Aditya Birla Group

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Databank Consisting of More Than Databank 3000 Companies on Our Website Updated Information RECENT DIVIDEND ANNOUNCEMENTS Company Name Annc

Subscribers can access the complete databank consisting of more than Databank 3000 companies on our website Updated Information RECENT DIVIDEND ANNOUNCEMENTS www.DSIJ.in Company Name Annc. Date Div BC/RD Date Company Name Annc. Date Div BC/RD Date Company Name Annc. Date Div BC/RD Date (MM/DD/YY) (%) (MM/DD/YY) (MM/DD/YY) (%) (MM/DD/YY) (MM/DD/YY) (%) (MM/DD/YY) Numbers ADC India Communicat 05/04/12 5 07/03/12 DIC India 02/09/12 40 05/20/12 Kirloskar Ferrou 04/27/12 20 - Aditya Birla Chemica 05/11/12 5 - Dr. Reddy’s Labs 05/11/12 275 - Kirloskar Industries 04/27/12 40 07/18/12 Ador Fontech Ltd 04/30/12 150 - Eimco Elecon Ind 05/08/12 40 - Kirloskar Oil Engine 04/26/12 200 07/12/12 That Matter Ador Welding Ltd. 04/27/12 60 - Emami Ltd. 05/08/12 800 - Kirloskar Pneumatic 04/24/12 120 07/10/12 AGC Networks 05/10/12 150 - Everest Industries L 04/26/12 70 - Kitex Garments 04/21/12 60 05/24/12 Agro Tech Foods Ltd. 04/26/12 17.5 - Exide Inds. 04/30/12 60 - Kotak Mahindra Bank 05/08/12 12 - Ajanta Pharma Lt 04/26/12 75 - Federal Bank 05/11/12 90 - KPIT Cummins Infosys 04/30/12 35 - Alembic Pharmaceutic 04/25/12 70 - Finolex Cables 05/03/12 40 07/28/12 KPR Mill Ltd. 05/04/12 - 05/21/12 Alfa Laval (I) Ltd. 02/09/12 300 - Finolex Industri 04/30/12 30 - Lakshmi Finance 04/30/12 15 - 5821819 crore Allahabad Bank 05/07/12 60 05/26/12 Futuristic Solutions 05/11/12 8 - LG Balakrishnan&Bros 04/28/12 110 - ` Alstom Projects Ind. -

Mf Movers & Shakers

MF MOVERS & SHAKERS MARCH 2021 DART Research Tel: +91 22 40969700 E-mail: [email protected] April 12, 2021 April 12, 2021 2 Top Five Buys & Sells Top Ten MF's March 2021 3 Top Five Buys & Sells of Top MFs for the month of March 2021 No of Shares No of Shares Highest Increase in Exposure Names Bought in Highest Decrease in Exposure (by nos of shares) Bought in (by nos of shares) March 2021 March 2021 Bharat Petroleum Corporation 4,547,448 The Indian Hotels 9,826,101 Steel Authority Of India 1,995,000 Vedanta 2,988,456 Axis MF Torrent Power 1,889,278 Tata Motors 2,574,406 Suryoday Small Finance Bank 1,887,039 EPL 2,572,954 Mahindra & Mahindra Financial Services 1,644,663 Wipro 2,226,978 Bank Of Baroda 36,590,405 Vodafone Idea 21,490,000 Steel Authority Of India 9,632,297 Vedanta 7,799,200 Birla SL MF National Aluminium 7,524,001 GMR Infrastructure 4,837,500 IDFC First Bank 3,122,875 Ashok Leyland 4,252,923 State Bank Of India 2,870,884 Bharti Airtel 3,662,791 Motherson Sumi Systems 6,769,756 Vodafone Idea 8,750,000 GAIL 3,502,259 Oil & Natural Gas Corporation 8,463,632 DSP BR MF Welspun Corp 2,559,989 Vedanta 7,199,288 ITC 2,520,668 Hindalco Industries 2,468,290 Prism Johnson 2,389,002 ICICI Prudential Life Insurance 2,343,372 Max Healthcare Institute 21,422,593 Vodafone Idea 18,830,000 Indian Railway Finance Corporation 13,939,480 Siti Networks 17,967,767 HDFC MF Oil & Natural Gas Corporation 7,327,497 Power Grid Corporation Of India 13,081,255 Varroc Engineering 6,735,218 State Bank Of India 12,478,973 Bharti Airtel 5,846,094 -

