QV.Co.Nz Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download Original Attachment

Call Sign Location AAA OHAKEA AAA1 AUCKLAND CITY DISTRICT AAA2 AUCKLAND CITY DISTRICT AAA3 AUCKLAND CITY DISTRICT AAA4 AUCKLAND CITY DISTRICT AAA5 AUCKLAND CITY DISTRICT AAA6 AUCKLAND CITY DISTRICT AAA7 AUCKLAND CITY DISTRICT AAA8 AUCKLAND CITY DISTRICT AAA9 AUCKLAND CITY DISTRICT AAD1 AUCKLAND CITY DISTRICT AAD10 AUCKLAND CITY DISTRICT AAD11 AUCKLAND CITY DISTRICT AAD12 AUCKLAND CITY DISTRICT AAD14 AUCKLAND CITY DISTRICT AAD15 AUCKLAND CITY DISTRICT AAD16 AUCKLAND CITY DISTRICT AAD17 AUCKLAND CITY DISTRICT AAD18 AUCKLAND CITY DISTRICT AAD19 AUCKLAND CITY DISTRICT AAD2 AUCKLAND CITY DISTRICT AAD20 AUCKLAND CITY DISTRICT AAD21 AUCKLAND CITY DISTRICT AAD22 AUCKLAND CITY DISTRICT AAD23 AUCKLAND CITY DISTRICT AAD24 AUCKLAND CITY DISTRICT AAD25 AUCKLAND CITY DISTRICT AAD26 AUCKLAND CITY DISTRICT AAD27 AUCKLAND CITY DISTRICT AAD28 AUCKLAND CITY DISTRICT AAD29 AUCKLAND CITY DISTRICT AAD3 AUCKLAND CITY DISTRICT AAD30 AUCKLAND CITY DISTRICT AAD31 AUCKLAND CITY DISTRICT AAD32 AUCKLAND CITY DISTRICT AAD33 AUCKLAND CITY DISTRICT AAD34 AUCKLAND CITY DISTRICT AAD35 AUCKLAND CITY DISTRICT AAD4 AUCKLAND CITY DISTRICT AAD5 AUCKLAND CITY DISTRICT AAD50 AUCKLAND CITY DISTRICT AAD51 AUCKLAND CITY DISTRICT AAD52 AUCKLAND CITY DISTRICT AAD6 AUCKLAND CITY DISTRICT AAD7 AUCKLAND CITY DISTRICT AAD8 AUCKLAND CITY DISTRICT AAD9 AUCKLAND CITY DISTRICT AADN AUCKLAND CITY DISTRICT AADS1 AUCKLAND CITY DISTRICT AADS2 AUCKLAND CITY DISTRICT AADS3 AUCKLAND CITY DISTRICT AADS4 AUCKLAND CITY DISTRICT AADS5 AUCKLAND CITY DISTRICT AAF10 METRO CRIME AAF11 METRO CRIME AAF12 -

The Politics of Presence: Political Representation and New Zealand’S Asian Members of Parliament

THE POLITICS OF PRESENCE: POLITICAL REPRESENTATION AND NEW ZEALAND’S ASIAN MEMBERS OF PARLIAMENT By Seonah Choi A thesis submitted in fulfilment of the requirements for the degree of Master of Arts in Political Science at Victoria University of Wellington 2014 2 Contents Abstract .................................................................................................................................. 3 Acknowledgements ............................................................................................................... 4 List of Tables ......................................................................................................................... 5 Definitions ............................................................................................................................. 6 Chapter I: Introduction .......................................................................................................... 8 Chapter II: Literature Review .............................................................................................. 11 2.1 Representative Democracy ........................................................................................ 11 2.2 Theories of Political Representation .......................................................................... 12 2.3 Theories of Minority Representation ......................................................................... 27 2.4 Formulating a Framework ........................................................................................ -

Number of Electorates and Electoral Populations: 2013 Census Embargoed Until 10:45Am – 07 October 2013

Number of Electorates and Electoral Populations: 2013 Census Embargoed until 10:45am – 07 October 2013 Key facts The number of electorates will increase from 70 to 71 at the next general election. The number of North Island general electorates will increase from 47 to 48. The number of Māori electorates will remain at seven. The number of general electorates in the South Island is set at 16 by the Electoral Act 1993. In a 120-seat parliament (excluding any overhang seats), a total of 71 electorates will result in 49 list seats being allocated. This is one less list seat than in the 2011 General Election. The Representation Commission can now review the electorate boundaries for the next general election. Liz MacPherson 7 October 2013 Government Statistician ISBN 978-0-478-40854-6 Commentary Electoral populations increase since 2006 Number of electorates will increase Twenty-one current electorates vary from quota by more than 5 percent Enrolments on Māori roll increase Electoral populations increase since 2006 The general electoral population of the North Island is 2,867,110, up 176,673 (6.6 percent) from 2006. For the South Island it is 954,871, up 33,872 (3.7 percent) from 2006. Based on the latest electoral population figures, the electoral population quota (the average population in an electorate) is 59,731 people for each North Island general electorate and 59,679 people for each South Island general electorate. The general electoral population quota has increased by 2,488 people for the North Island and by 2,117 people for the South Island. -

