Lephalale – Limpopo

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sub-National Governments and Foreign Policy: the Case of the Limpopo Province in South Africa

SUB-NATIONAL GOVERNMENTS AND FOREIGN POLICY: THE CASE OF THE LIMPOPO PROVINCE IN SOUTH AFRICA by Vhulenda Edna Matshili Submitted in accordance with the requirements of the degree of Masters of Arts in the subject Politics at the University of South Africa Supervisor: Professor Jo-Ansie van Wyk 2013 DECLARATION I declare that “Sub-national governments and foreign policy: The case of the Limpopo province in South Africa ” is my own work and that all the sources that I have used or quoted have been indicated and acknowledged by means of complete references. ________________________ _____________________ Signature Date (Miss Vhulenda Edna Matshili) i ABSTRACT The aim of this study is to analyse and describe the role of sub-national governments (SNG’s) in foreign policy and how the conduct of diplomacy has developed in the South African context, and to assess why and how provinces engage in this phenomenon. The theoretical approach to this study is embedded in neo- functionalism. In order to illustrate this, the South African province, the Limpopo Province is used as an illustrative case study. In particular, the study will analyse the role of the International Relations Unit (IRU) within the Office of the Premier (OtP) in the Limpopo Province as a case study. Limpopo is the main focus of this study because it, inter alia, borders on three sovereign states (Botswana, Mozambique and Zimbabwe) which place the province in a good position to engage in international relations, mutual intentions and friendly relations with its neighbouring and other distant countries. The results of this study is that provinces have become important foreign policy and international relations actors in the area of low politics; however the national government remains as the main actor in the international relations and foreign policy making process. -

Proposed Coal-Fired Power Stations and Associated Infrastructure in the Waterberg, Limpopo

Report No: [4793A/402719] ENVIRONMENTAL IMPACT ASSESSMENT PROCESS: PROPOSED COAL-FIRED POWER STATIONS AND ASSOCIATED INFRASTRUCTURE IN THE WATERBERG, LIMPOPO FINAL SCOPING REPORT March 2009 LEAD CONSULTANT PROPONENT Ninham Shand (Pty) Ltd. Eskom Holdings Ltd. 81 Church Street Eskom Generation PO Box 1347 Megawatt Park Cape Town Maxwell Drive 8000 Sandton, 2199 Tel: (021) 481 2400 Tel: (011) 800 3501 Fax: (021) 424 5588 Fax : (011) 800 5140 Email: [email protected] Website : www.eskom.co.za PROPOSED COAL-FIRED POWER STATIONS IN THE WATERBERG, LIMPOPO: SCOPING REPORT Page i PROJECT DETAILS DEAT REFERENCE NO. : 12/12/20/1255 TITLE : FINAL SCOPING REPORT AUTHORS : Louise Corbett, Ashwin West, Brett Lawson SUBCONSULTANTS : AirShed Planning Professionals Golder Associates Groundwater Consulting Services InfoTox Ivuzi Johnny van Schalkwyk (Private Consultant) Jongens Keet Associates Makecha Development Association Ndodana Consulting Engineers Ptersa Environmental Management Consultants Riscom Smith, Summers, Ndlovu Associates Strategic Environmental Focus Urban-Econ Zitholele Consulting CLIENT : Eskom Holdings Limited (Generation Division) REPORT STATUS : Final REPORT NUMBER : 4793A/402719 REPORT DATE : 31 March 2009 ................................................ ………........................................... LOUISE CORBETT ASHWIN WEST (Pr. Sci Nat) Environmental Practitioner Associate: Environmental Discipline Group ................................................ BRETT LAWSON (Cert. EAPSA)(Pr Sci Nat) Associate: Environmental Discipline -

Management Has Reviewed the Request for Inspection of the Republic of South Africa Eskom Investment Support Project (Lbrd Loan No

BANK MANAGEMENT RESPONSE TO REQUEST FOR INSPECTION PANEL REVIEW OF THE REPUBLIC OF SOUTH AFRICA ESKOM INVESTMENT SUPPORT PROJECT (IBRD Loan No. 78620) Management has reviewed the Request for Inspection of the Republic of South Africa Eskom Investment Support Project (lBRD Loan No. 78620), received by the Inspection Panel on April 6, 2010 and registered on April 7, 2010 (RQI0/03). Management has prepared the following response. May 25,2010 Eskom Investment Support Project CONTENTS Abbreviations and Acronyms ......................................................................................... iii Executive Summary ......................................................................................................... iv I. INTRODUCTION.................................................................................................... 1 II. THE REQ VEST ....................................................................................................... 1 III. COUNTRY CONTEXT AND PROJECT BACKGROUND ............................... 2 IV. SPECIAL ISSUES ................................................................................................... 7 V. MANAGEMENT'S RESPONSE .......................................................................... 20 ANNEXES Annex 1. Claims and Responses MAPS IBRD 37886 South Africa - Eskom Investment Support Project, Request for Inspection (project area) IBRD 37853 South Africa - Eskom Investment Support Project, Request for Inspection (detail) ii Republic ofSouth Africa ABBREVIATIONS AND ACRONYMS -

