Avenue Supermarts (DMART IN)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Strategy – Alternate View

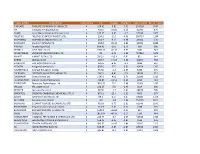

Strategy – Alternate view ICICI Securities Limited is the author and distributor of this report New-age stocks poised for entry into NIFTY50 but could miss entry in Sep’21 reshuffle; Cyclicals also improve free float market cap rank! Research Analysts: Vinod Karki [email protected] +91 22 6637 7586 Siddharth Gupta, CFA [email protected] +91 22 2277 7607 Alternate view is a differentiated approach of analysing stocks and markets which combines the discipline of our proprietary fundamental quantitative frameworks with the judgement of bottom‐up research for generating investment ideas Please refer to important disclosures at the end of this report ` Equity Research July 23, 2021 INDIA CNX Nifty: 15824 Strategy ICICI Securities Limited is the author and distributor of this report New-age stocks poised for entry into NIFTY50 but could miss entry in Sep’21 reshuffle; Cyclicals also improve Alternate View: Nifty50 reshuffle free float market cap rank! Based on data till 19th Jul’21, the upcoming semi-annual NIFTY50 reshuffle could result in Info-edge being the closest contender to replace IOCL on 29th Sep’21. However, Info-edge is marginally behind in terms of average free float market capitalisation criteria (US$ 5bn and 3.7% lower than 1.5x that of IOCL – the smallest free float market cap stock within the current NIFTY50 index) while fulfilling other conditions such as inclusion in the F&O list and being part of the upcoming proforma NSE100 universe amongst others (full list of criteria is given below). New-age economy stocks with >100x P/E ratio poised to enter the NIFTY50 index: Info edge will be the first pure play internet platform company to be included in the NIFTY50 index as and when it qualifies. -

Market Outlook

November 4, 2019 Derivatives Thematic Report – • PRODUCT 1 Stocks likely to be included in F&O… • PRODUCT 2 Retail Equity Research Equity Retail – Research Analysts Dipesh Dedhia Amit Gupta Securities ICICI [email protected] [email protected] Raj Deepak Singh Nandish Patel [email protected] [email protected] Eligibility criteria of stocks for inclusion in F&O segment The eligibility of a stock for inclusion in the derivatives segment is based on the criteria laid down by Sebi through various circulars issued from time to time. Based on Sebi guidelines, the following criteria has been adopted by the exchange for selecting stocks on which futures & options (F&O) contracts would be introduced. Futures & options contracts may be introduced on new securities, which meet the below mentioned eligibility criteria, subject to approval by Sebi. Thematic Report Thematic 1) The stock shall be chosen from among the top 500 stocks in terms of average daily market capitalisation and average daily traded value in the previous six months on a rolling basis 2) The stock's median quarter-sigma order size over the last six months shall not be less than | 25 lakh. For this purpose, a stock's quarter-sigma order size shall mean the order size (in value terms) required to cause a change in the stock price equal to one-quarter of a standard deviation 3) The market wide position limit in the stock shall not be less than | 500 crore on a rolling basis. The market wide position limit (number of shares) shall be valued taking the closing price of stocks in the underlying cash market on the date of expiry of contract in the month. -

Of 21 Voya Emerging Markets Index Portfolio Portfolio Holdings As of August 31, 2021 (Unaudited)

