Emico-Annual-Report-2012.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Universiti Sains Malaysia

ALAMAT MAJIKAN BIL ALAMAT MAJIKAN 11. ARCHITECT DESIGN PRACTICE 1. AB LER ARCHITECT Suite 2-1, Lot 2812 31-3-2 Jalan 1/4B Bukit Mas Block 195, Rubber Road West Taman Melawati 93400 Kuching, Sarawak 53100 Kuala Lumpur Tel: 082-415278 Fax: 082-243521 Tel: 03-41072032 Fax: 03-41078332 12. ARI PLANNING 2. ABH MEGA SDN BHD No. 70-B, Jalan PSK 2 No. 10, Jalan Sembilang 2 Pekan Simpang Kuala Bandar Seberang Jaya, Perai 05400 Alor Setar, Kedah Pulau Pinang Tel: 04-7728848 Fax: 04-7712708 Tel: 04-3992702/ 3992703 ARIFFIN ARCHITECTS Fax: 04-3980196 56C, Jalan Mamanda 9, Ampang Point 3. AJC PLANNING CONSULTANTS SDN BHD 68000 Ampang, Selangor 5, Jalan Semangat, First Floor Tel: 03-42604288 Fax: 03-42604289 46200 Petaling Jaya 13. ARKITEK AAP Selangor Darul Ehsan 589-A, Taman Melaka Raya Tel: 03-79568999 Fax: 03-79569320 75000 Melaka 4. AJM PLANNING & URBAN DESIGN GROUP Tel: 06-2825795 SDN BHD 14. ARKITEK DING POI KOOI Unit 46E-8, Level 8, Mentari Business Park 44-46B, Medan Istana 1 Jalan PJS 8/2, Dataran Mentari Bandar, Ipoh Raya 46150 Petaling Jaya, Selangor 30000 Ipoh, Perak Tel: 03-56377703 / 56379615 / 56317785 Tel: 05-2533179 / 2417949 Fax: 03-56378701 Fax: 05-2410414 5. AKI MEDIA 15. ARKITEK EHWAN OTHMAN SDN BHD 1st & 2nd Floor, Lot 9034, Section 64 32, Taman Perkota, 75350 Melaka Lorong Sekama No. 3, Jalan Sekama Tel: 06-2841398 Fax: 06-2839599 93300 Kuching, Sarawak 16. ARKITEK HALUAN REKA Tel: 082-484366 1931-E, Taman Darulaman 6. ALIRAN MURNI SDN BHD 05100 Alor Setar, Kedah No. -

Chapter 5 Description of Existing Environment 5.1

Commercial In Confidence Enviro Services Sdn. Bhd. CHAPTER 5 DESCRIPTION OF EXISTING ENVIRONMENT 5.1 General Environmental Setting (5.1) The future transformation in line for the Proposed Project site is the change in use of an existing office block to a hotel with related facilities on 3,272 m2 (0.808 acres) of land. The project site lies close to the coastal zone whereby Jalan Sultan Ahmad Shah forms the boundary in the north and Jalan Clove Hall forms the boundary to the west. The Mayfair Condominium occupies Lot 1238 located to the northeast of the project site. 5.2 Physical-Chemical Environment 5.2.1 Land Form And Topography (5.2) The project site is easily accessibly by taking Jalan Sultan Ahmad Shah which provides linkages to Jalan Clove Hall which is the primary access to the Proposed project. (5.3) The Proposed Project lies on flat terrains of RL+ 4.10 m to RL+ 4.36 m above mean sea level as shown in the survey plan in Figure 5.1 and in Appendix B. There is no stream or river that transverses the site. Presently an office block of 25 storey high occupies the site of which AmBank is the major tenant occupying the building. Jalan Sultan Ahmad Shah forms the northern boundary of the site whilst Jalan Clove Hall forms the boundary in the west. 5.2.2 General Geology (5.4) According to Ong (1993), the main island of Pulau Pinang can be divided morphologically into five slopes categories: 0-30, 30-100, 100-190, 200-300, and greater than 300. -

