FBD Holdings Annual Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 Annual Report and Form 20-F

Overview Strategy Review Business Performance Governance Financial Statements Supplementary 20-F Disclosures Shareholder Information Index 2018 Annual Report and Form 20-F Overview Strategy Review Business Performance Governance Financial Statements Supplementary 20-F Disclosures Shareholder Information Index CRH Annual Report and Form 20-F I 2018 CRH Annual Report and Form 20-F I 2018 Contents 2018 How our Performance Overview Business Performance Financial Statements Our Global Business in 2018 ....................2 Business Overview .................................26 Independent Auditor’s Reports .............112 Why Invest in Us .......................................4 Finance Director’s Review .......................27 Consolidated Financial Statements .......123 Highlights Chairman’s Introduction ............................5 Segmental Reviews ................................32 Accounting Policies ..............................128 Notes on Consolidated Strategy Review Governance Financial Statements ............................139 €26.8bn Chief Executive’s Review ..........................8 Board of Directors ..................................54 global Sales €25.2bn Strategy ..................................................10 Corporate Governance Report ...............58 Supplementary 20-F Disclosures ......214 Business Model ......................................12 Directors’ Remuneration Report..............68 Shareholder Information ....................238 Measuring Performance ..........................14 Directors’ Report -

Applications Granted

DATE : 21/09/2011 KILKENNY COUNTY COUNCIL TIME : 15:40:28 PAGE : 1 P L A N N I N G A P P L I C A T I O N S PLANNING APPLICATIONS GRANTED FROM 11/09/2011 TO 17/09/2011 in deciding a planning application the planning authority, in accordance with section 34(3) of the Act, has had regard to submissions or observations recieved in accordance with these Regulations; that it is the responsibility of any person wishing to use the personal data on planning applications and decisions lists for direct marketing purposes to be satisfied that they may do so legitimately under the requirements of the Data Protection Acts 1988 and 2003 taking into account of the preferences outlined by applicants in their application FILE APP. DATE M.O. M.O. NUMBER APPLICANTS NAME TYPE RECEIVED DEVELOPMENT DESCRIPTION AND LOCATION DATE NUMBER 10/718 The Aspect Hotel Kilkenny c/o R 23/12/2010 RETENTION PERMISSION for a new bored well to 16/09/2011 420 Clement Gleeson GM on behalf of supplement existing public supply and all associated site the Dirs of PREM Group works the townlands of Springhill and Smithland South Co. Kilkenny 11/189 Stephen & Jean Calnan P 18/04/2011 to construct (1) A single storey extension to the side and 12/09/2011 411 rear (2) A first floor extension over the living area, along with all associated works to an existing bungalow Ballytarsney Mooncoin Co. Kilkenny 11/275 Michael E. Walsh P 02/06/2011 to erect dwellinghouse and all associated works 16/09/2011 419 Ballyhomuck Bigwood Mullinavat Co. -

2015-Annual-Report-Glanbia.Pdf

Glanbia plc Annual Report and Accounts 2015 DELIVERING BETTER NUTRITION FOR EVERY STEP OF LIFE’S JOURNEY Glanbia plc Annual Report and Accounts 2015 HIGHLIGHTS OF 2015 Another year of DOUBLE DIGIT GROWTH Forward-Looking Statements We are pleased to report a sixth consecutive year Glanbia plc (‘the Group’) has made forward-looking of double digit growth. We achieved a reported statements in this Annual Report that are based on management’s beliefs and assumptions and growth of 29.4% in adjusted earnings per share on information currently available to management. Forward-looking statements include, but are not (10.6% increase constant currency). We also achieved limited to, information concerning the Group’s possible or assumed future results of operations, a 29.9% increase in EBITA (10.5% constant currency) business strategies, financing plans, competitive with margin expansion of 160bps (130bps constant position, potential growth opportunities, potential operating performance improvements, the effects currency) and strong operating cashflow of €281.4 of competition and the effects of future legislation or regulations. Forward-looking statements include million. We are increasing our dividend by 10% to all statements that are not historical facts and can be identified by the use of forward-looking 12.1 cent per share. The outlook is positive and terminology such as the words ‘believe,’ ‘develop,’ we are guiding 8% to 10% growth in adjusted ‘ensure,’ ‘arrive,’ ‘achieve,’ ‘anticipate,’ ‘maintain,’ ‘grow,’ ‘aim,’ ‘deliver,’ ‘sustain,’ ‘should’ or the earnings per share, constant currency, for 2016. negative of these terms or similar expressions. Forward-looking statements involve risks, uncertainties and assumptions. -

