Mackenzie Valley Highway: Wrigley to Norman Wells

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Executive Summary: the Northern

EXECUTIVE SUMMARY THE NORTHERN TRANSPORTATION SYSTEMS ASSESSMENT Executive Summary January 2011 PROLOG CANADA INC. PAGE 1 NORTHERN TRANSPORTATION SYSTEMS ASSESSMENT Disclaimer This report reflects the views of PROLOG Canada Inc. only and does not necessarily reflect the official views or policies of Transport Canada. Neither Transport Canada, nor its employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy or completeness of any information contained in this report, or process described herein, and assumes no responsibility for anyone’s use of the information. Transport Canada is not responsible for errors or omissions in this report and makes no representations as to the accuracy or completeness of the information. Transport Canada does not endorse products or companies. Reference in this report to any specific commercial products, process, or service by trade name, trademark, manufacturer or otherwise does not constitute or imply its endorsement, recommendation, or favouring by Transport Canada and shall not be used for advertising or service endorsement purposes. Trade or company names appear in this report only because they are essential to the objectives of the report. PAGE 2 PROLOG CANADA INC. EXECUTIVE SUMMARY THE NORTHERN TRANSPORTATION SYSTEMS ASSESSMENT Executive Summary Prepared for Transport Canada Prepared by PROLOG Canada Inc. In Association with EBA Engineering Consultants Ltd. January 2011 PROLOG CANADA INC. PAGE 3 NORTHERN TRANSPORTATION SYSTEMS ASSESSMENT PAGE 4 PROLOG CANADA INC. EXECUTIVE SUMMARY Northern Transportation Systems Assessment Executive Summary 1. Introduction The purpose of the Northern Transportation Systems Assessment is to determine what transportation infrastructure is required to support growing demand in the North over the next 20 years; and to determine what incremental improvements will build towards a transportation system that supports Canada’s vision for northern development. -

Pipeline Safety and Emergency Information for Our Neighbours

Pipeline safety and emergency information for our neighbours. Emergency: 1-877-420-8800 About Enbridge Enbridge is a global energy infrastructure Incaseofemergency: leader. Our assets are diversified and balanced between natural gas and oil, Please find a safe place to call your local and we provide integrated services and emergency service or 911, if it’s available. first-and-last-mile connectivity to key Then call Enbridge at: supply basins and demand markets. 1-877-420-8800 We transport energy, operating the world’s longest, most sophisticated crude oil and liquids transportation system, with How to reach us: 17,018 miles (27,388 km) of active pipe. Public Awareness Hotline We deliver an average of 2.8 million (Non-EmergencyCalls Only) barrels of crude oil each day through our Mainline and Express pipelines, Phone and we transport 28% of the crude 1-877-640-8665 oil produced in North America. Email WedistributeenergyandareCanada’s [email protected] largest natural gas distribution provider, Mail with approximately 3.7 million retail Box 280 customers in Ontario, Quebec, New Norman Wells, NT Brunswick and New York State. X0E 0V0 Wegenerateenergywithaportfoliothat includes nearly 3,000 megawatts (MW), Website net, of wind, solar and geothermal projects. Enbridge.com/publicawareness Facebook Call or Click Before You Dig facebook.com/enbridge Before performing any ground disturbance activity on, along, across or under a pipeline, please contact your local one-call centre. Northwest Territories Enbridge Pipelines (NW) Inc. 1-867-597-7000 (collect) Alberta Alberta One Call 1-800-242-3447 (toll-free) Pipeline Safety: 1 A shared responsibility As the owner and operator Your Role of thousands of kilometres As a resident, business owner or of pipelines transporting oil community member along Enbridge’s pipeline right-of-way (ROW), you also and natural gas, our highest have an important role to play. -

