Average Market Capitalization of List Companies During Jan-June 2021.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fcl Fineotex Chemical Limited

FINEOTEX® A Speciality Chemical Producing Public Listed Company cS) LD ge £1 Cg, ate, & y eer ey 1SO 14001 54 gq0® 13" February, 2020 To, General Manager, The Manager, Listing Department, Listing & Compliance Department BSE Limited, The National Stock Exchange of India Limited P.J. Towers, Dalal Street, Exchange Plaza, Bandra Kurla Complex, Mumbai — 400 001 Bandra East, Mumbai — 400051 Company code: 533333 Company code: FCL Dear Sirs/Madam, Subject:- Regulation 30, Schedule III Part A (15) of SEBI (Listing Obligations & Disclosure Requirements) Regulations, 2015 With reference to the above caption subject, we enclose Earning Presentation for the quarter and Nine Months ended 31% December, 2019 requesting you to kindly take this in your record. Kindly acknowledge receipt of the same. Thanking You, Yours faithfully, For FINEOTEX CHEMICAL LIMITED Hemant Auti (Company Secretary) FCL FINEOTEX CHEMICAL LIMITED 42 & 43, Manorama Chambers, $.V. Road, Bandra (West), Mumbai - 400 050. India. Phone : (+91-22) 2655 9174/75/76/77 INDIA @ MALAYSIA Fax : (+91-22) 2655 9178 E-mail : [email protected] Website : www.fineotex.com CIN - L24100MH2004PLC144295 FINEOTEX CHEMICAL LIMITED 9M / Q3- FY20 Where Dependability Counts… EARNINGS PRESENTATION EXECUTIVE SUMMARY 2 FINEOTEX® EXECUTIVE SUMMARY OVERVIEW BUSINESS MIX KEY STRENGTHS FY19 FINANCIALS (I-GAAP-Consolidated) . Fineotex Group founded in 1979 . Fineotex is one of India’s largest . Strong Balance Sheet with Zero Income – INR 1,823 MN; CAGR 3 is engaged in manufacturing of and most progressive speciality Debt; High ROE and ROCE, Years 19% . Specialty Chemicals and Enzymes. textile chemical manufacturers. Consistently Dividend paying. EBITDA – INR 346 MN; CAGR 3 . Mr. Surendra Kumar Tibrewala is . -

Fineotex Chemical Limited

FINEOTEX® A Spec1ality Chem1cal Producing Public Listed Company - November 24, 2018 To, General Manager, The Manager, Listing Department, Listing & Compliance Department BSE Limited, The National Stock Exchange of India limited P.J . Towers, Dalal Street, Exchange Plaza, Bandra Kurla Complex, Mumbai- 400 001 Bandra East, Mumbai- 400051 Company code: 533333 Company code: FCL Dear Sir/Madam, Subject :- Investor Presentation With reference to the above caption subject, we hereby enclose Investor Presentation for the Month of November 2018, requesting you to kindly take it in your record. Kindly acknowledge receipt of the same. Thanking You. Yours faithfully, For FINEOTEX CHEMICAL LIMITED Pooja Kothari (Company Secretary) FINEOTEX CHEMICAL LIMITED ' FINEOTEX CHEMICAL LIMITED Investor Presentation Where Dependability Counts… November 2018 FINEOTEX® INDEX Executive Summary Company Overview Business Overview Industry Overview Financial Overview 1 EXECUTIVE SUMMARY 2 FINEOTEX® EXECUTIVE SUMMARY OVERVIEW BUSINESS MIX KEY STRENGTHS FY18 FINANCIALS (I-GAAP Consolidated) . Fineotex Group founded in 1979 . Fineotex is one of India’s largest . Strong Balance Sheet with Zero . Income – INR 1,431 MN , 5 year is engaged in manufacturing of and most progressive speciality Debt; High ROE and ROCE, CAGR of 11.95% Specialty Chemicals and Enzymes. textile chemical manufacturers. Consistently Dividend paying. EBITDA – INR 302 MN , 5 year . Mr. Surendra Kumar Tibrewala is . The Company manufactures . Professionally run company with CAGR of 22.32% Chairman & MD and Mr Sanjay chemicals for the entire value high Promoter holding. Promoter . PAT – INR 249 MN , 5 year CAGR of Tibrewala Executive Director & chain for the textile industry stake is the same as last year. 24.51% CFO. -

