Best Performing Corporate Leaders of India 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Great Tradition Globalizes: Reflections on Two Studies of ‘The Industrial Leaders’ of Madras

Working Paper Series ISSN 1470-2320 2001 No. 01-17 THE GREAT TRADITION GLOBALIZES: REFLECTIONS ON TWO STUDIES OF ‘THE INDUSTRIAL LEADERS’ OF MADRAS Prof. John Harriss Published: November 2001 Development Studies Institute London School of Economics and Political Science Houghton Street Tel: +44 (020) 7955-6252 London Fax: +44 (020) 7955-6844 WC2A 2AE UK Email: [email protected] Web site: www.lse.ac.uk/depts/destin The London School of Economics is a School of the University of London. It is a charity and is incorporated in England as a company limited by guarantee under the Companies Act (Reg. No. 70527). 1 THE GREAT TRADITION GLOBALIZES: REFLECTIONS ON TWO STUDIES OF ‘THE INDUSTRIAL LEADERS’ OF MADRAS By John Harriss The title of this paper alludes, of course, to Milton Singer’s book When A Great Tradition Modernizes: an anthropological approach to Indian civilization (1972), and particularly to Part IV of the book, which has the title ‘Modernization and Traditionalization’ and includes a long essay called ‘Industrial Leadership, the Hindu Ethic and the Spirit of Socialism’. The book, though it does not have the same stature in Indian anthropology as Dumont’s Homo Hierarchicus, or the essays of M N Srinivas, constituted a major contribution in its time, both as a study of Hinduism in an urban context, and as a critique of the stale old comparative statics of conventional sociological modernization theory. The core of Singer’s argument about modernization is contained in the concluding words of the long chapter which is based on his interviews with (nineteen) ‘industrial leaders’ of Madras in 1964: (The book is about) how Indians are changing their cultural traditions as they incorporate modern industry and how they are changing modern industry in order to maintain their cultural traditions. -

Aditya Birla Group

e:J .N-'U8S110:Ka20180029S ADITYA BIRLA GROUP NO. fHRD/76[C]-Fl2018/ \C30 Date: 10104/2018 This is to verify that Mr PUNITH J N, MBA student, USN: 1AY16MBA51 of Acharya Institute Of Technology, Acharya Dr. Sarvapalli Radhakrishna Road, Hesaraghatta Main Road,Bengaluru-560090. Affiliated to Visvesvaraya University, Belgaum, has done Project work on the topic "A Study On Cash From Operating Activities And Its Management "at Aditya Birla limited, Bengalurur Kamataka Soaps And Detergents Limited, Bengalur, from 15- 01-2018 to 10-04-2018. During his Project work in the Organisation , We have found his Character & Conduct to be good. We wish bis success in life and Career. Aditya Birla Groups 3, Industry House #45, Race Course Road, Beside Chalukya Hotel, Bengaluru, Karnataka-560001 ACHARYA INSTITUTE OF TECHNOLOGY (Affiliated to Visvesvaraya Technological University, Belagavi, Approved by AICTE, New Delhi and Accredited by NBA and NAAC) Date: 25/05/2018 CERTIFICATE This is to certify that Mr. Punith J N bearing USN 1AY16MBA51 is a bonafide student of Master of Business Administration course of the Institute 2016-18 batch, affiliated to Visvesvaraya Technological University, Belagavi. Project report on "A Study on Cash from Operating Activities and its Management at Aditya Birla Ltd. Bangalore" is prepared by him under the guidance of Prof. Mallika B K, in partial fulfillment of the· requirements for the award of the degree of Master of Business Administration, Visvesvaraya Technological University, Belagavi, Kamataka. Signature of Internal Guide Signature~ of HOD k" Signature of Principal PRINCIPAL ACHARYA INSTITUTE OF Tfa.,m~OLOG'/ ia1uevanahalli Bangalore-560 10( Acharya Dr. -

Databank Consisting of More Than Databank 3000 Companies on Our Website Updated Information RECENT DIVIDEND ANNOUNCEMENTS Company Name Annc

