Pwc China Automobile Industry M&A Review and Outlook

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Development of Pedestrian Protection for the Qoros 3 Sedan

13th International LS-DYNA Users Conference Session: Occupant Safety Development of Pedestrian Protection for the Qoros 3 Sedan Niclas Brannberg, Pere Fonts, Chenhui Huang, Andy Piper, Roger Malkusson Qoros Automotive Co., Ltd. 15/F HSBC Building IFC, No 8. Century Avenue Shanghai 200120, P.R. China Abstract Pedestrian protection has become an important part of the Euro NCAP consumer test and to achieve a 5-star rating for crash safety, a good rating for the different pedestrian load cases is imperative. It was decided at the very start of the Qoros 3 Sedan’s development program that this should be made a priority. A skilled team of safety engineers defined the layout of the vehicle to support this target, and an extensive simulation program using LS-DYNA® was planned to define and validate the design intent without compromising the design of the vehicle as well as maintaining all other important vehicle functions. This paper will provide an insight into part of the journey taken to establish a new vehicle brand in China, fulfilling high European safety standards at an affordable cost, and how Qoros succeeded in this mission with a combination of skills, extensive CAE analysis and finally the validation of the recipe during physical testing. The paper will highlight how the high rating for pedestrian protection was obtained and give a short overview of the complete safety development of the Qoros 3 Sedan. Introduction This paper introduces Qoros and the development of the first vehicle on Qoros’ new compact-segment platform, the Qoros 3 Sedan. It is difficult to present a whole vehicle development in one paper so this text focuses on pedestrian protection as the main topic and will discuss how the rating for pedestrian protection was obtained in the Euro NCAP test as well as discussing some areas where difficulties were encountered with the initial assessment using CAE. -

2017 Passenger Vehicles Actual and Reported Fuel Consumption: a Gap Analysis

2017 Passenger Vehicles Actual and Reported Fuel Consumption: A Gap Analysis Innovation Center for Energy and Transportation December 2017 1 Acknowledgements We wish to thank the Energy Foundation for providing us with the financial support required for the execution of this report and subsequent research work. We would also like to express our sincere thanks for the valuable advice and recommendations provided by distinguished industry experts and colleagues—Jin Yuefu, Li Mengliang, Guo Qianli,. Meng Qingkuo, Ma Dong, Yang Zifei, Xin Yan and Gong Huiming. Authors Lanzhi Qin, Maya Ben Dror, Hongbo Sun, Liping Kang, Feng An Disclosure The report does not represent the views of its funders nor supporters. The Innovation Center for Energy and Transportation (iCET) Beijing Fortune Plaza Tower A Suite 27H No.7 DongSanHuan Middle Rd., Chaoyang District, Beijing 10020 Phone: 0086.10.6585.7324 Email: [email protected] Website: www.icet.org.cn 2 Glossary of Terms LDV Light Duty Vehicles; Vehicles of M1, M2 and N1 category not exceeding 3,500kg curb-weight. Category M1 Vehicles designed and constructed for the carriage of passengers comprising no more than eight seats in addition to the driver's seat. Category M2 Vehicles designed and constructed for the carriage of passengers, comprising more than eight seats in addition to the driver's seat, and having a maximum mass not exceeding 5 tons. Category N1 Vehicles designed and constructed for the carriage of goods and having a maximum mass not exceeding 3.5 tons. Real-world FC FC values calculated based on BearOil app user data input. -