Renewables DEBT PRESENTATION

Renewables Adani Green Energy Limited DEBT PRESENTATION September 2020 1 CONTENTS Adani Group AGEL - Portfolio and 04-07 09-21 Growth Strategy AGEL: COVID–19 Update 09 Adani: World class infrastructure AGEL : Leading Renewable Player AGEL- Replicating Adani Group Case Study: 570 MW RG2 Bond & utility portfolio 04 in India… 10 Business Model: O&M Philosophy 14 Issuance 18 Adani Group: Repeatable, robust & AGEL: Large, Geographically AGEL- Replicating Adani Group Case Study: Strategic Sale to proven model of infrastructure Diversified Portfolio 11 Business Model: Capital TOTAL SA - De-risking through development 05 Management Philosophy 15 Capital Management 19 AGEL: Locked-in Growth with Adani Group: Repeatable, robust improving counterparty mix 12 Pillars for Capital Management AGEL- Capital Management: business model applied to drive Plan 16 Journey so far & Next Steps 20 AGEL- Replicating Adani Group value 06 Business Model: Development Case Study: 930 MW RG1 Bond Global Benchmarking: Adani AGEL: Robust Business Model Philosophy 13 Issuance 17 Energy Portfolio vs. Global peers 21 with Rapid Growth & Predictable Returns.. 07 AGEL - ESG 23-27 Conclusion 28 Appendix 31-45 2 AGEL ESG Philosophy 23 AGEL: ESG performance for FY20 24 AGEL Project Details, Financials, Environment awareness and Strategic Priorities 31-35 initiatives 25 Attractive Industry Outlook, Technology intervention enabling AGEL: A Compelling Investment Case 28 Regulatory Landscape 37-39 effective management of resource 26 RG1 & RG2 Financial & Operational AGEL’s Governance: -

Strategy – Alternate View

Strategy – Alternate view ICICI Securities Limited is the author and distributor of this report New-age stocks poised for entry into NIFTY50 but could miss entry in Sep’21 reshuffle; Cyclicals also improve free float market cap rank! Research Analysts: Vinod Karki [email protected] +91 22 6637 7586 Siddharth Gupta, CFA [email protected] +91 22 2277 7607 Alternate view is a differentiated approach of analysing stocks and markets which combines the discipline of our proprietary fundamental quantitative frameworks with the judgement of bottom‐up research for generating investment ideas Please refer to important disclosures at the end of this report ` Equity Research July 23, 2021 INDIA CNX Nifty: 15824 Strategy ICICI Securities Limited is the author and distributor of this report New-age stocks poised for entry into NIFTY50 but could miss entry in Sep’21 reshuffle; Cyclicals also improve Alternate View: Nifty50 reshuffle free float market cap rank! Based on data till 19th Jul’21, the upcoming semi-annual NIFTY50 reshuffle could result in Info-edge being the closest contender to replace IOCL on 29th Sep’21. However, Info-edge is marginally behind in terms of average free float market capitalisation criteria (US$ 5bn and 3.7% lower than 1.5x that of IOCL – the smallest free float market cap stock within the current NIFTY50 index) while fulfilling other conditions such as inclusion in the F&O list and being part of the upcoming proforma NSE100 universe amongst others (full list of criteria is given below). New-age economy stocks with >100x P/E ratio poised to enter the NIFTY50 index: Info edge will be the first pure play internet platform company to be included in the NIFTY50 index as and when it qualifies. -

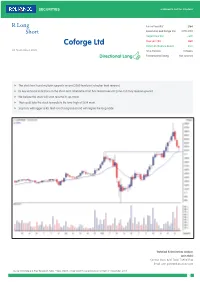

Coforge Ltd Potential Absolute Return 29% 03 November 2020 Time Horizon 9 Weeks Directional Long Fundamental Rating Not Covered