Best Performing Corporate Leaders of India 2015

Prasad S N. Associate Professor Shri Dharmasthala Manjunatheshwara Institute for Management Development (SDMIMD) Mysuru [email protected] Shri Dharmasthala Manjunatheshwara Institute for Management Development Applied Research Series, 2016 © Applied Research Series, 2016, SDM RCMS, SDMIMD, Mysuru ISBN: 978-93-83302-21-5 Note: All views expressed in this work are that of the author(s). SDM RCMS does not take any responsibility for the views expressed herein by the author(s). No part of this publication can be reproduced or transmitted in any form or by any means, without prior permission of the publisher. ~ 2 ~ Best Performing Corporate Leaders of India 2015 Preface of current importance in the field of management in various sectors. Data is collected mostly through Research Center for Management Studies (RCMS), primary research, through interviews and field study. which was created five years ago at SDMIMD, has endeavoured to promote research in the field of The institute takes into account the time and management education in the Institute, in various resources required by a faculty member to carry out ways. The Research Centre has encouraged faculty and such projects, and, fully sponsors them to cover the students to actively take part in research activities various costs of the project work (for data collection, jointly, collate and disseminate findings of the travel, etc), thereby providing a unique opportunity to research activities through various types of projects to the two most important institutional stakeholders contribute to the body of knowledge to the academic (faculty and students), to enrich their knowledge by fraternity in general, and management education in extending their academic activities, outside the particular. -

Proxy Voting Report 01-07-2016 to 30-09-2016

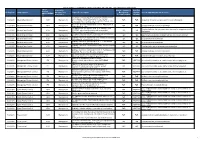

Details of Votes cast during the quarter ended September 30, 2016, of the Financial year 2016-2017 Type of Proposal by Investee company’s Vote (For/ meetings Meeting Date Company Name Management or Proposal's description Management Against/ Reason supporting the vote decision (AGM/CCM/EGM/ Shareholder Recommendation Abstain) PB) To receive, consider and adopt the Audited Standalone and Consolidated Financial Statements for the Financial 1/Jul/2016 IndusInd Bank Limited AGM Management FOR FOR Unqualified Accounts. Compliant with Accounting Standards Year ended March 31, 2016, together with the Reports of the Board of Directors and Auditors thereon. To declare Dividend on Equity Shares for the Financial Year 1/Jul/2016 IndusInd Bank Limited AGM Management FOR FOR Compliant with law, no concern identified ended March 31, 2016. To appoint a Director in place of Mr. R. Seshasayee, DIN Compliant with law. No governance issue observed in re-appointment of Mr. 1/Jul/2016 IndusInd Bank Limited AGM Management 00047985, who retires by rotation and, being eligible, FOR FOR Seshasayee offers himself for re-appointment. To appoint Statutory Auditors of the Bank and authorise the 1/Jul/2016 IndusInd Bank Limited AGM Management FOR FOR Appointment of Auditors is compliant with law. No concern identified Board of Directors to fix their remuneration. Ordinary Resolution: Appointment of Mr. Shanker Annaswamy, 1/Jul/2016 IndusInd Bank Limited AGM Shareholders FOR FOR No governance issue observed DIN 00449634, as Independent Director Ordinary Resolution: Appointment of Dr. T. T. Ram Mohan, 1/Jul/2016 IndusInd Bank Limited AGM Shareholders FOR FOR No governance issue observed DIN 00008651, as Independent Director Ordinary Resolution: Remuneration to Non-Executive Directors 1/Jul/2016 IndusInd Bank Limited AGM Management FOR FOR Compliant with Law, no governance issues identified. -