Asian Insights Sparx Regional Automobile, Oil & Metal Sectors

Asian Insights SparX Regional Automobile, Oil & Metal Sectors DBS Group Research . Equity 17 JulyRefer 2018 to important disclosures at the end of this report Asia leapfrogs in E-mobility HSI: 28,481 Transportation sector one of the largest generators of ANALYST air pollutants in major global cities Rachel MIU +852 2863 8843 [email protected] Intensifying vehicle electrification could translate to Suvro Sarkar +65 81893144 electric vehicle (EV) penetration rate of over 20% by [email protected] 2030 globally Pei Hwa HO +65 6682 3714 [email protected] For every two EVs sold globally, one will be in China, Lee Eun Young +65 6682 3708 creating a huge EV supply chain network [email protected] Yi Seul SHIN +65 6682 3704 Expect Chinese upstream suppliers to benefit from [email protected] robust development of global EV market Recommendation & valuation E-mobility is a game-changer. Electrification aims to address vehicle pollution. Western governments have plans to phase T arget out or cut fossil-fuel vehicle sales from 2025 to 2040. We Price Price PE Mk t Cap estimate global EV to account for some 20% of total vehicle Company Name Local$ Local$ Recom 18F x US$m sales by 2030, translating to about 27m units. With the rise in Battery EVs, approximately 6% of annual oil demand could disappear Contemporary Amperex 83.90 n.a. NR 55.1 27,566 by 2030. To power EV development, governments are leaning (300750 CH) more on clean energy and by 2030, half of the global energy Guoxuan High-Tech Co 13.64 n.a. -

Official Journal L 315 of the European Union

Official Journal L 315 of the European Union ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ Volume 57 English edition Legislation 1 November 2014 Contents II Non-legislative acts REGULATIONS ★ Commission Implementing Regulation (EU) No 1170/2014 of 29 October 2014 correcting the Slovenian version of Commission Regulation (EC) No 504/2008 implementing Council Directives 90/426/EEC and 90/427/EEC as regards methods for the identification of equidae (1) 1 ★ Commission Regulation (EU) No 1171/2014 of 31 October 2014 amending and correcting Annexes I, III, VI, IX, XI and XVII to Directive 2007/46/EC of the European Parliament and of the Council establishing a framework for the approval of motor vehicles and their trailers, and of systems, components and separate technical units intended for such vehicles (1) .................. 3 Commission Implementing Regulation (EU) No 1172/2014 of 31 October 2014 establishing the standard import values for determining the entry price of certain fruit and vegetables ...................... 13 DECISIONS 2014/768/EU: ★ Commission Implementing Decision of 30 October 2014 establishing the type, format and frequency of information to be made available by the Member States on integrated emission management techniques applied in mineral oil and gas refineries, pursuant to Directive 2010/75/EU of the European Parliament and of the Council (notified under document C(2014) 7517) (1) .............................................................................................................. 15 2014/769/EU: ★ Commission Implementing Decision of 30 October 2014 confirming or amending the average specific emissions of CO2 and specific emissions targets for manufacturers of new light commercial vehicles for the calendar year 2013 pursuant to Regulation (EU) No 510/2011 of the European Parliament and of the Council (notified under document C(2014) 7863) ................... -

Chinese Carmakers Slash Sales Targets

16 | MOTORING Monday, March 23, 2020 HONG KONG EDITION | CHINA DAILY Nio bullish about its Short Torque BYD transforms lines business performance to support masks Many companies in China have transformed their businesses to despite coronavirus cater to the rising demand for masks amid the coronavirus epi- demic, and leading new energy By LI FUSHENG vehicle manufacturer BYD has [email protected] joined them. On Feb 17, BYD pro- duced its first batch of masks. Chinese electric car startup We are pleased to Each of its production lines can Nio is confident about its see encouraging make 50,000 masks a day, and in prospects this year despite the total five million masks and coronavirus outbreak, expecting results to date, and 300,000 bottles of disinfectant its gross profit margin to become expect around 35 can be made on a daily basis, positive in the second quarter. making the company one of the “Based on the current trend, percent expense biggest mask manufacturers in we would hope the daily new reduction compared the world. The company plans to order rate to return to the level of expand its production lines to a last December in April,” said to the prior quarter daily capacity of up to 10 million William Li, founder and chair- even under the masks. The masks will also be man of Nio, on an earnings call pressure of the provided to other countries hit last week. hard by the virus, after meeting He expected production, outbreak.” GAC showcases its Aion LX model in Shenzhen, Guangdong province last July. -

