Lessons Learned from Alternative Fuels Experience China's Case Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Educated Youth Should Go to the Rural Areas: a Tale of Education, Employment and Social Values*

Educated Youth Should Go to the Rural Areas: A Tale of Education, Employment and Social Values* Yang You† Harvard University This draft: July 2018 Abstract I use a quasi-random urban-dweller allocation in rural areas during Mao’s Mass Rustication Movement to identify human capital externalities in education, employment, and social values. First, rural residents acquired an additional 0.1-0.2 years of education from a 1% increase in the density of sent-down youth measured by the number of sent-down youth in 1969 over the population size in 1982. Second, as economic outcomes, people educated during the rustication period suffered from less non-agricultural employment in 1990. Conversely, in 2000, they enjoyed increased hiring in all non-agricultural occupations and lower unemployment. Third, sent-down youth changed the social values of rural residents who reported higher levels of trust, enhanced subjective well-being, altered trust from traditional Chinese medicine to Western medicine, and shifted job attitudes from objective cognitive assessments to affective job satisfaction. To explore the mechanism, I document that sent-down youth served as rural teachers with two new county-level datasets. Keywords: Human Capital Externality, Sent-down Youth, Rural Educational Development, Employment Dynamics, Social Values, Culture JEL: A13, N95, O15, I31, I25, I26 * This paper was previously titled and circulated, “Does living near urban dwellers make you smarter” in 2017 and “The golden era of Chinese rural education: evidence from Mao’s Mass Rustication Movement 1968-1980” in 2015. I am grateful to Richard Freeman, Edward Glaeser, Claudia Goldin, Wei Huang, Lawrence Katz, Lingsheng Meng, Nathan Nunn, Min Ouyang, Andrei Shleifer, and participants at the Harvard Economic History Lunch Seminar, Harvard Development Economics Lunch Seminar, and Harvard China Economy Seminar, for their helpful comments. -

Harbin Bank Co., Ltd. 哈爾濱銀行股份有限公司* (A Joint Stock Company Incorporated in the People’S Republic of China with Limited Liability) (Stock Code: 6138)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Harbin Bank Co., Ltd. 哈爾濱銀行股份有限公司* (A joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 6138) ANNOUNCEMENT OF INTERIM RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2021 The board of directors (the “Board”) of Harbin Bank Co., Ltd. (the “Bank”) is pleased to announce the unaudited consolidated interim results of the Bank and its subsidiaries (the “Group”) for the six months ended 30 June 2021. This results announcement, containing the full text of the 2021 interim report of the Bank, complies with the relevant content requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to preliminary announcement of interim results. The condensed consolidated financial statements for the six months ended 30 June 2021 prepared by the Group have been reviewed by BDO Limited in accordance with International Standard on Review Engagements. Such interim results have also been reviewed by the Board and the audit committee of the Bank. Unless otherwise stated, financial data of the Group are presented in Renminbi. This results announcement is published on the websites of the Bank (www.hrbb.com.cn) and HKEXnews (www.hkexnews.hk). The interim report of the Bank for the six months ended 30 June 2021 will be dispatched to shareholders of the Bank and will be available on the above websites in due course. -

Annual Report 2019

HAITONG SECURITIES CO., LTD. 海通證券股份有限公司 Annual Report 2019 2019 年度報告 2019 年度報告 Annual Report CONTENTS Section I DEFINITIONS AND MATERIAL RISK WARNINGS 4 Section II COMPANY PROFILE AND KEY FINANCIAL INDICATORS 8 Section III SUMMARY OF THE COMPANY’S BUSINESS 25 Section IV REPORT OF THE BOARD OF DIRECTORS 33 Section V SIGNIFICANT EVENTS 85 Section VI CHANGES IN ORDINARY SHARES AND PARTICULARS ABOUT SHAREHOLDERS 123 Section VII PREFERENCE SHARES 134 Section VIII DIRECTORS, SUPERVISORS, SENIOR MANAGEMENT AND EMPLOYEES 135 Section IX CORPORATE GOVERNANCE 191 Section X CORPORATE BONDS 233 Section XI FINANCIAL REPORT 242 Section XII DOCUMENTS AVAILABLE FOR INSPECTION 243 Section XIII INFORMATION DISCLOSURES OF SECURITIES COMPANY 244 IMPORTANT NOTICE The Board, the Supervisory Committee, Directors, Supervisors and senior management of the Company warrant the truthfulness, accuracy and completeness of contents of this annual report (the “Report”) and that there is no false representation, misleading statement contained herein or material omission from this Report, for which they will assume joint and several liabilities. This Report was considered and approved at the seventh meeting of the seventh session of the Board. All the Directors of the Company attended the Board meeting. None of the Directors or Supervisors has made any objection to this Report. Deloitte Touche Tohmatsu (Deloitte Touche Tohmatsu and Deloitte Touche Tohmatsu Certified Public Accountants LLP (Special General Partnership)) have audited the annual financial reports of the Company prepared in accordance with PRC GAAP and IFRS respectively, and issued a standard and unqualified audit report of the Company. All financial data in this Report are denominated in RMB unless otherwise indicated. -

