FTSE Global All Cap Choice Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gamania Digital Entertainment Co., Ltd. Financial

GAMANIA DIGITAL ENTERTAINMENT CO., LTD. FINANCIAL STATEMENTS AND REPORT OF INDEPENDENT ACCOUNTANTS DECEMBER 31, 2009 AND 2008 For the convenience of readers and for information purpose only, the auditors’ report and the accompanying financial statements have been translated into English from the original Chinese version prepared and used in the Republic of China. In the event of any discrepancy between the English version and the original Chinese version or any differences in the interpretation of the two versions, the Chinese-language auditors’ report and financial statements shall prevail. Report of Independent Accountants Translated from Chinese PWCR09000120 To the Board of Directors and Stockholders of Gamania Digital Entertainment Co., Ltd. We have audited the accompanying balance sheets of Gamania Digital Entertainment Co., Ltd. as of December 31, 2009 and 2008, and the related statements of income, of changes in stockholders’ equity and of cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits. As described in Note 4(7), we did not audit the financial statements of certain investees accounted for under the equity method. These long-term investments amounted to $691,506 thousand and $662,757 thousand as of December 31, 2009 and 2008, respectively, and the related investment loss was $33,714 thousand and $28,140 thousand for the years then ended, respectively. The financial statements of these companies were audited by other auditors whose reports thereon have been furnished to us, and our opinion expressed herein, insofar as it relates to long-term investments in these companies, is based solely on the reports of the other auditors. -

Outdoor Club Japan (OCJ) 国際 アウトドア・クラブ・ジャパン Events

Outdoor Club Japan (OCJ) 国際 アウトドア・クラブ・ジャパン Events Norikuradake Super Downhill 10 March Friday to 12 March Monday If you are not satisfied ski & snowboard in ski area. You can skiing from summit. Norikuradake(3026m)is one of hundred best mountain in Japan. This time is good condition of backcountry ski season. Go up to the summit of Norikuradake by walk from the top of last lift(2000m). Climb about 5 hours and down to bottom lift(1500m) about 50 min. (Deta of last time) Transport: Train from Shinjuku to Matsumoto and Taxi from Matsumoto to Norikura-kogen. Return : Bus from Norikura-kogen to Sinshimashima and train to Shinjuku. Meeting Time & Place : 19:30 Shijuku st. platform 5 car no.1 for super Azusa15 Cost : About Yen30000 Train Shinjuku to matsumoto Yen6200(ow) but should buy 4coupon ticket each coupon Yen4190 or You can buy discount ticket shop in town price is similar. (price is non-reserve seat) Taxi about Yen13000 we will share. Return bus Yen1300 and local train Yen680. Inn Yen14000+tax 2 overnight 2 breakfast 1 dinner (no dinner Friday) Japanese room and hot spring! Necessary equipment : Skiers & Telemarkers need a nylon mohair skin. Snowboarders need snowshoes. Crampons(over 8point!) Clothes: Gore-tex jacket and pants, fleece, hut, musk, gloves, sunglasses, headlamp, thermos, lunch, sunscreen If you do not go up to the summit, you can enjoy the ski area and hot springs. 1 day lift pass Yen4000 Limit : 12persons (priority is downhill from summit) In Japanese : 026m)の頂上からの滑降です。 ゲレンデスキーに物足りないスキーヤー、スノーボーダー向き。 山スキーにいいシーズンですが、天気次第なので一応土、日と2日間の時間をとりました。 -

