Corporate Tax 2018 14Th Edition a Practical Cross-Border Insight Into Corporate Tax Work

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tax Appeals Rules Procedures

Tax Appeals Tribunal Rules & Procedures The rules of the game February 2017 Glossary of terms KRA Kenya Revenue Authority TAT Tax Appeals Tribunal TATA Tax Appeals Tribunal Act TPA Tax Procedures Act VAT Value Added Tax 2 © Deloitte & Touche 2017 Definition of terms Tax decision means: a) An assessment; Tax law means: b) A determination of tax payable made to a a) The Tax Procedures Act; trustee-in-bankruptcy, receiver, or b) The Income Tax Act, Value Added liquidator; Tax Act, and Excise Duty Act; and c) A determination of the amount that a tax c) Any Regulations or other subsidiary representative, appointed person, legislation made under the Tax director or controlling member is liable Procedures Act or the Income Tax for under specified sections in the TPA; Act, Value Added Tax Act, and Excise d) A decision on an application by a Duty Act. taxpayer to amend their self-assessment return; Objection decision means: e) A refund decision; f) A decision requiring repayment of a The Commissioner’s decision either to refund; or allow an objection in whole or in part, or g) A demand for a penalty. disallow it. Appealable decision means: a) An objection decision; and b) Any other decision made under a tax law but excludes– • A tax decision; or • A decision made in the course of making a tax decision. 3 © Deloitte & Touche 2017 Pre-objection process; management of KRA Audit KRA Audit Notes The TPA allows the Commissioner to issue to • The KRA Audits are a tax payer a default assessment, amended undertaken by different assessment or an advance assessment departments of the KRA that (Section 29 to 31 TPA). -

Creating Market Incentives for Greener Products Policy Manual for Eastern Partnership Countries

Creating Market Incentives for Greener Products Policy Manual for Eastern Partnership Countries Creating Incentives for Greener Products Policy Manual for Eastern Partnership Countries 2014 About the OECD The OECD is a unique forum where governments work together to address the economic, social and environmental challenges of globalisation. The OECD is also at the forefront of efforts to understand and to help governments respond to new developments and concerns, such as corporate governance, the information economy and the challenges of an ageing population. The Organisation provides a setting where governments can compare policy experiences, seek answers to common problems, identify good practice and work to co-ordinate domestic and international policies. The OECD member countries are: Australia, Austria, Belgium, Canada, Chile, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Japan, Korea, Luxembourg, Mexico, the Netherlands, New Zealand, Norway, Poland, Portugal, the Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Turkey, the United Kingdom and the United States. The European Union takes part in the work of the OECD. Since the 1990s, the OECD Task Force for the Implementation of the Environmental Action Programme (the EAP Task Force) has been supporting countries of Eastern Europe, Caucasus and Central Asia to reconcile their environment and economic goals. About the EaP GREEN programme The “Greening Economies in the European Union’s Eastern Neighbourhood” (EaP GREEN) programme aims to support the six Eastern Partnership countries to move towards green economy by decoupling economic growth from environmental degradation and resource depletion. The six EaP countries are: Armenia, Azerbaijan, Belarus, Georgia, Republic of Moldova and Ukraine. -

Environmental Taxes and Subsidies: What Is the Appropriate Fiscal Policy for Dealing with Modern Environmental Problems?