HARBIN BANK CO., LTD. (A Joint Stock Company Incorporated in the People’S Republic of China with Limited Liability) Stock Code: 6138

HARBIN BANK CO., LTD. (A joint stock company incorporated in the People’s Republic of China with limited liability) Stock Code: 6138 2020 INTERIM REPORT Harbin Bank Co., Ltd. Contents Interim Report 2020 Definitions 2 Company Profile 3 Summary of Accounting Data and Financial Indicators 7 Management Discussion and Analysis 9 Changes in Share Capital and Information on Shareholders 73 Directors, Supervisors, Senior Management and Employees 78 Important Events 84 Organisation Chart 90 Financial Statements 91 Documents for Inspection 188 The Company holds the Finance Permit No. B0306H223010001 approved by the China Banking and Insurance Regulatory Commission and has obtained the Business License (Unified Social Credit Code: 912301001275921118) approved by the Market Supervision and Administration Bureau of Harbin. The Company is not an authorised institution within the meaning of the Hong Kong Banking Ordinance (Chapter 155 of the Laws of Hong Kong), not subject to the supervision of the Hong Kong Monetary Authority, and not authorised to carry on banking/deposit-taking business in Hong Kong. Denitions In this report, unless the context otherwise requires, the following terms shall have the meanings set out below. “Articles of Association” the Articles of Association of Harbin Bank Co., Ltd. “Board” or “Board of Directors” the board of directors of the Company “Board of Supervisors” the board of supervisors of the Company “CBIRC”/”CBRC” the China Banking and Insurance Regulatory Commission/China Banking Regulatory Commission (before 17 March -

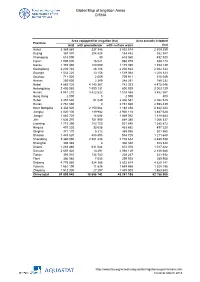

Global Map of Irrigation Areas CHINA

Global Map of Irrigation Areas CHINA Area equipped for irrigation (ha) Area actually irrigated Province total with groundwater with surface water (ha) Anhui 3 369 860 337 346 3 032 514 2 309 259 Beijing 367 870 204 428 163 442 352 387 Chongqing 618 090 30 618 060 432 520 Fujian 1 005 000 16 021 988 979 938 174 Gansu 1 355 480 180 090 1 175 390 1 153 139 Guangdong 2 230 740 28 106 2 202 634 2 042 344 Guangxi 1 532 220 13 156 1 519 064 1 208 323 Guizhou 711 920 2 009 709 911 515 049 Hainan 250 600 2 349 248 251 189 232 Hebei 4 885 720 4 143 367 742 353 4 475 046 Heilongjiang 2 400 060 1 599 131 800 929 2 003 129 Henan 4 941 210 3 422 622 1 518 588 3 862 567 Hong Kong 2 000 0 2 000 800 Hubei 2 457 630 51 049 2 406 581 2 082 525 Hunan 2 761 660 0 2 761 660 2 598 439 Inner Mongolia 3 332 520 2 150 064 1 182 456 2 842 223 Jiangsu 4 020 100 119 982 3 900 118 3 487 628 Jiangxi 1 883 720 14 688 1 869 032 1 818 684 Jilin 1 636 370 751 990 884 380 1 066 337 Liaoning 1 715 390 783 750 931 640 1 385 872 Ningxia 497 220 33 538 463 682 497 220 Qinghai 371 170 5 212 365 958 301 560 Shaanxi 1 443 620 488 895 954 725 1 211 648 Shandong 5 360 090 2 581 448 2 778 642 4 485 538 Shanghai 308 340 0 308 340 308 340 Shanxi 1 283 460 611 084 672 376 1 017 422 Sichuan 2 607 420 13 291 2 594 129 2 140 680 Tianjin 393 010 134 743 258 267 321 932 Tibet 306 980 7 055 299 925 289 908 Xinjiang 4 776 980 924 366 3 852 614 4 629 141 Yunnan 1 561 190 11 635 1 549 555 1 328 186 Zhejiang 1 512 300 27 297 1 485 003 1 463 653 China total 61 899 940 18 658 742 43 241 198 52 -