SPDR INDEX SHARES FUNDS Form NPORT-P Filed 2020-02-28

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2020-02-28 | Period of Report: 2019-12-31 SEC Accession No. 0001752724-20-042739 (HTML Version on secdatabase.com) FILER SPDR INDEX SHARES FUNDS Mailing Address Business Address ONE LINCOLN STREET ONE LINCOLN STREET CIK:1168164| IRS No.: 421537593 | State of Incorp.:MA | Fiscal Year End: 0930 BOSTON MA 02111 BOSTON MA 02111 Type: NPORT-P | Act: 40 | File No.: 811-21145 | Film No.: 20669045 617-664-1465 Copyright © 2020 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Quarterly Report December 31, 2019 SPDR® Index Shares Funds The information contained in this report is intended for the general information of shareholders of the Trust. This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current Trust prospectus which contains important information concerning the Trust. You may obtain a current prospectus and SAI from the Distributor by calling 1-866-787-2257 or visiting www.spdrs.com. Please read the prospectus carefully before you invest. TABLE OF CONTENTS (Unaudited) Schedules of Investments (Unaudited) SPDR Portfolio Europe ETF (SPEU) 1 SPDR EURO STOXX 50 ETF (FEZ) 17 SPDR EURO STOXX Small Cap ETF (SMEZ) 19 SPDR S&P Emerging Asia Pacific ETF (GMF) 22 SPDR S&P China ETF (GXC) 42 SPDR Portfolio Emerging Markets ETF (SPEM) 56 SPDR S&P Emerging Markets Dividend ETF (EDIV) 87 SPDR Portfolio Developed World ex-US ETF (SPDW) 90 SPDR S&P International Small Cap ETF (GWX) -

Fidelity® Emerging Markets Index Fund

Quarterly Holdings Report for Fidelity® Emerging Markets Index Fund January 31, 2021 EMX-QTLY-0321 1.929351.109 Schedule of Investments January 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 92.5% Shares Value Shares Value Argentina – 0.0% Lojas Americanas SA rights 2/4/21 (b) 4,427 $ 3,722 Telecom Argentina SA Class B sponsored ADR (a) 48,935 $ 317,099 Lojas Renner SA 444,459 3,368,738 YPF SA Class D sponsored ADR (b) 99,119 361,784 Magazine Luiza SA 1,634,124 7,547,303 Multiplan Empreendimentos Imobiliarios SA 156,958 608,164 TOTAL ARGENTINA 678,883 Natura & Co. Holding SA 499,390 4,477,844 Notre Dame Intermedica Participacoes SA 289,718 5,003,902 Bailiwick of Jersey – 0.1% Petrobras Distribuidora SA 421,700 1,792,730 Polymetal International PLC 131,532 2,850,845 Petroleo Brasileiro SA ‑ Petrobras (ON) 2,103,697 10,508,104 Raia Drogasil SA 602,000 2,741,865 Bermuda – 0.7% Rumo SA (b) 724,700 2,688,783 Alibaba Health Information Technology Ltd. (b) 2,256,000 7,070,686 Sul America SA unit 165,877 1,209,956 Alibaba Pictures Group Ltd. (b) 6,760,000 854,455 Suzano Papel e Celulose SA (b) 418,317 4,744,045 Beijing Enterprises Water Group Ltd. 2,816,000 1,147,720 Telefonica Brasil SA 250,600 2,070,242 Brilliance China Automotive Holdings Ltd. 1,692,000 1,331,209 TIM SA 475,200 1,155,127 China Gas Holdings Ltd. 1,461,000 5,163,177 Totvs SA 274,600 1,425,346 China Resource Gas Group Ltd. -

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Global Diversified Income Fund As of December 31, 2017

