Mindtree, Sonata 3-5

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

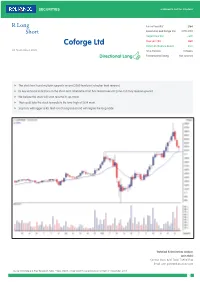

Coforge Ltd Potential Absolute Return 29% 03 November 2020 Time Horizon 9 Weeks Directional Long Fundamental Rating Not Covered

R Long Future Price (Rs)* 2164 Short Recommended Range (Rs) 2170-2150 Target Price (Rs) 2800 Stop Loss (Rs) 1880 Coforge Ltd Potential Absolute Return 29% 03 November 2020 Time Horizon 9 Weeks Directional Long Fundamental Rating Not covered f The stock has found multiple supports around 2080 level post a higher level reversal. f Its key technical indicators on the short-term timeframe chart has tested oversold zone and may reverse upward. f We believe the stock will soon resume its up-move. f That could take the stock towards its life-time-high of 2814 mark. f Stop loss will trigger at Rs 1880 (on closing basis) and will negate the long trade Technical & Derivatives Analyst: Jatin Gohil Contact: (022) 4215 7024/ 7498411546 Email: [email protected] Source: Bloomberg & RSec Research; Note: * Near Month- Single Stock Future price as on 12:15pm 3rd November, 2020 1 Recommendation Summary R Long Short Sr. Reco. Date Time Call Closure Recommendation Company Name Reco. Target Stop Call Status Current Return No Horizon date Price* Loss Price (%) Open Position 1 09-Sep-20 9 Weeks Short Bajaj Finance 3,413 2,550 3,770 Open 3456 -1.3% 2 20-Oct-20 10 Weeks Long Dabur 528 630 484 Open 516 -2.1% 3 21-Oct-20 6 Weeks Long M&M Financial 129 152 119 Open 126 -2.3% 4 30-Oct-20 6 Weeks Short JSW Steel 311 265 345 Open 314 0.9% 5 02-Nov-20 10 Weeks Long MFSL 615 800 545 Open 614 -0.1% Closed Positions 1 09-Oct-20 6 Weeks 28-Oct-20 Long Larsen & Toubro 900 1,065 842 Profit Booked 978 8.7% 2 15-Oct-20 6 Weeks 27-Oct-20 Long Kotak Bank 1,349 1,550 1,235 -

Coforge Ltd (NIITEC)

Coforge Ltd (NIITEC) CMP: | 2456 Target: | 2690 ( 10%) Target Period: 12 months HOLD October 23, 2020 Robust operating performance… Coforge Ltd (Coforge) registered healthy revenue growth, up 8.1% QoQ in constant currency terms, above our estimate of 7.0% QoQ growth. The revenue growth was broad based across verticals mainly led by insurance (up 13.5% QoQ) and BFS (up 10.2% QoQ). Digital revenues (including IP) also increased 18.7% QoQ. Further, Coforge has guided for revenue growth Particulars of 6% YoY organic growth in FY21E and 17.8% EBITDA margin in FY21E Particular Amount before Esop cost. Market Capi (| Crore) 15,116.7 Healthy deal pipeline, digital to drive growth Total Debt (| Crore) 4.8 Update Result Cash & Invests (| Crore) 917.1 Coforge is witnessing healthy traction in cloud, data and artificial intelligence EV (| Crore) 14,204.4 (AI). This has led to healthy growth in digital revenues. The company is driving this growth via partnerships with large players in cloud like Microsoft 52 week H/L 2813 / 739 Azure, Google cloud and AWS and partnering with product start-ups that Equity capital 62.5 can help it to drive new age technology growth. Hence, we expect the Face value 10.0 company to benefit from improved traction in digital technology, going forward. Further, we expect Coforge to witness healthy traction in the BFS Key Highlights and insurance vertical led by large deal wins and wallet share gain in travel segment. In addition, the company expects strong revenue growth in Dollar revenue to improve in coming quarters based on large deal won and healthcare vertical (as seen in this quarter). -