For Rent - MBF Tower, Georgetown, Penang

iProperty.com Malaysia Sdn Bhd Level 35, The Gardens South Tower, Mid Valley City, Lingkaran Syed Putra, 59200 Kuala Lumpur Tel: +603 6419 5166 | Fax: +603 6419 5167 For Rent - MBF Tower, Georgetown, Penang Reference No: 100274776 Tenure: Freehold Address: No. 53, Jalan Sultan Ahmad Occupancy: Vacant Shah, Georgetown, 10050, Furnishing: Fully furnished Penang Unit Type: Intermediate State: Penang Land Title: Residential Property Type: Apartment Property Title Type: Strata Rental Price: RM 2,299 Posted Date: 31/05/2021 Built-up Size: 1,500 Square Feet Facilities: BBQ, Parking, Jogging track, Built-up Price: RM 1.53 per Square Feet Playground, Business centre, No. of Bedrooms: 3 Gymnasium, Mini market, No. of Bathrooms: 2 Swimming pool, 24-hours security, Jacuzzi, Sauna, Wading pool Property Features: Kitchen cabinet,Air Name: Kevin Kwan conditioner,Bath tub,Balcony Company: Chin Housing Realty Email: [email protected] MBF Tower For Rent 1+1 car park Fully Renovated Fully Furnished Beautiful view of the sea. Near Gleneagles Hospital Island Hospital Wawasan University Livingston Tower KDU Gurney Paragon Gurney Plaza Close to Penang Ferry. Close to the city and a variety of amenities. Close to amenities and facilities. MBF Tower is a freehold condominium located along Jalan Sultan Ahmad Shah in Heart of Georgetown, next to the Northam Hotel. 5 minutes walk to Gurney Drive. MBF Tower consists of a 29- storey apartment blocks. Each apartment has a built-up area of 1,500 and come with .... [More] View More Details On iProperty.com iProperty.com Malaysia Sdn Bhd Level 35, The Gardens South Tower, Mid Valley City, Lingkaran Syed Putra, 59200 Kuala Lumpur Tel: +603 6419 5166 | Fax: +603 6419 5167 For Rent - MBF Tower, Georgetown, Penang. -

The 21St Century Kitchen 未来21 世纪环保厨房

François obtained his Baccalauréat Degree in France and his DESA designation by completing his architect studies in December of 1995 from Ecole Spéciale d'Architecture (E.S.A.), Paris France. He is the founder of 3bornes ARCHITECTES, specialised in Food Service: in particular on the design and building of kitchen and equipment and advising (auditing, feasibilities, programs). François is the recipient of many prestigious awards namely: Label de l'Observeur du Design 2004; Etoile du design, Paris. 2002; finalist at the Stainless Steel Awards 2002 awarded by SASSDA (Southern Africa Stainless Steel Development Association), Johannesburg. 2001 Grand Prix de l’Innovation du SIRHA 2001, Lyon. 1999 ; Prix International de l’Innovation Technologique en Restauration APRIA 99 (special mention), Paris. He is also a member The 21st Century Kitchen of many distinguished associations and societies including: Ordre des architectes, 未来 21 世纪环保厨房 MERIA (Association des Métiers de la Restauration et de l’Ingénierie Alimentaire) , SYNAIRH (Syndicat National des Consultants et de l’Ingénierie de la Restauration et de Main Speaker 主讲者 l’Hôtellerie) , CICF R & H (Chambre de l'Ingénierie et du Conseil de France Restauration Francois Tesnière, D.E.S.A. FCSI, & Hôtellerie) , CPRC (Comité Permanent de la Restauration Collective) , AFEX CPRC 佛兰斯 特奈尔先生 (Architectes Français à l'EXport) and FCSI. François is a visionary and revolutionary creator/designer, won world acclaim to his ® Founder and Director of 3bornes 2zones² design on international press (more than 250 articles, on 5 continents and in ARCHITECTES 13 languages. His design was considered as one of the 5 most important innovations of the last 30 years and was declared as the only innovation in term of kitchen design since ® Address: MBF Tower, Jalan Sultan the "Marche en Avant" regulation in 1974. -