Lands Regional Contacts

LANDS REGIONAL CONTACTS Beaufort-Delta Region 86 Duck Lake Road ³ Bag Service #1 Inuvik, NT X0E 0T0 Telephone: 867-777-8900 Fax: 867-777-2090 E-mail: [email protected] Sahtu Region 31 Forrestry Drive Northern Cartrols Building Beaufort-Delta Box 126 Norman Wells, NT X0E 0V0 Telephone: 867-587-7200 Fax: 867-587-2928 E-mail: [email protected] Dehcho Region Regional Education Centre, 2nd Floor PO Box 150 Fort Simpson, NT X0E 0N0 Telephone: 867-695-2626 Ext. 202 Fax: 867-695-2615 e-mail: [email protected] Beaufort Sea North Slave Region Sachs Harbour 140 Bristol Avenue !( 16 Yellowknife Airport (mailing) Yellowknife, NT X1A 3T2 Telephone: 867-767-9187 Ext. 24185 Fax: 867-873-9754 E-mail: [email protected] South Slave Region Ulukhaktok !( 136 Simpson Street Tuktoyaktuk !( Evergreen Building Box 658 Fort Smith, NT X0E 0P0 Manager, Resource Management Telephone: 867-872-4343 Ext. 23 Aklavik Paulatuk !( Inuvik !( !( Donald Arey Fax: 867-872-3472 867-777-8906 E-mail: [email protected] Hay River Area Office Fort McPherson !( Tsiigehtchic Suite 203, 41 Capital Drive !( N.W Government of Canada Building .T. Yu kon Hay River, NT X0E 0R0 Telephone: 867-874-6995 Ext. 21 Fax: 867-874-2460 E-mail: [email protected] Colville Lake !( Fort Good Hope !( Manager, Resource Management Katherine Ades 867-587-7205 LEGEND LANDS Regional Boundaries M Great a c k Bear 0 20 40 80 120 e n z Sahtu Lake 1:2,100,000 KILOMETERS ie R iv DISCLAIMER !( e Norman Wells r THIS MAP IS FOR ILLUSTRATIVE PURPOSES ONLY. -

October 16, 2020

TD 187-19(2) TABLED ON OCTOBER 19, 2020 October 16, 2020 MS. LESA SEMMLER MLA, INUVIK TWIN LAKES OQ 274-19(2) Support for Residents Impacted by Flooding This letter is in follow up to the Oral Question you raised on June 2, 2020, regarding support for residents impacted by flooding in the Beaufort Delta. I committed to providing an update on the resources available for residents of the Northwest Territories (NWT) in dealing with floods. In the NWT, flood risk is considered to be one of the most destructive natural hazards, second to wildfires. There are nine communities considered flood risk areas; including Hay River, Fort Simpson, Fort Liard, Nahanni Butte, Tulita, Fort Good Hope, Fort McPherson, Aklavik, and Tuktoyaktuk. As part of its mandate, Municipal and Community Affairs (MACA), through the Emergency Management Organization (EMO), works with communities to mitigate, prepare for, respond to and recover from emergencies including flooding events. Starting in April each year, the EMO monitors seasonal breakup and high-water conditions across the territory and advises communities of high-risk conditions. MACA Regional staff work with flood risk communities to ensure community awareness and the updating of emergency plans to support community preparedness activities. When flood situations occur, the local emergency plan is enacted, and the EMO activates the community’s NWT Emergency Plan, at the level required to provide the support and resources required. Should the event cause wide spread damage to a community, the Government of the Northwest Territories’ (GNWT) Disaster Assistance Policy may apply to assist the recovery of residents, businesses and the community. -

Grants and Contributions Results Report 2015 – 2016

TABLED DOCUMENT 230-18(2) TABLED ON NOVEMBER 3, 2016 Grants and Contributions Results Report 2015 – 2016 November 2016 If you would like this information in another official language, call us. English Si vous voulez ces informations dans une autre langue officielle, contactez-nous. French Kīspin ki nitawihtīn ē nīhīyawihk ōma ācimōwin, tipwāsinān. Cree ch yat k . w n w , ts n . ch Ɂ ht s n n yat t a h ts k a y yat th at , n w ts n y t . Chipewyan n h h t hat k at h nah h n na ts ah . South Slavey K hsh t n k h ht y n w n . North Slavey ii wan ak i hii in k at at i hch hit yin hthan , iits t in hkh i. Gwich in Uvanittuaq ilitchurisukupku Inuvialuktun, ququaqluta. Inuvialuktun ᑖᒃᑯᐊ ᑎᑎᕐᒃᑲᐃᑦ ᐱᔪᒪᒍᕕᒋᑦ ᐃᓄᒃᑎᑐᓕᕐᒃᓯᒪᓗᑎᒃ, ᐅᕙᑦᑎᓐᓄᑦ ᐅᖄᓚᔪᓐᓇᖅᑐᑎᑦ. Inuktitut Hapkua titiqqat pijumagupkit Inuinnaqtun, uvaptinnut hivajarlutit. Inuinnaqtun Aboriginal Languages Secretariat: 867-767-9346 ext. 71037 Francophone Affairs Secretariat: 867-767-9343 TABLE OF CONTENTS MINISTER’S MESSAGE ....................................................................................................................................................................................................1 EXECUTIVE SUMMARY ...................................................................................................................................................................................................2 Preface ............................................................................................................................................................................................................. -