Reportable in the Supreme Court of India Criminal Appellate Jurisdiction

WWW.LIVELAW.IN REPORTABLE IN THE SUPREME COURT OF INDIA CRIMINAL APPELLATE JURISDICTION CRIMINAL APPEAL NO. 875 OF 2019 (Arising out of SLP(Crl.) No.9053 of 2016) BIRLA CORPORATION LIMITED ...Appellant VERSUS ADVENTZ INVESTMENTS AND HOLDINGS ...Respondents LIMITED & OTHERS WITH CRIMINAL APPEAL NO. 877 OF 2019 (Arising out of SLP(Crl.) No.4609 of 2019 @ D. No.6405 of 2019) BIRLA BUILDINGS LIMITED ...Appellant VERSUS BIRLA CORPORATION LIMITED ...Respondent WITH CRIMINAL APPEAL NO. 876 OF 2019 (Arising out of SLP(Crl.) No. 4608 of 2019 @ D. No.6122 of 2019) GOVIND PROMOTERS PVT. LTD. ...Appellant VERSUS BIRLA CORPORATION LIMITED ...Respondent J U D G M E N T R. BANUMATHI, J. Leave granted. Signature Not Verified Digitally signed by MADHU BALA Date: 2019.05.09 17:04:23 IST 2. These appeals arise out of the judgment dated 15.05.2015 Reason: passed by the High Court of Calcutta in C.R.R. No.323 of 2011 in 1 WWW.LIVELAW.IN and by which the High Court quashed the complaint of the appellant-Company filed under Sections 379, 403 and 411 IPC read with Section 120-B IPC qua documents No.1 to 28 of the Schedule. Insofar as documents No.29 to 54 of the Schedule, the High Court remitted the matter to the trial court to proceed with the matter in accordance with law. 3. Being aggrieved by quashing of the complaint qua documents No.1 to 28, the appellant-complainant has preferred appeal (SLP (Crl.) No.9053 of 2016). Being aggrieved by remitting the matter to the trial court qua documents No.29 to 54, the respondents have filed appeal [SLP(Crl.) D No.6405 of 2019 and SLP(Crl.) D. -

Average Market Capitalization of List Companies During Jan-June 2021.Pdf

Average Market Capitalization of listed companies during the six months ended 30 June 2021 BSE 6 month Avg NSE 6 month MSE 6 month Average of Categorization as Total Avg Total MSE Avg Total All Sr. No. Company name ISIN BSE Symbol NSE Symbol per SEBI Circular Market Market Cap Symbol Market Cap in Exchanges dated Oct 6, 2017 Cap in (Rs. (Rs. Crs.) (Rs Crs.) (Rs. Cr.) Crs.) 1 Reliance Industries Ltd INE002A01018 RELIANCE 1290062.9 RELIANCE 13,55,067.51 13,22,565.20 Large Cap 2 Tata Consultancy Services Ltd. INE467B01029 TCS 1169783.6 TCS 11,73,068.17 11,71,425.86 Large Cap 3 HDFC Bank Ltd. INE040A01034 HDFCBANK 819037.95 HDFCBANK 8,18,713.67 8,18,875.81 Large Cap 4 Infosys Ltd INE009A01021 INFY* 579784.19 INFY 5,79,697.39 5,79,740.79 Large Cap 5 Hindustan Unilever Ltd., INE030A01027 HINDUNILVR 549336.78 HINDUNILVR 5,49,358.91 5,49,347.84 Large Cap 6 Housing Development Finance Corp.Lt INE001A01036 HDFC 462288.58 HDFC 4,61,373.11 4,61,830.84 Large Cap 7 ICICI Bank Ltd. INE090A01021 ICICIBANK 416645.51 ICICIBANK 4,16,389.02 4,16,517.27 Large Cap 8 Kotak Mahindra Bank Ltd. INE237A01028 KOTAKBANK 361640.52 KOTAKBANK 3,61,438.64 3,61,539.58 Large Cap 9 State Bank Of India, INE062A01020 SBIN 329767.32 SBIN 3,29,789.27 3,29,778.29 Large Cap 10 Bajaj Finance Limited INE296A01024 BAJFINANCE 324996.53 BAJFINANCE 3,24,843.50 3,24,920.02 Large Cap 11 Bharti Airtel Ltd. -