Subscribers can access the complete databank consisting of more than Databank 3000 companies on our website Updated Information RECENT DIVIDEND ANNOUNCEMENTS www.DSIJ.in Company Name Annc. Date Div BC/RD Date Company Name Annc. Date Div BC/RD Date Company Name Annc. Date Div BC/RD Date (MM/DD/YY) (%) (MM/DD/YY) (MM/DD/YY) (%) (MM/DD/YY) (MM/DD/YY) (%) (MM/DD/YY) Numbers ADC India Communicat 05/04/12 5 07/03/12 DIC India 02/09/12 40 05/20/12 Kirloskar Ferrou 04/27/12 20 - Aditya Birla Chemica 05/11/12 5 - Dr. Reddy’s Labs 05/11/12 275 - Kirloskar Industries 04/27/12 40 07/18/12 Ador Fontech Ltd 04/30/12 150 - Eimco Elecon Ind 05/08/12 40 - Kirloskar Oil Engine 04/26/12 200 07/12/12 That Matter Ador Welding Ltd. 04/27/12 60 - Emami Ltd. 05/08/12 800 - Kirloskar Pneumatic 04/24/12 120 07/10/12 AGC Networks 05/10/12 150 - Everest Industries L 04/26/12 70 - Kitex Garments 04/21/12 60 05/24/12 Agro Tech Foods Ltd. 04/26/12 17.5 - Exide Inds. 04/30/12 60 - Kotak Mahindra Bank 05/08/12 12 - Ajanta Pharma Lt 04/26/12 75 - Federal Bank 05/11/12 90 - KPIT Cummins Infosys 04/30/12 35 - Alembic Pharmaceutic 04/25/12 70 - Finolex Cables 05/03/12 40 07/28/12 KPR Mill Ltd. 05/04/12 - 05/21/12 Alfa Laval (I) Ltd. 02/09/12 300 - Finolex Industri 04/30/12 30 - Lakshmi Finance 04/30/12 15 - 5821819 crore Allahabad Bank 05/07/12 60 05/26/12 Futuristic Solutions 05/11/12 8 - LG Balakrishnan&Bros 04/28/12 110 - ` Alstom Projects Ind. -

Mf Movers & Shakers

MF MOVERS & SHAKERS MARCH 2021 DART Research Tel: +91 22 40969700 E-mail: [email protected] April 12, 2021 April 12, 2021 2 Top Five Buys & Sells Top Ten MF's March 2021 3 Top Five Buys & Sells of Top MFs for the month of March 2021 No of Shares No of Shares Highest Increase in Exposure Names Bought in Highest Decrease in Exposure (by nos of shares) Bought in (by nos of shares) March 2021 March 2021 Bharat Petroleum Corporation 4,547,448 The Indian Hotels 9,826,101 Steel Authority Of India 1,995,000 Vedanta 2,988,456 Axis MF Torrent Power 1,889,278 Tata Motors 2,574,406 Suryoday Small Finance Bank 1,887,039 EPL 2,572,954 Mahindra & Mahindra Financial Services 1,644,663 Wipro 2,226,978 Bank Of Baroda 36,590,405 Vodafone Idea 21,490,000 Steel Authority Of India 9,632,297 Vedanta 7,799,200 Birla SL MF National Aluminium 7,524,001 GMR Infrastructure 4,837,500 IDFC First Bank 3,122,875 Ashok Leyland 4,252,923 State Bank Of India 2,870,884 Bharti Airtel 3,662,791 Motherson Sumi Systems 6,769,756 Vodafone Idea 8,750,000 GAIL 3,502,259 Oil & Natural Gas Corporation 8,463,632 DSP BR MF Welspun Corp 2,559,989 Vedanta 7,199,288 ITC 2,520,668 Hindalco Industries 2,468,290 Prism Johnson 2,389,002 ICICI Prudential Life Insurance 2,343,372 Max Healthcare Institute 21,422,593 Vodafone Idea 18,830,000 Indian Railway Finance Corporation 13,939,480 Siti Networks 17,967,767 HDFC MF Oil & Natural Gas Corporation 7,327,497 Power Grid Corporation Of India 13,081,255 Varroc Engineering 6,735,218 State Bank Of India 12,478,973 Bharti Airtel 5,846,094 -