Malaysia 2018 ASIA PACIFIC REAL ESTATE MARKET OUTLOOK | MALAYSIA

CBRE | WTW RESEARCH 2018 ASIA PACIFIC REAL ESTATE MARKET OUTLOOK Malaysia 2018 ASIA PACIFIC REAL ESTATE MARKET OUTLOOK | MALAYSIA FORMATION A B OU T W T W CBRE | WTW entered into an agreement in May 2016 to Colin Harold Williams established C H Williams & Co in form a joint venture to provide a deep, broad service offering Kuala Lumpur in 1960. C H Williams & Company merged for the clients of both firms. This combines Malaysia’s in 1974 with Talhar & Company founded by Mohd Talhar largest real estate services provider, WTW’s local expertise Abdul Rahman and the inclusion of Wong Choon Kee to and in-depth relationships in Malaysia with CBRE’s global form C H Williams Talhar & Wong (WTW). reach and broad array of market leading services. In 1975, C H Williams Talhar Wong & Yeo (WTWY) was The union of CBRE and WTW is particularly significant established in Sarawak. C H Williams Talhar & Wong because of our shared history. In the1970s, CBRE acquired (Sabah) (WTWS) was established in 1977. businesses from WTW in Singapore and Hong Kong, which remain an integral part of CBRE’s Asian operations. The current management is headed by Group Chairman, Mohd Talhar Abdul Rahman. The wider WTW Group comprises a number of subsidiaries and associated offices located in East Malaysia including: The current Managing Directors of the WTW Group operations are: • C H Williams Talhar Wong & Yeo Sdn Bhd (1975) • CBRE | WTW: Mr. Foo Gee Jen • C H Williams Talhar & Wong (Sabah) Sdn Bhd (1977) • C H Williams Talhar & Wong (Sabah) Sdn Bhd: Mr. -

No. Name Address City Postcod State Country Off. No. Email 1 JING

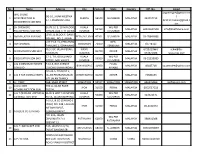

No. Name Address City Postcod State Country Off. No. Email [email protected] JING SHENG BG-16, JALAN MESTIKA / 1 CONSTRUCTION & CHERAS 56100 SELANGOR MALAYSIA 342957713 17, TAMAN MESTIKA [email protected] ENGINEERING SDN BHD om 2H OFFSHORE SUITE 16-3, 16TH FLOOR, KUALA WIL PER 2 50450 MALAYSIA 60321627500 [email protected] ENGINEERING SDN BHD WISMA UOA II, 21 JALAN LUMPUR K.LUMPUR LEVEL 8, BLOCK F, OASIS 3 3M MALAYSIA SDN BHD PETALING JAYA 47301 SELANGOR MALAYSIA 03-78842888 SQUARE, NO. 2, JALAN LOT 15 & 19, PERSIARAN NEG. 4 3M SEREMBA SEREMBAN 70450 MALAYSIA 66778111 TANJUNG 2, SENAWANG SEMBILAN PLO 317, JALAN PERAK, PASIR 072521288 / schw@5e- 5 5E RESOURCES SDN BHD 81700 JOHOR MALAYSIA KAWASAN GUDANG 072521388 resources.com 17-6, THE BOULEVARD KUALA WIL PER 6 8 EDUCATION SDN BHD 59200 MALAYSIA 03-22018089 OFFICE, MID VALLEY LUMPUR K.LUMPUR A & D DESIGN NETWORK F-10-3, BAY AVENUE PULAU 7 BAYAN LEPAS 11900 MALAYSIA 46447718 [email protected] SDN BHD LORONG BAYAN INDAH 1 PINANG NO 23-A, TINGKAT 1, 8 A & K TAX CONSULTANTS JALAN PEMBANGUNAN JOHOR BAHRU 81200 JOHOR MALAYSIA 72385635 OFF JALAN TAMPOI 9 A + PGRP 36B, SAGO STREET SINGAPORE 50927 SINGAPORE SINGAPORE 656325866 [email protected] A A DESIGN 390-A, JALAN PASIR 10 IPOH 31650 PERAK MALAYSIA 6052537518 COMMUNICATION SDN PUTEH, A H T (NORLAN UNITED) & BLOK B UNIT 4-8 IMPIAN KUALA WIL PER 11 50460 MALAYSIA 322722171 CARRIAGE SDN BHD KOTA, JALAN KAMPUNG LUMPUR K.LUMPUR A JALIL & CO SDN BHD ( IPOH ) NO. 14B, LALUAN IPOH 31350 PERAK MALAYSIA 05-3132072 MEDAH RAPAT, 12 A JALIL & CO SDN BHD GUNUNG RAPAT, NO. -

