Refco Trustee Comm App FINAL[2]

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Growth of the Internet

Growth of the Internet K. G. Coffman and A. M. Odlyzko AT&T Labs - Research [email protected], [email protected] Preliminary version, July 6, 2001 Abstract The Internet is the main cause of the recent explosion of activity in optical fiber telecommunica- tions. The high growth rates observed on the Internet, and the popular perception that growth rates were even higher, led to an upsurge in research, development, and investment in telecommunications. The telecom crash of 2000 occurred when investors realized that transmission capacity in place and under construction greatly exceeded actual traffic demand. This chapter discusses the growth of the Internet and compares it with that of other communication services. Internet traffic is growing, approximately doubling each year. There are reasonable arguments that it will continue to grow at this rate for the rest of this decade. If this happens, then in a few years, we may have a rough balance between supply and demand. Growth of the Internet K. G. Coffman and A. M. Odlyzko AT&T Labs - Research [email protected], [email protected] 1. Introduction Optical fiber communications was initially developed for the voice phone system. The feverish level of activity that we have experienced since the late 1990s, though, was caused primarily by the rapidly rising demand for Internet connectivity. The Internet has been growing at unprecedented rates. Moreover, because it is versatile and penetrates deeply into the economy, it is affecting all of society, and therefore has attracted inordinate amounts of public attention. The aim of this chapter is to summarize the current state of knowledge about the growth rates of the Internet, with special attention paid to the implications for fiber optic transmission. -

The Great Telecom Meltdown for a Listing of Recent Titles in the Artech House Telecommunications Library, Turn to the Back of This Book

The Great Telecom Meltdown For a listing of recent titles in the Artech House Telecommunications Library, turn to the back of this book. The Great Telecom Meltdown Fred R. Goldstein a r techhouse. com Library of Congress Cataloging-in-Publication Data A catalog record for this book is available from the U.S. Library of Congress. British Library Cataloguing in Publication Data Goldstein, Fred R. The great telecom meltdown.—(Artech House telecommunications Library) 1. Telecommunication—History 2. Telecommunciation—Technological innovations— History 3. Telecommunication—Finance—History I. Title 384’.09 ISBN 1-58053-939-4 Cover design by Leslie Genser © 2005 ARTECH HOUSE, INC. 685 Canton Street Norwood, MA 02062 All rights reserved. Printed and bound in the United States of America. No part of this book may be reproduced or utilized in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without permission in writing from the publisher. All terms mentioned in this book that are known to be trademarks or service marks have been appropriately capitalized. Artech House cannot attest to the accuracy of this information. Use of a term in this book should not be regarded as affecting the validity of any trademark or service mark. International Standard Book Number: 1-58053-939-4 10987654321 Contents ix Hybrid Fiber-Coax (HFC) Gave Cable Providers an Advantage on “Triple Play” 122 RBOCs Took the Threat Seriously 123 Hybrid Fiber-Coax Is Developed 123 Cable Modems -

Designated Agents for Local Exchange Carriers

Designated Agents for Local Exchange Carriers Document Processor Document Processor 321 Communications, Inc. Access Point, Inc. InCorp Services, Inc. Illinois Corporation Service Company 2501 Chatham Rd., Ste. 110 801 Adlai Stevenson Dr. Springfield IL 62704-7100 Springfield IL 62703-4261 Lisa Brown John Petrakis 321 Communications, Inc. Access2Go, Inc. Regulatory and Tax Consultants 4700 N. Prospect Rd. 3483 Satellite Blvd., Ste. 202 Peoria Heights IL 61616 Duluth GA 30096-5800 Document Processor Document Processor ACN Communication Services, Inc. 360networks (USA) inc. C T Corporation System C T Corporation System 208 S. LaSalle St. 208 S. LaSalle St. Chicago IL 60604 Chicago IL 60604 Doug Forster Document Processor ACN Communication Services, Inc. AboveNet Communications, Inc. Technologies Management, Inc. d/b/a AboveNet Media Networks PO Drawer 200 Illinois Corporation Service Company Winter Park FL 32790-0200 801 Adlai Stevenson Dr. Springfield IL 62703-4261 James W. Broemmer Jr Adams Telephone Co-Operative Robert Sokota PO Box 217 AboveNet Communications, Inc. Golden IL 62339 d/b/a AboveNet Media Networks 360 Hamilton Blvd. James W. Broemmer Jr White Plains NY 10601 Adams TelSystems, Inc. PO Box 217 Robert Neumann Golden IL 62339 Access Media 3, Inc. 900 Commerce Dr., Ste. 200 Gary Pieper Oak Brook IL 60523 Advanced Integrated Technologies Inc. PO Box 51 Brian McDermott Columbia IL 62236 Access Media 3, Inc. Synergies Law Group, PLLC Mark Lammert 1002 Parker St. Advanced Integrated Technologies Inc. Falls Church VA 22046 Compliance Solutions Inc. 740 Florida Central Pkwy., Ste. 2028 Document Processor Longwood FL 32750 Access One, Inc. Corporation Service Company Ronald Dougherty 422 N. -