Twenty Fourth Annual Report 2015-2016

Twenty Fourth Annual Report 2015-2016 TVS MOTOR COMPANY LIMITED Board of Directors VENU SRINIVASAN Bankers STATE BANK OF INDIA Chairman & Managing Director Corporate Accounts Group Branch, Chennai. SUDARSHAN VENU STATE BANK OF MYSORE Joint Managing Director Corporate Accounts Branch, Bengaluru. H. LAKSHMANAN T. KANNAN Registered Office "Jayalakshmi Estates", No. 29 (Old No.8), Haddows Road, C. R. DUA Chennai - 600 006, Tamil Nadu, India. R. RAMAKRISHNAN Tel : 044 - 2827 2233; Fax : 044 - 2825 7121 PRINCE ASIRVATHAM CIN No. L35921TN1992PLC022845 HEMANT KRISHAN SINGH E-mail: [email protected] Dr. LAKSHMI VENU Website: www.tvsmotor.com Audit Committee T. KANNAN Plant Locations Chairman 1. Post Box No. 4, Harita, Hosur - 635 109, Tamil Nadu, India. C.R. DUA Tel : 04344 - 276780; Fax : 04344 - 276016 R. RAMAKRISHNAN PRINCE ASIRVATHAM 2. Post Box No. 1, Byathahalli Village, Kadakola Post, Mysore - 571 311, Karnataka, India. Stakeholders' R. RAMAKRISHNAN Relationship Chairman Tel : 0821 - 2596561; Fax : 0821 - 2596550 / 2596553 Committee VENU SRINIVASAN 3. Bhatian Village, Bharatgarh Road, Teh. Nalagarh SUDARSHAN VENU Solan District - 174 101, Himachal Pradesh, India. Nomination and T. KANNAN Tel : 01795 - 220492/93; Fax : 01795 - 220496 Remuneration Chairman Subsidiary Companies Committee C.R. DUA H. LAKSHMANAN Sundaram Auto Components Limited, Chennai Corporate VENU SRINIVASAN TVS Housing Limited, Chennai Social Responsibility Chairman TVS Motor Company (Europe) B.V., Amsterdam Committee H. LAKSHMANAN TVS Motor (Singapore) Pte. Limited, Singapore PRINCE ASIRVATHAM PT. TVS Motor Company Indonesia, Jakarta President & CEO K.N. RADHAKRISHNAN Sundaram Business Development Consulting Chief Financial S.G. MURALI Officer (CFO) (Shanghai) Co. Ltd., Shanghai Company Secretary K.S. SRINIVASAN Sundaram Holding USA Inc. -

TVS Electronics Limited

TVS Electronics Limited Contents TVS ELECTRONICS LIMITED 1. Board of Directors ... ... ... 2 2. Financial Highlights ... ... ... 3 2. Notice ... ... ... 4 3. Directors’ Report ... ... ... 8 4. Report on Corporate Governance ... ... ... 15 5. Auditors’ Report ... ... ... 23 6. Balance Sheet ... ... ... 26 7. Profit & Loss Account ... ... ... 27 8. Schedules ... ... ... 28 9. Notes on Accounts ... ... ... 35 10. Disclosure-Clause 32 of the Listing Agreement ... ... ... 55 11. Cash Flow Statement ... ... ... 56 12. Company Profile ... ... ... 57 13. Statement relating to Subsidiary ... ... ... 58 CONSOLIDATED ACCOUNTS 1. Auditors’ Report on Consolidated Accounts ... ... ... 61 2. Consolidated Balance Sheet ... ... ... 62 3. Consolidated Profit & Loss Account ... ... ... 63 4. Consolidated Schedules ... ... ... 64 5. Consolidated Cash Flow Statement ... ... ... 71 6. Accounting Policies on Consolidation ... ... ... 72 TUMKUR PROPERTY HOLDINGS LIMITED (Subsidiary) 1. Directors’ Report ... ... ... 74 2. Auditors’ Report ... ... ... 76 3. Balance Sheet ... ... ... 78 4. Profit & Loss Account ... ... ... 79 5. Schedules ... ... ... 80 6. Notes on Accounts ... ... ... 81 PRIME PROPERTY HOLDINGS LIMITED (Subsidiary) 1. Directors’ Report ... ... ... 86 2. Auditors’ Report ... ... ... 88 3. Balance Sheet ... ... ... 90 4. Profit & Loss Account ... ... ... 91 5. Schedules ... ... ... 92 6. Notes on Accounts ... ... ... 93 1 TVS Electronics Limited Board of Directors Registered Office Gopal Srinivasan Chairman "Jayalakshmi Estates", H Lakshmanan 29, -

