For Personal Use Only Use Personal for Both Kroondal and Mimosa Produced Ahead of Guidance and at Reduced Costs During the Half Year

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Helmsec's Annual Mining Forum 2011

THE MANDARIN ORIENTAL HELMSEC’S 5 CONNAUGHT ROAD, CENTRAL ANNUAL MINING HONG KONG FORUM 2011 THURSDAY, 24TH MARCH 2011 SYDNEY | MELBOURNE | HONG KONG | SINGAPORE TABLE OF CONTENT PG FORUM SCHEDULE 3 INDIVIDUAL COMPANY INFORMATION SHEETS 8 ALPHABETIC BY COMPANY HELMSEC STAFF AT THE CONFERENCE 50 WHO WE ARE – THE PAN-ASIAN MINING INVESTMENT HOUSE 52 HELMSEC’S GLOBAL NETWORK & RECENT TRANSACTION 53 DIRECTORY & CONTACTS 54 This Helmsec Global Markets Limited and Helmsec Global Capital Limited (Individually and collectively “Helmsec”) publication is intended for the use of licensed Investment professionals. Past performance is not a reliable indicator of future performance. Any express or implied recommendations or advice presented in this document is limited to “General Advice” and based solely on consideration of the investment and/or trading merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs of any particular person. Before making an investment decision based on the recommendations of advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances or should seek further advice in its appropriateness. Disclaimer: This document is only intended to provide background information and does not purport to be complete and/or to contain all the information that an investor may consider when making an investment decision. This document is not an offer, invitation, solicitation or recommendation with respect to the subscription for, purchase or sale of any securities. This note does not form the basis of any contract or commitment. Helmsec and its respective affiliates, agents, officers or employees make no recommendation as to whether you should participate in any securities in any Company referred to in this document (Company) nor do they make any recommendation or warranty to you concerning any Company an/or the accuracy, reliability or completeness of the information provided herein and/or the performance of any Company. -

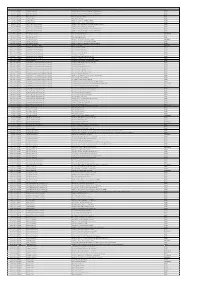

HESTA Share Voting Record Australian Equities Managers 1 Jan-30 Jun 2016

HESTA Share Voting Record - Australian Equities Managers 1 January to 30 June 2016 Resolutio Management/ Company Name Country Market Identifier Meeting Date Meeting Type Details of Resolution HESTA Vote n No. Shareholder Proposal ADELAIDE BRIGHTON LTD, ADELAIDE Australia AU000000ABC7 25-May-2016 Annual General Meeting 2 RE-ELECTION OF MR GF PETTIGREW Management For ADELAIDE BRIGHTON LTD, ADELAIDE Australia AU000000ABC7 25-May-2016 Annual General Meeting 3 ISSUE OF AWARDS TO THE MANAGING DIRECTOR Management For ADELAIDE BRIGHTON LTD, ADELAIDE Australia AU000000ABC7 25-May-2016 Annual General Meeting 4 ADOPTION OF REMUNERATION REPORT Management For AINSWORTH GAME TECHNOLOGY LTD, NEWINGTON Australia AU000000AGI3 27-Jun-2016 Ordinary General Meeting 1 APPROVAL FOR ACQUISITION OF SHARES BY NOVOMATIC AG Management For (NOVOMATIC) AIRXPANDERS, INC United States AU000000AXP3 17-May-2016 Annual General Meeting 1.A ELECTION OF MR. GREGORY LICHTWARDT AS A DIRECTOR OF THE Management For COMPANY AIRXPANDERS, INC United States AU000000AXP3 17-May-2016 Annual General Meeting 1.B ELECTION OF MS. ZITA PEACH AS A DIRECTOR OF THE COMPANY Management For AIRXPANDERS, INC United States AU000000AXP3 17-May-2016 Annual General Meeting 2 APPROVAL OF 10% PLACEMENT FACILITY Management Against AIRXPANDERS, INC United States AU000000AXP3 17-May-2016 Annual General Meeting 3 GRANT OF OPTIONS TO MR SCOTT DODSON Management Against AIRXPANDERS, INC United States AU000000AXP3 17-May-2016 Annual General Meeting 4.A GRANT OF OPTIONS TO MR BARRY CHESKIN Management Against -