India Meets Britain Tracker 2020 17 © 2021 Grant Thornton UK LLP

India meets Britain Tracker The latest trends in Indian investment in the UK 2021 About our research Our Tracker, developed in collaboration with the Confederation of Indian Industry, identifies the top fastest-growing Indian companies in the UK as measured by percentage revenue growth year-on-year. The Tracker includes Indian-owned corporates with operations headquartered or with a significant base in the UK, with turnover of more than £5 million, year-on-year revenue growth of at least 10% and a minimum two-year track record in the UK, based on the latest published accounts filed as at 31 March 2021, where available. Turnover figures have been annualised where periods of less or more than 12 months have been reported1. In the UK, to reflect the pandemic challenges, companies were granted a three-month extension to the usual filing period. Indian companies that took advantage of this option may therefore not appear in this year’s research. Our report also highlights the top Indian employers – those companies that employ more than 1,000 people in the UK2. To compile the India meets Britain Tracker 2021, Grant Thornton analysed data from 850 UK- incorporated limited companies that are owned directly or indirectly, or controlled, by either an Indian-incorporated parent or an Indian citizen resident outside the UK3. 1 As our research relies on published and filed accounts, there is inevitably a time lag between the recording of the performance of the companies and the publication of this report. 2 Employment numbers may include employees -

John Hancock Emerging Markets Fund

John Hancock Emerging Markets Fund Quarterly portfolio holdings 5/31/2021 Fund’s investments As of 5-31-21 (unaudited) Shares Value Common stocks 98.2% $200,999,813 (Cost $136,665,998) Australia 0.0% 68,087 MMG, Ltd. (A) 112,000 68,087 Belgium 0.0% 39,744 Titan Cement International SA (A) 1,861 39,744 Brazil 4.2% 8,517,702 AES Brasil Energia SA 14,898 40,592 Aliansce Sonae Shopping Centers SA 3,800 21,896 Alliar Medicos A Frente SA (A) 3,900 8,553 Alupar Investimento SA 7,050 36,713 Ambev SA, ADR 62,009 214,551 Arezzo Industria e Comercio SA 1,094 18,688 Atacadao SA 7,500 31,530 B2W Cia Digital (A) 1,700 19,535 B3 SA - Brasil Bolsa Balcao 90,234 302,644 Banco Bradesco SA 18,310 80,311 Banco BTG Pactual SA 3,588 84,638 Banco do Brasil SA 15,837 101,919 Banco Inter SA 3,300 14,088 Banco Santander Brasil SA 3,800 29,748 BB Seguridade Participacoes SA 8,229 36,932 BR Malls Participacoes SA (A) 28,804 62,453 BR Properties SA 8,524 15,489 BrasilAgro - Company Brasileira de Propriedades Agricolas 2,247 13,581 Braskem SA, ADR (A) 4,563 90,667 BRF SA (A) 18,790 92,838 Camil Alimentos SA 11,340 21,541 CCR SA 34,669 92,199 Centrais Eletricas Brasileiras SA 5,600 46,343 Cia Brasileira de Distribuicao 8,517 63,718 Cia de Locacao das Americas 18,348 93,294 Cia de Saneamento Basico do Estado de Sao Paulo 8,299 63,631 Cia de Saneamento de Minas Gerais-COPASA 4,505 14,816 Cia de Saneamento do Parana 3,000 2,337 Cia de Saneamento do Parana, Unit 8,545 33,283 Cia Energetica de Minas Gerais 8,594 27,209 Cia Hering 4,235 27,141 Cia Paranaense de Energia 3,200 -

Equity Research

Equity Research INDIA May 19, 2021 BSE Sensex: 50193 Technology ICICI Securities Limited is the author and A wake up call against unrealistic expectations! distributor of this report Our anti-consensus sector stance that steady state growth/margins are unlikely to be higher vs pre-covid (Link, Link, Link) echoed in Q4FY21 performance/outlook. As consensus rationalised lofty expectations to an extent, sector witnessed downgrades - notwithstanding the sharp INR depreciation. Despite the continued Sector update euphoria, incremental cloud sales at hyper-scalars remained range bound. The sector continued reporting strong deal wins. However, this metric per se is noticed to be incomplete with no strong causal relationship on future growth. In FY21, BFS Reco Snapshot TP / Healthcare witnessed ‘reactive’ (to covid crisis) spends. (1) Rebalancing of these Reco (Rs) Upside spends in FY22 and (2) geographic de-risking by clients pose key risks to outlook. TCS HOLD 3,230 5% (1) Resumption of office/marketing events onsite, (2) increase in onsite effort, (3) Infosys BUY 1,600 19% Wipro SELL 365 -28% employee absenteeism in India, (4) catch-up investments and (5) acquisitions HCLT ADD 1,050 13% should translate into largely pre-covid (or lower) margins. Multiples remain TechM HOLD 1,000 3% significantly higher (NIFTY IT: +41%, vs pre-covid averages) on absolute and even Mphasis ADD 1,910 8% Persistent REDUCE 2,050 -12% relative basis (NIFTY: +19%, BANK NIFTY: -8%, NIFTY FMCG: +3% and NIFTY LTI BUY 4,705 29% Pharma: +24%). More overheated in case of mid-cap IT. Valuation premia are still Mindtree HOLD 2,173 4% banking on ‘post covid growth acceleration (g)’ expectations implying further Coforge REDUCE 2,950 -14% LTTS SELL 2,000 -24% scope for disappointments. -