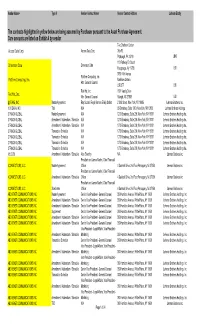

The Contracts Highlighted in Yellow Below Are Being Assumed by Purchaser Pursuant to the Asset Purchase Agreement. Cure Amounts Are Listed on Exhibit a by Vendor

Vendor Name+ Type II Vendor Contact Name Vendor Contact Address Lehman Entity The contracts highlighted in yellow below are being assumed by Purchaser pursuant to the Asset Purchase Agreement. Cure amounts are listed on Exhibit A by vendor. Two Chatham Center Access Data Corp. Access Data Corp. 24th FL Pittsburgh, PA 15219 LBHI 110 Parkway Dr. South Dimension Data Dimension Data Hauppauge, Ny 11788 LBI 3760 14th Avenue Platform Computing, Inc. Platform Computing, Inc. Markham Ontario Attn: General Counsel L3R 3T7 LBI Red Hat, Inc. 1801 Varsity Drive Red Hat, Inc. Attn: General Counsel Raleigh, NC 27606 LBI @STAKE, INC Master Agreement Ray Scutari, Royal Hansen, Emily Sebert 2 Wall Street, New York, NY 10005 Lehman Brothers, Inc. 1010 DATA, INC Trial N/A 65 Broadway, Suite 1010, New York, NY 10006 Lehman Brothers Holdings 2 TRACK GLOBAL Master Agreement N/A 1270 Broadway, Suite 208, New York, NY 10001 Lehman Brothers Holdings Inc. 2 TRACK GLOBAL Amendment / Addendum / Schedule N/A 1270 Broadway, Suite 208, New York, NY 10001 Lehman Brothers Holdings Inc. 2 TRACK GLOBAL Amendment / Addendum / Schedule N/A 1270 Broadway, Suite 208, New York, NY 10001 Lehman Brothers Holdings Inc. 2 TRACK GLOBAL Transaction Schedule N/A 1270 Broadway, Suite 208, New York, NY 10001 Lehman Brothers Holdings Inc. 2 TRACK GLOBAL Transaction Schedule N/A 1270 Broadway, Suite 208, New York, NY 10001 Lehman Brothers Holdings Inc. 2 TRACK GLOBAL Transaction Schedule N/A 1270 Broadway, Suite 208, New York, NY 10001 Lehman Brothers Holdings Inc. 2 TRACK GLOBAL Transaction Schedule N/A 1270 Broadway, Suite 208, New York, NY 10001 Lehman Brothers Holdings Inc. -

NASD Notice to Members 99-46

Executive Summary $250, and two or more Market NASD Effective July 1, 1999, the maximum Ma k e r s . Small Order Execution SystemSM (S O E S SM ) order sizes for 336 Nasdaq In accordance with Rule 4710, Nas- Notice to National Market® (NNM) securities daq periodically reviews the maxi- will be revised in accordance with mum SOES order size applicable to National Association of Securities each NNM security to determine if Members Dealers, Inc. (NASD®) Rule 4710(g). the trading characteristics of the issue have changed so as to warrant For more information, please contact an adjustment. Such a review was 99-46 ® Na s d a q Market Operations at conducted using data as of March (203) 378-0284. 31, 1999, pursuant to the aforemen- Maximum SOES Order tioned standards. The maximum Sizes Set To Change SOES order-size changes called for Description by this review are being implemented July 1, 1999 Under Rule 4710, the maximum with three exceptions. SOES order size for an NNM security is 1,000, 500, or 200 shares, • First, issues were not permitted to depending on the trading characteris- move more than one size level. For Suggested Routing tics of the security. The Nasdaq example, if an issue was previously ® Senior Management Workstation II (NWII) indicates the categorized in the 1,000-share maximum SOES order size for each level, it would not be permitted to Ad v e r t i s i n g NNM security. The indicator “NM10,” move to the 200-share level, even if Continuing Education “NM5,” or “NM2” displayed in NWII the formula calculated that such a corresponds to a maximum SOES move was warranted. -