Voya Emerging Markets Index Portfolio Portfolio Holdings as of August 31, 2021 (Unaudited) Ticker Security Name Crncy Country Price Quantity Market Value VNET 21Vianet Group, Inc. USD China 19.79 8,311 $164,475 QFIN 360 DigiTech, Inc. USD China 22.80 8,162 $186,094 601360 360 Security Technology, Inc. - A Shares CNY China 1.84 29,600 $54,506 1530 3SBio, Inc. HKD China 1.11 111,500 $124,214 JOBS 51job, Inc. USD China 76.80 2,743 $210,662 3319 A-Living Smart City Services Co. Ltd. HKD China 3.97 54,250 $215,608 2018 AAC Technologies Holdings, Inc. HKD China 5.54 72,500 $401,916 AOTHAI Abdullah Al Othaim Markets Co. SAR Saudi Arabia 30.74 4,275 $131,424 M AEV Aboitiz Equity Ventures, Inc. PHP Philippines 0.86 180,620 $155,767 ABG Absa Group Ltd. ZAR South Africa 10.83 70,934 $768,205 ADCB Abu Dhabi Commercial Bank PJSC AED United Arab Emirates 2.04 280,089 $572,661 ADIB Abu Dhabi Islamic Bank PJSC AED United Arab Emirates 1.54 99,971 $153,456 ADNOC Abu Dhabi National Oil Co. for Distribution PJSC AED United Arab Emirates 1.23 199,367 $245,264 DIS ACC ACC Ltd. INR India 33.00 7,090 $233,946 2345 Accton Technology Corp. TWD Taiwan 10.13 50,000 $506,568 2353 Acer, Inc. TWD Taiwan 0.91 286,462 $259,982 ADE Adani Enterprises Ltd. INR India 21.72 26,370 $572,781 ADANIG Adani Green Energy Ltd. INR India 14.60 38,606 $563,753 R ADSEZ Adani Ports & Special Economic Zone, Ltd. -

D-Mart's Radhakishan Damani Buys 8.8-Acre Mixed Use Plot from CCI for Rs 500 Cr - the Economic Times

1/2/2020 D-Mart's Radhakishan Damani buys 8.8-acre mixed use plot from CCI for Rs 500 cr - The Economic Times SECTIONS ET APPS ENGLISH E-PAPER ET PRIME CLAIM YOUR TIMESPOINTS FOLLOW US SIGN-IN Property / C'struction LATEST NEWS Have proposed rules to centre for CAA, says Sarbananda Sonowal Home Industry Auto Banking/Finance Cons. Products Energy Ind'l Goods/Svs Healthcare/Biotech Services More Advertising Consultancy / Audit Education Hotels / Restaurants Property / C'struction Retail Travel Business News › Industry › Services › Property / C'struction › D-Mart's Radhakishan Damani buys 8.8-acre mixed use plot from CCI for Rs 500 cr Search for News, Stock Quotes & NAV's Benchmarks NSE Loser-Large Cap Stock Analysis, IPO, Mutual Funds, Bonds & More Sensex LIVE Eicher Motors 41,524.54 218.52 21,640.00 -435.80 Market Watch D-Mart's Radhakishan Damani buys 8.8-acre mixed use plot from CCI for Rs 500 cr The land is part of 22 acres owned by Cable Corporation of India, which had mortgaged the entire plot to Indiabulls Housing Finance for a residential-led mixed-use project. The funds remaining after payment to Indiabulls Housing Finance will be used to complete the proposed project, sources said. By Kailash Babar, ET Bureau | Jan 01, 2020, 08.34 AM IST Save 0 Comments Agencies MUMBAI: D-Mart founder Radhakishan Damani has bought an 8.8-acre parcel close to Sanjay Gandhi National Park from CCI Related Most Read Most Shared Projects for over Rs 500 crore, two people Radhakishan Damani picks stake in this smallcap aware of the development said. -

India Internet a Closer Look Into the Future We Expect the India Internet TAM to Grow to US$177 Bn by FY25 (Excl