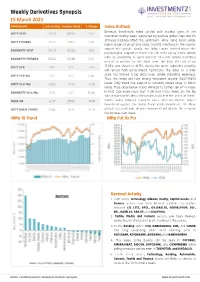

Weekly Derivatives Synopsis

Weekly Derivatives Synopsis 15 March 2021 PARTICULARS Last Closing Previous Week % Change Index Outlook Domestic benchmark index settled with modest gains in the NIFTY SPOT 15031 14938 0.62 truncated trading week, supported by positive global cues and US stimulus package lifted the sentiment, while rising bond yields, NIFTY FUTURES 15051 14953 0.66 higher crude oil prices and rising Covid-19 infections in the country capped the upside. Finally, the Nifty Future settled above the BANKNIFTY SPOT 35497 35228 0.76 psychological support of 15000 level at 15051 up by 0.66% (WoW) with an unwinding in open interest of 6.70% (WoW) indicating BANKNIFTY FUTURES 35522 35288 0.66 neutral to positive for the short term. The India VIX cool off by NIFTY PCR 1.02 1.12 -8.93 15.06% and closed at 21.71% during the week, expecting volatility will remain high going ahead. Technically, the index on a daily NIFTY PCR-VOL 1.00 1.00 0.00 scale has formed a big black body candle indicating weakness. Thus, the index will face strong resistance around 15300-15400 NIFTY OI(In Mn) 13.65 14.63 -6.70 levels. Daily trend line support is currently placed close to 14900 levels. Thus, close below 14900, will lead to further sell off in index. BANKNIFTY OI(In Mn) 3.19 2.67 19.48 In that case index could test 14700 and 14500 levels. On the flip side, if index holds 14900 then index could test the levels of 15300- INDIA VIX 21.71 25.56 -15.06 15400. -

ISG Providerlens™ Quadrant Report

Public Cloud - Solutions & A research report Services comparing provider strengths, challenges Consulting and Transformational Services and competitive for Midmarket differentiators USA 2020 Quadrant Report Customized report courtesy of: November 2020 ISG Provider Lens™ Quadrant Report | November 2020 Section Name About this Report Information Services Group Inc. is solely responsible for the content of this report. Un- ISG Provider Lens™ delivers leading-edge and actionable research studies, reports less otherwise cited, all content, including illustrations, research, conclusions, assertions and consulting services focused on technology and service providers’ strengths and and positions contained in this report were developed by, and are the sole property of weaknesses and how they are positioned relative to their peers in the market. These Information Services Group Inc. reports provide influential insights accessed by our large pool of advisors who are The research and analysis presented in this report includes research from the ISG actively advising outsourcing deals as well as large numbers of ISG enterprise clients Provider Lens™ program, ongoing ISG Research programs, interviews with ISG advisors, who are potential outsourcers. briefings with services providers and analysis of publicly available market information from multiple sources. The data collected for this report represents information that For more information about our studies, please email [email protected], ISG believes to be current as of September 2020 for providers who actively participated call +49 (0) 561-50697537, or visit ISG Provider Lens™ under ISG Provider Lens™. as well as for providers who did not. ISG recognizes that many mergers and acquisitions have taken place since that time, but those changes are not reflected in this report. -