Otahuhu Historic Heritage Survey

OTAHUHU HISTORIC HERITAGE SURVEY Overview Report PREPARED FOR AUCKLAND COUNCIL BY MATTHEWS & MATTHEWS ARCHITECTS LTD IN ASSOCIATION WITH LYN WILLIAMS LISA TRUTTMAN BRUCE W HAYWARD CLOUGH & ASSOCIATES LTD JP ADAM RA SKIDMORE URBAN DESIGN LTD FINAL August 2014 OTAHUHU HISTORIC HERITAGE SURVEY 2013 Contents 1.0 INTRODUCTION .................................................................................................. 4 1.1 Brief .................................................................................................................. 4 1.2 The Study area ................................................................................................. 5 1.3 Methodology and Approach .............................................................................. 5 1.4 Acknowledgements ........................................................................................... 5 1.5 Overview of report structure and component parts ........................................... 7 2.0 ŌTĀHUHU STUDY AREA-SUMMARY OF HISTORIC HERITAGE ISSUES ....... 9 2.1 Built Heritage Overview and recommendations ................................................ 9 2.2 Overview and recommendations in relation to geology .................................. 12 2.3 Overview and recommendations in relation to archaeology ........................... 13 2.4 Overview and recommendations Landscape History ...................................... 13 2.5 Overview and recommendations related to Maori Ancestral Relationships and issues identified. .................................................................................................. -

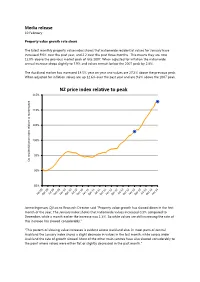

NZ Price Index Relative to Peak

Media release 10 February Property value growth rate slows The latest monthly property value index shows that nationwide residential values for January have increased 9.6% over the past year, and 2.2 over the past three months. This means they are now 12.8% above the previous market peak of late 2007. When adjusted for inflation the nationwide annual increase drops slightly to 7.9% and values remain below the 2007 peak by 2.8%. The Auckland market has increased 14.5% year on year and values are 27.2% above the previous peak. When adjusted for inflation values are up 12.6% over the past year and are 9.6% above the 2007 peak. NZ price index relative to peak 115% 110% 105% 100% 95% QV residential peak to index relative market residential QV price 90% 85% Jonno Ingerson, QV.co.nz Research Director said “Property value growth has slowed down in the first month of the year. The January index shows that nationwide values increased 0.3% compared to December, while a month earlier the increase was 1.3%. So while values are still increasing the rate of this increase has slowed considerably." "This pattern of slowing value increases is evident across Auckland also. In most parts of central Auckland the January index shows a slight decrease in values in the last month, while across wider Auckland the rate of growth slowed. Most of the other main centres have also slowed considerably to the point where values were either flat or slightly decreased in the past month." "While this is the first month that values appear to have slowed, and generally we would wait for subsequent months before claiming a trend, the timing does align to the LVR speed limits. -

Election 2014 (Final Result) Data Insights Topix

Election 2014 (Final Result) Data Insights Topix October 2014 To celebrate the launch of our data analytics MMP vs. FPTP practice we have put together some quick statistics If the party vote victories by electorate are anything on the election results. Whilst the overall results to go by, National, which won in 60 electorates, are well known and publicised, some interesting would have fared even better under FPTP. observations arise when combined with last year’s census data. It is interesting to note the absence of the Green Party in the chart below. Despite being New The results presented here don’t do justice to the Zealand’s third largest party (by overall party vote true power of data analytics; such are the limitations percentage), the Green Party failed to achieve of using aggregated publicly available data. either a party vote victory or a candidate victory in Nevertheless, there is always some ‘juice’ to be any electorate. Clearly the Green Party would squeezed from any dataset. need to adopt a different strategy under a FPTP system. New Zealand First is in the same position. Background information While there are 120 seats in Parliament there are The statistics only 71 electorates around the country, including On page 2 we set the scene for the country as a the seven Māori seats. whole. We take a look at the overall proportions for each party and set the scene in terms of age, Nationwide results income and family makeup. The chart below illustrates the clear victory to Then further on we get to the interesting parts: National. -