Morning Wrap

Morning Wrap Today ’s Newsflow Equity Research 26 May 2020 08:37 BST Upcoming Events Select headline to navigate to article ARYZTA COVID-19 challenges to the fore, though liquidity Company Events robust 26-May ARYZTA; Q320 Results 27-May Hibernia REIT; FY Results FBD Holdings Business update on BI cover; test case to 28-May Non-Standard Finance; FY19 Results Norwegian Air Shuttle; Q120 Results go to commercial courts Irish Banks EBA paper on first insights into Covid-19 impact on EU banks Mondi Ferguson CFO joins Mondi Economic Events Ireland 28-May Retail Sales Apr20 United Kingdom United States Europe This document is intended for the sole use of Goodbody Stockbrokers and its affiliates Goodbody Capital Markets Equity Research +353 1 6419221 Equity Sales +353 1 6670222 Bloomberg GDSE<GO> Goodbody Stockbrokers UC, trading as “Goodbody”, is regulated by the Central Bank of Ireland. In the UK, Goodbody is authorised and subject to limited regulation by the Financial Conduct Authority. Goodbody is a member of Euronext Dublin and the London Stock Exchange. Goodbody is a member of the FEXCO group of companies. For the attention of US clients of Goodbody Securities Inc, this third-party research report has been produced by our affiliate, Goodbody Stockbrokers Goodbody Morning Wrap ARYZTA COVID-19 challenges to the fore, though liquidity robust ARYZTA provided a Q3 update (end April) this morning with organic revenues down 21.5%. Recommendation: Hold ARYZTA now expects that COVID-19 will have a material impact on FY20 performance Closing Price: €0.44 though it is not possible to fully assess the consequences that will result from the short and longer-term impact. -

Glanbia Reports Improving Trends in Q3 2020

THIRD QUARTER 2020 INTERIM MANAGEMENT STATEMENT Glanbia reports improving trends in Q3 2020 29 October 2020 – Glanbia plc, the global nutrition group (‘Glanbia’ or the ‘Group’), is issuing this Interim Management Statement for the nine month trading period ended 3 October 2020 (“Q3 YTD” or “first nine months of 2020”). Summary Improving trends in Q3 2020 while navigating the challenges resulting from the Covid-19 pandemic; Q3 YTD wholly owned revenues up 1.0% reported. On a like-for-like* basis up 3.1% versus prior year; Good performance from Glanbia Nutritionals (“GN”) maintaining growth trajectory, Q3 YTD like-for-like revenues up 10.9% versus prior year; Foodarom acquisition closed in the third quarter; Improving trends in Glanbia Performance Nutrition (“GPN”) in the third quarter. Q3 2020 like-for-like branded revenue down 2.3% versus Q3 2019 with positive pricing. Q3 2020 EBITA margin in double digits; GPN transformation programme on track and delivering margin improvements; Joint Ventures (“JVs”) continue to deliver a robust performance; Group is in a strong financial position, net debt at Q3 period end improved by €187.7 million versus the prior year with a net debt to EBITDA ratio of 1.95 times; Glanbia announces intention to launch a share buy-back programme of up to €50 million; and In Q4 2020, notwithstanding continued Covid-19 related uncertainty, Glanbia expects GN and JVs to continue to deliver a resilient earnings performance in addition to further sequential improvement in GPN. Commenting today, Siobhán Talbot, Group Managing Director said: “I would like to again acknowledge the tremendous efforts of all my Glanbia colleagues as well as our supplier and customer partners as we navigate the challenges of 2020. -