William & Mary Environmental Law and Policy Review Volume 24 (2000) Issue 1 Environmental Justice Article 6 February 2000 Environmental Taxes and Subsidies: What is the Appropriate Fiscal Policy for Dealing with Modern Environmental Problems? Charles D. Patterson III Follow this and additional works at: https://scholarship.law.wm.edu/wmelpr Part of the Environmental Law Commons, and the Tax Law Commons Repository Citation Charles D. Patterson III, Environmental Taxes and Subsidies: What is the Appropriate Fiscal Policy for Dealing with Modern Environmental Problems?, 24 Wm. & Mary Envtl. L. & Pol'y Rev. 121 (2000), https://scholarship.law.wm.edu/wmelpr/vol24/iss1/6 Copyright c 2000 by the authors. This article is brought to you by the William & Mary Law School Scholarship Repository. https://scholarship.law.wm.edu/wmelpr ENVIRONMENTAL TAXES AND SUBSIDIES: WHAT IS THE APPROPRIATE FISCAL POLICY FOR DEALING WITH MODERN ENVIRONMENTAL PROBLEMS? CHARLES D. PATTERSON, III* 1 Oil spills and over-fishing threaten the lives of Pacific sea otters. Unusually warm temperatures are responsible for an Arctic ice-cap meltdown. 2 Contaminated drinking water is blamed for the spread of avian influenza from wild waterfowl to domestic chickens.' Higher incidences of skin cancer are projected, due to a reduction in the ozone layer. Our environment, an essential and irreplaceable resource, has been under attack since the industrial age began. Although we have harnessed nuclear energy, made space travel commonplace, and developed elaborate communications technology, we have been unable to effectively eliminate the erosion and decay of our environment. How can we deal with these and other environmental problems? Legislators have many methods to encourage or discourage individual or corporate conduct. -

Financial Transaction Taxes

FINANCIAL MM TRANSACTION TAXES: A tax on investors, taxpayers, and consumers Center for Capital Markets Competitiveness 1 FINANCIAL TRANSACTION TAXES: A tax on investors, taxpayers, and consumers James J. Angel, Ph.D., CFA Associate Professor of Finance Georgetown University [email protected] McDonough School of Business Hariri Building Washington, DC 20057 202-687-3765 Twitter: @GUFinProf The author gratefully acknowledges financial support for this project from the U.S. Chamber of Commerce. All opinions are those of the author and do not necessarily reflect those of the Chamber or Georgetown University. 2 Financial Transaction Taxes: A tax on investors, taxpayers, and consumers FINANCIAL TRANSACTIN TAES: Table of Contents A tax on investors, taxpayers, and Executive Summary .........................................................................................4 consumers Introduction .....................................................................................................6 The direct tax burden .......................................................................................7 The indirect tax burden ....................................................................................8 The derivatives market and risk management .............................................. 14 Economic impact of an FTT ............................................................................17 The U.S. experience ..................................................................................... 23 International experience -

Transfer of Ownership Guidelines

Transfer of Ownership Guidelines PREPARED BY THE MICHIGAN STATE TAX COMMISSION Issued October 30, 2017 TABLE OF CONTENTS Background Information 3 Transfer of Ownership Definitions 4 Deeds and Land Contracts 4 Trusts 5 Distributions Under Wills or By Courts 8 Leases 10 Ownership Changes of Legal Entities (Corporations, Partnerships, Limited Liability Companies, etc.) 11 Tenancies in Common 12 Cooperative Housing Corporations 13 Transfer of Ownership Exemptions 13 Spouses 14 Children and Other Relatives 15 Tenancies by the Entireties 18 Life Leases/Life Estates 19 Foreclosures and Forfeitures 23 Redemptions of Tax-Reverted Properties 24 Trusts 25 Court Orders 26 Joint Tenancies 27 Security Interests 33 Affiliated Groups 34 Normal Public Trades 35 Commonly Controlled Entities 35 Tax-Free Reorganizations 37 Qualified Agricultural Properties 38 Conservation Easements 41 Boy Scout, Girl Scout, Camp Fire Girls 4-H Clubs or Foundations, YMCA and YWCA 42 Property Transfer Affidavits 42 Partial Uncapping Situations 45 Delayed Uncappings 46 Background Information Why is a transfer of ownership significant with regard to property taxes? In accordance with the Michigan Constitution as amended by Michigan statutes, a transfer of ownership causes the taxable value of the transferred property to be uncapped in the calendar year following the year of the transfer of ownership. What is meant by “taxable value”? Taxable value is the value used to calculate the property taxes for a property. In general, the taxable value multiplied by the appropriate millage rate yields the property taxes for a property. What is meant by “taxable value uncapping”? Except for additions and losses to a property, annual increases in the property’s taxable value are limited to 1.05 or the inflation rate, whichever is less. -