Global Diversified Income Fund As of December 31, 2017 SCHEDULE OF INVESTMENTS ISSUER SHARES MARKET % TOTAL NET VALUE ASSETS CMBS FREMF 2016-KBAM Mortgage Trust 68,415,100 $ 69,966,481 0.56% Principal Government Money Market Fund 37,738,923 $ 37,738,923 0.30% JP Morgan Chase Commercial Mortgage Securities Trust 2007-CIBC19 35,000,000 $ 26,044,155 0.21% UBS-Barclays Commercial Mortgage Trust 2012-C3 25,827,000 $ 25,129,322 0.20% JPMBB Commercial Mortgage Securities Trust 2013-C15 23,750,000 $ 23,255,494 0.19% ML-CFC Commercial Mortgage Trust 2007-9 23,564,753 $ 19,307,284 0.15% COMM 2014-UBS3 Mortgage Trust 21,861,000 $ 18,237,080 0.15% UBS-Barclays Commercial Mortgage Trust 2012-C4 21,000,000 $ 17,890,927 0.14% UBS-Barclays Commercial Mortgage Trust 2012-C3 20,994,000 $ 17,400,621 0.14% JPMBB Commercial Mortgage Securities Trust 2014-C24 20,500,000 $ 17,331,428 0.14% Morgan Stanley Bank of America Merrill Lynch Trust 2013-C8 18,500,000 $ 16,991,891 0.14% JP Morgan Chase Commercial Mortgage Securities Trust 2013-C16 16,202,517 $ 15,710,707 0.13% Credit Suisse Commercial Mortgage Trust Series 2007-C1 30,000,000 $ 15,276,549 0.12% Comm 2013-CCRE13 Mortgage Trust 18,660,000 $ 14,244,533 0.11% UBS-Barclays Commercial Mortgage Trust 2012-C4 17,981,000 $ 13,393,907 0.11% LB-UBS Commercial Mortgage Trust 2007-C6 13,250,000 $ 13,228,140 0.11% Morgan Stanley Bank of America Merrill Lynch Trust 2014-C16 17,104,000 $ 12,674,755 0.10% JPMBB Commercial Mortgage Securities Trust 2013-C12 13,826,000 $ 12,608,030 0.10% DBJPM 17-C6 Mortgage Trust 15,000,000 -

Nomura Funds Ireland Plc

NOMURA FUNDS IRELAND PLC Interim Report and Unaudited Financial Statements for the half year ended 30th June, 2013 Company Registration No. 418598 NOMURA FUNDS IRELAND PLC TABLE OF CONTENTS Page MANAGEMENT AND ADMINISTRATION 2 GENERAL INFORMATION 3 INVESTMENT MANAGER’S REPORT 9 NOMURA FUNDS IRELAND - GLOBAL EMERGING MARKETS FUND 9 NOMURA FUNDS IRELAND - INDIA EQUITY FUND 10 NOMURA FUNDS IRELAND - ASIA EX JAPAN FUND 12 NOMURA FUNDS IRELAND - FUNDAMENTAL INDEX GLOBAL EQUITY FUND 14 NOMURA FUNDS IRELAND - JAPAN STRATEGIC VALUE FUND 16 NOMURA FUNDS IRELAND - US HIGH YIELD BOND FUND 18 NOMURA FUNDS IRELAND - NEWS EMERGING MARKETS SMALL CAP EQUITY FUND 20 NOMURA FUNDS IRELAND - ASIAN SMALLER COMPANIES FUND 21 STATEMENT OF FINANCIAL POSITION 23 STATEMENT OF COMPREHENSIVE INCOME 26 STATEMENT OF CHANGES IN NET ASSETS ATTRIBUTABLE TO HOLDERS OF REDEEMABLE PARTICIPATING SHARES 29 STATEMENT OF CASH FLOWS 32 NOTES TO THE FINANCIAL STATEMENTS 37 STATEMENT OF INVESTMENTS NOMURA FUNDS IRELAND - GLOBAL EMERGING MARKETS FUND 51 NOMURA FUNDS IRELAND - INDIA EQUITY FUND 63 NOMURA FUNDS IRELAND - ASIA EX JAPAN FUND 65 NOMURA FUNDS IRELAND - FUNDAMENTAL INDEX GLOBAL EQUITY FUND 69 NOMURA FUNDS IRELAND - JAPAN STRATEGIC VALUE FUND 118 NOMURA FUNDS IRELAND - US HIGH YIELD BOND FUND 123 NOMURA FUNDS IRELAND - NEWS EMERGING MARKETS SMALL CAP EQUITY FUND 144 NOMURA FUNDS IRELAND - ASIAN SMALLER COMPANIES FUND 160 STATEMENT OF CHANGES IN THE PORTFOLIO NOMURA FUNDS IRELAND - GLOBAL EMERGING MARKETS FUND 163 NOMURA FUNDS IRELAND - INDIA EQUITY FUND 165 NOMURA FUNDS -