Appendix A: Proof of Eap Qualifications

SLR Consulting (Africa) (Pty) Ltd Page A APPENDIX A: PROOF OF EAP QUALIFICATIONS SECTION 24G ENVIRONMENTAL ASSESSMENT REPORT FOR SLR Ref. 710.23031.00002 THE TSHIPI BORWA MINE August 2017 Report No.1 SLR Consulting (Africa) (Pty) Ltd Page B APPENDIX B: CURRICULUM VITAE OF EAP SECTION 24G ENVIRONMENTAL ASSESSMENT REPORT FOR SLR Ref. 710.23031.00002 THE TSHIPI BORWA MINE August 2017 Report No.1 Alessandra (Alex) Pheiffer Environmental Assessment Practitioner Curriculum Vitae Qualifications BSc 1998 Biological Sciences BSc (Hons) 1999 Zoology MSc 2004 Environmental Management Professional affiliations and registrations Registered with the South African Council for Natural Scientific Professions as a Professional Natural Scientist (PrSciNat) in Environmental Science (Reg. No. 400183/05) Registered with the Environmental Assessment Professionals of Namibia (EAPAN) as a Lead Practitioner (Membership No. 121) Member of the International Association for Impact Assessments (IAIA), South African Affiliate Summary of Key Areas of Expertise Management and facilitation of permitting and licensing processes Management of stakeholder engagement processes Overall Project Management Due Diligence, Reviews Summary of Experience and Capability Alex is a Director (since March 2013) and Operations Manager: Environmental Management, Planning and Approvals (EMPA) with SLR Africa and is responsible for co-ordinating SLR’s environmental management team. Alex has 16 years’ experience in the field of Environmental Management. Alex has managed a wide range of permitting and licensing projects including environmental assessments, water use license applications and waste management license applications, mainly in the exploration, mining and industrial sectors. These included project management and co-ordination; specialist and engineering team management; co-ordination, facilitation and undertaking of stakeholder engagement processes including for contentious projects, and environmental assessment. -

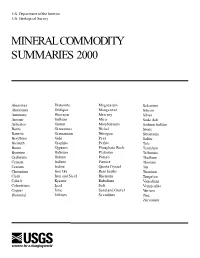

Mineral Commodity Summaries 2000

U.S. Department of the Interior U.S. Geological Survey MINERAL COMMODITY SUMMARIES 2000 Abrasives Diatomite Magnesium Selenium Aluminum Feldspar Manganese Silicon Antimony Fluorspar Mercury Silver Arsenic Gallium Mica Soda Ash Asbestos Garnet Molybdenum Sodium Sulfate Barite Gemstones Nickel Stone Bauxite Germanium Nitrogen Strontium Beryllium Gold Peat Sulfur Bismuth Graphite Perlite Talc Boron Gypsum Phosphate Rock Tantalum Bromine Hafnium Platinum Tellurium Cadmium Helium Potash Thallium Cement Indium Pumice Thorium Cesium Iodine Quartz Crystal Tin Chromium Iron Ore Rare Earths Titanium Clays Iron and Steel Rhenium Tungsten Cobalt Kyanite Rubidium Vanadium Columbium Lead Salt Vermiculite Copper Lime Sand and Gravel Yttrium Diamond Lithium Scandium Zinc Zirconium CONTENTS Page Page General: The Role of Nonfuel Minerals in the U.S. Economy ... 3 Appendix A—Units of Measure ................ 194 1999 U.S. Net Import Reliance for Selected Nonfuel Appendix B—Terms Used for Materials in the National Mineral Materials ........................... 4 Defense Stockpile ........................ 194 Significant Events, Trends, and Issues ............ 5 Appendix C—Resource/Reserve Definitions ...... 195 Commodities: Abrasives (Manufactured) .................... 20 Mercury .................................. 108 Aluminum ................................. 22 Mica (Natural), Scrap and Flake ............... 110 Antimony .................................. 24 Mica (Natural), Sheet ....................... 112 Arsenic ................................... 26 -

