Chapter 211. Taxation of Real and Personal Property The

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tax Appeals Rules Procedures

Tax Appeals Tribunal Rules & Procedures The rules of the game February 2017 Glossary of terms KRA Kenya Revenue Authority TAT Tax Appeals Tribunal TATA Tax Appeals Tribunal Act TPA Tax Procedures Act VAT Value Added Tax 2 © Deloitte & Touche 2017 Definition of terms Tax decision means: a) An assessment; Tax law means: b) A determination of tax payable made to a a) The Tax Procedures Act; trustee-in-bankruptcy, receiver, or b) The Income Tax Act, Value Added liquidator; Tax Act, and Excise Duty Act; and c) A determination of the amount that a tax c) Any Regulations or other subsidiary representative, appointed person, legislation made under the Tax director or controlling member is liable Procedures Act or the Income Tax for under specified sections in the TPA; Act, Value Added Tax Act, and Excise d) A decision on an application by a Duty Act. taxpayer to amend their self-assessment return; Objection decision means: e) A refund decision; f) A decision requiring repayment of a The Commissioner’s decision either to refund; or allow an objection in whole or in part, or g) A demand for a penalty. disallow it. Appealable decision means: a) An objection decision; and b) Any other decision made under a tax law but excludes– • A tax decision; or • A decision made in the course of making a tax decision. 3 © Deloitte & Touche 2017 Pre-objection process; management of KRA Audit KRA Audit Notes The TPA allows the Commissioner to issue to • The KRA Audits are a tax payer a default assessment, amended undertaken by different assessment or an advance assessment departments of the KRA that (Section 29 to 31 TPA). -

Transfer of Ownership Guidelines

Transfer of Ownership Guidelines PREPARED BY THE MICHIGAN STATE TAX COMMISSION Issued October 30, 2017 TABLE OF CONTENTS Background Information 3 Transfer of Ownership Definitions 4 Deeds and Land Contracts 4 Trusts 5 Distributions Under Wills or By Courts 8 Leases 10 Ownership Changes of Legal Entities (Corporations, Partnerships, Limited Liability Companies, etc.) 11 Tenancies in Common 12 Cooperative Housing Corporations 13 Transfer of Ownership Exemptions 13 Spouses 14 Children and Other Relatives 15 Tenancies by the Entireties 18 Life Leases/Life Estates 19 Foreclosures and Forfeitures 23 Redemptions of Tax-Reverted Properties 24 Trusts 25 Court Orders 26 Joint Tenancies 27 Security Interests 33 Affiliated Groups 34 Normal Public Trades 35 Commonly Controlled Entities 35 Tax-Free Reorganizations 37 Qualified Agricultural Properties 38 Conservation Easements 41 Boy Scout, Girl Scout, Camp Fire Girls 4-H Clubs or Foundations, YMCA and YWCA 42 Property Transfer Affidavits 42 Partial Uncapping Situations 45 Delayed Uncappings 46 Background Information Why is a transfer of ownership significant with regard to property taxes? In accordance with the Michigan Constitution as amended by Michigan statutes, a transfer of ownership causes the taxable value of the transferred property to be uncapped in the calendar year following the year of the transfer of ownership. What is meant by “taxable value”? Taxable value is the value used to calculate the property taxes for a property. In general, the taxable value multiplied by the appropriate millage rate yields the property taxes for a property. What is meant by “taxable value uncapping”? Except for additions and losses to a property, annual increases in the property’s taxable value are limited to 1.05 or the inflation rate, whichever is less. -

The Cost of the Vote: Poll Taxes, Voter Identification Laws, and the Price of Democracy