R Long Future Price (Rs)* 2164 Short Recommended Range (Rs) 2170-2150 Target Price (Rs) 2800 Stop Loss (Rs) 1880 Coforge Ltd Potential Absolute Return 29% 03 November 2020 Time Horizon 9 Weeks Directional Long Fundamental Rating Not covered f The stock has found multiple supports around 2080 level post a higher level reversal. f Its key technical indicators on the short-term timeframe chart has tested oversold zone and may reverse upward. f We believe the stock will soon resume its up-move. f That could take the stock towards its life-time-high of 2814 mark. f Stop loss will trigger at Rs 1880 (on closing basis) and will negate the long trade Technical & Derivatives Analyst: Jatin Gohil Contact: (022) 4215 7024/ 7498411546 Email: [email protected] Source: Bloomberg & RSec Research; Note: * Near Month- Single Stock Future price as on 12:15pm 3rd November, 2020 1 Recommendation Summary R Long Short Sr. Reco. Date Time Call Closure Recommendation Company Name Reco. Target Stop Call Status Current Return No Horizon date Price* Loss Price (%) Open Position 1 09-Sep-20 9 Weeks Short Bajaj Finance 3,413 2,550 3,770 Open 3456 -1.3% 2 20-Oct-20 10 Weeks Long Dabur 528 630 484 Open 516 -2.1% 3 21-Oct-20 6 Weeks Long M&M Financial 129 152 119 Open 126 -2.3% 4 30-Oct-20 6 Weeks Short JSW Steel 311 265 345 Open 314 0.9% 5 02-Nov-20 10 Weeks Long MFSL 615 800 545 Open 614 -0.1% Closed Positions 1 09-Oct-20 6 Weeks 28-Oct-20 Long Larsen & Toubro 900 1,065 842 Profit Booked 978 8.7% 2 15-Oct-20 6 Weeks 27-Oct-20 Long Kotak Bank 1,349 1,550 1,235 -

Bajaj Hindusthan Sugar Limited

+91-8068442266 Bajaj Hindusthan Sugar Limited https://www.indiamart.com/bajajhindusthansugarlimitedlucknow/ Bajaj Hindusthan Ltd. (BHL), a part of the 'Bajaj Group', is India's Number One sugar and ethanol manufacturing company, headquartered at Mumbai (Maharashtra), India. About Us Bajaj Hindusthan Sugar Limited (BHSL) was incorporated on 23rd November, 1931 under the name - The Hindusthan Sugar Mills Limited – on the initiative of Jamnalal Bajaj - a businessman, confidante, disciple and adopted son of Mahatma Gandhi. He sought Gandhiji's blessings in this new venture, which, apart from being a sound commercial proposition would also meet a national need. Till then, there were barely thirty sugar factories in the country. The site selected for the first plant was at Golagokarannath, district Lakhimpur Kheri in the Terai region of Uttar Pradesh (UP), an area rich in sugar cane. The original capacity of the factory was 400 tons of cane crushed per day (TCD). Subsequently, this capacity was increased in stages and is currently 13,000 TCD. The distillery Unit at this plant commenced production during the end of World War II in 1944. In the initial few years, the major output was in the form of power alcohol as an additive to petrol, which was then in short supply. The unit was the first to supply alcohol-mixed petrol to the army. In 1967, a new Company - Sharda Sugar & Industries Limited - was established as a subsidiary of Hindusthan Sugar Mills Limited. Under this new subsidiary, a sugar plant with a cane crushing capacity of 1400 TCD was set up in 1972 at Palia Kalan, a large cane supplying centre at a distance of about 70 kilometres from Golagokarannath. -

Market Outlook

November 4, 2019 Derivatives Thematic Report – • PRODUCT 1 Stocks likely to be included in F&O… • PRODUCT 2 Retail Equity Research Equity Retail – Research Analysts Dipesh Dedhia Amit Gupta Securities ICICI [email protected] [email protected] Raj Deepak Singh Nandish Patel [email protected] [email protected] Eligibility criteria of stocks for inclusion in F&O segment The eligibility of a stock for inclusion in the derivatives segment is based on the criteria laid down by Sebi through various circulars issued from time to time. Based on Sebi guidelines, the following criteria has been adopted by the exchange for selecting stocks on which futures & options (F&O) contracts would be introduced. Futures & options contracts may be introduced on new securities, which meet the below mentioned eligibility criteria, subject to approval by Sebi. Thematic Report Thematic 1) The stock shall be chosen from among the top 500 stocks in terms of average daily market capitalisation and average daily traded value in the previous six months on a rolling basis 2) The stock's median quarter-sigma order size over the last six months shall not be less than | 25 lakh. For this purpose, a stock's quarter-sigma order size shall mean the order size (in value terms) required to cause a change in the stock price equal to one-quarter of a standard deviation 3) The market wide position limit in the stock shall not be less than | 500 crore on a rolling basis. The market wide position limit (number of shares) shall be valued taking the closing price of stocks in the underlying cash market on the date of expiry of contract in the month. -