FINAL RESULTS for the 2017 NEW ZEALAND GENERAL ELECTION December 2017

FINAL RESULTS FOR THE 2017 NEW ZEALAND GENERAL ELECTION December 2017 Parliamentary Library Research Paper Final Results after Special Votes The General Election of 23 September 2017 was New Zealand’s 52nd since general elections began in 1853. It was the eighth election conducted under the Mixed Member Proportional (MMP) voting system that was used first for the 1996 election. Following the counting of special votes and the release of the official results, there are five political parties and 120 members represented in the 52nd Parliament. This research paper summarizes differences between the preliminary (election night count) and the final election results, compares the 2017 election result with that of 2014, shows trends in voter turnout, and analyses the demographic makeup of the 52nd Parliament. Figure 1: Location of polling stations for the 2017 election FinalImmigration results forchronology: the 2017 N selectedew Zealand events General 1840 Election-2017 Parlia 27mentary February Library 2017 Research Paper 2017/041 1 Figure 1 shows the location of the nearly 2,400 polling booths for the general electorates in New Zealand. On average there are 37 polling booths per general electorate; the highest number occurs in the Northland electorate (97), while Pakuranga and Kelston have the fewest polling booths (17 each). The largest general electorate, Clutha-Southland has an area of 37,378 sq km and 69 polling booths, or 1 booth per 542 sq km. Mt Albert is the general electorate with the highest density of polling booths – 1 booth per 0.8 sq km. Voting in the 2017 General Election began on 6 September when voters from overseas could download voting papers, vote in person at overseas posts, or vote by post. -

Dissertation (1.566Mb)

Determinants and Dynamics of New Zealand Housing Prices: National- and Regional- Level Analyses Olga Koveshnikova A dissertation submitted to Auckland University of Technology in partial fulfilment of the requirements for the degree of Master of Business (MBus) 2017 School of Business Auckland University of Technology ABSTRACT In this study we set out to find if macroeconomic factors have any strong association with house prices in New Zealand. To conduct our empirical analysis, we used a unique dataset with Residential Property Prices Indices with monthly frequency from SIRCA. The data sample spans 13 years from December 2003 to January 2017. Long run (cointegration) relationships and short run (error correction) relationships are estimated across 14 regions within New Zealand. The results of our empirical study indicate that house prices at both national and regional level between 2003 and 2017 are positively determined by household income in the long run. The impact of mortgage rate on housing indices is different for before and after crises subperiods: positive influence before and negative after crisis. In short- term relationships between changes in residential property price indices and their determinants at national level indicate that household income and population growth positively influence property prices, while mortgage rate increases lead to a decrease in house prices. Regions exhibit different short run behaviours across New Zealand in the responsiveness to the economic and demographic indicators change. We also analyse whether the movement of price in Auckland spillover to the neighbour Auckland cities and the other main cities of New Zealand. To do that, we estimate multivariate VAR models and then conduct a Granger causality test, impulse response functions and Variance Decomposition. -

Roll of Members of the New Zealand House of Representatives, 1854 Onwards

Roll of members of the New Zealand House of Representatives, 1854 onwards Sources: New Zealand Parliamentary Record, Newspapers, Political Party websites, New Zealand Gazette, New Zealand Parliamentary Debates (Hansard), Political Party Press Releases, Appendix to the Journal of the House of Representatives, E.9. Last updated: 17 November 2020 Abbreviations for the party affiliations are as follows: ACT ACT (Association of Consumers and Taxpayers) Lib. Liberal All. Alliance LibLab. Liberal Labour CD Christian Democrats Mana Mana Party Ch.H Christian Heritage ManaW. Mana Wahine Te Ira Tangata Party Co. Coalition Maori Maori Party Con. Conservative MP Mauri Pacific CR Coalition Reform Na. National (1925 Liberals) CU Coalition United Nat. National Green Greens NatLib. National Liberal Party (1905) ILib. Independent Liberal NL New Labour ICLib. Independent Coalition Liberal NZD New Zealand Democrats Icon. Independent Conservative NZF New Zealand First ICP Independent Country Party NZL New Zealand Liberals ILab. Independent Labour PCP Progressive Coalition ILib. Independent Liberal PP Progressive Party (“Jim Anderton’s Progressives”) Ind. Independent R Reform IP. Independent Prohibition Ra. Ratana IPLL Independent Political Labour League ROC Right of Centre IR Independent Reform SC Social Credit IRat. Independent Ratana SD Social Democrat IU Independent United U United Lab. Labour UFNZ United Future New Zealand UNZ United New Zealand The end dates of tenure before 1984 are the date the House was dissolved, and the end dates after 1984 are the date of the election. (NB. There were no political parties as such before 1890) Name Electorate Parl’t Elected Vacated Reason Party ACLAND, Hugh John Dyke 1904-1981 Temuka 26-27 07.02.1942 04.11.1946 Defeated Nat. -

