Commodity Traders in a Storm: Financialization, Corporate Power and Ecological Crisis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Middle East Oil Pricing Systems in Flux Introduction

May 2021: ISSUE 128 MIDDLE EAST OIL PRICING SYSTEMS IN FLUX INTRODUCTION ........................................................................................................................................................................ 2 THE GULF/ASIA BENCHMARKS: SETTING THE SCENE...................................................................................................... 5 Adi Imsirovic THE SHIFT IN CRUDE AND PRODUCT FLOWS ..................................................................................................................... 8 Reid l'Anson and Kevin Wright THE DUBAI BENCHMARK: EVOLUTION AND RESILIENCE ............................................................................................... 12 Dave Ernsberger MIDDLE EAST AND ASIA OIL PRICING—BENCHMARKS AND TRADING OPPORTUNITIES......................................... 15 Paul Young THE PROSPECTS OF MURBAN AS A BENCHMARK .......................................................................................................... 18 Michael Wittner IFAD: A LURCHING START IN A SANDY ROAD .................................................................................................................. 22 Jorge Montepeque THE SECOND SPLIT: BASRAH MEDIUM AND THE CHALLENGE OF IRAQI CRUDE QUALITY...................................... 29 Ahmed Mehdi CHINA’S SHANGHAI INE CRUDE FUTURES: HAPPY ACCIDENT VERSUS OVERDESIGN ............................................. 33 Tom Reed FUJAIRAH’S RISE TO PROMINENCE .................................................................................................................................. -

The Profitable and Untethered March to Global Resource Dominance!

Athens Journal of Business and Economics X Y GlencoreXstrata… The Profitable and Untethered March to Global Resource Dominance! By Nina Aversano Titos Ritsatos† Motivated by the economic causes and effects of their merger in 2013, we study the expansion strategy deployment of Glencore International plc. and Xstrata plc., before and after their merger. While both companies went through a series of international acquisitions during the last decade, their merger is strengthening effective vertical integration in critical resource and commodity markets, following Hymer’s theory of internationalization and Dunning’s theory of Eclectic Paradigm. Private existence of global dominant positioning in vital resource markets, posits economic sustainability and social fairness questions on an international scale. Glencore is alleged to have used unethical business tactics, increasing corruption, tax evasion and money laundering, while attracting the attention of human rights organizations. Since the announcement of their intended merger, the company’s market performance has been lower than its benchmark index. Glencore’s and Xstrata’s economic success came from operating effectively and efficiently in markets that scare off risk-averse companies. The new GlencoreXstrata is not the same company anymore. The Company’s new capital structure is characterized by controlling presence of institutional investors, creating adherence to corporate governance and increased monitoring and transparency. Furthermore, when multinational corporations like GlencoreXstrata increase in size attracting the attention of global regulation, they are forced by institutional monitoring to increase social consciousness. When ensuring full commitment to social consciousness acting with utmost concern with regard to their commitment by upholding rules and regulations of their home or host country, they have but to become “quasi-utilities” for the global industry. -

Foreignpolicyleopold

Foreign Policy VOICE The 750 Million Dollar Man How a Swiss commodities giant used shell companies to make an Angolan general three-quarters of a billion dollars richer. BY Michael Weiss FEBRUARY 13, 2014 Revolutionary communist regimes have a strange habit of transforming themselves into corrupt crony capitalist ones and Angola -- with its massive oil reserves and budding crop of billionaires -- has proved no exception. In 2010, Trafigura, the world’s third-largest private oil and metals trader based in Switzerland, sold an 18.75-percent stake in one of its major energy subsidiaries to a high-ranking and influential Angolan general, Foreign Policy has discovered. The sale, which amounted to $213 million, appears on the 2012 audit of the annual financial statements of a Singapore-registered company, which is wholly owned by Gen. Leopoldino Fragoso do Nascimento. Details of the sale and purchaser are also buried within a prospectus document of the sold company which was uploaded to the Luxembourg Stock Exchange within the last week. “General Dino,” as he’s more commonly called in Angola, purchased the 18.75 percent stake not in any minor bauble, but in a $5 billion multinational oil company called Puma Energy International. By 2011, his shares were diluted to 15 percent; but that’s still quite a hefty prize: his stake in the company is today valued at around $750 million. The sale illuminates not only a growing and little-scrutinized relationship between Trafigura, which earned nearly $1 billion in profits in 2012, and the autocratic regime of 71-year-old Angolan President Jose Eduardo dos Santos, who has been in power since 1979 -- but also the role that Western enterprise continues to play in the Third World. -