CHINA CORP. 2015 AUTO INDUSTRY on the Wan Li Road

CHINA CORP. 2015 AUTO INDUSTRY On the Wan Li Road Cars – Commercial Vehicles – Electric Vehicles Market Evolution - Regional Overview - Main Chinese Firms DCA Chine-Analyse China’s half-way auto industry CHINA CORP. 2015 Wan Li (ten thousand Li) is the Chinese traditional phrase for is a publication by DCA Chine-Analyse evoking a long way. When considering China’s automotive Tél. : (33) 663 527 781 sector in 2015, one may think that the main part of its Wan Li Email : [email protected] road has been covered. Web : www.chine-analyse.com From a marginal and closed market in 2000, the country has Editor : Jean-François Dufour become the World’s first auto market since 2009, absorbing Contributors : Jeffrey De Lairg, over one quarter of today’s global vehicles output. It is not Du Shangfu only much bigger, but also much more complex and No part of this publication may be sophisticated, with its high-end segment rising fast. reproduced without prior written permission Nevertheless, a closer look reveals China’s auto industry to be of the publisher. © DCA Chine-Analyse only half-way of its long road. Its success today, is mainly that of foreign brands behind joint- ventures. And at the same time, it remains much too fragmented between too many builders. China’s ultimate goal, of having an independant auto industry able to compete on the global market, still has to be reached, through own brands development and restructuring. China’s auto industry is only half-way also because a main technological evolution that may play a decisive role in its future still has to take off. -

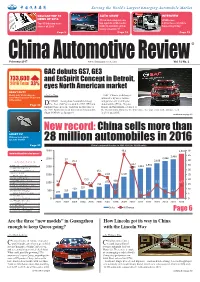

28 Million Automobiles in 2016 Page 22 China's Automobile Sales in 2001-2016 (In 10,000 Units)

中国汽车要闻 Serving the World’s Largest Emerging Automobile Market CBU/CAR TOP 10 AUTO SHOW INTERVIEW NEWS OF 2016 China and compact cars UISEE sees Top 10 industry news top agenda as Mercedes a driverless car future stories of 2016 looks to maintain global happening today luxury crown in ‘17 Page 5 Page 13 Page 19 ChinaFebruary 2017 Automotive www.chinaautoreview.com ReviewVol. 12 No. 2 GAC debuts GS7, GE3 733,600 and EnSpirit Concept in Detroit, 2016 Total 33% eyes North American market HEAVY-DUTY Heavy-duty truck sales up – by Lei Xing GAC, China’s sixth largest lower-than-expected 56 percent automaker by sales volume in December ETROIT – Guangzhou Automobile Group and partner of Fiat Chrysler Page 26 DCo., Ltd. (GAC) presented the GS7, GE3 and Automobiles (FCA), Toyota, EnSpirit Concept to the world for the fi rst time at Honda and Mitsubishi, returned to the 2017 North American International Automobile the Detroit Auto Show for the third time after appearing at the annual event Show (NAIAS) on January 9. in 2013 and 2015. continued on page 12 New record: China sells more than SMART EV Chinese tech giants eye auto market 28 million automobiles in 2016 Page 22 China's automobile sales in 2001-2016 (in 10,000 units) 本期精选中文目录 新科张榜: 2016 年中国汽车销量突破 2800 万辆 1 广汽携GS7、GE3和EnSpirit概念车 登陆底特律车展,有意进军北美市场 1 广州车展上的“新三剑客” 能否成功 “救驾” 观致? 1 林肯之道如何让中国“着了道”? 1 《中国汽车要闻》 2016 年行业十大新闻 5 哈罗米国:中国汽车品牌又来了 8 峰回路转:永远不要低估中国汽车市场的潜力 8 《中国汽车要闻》恭祝各位鸡年大吉! 8 继续深耕中国市场扩张紧凑型车型, 梅赛德斯-奔驰欲在 2017 年成功守擂 13 2017年电动汽车百人会: 提升核心技术,创新引领发展 16 专访驭势科技创始人兼CEO吴甘沙: 无人驾驶汽车,今日未来 19 中国 IT 大鳄瞄准汽车产业 22 12 月重型车增势低于预估但依旧大增 56% 26 中国市场前景空前,斯堪尼亚属意扎根 28 Page 6 Are the three “new models” in Guangzhou How Lincoln got its way in China enough to keep Qoros going? with the Lincoln Way – by Mark Andrews – by Melanie Xing ream off some of Europe’s top auto hina has turned into a Cprofessionals, give them a green fi eld Csecond large pillar of site in Changshu, a blank CAD screen, revenue and profi t for Ford and a seemingly open ended check book. -