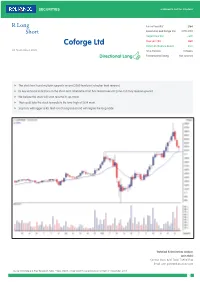

Coforge Ltd Potential Absolute Return 29% 03 November 2020 Time Horizon 9 Weeks Directional Long Fundamental Rating Not Covered

R Long Future Price (Rs)* 2164 Short Recommended Range (Rs) 2170-2150 Target Price (Rs) 2800 Stop Loss (Rs) 1880 Coforge Ltd Potential Absolute Return 29% 03 November 2020 Time Horizon 9 Weeks Directional Long Fundamental Rating Not covered f The stock has found multiple supports around 2080 level post a higher level reversal. f Its key technical indicators on the short-term timeframe chart has tested oversold zone and may reverse upward. f We believe the stock will soon resume its up-move. f That could take the stock towards its life-time-high of 2814 mark. f Stop loss will trigger at Rs 1880 (on closing basis) and will negate the long trade Technical & Derivatives Analyst: Jatin Gohil Contact: (022) 4215 7024/ 7498411546 Email: [email protected] Source: Bloomberg & RSec Research; Note: * Near Month- Single Stock Future price as on 12:15pm 3rd November, 2020 1 Recommendation Summary R Long Short Sr. Reco. Date Time Call Closure Recommendation Company Name Reco. Target Stop Call Status Current Return No Horizon date Price* Loss Price (%) Open Position 1 09-Sep-20 9 Weeks Short Bajaj Finance 3,413 2,550 3,770 Open 3456 -1.3% 2 20-Oct-20 10 Weeks Long Dabur 528 630 484 Open 516 -2.1% 3 21-Oct-20 6 Weeks Long M&M Financial 129 152 119 Open 126 -2.3% 4 30-Oct-20 6 Weeks Short JSW Steel 311 265 345 Open 314 0.9% 5 02-Nov-20 10 Weeks Long MFSL 615 800 545 Open 614 -0.1% Closed Positions 1 09-Oct-20 6 Weeks 28-Oct-20 Long Larsen & Toubro 900 1,065 842 Profit Booked 978 8.7% 2 15-Oct-20 6 Weeks 27-Oct-20 Long Kotak Bank 1,349 1,550 1,235 -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Tuesday July 30, 1996

7±30±96 Tuesday Vol. 61 No. 147 July 30, 1996 Pages 39555±39838 federal register 1 II Federal Register / Vol. 61, No. 147 / Tuesday, July 30, 1996 SUBSCRIPTIONS AND COPIES PUBLIC Subscriptions: Paper or fiche 202±512±1800 FEDERAL REGISTER Published daily, Monday through Friday, Assistance with public subscriptions 512±1806 (not published on Saturdays, Sundays, or on official holidays), by General online information 202±512±1530 the Office of the Federal Register, National Archives and Records Administration, Washington, DC 20408, under the Federal Register Single copies/back copies: Act (49 Stat. 500, as amended; 44 U.S.C. Ch. 15) and the Paper or fiche 512±1800 regulations of the Administrative Committee of the Federal Register Assistance with public single copies 512±1803 (1 CFR Ch. I). Distribution is made only by the Superintendent of Documents, U.S. Government Printing Office, Washington, DC FEDERAL AGENCIES 20402. Subscriptions: The Federal Register provides a uniform system for making Paper or fiche 523±5243 available to the public regulations and legal notices issued by Assistance with Federal agency subscriptions 523±5243 Federal agencies. These include Presidential proclamations and For other telephone numbers, see the Reader Aids section Executive Orders and Federal agency documents having general applicability and legal effect, documents required to be published at the end of this issue. by act of Congress and other Federal agency documents of public interest. Documents are on file for public inspection in the Office of the Federal Register the day before they are published, unless earlier filing is requested by the issuing agency. -