Vitol-Brochure-2019 FINAL-1.Pdf

02 VITOL | Contents Vitol 04 VLC Renewables 14 Vitol at a glance 05 Our investments 16 Operating Globally 08 VTTI 17 Trading portfolio 10 Vitol Aviation 17 Crude oil 10 Viva Energy 18 Middle distillates 10 Vivo Energy 18 Gasoline 10 Petrol Ofisi 19 Biofuel 11 OVH Energy 19 Fuel oil 11 VARO 20 Naphtha 12 Rodoil 20 Bitumen 12 Hascol 20 Coal 13 Cockett Marine Oil 20 Liquid petroleum gas (LPG) 13 VPI Immingham 21 Liquefied natural gas (LNG) 13 VLC Renewables 21 Natural gas 13 Exploration and production 24 Power 14 Vitol Foundation 25 Renewables 14 Our worldwide capabilities 26 Shipping 14 VITOL VITOL | 03 Vitol Vitol is at the For over 50 years Vitol has served the Responsibility heart of the world’s world’s energy markets, trading over We are mindful of the risks associated seven million barrels of crude oil and with handling energy. Our assets energy flows. Every products a day and delivering energy operate to international HSE standards day we use our products to countries worldwide. and we expect the same of our partners expertise and throughout the energy chain. We seek logistical networks Our customers include national oil to conduct our business in line with to distribute energy companies, multinationals, leading the ten principles of the UN Global industrial and chemical companies and Compact and to work with partners around the world, the world’s largest airlines. We deliver who share our commitment to high efficiently and the products they need on time and to standards of operation. responsibly. specification by sourcing and managing the movement of energy through the relevant infrastructures. -

GLENCORE: a Guide to the 'Biggest Company You've Never Heard

GLENCORE: a guide to the ‘biggest company you’ve never heard of’ WHO IS GLENCORE? Glencore is the world’s biggest commodities trading company and 16th largest company in the world according to Fortune 500. When it went public, it controlled 60% of the zinc market, 50% of the trade in copper, 45% of lead and a third of traded aluminium and thermal coal. On top of that, Glencore also trades oil, gas and basic foodstuffs like grain, rice and sugar. Sometimes refered to as ‘the biggest company you’ve never heard of’, Glencore’s reach is so vast that almost every person on the planet will come into contact with products traded by Glencore, via the minerals in cell phones, computers, cars, trains, planes and even the grains in meals or the sugar in drinks. It’s not just a trader: Glencore also produces and extracts these commodities. It owns significant mining interests, and in Democratic Republic of Congo it has two of the country’s biggest copper and cobalt operations, called KCC and MUMI. Glencore listed on the London Stock Exchange in 2011 in what is still the biggest ever Initial Public Offering (IPO) in the stock exchange’s history, with a valuation of £36bn. Glencore started life as Marc Rich & Co AG, set up by the eponymous and notorious commodities trader in 1974. In 1983 Rich was charged in the US with massive tax evasion and trading with Iran. He fled to Switzerland and lived in exile while on the FBI's most-wanted list for nearly two decades. -

Chapter 48 – Creative Destructor

Chapter 48 Creative destructor Starting in the late 19th century, when the Hall-Heroult electrolytic reduction process made it possible for aluminum to be produced as a commodity, aluminum companies began to consolidate and secure raw material sources. Alcoa led the way, acquiring and building hydroelectric facilities, bauxite mines, alumina refineries, aluminum smelters, fabricating plants and even advanced research laboratories to develop more efficient processing technologies and new products. The vertical integration model was similar to the organizing system used by petroleum companies, which explored and drilled for oil, built pipelines and ships to transport oil, owned refineries that turned oil into gasoline and other products, and even set up retail outlets around the world to sell their products. The global economy dramatically changed after World War II, as former colonies with raw materials needed by developed countries began to ask for a piece of the action. At the same time, more corporations with the financial and technical means to enter at least one phase of aluminum production began to compete in the marketplace. As the global Big 6 oligopoly became challenged on multiple fronts, a commodity broker with a Machiavellian philosophy and a natural instinct for deal- making smelled blood and started picking the system apart. Marc Rich began by taking advantage of the oil market, out-foxing the petroleum giants and making a killing during the energy crises of the 1970s. A long-time metals trader, Rich next eyed the weakened aluminum industry during the 1980s, when depressed demand and over-capacity collided with rising energy costs, according to Shawn Tully’s 1988 account in Fortune. -