Positive Actions in Turbulent Times

positive actions in turbulent times Our strategy remains unchanged and our value proposition intact. Balancing short-term needs and long-term sustainability, we have continued to renew our business basics, preserving Sasol’s robust fundamentals and delivering a solid performance in deteriorating markets. Our pipeline of growth projects remains strong, even though we have reprioritised capital spending. With our shared values as our guide, we have dealt decisively with disappointments and unprecedented challenges. We are confident that our positive actions will help us navigate the storm and emerge stronger than before. About Sasol sasol annual review and summarised financial information 2009 financial information and summarised review sasol annual Sasol is an energy and chemicals company. We convert coal and gas into liquid fuels, fuel components and chemicals through our proprietary Fischer-Tropsch (FT) processes. We mine coal in South Africa, and produce gas and condensate in Mozambique and oil in Gabon. We have chemical manufacturing and marketing operations in South Africa, Europe, the Middle East, Asia and the Americas. In South Africa, we refine imported crude oil and retail liquid fuels through our network of Sasol convenience centres. We also supply fuels to other distributors in the region and gas to industrial customers in South Africa. Based in South Africa, Sasol has operations in 38 countries and employs some 34 000 people. We continue to pursue international opportunities to commercialise our gas-to-liquids (GTL) and coal-to-liquids (CTL) technology. In partnership with Qatar Petroleum we started up our first international GTL plant, Oryx GTL, in Qatar in 2007. -

Focused and Energised About Sasol

sustainable development report 2010 focused and energised about sasol Sasol is an energy and chemicals company. We are technology driven, converting gas and coal into liquid fuels, fuel components and chemicals through our proprietary processes. We are focused on commercialising our gas-to-liquids (GTL) and coal- to-liquids (CTL) technology internationally. We mine coal in South Africa, and produce gas and condensate in Mozambique and oil in Gabon. We continue to advance our upstream oil and gas activities in Mozambique, Nigeria, Gabon, South Africa, Papua New Guinea and Australia. In South Africa, we refi ne imported crude oil and retail liquid fuels through our network of Sasol convenience centres, and supply gas to industrial customers. We also supply fuel to other distributors in the region. We have chemical manufacturing and marketing operations in South Africa, Europe, the Middle East, Asia and the Americas. Formed in 1950, Sasol has been producing liquid fuels since 1955. Sasol is listed on the JSE Limited in South Africa and the New York Stock Exchange. our vision A more detailed review of Sasol’s primary brands, products and services, its operational structure, the countries in which it operates, and the primary markets served To grow profi tably, sustainably and inclusively is provided on our website while delivering value to stakeholders http://sasolsdr.com through proprietary technology and the talent of our people in the energy GRI – 2.1 – 2.8 and chemical markets in Southern Africa and worldwide. sasol’s values The Sasol group’s vision, strategic growth drivers and daily business operations are founded on, and inspired by, six shared values: Customer focus Safety Continuous improvement We meet customers’ needs by providing We commit to eliminate all incidents Our innovative spirit drives us as we world-class service, optimal product and work to world-class safety standards. -

South African Police Service South African Police Service Annual Report 2017/2018 Annual Report 2017/2018 Part A

