Market Outlook

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Strategy – Alternate View

Strategy – Alternate view ICICI Securities Limited is the author and distributor of this report New-age stocks poised for entry into NIFTY50 but could miss entry in Sep’21 reshuffle; Cyclicals also improve free float market cap rank! Research Analysts: Vinod Karki [email protected] +91 22 6637 7586 Siddharth Gupta, CFA [email protected] +91 22 2277 7607 Alternate view is a differentiated approach of analysing stocks and markets which combines the discipline of our proprietary fundamental quantitative frameworks with the judgement of bottom‐up research for generating investment ideas Please refer to important disclosures at the end of this report ` Equity Research July 23, 2021 INDIA CNX Nifty: 15824 Strategy ICICI Securities Limited is the author and distributor of this report New-age stocks poised for entry into NIFTY50 but could miss entry in Sep’21 reshuffle; Cyclicals also improve Alternate View: Nifty50 reshuffle free float market cap rank! Based on data till 19th Jul’21, the upcoming semi-annual NIFTY50 reshuffle could result in Info-edge being the closest contender to replace IOCL on 29th Sep’21. However, Info-edge is marginally behind in terms of average free float market capitalisation criteria (US$ 5bn and 3.7% lower than 1.5x that of IOCL – the smallest free float market cap stock within the current NIFTY50 index) while fulfilling other conditions such as inclusion in the F&O list and being part of the upcoming proforma NSE100 universe amongst others (full list of criteria is given below). New-age economy stocks with >100x P/E ratio poised to enter the NIFTY50 index: Info edge will be the first pure play internet platform company to be included in the NIFTY50 index as and when it qualifies. -

25February 2020 India Daily

INDIA DAILY February 25, 2020 India 24-Feb 1-day 1-mo 3-mo Sensex 40,363 (2.0) (3.0) (1.3) Nifty 11,829 (2.1) (3.4) (2.0) Contents Global/Regional indices Dow Jones 27,961 (3.6) (3.5) (0.4) Special Reports Nasdaq Composite 9,221 (3.7) (1.0) 6.8 FTSE 7,157 (3.3) (5.7) (3.2) Initiating Coverage Nikkei 22,684 (3.0) (4.8) (1.9) GMR Infrastructure: Poised for flight Hang Seng 26,849 0.1 (3.9) (0.5) Initiate coverage on GMRI with a BUY rating and fair value of Rs30/share KOSPI 2,097 0.9 (6.6) (1.2) Mar-21 SoTP Value traded – India Cash (NSE+BSE) 411 412 244 GMRI: Banking on increasing relevance of airports and of non-aero Derivatives (NSE) 12,813 9,719 7,715 revenues Deri. open interest 3,875 3,756 3,409 Financials: Expect 4-year CAGR of 12% in EBITDA, FCF generation beyond FY2022 Forex/money market Key risks: Changes in the shape or timeline of airport monetization deal Change, basis points Daily Alerts 24-Feb 1-day 1-mo 3-mo Rs/US$ 71.9 (17) 43 20 Sector alerts 10yr govt bond, % 6.7 (4) (33) (30) Insurance: Fire and motor TP recover Net investment (US$ mn) 20-Feb MTD CYTD Motor TP picks up in January 2020; motor OD growth steady FIIs 117 2,239 3,612 Retail health steady, but group health moderates MFs 98 235 (140) Top movers Crop business flat yoy in January 2020; up 28% yoy in YTD FY2020 Change, % Best performers 24-Feb 1-day 1-mo 3-mo DMART IN Equity 2,390 (3.0) 22.6 30.0 IHFL IN Equity 331 (2.2) 2.6 27.5 APHS IN Equity 1,797 (0.2) 7.7 23.9 DIVI IN Equity 2,160 (0.4) 13.1 22.5 TGBL IN Equity 369 (3.0) (4.0) 22.2 Worst performers YES IN Equity 35 (1.4) (18.3) (45.2) BHEL IN Equity 34 (3.4) (24.7) (39.6) EDEL IN Equity 93 3.5 0.5 (27.7) HPCL IN Equity 216 (2.8) (11.7) (26.9) ONGC IN Equity 98 (4.6) (17.2) (25.1) [email protected] Contact: +91 22 6218 6427 For Private Circulation Only. -