LBEX-AM 008114-008208.Pdf

Schedule B CUSIP Security Description Par Amount 901200105 20TH CENTURY ENERGY CORP 100 90131B108 21ST CENTURY FILM CORP 2,000 90130C305 21ST CENTURY TECHNOLOGIES 2,585 90206R103 2-INFINITY INC 40,610 316811108 50 OFF STORES INC 1,050 28251TAQ6 801 GRAND COO SERIES 2006-1 LLC 11.79% 675,000 001075100 A G AUTOMOTIVE WAREHOUSE-A 7,100 002062107 A T & E CORPORATION 146,163 00088U108 A.D.A.M. INC 857 002528107 AADAN CORP 50 000336305 AAG HOLDING CO INC 7.25% 01/23/34 PFD 21 00252W104 AAIPHARMA INC USD0.001 247,908 002919108 ABACAN RESOURCE CORP NEW 34 000375204 ABB LTD-SPON ADR 43,522 003450BN2 ABILENE TEX HEALTH FACILITY DEV CORP. 150,000 000780KM7 ABN AMRO MORTGAGE CORP 4.75% 07/25/1 135,000 00374N107 ABOVENET INC 66 003748100 ABRAHAM LINCOLN FEDERAL SAVINGS BAI\ 700 003830106 ABRAXAS PETROLEUM CORP 1,381 003865102 ABSOLUTE FUTURE.COM 10,000 00386SAB8 ABU DHABI NATIONAL ENERGY COMPANY F 9,000 004315305 ACCESS HEALTHNET INC NEW 19,030 004337101 ACCESS NATIONAL CORP 148 004325205 ACCLAIM ENTERTAINMENT INC 100 00437W102 ACCRUE SOFTWARE INC 319,310 004480201 ACHILLION PHARMACEUTICALS 154 004631107 ACME COMMUNICATIONS INC 35 004845202 ACOM CO LTO-SPONSORED ADR 1,204 004848107 ACORN ENERGY INC 200 00503U105 ACTERNA CORP 19,900 00506P103 ACTIVIDENTITY CORP 1,775 00507P102 ACTRADE FINL TECHNOLOGIES LTD 3,100 00509L703 ACURA PHARMACEUTICALS INC 37 005315205 ADACORP INC NEW 3 005208103 ADA-ES INC 2,473 00651F108 ADAPTECINC 12,500 006847107 ADELPHIA BUSINESS SOLUTIONS INC CL A 12,950 006ESC982 ADELPHIA COMMUNICATIONS CORP 13% PE 14,899 00685R870 ADELPHIA -

Service List Dennis Kelley Director of Operations (Provisioning)

Service List Dennis Kelley Director of Operations (Provisioning) 1-800-Reconex Inc. 2500 Industrial Avenue Hubbard, OR 97032 William E. Braun Vice President and General Counsel 1-800-Reconex Inc. 2500 Industrial Avenue Hubbard, OR 97032 Andrew M. Klein A.R.C. Networks Inc. Kelley Drye & Warren LLP 1200 19th Street, NW Suite 500 Washington, DC 20036 Genevieve Morelli A.R.C. Networks Inc. Kelley Drye & Warren LLP 1200 19th Street, NW Suite 500 Washington, DC 20036 Paola M. Bulloch Director of Regulatory Affairs A.R.C. Networks Inc. 1333 Broadway, Suite 1001 New York, NY 10018 Jill Sandford Senior Attorney AboveNet Communications Inc. 360 Hamilton Avenue White Plains, NY 10601 Robert Sokota, Esquire General Counsel AboveNet Communications Inc. 360 Hamilton Avenue White Plains, NY 10601 Service List Brian M. Kelleher, Esquire ACC National Telecom Corp. AT&T Corp. 14 Mark Lane New City, NY 10956 Manager - ICA Negotiations Local Service & Access Management ACC National Telecom Corp. AT&T Corp. 32 Avenue of the Americas 5th Floor New York, NY 10013 Regional V.P. - Law & Government Affairs ACC National Telecom Corp. AT&T Corp. 32 Avenue of the Americas 6th Floor New York, NY 10013 Kaye Davis Access Point Inc. 16 Hyland Road Suite D Greenville, SC 29615 Daniel J. Kelley President, COO AccessBridge Communications, Inc. 1 Federal Street, Bldg 102-3 Springfield, MA 01105 Douglas R. Norton President AccessPlus Communications Inc. 7 Knobb Hill Byfield, MA 01922 David Stevanovski ACN Communications Services Inc. 32991 Hamilton Court Farmington Hills, MI 48334 Service List Teny J. Romine Director of Legal and Regulatory Affairs Adelphia Business Solutions Operations Inc. -