The Cost of the Vote: Poll Taxes, Voter Identification Laws, and the Price of Democracy

File: Ellis final for Darby Created on: 4/9/2009 8:17:00 PM Last Printed: 5/19/2009 1:10:00 PM THE COST OF THE VOTE: POLL TAXES, VOTER IDENTIFICATION LAWS, AND THE PRICE OF DEMOCRACY ATIBA R. ELLIS† INTRODUCTION The election of Barack Obama as the forty-fourth President of the United States represents both the completion of a historical campaign season and a triumph of the Civil Rights revolution of the twentieth cen- tury. President Obama’s 2008 campaign, along with the campaigns of Senators Hillary Rodham Clinton and John McCain, was remarkable in both the identities of the politicians themselves1 and the attention they brought to the political process. In particular, Obama attracted voters from populations which have not been traditionally represented in na- tional politics. His run was hallmarked, in large part, by significant grassroots fundraising, a concerted effort to generate popular appeal, and, most important, massive voter turnout efforts.2 As a result, this election cycle generated significant increases in participation during the primary season.3 Turnout in the general election did not meet anticipated record † Legal Writing Instructor, Howard University School of Law. J.D., M.A., Duke Univer- sity, 2000. An early version of this paper was presented at the Writer’s Workshop of the Legal Writing Institute in summer 2007. Later versions were presented at the November 2007 Howard University School of Law faculty colloquy and the September 2008 Northeast People of Color Legal Scholarship Conference. I gratefully acknowledge Andrew Taslitz, Sherman Rogers, Derek Black, Paulette Caldwell, Phoebe Haddon, and Daniel Tokaji for their thoughtful comments on earlier drafts of this paper. -

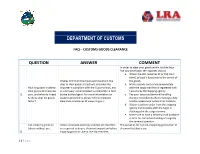

Department of Customs

DEPARTMENT OF CUSTOMS FAQ – CUSTOMS GOODS CLEARANCE QUESTION ANSWER COMMENT In order to clear your goods within the five hour – five day timeframe, the importer should: a. Obtain the CRF (whether DI or PSI) from BIVAC at least 5 days prior to the arrival of It takes minimum five hours and maximum five the goods. days to clear goods at Customs, provided the b. Make a goods declaration immediately How long does it take to importer is compliant with the Customs laws, and after the cargo manifest is registered with clear goods at a Customs all necessary documentation is completed in time Customs by the shipping agency. 1. port, and what do I need by the broker/agent. For more information on c. Pay your taxes and terminal handling to do to clear my goods customs procedures, please refer to Customs charges immediately after receiving a duty faster? clearance procedures at www.lra.gov.lr. and tax assessment notice from Customs. d. Obtain a delivery order from the shipping agency immediately after the cargo is discharged in the cargo terminal. e. Make sure to have a delivery truck available in time for immediate loading of cargo by the terminal operator. Can I ship my goods to Unless otherwise expressly exempt, all importers The penalties for not pre-inspecting goods prior to Liberia without pre- are required to do pre-shipment inspection before shipment to Liberia are: 2. shipping goods to Liberia. the Government, 1 | P a g e shipment inspection through Administrative Regulation No. 12. 14263 – a. 10% of CIF value for first and second (PSI)? 2/MOF/R/BCE/14 October 2013, requires offense penalties for failure to have goods pre-inspected. -