Corporate-Brochure 2020.Pdf

02 VITOL | Contents Vitol 04 VLC Renewables 14 Vitol at a glance 05 Our investments 16 Operating Globally 08 VTTI 17 Trading portfolio 10 Vitol Aviation 17 Crude oil 10 Viva Energy 18 Middle distillates 10 Vivo Energy 18 Gasoline 10 Petrol Ofisi 19 Biofuel 11 OVH Energy 19 Fuel oil 11 VARO 20 Naphtha 12 Rodoil 20 Bitumen 12 Hascol 20 Coal 13 Cockett Marine Oil 20 Liquid petroleum gas (LPG) 13 VPI Immingham 21 Liquefied natural gas (LNG) 13 VLC Renewables 21 Natural gas 13 Exploration and production 24 Power 14 Vitol Foundation 25 Renewables 14 Our worldwide capabilities 26 Shipping 14 VITOL VITOL | 03 Vitol Vitol is at the For over 50 years Vitol has served the Responsibility world’s energy markets, trading over We are mindful of the risks associated heart of the world’s eight million barrels of crude oil and with handling energy. Our assets energy flows. Every products a day and delivering energy operate to international HSE standards day we use our products to countries worldwide. and we expect the same of our partners expertise and throughout the energy chain. We seek logistical networks Our customers include national oil to conduct our business in line with to distribute energy companies, multinationals, leading the ten principles of the UN Global industrial and chemical companies and Compact and to work with partners around the world, the world’s largest airlines. We deliver who share our commitment to high efficiently and the products they need on time and to standards of operation. responsibly. specification by sourcing and managing the movement of energy through the relevant infrastructures. -

Oil and Gas News Briefs, December 3, 2018

Oil and Gas News Briefs Compiled by Larry Persily December 3, 2018 First Nation approves benefits agreements for LNG project in B.C. (Vancouver Sun; Nov. 29) - It wasn’t an easy decision for the Squamish First Nation to approve the C$1.6 billion Woodfibre LNG project 35 miles north of Vancouver, B.C., according to a spokesman, but it came with potential benefits of cash and land. The First Nation council approved three economic benefits agreements last week — one each with Woodfibre LNG, pipeline company FortisBC and the province, “contingent on the environmental conditions being met,” according to a news release Nov. 29. The 40-year agreements include cash totaling C$225.65 million, 1,600 short-term and 330 long-term jobs, business opportunities, and land transfers of almost 1,100 acres. “Communities are sometimes faced with difficult decisions and it is recognized that this was a difficult decision for many,” said Squamish Councillor Khelsilem, whose English name is Dustin Rivers. “As agreed by the proponents, we will be co-developing management plans for the project and will have our own monitors on the ground to report on any non-compliance with cultural, employment, and training conditions.” Work is expected to start next fall at the former pulp mill site. At full operation, the plant will be capable of making 2.1 million tonnes of LNG per year. The money will be paid to the First Nation at project milestones, including the start of construction and start of operations. Other payments will go toward a cultural fund for the Indigenous community and training and education programs. -

Vitol Pays $164 Mln to Resolve U.S. Allegations of Oil Bribes in Latin

December 4, 2020 Vitol pays $164 mln to resolve U.S. allegations of according to the DOJ statement. oil bribes in Latin America Prosecutors said the bribes went to employees at Mexico's Vitol Group's U.S. subsidiary agreed to pay $164 state-run Pemex and Ecuadorian state oil company million to resolve probes by the U.S. government that Petroecuador. the energy trader paid bribes in Brazil and other Petroecuador and Pemex did not respond to requests for countries to boost its oil trading business, the U.S. comment. Department of Justice said on Thursday. Brazilian prosecutors announced in late 2018 that they Under a three-year deferred prosecution agreement, were investigating Petrobras' oil deals with trading houses, the Swiss trading firm admitted guilt and agreed to including the world's biggest oil traders - Vitol, Trafigura improve internal reporting and compliance functions. and Glencore. Vitol, run out of London, is the world's largest In early 2019, the DOJ opened its own probe into the three independent oil trader, trading some 8 million barrels company's dealings in Brazil. The FBI investigated two key of oil a day. Vitol executives who were overseeing the region during "Vitol paid bribes to government officials in Brazil, those years, including the head of Vitol's U.S. arm, Michael Ecuador and Mexico to win lucrative business "Mike" Loya, who retired earlier this year. contracts and obtain competitive advantages to which Loya did not immediately respond to a message sent to his they were not fairly entitled," Acting U.S. Attorney LinkedIn account. -