Information Technology14may21

IT Services Q4FY21 Result Review May 15, 2021 Strong growth momentum in key sectors… Quick Pointers: PL Universe . Demand Environment remains strong, Strong deal wins across companies. Companies Rating CMP (Rs) TP (Rs) . Margin headwinds arriving from supply side constraints will be easily absorbed by 1) Strong revenue growth, 2) Better pricing for CX & digital deals, 3) Focus TCS BUY 3,052 3,636 on offshoring & 4) Pyramid optimization. Infosys BUY 1,316 1,632 Wipro BUY 498 500 . We like TCS, INFY, Wipro in large caps & Coforge, MTCL & LTTS in midcap HCL Tech BUY 910 1,010 space. Tech M BUY 952 1,132 L&T Infotech BUY 3,598 4,415 Tier-1 IT Services’ revenue growth in 4QFY21 was tad lower at 3.7% QoQ USD Mindtree BUY 2,104 2,567 as compared to previous two quarters. 3 out of 5 tier-1 IT companies reported Mphasis BUY 1,789 1,935 miss on revenue estimates. However, we still continue to be confident of COFORGE BUY 3,357 3,762 strong demand environment and miss is only due to moderation of revenue Persistent BUY 2,278 2,344 growth post 2 quarters of strong growth. Revenue growth was led by strong Zensar BUY 271 290 demand momentum in BFSI and sustained recovery in manufacturing & retail L&T Tech. BUY 2,540 3,006 sectors. Communications vertical was weak for all companies. Management Cyient BUY 775 825 commentary across board indicated record high deal pipeline and broad- Source: Company, PL based demand environment characterized by (1) cost take-out and transformation led outsourcing or lift-shift-transform deals and (2) digital and cloud adoption led deals. -

(ADS) in Life and Annuities (L&A) Insurance Services 2021

Everest Group PEAK Matrix® for Application and Digital Service (ADS) Providers in Life and Annuities (L&A) Insurance 2021 Focus on Infosys February 2021 Copyright © 2021 Everest Global, Inc. This document has been licensed for exclusive use and distribution by Infosys EGR-2020-31-E-4211 Everest Group PEAK Matrix® for Application and Digital Service (ADS) Providers in Life and Annuities (L&A) Insurance 2021 Background of the research Life and Annuities (L&A) insurers are facing dual pressures – significant profitability pressures due to interest rate depressions around the globe and increasing legacy technology costs due to outdated core systems and modernization as compared to their Property and Casualty (P&C) counterparts. This has accelerated the need to rapidly adopt modern core systems, leverage analytics and current technology to rationalize costs, seek insights form existing data to develop new and innovative products with a shorter time-to-market cycle, and at the same time deal with increasing regulatory pressures to be compliant and undertake best-interest sales. The writing on the wall is clear, the time for L&A insurers to change is now. In this research, we present an assessment and detailed profiles of 21 leading IT service providers on the Application and Digital Services in L&A insurance PEAK Matrix®. Each service provider profile provides a comprehensive picture of its service focus, key Intellectual Property (IP) / solutions, domain investments, and case studies. The assessment is based on Everest Group’s annual RFI process for calendar year 2020, interactions with leading insurance IT services providers, client reference checks, and an ongoing analysis of the insurance IT services market. -

Tech Mahindra (TECMAH)

Tech Mahindra (TECMAH) CMP: | 848 Target: | 1040 (23%) Target Period: 12 months BUY October 24, 2020 Robust margin expansion... Tech Mahindra’s (TechM) revenues increased 2.9% QoQ in constant currency terms (above our estimate of 1.1% QoQ in CC terms) mainly led by 0.8% QoQ growth in communication revenues and 4.3% QoQ growth in Particulars enterprise revenues. The company also reported a healthy expansion in EBITDA margins (up 397 bps QoQ to 18.2%) mainly led by higher utilisation, Particular Amount offshoring and rationalisation of SG&A expenses. The order book improved Market Cap (| Crore) 81,951.9 45.2% QoQ to US$421 million. Total Debt (| Crore) 2,428.2 Healthy deal pipeline, traction in digital to drive growth Cash and Invest (| Crore) 8,760.6 Update Result EV (| Crore) 75,619.5 TechM saw healthy growth in revenues in the current quarter mainly led by 52 week H/L 888 / 470 robust growth in enterprise segment (led by banking & technology vertical). Equity capital 435.9 Going forward, the company believes manufacturing has bottomed out and Face value | 5 could see healthy traction led by improving growth in engineering side (especially in auto). In addition, TechM is witnessing improving trends in retail and utility. Further, on the communication side, expect IT spends to Key Highlights improve led by 5G, digital, customer experience, AI, cloud and network Leadership in communication vertical operations. Further, TechM is seeing healthy funnel in holistic to drive long term growth. Enterprise transformation of telecom service providers and the company is in advanced segment to benefit from improved stages with many customers in transformational projects. -