Quality of Life Book 4

QUALITY OF LIFE IN NEW ZEALAND’S SIX LARGEST CITIES Foreword from the Mayors Improving the quality of life of people is perhaps the most important role of local and central government. This first Quality of Life report presents a picture of wellbeing in New Zealand’s six most populated cities. These cities are great places to live, work and play and are vibrant with a rich diversity of people from different cultures and backgrounds. However some communities are excluded from the social and economic benefits that others in our cities are enjoying. In fact the inequalities have been widening. By monitoring the complex factors that interplay in assessing quality of life, we can continue to address these issues and pinpoint areas for further action. Addressing the matters raised in this report requires a co-operative effort by local and central government, community organisations, businesses and citizens. The report is an extremely important document that will prove invaluable as we strive to measure our progress as cities and improve the quality of life of those who live in them. It is also a valuable information resource that will stimulate debate and focus planning, policies and decision making. The work provides an excellent example of how local authorities can work together to deliver common outcomes. The Councils involved remain committed to ensuring their cities are vibrant, exciting urban centres. All are already taking action through partnerships with central government and the community sector in areas such as affordable housing, health and employment. Continuing to work together can positively impact on the challenges raised in this report to ensure that quality of life in cities remains a priority for all. -

GRANTEES :: from 2009 to 2014

GRANT RECIPIENTS GRANTEES :: FROM 2009 to 2014 December, 2014 Funding Round Co-Location of Child & Family Social Services - $10,000.00 Purpose: To co-locate several Canterbury agencies and deliver increased support to vulnerable families. Organisations: Aviva, Family Help Trust, Barnardos New Zealand, He Waka Tapu RAW 2014 Ltd Corrections Initiative - $10,000.00 Purpose: To work with the Department of Corrections to reduce the cycle of family violence through education and mentoring of women prisoners. Organisations: RAW 2014 Ltd, Department of Corrections Future Focus Project (Phase 2) - $16,000.00 Purpose: To progress phase two of the Future Focus project. Organisations: Birthright New Zealand Incorporated Gateway to Aquatics - $4,250.00 Purpose: To enhance the outcomes already achieved with your Gateway programme by including young Muslim women. Organisations: WaterSafe Auckland Inc, Community Leisure Management, Swimming NZ, New Zealand Maritime Museum Pick Up Collaboration - $20,000.00 Purpose: To consider how best to collaboratively approach social enterprise development. Organisations: Project Lyttelton, Youth Alive Trust, SPAN Charitable Trust – trading as SkillWise, Big Brothers Big Sisters of Christchurch, Canterbury Community Business Trust, Aviva Building Our Community Together - $15,000.00 Purpose: To recruit a project coordinator to identify opportunities for research and evaluation of potential collaborations. Organisations: Merivale Community Centre, Te Tuinga Whanau, Merivale Community Garden, Employ NZ, Homes -

'New Zealand Economy Appears to Be Improving' While Labour Electorates

Article No. 5709 Available on www.roymorgan.com Roy Morgan New Zealand Electorate Profiles Measuring Public Opinion for over 70 Years National electorates more likely to agree ‘New Zealand economy appears to be improving’ while Labour electorates tend to disagree Qualitative research conducted around New Zealand over the past three years reveals that National electorates are, in general, far more likely to agree with the statement that the ‘New Zealand economy appears to be improving’ than Labour electorates. This is not altogether surprising given that National have been the governing party in New Zealand since John Key came to power after the 2008 New Zealand election – but it is very good news for Key as he faces re-election in late September when he tries to win a third term as Prime Minister. Analysing agreement with this question by electorate over the period since the last New Zealand election (since December 2011) shows the highest E agreement with the statement the “New Zealand economy appears to be E improving” is actually in the National-aligned Act NZ electorate of Epsom (56.8%) agree with the statement. Epsom is followed by the National electorates of Hamilton East (50.8%), Pakuranga (49.8%), North Shore (48.9%), Auckland Central (48.5%), Selwyn (48.4%) and East Coast Bays (48.4%). In addition, agreement is also high in the new electorates of Upper Harbour (49.8%). In contrast, agreement with this statement is lowest in primarily Labour electorates – lowest of all in Manukau East (34.4%), Dunedin South (34.4%) and Manurewa (34.6%) – all Labour electorates.