Adapting to Climate Change: a Guide for the Mining Industry

Adapting to Climate Change: A Guide for the Mining Industry Julia Nelson, Manager, Advisory Services Ryan Schuchard, Manager, Climate and Energy This guide is part of a BSR This primer on climate change adaptation summarizes how companies in the industry series. For additional mining industry are reporting on climate change risks and opportunities, and highlights current and emerging best practices and guidance for E&U companies climate adaptation briefs, please visit www.bsr.org/adaptation. on how to develop a proactive approach to climate change adaptation. In this brief, mining refers to companies involved in the extraction of a broad range of metals and minerals, including precious metals, base metals, industrial Contents and Methodology minerals, coal, and uranium. This brief covers: Introduction Reporting on Risks and Opportunities: A synopsis Due to the wide geographic distribution of mining operations, climate change, including temperature and precipitation shifts as well as more frequent and based on reporting of climate severe extreme weather events, will have complex impacts on the sector. risk in 2009 by 41 mining Climactic conditions will affect the stability and effectiveness of infrastructure and companies to the Carbon equipment, environmental protection and site closure practices, and the Disclosure Project (CDP). availability of transportation routes. Climate change may also impact the stability and cost of water and energy supplies. Current Practices: An outline of actions related to climate Some examples: Warming temperatures will increase water scarcity in some change adaptation based on locations, inhibiting water-dependent operations, complicating site rehabilitation reporting from the CDP, and bringing companies into direct conflict with communities for water resources. -

De Beers' New Strategy

Personal copy; not for onward transmission De Beers’ new td. pany L strategy om In what is described by its chairman, Instead, it aims to be the ‘supplier of Nicky Oppenheimer, as “one of the choice’. However, it currently sells ron & C most significant developments the dia- about two thirds of the world’s annual mond industry has seen since the supply of rough diamonds, and the Georgian House 1930s”, De Beers this week unveiled a mines that it manages contribute about oeb A 63, Coleman Street new strategy whereby it will abandon 40% of world production. Hence it L London EC2R 5BB Tel :+44 (0)20 7628-1128 its long-held role as custodian of the remains very much the dominant play- REGULATED BY THE SFA diamond market, and focus instead on er, and intends to continue to sell dia- boosting demand. Since the depression monds to selected clients through its years of the 1930s when the price of dia- regular sales or ‘sights’ held roughly monds slumped, De Beers has stock- every five weeks. piled the world’s surplus diamonds as a There will be some marked changes means of controlling supply (and though in how the sights are conducted. prices). Under the new strategy, the At present, they are characterised by stockpile is not being eliminated but it their opacity. The 125 selected will be substantially reduced – to a sightholders or diamantaires – it is esti- working level of around six months’ mated that as many as 900 diaman- supply, equivalent to some US$2.5 bil- taires are on the ‘waiting list’ – have no lion. -

Noranda-Codelco Hunt Rio Algom

Personal copy; not for onward transmission Reliability is the point Noranda-Codelco hunt Rio Algom Noranda has announced a C$1.5 billion cash on hand and credit facilities, and bid for Toronto-based Rio Algom and, Codelco from an external bridging loan if successful, will pass half of Rio of up to US$800 million. Both compa- Algom’s assets on to state-owned nies are seeking strategic benefits. For Corporacion Nacional del Cobre de the past few years, Noranda has been Chile (Codelco) at the same price. The divesting its assets to focus on mining, unsolicited bid by Noranda, which and has been looking to increase its already owns 8.9% of Rio Algom, is at exploration portfolio. Codelco, which is ht t p : / / w w w. e n s iv al - m o re t . c o m C$24.50/share – representing a 35% already the world’s largest copper pro- premium to Rio Algom’s share price of ducer, is seeking to extend its assets August 21, the day before the bid was outside Chile. Algom) and Phelps Dodge Corp. announced. Mr Kerr described the offer as “fair” (which has previously expressed an The offer is conditional on Noranda for shareholders of both Noranda and interest in Rio Algom and is keen to acquiring at least two-thirds of Rio Rio Algom. However, Rio Algom’s retain its status as the second largest Algom’s 60.6 million shares and the shares jumped by C$8 on the copper producer). company waiving its shareholder rights announcement to over C$26/share (a Not all analysts agree on the likeli- plan (which restricts the actions of hos- record high for the company), sig- hood of a higher bid. -