EQUITY RESEARCH | July 27, 2020 | 10:48PM IST India Internet A Closer Look Into the Future We expect the India internet TAM to grow to US$177 bn by FY25 (excl. payments), 3x its current size, with our broader segmental analysis driving the FY20-25E CAGR higher to 24%, vs 20% previously. We see market share likely to shift in favour of Reliance Industries (c.25% by For the exclusive use of [email protected] FY25E), in part due to Facebook’s traffic dominance; we believe this partnership has the right building blocks to create a WeChat-like ‘Super App’. However, we do not view India internet as a winner-takes-all market, and highlight 12 Buy names from our global coverage which we see benefiting most from growth in India internet; we would also closely watch the private space for the emergence of competitive business models. Manish Adukia, CFA Heather Bellini, CFA Piyush Mubayi Nikhil Bhandari Vinit Joshi +91 22 6616-9049 +1 212 357-7710 +852 2978-1677 +65 6889-2867 +91 22 6616-9158 [email protected] [email protected] [email protected] [email protected] [email protected] 85e9115b1cb54911824c3a94390f6cbd Goldman Sachs India SPL Goldman Sachs & Co. LLC Goldman Sachs (Asia) L.L.C. Goldman Sachs (Singapore) Pte Goldman Sachs India SPL Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. -

Dr. Ashok Ajmera's Column Ajmera's Column Ajmera's

Dr. Ashok Ajmera (FCA), CMD & CEO DrDrDr.Dr . Ashok Ajmera’s column as on Oct. 1919,, 2019 Domestic equities bounceback strongly; Reliance Industries Q2FY20 results above street expectations.. On a weekly basis, the S&P BSE Sensex rose 3.07 percent while the Nifty added 3.15 percent compared to 2.7 percent gain seen in the Small-cap index, and 4.6 percent rally witnessed in the Mid-cap index, for the week ended October 18, 2019. Small & mid-cap stocks witnessed continued buying as more than 60 stocks in the S&P BSE index rose 10-50 percent in the same period. India's retail inflation in September grew 3.99 percent against 3.21 percent in August 2019, while India's August Index of Industrial Production (IIP) stood at -1.1 percent versus 4.6 percent, month-on-month (MoM). Recently, the International Monetary Fund (IMF) and the World Bank, trimmed India’s gross domestic product (GDP) growth prospects by a whopping 0.9 percent and 1.5 percent respectively. Sectors and stocks Shares of Reliance Industries (RIL), Hindustan Unilever (HUL), Bajaj Finance and Nestle India from the Nifty 50 index hit their respective all-time high on the National Stock Exchange (NSE) in intra-day deal on Friday. Avenue Supermarts, which runs the DMart chain of stores, Adani Green Energy, Berger Paints, Blue Star, Indraprastha Gas, Manappuram Finance, SBI Life Insurance, Siemens and Whirlpool of India among total 16 stocks from the Nifty 500 index that also reached their record high in intra-day trade on Friday. -

List of Nodal Officer

List of Nodal Officer Designa S.No tion of Phone (With Company Name EMAIL_ID_COMPANY FIRST_NAME MIDDLE_NAME LAST_NAME Line I Line II CITY PIN Code EMAIL_ID . Nodal STD/ISD) Officer 1 VIPUL LIMITED [email protected] PUNIT BERIWALA DIRT Vipul TechSquare, Golf Course Road, Sector-43, Gurgaon 122009 01244065500 [email protected] 2 ORIENT PAPER AND INDUSTRIES LTD. [email protected] RAM PRASAD DUTTA CSEC BIRLA BUILDING, 9TH FLOOR, 9/1, R. N. MUKHERJEE ROAD KOLKATA 700001 03340823700 [email protected] COAL INDIA LIMITED, Coal Bhawan, AF-III, 3rd Floor CORE-2,Action Area-1A, 3 COAL INDIA LTD GOVT OF INDIA UNDERTAKING [email protected] MAHADEVAN VISWANATHAN CSEC Rajarhat, Kolkata 700156 03323246526 [email protected] PREMISES NO-04-MAR New Town, MULTI COMMODITY EXCHANGE OF INDIA Exchange Square, Suren Road, 4 [email protected] AJAY PURI CSEC Multi Commodity Exchange of India Limited Mumbai 400093 0226718888 [email protected] LIMITED Chakala, Andheri (East), 5 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 6 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 7 NECTAR LIFE SCIENCES LIMITED [email protected] SUKRITI SAINI CSEC NECTAR LIFESCIENCES LIMITED SCO 38-39, SECTOR 9-D CHANDIGARH 160009 01723047759 [email protected] 8 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 9 SMIFS CAPITAL MARKETS LTD. -

