TIGER KRX Game K-New Deal ETF to Increase 24% in 2020 and 17% in 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Semi-Annual Report

SEMI-ANNU A L REPOR T MARCH 31, 2021 KEY FUND STATISTICS 2 MARKET ENVIRONMENT 5 MARSICO FOCUS FUND Investment Review 7 Fund Overview 10 Schedule of Investments 11 MARSICO GROWTH FUND Investment Review 12 Fund Overview 14 DEAR SHAREHOLDER: Schedule of Investments 15 Enclosed is your semi-annual report for each portfolio of The Marsico Investment Fund (the “Marsico MARSICO 21ST CENTURY FUND OF CONTENTS TABLE Funds”), encompassing the six-month fiscal period from October 1, 2020 to March 31, 2021. Investment Review 16 Fund Overview 18 The purpose of this report is to provide a review of the Marsico Funds’ six-month investment results Schedule of Investments 19 by discussing what we believe were the main areas that impacted performance – including the macroeconomic environment, sector and industry positioning, and individual stock selection – as MARSICO INTERNATIONAL OPPORTUNITIES FUND compared to the Funds’ performance benchmark indices. Investment Review 21 Fund Overview 23 For updated information regarding the market environment and each Fund’s overall investment Schedule of Investments 24 positioning and performance, please refer to the Funds’ most recent monthly fact sheets and quarterly investment updates, which are available in the Investor Resources section of the Funds’ MARSICO GLOBAL FUND Investment Review 27 website at marsicofunds.com.(1) Fund Overview 29 Schedule of Investments 30 Note: Effective December 21, 2020, James D. Marsico became co-manager of the Marsico Growth APRIL 2021 Fund with Thomas F. Marsico, Brandon A. Geisler, and Peter C. Marsico. FINANCIAL STATEMENTS 32 NOTES TO FINANCIAL STATEMENTS 42 EXPENSE EXAMPLE 47 CONSIDERATION OF INVESTMENT ADVISORY AGREEMENTS 48 OTHER INFORMATION 51 (1) The references to the Marsico Funds website (marsicofunds.com) included throughout this semi-annual report do not incorporate the website’s contents into this report. -

The Economics of Exclusivity

Decision Support Systems 50 (2010) 79–92 Contents lists available at ScienceDirect Decision Support Systems journal homepage: www.elsevier.com/locate/dss Platform-based information goods: The economics of exclusivity Ravindra Mantena a, Ramesh Sankaranarayanan b,⁎, Siva Viswanathan c a Simon Graduate School of Business, CS-3-318 Carol Simon Hall, University of Rochester, Rochester, NY 14627, United States b School of Business, U-1041, 2100 Hillside Road, University of Connecticut, Storrs, CT 06269, United States c Robert H. Smith School of Business, 4313, Van Munching Hall, University of Maryland, College Park, MD 20185, United States article info abstract Article history: This paper explores the role of exclusive contracting between vendors of platforms (such as video game Received 1 December 2008 consoles) and vendors of complements (such as video games). The main questions of interest are: When do Received in revised form 2 July 2010 we observe complement exclusivity, and what is the impact of exclusive contracting on prices, profits and Accepted 14 July 2010 efficiency? We answer these questions by developing a model of competition between platforms in an Available online 19 July 2010 industry with indirect network effects, and deriving some insightful analytical and numerical results. While complement vendors have natural incentives to be available on all platforms, we establish conditions under Keywords: Exclusivity which they can be contracted for exclusive supply on a single platform. Exclusivity eases competition in the Platform competition platform market and can significantly help increase a platform's adoption. However, exclusivity choice Complements presents a key trade-off for the complement vendor—a larger platform offers access to a larger market, but Indirect network effects also more competition, as compared to a smaller platform. -