File: Ellis final for Darby Created on: 4/9/2009 8:17:00 PM Last Printed: 5/19/2009 1:10:00 PM THE COST OF THE VOTE: POLL TAXES, VOTER IDENTIFICATION LAWS, AND THE PRICE OF DEMOCRACY ATIBA R. ELLIS† INTRODUCTION The election of Barack Obama as the forty-fourth President of the United States represents both the completion of a historical campaign season and a triumph of the Civil Rights revolution of the twentieth cen- tury. President Obama’s 2008 campaign, along with the campaigns of Senators Hillary Rodham Clinton and John McCain, was remarkable in both the identities of the politicians themselves1 and the attention they brought to the political process. In particular, Obama attracted voters from populations which have not been traditionally represented in na- tional politics. His run was hallmarked, in large part, by significant grassroots fundraising, a concerted effort to generate popular appeal, and, most important, massive voter turnout efforts.2 As a result, this election cycle generated significant increases in participation during the primary season.3 Turnout in the general election did not meet anticipated record † Legal Writing Instructor, Howard University School of Law. J.D., M.A., Duke Univer- sity, 2000. An early version of this paper was presented at the Writer’s Workshop of the Legal Writing Institute in summer 2007. Later versions were presented at the November 2007 Howard University School of Law faculty colloquy and the September 2008 Northeast People of Color Legal Scholarship Conference. I gratefully acknowledge Andrew Taslitz, Sherman Rogers, Derek Black, Paulette Caldwell, Phoebe Haddon, and Daniel Tokaji for their thoughtful comments on earlier drafts of this paper. -

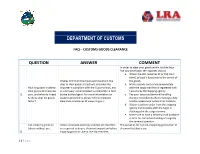

Department of Customs

DEPARTMENT OF CUSTOMS FAQ – CUSTOMS GOODS CLEARANCE QUESTION ANSWER COMMENT In order to clear your goods within the five hour – five day timeframe, the importer should: a. Obtain the CRF (whether DI or PSI) from BIVAC at least 5 days prior to the arrival of It takes minimum five hours and maximum five the goods. days to clear goods at Customs, provided the b. Make a goods declaration immediately How long does it take to importer is compliant with the Customs laws, and after the cargo manifest is registered with clear goods at a Customs all necessary documentation is completed in time Customs by the shipping agency. 1. port, and what do I need by the broker/agent. For more information on c. Pay your taxes and terminal handling to do to clear my goods customs procedures, please refer to Customs charges immediately after receiving a duty faster? clearance procedures at www.lra.gov.lr. and tax assessment notice from Customs. d. Obtain a delivery order from the shipping agency immediately after the cargo is discharged in the cargo terminal. e. Make sure to have a delivery truck available in time for immediate loading of cargo by the terminal operator. Can I ship my goods to Unless otherwise expressly exempt, all importers The penalties for not pre-inspecting goods prior to Liberia without pre- are required to do pre-shipment inspection before shipment to Liberia are: 2. shipping goods to Liberia. the Government, 1 | P a g e shipment inspection through Administrative Regulation No. 12. 14263 – a. 10% of CIF value for first and second (PSI)? 2/MOF/R/BCE/14 October 2013, requires offense penalties for failure to have goods pre-inspected. -

Worldwide Estate and Inheritance Tax Guide

Worldwide Estate and Inheritance Tax Guide 2021 Preface he Worldwide Estate and Inheritance trusts and foundations, settlements, Tax Guide 2021 (WEITG) is succession, statutory and forced heirship, published by the EY Private Client matrimonial regimes, testamentary Services network, which comprises documents and intestacy rules, and estate Tprofessionals from EY member tax treaty partners. The “Inheritance and firms. gift taxes at a glance” table on page 490 The 2021 edition summarizes the gift, highlights inheritance and gift taxes in all estate and inheritance tax systems 44 jurisdictions and territories. and describes wealth transfer planning For the reader’s reference, the names and considerations in 44 jurisdictions and symbols of the foreign currencies that are territories. It is relevant to the owners of mentioned in the guide are listed at the end family businesses and private companies, of the publication. managers of private capital enterprises, This publication should not be regarded executives of multinational companies and as offering a complete explanation of the other entrepreneurial and internationally tax matters referred to and is subject to mobile high-net-worth individuals. changes in the law and other applicable The content is based on information current rules. Local publications of a more detailed as of February 2021, unless otherwise nature are frequently available. Readers indicated in the text of the chapter. are advised to consult their local EY professionals for further information. Tax information The WEITG is published alongside three The chapters in the WEITG provide companion guides on broad-based taxes: information on the taxation of the the Worldwide Corporate Tax Guide, the accumulation and transfer of wealth (e.g., Worldwide Personal Tax and Immigration by gift, trust, bequest or inheritance) in Guide and the Worldwide VAT, GST and each jurisdiction, including sections on Sales Tax Guide. -