Worldwide Estate and Inheritance Tax Guide

Worldwide Estate and Inheritance Tax Guide 2021 Preface he Worldwide Estate and Inheritance trusts and foundations, settlements, Tax Guide 2021 (WEITG) is succession, statutory and forced heirship, published by the EY Private Client matrimonial regimes, testamentary Services network, which comprises documents and intestacy rules, and estate Tprofessionals from EY member tax treaty partners. The “Inheritance and firms. gift taxes at a glance” table on page 490 The 2021 edition summarizes the gift, highlights inheritance and gift taxes in all estate and inheritance tax systems 44 jurisdictions and territories. and describes wealth transfer planning For the reader’s reference, the names and considerations in 44 jurisdictions and symbols of the foreign currencies that are territories. It is relevant to the owners of mentioned in the guide are listed at the end family businesses and private companies, of the publication. managers of private capital enterprises, This publication should not be regarded executives of multinational companies and as offering a complete explanation of the other entrepreneurial and internationally tax matters referred to and is subject to mobile high-net-worth individuals. changes in the law and other applicable The content is based on information current rules. Local publications of a more detailed as of February 2021, unless otherwise nature are frequently available. Readers indicated in the text of the chapter. are advised to consult their local EY professionals for further information. Tax information The WEITG is published alongside three The chapters in the WEITG provide companion guides on broad-based taxes: information on the taxation of the the Worldwide Corporate Tax Guide, the accumulation and transfer of wealth (e.g., Worldwide Personal Tax and Immigration by gift, trust, bequest or inheritance) in Guide and the Worldwide VAT, GST and each jurisdiction, including sections on Sales Tax Guide. -

Guiding Principles of Good Tax Policy: a Framework for Evaluating Tax Proposals

Tax Policy Concept Statement 1 Guiding principles of good tax policy: A framework for evaluating tax proposals i About the Association of International Certified Professional Accountants The Association of International Certified Professional Accountants (the Association) is the most influential body of professional accountants, combining the strengths of the American Institute of CPAs (AICPA) and The Chartered Institute of Management Accountants (CIMA) to power opportunity, trust and prosperity for people, businesses and economies worldwide. It represents 650,000 members and students in public and management accounting and advocates for the public interest and business sustainability on current and emerging issues. With broad reach, rigor and resources, the Association advances the reputation, employability and quality of CPAs, CGMAs and accounting and finance professionals globally. About the American Institute of CPAs The American Institute of CPAs (AICPA) is the world’s largest member association representing the CPA profession, with more than 418,000 members in 143 countries, and a history of serving the public interest since 1887. AICPA members represent many areas of practice, including business and industry, public practice, government, education and consulting. The AICPA sets ethical standards for its members and U.S. auditing standards for private companies, nonprofit organizations, federal, state and local governments. It develops and grades the Uniform CPA Examination, offers specialized credentials, builds the pipeline of future talent and drives professional competency development to advance the vitality, relevance and quality of the profession. About the Chartered Institute of Management Accountants The Chartered Institute of Management Accountants (CIMA), founded in 1919, is the world’s leading and largest professional body of management accountants, with members and students operating in 176 countries, working at the heart of business. -