Redstone Commodity Update Q3

Welcome to the Redstone Commodity Update 2020: Q3 Welcome to the Redstone Commodity Moves Update Q3 2020, another quarter in a year that has been strongly defined by the pandemic. Overall recruitment levels across the board are still down, although we have seen some pockets of hiring intent. There appears to be a general acknowledgement across all market segments that growth must still be encouraged and planned for, this has taken the form in some quite senior / structural moves. The types of hires witnessed tend to pre-empt more mid-junior levels hires within the same companies in following quarters, which leaves us predicting a stronger than expected finish to Q4 2020 and start to Q1 2021 than we had previously planned for coming out of Q2. The highest volume of moves tracked fell to the energy markets, notably, within power and gas and not within the traditional oil focused roles, overall, we are starting to see greater progress towards carbon neutrality targets. Banks such as ABN, BNP and SocGen have all reduced / pulled out providing commodity trade finance, we can expect competition for the acquiring of finance lines to heat up in the coming months until either new lenders step into the market or more traditional lenders swallow up much of the market. We must also be aware of the potential impact of the US elections on global trade as countries such as Great Britain and China (amongst others) await the outcome of the impending election. Many national trade strategies and corporate investment strategies will hinge on this result in a way that no previous election has. -

Financing Options in the Oil and Gas Industry, Practical Law UK Practice Note

Financing options in the oil and gas industry, Practical Law UK Practice Note... Financing options in the oil and gas industry by Suzanne Szczetnikowicz and John Dewar, Milbank, Tweed, Hadley & McCloy LLP and Practical Law Finance. Practice notes | Maintained | United Kingdom Scope of this note Industry overview Upstream What is an upstream oil and gas project? Typical equity structure Relationship with the state Key commercial contracts in an upstream project Specific risks in financing an upstream project Sources of financing in the upstream sector Midstream, downstream and integrated projects Typical equity structures What is a midstream oil and gas project? Specific risks in financing a midstream project What is a downstream oil and gas project? Specific risks in financing a downstream project Integrated projects Sources of financing in midstream, downstream and integrated projects Multi-sourced project finance Shareholder funding Equity bridge financing Additional sources of financing Other financing considerations for the oil and gas sectors Expansion financings Hedging Refinancing Current market trends A note on the structures and financing options and risks typically associated with the oil and gas industry. © 2018 Thomson Reuters. All rights reserved. 1 Financing options in the oil and gas industry, Practical Law UK Practice Note... Scope of this note This note considers the structures, financing options and risks typically associated with the oil and gas industry. It is written from the perspective of a lawyer seeking to structure a project that is capable of being financed and also addresses the aspects of funding various components of the industry from exploration and extraction to refining, processing, storage and transportation. -

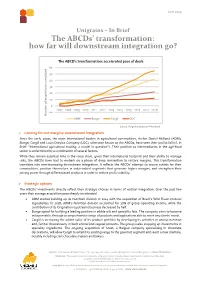

The Abcds' Transformation: How Far Will Downstream Integration

June 2019 Unigrains – In Brief The ABCDs’ transformation: how far will downstream integration go? The ABCD's transformation: accelerated pace of deals 60 50 40 30 20 10 0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 -10 Number Number acquisitions of cumulated ADM Bunge Cargill LDC Source: Unigrains based on Pitchbook ➢ Looking for lost margins: downstream integration Since the early 2010s, the main international traders in agricultural commodities, Archer Daniel Midland (ADM), Bunge, Cargill and Louis Dreyfus Company (LDC), otherwise known as the ABCDs, have seen their profits fall (cf. In Brief: “International agricultural trading: a model in question”). Their position as intermediaries in the agri-food sector is undermined by a combination of several factors. While they remain essential links in the value chain, given their international footprint and their ability to manage risks, the ABCDs have had to embark on a phase of deep reinvention to restore margins. This transformation translates into ever-increasing downstream integration. It reflects the ABCDs’ attempt to secure outlets for their commodities, position themselves in value-added segments that generate higher margins, and strengthen their pricing power through differentiated products in order to reduce profit volatility. ➢ Strategic options The ABCDs’ investments directly reflect their strategic choices in terms of vertical integration. Over the past few years their average acquisition pace sharply accelerated. • ADM started building up its Nutrition division in 2014 with the acquisition of Brazil’s Wild Flavor (natural ingredients). In 2018, ADM’s Nutrition division accounted for 10% of group operating income, while the contribution of its Origination (upstream) business decreased by half.