MASPEX2015 MALAYSIAN SECONDARY PROPERTY EXHIBITION P E N a N G 13 - 16 August 2015 • Queensbay Mall, Penang

MASPEX2015 MALAYSIAN SECONDARY PROPERTY EXHIBITION P E N A N G 13 - 16 August 2015 • Queensbay Mall, Penang ORGANISING COMMITTEE Mark Saw Organising Chairman MASPEX Penang 2015 Kayte Teh Erick Kho Danny Ooi Kayrens Lee Vice President President Immediate Past President Honorary Secretary Advisor Advisor Advisor Mark Saw - Chairman Danny Ooi - Immediate Past Chairman Kayrens Lee - Honorary Secretary Lena Lim - Honorary Treasurer Jarrone Long - Deputy Head Of Youth Michael Geh - Committee Member Johnny Khoo - Committee Member\ Genny Tse - Committee Member Lena Lim Jarrone Long Michael Geh Johnny Khoo Mary Looi - Committee Member Honorary Treasurer Deputy Head Of Youth Committee Member Committee Member Florence Lim - Committee Member Long Soo Keat - Head Of Youth Celvin Tan - Youth Committee Member Miki Lim - Youth Committee Member Sunny Tse - Youth Committee Member Season Ting - Youth Committee Member Genny Tse Mary Looi Florence Lim Long Soo Keat Committee Member Committee Member Committee Member Head Of Youth Celvin Tan Miki Lim Sunny Tse Season Ting Youth Committee Member Youth Committee Member Youth Committee Member Youth Committee Member MASPEX2015 MALAYSIAN SECONDARY PROPERTY EXHIBITION P E N A N G 13 - 16 August 2015 • Queensbay Mall, Penang PROGRAMME -Thursday, 13th Aug 2015 11.00 am Arrival of Guests 11.30 am Speech by Chairman of MASPEX, Mr Mark Saw 11.40am Speech by MIEA President, Mr Erick Kho 11.55 am Speech by Maybank, Ms Tracy Pan, Head of Mortgage 12 noon Speech by Guest Of Honour, YB Chow Kon Yeow 12.15 pm Official Opening Ceremony 12.30 pm Walk About Exhibition 12.45 pm Press Conference 1.00 pm Lunch PROGRAMME - Saturday, 15th Aug 2015 10.45 am Why Purchase Secondary Properties? Erick Kho, President of MIEA 11.30 am Penang State Government's Affordable Homes and Penang's Transportation Master Plan Y.B. -

Towards a Sustainable Architecture

PASCUAL PATUEL CHUST Profesor Titular de la Universidad de Valencia. Facultad de Geografía e Historia. Departamento de Historia del Arte. [email protected] Towards a Sustainable Architecture 227-250 pp Recibido: 17-04-2014 - revisado 11-05-2014 - aceptado: 30-05-2014 © Copyright 2012: Servicio de Publicaciones de la Universidad de Murcia. Murcia (España) vol 10-11 / Jul-Dic. 2014 ISSN edición impresa: 1889-979X. ISSN edición web (http://revistas.um.es/api): 1989-8452 Towards a Sustainable Architecture Pascual Patuel Chust HACIA UNA ARQUITECTURA SOSTENIBLE ABSTRACT The growing awareness of the importance of ecology in the last decades has led many architects to rethink their construction proposals to make them more respectful of the environment and sustainability. The present article analyzes the legislation, conferences and international declarations (Earth Summit, Declaration of Interdependence for a Sustainable Future, Introduction to Sustainable Design) that have advocated the practice of a more ecological architecture. Also examined are the technological guidelines used to create an architecture that is both sustainable and harmonious with the natural surroundings, the construction materials employed in these buildings, their processes of air conditioning and lighting, and the physical and spiritual health of their occupants. Reference is made to the pioneers in the development of this sustainable architecture: Charles Correa, Brenda and Robert Vale, Kenneth Yeang. Finally, we provide some current examples of cities and buildings that have been the object of special ecological attention, realized by architects such as: Richard Rogers, Renzo Piano, Norman Foster, Jean Nouvel and Herzog & de Meuron. Keywords Sustainable architecture, Ecological architecture, Green architecture, Low energy architecture. -