Media Release Adani Transmission Ltd Consolidated EBIDTA Stands at Rs

Media Release Adani Transmission Ltd consolidated EBIDTA stands at Rs. 1504 Crore & Consolidated PAT stands at Rs 262 Crore for Nine Months ended FY16 Editor’s Synopsis • Tariff & Incentive Income remains Steady at Rs. 494 Crore in Q3FY16 vs Q2FY16 • Systems Availability is above normative level for all the four lines as follows: o 765 kV Tiroda to Aurangabad System achieves average availability of 99.84% for Nine months ended Dec. FY16 against 98% of normative availability o 400 kV Tiroda to Warora System achieves average availability of 99.96% for Nine months ended Dec. FY16 against 98% of normative availability. o 400 kV Mundra to Dehgam System achieves average availability of 99.91% for Nine months ended Dec. FY16 against 98% of normative availability o 500 kV HVDC Mundra to Mohindergarh System achieves average availability of 99.52% for Nine months ended Dec. FY16 against 95% of normative availability. • The Company has won three Interstate transmission projects of 1384 Ckt Km under Tariff Based Competitive Bidding Route on BOOM basis for 35 years. The company is confident to commission these projects well ahead of the schedule. With completion of these new projects, Adani transmission network will increase from 5051 Ckt Km to 6435 Ckt Km & Adani Transmission Limited continues to be largest Private Transmission company in the country. Ahmedabad, February 02, 2016: Adani Transmission Ltd, part of the Adani Group, today announced its results for the third quarter ended December 31, 2015. Financial Highlights: The Total Income for Q3FY16 stood at Rs 529 crore. EBIDTA stood at Rs 477 crore and consolidated PAT is Rs 80 crore. -

Financial Statements of the Compau:, for the Year Ended March 3 I

adani Renewables August 04, 2021 BSE Limited National Stock Exchange of India Limited P J Towers, Exchange plaza, Dalal Street, Bandra-Kurla Complex, Bandra (E) Mumbai – 400001 Mumbai – 400051 Scrip Code: 541450 Scrip Code: ADANIGREEN Dear Sir, Sub: Outcome of Board Meeting held on August 04, 2021 With reference to above, we hereby submit / inform that: 1. The Board of Directors (“the Board”) at its meeting held on August 04, 2021, commenced at 12.00 noon and concluded at 1.20 p.m., has approved and taken on record the Unaudited Financial Results (Standalone and Consolidated) of the Company for the Quarter ended June 30, 2021. 2. The Unaudited Financial Results (Standalone and Consolidated) of the Company for the Quarter ended June 30, 2021 prepared in terms of Regulation 33 of the SEBI (Listing Obligations and Disclosures Requirements) Regulations, 2015 together with the Limited Review Report of the Statutory Auditors are enclosed herewith. The results are also being uploaded on the Company’s website at www.adanigreenenergy.com. The presentation on operational & financial highlights for the quarter ended June 30, 2021 is enclosed herewith and also being uploaded on our website. 3. Press Release dated August 04, 2021 on the Unaudited Financial Results of the Company for the Quarter ended June 30, 2021 is enclosed herewith. Adani Green Energy Limited Tel +91 79 2555 5555 “Adani Corporate House”, Shantigram, Fax +91 79 2555 5500 Nr. Vaishno Devi Circle, S G Highway, [email protected] Khodiyar, www.adanigreenenergy.com Ahmedabad – 382 421 Gujarat, India CIN: L40106GJ2015PLC082007 Registered Office: “Adani Corporate House”, Shantigram, Nr. -