STOXX Australia 150 Last Updated: 02.06.2014

STOXX Australia 150 Last Updated: 02.06.2014 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Y 89.5 1 AU000000BHP4 6144690 BHP.AX 614469 BHP Billiton Ltd. AU AUD Y 81.0 2 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Y 72.3 3 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Y 62.7 4 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Y 53.5 5 AU000000TLS2 6087289 TLS.AX 608545 Telstra Corp. Ltd. AU AUD Y 45.3 6 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 33.8 7 AU000000WOW2 6981239 WOW.AX 698123 Woolworths Ltd. AU AUD Y 32.1 8 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Y 23.5 9 AU000000WPL2 6979728 WPL.AX 697972 Woodside Petroleum Ltd. AU AUD Y 18.1 10 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. AU AUD Y 17.6 11 AU000000WDC7 B01BTX7 WDC.AX 605414 Westfield Group AU AUD Y 14.2 12 AU000000SUN6 6585084 SUN.AX 658508 SUNCORP GROUP LTD. AU AUD Y 11.7 13 AU000000MQG1 B28YTC2 MQG.AX 655135 Macquarie Group Ltd. AU AUD Y 11.7 14 AU000000ORG5 6214861 ORG.AX 611220 Origin Energy Ltd. AU AUD Y 11.3 15 AU000000AMP6 6709958 AMP.AX 611571 AMP Ltd. AU AUD Y 10.6 16 AU000000BXB1 B1FJ0C0 BXB.AX 612000 Brambles Ltd. AU AUD Y 10.2 17 AU000000QBE9 6715740 QBE.AX 671574 QBE Insurance Group Ltd. -

Meeting Date ASX Code Company Name Summary Caresuper Vote 6

Meeting Date ASX Code Company Name Summary CareSuper Vote 6/07/2011 CDU Cudeco Limited Ratify the prior issue of shares to Oceanwide FOR 6/07/2011 CDU Cudeco Limited Ratify the prior issue of shares to Oceanwide FOR 6/07/2011 CDU Cudeco Limited Approve the issue of shares to Oceanwide FOR 7/07/2011 CSR CSR Limited Elect Kathleen Conlon FOR 7/07/2011 CSR CSR Limited Elect Rob Sindel FOR 7/07/2011 CSR CSR Limited Approve grant of ZEPOs to CEO FOR 7/07/2011 CSR CSR Limited Approve the remuneration report FOR 8/07/2011 GCL Gloucester Coal Limited Approve the acquisition of the Donaldson Group FOR 8/07/2011 GCL Gloucester Coal Limited Approve the marketing agreement FOR 8/07/2011 GCL Gloucester Coal Limited Approve the acquisition of the Monash Group FOR 8/07/2011 GCL Gloucester Coal Limited Approve the amendment to the constitution FOR 8/07/2011 GCL Gloucester Coal Limited Approve provision of financial assistance FOR 13/07/2011 SPN SP Ausnet Group Re-elect Jeremy Davis AGAINST 13/07/2011 SPN SP Ausnet Group Re-elect Ian Renard FOR 13/07/2011 SPN SP Ausnet Group Elect Tina McMeckan FOR 13/07/2011 SPN SP Ausnet Group Approve the remuneration report AGAINST 13/07/2011 SPN SP Ausnet Group Approve issue to underwriter of DRP FOR 13/07/2011 SPN SP Ausnet Group Approve issue for Singapore law purposes FOR 27/07/2011 CQO Charter Hall Office REIT Remove the RE AGAINST 28/07/2011 MQG Macquarie Group Limited Re-elect Peter Kirby FOR 28/07/2011 MQG Macquarie Group Limited Re-elect John Niland FOR 28/07/2011 MQG Macquarie Group Limited Re-elect Helen -

DERA Rohstoffinformationen

22 DERA Rohstoffinformationen Investor’s and Procurement Guide South Africa Part 2: Fluorspar, Chromite, Platinum Group Elements Impressum Editors: Dr. Peter Buchholz, Head of the German Mineral Resources Agency (DERA) within the Federal Institute for Geosciences and Natural Resources (BGR) Wilhelmstraße 25 – 30 13593 Berlin Tel.: +49 30 36993 226 Fax.: +49 30 36993 100 [email protected] www.deutsche-rohstoffagentur.de Dr. Stewart Foya, Head of the Department of Mineral Resources Development at the Council for Geoscience (CGS) 280 Pretoria Street, Silverton Pretoria, South Africa Tel.: +27 12 841 1101 Fax.: +27 86 679 8334 [email protected] Authors: Dr. Peter Buchholz (BGR), Dr. Katrin Kärner (BGR), Abdul O. Kenan (CGS), Dr. Herwig Marbler (BGR), Rehan Opperman (CGS), Dr. Simone Röhling (BGR) Project Dr. Herwig Marbler (BGR) coordination: Rehan Opperman (CGS) Contact Dr. Herwig Marbler: [email protected] BGR: Contact Rehan Opperman: [email protected] CGS: Date: October 2015 Cover Images: © Anglo American Platinum Ltd. ISBN: 978-3-943566-26-0 (print version) ISBN: 978-3-943566-25-3 (online pdf version) ISSN: 2193-5319 Reference: Buchholz, P. & Foya, S. (2015) (eds.): Investor’s and Procurement Guide South Africa Part 2: Fluorspar, Chromite, Platinum Group Elements. – DERA Rohstoffinformationen 22: 120 pp.; Berlin. Berlin, 2015 Die Bundesanstalt für Geowissenschaften und Rohstoffe ist eine technisch-wissenschaftliche Oberbehörde im Geschäftsbereich des Bundesministeriums für Wirtschaft und Energie (BMWi). Investor‘s and Procurement Guide South Africa Part 2: Fluorspar, Chromite, Platinum Group Elements Published jointly by the German Mineral Resources Agency (DERA) and the Council for Geoscience, South Africa (CGS) Investor’s and Procurement Guide South Africa 3 Foreword This is the second part of the “Investor’s and Procurement Guide South Africa”, a handbook for investing, procuring raw mineral materials and doing business in South Africa’s mineral industry. -