Hakelberg Rixen End of Neoliberal Tax Policy

Is Neoliberalism Still Spreading? The Impact of International Cooperation on Capital Taxation Lukas Hakelberg and Thomas Rixen Freie Universität Berlin Ihnestr. 22 14195 Berlin, Germany E.mail: [email protected] and [email protected] Postprint. Please cite as: Hakelberg, L. and T. Rixen (2020). "Is neoliberalism still spreading? The impact of international cooperation on capital taxation." Review of International Political Economy. https://doi.org/10.1080/09692290.2020.1752769 Acknowledgments Leo Ahrens, Fulya Apaydin, Frank Bandau, Benjamin Braun, Benjamin Faude, Valeska Gerstung, Leonard Geyer, Matthias vom Hau, Steffen Hurka, Friederike Kelle, Christoph Knill, Simon Linder, Daniel Mertens, Richard Murphy, Sol Picciotto, Nils Redeker, Max Schaub, Yves Steinebach, Alexandros Tokhi, Frank Borge Wietzke, Michael Zürn and other participants at the ECPR General Conference in Oslo 2017, the IBEI Research Seminar and Workshop ‘Pol- icy-Making in Hard Times’ in Barcelona in 2017, the Conference of the German Political Sci- ence Association’s (DVPW) Political Economy Section in Darmstadt 2018, the Tax Justice Network’s Annual Conference 2018 in Lima and the Global Governance Colloquium at the Social Science Research Center Berlin (WZB) in May 2019 as well as three anonymous re- viewers provided very helpful comments and suggestions. We thank all of them. Is Neoliberalism Still Spreading? The Impact of International Cooperation on Capital Taxation Abstract The downward trend in capital taxes since the 1980s has recently reversed for personal capital income. At the same time, it continued for corporate profits. Why have these tax rates diverged after a long period of parallel decline? We argue that the answer lies in different levels of change in the fights against tax evasion and tax avoidance. -

Investors' Reaction to a Reform of Corporate Income Taxation

Investors' Reaction to a Reform of Corporate Income Taxation Dennis Voeller z (University of Mannheim) Jens M¨uller z (University of Graz) Draft: November 2011 Abstract: This paper investigates the stock market response to the corporate tax reform in Germany of 2008. The reform included a decrease in the statutary corporate income tax rate from 25% to 15% and a considerable reduction of interest taxation at the shareholder level. As a result, it provided for a higher tax benefit of debt. As it comprises changes in corporate taxation as well as the introduction of a final withholding tax on capital income, the German tax reform act of 2008 allows for a joint consideration of investors' reactions on both changes in corporate and personal income taxes. Analyzing company returns around fifteen events in 2006 and 2007 which mark important steps in the legislatory process preceding the passage of the reform, the study provides evidence on whether investors expect a reduction in their respective tax burden. Especially, it considers differences in investors' reactions depending on the financial structure of a company. While no significant average market reactions can be observed, the results suggest positive price reactions of highly levered companies. Keywords: Tax Reform, Corporate Income Tax, Stock Market Reaction JEL Classification: G30, G32, H25, H32 z University of Mannheim, Schloss Ostfl¨ugel,D-68161 Mannheim, Germany, [email protected]. z University of Graz, Universit¨atsstraße15, A-8010 Graz, Austria, [email protected]. 1 Introduction Previous literature provides evidence that companies adjust their capital structure as a response to changes in the tax treatment of different sources of finance. -

1 Virtues Unfulfilled: the Effects of Land Value

VIRTUES UNFULFILLED: THE EFFECTS OF LAND VALUE TAXATION IN THREE PENNSYLVANIAN CITIES By ROBERT J. MURPHY, JR. A THESIS PRESENTED TO THE GRADUATE SCHOOL AT THE UNIVERSITY OF FLORIDA IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF ARTS IN URBAN AND REGIONAL PLANNING UNIVERSITY OF FLORIDA 2011 1 © 2011 Robert J. Murphy, Jr. 2 To Mom, Dad, family, and friends for their support and encouragement 3 ACKNOWLEDGEMENTS I would like to thank my chair, Dr. Andres Blanco, for his guidance, feedback and patience without which the accomplishment of this thesis would not have been possible. I would also like to thank my other committee members, Dr. Dawn Jourdan and Dr. David Ling, for carefully prodding aspects of this thesis to help improve its overall quality and validity. I‟d also like to thank friends and cohorts, such as Katie White, Charlie Gibbons, Eric Hilliker, and my parents - Bob and Barb Murphy - among others, who have offered their opinions and guidance on this research when asked. 4 TABLE OF CONTENTS page ACKNOWLEDGEMENTS .............................................................................................. 4 LIST OF TABLES........................................................................................................... 9 LIST OF FIGURES ...................................................................................................... 10 LIST OF ABBREVIATIONS .......................................................................................... 11 ABSTRACT.................................................................................................................