3Rd February, 2021 BSE Limited Corporate

3rd February, 2021 BSE Limited The Manager Corporate Relationship Department Listing Department Phiroze Jeejeebhoy Towers The National Stock Exchange of India Limited Dalal Street “Exchange Plaza”, Bandra-Kurla Complex Mumbai 400 001 Bandra (East), Mumbai 400 051 Tel.: 22721233/4 Tel.: 26598236 Scrip Code: 532538 Scrip Code: ULTRACEMCO Sub: Intimation under the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended (“Listing Regulations”) Dear Sir/ Madam, This is in continuation to our letter dated 23rd January, 2021 wherein we had informed the stock exchanges that the Board of Directors of the Company (“Board”) at its meeting held on 23rd January, 2021 considered and evaluated a proposal for raising of funds through permissible mode(s) and accordingly, approved raising of funds for an aggregate amount not exceeding Rs. 3,000 crores, subject to applicable regulatory approvals and market conditions, by way of issue of any instruments or securities in India and / or overseas. Further, the Board had also authorised the Finance Committee of the Board of Directors to finalise the manner of raising the funds and decide on all matters and transactions relating to the same, including but not limited to the finalisation and approval of detailed terms and conditions of issue, size, pricing and timing of the transaction. We now write to inform you that the Finance Committee, in terms of the aforesaid authority, at its meeting held today, approved raising funds by way of issuance of foreign currency (US$) denominated bonds (“Notes”) aggregating up to US$ 400 million, corresponding to Rs.3,000 crores, to be offered and sold within the United States to qualified institutional buyers in reliance on Rule 144A of the United States Securities Act of 1933, as amended (“US Securities Act”) and outside the United States in offshore transactions as defined in and with reliance on Regulation S under the US Securities Act (“Offering”), in one or more tranches. -

Mf Movers & Shakers

MF MOVERS & SHAKERS SEPTEMBER 2020 DART Research Tel: +91 22 40969700 E-mail: [email protected] October 13, 2020 October 13, 2020 2 Top Five Buys & Sells Top Ten MF's September 2020 3 Top Five Buys & Sells of Top MFs for the month of May 2020 No of Shares No of Shares Highest Increase in Exposure Names Bought in Sept Highest Decrease in Exposure (by nos of shares) Bought in Sept (by nos of shares) 2020 2020 ITC Ltd. 7,752,822 JSW Energy Ltd. (18,602,000) Ashok Leyland Ltd. 7,060,553 IDFC Ltd. (13,469,131) Birla SL MF Essel Propack Ltd. 5,852,517 ICICI Bank Ltd. (10,118,760) Tata Power Company Ltd. 3,869,403 Mahindra CIE Automotive Ltd. (7,672,213) The India Cements Ltd. 2,807,855 Axis Bank Ltd. (4,991,592) Essel Propack Ltd. 4,459,431 Vodafone Idea Ltd. (16,520,000) Chambal Fertilisers & Chemicals Ltd. 3,881,360 Coal India Ltd. (8,297,650) DSP BR MF Manappuram Finance Ltd. 3,339,718 L&T Finance Holdings Ltd. (7,198,491) Hindustan Petroleum Corporation Ltd 3,126,205 Satin Creditcare Network Ltd. (1,954,380) Century Plyboards (India) Ltd. 3,109,319 JB Chemicals & Pharmaceuticals Ltd. (1,449,404) Essel Propack Ltd. 3,014,650 Vodafone Idea Ltd. (47,000,000) Bharat Electronics Ltd. 3,000,000 CG Power & Industrial Solutions Ltd. (12,000,000) Franklin Templeton The Federal Bank Ltd. 2,785,914 Oil & Natural Gas Corporation Ltd. (3,511,529) MF NTPC Ltd. 2,581,062 Hexaware Technologies Ltd. -