Gwich'in Land Use Plan

NÀNHÀNH’ GEENJIT GWITRWITR’IT T’T’IGWAAIGWAA’IN WORKING FOR THE LAND Gwich’in Land Use Plan Gwich’in Land Use Planning Board August 2003 NÀNH’ GEENJIT GWITR’IT T’IGWAA’IN / GWICH’IN LAND USE PLAN i ii NÀNH’ GEENJIT GWITR’IT T’IGWAA’IN / GWICH’IN LAND USE PLAN Ta b le of Contents Acknowledgements . .2 1Introduction . .5 2Information about the Gwich’in Settlement Area and its Resources . .13 3 Land Ownership, Regulation and Management . .29 4 Land Use Plan for the Future: Vision and Land Zoning . .35 5 Land Use Plan for the Future: Issues and Actions . .118 6Procedures for Implementing the Land Use Plan . .148 7Implementation Plan Outline . .154 8Appendix A . .162 NÀNH’ GEENJIT GWITR’IT T’IGWAA’IN / GWICH’IN LAND USE PLAN 1 Acknowledgements The Gwich’in are as much a part of the land as the land is a part of their culture, values, and traditions. In the past they were stewards of the land on which they lived, knowing that their health as people and a society was intricately tied to the health of the land. In response to the Berger enquiry of the mid 1970’s, the gov- ernment of Canada made a commitment to recognize this relationship by estab- lishing new programmes and institutions to give the Gwich’in people a role as stewards once again. One of the actions taken has been the creation of a formal land use planning process. Many people from all communities in the Gwich’in Settlement Area have worked diligently on land use planning in this formal process with the government since the 1980s. -

Tulita Solid Waste Facilities Report

Tulita Solid Waste Facilities Report Issued for Use Prepared for: Hamlet of Tulita Prepared by: Stantec Consulting Ltd. 4910 – 53rd Street Yellowknife, NT X1A 2P4 Project Number: 144930036 December 23, 2016 Revision Date Notes 0 2016 Dec 23 Submitted to SLWB for approval Sign-off Sheet This document entitled Tulita Solid Waste Facilities Report was prepared by Stantec Consulting Ltd. (“Stantec”) for the account of Hamlet of Tulita (the “Client”). The material in it reflects Stantec’s professional judgment in light of the scope, schedule and other limitations stated in the document and in the contract between Stantec and the Client. The opinions in the document are based on conditions and information existing at the time the document was published and do not take into account any subsequent changes. In preparing the document, Stantec did not verify information supplied to it by others. Any use which a third party makes of this document is the responsibility of such third party. Prepared by (signature) Jamie Davignon, EIT Reviewed by (signature) Walter Orr, P.Eng Approved by (signature) Erica Bonhomme, P.Geo Sign-off Sheet Table of Contents 1.0 INTRODUCTION ............................................................................................................. 1 1.1 BACKGROUND .................................................................................................................. 1 1.2 SETTING ............................................................................................................................... 1 1.3 -