Openbsd Gaming Resource

OPENBSD GAMING RESOURCE A continually updated resource for playing video games on OpenBSD. Mr. Satterly Updated August 7, 2021 P11U17A3B8 III Title: OpenBSD Gaming Resource Author: Mr. Satterly Publisher: Mr. Satterly Date: Updated August 7, 2021 Copyright: Creative Commons Zero 1.0 Universal Email: [email protected] Website: https://MrSatterly.com/ Contents 1 Introduction1 2 Ways to play the games2 2.1 Base system........................ 2 2.2 Ports/Editors........................ 3 2.3 Ports/Emulators...................... 3 Arcade emulation..................... 4 Computer emulation................... 4 Game console emulation................. 4 Operating system emulation .............. 7 2.4 Ports/Games........................ 8 Game engines....................... 8 Interactive fiction..................... 9 2.5 Ports/Math......................... 10 2.6 Ports/Net.......................... 10 2.7 Ports/Shells ........................ 12 2.8 Ports/WWW ........................ 12 3 Notable games 14 3.1 Free games ........................ 14 A-I.............................. 14 J-R.............................. 22 S-Z.............................. 26 3.2 Non-free games...................... 31 4 Getting the games 33 4.1 Games............................ 33 5 Former ways to play games 37 6 What next? 38 Appendices 39 A Clones, models, and variants 39 Index 51 IV 1 Introduction I use this document to help organize my thoughts, files, and links on how to play games on OpenBSD. It helps me to remember what I have gone through while finding new games. The biggest reason to read or at least skim this document is because how can you search for something you do not know exists? I will show you ways to play games, what free and non-free games are available, and give links to help you get started on downloading them. -

Lineage 2M Pre-Registration Faring Well

NCSOFT (036570.KS) Lineage 2M pre-registration faring well Company Comment │ Sep 9, 2019 Pre-registration for NCSOFT’s Lineage 2M chalked up over 2mn subscribers within the first 18 hours. Large-scale marketing events for the title are scheduled for Oct 15, with an official launch expected in November. In light of strong expectations for Lineage 2M, we anticipate considerable earnings Buy (maintain) growth in 2020. TP W750,000 (maintain) CP (’19/09/09) W552,000 Sector Game Lineage 2M set to make domestic mobile game history Kospi/Kosdaq 2,009.13 / 631.15 Market cap (common) US$10,150.43mn We maintain a Buy rating on NCSOFT, our top pick in the game sector, with a Outstanding shares (common) 22.0mn TP of W750,000. Following a showcase for Lineage 2M and the initiation of 52W high (’19/09/06) W552,000 low (’18/09/06) W399,500 pre-registration for the title on Sep 5, preparations for the game’s official launch Average trading value (60D) US$27.89mn are now in the final stages. Large-scale marketing events are slated for Oct 15, Dividend yield (2019E) 1.10% with an official launch expected in November. With the success of Lineage 2M Foreign ownership 50.8% becoming more and more certain, expectations towards NCSOFT’s earnings Major shareholders should rise, in turn pumping the company’s share price. NPS 12.6% TJ Kim & 8 others 12.0% Pre-registration for Lineage 2M drew over 2mn subscribers in just the first 18 Share perf 3M 6M 12M hours, an incredible figure. -

Desarrollo De Un Prototipo De Videojuego

UNIVERSIDAD DE EXTREMADURA Escuela Politécnica Máster en Ingeniería Informática Trabajo de Fin de Máster Desarrollo de un Prototipo de Videojuego Ricardo Franco Martín Noviembre, 2016 UNIVERSIDAD DE EXTREMADURA Escuela Politécnica Máster en Ingeniería Informática Trabajo de Fin de Máster Desarrollo de un Prototipo de Videojuego Autor: Ricardo Franco Martín Fdo: Directores: Pablo García Rodriguez y Rober Morales Chaparro Fdo: Tribunal Calicador Presidente: Fdo: Secretario: Fdo: Vocal: Fdo: Dedicado a mi familia i ii Agradecimientos Quisiera agradecer a varias personas el apoyo y ayuda que me han prestado en la realización de este Trabajo de Fin de Máster. En primer lugar, agradecer a mi director Pablo García Rodríguez por per- mitirme realizar este proyecto y recibirme con los brazos abiertos cada vez que he necesitado su ayuda. También quiero agradecer a mi codirector Rober Morales Chaparro por conar en mí y proporcionarme una de las fases profesional y educativa más importantes de mi vida. Por último, agradecer a mi familia y amigos, que sin su apoyo, no habría llegado tan lejos. En especial, darle las gracias a mi hermano José Carlos Franco Martín que ha realizado y proporcionado algunos recursos artísticos para el proyecto. ½Muchas gracias a todos! iii iv Resumen Este Trabajo de Fin de Máster (en adelante TFM) trata sobre todo el proceso de investigación, conguración de un entorno de trabajo y desarrollo de un prototipo de videojuego. Analizaremos la tecnología actual y repasaremos algunas de las herramien- tas más relevantes utilizadas en el proceso de desarrollo de un videojuego. Seguidamente, trataremos de desarrollar un videojuego. Para ello, a partir de una idea de juego, diseñaremos las mecánicas y construiremos un prototipo funcional que pueda ser jugado y que reeje las principales características planteadas en la idea inicial, con el objetivo de comprobar si el juego es viable, si es divertido y si interesa desarrollar el juego completo. -