NSE Symbol NSE 6 Month Avg Total Market

Average Market Cap of 200 listed companies on BSE & NSE for the six months ended 30 June 2021 BSE 6 month Avg NSE 6 month Avg Average of BSE and NSE 6 Total Market Cap Total Market Cap month Avg Total Market Cap S.No. Company Name ISIN BSE SYMBOL (Rs. In Crs.) NSE Symbol (Rs. In Crs.) (Rs. in Crs.) 1 Reliance Industries Ltd INE002A01018 RELIANCE 1338017.01 RELIANCE 1355067.509 1346542.26 Tata Consultancy Services 2 Ltd. INE467B01029 TCS 1169783.56 TCS 1173068.166 1171425.86 3 HDFC Bank Ltd. INE040A01034 HDFCBANK 819037.95 HDFCBANK 818713.671 818875.81 4 Infosys Ltd INE009A01021 INFY 579784.19 INFY 579697.3885 579740.79 5 Hindustan Unilever Ltd., INE030A01027 HINDUNILVR 549336.78 HINDUNILVR 549358.908 549347.84 Housing Development 6 Finance Corp.Lt INE001A01036 HDFC 462288.58 HDFC 461373.1089 461830.84 7 ICICI Bank Ltd. INE090A01021 ICICIBANK 416645.51 ICICIBANK 416389.0234 416517.27 8 Kotak Mahindra Bank Ltd. INE237A01028 KOTAKBANK 361640.52 KOTAKBANK 361438.6361 361539.58 9 State Bank Of India, INE062A01020 SBIN 329767.32 SBIN 329789.268 329778.29 10 Bajaj Finance Limited INE296A01024 BAJFINANCE 324996.53 BAJFINANCE 324843.5005 324920.02 11 Bharti Airtel Ltd. INE397D01024 BHARTIARTL 299981.36 BHARTIARTL 299955.7729 299968.57 12 HCL Technologies Ltd INE860A01027 HCLTECH 261400.46 HCLTECH 261392.0109 261396.24 13 Wipro Ltd., INE075A01022 WIPRO 258617.45 WIPRO 261102.3994 259859.92 14 ITC Ltd INE154A01025 ITC 259423.16 ITC 259396.0648 259409.61 15 Asian Paints Ltd. INE021A01026 ASIANPAINT 253487.28 ASIANPAINT 253454.4536 253470.87 16 AXIS Bank Ltd. -

Today's Top Research Idea Market Snapshot

23 July 2021 Motilal Oswal values your support in the Today’s top research idea Asiamoney Brokers Poll 2021 for India Research, Sales, Corporate Access and UltraTech Cememnt: Margin outlook continues to improve Trading team. We request your ballot. Expansions provide strong growth visibility UltraTech Cement (UTCEM) continued to improve its costs and margins in 1QFY22; it reported the highest ever EBITDA/unit of INR1,536/t (+8% YoY) during the quarter. Coupled with volume growth of 47% YoY, this led to 59% YoY growth in EBITDA. Market snapshot Market share gains should continue, aided by the ongoing 20mtpa expansion Equities - India Close Chg .% CYTD.% program, which should drive a 13% volume CAGR over FY21–24E. Sensex 52,837 1.2 10.7 We estimate a 15%/26% CAGR in consolidated EBITDA/PAT over FY21–23E, Nifty-50 15,824 1.2 13.2 Nifty-M 100 27,538 1.1 32.1 driven by a 13% volume CAGR, better realizations, lower operating costs, and Equities-Global Close Chg .% CYTD.% lower interest costs. S&P 500 4,367 0.2 16.3 The valuation is reasonable at 13.7x FY23E EV/EBITDA – a 10% discount to its Nasdaq 14,685 0.4 13.9 last five years’ average. We value UTCEM at 16x FY23E EV/EBITDA to arrive at FTSE 100 6,968 -0.4 7.9 DAX 15,515 0.6 13.1 TP of INR8,770. Reiterate Buy. Hang Seng 10,007 1.8 -6.8 Nikkei 225 27,548 0.0 0.4 Commodities Close Chg .% CYTD.% Research covered Brent (US$/Bbl) 73 6.8 43.2 Gold ($/OZ) 1,807 -0.2 -4.8 Cos/Sector Key Highlights Cu (US$/MT) 9,418 1.2 21.5 Almn (US$/MT) 2,469 0.8 25.1 UltraTech Cement Margin outlook continues -

Constituents of NIFTY Next 50 July 31, 2018

Constituents of NIFTY Next 50 July 31, 2018 Weightage Symbol Security Name Industry Close Price Index Mcap (Rs. Crores) (%) ABB ABB India Ltd. INDUSTRIAL MANUFACTURING 1218.35 6454 0.91 ACC ACC Ltd. CEMENT & CEMENT PRODUCTS 1529.75 12927 1.83 ABCAPITAL Aditya Birla Capital Ltd. FINANCIAL SERVICES 146.50 8062 1.14 AMBUJACEM Ambuja Cements Ltd. CEMENT & CEMENT PRODUCTS 230.70 16949 2.40 ASHOKLEY Ashok Leyland Ltd. AUTOMOBILE 112.80 16223 2.30 AUROPHARMA Aurobindo Pharma Ltd. PHARMA 591.55 16636 2.36 DMART Avenue Supermarts Ltd. CONSUMER GOODS 1654.90 16525 2.34 BANKBARODA Bank of Baroda FINANCIAL SERVICES 153.35 14605 2.07 BEL Bharat Electronics Ltd. INDUSTRIAL MANUFACTURING 116.35 9355 1.32 BHEL Bharat Heavy Electricals Ltd. INDUSTRIAL MANUFACTURING 74.05 10059 1.42 BOSCHLTD Bosch Ltd. AUTOMOBILE 18720.70 17141 2.43 BRITANNIA Britannia Industries Ltd. CONSUMER GOODS 6542.20 38487 5.45 CADILAHC Cadila Healthcare Ltd. PHARMA 381.45 9763 1.38 COLPAL Colgate Palmolive (India) Ltd. CONSUMER GOODS 1145.25 15263 2.16 Container Corporation of India Ltd. CONCOR SERVICES 669.30 14681 2.08 CUMMINSIND Cummins India Ltd. INDUSTRIAL MANUFACTURING 673.50 9148 1.30 DLF DLF Ltd. CONSTRUCTION 196.30 8755 1.24 DABUR Dabur India Ltd. CONSUMER GOODS 421.55 23826 3.37 EMAMILTD Emami Ltd. CONSUMER GOODS 591.20 7246 1.03 General Insurance Corporation of 356.55 8757 1.24 GICRE India FINANCIAL SERVICES Godrej Consumer Products Ltd. GODREJCP CONSUMER GOODS 1316.90 33198 4.70 HAVELLS Havells India Ltd. CONSUMER GOODS 634.40 15872 2.25 HINDZINC Hindustan Zinc Ltd. -

Ticker Symbol Ticker Name Ticker Group LTP Change Change % Trade Volume No

Ticker Symbol Ticker Name Ticker Group LTP Change Change % Trade Volume No. of Trades TINPLATE TINPLATE COMPANY OF INDIA LTD. A 169.95 -9.95 -5.53 153718 3337 NH Narayana Hrudayalaya Ltd A 401.5 -21.85 -5.16 12932 676 YAARII Yaarii Digital Integrated Services Ltd A 100.35 -4.95 -4.7 67244 1006 PRESTIGE PRESTIGE ESTATES PROJECTS LTD. A 294.2 -12.5 -4.08 185797 1354 RESPONIND RESPONSIVE INDUSTRIES LTD. A 162.9 -6.75 -3.98 26584 770 RAMCOSYS RAMCO SYSTEMS LTD. A 504.8 -20.35 -3.88 33782 2838 PAISALO Paisalo Digital Ltd A 666.45 -26.2 -3.78 699 166 KPRMILL K.P.R. Mill Limited A 1183.35 -45.35 -3.69 3442 943 MOREPENLAB MOREPEN LABORATORIES LTD. A 39 -1.45 -3.58 484850 1675 VMART V-MART RETAIL LTD. A 2812.9 -102.9 -3.53 821 345 SOBHA Sobha Limited A 504.7 -17.65 -3.38 10297 738 ELGIEQUIP ELGI EQUIPMENTS LTD. A 195.5 -6.25 -3.1 9966 597 NEOGEN Neogen Chemicals Ltd A 878.6 -27.5 -3.03 10454 1267 NAVNETEDUL Navneet Education Limited A 75.55 -2.3 -2.95 6298 273 EVEREADY EVEREADY INDUSTRIES INDIA LTD. A 282.5 -8.45 -2.9 19378 571 DALBHARAT Dalmia Bharat Ltd A 1543.3 -43.8 -2.76 21030 5329 FLUOROCHEM Gujarat Fluorochemicals Ltd A 730.85 -19.55 -2.61 9223 743 THYROCARE Thyrocare Technologies Ltd A 1010.35 -25.7 -2.48 15603 1332 VRLLOG VRL Logistics Ltd A 226.35 -5.6 -2.41 3614 206 SPENCER Spencers Retail Ltd A 68.95 -1.7 -2.41 28478 509 ORIENTCQ ORIENTAL CARBON & CHEMICALS LTD.-$ A 873.1 -21.4 -2.39 4605 373 SUVEN SUVEN LIFE SCIENCES LTD. -

Press Release February 23, 2021

Press Release February 23, 2021 Replacements in Indices The Index Maintenance Sub-Committee (Equity) has decided to make the following replacement of stocks in various indices as part of its periodic review. These changes shall become effective from March 31, 2021 (close of March 30, 2021). 1) NIFTY 50 The following company is being excluded: Sr. No. Company Name Symbol 1 GAIL (India) Ltd. GAIL The following company is being included: Sr. No. Company Name Symbol 1 Tata Consumer Products Ltd. TATACONSUM The above replacements will also be applicable to NIFTY50 Equal Weight Index. 2) NIFTY Next 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Bank of Baroda BANKBARODA 2 Container Corporation of India Ltd. CONCOR 3 General Insurance Corporation of India GICRE 4 Hindustan Zinc Ltd. HINDZINC 5 Oracle Financial Services Software Ltd. OFSS 6 Power Finance Corporation Ltd. PFC 7 Tata Consumer Products Ltd. TATACONSUM The following companies are being included: Sr. No. Company Name Symbol 1 Adani Enterprises Ltd. ADANIENT 2 Apollo Hospitals Enterprise Ltd. APOLLOHOSP 3 GAIL (India) Ltd. GAIL 4 Jubilant Foodworks Ltd. JUBLFOOD 5 MRF Ltd. MRF Sr. No. Company Name Symbol 6 Vedanta Ltd. VEDL 7 Yes Bank Ltd. YESBANK 3) NIFTY 500 The following companies are being excluded: Sr. No. Company Name Symbol 1 Bombay Dyeing & Manufacturing Co. Ltd. BOMDYEING 2 CARE Ratings Ltd. CARERATING 3 Chennai Petroleum Corporation Ltd. CHENNPETRO 4 D.B.Corp Ltd. DBCORP 5 ESAB India Ltd. ESABINDIA 6 Gujarat Mineral Development Corporation Ltd. GMDCLTD 7 Hathway Cable & Datacom Ltd. HATHWAY 8 Heritage Foods Ltd.