53203 Mining Weekly 6 Februa

RSA – R14,50 (Incl.VAT) ISSN 1562-9619 Volume 21 no 4 February 6–12, 2015 NEWS FOCUS Eskom urged to go for stability before improvement Page 14 INSIGHT First output from Lace mine due in second half despite AMCU strike Page 6 FEATURES Platinum-Group Metals Page 24 NEW POSSIBILITIES With launch of Africa’s first nano computer tomography scanner, SA university opens way for 3D analysis of ores Page 10 Also publisher of Engineering News and Polity www.miningweekly.com LASER TECHNOLOGY This feature will provide an overview of laser technology in South Africa Advertising booking deadline 24 February 2015 For more information, or to book advertising in the print and iPad editions, please contact Reinette Classen on +27 11 622 3744 or email: [email protected] Cover Story & Highlights 10 With launch of Africa’s first nano computer 15 DRC conflict gold being sold 20 African growth tied to trade, tomography scanner, SA university opens on international markets not mining – consultant way for 3D analysis of ores News & Insight Advertisers 6 First output from Lace mine due in H2 despite AMCU strike 17 African Modular Building Solutions 7 Treasury unlikely to raise, amend mining taxes in 2015/16 – Deloitte 29 BMG 30 Cyest Technology 8 Mining boosts world’s poorest regions – ICMM 33 Dymot Engineering 8 Glencore mulls closure of some South African coal operations 13 ExecuJet South Africa 12 Record-quarter Sibanye forecasting best ever 2015 gold output 21 Filvent 12 Lonmin’s refined platinum output plummets on smelter shutdowns 12 GoIndustry -

Equity Financing for Africa

ASX – Equity Financing for Africa There are now over 210 ASX mining and exploration companies with 1,200 projects in Africa spread across 36 countries. Over $5.6 billion has been raised through follow-on raisings by ASX listed companies for projects in Africa over the last 5 years. Source: IntierraLive August 2013 Mining Companies by Stage of Projects Number of Listed Mining Companies in Africa Diversified HKE 11 7% Producer 17% JSE 54 LSE & AIM 99 TSX & TSXV 192 Explorer 76% ASX 218 Source: IntierraLive, August 2013 Source: Intierralive, August 2013 • Over 210 ASX listed companies with assets in Africa • 1,200 projects spread across 36 African nations. • Of these projects, 37% are at grass-roots stage, 34% at exploration stage, and 29% are at advanced exploration stage ASX – Equity Financing for Africa Top 100 Stocks ASX COMPANY NAME COMPANY MARKET SECTOR* CODE TYPE^ CAPITALISATION (A$)* BHP BHP Billiton Limited Diversified $100,750,749,963 Diversified Metals & Mining RIO Rio Tinto Limited Producer $22,820,684,166 Diversified Metals & Mining NCM Newcrest Mining Limited Producer $7,565,463,283 Gold AAI Alcoa Inc. Diversified $7,274,558,272 Aluminium AWC Alumina Limited Diversified $2,764,132,230 Aluminum ZIM Zimplats Holdings Limited Producer $915,996,392 Precious Metals & Minerals LYC Lynas Corporation Ltd Producer $735,300,484 Diversified Metals & Mining AQA Aquila Resources Limited Producer $733,011,906 Coal & Consumable Fuels PDN Paladin Energy Ltd Producer $732,539,332 Coal & Consumable Fuels AGO Atlas Iron Limited Producer $677,740,214