Heilongjiang Road Development II Project (Yichun-Nenjiang)

Technical Assistance Consultant’s Report Project Number: TA 7117 – PRC October 2009 People’s Republic of China: Heilongjiang Road Development II Project (Yichun-Nenjiang) FINAL REPORT (Volume II of IV) Submitted by: H & J, INC. Beijing International Center, Tower 3, Suite 1707, Beijing 100026 US Headquarters: 6265 Sheridan Drive, Suite 212, Buffalo, NY 14221 In association with WINLOT No 11 An Wai Avenue, Huafu Garden B-503, Beijing 100011 This consultant’s report does not necessarily reflect the views of ADB or the Government concerned, ADB and the Government cannot be held liable for its contents. All views expressed herein may not be incorporated into the proposed project’s design. Asian Development Bank Heilongjiang Road Development II (TA 7117 – PRC) Final Report Supplementary Appendix A Financial Analysis and Projections_SF1 S App A - 1 Heilongjiang Road Development II (TA 7117 – PRC) Final Report SUPPLEMENTARY APPENDIX SF1 FINANCIAL ANALYSIS AND PROJECTIONS A. Introduction 1. Financial projections and analysis have been prepared in accordance with the 2005 edition of the Guidelines for the Financial Governance and Management of Investment Projects Financed by the Asian Development Bank. The Guidelines cover both revenue earning and non revenue earning projects. Project roads include expressways, Class I and Class II roads. All will be built by the Heilongjiang Provincial Communications Department (HPCD). When the project started it was assumed that all project roads would be revenue earning. It was then discovered that national guidance was that Class 2 roads should be toll free. The ADB agreed that the DFR should concentrate on the revenue earning Expressway and Class I roads, 2. -

Preparing the Heilongjiang Road Development II Project (Yichun–Nenjiang)

Technical Assistance Report Project Number: 42017 August 2008 People’s Republic of China: Preparing the Heilongjiang Road Development II Project (Yichun–Nenjiang) The views expressed herein are those of the consultant and do not necessarily represent those of ADB’s members, Board of Directors, Management, or staff, and may be preliminary in nature. CURRENCY EQUIVALENTS (as of 1 July 2008) Currency Unit – yuan (CNY) CNY1.00 = $0.1459 $1.00 = CNY6.8543 ABBREVIATIONS ADB – Asian Development Bank C&P – consultation and participatory EIA – environmental impact assessment GDP – gross domestic product HPCD – Heilongjiang Provincial Communications Department IPSA – initial poverty and social analysis PRC – People’s Republic of China TA – technical assistance TECHNICAL ASSISTANCE CLASSIFICATION Targeting Classification – General intervention Sector – Transport and communications Subsector – Roads and highways Themes – Sustainable economic growth, capacity development Subthemes – Fostering physical infrastructure development, institutional development NOTE In this report, "$" refers to US dollars. Vice-President C. Lawrence Greenwood, Jr., Operations 2 Director General K. Gerhaeusser, East Asia Department (EARD) Director C.S. Chin, Officer-in-Charge, Transport Division, EARD Team leader E. Oyunchimeg, Transport Specialist (Roads), EARD Team members S. Ferguson, Senior Social Development Specialist (Resettlement), EARD T. Yokota, Transport Specialist, EARD 121o 00'E 132o 00'E HEILONGJIANG ROAD DEVELOPMENT II PROJECT (YICHUN--NENJIANG) IN THE PEOPLE'S REPUBLIC OF CHINA RUSSIAN FEDERATION Provincial Capital City/Town Mohe County Highway Port National Key Tourism Scenic Spot H eilong River Proposed Project Road Tahe ADB--Financed Road Loop Line Radial Line Huma Vertical Line Horizontal Line River Provincial Boundary 52 o 00'N 52 o 00'N International Boundary Woduhe Jiagdaqi Boundaries are not necessarily authoritative. -