Inner 49 Retirement Savings Fund

Modera erate tely Mod High to e H w at ig o er h L d o M V e r y w H Tata Retirement Savings Fund - Moderate Plan o i L g (An open ended retirement solution oriented scheme having a lock-in of 5 years or till retirement age (whichever is earlier)) h Riskometer Investors understand that their principal As on 30th June 2021 PORTFOLIO will be at Very High Risk INVESTMENT STYLE Company name No. of Market Value % of Company name No. of Market Value % of A Fund that aims to provide an investment tool for retirement Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets planning to suit the risk profile of the investor. Equity & Equity Related Total 119762.82 81.89 Software INVESTMENT OBJECTIVE Auto Tata Consultancy Services Ltd. 165000 5520.49 3.77 To provide a financial planning tool for long term financial Eicher Motors Ltd. 64000 1709.54 1.17 Infosys Ltd. 345000 5453.76 3.73 security for investors based on their retirement planning goals. Bajaj Auto Ltd. 38500 1591.53 1.09 HCL Technologies Ltd. 345000 3393.08 2.32 However, there can be no assurance that the investment Banks Oracle Financials Services Soft Ltd. 60050 2192.73 1.50 objective of the fund will be realized, as actual market ICICI Bank Ltd. 1503000 9482.43 6.48 Birlasoft Ltd. 400000 1598.40 1.09 movements may be at variance with anticipated trends. HDFC Bank Ltd. 580000 8687.82 5.94 Other Equities^ 16009.86 10.95 DATE OF ALLOTMENT Kotak Mahindra Bank Ltd. -

ICICI LOMBARD Lemonade from Lemons

RESULT UPDATE ICICI LOMBARD Lemonade from lemons India Equity Research| Banking and Financial Services ICICI Lombard’s Q1FY21 PAT jumped 28.5% YoY to INR3.98bn. However, EDELWEISS 4D RATINGS gross direct premium income (GDPI) fell 5.3% YoY, marginally Absolute Rating BUY underperforming the industry (-4.2% YoY). Net earned premium (NEP) Rating Relative to Sector Outperformer grew 3.5% YoY. Investment leverage remained unchanged at 4.2x net Risk Rating Relative to Sector Low worth. The company continues to grow in the preferred areas of SME fire Sector Relative to Market Overweight and agency-driven health indemnity, accompanying added momentum in commercial lines. We estimate NEP would increase by only 3% in FY21 as 15% shrinkage in motor OD business is offset by growth in retail health MARKET DATA (R:ICIL.BO, B:ICICIGI IN) CMP : INR 1,289 and fire. Underwriting performance should improve greatly as more Target Price : INR 1,600 profitable areas of fire and health account for a higher share in business mix along with better economics in motor OD. These drive upward 52-week range (INR) : 1,440 / 806 revisions of 16% in FY21E and 8% in FY22E earnings. We maintain ‘BUY’ Share in issue (mn) : 454.5 with a revised TP of INR1,600 (INR1,490 earlier, multiple unchanged). We M cap (INR bn/USD mn) : 586/ 7,817 single out ICICI Lombard as a long-term beneficiary of the current Avg. Daily Vol.BSE/NSE(‘000) : 656.0 disruption with higher pricing freedom accompanying market share gain. Key risks remain growth/scale-agnostic focus on earning too high an RoE SHARE HOLDING PATTERN (%) and under-investment in distribution and technology. -

Of 21 Voya Emerging Markets Index Portfolio Portfolio Holdings As of August 31, 2021 (Unaudited)

Voya Emerging Markets Index Portfolio Portfolio Holdings as of August 31, 2021 (Unaudited) Ticker Security Name Crncy Country Price Quantity Market Value VNET 21Vianet Group, Inc. USD China 19.79 8,311 $164,475 QFIN 360 DigiTech, Inc. USD China 22.80 8,162 $186,094 601360 360 Security Technology, Inc. - A Shares CNY China 1.84 29,600 $54,506 1530 3SBio, Inc. HKD China 1.11 111,500 $124,214 JOBS 51job, Inc. USD China 76.80 2,743 $210,662 3319 A-Living Smart City Services Co. Ltd. HKD China 3.97 54,250 $215,608 2018 AAC Technologies Holdings, Inc. HKD China 5.54 72,500 $401,916 AOTHAI Abdullah Al Othaim Markets Co. SAR Saudi Arabia 30.74 4,275 $131,424 M AEV Aboitiz Equity Ventures, Inc. PHP Philippines 0.86 180,620 $155,767 ABG Absa Group Ltd. ZAR South Africa 10.83 70,934 $768,205 ADCB Abu Dhabi Commercial Bank PJSC AED United Arab Emirates 2.04 280,089 $572,661 ADIB Abu Dhabi Islamic Bank PJSC AED United Arab Emirates 1.54 99,971 $153,456 ADNOC Abu Dhabi National Oil Co. for Distribution PJSC AED United Arab Emirates 1.23 199,367 $245,264 DIS ACC ACC Ltd. INR India 33.00 7,090 $233,946 2345 Accton Technology Corp. TWD Taiwan 10.13 50,000 $506,568 2353 Acer, Inc. TWD Taiwan 0.91 286,462 $259,982 ADE Adani Enterprises Ltd. INR India 21.72 26,370 $572,781 ADANIG Adani Green Energy Ltd. INR India 14.60 38,606 $563,753 R ADSEZ Adani Ports & Special Economic Zone, Ltd. -