Glanbia Plc 2009 Annual Report

Glanbia plc 2009 Annual Report Glanbia plc Glanbia plc, Glanbia House, Tel +353 56 777 2200 Kilkenny, Ireland. Fax +353 56 777 2222 www.glanbia.com 2009 Annual Report Cautionary statement The 2009 Annual Report contains forward-looking statements. These statements have been made by the Directors in good faith, based on the information available to them up to the time of their approval of this report. Due to the inherent uncertainties, including both economic and business risk factors, underlying such forward- looking information, actual results may differ materially from those expressed or implied by these forward-looking statements. The Directors undertake no obligation to update any forward- looking statements contained in this report, whether as a result of new information, future events, or otherwise. Get more online www.glanbia.com Glanbia plc 2009 Annual Report Contents 1 Overview of Glanbia Introduction 2 Financial results 3 Glanbia at a glance 4 Directors’ report: Business review Chairman’s statement 6 Group Managing Director’s review 8 International growth strategy 10 Operations review US Cheese & Global Nutritionals 14 Dairy Ireland 16 Joint Ventures & Associates 18 Finance review 22 Risk management 28 Our responsibilities 30 Our people 31 Directors’ report: Corporate governance Board of Directors 34 Statement on corporate governance 36 Statement on Directors’ remuneration 46 Other statutory information 54 Statement of Directors’ responsibilities 55 Financial statements Independent auditors’ report to the members of Glanbia -

20100107 Trading Notice Functional 0221

Trading Notice - 0221 Date: 7th January 2010 Priority: Notification Bulletin Subject: Chi-X launches services in Irish stocks with EMCF N.V. on 22 nd January 2010 Sent from: Trading Operations Message: Chi-X Europe Ltd (Chi-X) is pleased to announce the addition of the Irish market segment to its EMCF cleared stock universe. The following ISEQ 20 stocks will be available to trade from Friday 22nd January 2010: Chi-X Bloomberg Name UMTF RIC Chi-X RIC Bloomberg Code ISIN Allied Irish Banks PLC AIBi ALBK.I ALBKi.CHI ALBK ID ALBK IX IE0000197834 Aryzta AG YZAi ARYN.I ARYNi.CHI YZA ID YZA IX CH0043238366 Bank of Ireland BIRi BKIR.I BKIRi.CHI BKIR ID BKIR IX IE0030606259 C&C Group PLC GCCi GCC.I GCCi.CHI GCC ID GCC IX IE00B010DT83 CRH PLC CRGi CRH.I CRHi.CHI CRH ID CRH IX IE0001827041 DCC PLC DCCi DCC.I DCCi.CHI DCC ID DCC IX IE0002424939 Dragon Oil PLC DRSi DGO.I DGOi.CHI DGO ID DGO IX IE0000590798 Elan Corporation PLC DRXi ELN.I ELNi.CHI ELN ID ELN IX IE0003072950 F.B.D Holdings PLC EG7i FBD.I FBDi.CHI FBD ID FBD IX IE0003290289 Glanbia PLC GL9i GL9.I GL9i.CHI GLB ID GLB IX IE0000669501 Grafton Group PLC GN5i GRF_u.I GRF_ui.CHI GN5 ID GN5 IX IE00B00MZ448 Greencore Group PLC GCGi GNC.I GNCi.CHI GNC ID GNC IX IE0003864109 Independent News & Media PLC IPDi INME.I INMEi.CHI INM ID INWS IX IE0004614818 Irish Life & Permanent PLC ILBi IPM.I IPMi.CHI IPM ID IPM IX IE0004678656 Kerry Group PLC KRZi KYGa.I KYGai.CHI KYG ID KYG IX IE0004906560 Kingspan Group PLC KRXi KSP.I KSPi.CHI KSP ID KSP IX IE0004927939 Paddy Power PLSi PAP.I PAPi.CHI PWL ID PWL IX IE0002588105 Ryanair Holdings PLC RY4Bi RYA.I RYAi.CHI RYA ID RYA IX IE00B1GKF381 Smurfit Kappa Group PLC SK3i SKG.I SKGi.CHI SKG ID SKG IX IE00B1RR8406 United Drug PLC UN6Ai UDG.I UDGi.CHI UDG ID UDG IX IE0033024807 Current Trading Participants who require access to the above market segment are required to complete, sign and return the Access to Markets form to Chi-X Compliance. -