1 Virtues Unfulfilled: the Effects of Land Value

VIRTUES UNFULFILLED: THE EFFECTS OF LAND VALUE TAXATION IN THREE PENNSYLVANIAN CITIES By ROBERT J. MURPHY, JR. A THESIS PRESENTED TO THE GRADUATE SCHOOL AT THE UNIVERSITY OF FLORIDA IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF ARTS IN URBAN AND REGIONAL PLANNING UNIVERSITY OF FLORIDA 2011 1 © 2011 Robert J. Murphy, Jr. 2 To Mom, Dad, family, and friends for their support and encouragement 3 ACKNOWLEDGEMENTS I would like to thank my chair, Dr. Andres Blanco, for his guidance, feedback and patience without which the accomplishment of this thesis would not have been possible. I would also like to thank my other committee members, Dr. Dawn Jourdan and Dr. David Ling, for carefully prodding aspects of this thesis to help improve its overall quality and validity. I‟d also like to thank friends and cohorts, such as Katie White, Charlie Gibbons, Eric Hilliker, and my parents - Bob and Barb Murphy - among others, who have offered their opinions and guidance on this research when asked. 4 TABLE OF CONTENTS page ACKNOWLEDGEMENTS .............................................................................................. 4 LIST OF TABLES........................................................................................................... 9 LIST OF FIGURES ...................................................................................................... 10 LIST OF ABBREVIATIONS .......................................................................................... 11 ABSTRACT................................................................................................................. -

A History of Property Tax in Utah

SEPTEMBER 2010 BRIEFING PAPER UTAH LEGISLATURE A History of Property Tax in Utah OFFICE OF LEGISLATIVE RESEARCH AND GENERAL COUNSEL Remarkably, property tax studies conducted in previous HIGHLIGHTS eras of Utah's history highlight many issues identical to those that policymakers grapple with today. A review of • Property taxes have continuously been Utah's property tax history reveals the following: imposed in Utah for over 160 years. Until the 1930s, the property tax was the main source (1) major initial dependence on the property tax, of revenue both for the state and for local followed by diminished use since the Great governments. Depression; (2) ongoing difficulties meeting the constitutional Data source: Department of Workforce Services and statutory mandate to impose property taxes • When the Great Depression hit, the state based on property market values; began reducing its reliance on property taxes (3) since statehood, a narrowing of the property tax in favor of income and sales taxes. Although base from a "general" property tax that applied local governments still rely on the property equally (at least in theory) to nearly all property, tax today, the property tax has also to today's classified property tax system that diminished as a local government revenue fully or partially exempts various property types source in favor of various sales and excise from taxation at full fair market value; and taxes and fees. (4) enormous disparities in taxable property values among local taxing entities, including school • Large portions of the property tax have districts. consistently been used for public education. Municipalities, counties, and local/special This briefing paper reviews the history of property taxes in Utah since the arrival of the Mormon pioneers. -

Act 206 of 1893 ASSESSMENT ROLL. 211.24 Property Tax Assessment Roll; Time; Use of Computerized Database System