D-Mart's Radhakishan Damani Buys 8.8-Acre Mixed Use Plot from CCI for Rs 500 Cr - the Economic Times

1/2/2020 D-Mart's Radhakishan Damani buys 8.8-acre mixed use plot from CCI for Rs 500 cr - The Economic Times SECTIONS ET APPS ENGLISH E-PAPER ET PRIME CLAIM YOUR TIMESPOINTS FOLLOW US SIGN-IN Property / C'struction LATEST NEWS Have proposed rules to centre for CAA, says Sarbananda Sonowal Home Industry Auto Banking/Finance Cons. Products Energy Ind'l Goods/Svs Healthcare/Biotech Services More Advertising Consultancy / Audit Education Hotels / Restaurants Property / C'struction Retail Travel Business News › Industry › Services › Property / C'struction › D-Mart's Radhakishan Damani buys 8.8-acre mixed use plot from CCI for Rs 500 cr Search for News, Stock Quotes & NAV's Benchmarks NSE Loser-Large Cap Stock Analysis, IPO, Mutual Funds, Bonds & More Sensex LIVE Eicher Motors 41,524.54 218.52 21,640.00 -435.80 Market Watch D-Mart's Radhakishan Damani buys 8.8-acre mixed use plot from CCI for Rs 500 cr The land is part of 22 acres owned by Cable Corporation of India, which had mortgaged the entire plot to Indiabulls Housing Finance for a residential-led mixed-use project. The funds remaining after payment to Indiabulls Housing Finance will be used to complete the proposed project, sources said. By Kailash Babar, ET Bureau | Jan 01, 2020, 08.34 AM IST Save 0 Comments Agencies MUMBAI: D-Mart founder Radhakishan Damani has bought an 8.8-acre parcel close to Sanjay Gandhi National Park from CCI Related Most Read Most Shared Projects for over Rs 500 crore, two people Radhakishan Damani picks stake in this smallcap aware of the development said. -

Avenue Supermarts (DMART IN)

INSTITUTIONAL EQUITY RESEARCH Avenue Supermarts (DMART IN) Solid execution + best store economics = Premium valuations INDIA | RETAIL | INITIATING COVERAGE 30 April 2021 Avenue Supermarts, which owns and operates the DMart chain of supermarket stores, is the BUY only retailer in India to grow consistently and profitably. Our positive view on this company CMP RS 2890 stems from industry-leading asset turnover, high throughput due to its core offering of ‘Every Day Low Price’ driving high customer footfalls, and conversion and loyalty. Best-in-class store TARGET RS 3320 (+15%) economics, aggressive store expansion, right product mix, and low inventory days give it an COMPANY DATA edge over competitors. We believe that the company’s premium valuations factor in a big O/S SHARES (MN) : 648 opportunity for the organised groceries market, a strong moat, and execution excellence. MARKET CAP (RSBN) : 1930 Based on these dynamics, we initiate coverage with a DCF-based target of Rs 3,320. BUY. MARKET CAP (USDBN) : 26 Slow and steady approach towards online: We believe DMart’s strategy of slowly expanding in 52 - WK HI/LO (RS) : 3330 / 1954 LIQUIDITY 3M (USDMN) : 3.9 bigger cities would be fruitful, as the online grocery category remains at low-single-digits as a PAR VALUE (RS) : 10 percentage of the overall grocery market. Our analysis of competition suggests that DMart Ready (DMart’s online market) is present in only 9% of the cities where DMart offline stores exist. SHARE HOLDING PATTERN, % However, its online presence already covers 45% of the population where its offline stores are Mar 21 Dec 20 Sep 20 present. -