Environment and Natural Nt and Natural Resources

ENVIRONMENT AND NATURAL RESOURCES Implementation Plan for the Action Plan for Boreal Woodland Caribou in the Northwest Territories: 2010-2015 The Action Plan for Boreal Woodland Caribou Conservation in the Northwest Territories was released after consulting with Management Authorities, Aboriginal organizations, communities, and interested stakeholders. This Implementation Plan is the next step of the Action Plan and will be used by Environment and Natural Resources to implement the actions in cooperation with the Tᰯch Government, Wildlife Management Boards and other stakeholders. In the future, annual status reports will be provided detailing the progress of the actions undertaken and implemented by Environment and Natural Resources. Implementation of these 21 actions will contribute to the national recovery effort for boreal woodland caribou under the federal Species at Risk Act . Implementation of certain actions will be coordinated with Alberta as part of our mutual obligations outlined in the signed Memorandum of Understanding for Cooperation on Managing Shared Boreal Populations of Woodland Caribou. This MOU acknowledges boreal caribou are a species at risk that are shared across jurisdictional lines and require co-operative management. J. Michael Miltenberger Minister Environment and Natural Resources IMPLEMENTATION PLAN Environment and Natural Resources Boreal Woodland Caribou Conservation in the Northwest Territories 2010–2015 July 2010 1 Headquarters Inuvik Sahtu North Slave Dehcho South Slave Action Initiative Involvement Region Region Region Region Region 1 Prepare and implement Co-lead the Dehcho Not currently Currently not Not currently To be developed To be developed comprehensive boreal caribou Boreal Caribou Working needed. needed. needed. by the Dehcho by the Dehcho range management plans in Group. -

For the Canadian Transportation Sector 2016 (Pp

3 · Northern Territories CHAPTER 3: NORTHERN TERRITORIES LEAD AUTHOR: KALA PENDAKUR1 CONTRIBUTING AUTHORS: JACKIE DAWSON (UNIVERSITY OF OTTAWA), KATERINE GRANDMONT (UNIVERSITY OF MONTREAL), DOUG MATTHEWS (MATTHEWS ENERGY CONSULTING), ART STEWART (GOVERNMENT OF NUNAVUT) RECOMMENDED CITATION: Pendakur, K. (2017). Northern Territories. In K. Palko and D.S. Lemmen (Eds.), Climate risks and adaptation practices for the Canadian transportation sector 2016 (pp. 27-64). Ottawa, ON: Government of Canada. 1 The Conference Board of Canada, Ottawa, ON Climate Risks & Adaptation Practices - For the Canadian Transportation Sector 2016 TABLE OF CONTENTS Key Findings .........................................................................................................................................................29 1.0 Introduction ..................................................................................................................................................29 1.1 Regional overview .............................................................................................................................30 2.0 An introduction to Canada’s northern transportation system...............................................................31 2.1 System overview ................................................................................................................................31 2.2 Road transportation ..........................................................................................................................33 2.3 -

Aviation Investigation Report A06w0002 In-Flight Engine Fire Buffalo Airways Limited Douglas C-54G-Dc (Dc-4) C-Gxkn Norman Well

AVIATION INVESTIGATION REPORT A06W0002 IN-FLIGHT ENGINE FIRE BUFFALO AIRWAYS LIMITED DOUGLAS C-54G-DC (DC-4) C-GXKN NORMAN WELLS, NORTHWEST TERRITORIES (CYVQ) 05 JANUARY 2006 The Transportation Safety Board of Canada (TSB) investigated this occurrence for the purpose of advancing transportation safety. It is not the function of the Board to assign fault or determine civil or criminal liability. Aviation Investigation Report In-Flight Engine Fire Buffalo Airways Limited Douglas C-54G-DC (DC-4) C-GXKN Norman Wells, Northwest Territories (CYVQ) 05 January 2006 Report Number A06W0002 Summary The Buffalo Airways Limited Douglas C-54G-DC (DC-4), registration C-GXKN, serial number 36090, departed from Norman Wells, Northwest Territories, at 1749 mountain standard time for a visual flight rules flight to Yellowknife, Northwest Territories, with a crew of four and 2000 pounds of cargo. While climbing through an altitude of approximately 3500 feet above sea level, the crew experienced a failure of the number 2 engine and a nacelle fire. The crew carried out the Engine Fire Checklist, which included discharging the fire bottles and feathering the number 2 propeller. The fire continued unabated. During this period, an uncommanded feathering of the number 1 propeller and an uncommanded extension of the main landing gear occurred. The crew planned for an emergency off-field landing, but during the descent to the landing area, the fuel selector was turned off as part of the Engine Securing Checklist, and the fire self-extinguished. A decision was made to return to the Norman Wells Airport where a successful two-engine landing was completed at 1804 mountain standard time. -