THE GENERAL PROPERTY TAX ACT (EXCERPT) Act 206 of 1893 ASSESSMENT ROLL. 211.24 Property tax assessment roll; time; use of computerized database system. Sec. 24. (1) On or before the first Monday in March in each year, the assessor shall make and complete an assessment roll, upon which he or she shall set down all of the following: (a) The name and address of every person liable to be taxed in the local tax collecting unit with a full description of all the real property liable to be taxed. If the name of the owner or occupant of any tract or parcel of real property is known, the assessor shall enter the name and address of the owner or occupant opposite to the description of the property. If unknown, the real property described upon the roll shall be assessed as "owner unknown". All contiguous subdivisions of any section that are owned by 1 person, firm, corporation, or other legal entity and all unimproved lots in any block that are contiguous and owned by 1 person, firm, corporation, or other legal entity shall be assessed as 1 parcel, unless demand in writing is made by the owner or occupant to have each subdivision of the section or each lot assessed separately. However, failure to assess contiguous parcels as entireties does not invalidate the assessment as made. Each description shall show as near as possible the number of acres contained in it, as determined by the assessor. It is not necessary for the assessment roll to specify the quantity of land comprised in any town, city, or village lot. -

GREEN PASSPORT Innovative Financing Solutions for Conservation in Hawai‘I

GREEN PASSPORT Innovative Financing Solutions for Conservation in Hawai‘i Improving the visitor experience and protecting Hawai‘i’s natural heritage © Pascal Debrunner Purpose: The purpose of this report is to identify and explore innovative conservation finance solutions that bring additional revenue to support conservation in Hawai‘i and effectively manage cultural and natural resources that are critical to our communities’ wellbeing and the visitor experience. Scope of Work: (1) This report reviews existing visitor green fee programs that support conservation in jurisdictions around the world. (2) Based on this information, the report then explores legal, economic, and political considerations in Hawai‘i that shape the implementation of a potential visitor green fee program for the State of Hawai‘i. (3) Lastly, the report presents potential pathways for a visitor green fee in Hawai‘i, noting that each of these options require further legal and policy research. How to cite: von Saltza, E. 2019. Green Passport: Innovative Financing Solutions for Conservation in Hawai‘i. A report prepared for Conservation International. Acknowledgements: The report was developed with the support of The Harold K.L. Castle Foundation, Hawai‘i Leadership Forum, and The Nature Conservancy. We are thankful for insights and perspectives from a wide range of thought leaders across the visitor and conservation sectors. October 2019 © Photo Rodolphe Holler TABLE OF CONTENTS Executive Summary ............................................................................................ -

Acea Tax Guide 2020 6 European Union

2020 WWW.ACEA.BE Foreword This 2020 edition of the annual Tax Guide published by the European Automobile Manufacturers’ Association (ACEA) presents a comprehensive overview of specific taxes that are levied on motor vehicles in Europe, as well as in other major markets around the world. Counting almost 320 pages, this is the most complete edition to date, which makes it an indispensable tool for anyone interested in the European automotive industry and related policies. The 2020 Tax Guide contains all the latest information about taxes on vehicle acquisition (VAT, sales tax, registration tax), ownership (annual circulation tax, road tax) and motoring (fuel tax). In addition to looking in detail at the 27 member states of the European Union, the United Kingdom and the three EFTA countries Iceland, Norway and Switzerland, the Guide also provides in-depth taxation information for China, India, Japan, Korea, Russia, Turkey and the United States. The ACEA Tax Guide is compiled with the help of the national associations of motor vehicle manufacturers or importers in all these countries. ACEA would like to extend its sincere gratitude to all involved for making up-to-date information available for this publication. Eric Marc Huitema ACEA Director General Copyright Reproduction of the content of this document is not permitted without the prior written consent of ACEA. Whenever reproduction is permitted, ACEA shall be referred to as source of the information. Summary EU member countries 4 EFTA 202 Other countries 211 EU member states EU summary tables 5 Austria 10 Belgium 19 Bulgaria 42 Croatia 46 Cyprus 49 Czech Republic 51 Denmark 59 Estonia 71 Finland 74 France 79 Germany 89 Greece 97 Hungary 105 Ireland 109 Italy 117 Latvia 127 Lithuania 132 Luxembourg 136 Malta 145 Netherlands 148 Poland 153 Portugal 158 Romania 165 Slovakia 169 Slovenia 179 Spain 188 Sweden 195 01 EU summary tables Chapter prepared by Francesca Piazza [email protected] ACEA European Automobile Manufacturers’ Association Avenue des Nerviens 85 B — 1040 Brussels T. -