FBD Insurance Plc Annual Report 2014

THROUGH FBD Insurance plc Annual Report 2014 Contents Financial Statements 2 Chairman’s Statement 14 Statement of Accounting Policies 5 Board of Directors and Other Information 17 Profit and Loss Account/Technical Account – General Business 6 Report of The Directors 18 Profit And Loss Account/Non-Technical Account 11 Corporate Governance Report 19 Balance Sheet 13 Independent Auditor’s Report 21 Cash Flow Statement 22 Statement of Reconciliation of Movement in Ordinary Shareholders’ Funds 23 Notes to the Financial Statements 44 Notice of Annual General Meeting FBD INSURANCE PLC Annual Report 2014 1 Chairman’s Statement OVERVIEW BUSINESS REVIEW 2014 was a very difficult year for the Irish insurance market Underwriting and FBD, with a significant market-wide deterioration in Premium Income the claims environment and severe weather experience. As a result, the Company recorded a loss before taxation FBD’s gross premium written increased by 3.6% to €363.7m of €5.9m. The Company’s first priority is to return to (2013: €351.2m), marginally increasing the Company’s profitability and, although significant progress was made in market share to 13.7%. FBD shifted emphasis during the 2014, it will be some time before the full benefits of the year so as to increase focus on risk selection and rate-led actions taken are reflected in profitability. price adequacy. This was necessary given that the industry is incurring losses, there is significant deterioration in the While it was known that the improving economy would claims environment and that the Company’s objective is to have an impact on the claims environment, the worsening of deliver only profitable growth. -

Introduction of a Central Counterparty at Irish Stock Exchange Information for Production Start

eurex circular 2 41/05 Date: Frankfurt, November 30, 2005 Recipients: All Eurex members, CCP members and vendors Authorized by: Daniel Gisler Introduction of a Central Counterparty at Irish Stock Exchange Information for Production Start Related Eurex Circulars: 057/05, 230/05 Contact: Customer Support, tel. +49-69-211-1 17 00 E-mail: [email protected] Content may be most important for: Attachment: Ü Front Office / Trading Updated List of CCP-eligible Securities for ISE Ü Middle + Back Office Ü Auditing / Security Coordination With this circular we complement information on the introduction of a Central Counterparty for the Irish stock market scheduled for next Monday, December 5, 2005. The Central Counterparty (CCP) for securities traded in the Xetra order book at Irish Stock Exchange (ISE) originated from a common initiative of Irish Stock Exchange, Euroclear/CRESTCo Limited and Deutsche Börse AG. Eurex Clearing AG, which already renders CCP services for other markets, acts as CCP. The product range for production start on December 5, 2005 comprises Irish stocks and Exchange Traded Funds (ETFs) traded in the Xetra order book at Irish Stock Exchange. Please find attached to this circular an updated list of securities which will be CCP-eligible for ISE effective December 5, 2005. Should you have any questions or require further information, please feel free to contact the Customer Support Team at tel. +49-69-211-1 17 00. Eurex Clearing AG Customer Support Chairman of the Executive Board: Aktiengesellschaft mit Sitz D-60485 Frankfurt/Main Tel. +49-69-211-1 17 00 Supervisory Board: Rudolf Ferscha (CEO), in Frankfurt/Main www.eurexchange.com Fax +49-69-211-1 17 01 Dr. -