• the 1984AT&T

DAIN RAUSCHER WESSELS " ~. '~! ~ ~ i : • , " , .: . ,.. -- " . i Simply put, regulation is the basis by which nearly all competitors offer broadband access. Over the past 16 years, several landmark laws and court rulings have spurred the development of competition, initially in the long-distance market and more recently in the local market. Although current trends point to a generally favorable environment for competitive providers, the regulatory climate is always fraught with some degree of contention and is therefore worthy of investor scrutiny. In this section, we describe the key role that regulation plays in the development ofcompetitive broadband services. • The 1984AT&T Divestiture Evolution of the Current Structure The genesis of today's local market structure was created in the wake of a 1984 federal court ruling, the Modified Final Judgement (MFJ), which mandated the separation ofAT&T's local operations from its long-distance operations. The local operations were divided into seven Regional Bell Operating Companies (RBOCs), each serving a separate, contiguous set of states, and each prohibited from providing long-distance services. ,-- Pre-Divestiture: One Monopoly I Exhibit 3-1 • Lang LI,.. AT&T Oepanment InI' Clnclnll8U Self Wisconsin New Vorl< Telepllo,. Telephone Michigan Se" CloP Tel. 'ilnol. Bell We.tVA Source: San Francisco Consulting Group June 2000 • Page 31 DAIN RAUSCHER WESSELS Exhibit 3-2 • Post-Divestiture: Several Local Monopolies r: ! Note: Mergers have since taken place between Bell AlianticlNYNEX and SBC/Pacific Telesis!Ameritech. Source: FCC _____________________--1 During the twelve years between the MFJ and the Telecommunications Act of 1996, the telecommunications industry changed significantly. In the long-distance market, MCI, Sprint, and a host of other long-distance carriers built networks and took approximately 50% of AT&T's market share. -

Telecommunications Provider Locator

Telecommunications Provider Locator Industry Analysis & Technology Division Wireline Competition Bureau January 2010 This report is available for reference in the FCC’s Information Center at 445 12th Street, S.W., Courtyard Level. Copies may be purchased by contacting Best Copy and Printing, Inc., Portals II, 445 12th Street S.W., Room CY-B402, Washington, D.C. 20554, telephone 800-378-3160, facsimile 202-488-5563, or via e-mail at [email protected]. This report can be downloaded and interactively searched on the Wireline Competition Bureau Statistical Reports Internet site located at www.fcc.gov/wcb/iatd/locator.html. Telecommunications Provider Locator This report lists the contact information, primary telecommunications business and service(s) offered by 6,493 telecommunications providers. The last report was released March 13, 2009.1 The information in this report is drawn from providers’ Telecommunications Reporting Worksheets (FCC Form 499-A). It can be used by customers to identify and locate telecommunications providers, by telecommunications providers to identify and locate others in the industry, and by equipment vendors to identify potential customers. Virtually all providers of telecommunications must file FCC Form 499-A each year.2 These forms are not filed with the FCC but rather with the Universal Service Administrative Company (USAC), which serves as the data collection agent. The pool of filers contained in this edition consists of companies that operated and collected revenue during 2007, as well as new companies that file the form to fulfill the Commission’s registration requirement.3 Information from filings received by USAC after October 13, 2008, and from filings that were incomplete has been excluded from this report. -

March 24, 20162017 the FOUR-RING CIRCUS

THE FOUR-RING CIRCUS - ROUND TWENTYTWENTY-ONE; A FURTHER UPDATED VIEW OF THE MATING DANCE AMONG ANNOUNCED MERGER PARTNERS AND AN UNSOLICITED SECOND OR THIRD BIDDER By: Robert E. Spatt, Esq. Eric M. Swedenburg, Esq. March 24, 20162017 _______________ Copyright © 20162017 Robert E. Spatt & Eric M. Swedenburg. All rights reserved. Special thanks to Lauren M. Colasacco, Jonathan G. Stradling, Paul Bennett and Christian E. WitzkeJake M. Phillips, associates at Simpson Thacher & Bartlett LLP (and to Jennifer J. Levitt, senior counsel at Simpson Thacher & Bartlett LLP, and Lauren M. Colasacco, associate at Simpson Thacher & Bartlett LLP, with respect to prior versions), for their invaluable assistance in updating this article. All or part of this article (or earlier versions thereof) may have been or be used in other materials published by the authors or their colleagues. A downloadable version of this article can be found on the Simpson Thacher & Bartlett LLP website (www.stblaw.com/FourRingCircus20162017.pdf), along with a marked version showing changes from the prior “Round NineteenTwenty” of this article (www.stblaw.com/FourRingUpdates20162017.pdf) to facilitate the identification of updated data. Simpson Thacher & Bartlett LLP The Four-Ring Circus - Round TwentyTwenty-One; A Further Updated View Of The Mating Dance Among Announced Merger Partners And An Unsolicited Second Or Third Bidder Congratulatory handshakes and champagne toasts often accompany the execution and announcement of a merger agreement between a public company and its chosen merger partner. All too often, though, the celebration is premature. In the U.S., the incidence of unsolicited second and even third bidders surfacing after two companies have announced a definitive friendly merger agreement (or in the case of some foreign jurisdictions, a target-endorsed friendly offer) has become a standard execution risk of getting a deal done, and tends to reflect the ebb and flow of hostile acquisition activity. -