Automotive Industry Weekly Digest

Automotive Industry Weekly Digest 25-29 January 2021 IHS Markit Automotive Industry Weekly Digest - Jan 2021 WeChat Auto VIP Contents [OEM Highlights] Great Wall to reshape brand image with new models 3 [OEM Highlights] VW begins sales of ID.4 CROZZ in China 4 [Sales Highlights] Chinese new vehicle sales contract 2% during 2020; demand rebound expected in 2021 6 [Sales Highlights] VW Group reports sales decline of 9.1% in China during 2020 8 [Technology and Mobility Highlights] Huawei develops smart roads in Wuxi that communicate with driverless vehicles 10 [Technology and Mobility Highlights] Geely teams up with Tencent to develop smart car technologies 10 [Supplier Trends and Highlights] DENSO collaborate with AEVA to develop next-generation FMCW lidar system 12 [Supplier Trends and Highlights] Freudenberg Sealing Technologies develops new DIAvent valves for safer lithium-ion batteries 12 [GSP] India/Pakistan Sales and Production Commentary -2020.12 14 [VIP ASSET] Stellantis: Scale Creates Opportunity 16 [VIP ASSET] Stellantis expects scale to support strong brand stable, investment into new tech 17 Confidential. ©2021 IHS Markit. All rights reserved. 2 IHS Markit Automotive Industry Weekly Digest - Jan 2021 WeChat Auto VIP [OEM Highlights] Great Wall to reshape brand image with new models IHS Markit perspective Implications Great Wall has delivered satisfactory sales results during 2020 despite the disruption from the coronavirus disease 2019 (COVID-19) pandemic. The automaker's sales rose by 5% to more than 1.11 million vehicles during 2020 on the back of strong demand for its new models, including the Haval H6 and the Pao pickup. The sales volumes of 1.11 million units exceeded the company’s target set for the year, which was 1.02 million units. -

2020 Annual Results Announcement

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. GUANGZHOU AUTOMOBILE GROUP CO., LTD. 廣 州 汽 車 集 團 股 份 有 限 公 司 (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2238) 2020 ANNUAL RESULTS ANNOUNCEMENT The Board is pleased to announce the audited consolidated results of the Group for the year ended 31 December 2020 together with the comparative figures of the corresponding period ended 31 December 2019. The result has been reviewed by the Audit Committee and the Board of the Company. - 1 - CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME Year ended 31 December Note 2020 2019 RMB’000 RMB’000 Revenue 3 63,156,985 59,704,322 Cost of sales (60,860,992) (57,181,363) Gross profit 2,295,993 2,522,959 Selling and distribution costs (3,641,480) (4,553,402) Administrative expenses (3,850,327) (3,589,516) Net impairment losses on financial assets (55,110) (53,831) Interest income 304,233 290,694 Other gains – net 4 1,379,690 2,620,340 Operating loss (3,567,001) (2,762,756) Interest income 127,551 171,565 Finance costs 5 (439,567) (516,481) Share of profit of joint ventures and associates 6 9,570,978 9,399,343 Profit before income tax 5,691,961 6,291,671 Income tax credit 7 355,990 -