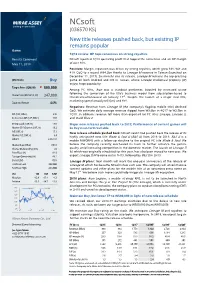

Ncsoft Reported 1Q18 Operating Profit That Topped the Consensus and an OP Margin May 11, 2018 of Over 40%

NC soft (036570 KS ) New title releases pushed back , but existing IP remains popular Game 1Q18 review: OP tops consensus on strong royalties Results Comment NCsoft reported 1Q18 operating profit that topped the consensus and an OP margin May 11, 2018 of over 40%. Positives: Margin expansion was driven by strong royalties, which grew 33% YoY and 41% QoQ to a record W84.2bn thanks to Lineage M revenue in Taiwan (launched on December 11, 2017). Six months into its release, Lineage M remains the top-grossing (Maintain) Buy game on both Android and iOS in Taiwan, where Lineage intellectual property (IP) enjoys huge popularity. Target Price (12M, W) ▼ 500,000 Among PC titles, Aion was a standout performer, boosted by in creased usage following the conversion of the title’s business model from subscription-based to Share Price (05/10/18, W) 347,000 microtransaction-based on January 17 th . Despite the launch of a major rival title, marketing spend actually fell QoQ and YoY. Expected Return 44% Negatives: Revenue from Lineage M (the company’s flagship mobile title) declined QoQ. We estimate daily average revenue slipped from W3.6bn in 4Q17 to W2.9bn in OP (18F, Wbn) 696 1Q18. In addition, revenue fell more than expected for PC titles Lineage , Lineage II , Consensus OP (18F, Wbn) 786 and Guild Wars 2 . EPS Growth (18F, %) 14.5 Major new releases pushed back to 2019; Performance of current games will Market EPS Growth (18F, %) 16.2 be key near-term variable P/E (18F, x) 15.1 New release schedule pushed back: NCsoft said it had pushed back the release of its Market P/E (18F, x) 9.4 highly anticipated new title Blade & Soul II (B&S II ) from 2018 to 2019. -

Ncsoft(036570.Ks)

NCSOFT (036570.KS) Earnings to enter recovery phase from November With the launch of B&S2 having been pushed back to 1Q21 (vs the previous Company Note │ Oct 19, 2020 expectation of an end-2020 release), NCSOFT’s share price has been adjusting as of late. However, noting both that the specifics of the B&S2 Refer to page 2 for ESG index/event tables launch are to be announced in November and that subsidiaries are slated to roll out new titles by the end of this year, we expect to see an accompanying resurgence in NCSOFT’s earnings momentum. Buy (maintain) TP W1,220,000 (lower) CP (’20/10/16) W767,000 Set to release B&S2; subsidiaries rolling out new offerings as well Sector Game Kospi/Kosdaq 2,341.53 / 833.84 We reiterate a Buy rating on NCSOFT, continuing to suggest it as our sector top Market cap (common) US$14,732.02mn pick. The company’s share price has recently been undergoing adjustment due Outstanding shares (common) 22.0mn 52W high (’20/07/06) W995,000 to both concerns over the delayed release of Blade & Soul 2 (B&S2) and low (’19/12/03) W485,000 slowing sales of Lineage 2M. However, we point out that the pushing back of Average trading value (60D) US$90.03mn the B&S2 launch stems from merely a scheduling issue, not a development Dividend yield (2020E) 0.79% issue. The new title appears safely on track to be released in 1Q21, with specific Foreign ownership 48.8% information regarding the launch to be released next month. -