Momentum Pick

Momentum Picks Open Recommendations New recommendations Gladiator Stocks Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 1-Oct-21 Nifty Nifty Sell 17520-17545 17482/17430 17583.00 Intraday Scrip Action 1-Oct-21 ONGC ONGC Buy 142.50-143.00 144.25/145.70 141.20 Intraday Hindalco Buy PICK MOMENTUM 1-Oct-21 UPL UPL Sell 707.00-708.00 700.60/693.80 714.60 Intraday Bata India Buy 30-Sep-21 Trent TRENT Buy 1010-1025 1125 948.00 30 Days HDFC Buy 30-Sep-21 Dhampur Sugar DHASUG Buy 290-294 312 282.00 07 Days Duration: 3 Months Click here to know more… Open recommendations Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 29-Sep-21 SJVN SJVLIM Buy 28.3-29 31.50 27.00 14 Days 29-Sep-21 National Aluminium NATALU Buy 92-94 101.00 86.50 07 Days Intraday recommendations are for current month futures. Positional recommendations are in cash segment Retail Equity Research Retail – October 1, 2021 For Instant stock ideas: SUBSCRIBE to mobile notification on ICICIdirect Mobile app… Research Analysts Securities ICICI Dharmesh Shah Nitin Kunte, CMT Ninad Tamhanekar, CMT [email protected] [email protected] [email protected] Pabitro Mukherjee Vinayak Parmar [email protected] [email protected] NSE (Nifty): 17618 Technical Outlook NSE Nifty Daily Candlestick Chart Domestic Indices Day that was… Open High Low Close Indices Close 1 Day Chg % Chg Equity benchmarks concluded the monthly expiry session on a subdued note tracking mixed global cues. -

NSE Symbol NSE 6 Month Avg Total Market

Average Market Cap of 200 listed companies on BSE & NSE for the six months ended 30 June 2021 BSE 6 month Avg NSE 6 month Avg Average of BSE and NSE 6 Total Market Cap Total Market Cap month Avg Total Market Cap S.No. Company Name ISIN BSE SYMBOL (Rs. In Crs.) NSE Symbol (Rs. In Crs.) (Rs. in Crs.) 1 Reliance Industries Ltd INE002A01018 RELIANCE 1338017.01 RELIANCE 1355067.509 1346542.26 Tata Consultancy Services 2 Ltd. INE467B01029 TCS 1169783.56 TCS 1173068.166 1171425.86 3 HDFC Bank Ltd. INE040A01034 HDFCBANK 819037.95 HDFCBANK 818713.671 818875.81 4 Infosys Ltd INE009A01021 INFY 579784.19 INFY 579697.3885 579740.79 5 Hindustan Unilever Ltd., INE030A01027 HINDUNILVR 549336.78 HINDUNILVR 549358.908 549347.84 Housing Development 6 Finance Corp.Lt INE001A01036 HDFC 462288.58 HDFC 461373.1089 461830.84 7 ICICI Bank Ltd. INE090A01021 ICICIBANK 416645.51 ICICIBANK 416389.0234 416517.27 8 Kotak Mahindra Bank Ltd. INE237A01028 KOTAKBANK 361640.52 KOTAKBANK 361438.6361 361539.58 9 State Bank Of India, INE062A01020 SBIN 329767.32 SBIN 329789.268 329778.29 10 Bajaj Finance Limited INE296A01024 BAJFINANCE 324996.53 BAJFINANCE 324843.5005 324920.02 11 Bharti Airtel Ltd. INE397D01024 BHARTIARTL 299981.36 BHARTIARTL 299955.7729 299968.57 12 HCL Technologies Ltd INE860A01027 HCLTECH 261400.46 HCLTECH 261392.0109 261396.24 13 Wipro Ltd., INE075A01022 WIPRO 258617.45 WIPRO 261102.3994 259859.92 14 ITC Ltd INE154A01025 ITC 259423.16 ITC 259396.0648 259409.61 15 Asian Paints Ltd. INE021A01026 ASIANPAINT 253487.28 ASIANPAINT 253454.4536 253470.87 16 AXIS Bank Ltd.