SOUTH AFRICAN POLICE SERVICE SOUTH AFRICAN POLICE SERVICE ANNUAL REPORT 2017/2018 ANNUAL REPORT 2017/2018 PART A A SOUTH AFRICAN POLICE SERVICE SOUTH AFRICAN POLICE SERVICE PART A ANNUAL REPORT 2017/2018 ANNUAL REPORT 2017/2018 B SOUTH AFRICAN POLICE SERVICE SOUTH AFRICAN POLICE SERVICE ANNUAL REPORT 2017/2018 ANNUAL REPORT 2017/2018 Compiled by South African Police Service (SAPS) Strategic Management Layout and Design SAPS Corporate Communication and Liaison Photographs SAPS Corporate Communication and Liaison Language Editing SAPS Strategic Management Further information on the Annual Report for the National Commissioner of the South African Police Service, for 2017/2018, can be obtained from: SAPS Strategic Management (Head Office) Telephone: 012 393 3082 RP Number: 328/2018 ISBN Number: 978-0-621-46664-5 i SOUTH AFRICAN POLICE SERVICE SOUTH AFRICAN POLICE SERVICE ANNUAL REPORT 2017/2018 ANNUAL REPORT 2017/2018 SUBMISSION OF THE ANNUAL REPORT TO THE MINISTER OF POLICE Mr BH Cele, MP MINISTER OF POLICE I have the honour of submitting the Annual Report of the Department of Police, for the period 1 April 2017 to 31 March 2018. GENERAL KJ SITOLE (SOEG) 31 August 2018 ii SOUTH AFRICAN POLICE SERVICE SOUTH AFRICAN POLICE SERVICE ANNUAL REPORT 2017/2018 ANNUAL REPORT 2017/2018 TABLE OF CONTENTS PART A: GENERAL INFORMATION 1 1. General Information of the Department 1 2. List of Abbreviations/Acronyms 2 3. Foreword by the Minister 6 4. Deputy Minister’s Statement 9 5. Report of the Accounting Officer 11 6. Statement of Responsibility and Confirmation of Accuracy of the Annual Report 24 7. -

Spatial Transformation: Are Intermediate Cities Different? South African Cities Network: Johannesburg

CENTRE FOR DEVELOPMENT SUPPORT SENTRUM VIR ONTWIKKELINGSTEUN ACKNOWLEDGEMENTS Lead authors: Lochner Marais (University of the Free State) Danie Du Plessis (Stellenbosch University) Case study authors: Drakenstein: Ronnie Donaldson (Stellenbosch University) King Sabata Dalindyebo: Esethu Ndzamela (Nelson Mandela University) and Anton De Wit (Nelson Mandela University Lephalale: Kgosi Mocwagae (University of the Free State) Matjhabeng: Stuart Denoon-Stevens (University of the Free State) Mahikeng: Verna Nel (University of the Free State) and James Drummond (North West University) Mbombela: Maléne Campbell (University of the Free State) Msunduzi: Thuli Mphambukeli (University of the Free State) Polokwane: Gemey Abrahams (independent consultant) Rustenburg: John Ntema (University of South Africa) Sol Plaatje: Thomas Stewart (University of the Free State) Stellenbosch: Danie Du Plessis (Stellenbosch University) Manager: Geci Karuri-Sebina Editing by Write to the Point Design by Ink Design Photo Credits: Page 2: JDA/SACN Page 16: Edna Peres/SACN Pages 18, 45, 47, 57, 58: Steve Karallis/JDA/SACN Page 44: JDA/SACN Page 48: Tanya Zack/SACN Page 64: JDA/SACN Suggested citation: SACN. 2017. Spatial Transformation: Are Intermediate Cities Different? South African Cities Network: Johannesburg. Available online at www.sacities.net ISBN: 978-0-6399131-0-0 © 2017 by South African Cities Network. Spatial Transformation: Are Intermediate Cities Different? is made available under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License. To view a copy of this license, visit http://creativecommons.org/licenses/by-nc-sa/4.0/. 2 SPATIAL TRANSFORMATION: ARE INTERMEDIATE CITIES DIFFERENT? Foreword As a network whose primary stakeholders are the largest cities, the South African Cities Network (SACN) typically focuses its activities on the “big” end of the urban spectrum (essentially, mainly the metropolitan municipalities). -

Written Statement of Mxolisi Mgojo, the Chief Executive Officer Of

1 PUBLIC ENTERPRISES PORTFOLIO COMMITTEE INQUIRY INTO ESKOM, TRANSNET AND DENEL WRITTEN STATEMENT OF MXOLISI MGOJO, THE CHIEF EXECUTIVE OFFICER OF EXXARO RESOURCES LIMITED INTRODUCTION ...................................................................................................... 2 COST-PLUS MINES VERSUS COMMERCIAL MINES .......................................... 5 THE SO-CALLED “PRE-PAYMENT” FOR COAL ................................................. 9 PREJUDICE TO EXXARO’S COST-PLUS MINES AND MAFUBE ..................... 11 Introduction ........................................................................................................... 11 Arnot mine ............................................................................................................. 12 Eskom’s failure to fund land acquisition ................................................................. 12 Non-funding of operational capital at Arnot ............................................................ 14 The termination of Arnot’s CSA .............................................................................. 15 Conclusion of the Arnot matters ............................................................................. 19 Mafube mine.......................................................................................................... 19 Matla mine ............................................................................................................. 21 Non-funding of capital of R1.8 billion for mine 1 ................................................... -