Proxy Voting Report 01-07-2016 to 30-09-2016

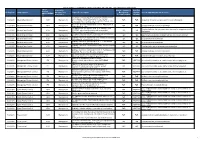

Details of Votes cast during the quarter ended September 30, 2016, of the Financial year 2016-2017 Type of Proposal by Investee company’s Vote (For/ meetings Meeting Date Company Name Management or Proposal's description Management Against/ Reason supporting the vote decision (AGM/CCM/EGM/ Shareholder Recommendation Abstain) PB) To receive, consider and adopt the Audited Standalone and Consolidated Financial Statements for the Financial 1/Jul/2016 IndusInd Bank Limited AGM Management FOR FOR Unqualified Accounts. Compliant with Accounting Standards Year ended March 31, 2016, together with the Reports of the Board of Directors and Auditors thereon. To declare Dividend on Equity Shares for the Financial Year 1/Jul/2016 IndusInd Bank Limited AGM Management FOR FOR Compliant with law, no concern identified ended March 31, 2016. To appoint a Director in place of Mr. R. Seshasayee, DIN Compliant with law. No governance issue observed in re-appointment of Mr. 1/Jul/2016 IndusInd Bank Limited AGM Management 00047985, who retires by rotation and, being eligible, FOR FOR Seshasayee offers himself for re-appointment. To appoint Statutory Auditors of the Bank and authorise the 1/Jul/2016 IndusInd Bank Limited AGM Management FOR FOR Appointment of Auditors is compliant with law. No concern identified Board of Directors to fix their remuneration. Ordinary Resolution: Appointment of Mr. Shanker Annaswamy, 1/Jul/2016 IndusInd Bank Limited AGM Shareholders FOR FOR No governance issue observed DIN 00449634, as Independent Director Ordinary Resolution: Appointment of Dr. T. T. Ram Mohan, 1/Jul/2016 IndusInd Bank Limited AGM Shareholders FOR FOR No governance issue observed DIN 00008651, as Independent Director Ordinary Resolution: Remuneration to Non-Executive Directors 1/Jul/2016 IndusInd Bank Limited AGM Management FOR FOR Compliant with Law, no governance issues identified. -

Reportable in the Supreme Court of India Criminal Appellate Jurisdiction

WWW.LIVELAW.IN REPORTABLE IN THE SUPREME COURT OF INDIA CRIMINAL APPELLATE JURISDICTION CRIMINAL APPEAL NO. 875 OF 2019 (Arising out of SLP(Crl.) No.9053 of 2016) BIRLA CORPORATION LIMITED ...Appellant VERSUS ADVENTZ INVESTMENTS AND HOLDINGS ...Respondents LIMITED & OTHERS WITH CRIMINAL APPEAL NO. 877 OF 2019 (Arising out of SLP(Crl.) No.4609 of 2019 @ D. No.6405 of 2019) BIRLA BUILDINGS LIMITED ...Appellant VERSUS BIRLA CORPORATION LIMITED ...Respondent WITH CRIMINAL APPEAL NO. 876 OF 2019 (Arising out of SLP(Crl.) No. 4608 of 2019 @ D. No.6122 of 2019) GOVIND PROMOTERS PVT. LTD. ...Appellant VERSUS BIRLA CORPORATION LIMITED ...Respondent J U D G M E N T R. BANUMATHI, J. Leave granted. Signature Not Verified Digitally signed by MADHU BALA Date: 2019.05.09 17:04:23 IST 2. These appeals arise out of the judgment dated 15.05.2015 Reason: passed by the High Court of Calcutta in C.R.R. No.323 of 2011 in 1 WWW.LIVELAW.IN and by which the High Court quashed the complaint of the appellant-Company filed under Sections 379, 403 and 411 IPC read with Section 120-B IPC qua documents No.1 to 28 of the Schedule. Insofar as documents No.29 to 54 of the Schedule, the High Court remitted the matter to the trial court to proceed with the matter in accordance with law. 3. Being aggrieved by quashing of the complaint qua documents No.1 to 28, the appellant-complainant has preferred appeal (SLP (Crl.) No.9053 of 2016). Being aggrieved by remitting the matter to the trial court qua documents No.29 to 54, the respondents have filed appeal [SLP(Crl.) D No.6405 of 2019 and SLP(Crl.) D. -