China July 25 - August 25, 1988

PLANT GERMPLASM COLLECTION REPORT USDA-ARS FORAGE AND RANGE RESEARCH LABORATORY LOGAN, UTAH Foreign Travel to: China July 25 - August 25, 1988 TITLE: A Report of Collecting Expedition to Northeast China for Triticeae Genetic Resources in 1988 U.S. Participants Richard R-C Wang - Research Geneticist USDA-Agricultural Research Service Logan, Utah U.S.A. Non U.S. Participants Prof. Y. Cauderon France INRA Centre Recherche de Versalles Dr. D. Banks Australia CSIRO Divison of Plant Industry GERMPLASM ACCESSIONS One month expedition on germplasm resources of Triticeae was carried out in both Jilin and Heilongjiang Province Northeast China, from July 25 to Aug 25, 1988. The trip covered Changbai Mt., Songnen Plain and Lesser Xing'an Mt. and traveled over 4000 kilometers. 97 seed samples and 104 herbaria were collected, which belong to 18 species and varieties of 7 genera respectively. All of then are perennials grown in natural population only one sample of rye is an annual mixture in spring wheat field. The collected materials kept in ICGR, CAAS. We have planned to go to Great Xing'an Mt. this year. But for encountered floods there then, we went to the Lesser Xing'an Mt. instead. Participants: Chinese specialists: Ms. Dong Yushen Team leader, Prof. ICGR, CAAS Ms. Zhou Ronghua Ass. Prof. ICGR, CAAS Mr. Xu Shujun Ass. Prof. ICGR, CAAS Mr. Sun Yikei Ass. Prof. Dept. of Biology, Northeast Normal University P.R.C Mr. Duan Xiaog'ang M. S. Dept. of Biology, Northeast Normal University, P.R.C. Participated Baicheng region only Mr. Sun Zhong'yan Senior specialist of forage, Animal Husbandry Bureau of Heilongjiang, participated Heilongjiang Province only Mr. -

A Spatial Study on Keshan Disease Prevalence And

ORIGINAL PAPER International Journal of Occupational Medicine and Environmental Health 2021;34(5):659 – 666 https://doi.org/10.13075/ijomeh.1896.01749 A SPATIAL STUDY ON KESHAN DISEASE PREVALENCE AND SELENOPROTEIN P IN THE HEILONGJIANG PROVINCE, CHINA YANAN WANG1, XIAO ZHANG1,2, TONG WANG1, JIE HOU1, ZHONGYING GUO1,3, XIAOMIN HAN1,3, HUIHUI ZHOU1,4, HONG LIANG1,5, and ZHIFENG XING6 1 Harbin Medical University, Harbin, China Institute of Keshan Disease, Chinese Center for Endemic Disease Control 2 Qingdao Municipal Hospital, Qingdao, China Department of Healthcare-Associated Infection Management 3 Harbin Center for Disease Control and Prevention, Harbin, China Director Office 4 Jining Medical University, Jining, China School of Public Health 5 Qiqihar Medical University, Qiqihar, China School of Public Health 6 Heilongjiang Center for Disease Control and Prevention, Harbin, China Institute for Endemic Disease Control and Prevention Abstract Objectives: Few spatial studies on Keshan disease (KD) prevalence and serum selenoprotein P (SELENOP) levels have been reported in the Heilongjiang Province, China. This study aimed to investigate the spatial relationships between KD prevalence, SELENOP levels, and the socio-economic status for the pre- cise prevention and control of KD. Material and Methods: The study was carried out in all the 66 KD endemic counties in the Heilongjiang Province using a non-probability sampling method of a key village survey based on county-wide case-searching. The participants completed a questionnaire and had their serum SELENOP levels measured using enzyme-linked immunosorbent assay. Thematic maps were created, and spatial regression analysis was performed by ordinary least squares using ArcGIS 9.0. -

Transition from Foraging to Farming in Northeast China

TRANSITION FROM FORAGING TO FARMING IN NORTHEAST CHINA VOLUME TWO (FIGURES, TABLES, BIBLIOGRAPHY AND APPENDIXES) A THESIS SUBMITTED IN FULFILMENT OF THE REQUIREMENTS FOR ADMISSION TO THE DEGREE OF DOCTOR OF PHILOSOPHY By (Peter) Wei Ming JIA Department of Archaeology The University of Sydney April 2005 TABLE OF CONTENTS..........................................................................I-VI Figures and Tables...................................................................................... i BIBLIOGRAPHY.....................................................................................125 APPENDIX 1 THE COLLECTION OF TOOLS .......................................154 APPENDIX 2 POLLEN DATA.................................................................158 APPENDIX 3 MAMMONTH AND C14DATES........................................161 APPENDIX 4 C14DATES IN NORTHEAST CHINA ...............................165 APPENDIX 5 C14DATES OF DOMESTIC SEEDS ................................171 APPENDIX 6 FIELDWORK REPORT ....................................................172 TABLE 1-1 LOCATION OF NORTHEAST CHINA..............................................................................................................1 FIGURE 1-1 UPPER PALAEOLITHIC SITES IN NORTHEAST ASIA ....................................................................................1 FIGURE 1-2 PALAEOLITHIC SITES WITH LGM VEGETATION..........................................................................................2 FIGURE 1-3 STONE ARTEFACTS.................................................................................................................................3 -