Annual Report 2009 a Nnu Al R Ep Or T 2009

SINGAPORE GERMANY euNetworks Group Limited euNetworks AG 50 Raffles Place Eschborner Landstraße 112 #32-01 Singapore Land Tower 60489 Frankfurt Annual Report 2009 Singapore 048623 Deutschland Tel: +65 6230 9795 Tel: +49 69 90554 0 Fax: +65 6532 1633 Fax: +49 69 90554 111 Email: [email protected] Email: [email protected] Directors Noel Meaney, Brady Reid Rafuse, Daniel Aegerter, Vorstand Noel Meaney Thomas P. Byrnes, Nicholas George, Lam Kwok Chong, William Vorsitzender des Aufsichtsrats Thomas P. Byrnes Gregory Mesch, Kai-Uwe Ricke, John Tyler Siegel Jr Umsatz-ID-Nr DE 201 739 716 Registered in Singapore Number 199905625E Steuernummer 04523251638 Amtsgericht Frankfurt am Main UNITED KINGDOM Handelsregister Nummer 58594 euNetworks Fiber UK Ltd Aufsichtsbehörde Bundesnetzagentur für Elektrizität, Gas, 7th Floor Telekommunikation, Post und Eisenbahnen; Tulpenfeld 4; 90 High Holborn 53113 Bonn London WC1V 6XX United Kingdom euNetworks Services GmbH Tel: +44 20 3178 8003 Eschborner Landstraße 112 Fax: +44 20 3178 8004 60489 Frankfurt Email: [email protected] Deutschland Directors Nicholas George, Brady Reid Rafuse Tel: +49 69 90554 0 Registered in England Number 4840874 Fax: +49 69 90554 111 VAT Registration Number 877685941 Email: [email protected] Geschäftsführer Albrecht W. Kraas IRELAND Umsatz-ID-Nr DE 188 444 657 euNetworks Ireland - Private Fiber Limited Steuernummer 04522802149 Suite D16 (2nd floor M) Amtsgericht Frankfurt am Main The Cubes Offices Handelsregister Nummer 48468 Beacon South Quarter Sandyford, Dublin 18 European -

Badwpad: the Lasting Menace of a Bad Protocol

badWPAD: The Lasting Menace of a Bad Protocol Max Goncharov Trend Micro Forward-Looking Threat Research (FTR) Team A TrendLabsSM Research Paper TREND MICRO LEGAL DISCLAIMER The information provided herein is for general information Contents and educational purposes only. It is not intended and should not be construed to constitute legal advice. The information contained herein may not be applicable to all situations and may not reflect the most current situation. Nothing contained herein should be relied on or acted upon without the benefit of legal advice based on the 4 particular facts and circumstances presented and nothing herein should be construed otherwise. Trend Micro What is WPAD? reserves the right to modify the contents of this document at any time without prior notice. Translations of any material into other languages are intended solely as a convenience. Translation accuracy is not guaranteed nor implied. If any questions arise related to the accuracy of a translation, please refer to 8 the original language official version of the document. Any discrepancies or differences created in the translation are badWPAD Attacks not binding and have no legal effect for compliance or enforcement purposes. Although Trend Micro uses reasonable efforts to include accurate and up-to-date information herein, Trend Micro makes no warranties or representations of any kind as to its accuracy, currency, or completeness. You agree 13 that access to and use of and reliance on this document and the content thereof is at your own risk. Trend Micro Our WPAD Experiment disclaims all warranties of any kind, express or implied. Neither Trend Micro nor any party involved in creating, producing, or delivering this document shall be liable for any consequence, loss, or damage, including direct, indirect, special, consequential, loss of business profits, or special damages, whatsoever arising out of access to, use of, or inability to use, or in connection with the use of 21 this document, or any errors or omissions in the content thereof.