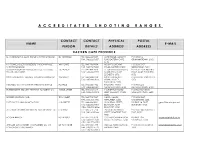

Accreditated Shooting Ranges

A C C R E D I T A T E D S H O O T I N G R A N G E S CONTACT CONTACT PHYSICAL POSTAL NAME E-MAIL PERSON DETAILS ADDRESS ADDRESS EASTERN CAPE PROVINCE D J SURRIDGE T/A ALOE RIDGE SHOOTING RANGE DJ SURRIDGE TEL: 046 622 9687 ALOE RIDGE MANLEY'S P O BOX 12, FAX: 046 622 9687 FLAT, EASTERN CAPE, GRAHAMSTOWN, 6140 6140 K V PEINKE (SOLE PROPRIETOR) T/A BONNYVALE WK PEINKE TEL: 043 736 9334 MOUNT COKE KWT P O BOX 5157, SHOOTING RANGE FAX: 043 736 9688 ROAD, EASTERN CAPE GREENFIELDS, 5201 TOMMY BOSCH AND ASSOCIATES CC T/A LOCK, T C BOSCH TEL: 041 484 7818 51 GRAHAMSTAD ROAD, P O BOX 2564, NOORD STOCK AND BARREL FAX: 041 484 7719 NORTH END, PORT EINDE, PORT ELIZABETH, ELIZABETH, 6056 6056 SWALLOW KRANTZ FIREARM TRAINING CENTRE CC WH SCOTT TEL: 045 848 0104 SWALLOW KRANTZ P O BOX 80, TARKASTAD, FAX: 045 848 0103 SPRING VALLEY, 5370 TARKASTAD, 5370 MECHLEC CC T/A OUTSPAN SHOOTING RANGE PL BAILIE TEL: 046 636 1442 BALCRAIG FARM, P O BOX 223, FAX: 046 636 1442 GRAHAMSTOWN, 6140 GRAHAMSTOWN, 6140 BUTTERWORTH SECURITY TRAINING ACADEMY CC WB DE JAGER TEL: 043 642 1614 146 BUFFALO ROAD, P O BOX 867, KING FAX: 043 642 3313 KING WILLIAM'S TOWN, WILLIAM'S TOWN, 5600 5600 BORDER HUNTING CLUB TE SCHMIDT TEL: 043 703 7847 NAVEL VALLEY, P O BOX 3047, FAX: 043 703 7905 NEWLANDS, 5206 CAMBRIDGE, 5206 EAST CAPE PLAINS GAME SAFARIS J G GREEFF TEL: 046 684 0801 20 DURBAN STREET, PO BOX 16, FORT [email protected] FAX: 046 684 0801 BEAUFORT, FORT BEAUFORT, 5720 CELL: 082 925 4526 BEAUFORT, 5720 ALL ARMS FIREARM ASSESSMENT AND TRAINING CC F MARAIS TEL: 082 571 5714 -

1 Proposed New Coal-Fired Power Station in The

PROPOSED NEW COAL-FIRED POWER STATION IN THE LEPHALALE AREA, LIMPOPO PROVINCE ENVIRONMENTAL IMPACT ASSESSMENT PUBLIC MEETING: LEPHALALE 29 March 2006 18:00 Mogol Club, Conference Room, Lephalale 1. WELCOME AND INTRODUCTION Dr. David de Waal, the facilitator, welcomed the attendants to the public meeting regarding the proposed new coal-fired power station in the Lephalale area, Limpopo Province. He indicated that the meeting proceedings would be minuted and recorded for record purposes. He said the purpose of the meeting was to: • Provide stakeholders with further information regarding the proposed new Coal- fired Power Station project; • Provide stakeholders with further information regarding the EIA and public participation process being undertaken for the proposed new Coal-fired Power Station project; • Provide a forum for stakeholders to engage with project team members; and • Provide an additional opportunity for stakeholders to formally raise any issues and concerns. The following members of the Eskom project team were introduced: • Ms. Deidre Herbst: Environmental Manager: Eskom Generation • Mr. Tony Stott: Stakeholder Manager: Eskom • Mr. Willem Laenen: Project Leader: Eskom • Mr. Nico Gewers: Chief Environmental Advisor • Mr. Heine Hoffman: Water Strategy Manager, Eskom Generation The EIA consultants present at the meeting were: • Ms. Ashlea Strong: Bohlweki Environmental: Project Manager • Mr. Gift Magangane: Bohlweki Environmental: Public Participation • Ms. Ingrid Snyman: Bohlweki Environmental: Public Participation 1 • Ms. Yvonne Scorgie: Airshed: Air Quality Impact Assessment Dr D de Waal outlined the proposed agenda. The agenda was accepted. 2. OVERVIEW OF THE ENVIRONMENTAL IMPACT ASSESSMENT PROCESS EIA AND PUBLIC PARTICIPATION Ms. Ashlea Strong provided an overview of the proposed project and gave the attendants an update on the EIA process and public participation. -

