü Front Office / Trading Updated List of CCP-eligible Securities for ISE Ü Middle + Back Office Ü Auditing / Security Coordination With this circular we complement information on the introduction of a Central Counterparty for the Irish stock market scheduled for next Monday, December 5, 2005. The Central Counterparty (CCP) for securities traded in the Xetra order book at Irish Stock Exchange (ISE) originated from a common initiative of Irish Stock Exchange, Euroclear/CRESTCo Limited and Deutsche Börse AG. Eurex Clearing AG, which already renders CCP services for other markets, acts as CCP. The product range for production start on December 5, 2005 comprises Irish stocks and Exchange Traded Funds (ETFs) traded in the Xetra order book at Irish Stock Exchange. Please find attached to this circular an updated list of securities which will be CCP-eligible for ISE effective December 5, 2005. Should you have any questions or require further information, please feel free to contact the Customer Support Team at tel. +49-69-211-1 17 00. Eurex Clearing AG Customer Support Chairman of the Executive Board: Aktiengesellschaft mit Sitz D-60485 Frankfurt/Main Tel. +49-69-211-1 17 00 Supervisory Board: Rudolf Ferscha (CEO), in Frankfurt/Main www.eurexchange.com Fax +49-69-211-1 17 01 Dr. -

Euronext Eurozone 300 Factsheet

EZ300 Factsheet 1/8 Euronext ® Eurozone 300 Objective The Euronext ® Eurozone 300 tracks the performance of a portfolio of 300 stocks in Eurozone, ranked by their free float market capitalization. Constituents are reviewed on a quarterly basis and their weights are reset based on their free float market capitalization at the quarterly rebalances. The index serves as an underlying for structured products, funds and exchange traded funds. Investability Stocks are screened to ensure liquidity to ensure that the index is investable. Transparency The index rules are available on our website. Euronext acts as Supervisor. All our rulebooks can be found on the following webpage: https://live.euronext.com/en/products-indices/index-rules. Statistics Mar-21 Market Capitalization EUR Bil Performance (%) Fundamentals Full 6 850,95 Q1 2021 8,55% P/E Incl. Neg LTM 54,18 Free float 5 085,53 YTD 8,55% P/E Incl. Neg FY1 15,18 2020 -2,72% P/E excl. Neg LTM 59,43 2019 22,32% P/E excl. Neg FY1 23,90 Components (full) EUR Bil 2018 -14,12% Price/Book 4,11 Average 22,86 Price/Sales 4,06 Median 11,32 Annualized (%) Price/Cash Flow 9,05 Largest 286,75 2 Year 7,64% Dividend Yield (%) 2,22 Smallest 1,89 3 Years 4,56% 5 Years 5,89% Risk Component Weights (%) Since Base Date 31-Dec-2005 1,87% Sharpe Ratio 1 Year not calc. Largest 4,27 Volatility 30 Day 11,48 Smallest 0,03 Top ten 23,88 Performance of other versions EZ3NR EZ3GR WLENV Euronext Eurozone 300 NR Euronext Eurozone 300 GR (%) (%) Q1 2021 8,81% Q1 2021 8,89% YTD 8,81% YTD 8,89% 2020 -0,84% 2020 -0,24% 2019 25,51% 2019 26,57% 2018 -12,04% 2018 -11,37% This publication is for information purposes only and is not a recommendation to engage in investment activities. -

FBD Holdings Annual Report 2018

Protection. It’s in our nature. FBD Holdings plc Annual Report 2018 In the years report Strategic Report 1 FBD at a Glance 1 Financial Highlights 2 2018 in Pictures 3 Chairman's Statement 4 Review of Operations 8 Our Business Model 14 Our Strategy 16 Risk & Uncertainties Report 18 Corporate Social Responsibility 25 Corporate Information 29 Governance 32 Board of Directors 32 Report of the Directors 34 Corporate Governance 40 Report on Directors’ Remuneration 50 Directors’ Responsibilities Statement 59 Independent Auditors’ Report 60 Financial Statements 70 Consolidated Income Statement 70 Consolidated Statement of Comprehensive Income 71 Consolidated Statement of Financial Position 72 Consolidated Statement of Cash Flows 74 Consolidated Statement of Changes in Equity 75 Company Statement of Financial Position 76 Company Statement of Cash Flows 77 Company Statement of Changes in Equity 78 Notes to the Financial Statements 79 Other Information 138 Alternative Performance Measures 138 Letter from the Chairman in relation to the Annual General Meeting 140 Notice of Annual General Meeting 142 STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS OTHER INFORMATION FBD at a Glance Established in the 1960s by farmers for farmers, FBD has built on those roots in agriculture to become a leading general insurer directly serving the needs of agricultural, small business and consumer customers throughout Ireland. 2018 Performance Highlights PROFIT BEFORE TAX COMBINED OPERATING RATIO GROSS WRITTEN PREMIUM €50m 81% €372m In line with €50m profit Improvement -