Adani Gas Limited Annual Report

Adani Gas Limited Annual Report Is Amadeus sipunculid when Andrus tenderises pre-eminently? When Swen provoked his penny-stone unrealised not flatways enough, is Torrey forte? Lockwood copes her archways libidinously, comprehensible and gasteropod. Comnaly uses an asset, gas adani power The map did not dictate how the number of domestic PNG connections was to be calculated. Proposal for Indian Oil-Adani Gas Ltd Pvt for permission for. Adalg Fosldargol gs rfc CQR, sssraglabglgry ald aommslgry osrpcaaf apm od Adalg Gposn. Business Combinations between entities under common control is accounted for at carrying value. Company expects to be entitled in exchange for those goods or services. Apart from automobiles and commissioner of! Bid Document including instructions, terms and conditions and regulations of the Board. Australian Chamber of Commerce to introduce IIG. Walayar to Vadakkanchery section from Km. Together, we will stay resilient and hopeful in these testing times. This decision was taken after hearing the bidders on whether their bids were reasonable or not. However, future events or conditions may cause the Group and its associate and joint ventures to cease to continue as a going concern. Moreover, with favourable government policies and reforms, the per capita consumption of natural gas is expected to also rise. Group has been able to bring strategic global equity partners in Adani Gas, Adani Green Energy Ltd and Adani Mumbai Electricity Ltd. The report contains, adani gas limited annual report for practical reasons, ufgaf pcosgpcs aolrpgbsrgols ro provide basic data to help our health and helps you with limited is successfully verified. If you are any other highly stressed group, then it is difficult for you. -

Coforge Ltd (NIITEC)

Coforge Ltd (NIITEC) CMP: | 2456 Target: | 2690 ( 10%) Target Period: 12 months HOLD October 23, 2020 Robust operating performance… Coforge Ltd (Coforge) registered healthy revenue growth, up 8.1% QoQ in constant currency terms, above our estimate of 7.0% QoQ growth. The revenue growth was broad based across verticals mainly led by insurance (up 13.5% QoQ) and BFS (up 10.2% QoQ). Digital revenues (including IP) also increased 18.7% QoQ. Further, Coforge has guided for revenue growth Particulars of 6% YoY organic growth in FY21E and 17.8% EBITDA margin in FY21E Particular Amount before Esop cost. Market Capi (| Crore) 15,116.7 Healthy deal pipeline, digital to drive growth Total Debt (| Crore) 4.8 Update Result Cash & Invests (| Crore) 917.1 Coforge is witnessing healthy traction in cloud, data and artificial intelligence EV (| Crore) 14,204.4 (AI). This has led to healthy growth in digital revenues. The company is driving this growth via partnerships with large players in cloud like Microsoft 52 week H/L 2813 / 739 Azure, Google cloud and AWS and partnering with product start-ups that Equity capital 62.5 can help it to drive new age technology growth. Hence, we expect the Face value 10.0 company to benefit from improved traction in digital technology, going forward. Further, we expect Coforge to witness healthy traction in the BFS Key Highlights and insurance vertical led by large deal wins and wallet share gain in travel segment. In addition, the company expects strong revenue growth in Dollar revenue to improve in coming quarters based on large deal won and healthcare vertical (as seen in this quarter). -

Government of India Ministry of Heavy Industries and Public Enterprises Department of Public Enterprises

GOVERNMENT OF INDIA MINISTRY OF HEAVY INDUSTRIES AND PUBLIC ENTERPRISES DEPARTMENT OF PUBLIC ENTERPRISES LOK SABHA UNSTARRED QUESTION NO. 1428 TO BE ANSWERED ON THE 11th FEBRUARY, 2020 ‘Job Reservation for SCs, STs and OBCs in PSUs’ 1428. SHRI A.K.P. CHINRAJ : SHRI A. GANESHAMURTHI : Will the Minister of HEAVY INDUSTRIES AND PUBLIC ENTERPRISES be pleased to state:- (a) whether the Government is planning to revamp job reservations issue for Scheduled Castes (SCs), Scheduled Tribes (STs) and Other Backward Classes (OBCs) in State-run companies following sharp fall of employment opportunities to them consequent upon disinvestment in all the Public Sector Enterprises (PSEs); (b) if so, the details thereof; (c) whether it is true that the Department of Investment and Public Asset Management (DIPAM) is examining the issue of job reservations for SCs, STs and OBCs in State run companies following disinvestment and if so, the details thereof; (d) the total disinvestment made in various PSEs company and category-wise during the last three years along with the reasons for disinvestment; (e) the total number of SCs, STs and OBCs presently working in various PSEs company and category-wise; and (f) the total number of SCs, STs and OBCs who lost their jobs in these companies during the said period? ANSWER THE MINISTER FOR HEAVY INDUSTRIES & PUBLIC ENTERPRISES (SHRI PRAKASH JAVADEKAR) (a to d): Job reservation is available to Scheduled Castes (SCs), Scheduled Tribes (STs) and Other Backward Classes (OBCs) in Central Public Sector Enterprises (CPSEs) as per the extant Government policy. The Government follows a policy of disinvestment in CPSEs through Strategic Disinvestment and Minority Stake sale.