Tax and Transfer Research Group, Berlin

UNIVERSITÄT POTSDAM WIRTSCHAFTS- UND SOZIALWISSENSCHAFTLICHE FAKULTÄT Lehrstuhl für Finanzwissenschaft Hans-Georg Petersen International Experience with Alternative Forms of Social Protection: Lessons for the Reform Process in Russia Diskussionsbeitrag 44 Potsdam 2004 Hans-Georg Petersen University of Potsdam and German Institute of Economic Research, Berlin Tel.: (+49) 0331 977 3394 E-mail: [email protected] International Experience with Alternative Forms of Social Protection: Lessons for the Reform Process in Russia Prof. Dr. Hans-Georg Petersen1 University of Potsdam and German Institute for Economic Research (DIW Berlin) Report for the Russian Foundation for Social Reforms in the Framework of the Project to Promote Structural Reforming in the System of the Population’s Social Protection Supported by the World Bank Mit den Finanzwissenschaftlichen Diskussionsbeiträgen werden Manuskripte von den Verfassern möglichen Interessenten in einer vorläufigen Fassung zugänglich gemacht. Für Inhalt und Verteilung sind die Autoren verantwortlich. Es wird gebeten, sich mit Anregungen und Kritik direkt an sie zu wenden und etwaige Zitate aus ihrer Arbeit vorher mit ihnen abzustimmen. Alle Rechte liegen bei den Verfassern. ISSN 0948 - 7549 1 The author would like to thank Mathias Brehe and Klaus Müller for great support. Of course, responsibility for any remaining errors rests with the author alone. 1 Contents Charts and Tables 3 1. Introduction 5 2. Basic Issues of Social Protection 8 2.1. Targets, Means and Benefits of Social Protection 8 2.2. Standard Risks and Possible Institutional Settings for Social Protection 12 2.2.1. Market Structure for Pension and Health Insurance 12 2.2.2. Systems of Social Protection and Security 14 2.2.2.1. -

Historic Records in Amherst (N.H.) Town Hall Vault – Part 2: Tax Records of Amherst, N.H

File: Amherst_Records_TownHallVault_Taxes_byKH_rev2018Mar.doc/pdf Rev. March 2018 This document/file is a supplement to the Finding Aids for records at Amherst Town Hall vault, from inventory taken in 2017-2018 by archivist Cynthia Swank of North Hampton and historical researcher Katrina Holman of Amherst, under the auspices of Amherst Heritage Commission, largely funded by a grant from Bertha Rogers Foundation. The purpose of this document is two-fold: 1) The information on contents with historical context is intended for historical researchers. 2) Detailed descriptions of the volumes of records will help with search & retrieval in case a volume or document should be misplaced or go missing. Inventory Catalog of the Historic Records in Amherst (N.H.) Town Hall Vault – Part 2: Tax Records of Amherst, N.H. 1. Tax Assessment Records * Invoice & Taxes (taxpayer rolls with inventories & valuations of taxable property & assessed taxes), made by Selectmen – Final copies: – Invoice & Taxes: 1820-1832 through 1953-1960 - “fair” or final copies (in 18 huge multi-year volumes, 9 for 19th c. & 9 for 20th c., manuscripts recorded by Town Clerk) – Inventory of Taxable Property with Valuation & Taxes: 1961-1973 (10 volumes, printed data) [Missing 1963, 1967, 1971] Note: Invoice & taxes for the years 1898, 1903, 1912, 1945, and 1953 are included with respective annual town reports, typeset. The invoice – now called inventory – of 1961 and that of 1966 were printed in respective annual town reports, without taxes. * Invoice & Taxes Workbooks (aka Selectmen's Blotter Book in 20th c.): 1814 (partial), 1818 (partial), 1823-1878 (with geographical & year gaps, usually just one or two years per volume) and 1881-1961 (usually two or three volumes per year, 100+ volumes total, handwritten) * Real Estate Revaluation (New Appraisal) Workbooks: 1903 (2 volumes) * Tax Assessor's pocket-size notebooks (partial inventories without taxes): 1849-1877 and other 19th c.