Doe-Annual-Report-2018-19.Pdf

ANNUAL REPORT 2018/2019 ANNUAL REPORT 2018/19 VOTE 26 CONTENTS PART A: GENERAL INFORMATION 5 PART C: GOVERNANCE 80 1.1 Department of Energy General 6 3.1 Introduction to Governance 81 Information 1.2 List of Abbreviations/Acronyms 7 3.2 Risk Management at the DoE 82 1.3 Foreword by the Minister of Mineral 9 3.3 Fraud and Corruption 83 Resources and Energy 1.4 Deputy Minister of Mineral Resources and 3.4 Minimising Conflict of Interest 83 12 Energy’s Statement 3.5 Code of Conduct 84 1.5 Report of the Accounting Officer 16 3.6 Health Safety and Environmental Issues 84 1.6 Vision, Mission and Values 27 3.7 Portfolio Committees 84 1.7 Legislative and Other Mandates 28 3.8 Standing Committee on Appropriations 85 1.8 Organisational Structure 29 Resolutions 1.9 Entities Reporting to the Minister 30 3.9 Prior Modifications to Audit Reports 85 1.10 Future Plans 33 3.10 Internal Control Unit 85 1.11 Statement of Responsibility and 3.11 Internal Audit and Audit Committees 85 Confirmation of Accuracy for the 35 Annual Report 3.12 Audit Committee Report 87 PART B: PERFORMANCE INFORMATION 36 PART D: HUMAN RESOURCE 90 MANAGEMENT 2.1 Performance Information 37 4.1 Human Resource Management 91 2.2 Auditor-General’s Report: Predetermined 37 Objectives 4.2 Introduction 91 2.3 Overview of Departmental Performance 37 4.3 Human Resources Oversight Statistics 92 2.4 Organisational Environment 43 2.5 Strategic Outcome Oriented Goals 44 PART E: FINANCIAL INFORMATION 121 2.6 Performance Information 50 5.1 Report of the Auditor-General to Parliament 123 on Vote -

SACAA/1008/ATO Gauteng Brakpan 2

Nr. Name of ATO Old ATO New ATO Number Province Suburb Number 1. 303 Squadron Flight School ATO 0251 SACAA/1008/ATO Gauteng Brakpan 2. 360 Aviation (Pty )Ltd ATO 0394 SACAA/1005/ATO Gauteng Wonderboom 3. 4 Aviators (Pty) Ltd ATO 0410 SACAA/1013/ATO Western Cape Cape Town 4. 43 Air School ATO 0074a SACAA/1000/ATO Gauteng Lanseria 5. 43 Air School (Pty) Ltd T/A 43 Air School ATO 0074 SACAA/1090/ATO Eastern Cape Port Elizabeth 6. 43 Air School Apprentice Training AC 018 New ATO number Eastern Cape Port Elizabeth not yet allocated 7. Accolade Aviation And Flight School (M) ATO 0104 SACAA/1015/ATO Gauteng Aero Park 8. Acend Flight Training (Pty) Ltd ATO 0401 SACAA/1027/ATO Gauteng Brits 9. Acher Aviation (Pty) Ltd T/A Acher Aviation ATO 0134 SACAA/1034/ATO Kwazulu-Natal Virginia 10. AeroMechanics (PTY) LTD AC 023 SACAA/1039/ATO Gauteng Brakpan 11. Aeronautic Solutions SA (Pty) Ltd T/A Aeronautic Solutions ATO 0384 SACAA/1122/ATO Gauteng Grand Central Training Academy 12. Aeronav Academy (Pty) Ltd ATO 0002 SACAA/1110/ATO Gauteng Lanseria 13. Aeronexus Corporate (Pty) Ltd T/A Aeronexus ATO 0132 SACAA/1042/ATO Gauteng Kempton Park 14. Aerospace Training Academy AC 013 SACAA/1529/ATO Polokwane Polokwane Airport 15. Aerosud Aerospace Systems (Pty) Ltd T/A Aerosud Jet ATO 0064 SACAA/1038/ATO Limpopo Hoedspruit Training Academy 16. Aerosud Innovation Training Centre AC 011 SACAA/1038/ATO Gauteng Centurion 17. African NDT Centre ATTC 016 SACAA/1016/ATO Gauteng Centurion 18. Air Safety Pilot Academy CC ATO 0015 SACAA/1021/ATO Gauteng Rand Airport 19.