ICICI Lombard General Insurance Company Limited Ref

Ref. No.: MUM/SEC/14-04/2022 April 17, 2021 To, To, General Manager Vice-President Listing Department Listing Department BSE Limited National Stock Exchange of India Ltd. Phiroze Jeejeebhoy Tower, Exchange Plaza, 5th Floor, Plot C/1, 14th Floor, Dalal Street, G Block, Bandra-Kurla Complex, Mumbai - 400 001 Bandra (East), Mumbai - 400 051 Equity (BSE: 540716/ NSE: ICICIGI); Debt (BSE: 954492/ NSE: ILGl26) Dear Sir/Madam, Sub: Outcome of the Board Meeting held on April 17, 2021 Pursuant to Regulation 30 and 33 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 ("Listing Regulations"), we wish to inform you that the Board of Directors of the Company, at their Meeting held today i.e. Saturday, April 17, 2021 in Mumbai, have inter-alia: Approved the Audited Financial Results of the Company for the quarter and financial year ended March 31, 2021. A copy of the Audited Financial Results for the quarter and financial year ended March 31, 2021 together with the Statutory Auditors’ Report in the prescribed format is enclosed herewith. A copy of the press release being issued in this connection is also attached. Please note that Chaturvedi & Co. and PKF Sridhar & Santhanam LLP, the Joint Statutory Auditors of the Company, have issued audit reports with unmodified opinion. Recommendation of final dividend of ₹ 4.0 per equity share i.e. at the rate of 40.0% of face value of ₹ 10 each for the financial year ended March 31, 2021, subject to approval of the Members at the ensuing Annual General Meeting (“AGM”) of the Company. -

Home Insurance Policy Wordings

Buy / Renew / Service / Claim related queries Log on to www.icicilombard.com or call 1800 2666 HOME INSURANCE POLICY WORDINGS Part II of the Schedule “Schedule” means the schedule, and any annexure to it, attached to and forming part of this Policy. 1. Definitions “Short Period Rates” means rates of premium for periods shorter than one year, as per details below- “Accident and Accidental” means a sudden, unforeseen, and unexpected physical event beyond the control of the Insured caused by external, visible and violent means. For a period not exceeding 15 days 10% of the annual rate “Actual Cash Value” means the cost of replacement less any depreciation, which would be For a period not exceeding 1 month 15% of the annual rate determined by considering the condition immediately before the loss or damage, the resale For a period not exceeding 2 months 30% of the annual rate value and the normal life expectancy. For a period not exceeding 3 months 40% of the annual rate “Bodily Injury” means any accidental physical bodily harm but does not include any For a period not exceeding 4 months 50% of the annual rate sickness or disease. For a period not exceeding 5 months 60% of the annual rate “Business or Business Purposes” means any full or part time, permanent or temporary, For a period not exceeding 6 months 70% of the annual rate activity undertaken in the dwelling with a view to profit or gain. For a period not exceeding 7 months 75% of the annual rate “Burglary” means an act involving the unauthorised entry to or exit from the Insured's Home For a period not exceeding 8 months 80 % of the annual rate or attempt threat by unexpected, forcible, visible and violent means, with the intent to For a period not exceeding 9 months 85% of the annual rate commit an act of Theft. -