A N N U a L R E P O

2 Annual Report 2 Board of Directors & Group Senior Management 3 Corporate Information 4 Chairman's Statement 6 Message from Managing Director & Chief Executive Officer 9 Financial Statements 73 Statistics on Shareholdings 76 List of Properties 86 Terms of Reference of Audit Committee 88 Notice of Annual General Meeting 90 Annexure l 99 Proxy Form TUNKU DATO SERI ISKANDAR BIN TUNKU ABDULLAH S.P.T.J., D.N.S. Chairman DATO' LOY TEIK NGAN D.I.M.P. Managing Director & Chief Executive Officer AZIZAN BIN ABDUL RAHMAN Executive Director Member of Audit Committee KALIMULLAH BIN MASHEERUL HASSAN Executive Director HAJI OTHMAN BIN HITAM Independent non-executive director Chairman of Audit Committee DATO' GHAZI BIN ISHAK Independent non-executive director Member of Audit Committee TAN SRI CHONG CHIN SHOONG P.S.M., D.P.M.P., JP. Director CORPORATE DATO' LOY TEIK NGAN D.I.M.P Managing Director & Chief Executive Officer YAP BOON TECK President-Corporate DING LIEN BING Senior Vice-President Group Financial Controller DIVISIONS CARD AND PAYMENT SERVICES DONALD LEE President MANUFACTURING CHIN CHUA ENG President PROPERTY YAW KEM KEONG General Manager TRADING & CONSUMER SERVICES-International MBf CARPENTERS LTD. KENNETH JOHN CLEMENS Managing Director MOTOR VEHICLES & EQUIPMENT YEOW EWE HOR President 3 REGISTERED OFFICE Block B1, Level 9 Pusat Dagang Setia Jaya (Leisure Commerce Square) No. 9, Jalan PJS 8/9 46150 Petaling Jaya Selangor Darul Ehsan Tel: 7861 2100 Fax: 7861 2200 REGISTRAR Insurban Corporate Services Sdn Bhd 149, Jalan Aminuddin Baki Taman Tun Dr Ismail 60000 Kuala Lumpur Tel: 7729 5529 / 7727 3873 Fax: 7728 5948 MAIN BANKERS Arab-Malaysian Finance Berhad Arab-Malaysian Bank Berhad Malayan Banking Berhad STOCK EXCHANGE LISTING The Kuala Lumpur Stock Exchange (Main Board) AUDITORS Arthur Andersen & Co. -

AMMB Holdings 2006 Annual.Pdf

AHB AR06-1a_060706.qxd 7/7/06 3:41 AM Page 203 ANNUAL REPORT 2006 AMMB Holdings Berhad (223035-V) (Incorporated in Malaysia) AHB AR06-1a_060706.qxd 7/7/06 1:40 AM Page 204 Corporate Mission “To entrench our position as a premier financial services group providing innovative products and services to our customers.” 2006 Cover Rationale What customers look for is a financial partner of choice who will provide better expertise and a spectrum of innovative financial solutions. It is all about experience, dedication, commitment, professionalism and integrity. The cover for 2006 is splashed with ‘waves’ that symbolise the arches of the AmBank Group logo. The strong colours of red and yellow are the core colours of the AmBank Group. Red symbolises energy, strength, power, courage, prosperity and tenacity, whilst yellow reflects confidence, cheerfulness, enthusiasm, creativity, encouragement and a vibrant presence. White enhances the positive values signifying our unity, consistency and simplicity of unwavering focus towards new levels of excellence. AHB AR06-1a_060706.qxd 7/7/06 1:40 AM Page 1 Customer Contents 2 Notice of Fifteenth Annual General Meeting 4 Letter to Shareholders F 9 Our Philosophy 10 History and Recent Corporate Developments 16 Service Quality Improvement 18 Corporate Structure – Subsidiaries and Associated Companies 19 Organisation Structure 20 Board of Directors/Corporate Information I 22 Profile of Directors 30 The Management 32 Corporate Governance 41 Compliance with Bursa Malaysia Listing Requirements 43 Managing Risks -

![Downloaded by [Central Uni Library Bucharest] at 03:22 26 September 2013 Concrete Slab](https://docslib.b-cdn.net/cover/5708/downloaded-by-central-uni-library-bucharest-at-03-22-26-september-2013-concrete-slab-6345708.webp)