Press Release Sundaram Auto Components Limited

Press Release Sundaram Auto Components Limited March 11, 2021 Ratings Amount Facilities Rating1 Rating Action (Rs. crore) 166.99 CARE A+; Stable Long Term Bank Facilities Reaffirmed (Reduced from 210.00) (Single A Plus; Outlook: Stable) CARE A+; Stable / CARE A1+ Long Term / Short Term Bank 43.01 (Single A Plus; Outlook: Stable / Reaffirmed Facilities (Enhanced from 20.00) A One Plus) 85.00 CARE A1+ Short Term Bank Facilities Reaffirmed (Enhanced from 65.00) (A One Plus) 295.00 Total Facilities (Rs. Two Hundred Ninety-Five Crore Only) Details of instruments/facilities in Annexure-1 Detailed Rationale & Key Rating Drivers The ratings assigned to the bank facilities of Sundaram Auto Components Limited (SACL) continue to draw strength from SACL being a part of the TVS group & wholly owned subsidiary of TVS Motor Company Limited (TVSM; rated CARE AA+; Stable/ CARE A1+). SACL’s experienced management team, synergies of operations with its parent, established track record of SACL as a supplier to Original Equipment Manufacturers (OEMs) and Tier-I suppliers in the domestic automobile market also adds to the strength of the credit profile of company. Company’s scale of operations was impacted in FY20 due to slowdown in automobile sector in FY20. Covid-19 led lockdown further impacted company’s business in H1FY21 but has shown recovery during Q3FY21 with sales returning to pre-Covid levels. However, the profitability for FY21 may come under pressure. Apart from weak sales in Q1FY21 and similar fixed expenses, increase in RM prices during H2FY21 which the company would be able to pass on to its customers with 1 quarter lag, is likely to affect profitability. -

Average Market Capitalization of List Companies During Jan-June 2021.Pdf

Average Market Capitalization of listed companies during the six months ended 30 June 2021 BSE 6 month Avg NSE 6 month MSE 6 month Average of Categorization as Total Avg Total MSE Avg Total All Sr. No. Company name ISIN BSE Symbol NSE Symbol per SEBI Circular Market Market Cap Symbol Market Cap in Exchanges dated Oct 6, 2017 Cap in (Rs. (Rs. Crs.) (Rs Crs.) (Rs. Cr.) Crs.) 1 Reliance Industries Ltd INE002A01018 RELIANCE 1290062.9 RELIANCE 13,55,067.51 13,22,565.20 Large Cap 2 Tata Consultancy Services Ltd. INE467B01029 TCS 1169783.6 TCS 11,73,068.17 11,71,425.86 Large Cap 3 HDFC Bank Ltd. INE040A01034 HDFCBANK 819037.95 HDFCBANK 8,18,713.67 8,18,875.81 Large Cap 4 Infosys Ltd INE009A01021 INFY* 579784.19 INFY 5,79,697.39 5,79,740.79 Large Cap 5 Hindustan Unilever Ltd., INE030A01027 HINDUNILVR 549336.78 HINDUNILVR 5,49,358.91 5,49,347.84 Large Cap 6 Housing Development Finance Corp.Lt INE001A01036 HDFC 462288.58 HDFC 4,61,373.11 4,61,830.84 Large Cap 7 ICICI Bank Ltd. INE090A01021 ICICIBANK 416645.51 ICICIBANK 4,16,389.02 4,16,517.27 Large Cap 8 Kotak Mahindra Bank Ltd. INE237A01028 KOTAKBANK 361640.52 KOTAKBANK 3,61,438.64 3,61,539.58 Large Cap 9 State Bank Of India, INE062A01020 SBIN 329767.32 SBIN 3,29,789.27 3,29,778.29 Large Cap 10 Bajaj Finance Limited INE296A01024 BAJFINANCE 324996.53 BAJFINANCE 3,24,843.50 3,24,920.02 Large Cap 11 Bharti Airtel Ltd. -