Grants and Contributions

TABLED DOCUMENT 287-18(3) TABLED ON NOVEMBER 1, 2018 Grants and Contributions Results Report 2017 – 2018 Subventions et Contributions Le present document contient la traduction française du résumé et du message du ministre Rapport 2017 – 2018 October 2018 | Octobre 2018 If you would like this information in another official language, call us. English Si vous voulez ces informations dans une autre langue officielle, contactez-nous. French Kīspin ki nitawihtīn ē nīhīyawihk ōma ācimōwin, tipwāsinān. Cree Tłı̨chǫ yatı k’ę̀ę̀. Dı wegodı newǫ dè, gots’o gonede. Tłı̨chǫ Ɂerıhtł’ıś Dëne Sųłıné yatı t’a huts’elkër xa beyáyatı theɂą ɂat’e, nuwe ts’ën yółtı. Chipewyan Edı gondı dehgáh got’ı̨e zhatıé k’ę́ę́ edatł’éh enahddhę nıde naxets’ę́ edahłı.́ South Slavey K’áhshó got’ı̨ne xǝdǝ k’é hederı ɂedı̨htl’é yerınıwę nı ́dé dúle. North Slavey Jii gwandak izhii ginjìk vat’atr’ijąhch’uu zhit yinohthan jì’, diits’àt ginohkhìi. Gwich’in Uvanittuaq ilitchurisukupku Inuvialuktun, ququaqluta. Inuvialuktun ᑖᒃᑯᐊ ᑎᑎᕐᒃᑲᐃᑦ ᐱᔪᒪᒍᕕᒋᑦ ᐃᓄᒃᑎᑐᓕᕐᒃᓯᒪᓗᑎᒃ, ᐅᕙᑦᑎᓐᓄᑦ ᐅᖄᓚᔪᓐᓇᖅᑐᑎᑦ. Inuktitut Hapkua titiqqat pijumagupkit Inuinnaqtun, uvaptinnut hivajarlutit. Inuinnaqtun Indigenous Languages Secretariat: 867-767-9346 ext. 71037 Francophone Affairs Secretariat: 867-767-9343 TABLE OF CONTENTS MINISTER’S MESSAGE ............................................................. i MESSAGE DU MINISTRE .......................................................... ii EXECUTIVE SUMMARY ............................................................ 3 RÉSUMÉ ................................................................................. -

Mackenzie Highway Extension, for Structuring EIA Related Field Investigations and for Comparative Assessment of Alternate Routes

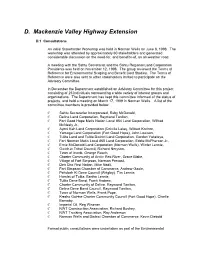

D. Mackenzie Valley Highway Extension D.1 Consultations An initial Stakeholder Workshop was held in Norman Wells on June 8, 1998. The workshop was attended by approximately 60 stakeholders and generated considerable discussion on the need-for, and benefits-of, an all-weather road. A meeting with the Sahtu Secretariat and the Sahtu Regional Land Corporation Presidents was held on November 12, 1998. The group reviewed the Terms of Reference for Environmental Scoping and Benefit Cost Studies. The Terms of Reference were also sent to other stakeholders invited to participate on the Advisory Committee. In December the Department established an Advisory Committee for this project consisting of 25 individuals representing a wide variety of interest groups and organizations. The Department has kept this committee informed of the status of projects, and held a meeting on March 17, 1999 in Norman Wells. A list of the committee members is provided below. C Sahtu Secretariat Incorporated, Ruby McDonald, C Deline Land Corporation, Raymond Taniton, C Fort Good Hope Metis Nation Local #54 Land Corporation, Wilfred McNeely Jr., C Ayoni Keh Land Corporation (Colville Lake), Wilbert Kochon, C Yamoga Land Corporation (Fort Good Hope), John Louison, C Tulita Land and Tulita District Land Corporation, Gordon Yakeleya, C Fort Norman Metis Local #60 Land Corporation, Eddie McPherson Jr., C Ernie McDonald Land Corporation (Norman Wells), Winter Lennie, C Gwich=in Tribal Council, Richard Nerysoo, C Town of Inuvik, George Roach, C Charter Community of Arctic Red