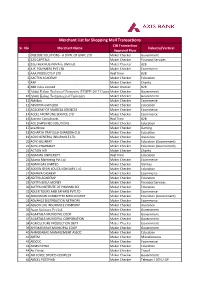

Merchant List for Shopping Mall Transactions CIB Transaction Sr

Merchant List for Shopping Mall Transactions CIB Transaction Sr. No Merchant Name Industry/Vertical Approval Flow 1 (N)CODE SOLUTIONS - A DIVN. OF GNFC LTD. Maker Checker Government 2 123 CAPITALS Maker Checker Financial Services 3 2GETHER HUB PRIVATE LIMITED Maker Checker B2B 4 A.R. POLYMERS PVT LTD Maker Checker Ecommerce 5 AAA PRODUCTS P LTD Real Time B2B 6 AACTEN ACADEMY Maker Checker Education 7 AAP Maker Checker Charity 8 ABB India Limited Maker checker B2B 9 Abdul Kalam Technical University (UPSEE-2017 Counselling)Maker Checker Government 10 Abdul Kalam Technological University Maker Checker Government 11 Abhibus Maker Checker Ecommerce 12 ABVIIITM-GWALIOR Maker Checker Education 13 ACADEMY OF MAGICAL SCIENCES Maker Checker Ecommerce 14 ACCEL FRONTLINE SERVICE LTD Maker Checker Ecommerce 15 Accrete Consultants Real Time B2B 16 ACE SIMPLIFIED SOLUTIONS Maker Checker Education 17 ace2three Maker Checker Gaming 18 ACHARYA PRAFULLA CHANDRA CLG Maker Checker Education 19 ACKO GENERAL INSURANCE LTD Maker Checker Insurance 20 ACPC-GUJARAT Maker Checker Education (Government) 21 ACPC-PHARMACY Maker Checker Education (Government) 22 ACTION AID Maker Checker Charity 23 ADAMAS UNIVERSITY Real Time Education 24 Adams Marketing Pvt Ltd Maker Checker Ecommerce 25 ADANI GAS LIMITED Maker Checker Utilities 26 ADDON GYAN EDUCATION SERV LTD Maker Checker Education 27 ADHAVA CASHEW Maker Checker Ecommerce 28 ADITYA ACADEMY Maker Checker Education 29 ADITYA BIRLA MONEY Maker Checker Financial Services 30 ADITYA INSTITUTE OF PHARMA SCI Maker Checker -

Star Health and Bank of Baroda Enter Into a Corporate Agency Agreement

Star Health and Bank of Baroda enter into a corporate agency agreement 1 Media Coverage Details Sr. No Publication Headline Date Wire 1. PTI BoB, Star Health enter into Corporate Agency May 9, 2016 agreement Print - English 2. Deccan Herald BoB inks MoU with Max Bupa and Star Health May 8, 2016 3. Free Press Journal BoB signs MoU with max Bupa and Star Heath May 9, 2016 4. Business Standard Bank of Baroda enters into an MoU May 10, 2016 5. Financial Chronicle BoB, Star Heath ties-up May 10, 2016 6. The Financial Express Star Health ties up with BoB to market insurance May 12, 2016 products 7. Lucknow News Bank of Baroda branches to offer Star Health and May 12, 2016 Allied Health Insurance products 8. The Financial Express BoB to offer Star health Insurance products May 13, 2016 9. The Economic Times BoB joins MOU with Max Bupa Health Insurance May 16, 2016 10. The Financial Express Star Health Insurance tie up with Bank of Baroda May 17, 2016 11. The Indian Express Star Health Insurance tie up with Bank of Baroda May 17, 2016 12. Daily News and Analysis BoB ties up with Star Health May 17, 2016 13. Daily News and Analysis BoB ties up with Star Health May 17, 2016 14. Mid -Day Star Health and BoB enter into an agreement May 17, 2016 Print - Regionals 15. Punjab Kesari Bank of Baroda branches to offer Star Health and May 11, 2016 Allied Health Insurance products 16. Loksatta Bank of Baroda ties up with insurance companies May 11, 2016 17. -

India Internet a Closer Look Into the Future We Expect the India Internet TAM to Grow to US$177 Bn by FY25 (Excl

EQUITY RESEARCH | July 27, 2020 | 10:48PM IST India Internet A Closer Look Into the Future We expect the India internet TAM to grow to US$177 bn by FY25 (excl. payments), 3x its current size, with our broader segmental analysis driving the FY20-25E CAGR higher to 24%, vs 20% previously. We see market share likely to shift in favour of Reliance Industries (c.25% by For the exclusive use of [email protected] FY25E), in part due to Facebook’s traffic dominance; we believe this partnership has the right building blocks to create a WeChat-like ‘Super App’. However, we do not view India internet as a winner-takes-all market, and highlight 12 Buy names from our global coverage which we see benefiting most from growth in India internet; we would also closely watch the private space for the emergence of competitive business models. Manish Adukia, CFA Heather Bellini, CFA Piyush Mubayi Nikhil Bhandari Vinit Joshi +91 22 6616-9049 +1 212 357-7710 +852 2978-1677 +65 6889-2867 +91 22 6616-9158 [email protected] [email protected] [email protected] [email protected] [email protected] 85e9115b1cb54911824c3a94390f6cbd Goldman Sachs India SPL Goldman Sachs & Co. LLC Goldman Sachs (Asia) L.L.C. Goldman Sachs (Singapore) Pte Goldman Sachs India SPL Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.