TVS Group in 1911 at the I Indian State of Tamil Nadu As a Rural Transport Service

TM POWERFUL AUTOMOTIVE | EDUCATION | ENERGY & POWER | FINANCE | FOOD & BEVERAGES | HEALTHCARE | HOUSEHOLD PRODUCTS IT & TELECOM | LIFESTYLE | MANUFACTURING & INFRASTRUCTURE | MEDIA & ENTERTAINMENT | PERSONAL CARE | REAL ESTATE | RETAIL | SERVICES TVSGROUP One of India’s oldest business groups, TVS has around 50 companies under it. This giant conglomerate has presence in diverse fields like automobile manufacturing, automotive dealerships, finance, and electronics. The brand has always remained faithful to its core ideals of trust, values, service, and ethics and is one of the most prominent conglomerates in the country t has been over a century since TV Sundaram Iyenger initiated the TVS Group in 1911 at the I Indian state of Tamil Nadu as a rural transport service. These 105 years have seen the group growing magnanimously in its virtue and diversifying into a very strategic and distinct approach to tackle various subsidiaries under the astute guidance and the issues at hand and minimize the competition leadership of four generations of the founding family. between the sister companies. The holding company only oversees the work its daughter companies are UNISON IN PRACTICE doing and doesn’t get involved in their policy making TVS Group has a strong foothold in Indian as well structure. The Group is headed like a close knit as international market because of its exceptional family where all the subsidiary companies have the services and perfection to precision. Through various full authority to make any decisions. The combined subsidiaries TVS Group provides various automotive efforts which all the group companies put in to reach products and spare components like axle housings, the zenith are completely respected by the holding braking equipments, fuel injections, bus bodies, and TVS group. -

3Rd February, 2021 BSE Limited Corporate

3rd February, 2021 BSE Limited The Manager Corporate Relationship Department Listing Department Phiroze Jeejeebhoy Towers The National Stock Exchange of India Limited Dalal Street “Exchange Plaza”, Bandra-Kurla Complex Mumbai 400 001 Bandra (East), Mumbai 400 051 Tel.: 22721233/4 Tel.: 26598236 Scrip Code: 532538 Scrip Code: ULTRACEMCO Sub: Intimation under the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended (“Listing Regulations”) Dear Sir/ Madam, This is in continuation to our letter dated 23rd January, 2021 wherein we had informed the stock exchanges that the Board of Directors of the Company (“Board”) at its meeting held on 23rd January, 2021 considered and evaluated a proposal for raising of funds through permissible mode(s) and accordingly, approved raising of funds for an aggregate amount not exceeding Rs. 3,000 crores, subject to applicable regulatory approvals and market conditions, by way of issue of any instruments or securities in India and / or overseas. Further, the Board had also authorised the Finance Committee of the Board of Directors to finalise the manner of raising the funds and decide on all matters and transactions relating to the same, including but not limited to the finalisation and approval of detailed terms and conditions of issue, size, pricing and timing of the transaction. We now write to inform you that the Finance Committee, in terms of the aforesaid authority, at its meeting held today, approved raising funds by way of issuance of foreign currency (US$) denominated bonds (“Notes”) aggregating up to US$ 400 million, corresponding to Rs.3,000 crores, to be offered and sold within the United States to qualified institutional buyers in reliance on Rule 144A of the United States Securities Act of 1933, as amended (“US Securities Act”) and outside the United States in offshore transactions as defined in and with reliance on Regulation S under the US Securities Act (“Offering”), in one or more tranches.