Purpose-Driven Automotive Business Model Is Key to Survival

Revving the Asian automotive market A purpose-driven exploration of trends and business models Abstract Driven by rapid urbanization, economic prosperity, and a rising population, mobility needs in Asian countries have increased for people and goods. While passenger transport is expected to rise, vehicle ownership remains low. This imbalance has created an enormous opportunity for mobility service providers to capture the Asia-Pacific (APAC) market, primarily dominated by a young population. With their high spending power and interest in value for money, they want to better utilize the time spent on the wheel and monetize their assets such as the vehicle they own. This paper highlights the specific characteristics of APAC automotive trends and how automakers can benefit by building purpose-driven business models. Challenges and opportunities in the APAC automotive market The automotive industry is witnessing disruption, as car owners increasingly question the value of money spent on purchasing an automobile. For a small population in Asia, owning a car may be a matter of pride, but a large proportion looks for a car’s utility. This trend has resulted in reduced car sales and profitability, overcapacity, consolidation, layoffs, and more. It has also affected the supplier ecosystem. To tackle the challenge head-on, car manufacturers in the APAC region are experimenting with a series of new product launches, smart features, connected services, immersive car buying experiences, and new market expansion programs. However, as the results are not too impressive, there is a need to revisit the fundamentals of the current business model with a focus on mobility. Going back to basics requires automotive firms to answer some fundamental questions: • What needs to be moved – people or goods – from point A to B? • How will the asset be designed and what is the end purpose? • If there is movement today, what problem needs to be solved? • Is vehicle ownership necessary? Let us look at how the automotive industry in Asia is addressing these questions. -

Article No.12

Originally published on LinkedIn on 11th November 2020: https://www.linkedin.com/pulse/chinese- customer-premiumization-budgetization-product-dr-jan-burgard/ Dr. Jan Burgard Executive Partner; Co-Founder at Berylls Strategy Advisors 4 successful brand strategies for the Chinese automotive market in 2020 and 2021 Chinese OEMs and to a lesser extent Western brands are introducing a number of new upscale/premium and budget brands • Volume brands are pressured to opt for premium and/or budget strategies because markets drift apart • The budget strategy requires superior cost structure and the premium strategy means an uneasy uphill battle which quite a few players may fail. The world of gasoline vehicles is difficult to penetrate while NEVs offer vastly more new chances • Berylls has identified 4 key success factors for any OEM to successfully set up its own new premium or budget brand Market drifts apart Our “CUSTOMER BEHAVIOR IN THE FACE OF COVID-19” study has revealed some interesting findings. It shows that a large portion of Chinese consumers are planning to buy a premium vehicle despite the COVID-19 pandemic. BERYLLS STRATEGY ADVISORS GmbH CONTACT www.berylls.com Dr. Jan Burgard T +49 89 710 410 40-0 [email protected] Maximilianstraße 34 [email protected] 80539 Munich On the other hand, market share of local Chinese brands has been constantly increasing up until 2018. Chinese local brands are mostly volume/budget brands. It seems, the market is drifting apart. New brands change the landscape Just a few years ago the Chinese automotive landscape was clear. There were basically 4 types of players. -

Call for Papers the Competition for the Practical Application of ICV Has Already Started in the Global Automotive Industry

Call for papers www.cicv.org.cn The competition for the practical application of ICV has already started in the global automotive industry. A sound environment for ICV are taking into shape, as China is embracing a clear trend of multi-industrial coordination and innovation and taking planned steps to make top-level policies and standards. As a national strategy, the development of ICV helps to create opportunities for cross-industrial innovation. In order to promote the development of ICV in China and build a world-class platform for technology exchange, China SAE, Tsinghua University Suzhou Automotive Research Institute and China Intelligent and Connected Vehicles (Beijing) Research Institute Co. Ltd jointly initiated an annual congress “International Congress of Intelligent and Connected Vehicles Technology (CICV)”. It is a world-class technology exchange platform for automotive, IT/Internet, communications and transportation industry. At the same time, as an important sign for policies, leading technologies showcases, and industry integration accelerator, CICV serves as a platform for communication and exchange between enterprises, universities and industrial research institutes and provide references for them. The 6th International Congress of Intelligent and Connected Vehicles Technology (CICV 2019) is to be held in June, 2019. Focusing on ADAS and key technologies of automated driving as well as ICV policies and regulations, CICV 2019 will invite about 80 experts and technical leaders to share new technology results and ideas on hot topics including Environment Perception and, Development and Testing, V2X, AI, Cyber Security, HD Map, Intelligent and Connected Transportation, Co-pilot and HMI. The concurrent activities including technical exhibition, promotional tours for innovative technologies and entrepreneurship programs.