Sl. No. COMPANY NAME

Sl. No. COMPANY NAME 1 3 GLOBAL SVCS PVT LTD 2 3i INFOTECH (ICICI INFOTECH LTD) 3 3M INDIA 4 4L IT SERVICES PRIVATE LTD 5 77 BANK 6 A C NIELSON 7 AAREAL BANK 8 AARTI DRUGS 9 AARTI INDUSTRIES 10 AARTI STEELS 11 AARVEE DENIM 12 AB MAURI INDIA PRIVATE LTD 13 ABAN LOYD CHILES 14 ABB 15 ABBOTT INDIA 16 ABBOTT LABORATORIES 17 ABERCROMBIE & FITCH 18 ABERTIS 19 ABHISHEK INDUSTRIES 20 ABITIBI CONSOLIDATED 21 ABN-AMRO HOLDING 22 ABSA GROUP 23 ACC 24 ACC RIO TINTO EXPLORATION LI 25 Accelrys Software solutions India Pvt Ltd 26 ACCENTURE 27 ACCIONA 28 ACCOR 29 ACE 30 ACER 31 ACERINOX 32 ACNIELSEN ORG-MARG PVT LTD 33 ACOM 34 ACS GROUP 35 ADANI EXPORTS 36 ADANI WILMAR 37 ADECCO 38 ADIDAS-SALOMON 39 ADLABS FILMS 40 ADOBE SYSTEMS 41 ADOR WELDING 42 ADVANCE AUTO PARTS 43 ADVANCED FIREFIGHTING TECH 44 ADVANCED INFO SERVICE 45 ADVANCED MICRO 46 ADVANTEST 47 AEGIS LOGISTICS 48 AEGON 49 AEM 50 AEON 51 AES 52 AETNA 53 AFFILIATED COMPUTER 54 AFLAC 55 AFTEK INFOSYS 56 AG EDWARDS 57 AG INDUSTRIES PVT LTD 58 AGCO 59 Agere systems India pvt ltd 60 AGFA-GEVAERT 61 AGGREGATE INDUSTRIES 62 AGILENT TECHNOLOGIES 63 AGRICULTURAL BANK GREECE 64 AGRIUM 65 AHMEDNAGAR FORGE 66 AHOLD 67 AICHI BANK 68 AIFUL 69 AIOI INSURANCE 70 AIR CHINA 71 AIR FRANCE-KLM GROUP 72 AIR INDIA . 73 AIR LINK INDIA 74 AIR LIQUIDE GROUP 75 AIR PRODS & CHEMS 76 AIRCEL DIGILINK INDIA LTD 77 AIRPORTS AUTHORITY OF INDIA 78 AISIN SEIKI 79 AJINOMOTO 80 AK STEEL HOLDING 81 Akamai Technologies 82 AKBANK 83 AKER 84 AKITA BANK 85 AKZO NOBEL GROUP 86 ALBERTO-CULVER 87 ALBERTSONS 88 ALCAN 89 ALCATEL 90 ALCOA 91 ALEMBIC 92 ALEXANDER FORBES 93 ALFA LAVAL (I) 94 ALFRESA HOLDINGS 95 ALITALIA AIRWAYS 96 ALITALIA GROUP 97 ALL NIPPON AIRWAYS 98 ALLAHABAD BANK 99 ALLEGHENY ENERGY 100 ALLERGAN 101 ALLIANCE & LEICESTER ALLIANCE CAPITAL ASSET 102 MANAGEMENT (INDIA) PVT. -

AV Birla Group Companies Performance Indicators

Business Case: IMC /05/09 XIMB-Centre for Case Research A V Birla Group: Legacy of Free Enterprise and Diversification Amar K.J.R Nayak© Disclaimer The present case is intended to be used as the basis for class discussion to help raise relevant questions to think and to contextualize management issues rather than to illustrate either effective or ineffective practices. It is neither intended to glorify nor intended to condemn any individual or organization. © Amar K.J.R.Nayak, Ph.D., Strategic Management, Xavier Institute of Management, Bhubaneswar. No part of this publication should be copied, stored, transmitted, reproduced or distributed in any form or medium whatsoever without the permission of the author. Author’s contact: [email protected] <http://www.ximb.ac.in/ccr/> A V Birla Group Legacy of Free Enterprise and Diversification The case of the Birla Group is an amazing story that reveals several aspects of the history of Indian industrial policies, nexus of businessmen-politicians-bureaucrats over the years, ambition to grow among the Indian businessmen, and the journey of a marwari family from small trading of spices and opium to big business over a period of about 140 years. The case highlights the legacy of a business house consisting of some significant businessmen, viz., Ghanashyam Das Birla, Basant Kumar Birla, Aditya Vikram Birla and Kumar Mangalam Birla. It provides a window to peep into the methods and strategy adopted by these business legends for building a business empire and for creating an Indian Multinational as early as by 1980. The case very well depicts diversification as a successful growth strategy in a developing country context with several institutional and policy deficiencies along with the politicians-bureaucrats being prey to business interests. -