Esg Playbook

ESG PLAYBOOK . . NCSOFT ESG PLAYBOOK 2020 . * NCSOFT ESG PLAYBOOK 2020 . Contents NC Overview PLAY for Sustainability CEO 04 44 Who We Are 06 46 What We Create 07 48 Highlight ‘PUSH, PLAY’ 08 54 10 55 56 ESG Appendix ESG 14 60 , 16 ESG 61 28 GRI Standards Index 63 34SASB Index 75 383 76 NC Overview 2 01 Blade & Soul 2 NC Overview CEO 04 Who We Are 06 07 08 10 NC Overview PLAY for Sustainability CEO 4 CEO NC Overview CEO 5 “ .” . . . . 1997 . . . NC Overview Who We Are 6 Who We Are NC . ) 1997 3 11 NC West Holdings 2012.12 418 Publishing/DeVeLopment , NC Japan KK 2001.09 151 Publishing/DeVeLopment NC Taiwan Co., Ltd. 2003.08 83 Publishing/DeVeLopment 4,231 ) NC Vietnam Visual Studio Co., Ltd. 2020.01 103 Art Outsourcing NC Europe, Ltd. 2004.07 10 Core Value 1996.10 90 , NEVER ENDING INTEGRITY PASSION CHALLENGE 2009.04 151 2011.04 69 6 12 12 _ ) 2 NC Overview What We create 7 1998 & What We Create IP . PC · · 2 2 M 2M Lineage Lineage 2 GuiLd Wars 2 Lineage M Lineage2M UNIVERSE & H3 AION Blade & Soul FUSER Pro BasebalL H3 PURPLE BUFFTOON NC Overview Highlight ‘PUSH, PLAY’ 8 PUSH, Highlight NC . . NC NC . PC , PURPLE & Yeti AI AI , ‘VocGAN’ -

Esg Playbook

ESG PLAYBOOK NCSOFT SUSTAINABILITY REPORT NCSOFT’s First Sustainability Report NCSOFT aspires to create a future where everyone is connected by joy. Contents Overview of NC PLAY for Sustainability 04 Governance 44 Who We Are 06 46 What We Create Care for Employees 48 08 Communication with Customers 54 10 Local Community 55 56 ESG Appendix 14 Materiality Test 60 A Healthy Corporate Culture, Unbiased Joy 16 61 28 01 Blade & Soul 2 Overview of NC CEO Message 04 Who We Are 06 What We Create Highlights ‘PUSH, PLAY’ 08 Value and Future of the Games Industry 10 Overview of NC PLAY for Sustainability ESG Appendix 4 CEO Message Overview of NC PLAY for Sustainability ESG Appendix 5 “ NCSOFT ceaselessly pusHes aHead, continuing on its Journey of growth.” Dear Stakeholders, improving shareholder value and protecting shareholder rights and interests, and creating As the CEO of NCSOFT, it is my great pleasure social value along the way. Going forward, we will advance sustainability management in the best sustainability report. possible way to our fullest capacity, and remain focused on giving back to society in a genuine way Since our inception back in 1997, all of us at while elevating our corporate value. NCSOFT have weathered a myriad of storms and have continued to rise up to new challenges to progress this far. Throughout it all, we have and encouragement in our journey ahead. transparent and responsible governance, Best regards, CEO Overview of NC PLAY for Sustainability ESG Appendix Who We Are 6 Ushering in a brand new future where all are connected by joy, Who We Are NC aspires to assist in the creation of a new frontier where truly impressive experiences await. -