Coforge Ltd (NIITEC)

Coforge Ltd (NIITEC) CMP: | 2456 Target: | 2690 ( 10%) Target Period: 12 months HOLD October 23, 2020 Robust operating performance… Coforge Ltd (Coforge) registered healthy revenue growth, up 8.1% QoQ in constant currency terms, above our estimate of 7.0% QoQ growth. The revenue growth was broad based across verticals mainly led by insurance (up 13.5% QoQ) and BFS (up 10.2% QoQ). Digital revenues (including IP) also increased 18.7% QoQ. Further, Coforge has guided for revenue growth Particulars of 6% YoY organic growth in FY21E and 17.8% EBITDA margin in FY21E Particular Amount before Esop cost. Market Capi (| Crore) 15,116.7 Healthy deal pipeline, digital to drive growth Total Debt (| Crore) 4.8 Update Result Cash & Invests (| Crore) 917.1 Coforge is witnessing healthy traction in cloud, data and artificial intelligence EV (| Crore) 14,204.4 (AI). This has led to healthy growth in digital revenues. The company is driving this growth via partnerships with large players in cloud like Microsoft 52 week H/L 2813 / 739 Azure, Google cloud and AWS and partnering with product start-ups that Equity capital 62.5 can help it to drive new age technology growth. Hence, we expect the Face value 10.0 company to benefit from improved traction in digital technology, going forward. Further, we expect Coforge to witness healthy traction in the BFS Key Highlights and insurance vertical led by large deal wins and wallet share gain in travel segment. In addition, the company expects strong revenue growth in Dollar revenue to improve in coming quarters based on large deal won and healthcare vertical (as seen in this quarter). -

Market Cap Close ADV

Market Cap Close ADV 1598 67th Pctl $745,214,477.91 $23.96 225,966.94 801 33rd Pctl $199,581,478.89 $10.09 53,054.83 2399 Listing_ Revised Ticker_Symbol Security_Name Exchange Effective_Date Mkt Cap Close ADV Stratum Stratum AAC AAC Holdings, Inc. N 20160906 M M M M-M-M M-M-M Altisource Asset Management AAMC Corp A 20160906 L M L L-M-L L-M-L AAN Aarons Inc N 20160906 H H H H-H-H H-H-H AAV Advantage Oil & Gas Ltd N 20160906 H L M H-L-M H-M-M AB Alliance Bernstein Holding L P N 20160906 H M M H-M-M H-M-M ABG Asbury Automotive Group Inc N 20160906 H H H H-H-H H-H-H ABM ABM Industries Inc. N 20160906 H H H H-H-H H-H-H AC Associated Capital Group, Inc. N 20160906 H H L H-H-L H-H-L ACCO ACCO Brand Corp. N 20160906 H L H H-L-H H-L-H ACU Acme United A 20160906 L M L L-M-L L-M-L ACY AeroCentury Corp A 20160906 L L L L-L-L L-L-L ADK Adcare Health System A 20160906 L L L L-L-L L-L-L ADPT Adeptus Health Inc. N 20160906 M H H M-H-H M-H-H AE Adams Res Energy Inc A 20160906 L H L L-H-L L-H-L American Equity Inv Life Hldg AEL Co N 20160906 H M H H-M-H H-M-H AF Astoria Financial Corporation N 20160906 H M H H-M-H H-M-H AGM Fed Agricul Mtg Clc Non Voting N 20160906 M H M M-H-M M-H-M AGM A Fed Agricultural Mtg Cla Voting N 20160906 L H L L-H-L L-H-L AGRO Adecoagro S A N 20160906 H L H H-L-H H-L-H AGX Argan Inc N 20160906 M H M M-H-M M-H-M AHC A H Belo Corp N 20160906 L L L L-L-L L-L-L ASPEN Insurance Holding AHL Limited N 20160906 H H H H-H-H H-H-H AHS AMN Healthcare Services Inc.