Right Issue of Equity Shares of the Company

CMYK LETTER OF OFFER (Private and Confidential) For Equity Shareholders of the Company only Dated : June 8, 2007 PM ORIENT PAPER & INDUSTRIES LIMITED (Originally incorporated under the Indian Companies Act, 1913, as “Orient Paper Mills Limited” vide certificate of registration dated July 25, 1936 issued by Registrar of Joint Stock Companies, Bengal and received its certificate of commencement of business on July 30, 1936. The name of our Company was changed to “Orient Paper & Industries Limited” on September 13, 1978. The registered office of our Company was shifted from 8, Royal Exchange Place, Calcutta-700001, West Bengal to Brajrajnagar, District – Jharsuguda - 768216, Orissa, in the year 1947 and further shifted to its current address, Unit-VIII, Plot No.7, Bhoinagar, Bhubaneswar-751012, Orissa in the year 2000. Registered Office: Unit-VIII, Plot No. 7, Bhoinagar, Bhubaneswar-751 012, Orissa Tel: +91 674 2396930/2392947; Fax: +91 674 2396364 Head office: 9/1, R. N. Mukherjee Road, Kolkata - 700 001 Company Secretary & Compliance Officer: Mr. S.L. Saraf Tel: +91 33 2248 3406; Fax: +9133 2243 0490; E-mail: [email protected] Website: www.orientpaperindia.com LETTER OF OFFER Issue of 44,51,187 Equity Shares of Rs. 10/- each for cash at a price of Rs. 360/-(including a premium of Rs. 350/-) per Equity Share aggregating to Rs. 16024.27 lacs on rights basis to the existing Equity Shareholders of our Company in the ratio of 3 Equity Shares for every 10 Equity Shares held on Record Date i.e. on June 15, 2007. The issue price for the equity shares will be payable in two installments: 50% of the issue price will be payable on application; 50% of the issue price will become payable at the option of our Company, between 3 and 12 months after the allotment date. -

Ingovern Vote Recommendations

Corporate Governance Proxy Voting Solutions Vote Recommendations INGOVERN VOTE RECOMMENDATION REPORTS InGovern published 439 vote recommendation reports for shareholder meetings from January 2012 to December 2012. This included 241 Annual General Meetings (AGMs), 63 Extraordinary General Meetings (EGMs), 104 Postal Ballots (PBs) and 31 Court Convened Meetings (CCMs). The months of July, August and September are peak proxy season months for AGMs with 448 AGMs being held by listed companies in India. The table on subsequent pages shows a list of vote recommendation reports published by InGovern and is sorted on the date of meeting. If you need any specific report, please write to us at February 2013 [email protected] ~4,750 resolutions were passed by the Top 585 listed InGovern companies in India from Jan 2012 to Dec 2012 Mumbai * Bangalore www.ingovern.com © 2012-2013 All rights reserved I N G O V E R N R E S E A R C H S ERVICES Type of Date of Company Name NSE Symbol Index Meeting Meeting Amtek India Ltd. AMTEKINDIA Other S&P 500 EGM 4-Jan-12 Patni Computer Systems Ltd. PATNI Other S&P 500 PB 6-Jan-12 Central Bank of India CENTRALBK Other S&P 500 EGM 9-Jan-12 Future Ventures India Ltd. FUTUREVENT Other S&P 500 PB 13-Jan-12 Automotive Axles Ltd. AUTOAXLES Other S&P 500 AGM 17-Jan-12 MphasiS Ltd. MPHASIS Junior Nifty PB 17-Jan-12 Dewan Housing Finance Corporation Ltd. DEWANHOUS Other S&P 500 PB 18-Jan-12 Bharat Petroleum Corporation Ltd.