Videogames & the Animation Industry

VIDEOGAMES & THE ANIMATION INDUSTRY How the animation industry can enrich their IP with an interactive experience. [email protected] A publication of: Happy Volcano www.happyvolcano.com © Happy Volcano BVBA, 2017. All rights reserved. The information in this document is subject to change without notice. No part of this document may be reproduced, stored or transmitted in any form or by any means, electronic or mechanical, for any purpose, without the express written permission of Happy Volcano BVBA. Happy Volcano BVBA assumes no liability for any damages incurred, directly or indirectly, from any errors or omissions of the information contained in this document. EXECUTIVE SUMMARY THE PROBLEM Video games have never been more popular. In recent years, the total revenue of the games industry has eclipsed the combined income of the film and music industry. Despite the financial growth and diversification of the medium, culturally video games remain the odd one out. The process of video game creation is largely unknown and few people outside of the industry really understand what video games are all about. Even to the animation industry, where similar technology is used on a daily basis, the games industry is a perfect stranger. THE SOLUTION This whitepaper aims to shed light in the darkness. Starting out with a brief look at the history of licensed video games, we point out the costs and benefits of enriching your animated property with a video game. We highlight the differences between the two industries, as well as the similarities and argue that the world of animation and video game creation exist closer to each other than you might think. -

Ncsoft (036570)

NCsoft (036570) New Title Launches to Resume with Trickster M Danny Lee Yonghyun Choi Internet & Games / Media Research Associate May 10, 2021 +822-6114-2960 [email protected] +822-2-6114-2915 [email protected] Maintain BUY; Revise down TP to We maintain BUY and revise down our TP by 4.5% to KRW1,100,000 for NCsoft. We have KRW1,100,000 revised down 2021E revenue and OP by 8.8% and 15.8%, respectively, to reflect sluggish results for mobile games in 1Q21, as well as delays in the rollouts of key game titles (e.g., Blade & Soul 2, Aion 2). We have also revised our valuation method from P/E to DCF model in order to better reflect the company’s long-term growth potential. Our revised TP implies 12m fwd P/E of 24.1x. Earnings shock attributable to NCsoft reported 1Q21 revenue of KRW512.5bn (-8.7% QoQ, -29.9% YoY) and OP of sluggish mobile game revenue and KRW56.7bn (-63.8% QoQ, -76.5% YoY), with OP missing the market consensus increase in labor expenses (KRW125.8bn) by 54.9%. We attribute the QoQ decline in revenue to lower revenues for Lineage M and Lineage 2M (-18.4% and -8.7% QoQ, respectively). The shock to OP came on the back of: (1) an increase in labor expenses upon wage hikes and one-off incentive payments (+25.8% QoQ to KRW232.5bn); and (2) higher marketing expenses due to new game rollouts (+22.6% QoQ to KRW55.0bn). Delays in new title launches New game rollouts will begin, starting with the release of Trickster M on May 20, but disappointing, but revenue forecast schedules for other key titles have been pushed back. -

The Free-To-Play Game in Its Connective Commodity Form

SMSXXX10.1177/2056305115621932Social Media + SocietyNieborg 621932research-article2015 SI: Social Media Public Space Social Media + Society July-December 2015: 1 –12 Crushing Candy: The Free-to-Play Game © The Author(s) 2015 DOI: 10.1177/2056305115621932 in Its Connective Commodity Form sms.sagepub.com David B. Nieborg Abstract The goal of this article is to add a complementary perspective to the study of social network sites by surveying how the political economy of social media platforms relates to the structure of free-to-play games in their commodity form. Drawing on the theory of multisided markets and critical political economy, this article surveys the political economy of game apps and investigates how it is symbiotically related to the technological and economic logic underlying connective platforms operated by Google, Apple, Facebook, and Amazon. These social media platforms operate app stores that sustain the transformation of games as fixed, physically distributed products that follow a transaction logic, into digitally distributed, freely accessible, or “free-to-play” apps. Through a case study of the popular casual game Candy Crush Saga it is contended that the connective properties of social media platforms affect the form and format of game apps as cultural commodities. Candy Crush Saga developer King Digital Entertainment has been able to attract hundreds of millions of players and build a business model that combines the commodification of virtual items, connectivity, user attention, user data, and play. It is argued that the free-to-play commodity form comprises three commodity types: the product commodity, the “prosumer commodity,” and the player commodity. Furthermore, Candy Crush Saga’s commodity form is structured by a platformed modality of cultural production and circulation and therefore embedded in the political economy of its host platform.