Morning Wrap

Morning Wrap Today ’s Newsflow Equity Research 26 Apr 2016 Upcoming Events Select headline to navigate to article Paper & Packaging Leipa capacity addition may be Company Events delayed further 27-Apr CRH; Q1 IMS Glanbia; Q1'16 resutls Kerry Group; Q1'16 results 28-Apr Bank of Ireland; Q1'16 results Origin Enterprises Q1 updates from Bayer and Du Pont Howden Joinery; Trading update Applegreen Another independent operator gets funding to drive growth Builders Merchants Growth slows for Carpetright but upgrade gross margin guidance Breedon Aggregates Proposal put forward to the CMA to satisfy competition concerns Economic Events Ireland 28-Apr Retail Sales Mar'16 29-Apr Unemployment Rate Apr'16 UK Economic View Sterling benefits as “Remain” Residental Property Prices YoY Mar campaign gains momentum United Kingdom 26-Apr BBA Loans for House Pucrhase Mincon Group Sandvik report Q1 results; Mining continues 27-Apr GDP YoY 28-Apr Nationwide House Price NSA YoY to see challenges United States 26-Apr US Services PMI CPL Resources Randstad Q1 in-line, though UK lags Durable Goods Orders 27-Apr Pending Home Sales MoM 28-Apr GDP Annualised QoQ Glanbia 8% organic growth at DSM’s human nutrition 29-Apr U. of Michigan Sentiment Chicago Purchasing Manager division Europe 29-Apr CPI Apr'16 Unemployment Rate GDP SA YoY Goodbody Capital Markets Equity Research +353 1 6419221 Equity Sales +353 1 6670222 Bloomberg GDSE<GO> Goodbody Stockbrokers (trading as Goodbody) is regulated by the Central Bank of Ireland. For the attention of US clients of Goodbody Securities Inc, this third-party research report has been produced by our affiliate Goodbody Stockbrokers. -

FBD Holdings Annual Report 2018

Protection. It’s in our nature. FBD Holdings plc Annual Report 2018 In the years report Strategic Report 1 FBD at a Glance 1 Financial Highlights 2 2018 in Pictures 3 Chairman's Statement 4 Review of Operations 8 Our Business Model 14 Our Strategy 16 Risk & Uncertainties Report 18 Corporate Social Responsibility 25 Corporate Information 29 Governance 32 Board of Directors 32 Report of the Directors 34 Corporate Governance 40 Report on Directors’ Remuneration 50 Directors’ Responsibilities Statement 59 Independent Auditors’ Report 60 Financial Statements 70 Consolidated Income Statement 70 Consolidated Statement of Comprehensive Income 71 Consolidated Statement of Financial Position 72 Consolidated Statement of Cash Flows 74 Consolidated Statement of Changes in Equity 75 Company Statement of Financial Position 76 Company Statement of Cash Flows 77 Company Statement of Changes in Equity 78 Notes to the Financial Statements 79 Other Information 138 Alternative Performance Measures 138 Letter from the Chairman in relation to the Annual General Meeting 140 Notice of Annual General Meeting 142 STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS OTHER INFORMATION FBD at a Glance Established in the 1960s by farmers for farmers, FBD has built on those roots in agriculture to become a leading general insurer directly serving the needs of agricultural, small business and consumer customers throughout Ireland. 2018 Performance Highlights PROFIT BEFORE TAX COMBINED OPERATING RATIO GROSS WRITTEN PREMIUM €50m 81% €372m In line with €50m profit Improvement -

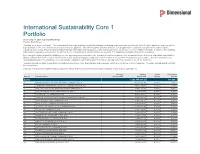

International Sustainability Core 1 Portfolio As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

International Sustainability Core 1 Portfolio As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions