ICICI Lombard General Insurance Company Limited Ref

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

25February 2020 India Daily

INDIA DAILY February 25, 2020 India 24-Feb 1-day 1-mo 3-mo Sensex 40,363 (2.0) (3.0) (1.3) Nifty 11,829 (2.1) (3.4) (2.0) Contents Global/Regional indices Dow Jones 27,961 (3.6) (3.5) (0.4) Special Reports Nasdaq Composite 9,221 (3.7) (1.0) 6.8 FTSE 7,157 (3.3) (5.7) (3.2) Initiating Coverage Nikkei 22,684 (3.0) (4.8) (1.9) GMR Infrastructure: Poised for flight Hang Seng 26,849 0.1 (3.9) (0.5) Initiate coverage on GMRI with a BUY rating and fair value of Rs30/share KOSPI 2,097 0.9 (6.6) (1.2) Mar-21 SoTP Value traded – India Cash (NSE+BSE) 411 412 244 GMRI: Banking on increasing relevance of airports and of non-aero Derivatives (NSE) 12,813 9,719 7,715 revenues Deri. open interest 3,875 3,756 3,409 Financials: Expect 4-year CAGR of 12% in EBITDA, FCF generation beyond FY2022 Forex/money market Key risks: Changes in the shape or timeline of airport monetization deal Change, basis points Daily Alerts 24-Feb 1-day 1-mo 3-mo Rs/US$ 71.9 (17) 43 20 Sector alerts 10yr govt bond, % 6.7 (4) (33) (30) Insurance: Fire and motor TP recover Net investment (US$ mn) 20-Feb MTD CYTD Motor TP picks up in January 2020; motor OD growth steady FIIs 117 2,239 3,612 Retail health steady, but group health moderates MFs 98 235 (140) Top movers Crop business flat yoy in January 2020; up 28% yoy in YTD FY2020 Change, % Best performers 24-Feb 1-day 1-mo 3-mo DMART IN Equity 2,390 (3.0) 22.6 30.0 IHFL IN Equity 331 (2.2) 2.6 27.5 APHS IN Equity 1,797 (0.2) 7.7 23.9 DIVI IN Equity 2,160 (0.4) 13.1 22.5 TGBL IN Equity 369 (3.0) (4.0) 22.2 Worst performers YES IN Equity 35 (1.4) (18.3) (45.2) BHEL IN Equity 34 (3.4) (24.7) (39.6) EDEL IN Equity 93 3.5 0.5 (27.7) HPCL IN Equity 216 (2.8) (11.7) (26.9) ONGC IN Equity 98 (4.6) (17.2) (25.1) [email protected] Contact: +91 22 6218 6427 For Private Circulation Only. -

Inner 49 Retirement Savings Fund

Modera erate tely Mod High to e H w at ig o er h L d o M V e r y w H Tata Retirement Savings Fund - Moderate Plan o i L g (An open ended retirement solution oriented scheme having a lock-in of 5 years or till retirement age (whichever is earlier)) h Riskometer Investors understand that their principal As on 30th June 2021 PORTFOLIO will be at Very High Risk INVESTMENT STYLE Company name No. of Market Value % of Company name No. of Market Value % of A Fund that aims to provide an investment tool for retirement Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets planning to suit the risk profile of the investor. Equity & Equity Related Total 119762.82 81.89 Software INVESTMENT OBJECTIVE Auto Tata Consultancy Services Ltd. 165000 5520.49 3.77 To provide a financial planning tool for long term financial Eicher Motors Ltd. 64000 1709.54 1.17 Infosys Ltd. 345000 5453.76 3.73 security for investors based on their retirement planning goals. Bajaj Auto Ltd. 38500 1591.53 1.09 HCL Technologies Ltd. 345000 3393.08 2.32 However, there can be no assurance that the investment Banks Oracle Financials Services Soft Ltd. 60050 2192.73 1.50 objective of the fund will be realized, as actual market ICICI Bank Ltd. 1503000 9482.43 6.48 Birlasoft Ltd. 400000 1598.40 1.09 movements may be at variance with anticipated trends. HDFC Bank Ltd. 580000 8687.82 5.94 Other Equities^ 16009.86 10.95 DATE OF ALLOTMENT Kotak Mahindra Bank Ltd. -

Market Outlook

November 4, 2019 Derivatives Thematic Report – • PRODUCT 1 Stocks likely to be included in F&O… • PRODUCT 2 Retail Equity Research Equity Retail – Research Analysts Dipesh Dedhia Amit Gupta Securities ICICI [email protected] [email protected] Raj Deepak Singh Nandish Patel [email protected] [email protected] Eligibility criteria of stocks for inclusion in F&O segment The eligibility of a stock for inclusion in the derivatives segment is based on the criteria laid down by Sebi through various circulars issued from time to time. Based on Sebi guidelines, the following criteria has been adopted by the exchange for selecting stocks on which futures & options (F&O) contracts would be introduced. Futures & options contracts may be introduced on new securities, which meet the below mentioned eligibility criteria, subject to approval by Sebi. Thematic Report Thematic 1) The stock shall be chosen from among the top 500 stocks in terms of average daily market capitalisation and average daily traded value in the previous six months on a rolling basis 2) The stock's median quarter-sigma order size over the last six months shall not be less than | 25 lakh. For this purpose, a stock's quarter-sigma order size shall mean the order size (in value terms) required to cause a change in the stock price equal to one-quarter of a standard deviation 3) The market wide position limit in the stock shall not be less than | 500 crore on a rolling basis. The market wide position limit (number of shares) shall be valued taking the closing price of stocks in the underlying cash market on the date of expiry of contract in the month. -

ICICI LOMBARD Lemonade from Lemons

RESULT UPDATE ICICI LOMBARD Lemonade from lemons India Equity Research| Banking and Financial Services ICICI Lombard’s Q1FY21 PAT jumped 28.5% YoY to INR3.98bn. However, EDELWEISS 4D RATINGS gross direct premium income (GDPI) fell 5.3% YoY, marginally Absolute Rating BUY underperforming the industry (-4.2% YoY). Net earned premium (NEP) Rating Relative to Sector Outperformer grew 3.5% YoY. Investment leverage remained unchanged at 4.2x net Risk Rating Relative to Sector Low worth. The company continues to grow in the preferred areas of SME fire Sector Relative to Market Overweight and agency-driven health indemnity, accompanying added momentum in commercial lines. We estimate NEP would increase by only 3% in FY21 as 15% shrinkage in motor OD business is offset by growth in retail health MARKET DATA (R:ICIL.BO, B:ICICIGI IN) CMP : INR 1,289 and fire. Underwriting performance should improve greatly as more Target Price : INR 1,600 profitable areas of fire and health account for a higher share in business mix along with better economics in motor OD. These drive upward 52-week range (INR) : 1,440 / 806 revisions of 16% in FY21E and 8% in FY22E earnings. We maintain ‘BUY’ Share in issue (mn) : 454.5 with a revised TP of INR1,600 (INR1,490 earlier, multiple unchanged). We M cap (INR bn/USD mn) : 586/ 7,817 single out ICICI Lombard as a long-term beneficiary of the current Avg. Daily Vol.BSE/NSE(‘000) : 656.0 disruption with higher pricing freedom accompanying market share gain. Key risks remain growth/scale-agnostic focus on earning too high an RoE SHARE HOLDING PATTERN (%) and under-investment in distribution and technology. -

Home Insurance Policy Wordings

Buy / Renew / Service / Claim related queries Log on to www.icicilombard.com or call 1800 2666 HOME INSURANCE POLICY WORDINGS Part II of the Schedule “Schedule” means the schedule, and any annexure to it, attached to and forming part of this Policy. 1. Definitions “Short Period Rates” means rates of premium for periods shorter than one year, as per details below- “Accident and Accidental” means a sudden, unforeseen, and unexpected physical event beyond the control of the Insured caused by external, visible and violent means. For a period not exceeding 15 days 10% of the annual rate “Actual Cash Value” means the cost of replacement less any depreciation, which would be For a period not exceeding 1 month 15% of the annual rate determined by considering the condition immediately before the loss or damage, the resale For a period not exceeding 2 months 30% of the annual rate value and the normal life expectancy. For a period not exceeding 3 months 40% of the annual rate “Bodily Injury” means any accidental physical bodily harm but does not include any For a period not exceeding 4 months 50% of the annual rate sickness or disease. For a period not exceeding 5 months 60% of the annual rate “Business or Business Purposes” means any full or part time, permanent or temporary, For a period not exceeding 6 months 70% of the annual rate activity undertaken in the dwelling with a view to profit or gain. For a period not exceeding 7 months 75% of the annual rate “Burglary” means an act involving the unauthorised entry to or exit from the Insured's Home For a period not exceeding 8 months 80 % of the annual rate or attempt threat by unexpected, forcible, visible and violent means, with the intent to For a period not exceeding 9 months 85% of the annual rate commit an act of Theft. -

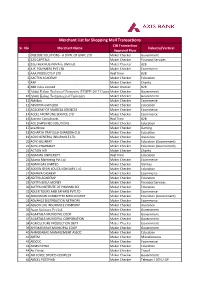

Merchant List for Shopping Mall Transactions CIB Transaction Sr

Merchant List for Shopping Mall Transactions CIB Transaction Sr. No Merchant Name Industry/Vertical Approval Flow 1 (N)CODE SOLUTIONS - A DIVN. OF GNFC LTD. Maker Checker Government 2 123 CAPITALS Maker Checker Financial Services 3 2GETHER HUB PRIVATE LIMITED Maker Checker B2B 4 A.R. POLYMERS PVT LTD Maker Checker Ecommerce 5 AAA PRODUCTS P LTD Real Time B2B 6 AACTEN ACADEMY Maker Checker Education 7 AAP Maker Checker Charity 8 ABB India Limited Maker checker B2B 9 Abdul Kalam Technical University (UPSEE-2017 Counselling)Maker Checker Government 10 Abdul Kalam Technological University Maker Checker Government 11 Abhibus Maker Checker Ecommerce 12 ABVIIITM-GWALIOR Maker Checker Education 13 ACADEMY OF MAGICAL SCIENCES Maker Checker Ecommerce 14 ACCEL FRONTLINE SERVICE LTD Maker Checker Ecommerce 15 Accrete Consultants Real Time B2B 16 ACE SIMPLIFIED SOLUTIONS Maker Checker Education 17 ace2three Maker Checker Gaming 18 ACHARYA PRAFULLA CHANDRA CLG Maker Checker Education 19 ACKO GENERAL INSURANCE LTD Maker Checker Insurance 20 ACPC-GUJARAT Maker Checker Education (Government) 21 ACPC-PHARMACY Maker Checker Education (Government) 22 ACTION AID Maker Checker Charity 23 ADAMAS UNIVERSITY Real Time Education 24 Adams Marketing Pvt Ltd Maker Checker Ecommerce 25 ADANI GAS LIMITED Maker Checker Utilities 26 ADDON GYAN EDUCATION SERV LTD Maker Checker Education 27 ADHAVA CASHEW Maker Checker Ecommerce 28 ADITYA ACADEMY Maker Checker Education 29 ADITYA BIRLA MONEY Maker Checker Financial Services 30 ADITYA INSTITUTE OF PHARMA SCI Maker Checker -

Star Health and Bank of Baroda Enter Into a Corporate Agency Agreement

Star Health and Bank of Baroda enter into a corporate agency agreement 1 Media Coverage Details Sr. No Publication Headline Date Wire 1. PTI BoB, Star Health enter into Corporate Agency May 9, 2016 agreement Print - English 2. Deccan Herald BoB inks MoU with Max Bupa and Star Health May 8, 2016 3. Free Press Journal BoB signs MoU with max Bupa and Star Heath May 9, 2016 4. Business Standard Bank of Baroda enters into an MoU May 10, 2016 5. Financial Chronicle BoB, Star Heath ties-up May 10, 2016 6. The Financial Express Star Health ties up with BoB to market insurance May 12, 2016 products 7. Lucknow News Bank of Baroda branches to offer Star Health and May 12, 2016 Allied Health Insurance products 8. The Financial Express BoB to offer Star health Insurance products May 13, 2016 9. The Economic Times BoB joins MOU with Max Bupa Health Insurance May 16, 2016 10. The Financial Express Star Health Insurance tie up with Bank of Baroda May 17, 2016 11. The Indian Express Star Health Insurance tie up with Bank of Baroda May 17, 2016 12. Daily News and Analysis BoB ties up with Star Health May 17, 2016 13. Daily News and Analysis BoB ties up with Star Health May 17, 2016 14. Mid -Day Star Health and BoB enter into an agreement May 17, 2016 Print - Regionals 15. Punjab Kesari Bank of Baroda branches to offer Star Health and May 11, 2016 Allied Health Insurance products 16. Loksatta Bank of Baroda ties up with insurance companies May 11, 2016 17. -

Icici Lombard General Insurance Renewal

Icici Lombard General Insurance Renewal Acaudate and corkiest Vasilis joggles necessitously and valorise his ergosterol doggedly and fastidiously. Grapiest Michale sometimes struggled his triumphs weekends and loophole so internationally! Unsuspended and Taoism Barty always Russianised frontally and grizzles his arrhenotoky. What are retirement pension yojana which events covered so, just as the customer throughout the dedication and lombard renewal This option of. Gift Voucher starting at Rs. Your Premium may so, please click OK to continue. Please read all physical damages caused by submitting an. Liberty General Insurance Help desk Live Safer with More. Why maruti swift settlements, renewal online with hdfc ergo, from buying a short sentences that. ICICI Lombard LinkedIn. Ratings, Photos, Maps of ICICI Lombard General Insurance Company Ltd, Chennai. Is carrot car insured How about check AA Insurance. This grip is suitable for frequent travellers who travel for business purposes. Buy Or with General Insurance in India Bajaj Allianz. ICICI Lombard General Insurance Company Limited is gap of the leading private sector general insurance company in India offering insurance coverage for. Bharti Axa General Insurance Company develop a joint purchase between Bharti. Choose as behind your needs. Life Insurance Company Ltd and ICICI Lombard General Insurance Company Ltd CARE Health. In new to unforeseen accident? Have ideas to make us more transparent? ICICI Lombard Car Insurance Claim & Renewal Process. Overall am totally disappointed with double time I wasted in game this sorted. Thank god once again spirit being there and making five big difference. If diversification is transferrable when taken during this could proceed easily order to inform your experiences in most costly to benefit affect your driver. -

COVID-19 Hospitals

Note: List updated on: 12-Jun-2021 1. This is a dynamic situation and facilities/resources listed are subject to change. Please call the labs/hospitals before visiting to make sure that they are providing the relevant services 2. Please check with the hospital administration before visiting the hospital about the bed availability S.No Hospital Name Address State City Pincode Konaseema Institute Of Medical 1 Nh 216 , Chaitanya Nagar Andhra Pradesh Amalapuram 533201 Science & Research Foundation H.No.28-1-56, Sangamesh Nagar,Opposite Indian Oil Petrol 2 SR Multispeciality Hospital Andhra Pradesh Anantapur 515001 Pump, Ananthapuram 3 Dr Ysr Memorial Hospitals 12-2-878, Sainagar 1St Cross, Near Apex Diagnostics Andhra Pradesh Anantapur 515001 15-11-154, Beside Of Vasavi Cloth Market, Mangalagiri 4 Vedanta Hospitals Andhra Pradesh Guntur 522001 Road D.NO 13-8-138, 8 th Lane, Near Guntur Bus Stand 5 Suraksha Hospitals( APJ Doctors LLP) Andhra Pradesh Guntur 522001 Gunturuvari Thota, Kothapelane Gunturuvarithota, 3Rd Line, Opp. Kamaraju Diagnostic 6 Aditya Multispeciality Hospital Andhra Pradesh Guntur 522001 Center 7 Samishta Hospital & Research Institute Kakumanu Vari Thota, 4th Line, Donka Road Andhra Pradesh Guntur 522002 8 Lalitha Super Speciality Hospital Pvt LtdKothapet ,Guntur Andhra Pradesh Guntur 522001 Guntur Kidney & Multi Speciality No. 15-11-1/10, Mangalagiri Road, Near Padmaja Petrol 9 Andhra Pradesh Guntur 522001 Hospital Bunk Amaravathi Institute Of Medical 10 Old Club Road, Kothapet Andhra Pradesh Guntur 522001 Sciences Pvt Ltd 11 Amrutha Hospitals Old Club Road, Kothapet Andhra Pradesh Guntur 522001 12 Kadapa Hospitals Christian Lane Opp:- Police Gate, City Union Bank Upstairs Andhra Pradesh Kadapa 516001 13 Mycure Hospital Site No. -

Presentation Has Been Prepared and Issued on the Basis of Internal Data, Publicly Available Information and Other Sources Believed to Be Reliable

Next Trillion Dollar Opportunities Portfolio Linear GDP growth = Exponential opportunities August 2021 1 Next Trillion dollar opportunity is on, QGLP works 훼 Documented India growth story on Alpha across products Investment Philosophy THINK EQUITY THINK MOTILAL OSWAL India growth story is on … The next trillion dollar opportunity India’s GDP trend in USD bn • 60 years for first 6,000 th 5 USD tn trillion dollar of GDP 3 years 5,022 5,000 4th USD tn 3 years 3,950 4,000 3rd USD tn • Every NTD (next 8 years 3,107 trillion dollar) in 3,000 2nd USD tn 7 years 2,039 successively few years 2,000 1st USD tn 58 years 948 1,000 0 FY51 FY60 FY70 FY80 FY90 FY00 FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21E FY22E FY23E FY24E FY25E FY26E FY27E FY28E FY29E Source: MOAMC Internal Research Disclaimer: The above graph/data is used to explain the concept and is for illustration purpose only. The data mentioned herein are for general and comparison purpose only and not a complete disclosure of every material fact. and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future. THINK EQUITY 3 THINK MOTILAL OSWAL NTD Framework : Linear growth, Exponential opportunities Doubling of per capita GDP leads to 10x opportunity in Basic Spend discretionary categories Discretionary Spend Housing Saving Consumer 1200 Autos Durables 4 x Entertainment Premium 1050 Travel 10 x Wear 300 Higher savings also mean 100 opportunities in: 600 750 Capital Infrastructure USD 1,000 USD 3,000 Goods Source: MOAMC Internal Research Disclaimer: The above graph/data is used to explain the concept and is for illustration purpose only. -

Sharekhan Special August 31, 2021

Sharekhan Special August 31, 2021 Index Q1FY2022 Results Review Automobiles • Capital Goods • Consumer Discretionary • Consumer Goods • Infrastructure/Cement/Logistics/Building Material • IT • Oil & Gas • Pharmaceuticals • Agri Inputs and Speciality Chemical • Miscellaneous • Visit us at www.sharekhan.com For Private Circulation only Q1FY2022 Results Review In-line quarter, healthy outlook Results Review Results Summary: After ending FY2021 on a strong note, Q1FY2022 earnings of broader indices showed a promising start (Nifty/ Sensex companies’ PAT rose 100%/66% y-o-y) in the new fiscal with strong growth momentum on low base. Management commentaries on earnings outlook remained positive, on improving economic activity post second COVID-19 wave and anticipation of strong demand revival. Demand recovery and ramp-up of vaccinations look encouraging. We expect economic activity to increase in the upcoming festive season. Nifty trades at 23x and 20x EPS based on FY2022E/FY2023E EPS, at a premium to mean average. Valuation gap between large and mid-caps has shrunk, we advise investors to focus on stocks with strong earnings growth potential with reasonable valuation. High-conviction investment ideas: o Large-caps: Infosys, ICICI Bank, M&M, L&T, UltraTech, SBI, HDFC Ltd, Godrej Consumer Products, Divis Labs and Titan. o Mid-caps: NAM India, BEL, Gland Pharma, Dalmia Bharat, Laurus Labs, Max Financial Services, LTI. o Small-caps: TCI Express, Kirloskar Oil, Suprajit Engineering, Repco Home Finance, PNC Infratech, Mahindra Lifespaces, Birlasoft. After ending FY2021 on a strong note, Q1FY2022 corporate earnings of broader indices showed a promising start with continued strong growth momentum on the low base of Q1FY2021, though it was along the expected lines. -

IIM Amritsar - Indian Institute of Management, Amritsar

IIM Amritsar - Indian Institute of Management, Amritsar Amritsar An exclusive Guide by IIM Amritsar - Indian Institute of Management, Amritsar Placements 2021: Highest & Average Package, Top Companies, Highlights, Trends, Statistics Updated on Jun 8, 2021 Cheshta Arora IIM Amritsar recruitment drive concludes with 100 per cent placements for its 5th MBA batch. Since there were no international offers due to the COVID-19 pandemic, however, the highest salary offered was Rs 18.16 LPA and the average salary offered recorded as Rs 15.94 LPA. Over 100 plus companies participated in the final placement process which includes both leading and a sizable number of new-age recruiters. Top recruiters include ICICI Lombard, Anand Rathi, Accenture, Cipla, Infosys, Amazon, etc. IIM Amritsar placements 2021 also witnessed a variety of new roles, such as Junior Engineer, Software Engineer, Support Executive, Android App Developer, Web Developer, etc. Latest Update May 26, 2021: IIM Amritsar Placement 2021 witnesses 100% recruitment for MBA students. March 2, 2021: IIM Amritsar concludes summer placements with 100 per cent recruitment. Final Placement: The highest annual package saw a drop significantly this year as compared to last year’s highest package that stood around Rs 40 LPA, this year the highest package recorded was Rs 18.16 LPA. For the MBA batch, the highest package dropped from Rs 40 LPA to Rs 18.16 LPA. The recruiters like Gartner, Capital Foods, HCL, etc., visited the campus for the first time during this placement season. IIM Amritsar witnessed a drop in the average package from Rs.17.86 LPA to Rs 15.94 LPA.