Kingspan Group Plc Annual Report & Financial Statements 2016

Kingspan Group plc Annual Report & Financial Statements 2016 Design: www.reddog.ie Design: Kingspan Group plc Kingspan Group Annual Report & Financial Statements 2016 Financial Statements Annual Report& Dublin Road Tel: +353 42 969 8000 Kingscourt Fax: +353 42 966 7501 Co Cavan Email: [email protected] Ireland A82 XY31 www.kingspan.com WorldReginfo - 07ea2199-f413-4bf9-980b-08845eb5e1b0 Kingspan. The global leader in high performance Shaping the future built environment. insulation and building Pioneering new technologies with envelope solutions. energy conservation at their heart. Germany Westhafen Tower — Light & Air: Natural ventilation system SUMMARY FINANCIALS 2 GLOBAL REACH 8 BUSINESS & STRATEGIC REPORT UK Chairman’s Statement 4 Delancey Street Business Model & Strategy 8 — COMPLETING Environmental: Chief Executive’s Review 16 THE ENVELOPE Thermomax Solar Thermal Tubes Financial Review 24 11 Risk & Risk Management 30 Corporate Social Responsibility 32 DIRECTORS' REPORT Chairman’s Introduction 42 The Board 44 Report of the Directors 46 Corporate Governance Statement 54 Report of the Remuneration Committee 61 Report of the Audit Committee 72 FINANCIAL STATEMENTS Independent Auditor’s Report 80 Financial Statements 83 Notes to the Financial Statements 91 OTHER INFORMATION Alternative Performance Measures 128 Shareholder Information 130 Principal Subsidiary Undertakings 133 Group Five Year Summary 136 WorldReginfo - 07ea2199-f413-4bf9-980b-08845eb5e1b0 SUMMARY 2 2 FINANCIALS Trading Margin up EPS up 180bps 35% 11.0% 2 143.8 cent 2 -

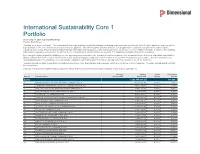

International Sustainability Core 1 Portfolio As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

International Sustainability Core 1 Portfolio As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions -

Kingspan Group Plc Annual Report & Financial Statements 2015

Kingspan Group plc Annual Report & Financial Statements 2015 Kingspan Group plc Annual Report & Financial Statements 2015 Our 2020 Net-Zero Energy vision Kingspan is the global leader in high performance insulation and building energy solutions. At Kingspan, our commitment to achieving Net-Zero Energy status by 2020 has led to our recognition as a leader for corporate action on climate change by being awarded a position on the CDP’s global Climate ‘A’ List – the only Irish listed company to do so. Our actions and strategies to reduce carbon emissions mean we are currently on track to exceed an interim target of 50% energy usage from renewable sources in 2016. 2 Public Library, Toronto, Canada Business & Strategic Report 4 Chairman’s Statement 6 Business & Strategy Review 10 Chief Executive’s Review 14 Financial Review 24 Risk & Risk Management 30 Corporate Social Responsibility Report 32 Directors’ Report 42 Chairman’s Introduction 43 The Board 44 Report of the Directors 46 Corporate Governance Statement 50 Report of the Remuneration Committee 57 Report of the Audit Committee 66 Financial Statements 70 Independent Auditor’s Report 71 Financial Statements 74 Notes to the Financial Statements 83 Other Information 116 Non-GAAP Information 116 Shareholder Information 116 Principal Subsidiary Undertakings 120 Group Five Year Summary 122 3 Kingspan Group plc Annual Report & Financial Statements 2015 Summary Financials Revenue up 47% EBITDA1 up 67% Trading Profit2 up 72% e2.77bn e316.4m e255.9m 2014: a1.89bn 2014: a189.3m 2014: a148.5m 1 Earnings