ID Province Study Site Latitude Longitude Altitude Aspect

ID Province Study site Latitude Longitude Altitude Aspect Slope Origin MAT MAP Age Height DBH Vtree Vstand Density Area Plot Year Reference 1 Heilongjiang Amuer Forest Bureau 52°54′N 123°21′E 549 SU 7 Planted -5.0 455 1 0.26 0.41B NA NA NA 600 1 2012 Han et al., 2015b 2 Heilongjiang Xinlin Forest Bureau 51°40′N 124°24′E 538 NA NA Planted -3.4 508 1 0.40 NA NA NA 3300P/ 600 3 2009 Huang, 2011; Yang et al., 2002* 3 Heilongjiang Yongcui Forest Farm 47°05′N 128°58′E 224 NA 5-10 Planted -0.3 575 1 0.42 0.60B NA NA 3045/ NA NA 1983 Liu & Deng, 2007; Zhang, 2008b* 4 Heilongjiang Jiagedaqi Forest Bureau 50°20′N 124°05′E 400 HSH <5 Planted -1.3 500 1 0.38 0.51B NA NA 2667P/ 150 3 1982 Liu et al., 1989; Liu et al., 1990b* 5 Heilongjiang Songling Forest Bureau 50°41′N 124°21′E 420 NA NA Planted -1.2 450 1 0.40 0.50B NA NA NA NA NA 1984 Song et al., 1992; Song et al., 1996* 6 Heilongjiang Songling Forest Bureau 50°41′N 124°21′E 420 NA NA Planted -1.2 450 1 0.24 0.30B NA NA NA NA 6 1984 Song et al., 1996 7 Heilongjiang Songling Forest Bureau 50°41′N 124°21′E 420 NA NA Planted -1.2 450 1 0.33 0.40B NA NA NA NA 6 1984 Song et al., 1996 8 Heilongjiang Songling Forest Bureau 50°41′N 124°21′E 420 NA NA Planted -1.2 450 1 0.31 0.34B NA NA NA NA 6 1984 Song et al., 1996 9 Heilongjiang Songling Forest Bureau 50°41′N 124°21′E 420 NA NA Planted -1.2 450 1 0.36 0.35B NA NA NA NA 6 1984 Song et al., 1996 10 Heilongjiang Songling Forest Bureau 50°41′N 124°21′E 420 NA NA Planted -1.2 450 1 0.38 0.35B NA NA NA NA 6 1984 Song et al., 1996 11 Heilongjiang Songling -

2020 Annual Report the Company Holds the Finance Permit No

(A joint stock company incorporated in the People's Republic of China with limited liability) Stock Code: 6138 2020 Annual Report The Company holds the Finance Permit No. B0306H223010001 approved by the China Banking and Insurance Regulatory Commission and has obtained the Business License (Unified Social Credit Code: 912301001275921118) approved by the Market Supervision and Administration Bureau of Harbin. The Company is not an authorised institution within the meaning of the Hong Kong Banking Ordinance (Chapter 155 of the Laws of Hong Kong), not subject to the supervision of the Hong Kong Monetary Authority, and not authorised to carry on banking/deposit-taking business in Hong Kong. Harbin Bank Co., Ltd. 1 Contents 2020 Annual Report Definitions 2 Company Profile 4 Summary of Accounting Data and Financial Indicators 11 Chairman’s Statement 14 President’s Statement 17 Report of the Board of Directors 20 Changes in Share Capital and Information on Shareholders 105 Corporate Governance Report 111 Report of the Board of Supervisors 145 Important Events 148 Basic Information on Directors, Supervisors, Senior Management, Employees and Organisations 154 Financial Statements 171 Documents for Inspection 308 2 Harbin Bank Co., Ltd. 2020 Annual Report Definitions Definitions Company Profile Summary of Accounting Data and Financial Indicators Chairman’s Statement President’s Statement In this report, unless the context otherwise requires, the following terms shall have the meanings set out below. “Articles of Association” the articles of association of Harbin Bank Co., Ltd. “Board” or “Board of Directors” the board of Directors of the Company “Board of Supervisors” the board of Supervisors of the Company “CBIRC”/“CBRC” the China Banking and Insurance Regulatory Commission/former China Banking Regulatory Commission (before 17 March 2018) “PRC” the People’s Republic of China “Company” Harbin Bank Co., Ltd.