Downloaded by [Central Uni Library Bucharest] at 03:22 26 September 2013 Concrete Slab

Encyclopedia of 20th-century architecture 428 Hopkins’s Patera system, is also exoskeletal but, in contrast with the central spine, is more restrained. Anthony Hunt Associates designed the steel structure, and the lightweight structures unit of Ove Arup and Partners designed the fabric roof. A zoned servicing strategy supports the contrasting spatial and structural characters of the central spine and flanking wings. The winter garden and test station, although weather tight, are conceived as quasi-external spaces; the labs are sealed spaces in which tightly controlled environmental conditions for research can be maintained; and the offices have opening windows and sunshading that can be adjusted by the occupants. The building works as an icon in the heroic modernist tradition and, by addressing human needs, significantly advances the idea of the workplace. Transparency—with fully glazed walls between winter garden, test station, and labs and a glazed external envelope—creates a high degree of visual interaction both within the building and between the building and the outside world. An egalitarian workplace laced together by open meeting spaces and the generosity of the winter garden integrates disparate functions—clean and dirty, quiet and noisy, front and back of house. This social and programmatic integration is reiterated in the marriage of orthogonal and curvilinear geometries, of compressive and tensile structures, and of rational Miesian discipline with more exuberant expressionism. This building for Schlumberger was Michael Hopkins’s first use of a tensile fabric structure and the first large-scale architectural use of Teflon-coated fabric in the United Kingdom. Hopkins would further explore fabric structures in subsequent projects including the Mound Stand at Lord’s Cricket Ground (1987), the amenity building and ventilation towers at Inland Revenue (1995), and the Younger Universe Pavilion in Edinburgh (1998). -

Corporate Directory

Corporate Directory AmFinance Berhad Level 48, Bangunan AmFinance Jalan Yap Kwan Seng, 50400 Kuala Lumpur Correspondence Address: P. O. Box 12540, 50782 Kuala Lumpur Tel: 03-2167 3000, 2167 3200 Fax: 03-2166 5593 Telex & Answerback: MA 31167 & 31169 ABMAL Cable Address: ABMALFIN Website: www.ambg.com.my 24-hour AmDirect Call Centre: 03-2612 6888 REGIONAL OFFICES: BRANCH OFFICES: Jalan Yap Kwan Seng Sri Petaling Tel: 03-2167 6200, 2167 6388 Tel: 03-9059 4462, 9059 5458 REGION 1 WILAYAH PERSEKUTUAN Fax: 03-2162 1606 Fax: 03-9056 2512 PULAU PINANG KUALA LUMPUR Menara Liang Court Bangsar Baru Jinjang Wangsa Maju Tel: 04-226 3939 Tel: 03-2282 8739, 2282 8740 Tel: 03-6251 8741, 6251 9262 Tel: 03-4149 5207, 4149 5213 Fax: 04-227 3305 Fax: 03-2282 8741 Fax: 03-6251 9480 Fax: 03-4149 5242 REGION 2 Cheras – Pandan Jaya Kepong SELANGOR DARUL EHSAN PERAK DARUL RIDZUAN Tel: 03-9283 2842, 9285 9594 Tel: 03-6251 3322, 6251 3355 Amcorp Mall Jalan Yang Kalsom, Ipoh Fax: 03-9283 0590 Fax: 03-6259 2870 Tel: 03-7954 1327, 7954 4401 Tel: 05-249 8518 Fax: 03-7955 2575 Fax: 05-255 1061 Cheras – Taman Connaught KL Sentral Tel: 03-9132 6231, 9132 6235 Tel: 03-2272 1964, 2272 1967 Ampang REGION 3 Fax: 03-9132 6237 Fax: 03-2272 1970 Tel: 03-4252 2630, 4252 2636 MELAKA Fax: 03-4252 4160 Jalan Munshi Abdullah Cheras – Taman Maluri Overseas Union Garden Tel: 06-283 9433, 283 9569 Tel: 03-9282 2917, 9285 5266 Tel: 03-7784 7035, 7784 7036 Balakong Fax: 06-281 6911 Fax: 03-9282 6261 Fax: 03-7784 7041 Tel: 03-9074 4013, 9074 4078 172 Fax: 03-9074 4148 REGION 4 Cheras