Creating Market Incentives for Greener Products Policy Manual for Eastern Partnership Countries

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Recycling Scrap Carpet

Advancing Carpet Stewardship: A How-To Guide The Product Stewardship Institute | October 2015 Product Stewardship Institute, Inc. is an equal opportunity employer and provider. Advancing Carpet Stewardship: A HOW-TO GUIDE WHAT IS CARPET STEWARDSHIP? Americans discard nearly 3.9 million tons of carpet and rugs annually. Yet, despite voluntary industry recycling programs, only about 7.5 percent gets recycled. Much of this bulky, cumbersome waste ends up in the nation’s landfills and imposes significant costs on local governments for its management. Reusing and recycling, rather than landfilling, scrap carpet can: • Reduce reliance on disposal; • Recover valuable materials to make other products (including decking, construction material, automotive and furniture parts, and carpet pad, among others); • Create recycling jobs; • Reduce waste management costs for governments; • Reduce the need for virgin materials to be extracted; and • Reduce greenhouse gas emissions and energy use by decreasing the energy-intensive production of new carpet. State and local governments, carpet manufacturers, and other stakeholders in the carpet life cycle need to work together to develop more effective ways of managing scrap carpet. Carpet stewardship is a way to minimize the health, safety, and environmental impacts of carpet from manufacturing through end-of- life, while also maximizing economic benefits. Carpet manufacturers have the greatest ability to increase sustainable production and recycling, but other stakeholders, such as suppliers, retailers, and consumers, also play a role. Carpet stewardship can be either voluntary or required by law. Extended producer responsibility (EPR) is a mandatory type of product stewardship that includes, at a minimum, the requirement that the manufacturer’s responsibility for its product extends to managing that product at end-of-life, including both financial and management responsibility. -

Principles of Product Stewardship

Advancing Tire Stewardship in the United States MEETING SUMMARY January 21 & 22, 2015—Hartford, CT Attendees More than 160 local, state, and federal government officials, recyclers, retailers, and other key stakeholders attended the meeting, with about half attending in person and the other half participating via live web streaming (see attendee list). Government officials participating represented 22 states. Meeting Materials Meeting materials are available on PSI's 2015 Tire Stewardship Dialogue Meeting web-site (http://www.productstewardship.us/?page=2015_Tires_Dialogue). We encourage you to consult the PowerPoint presentations when reviewing this summary. Welcoming Remarks Jessie Stratton, Connecticut Department of Energy and Environmental Protection (CT DEEP) Policy Director, welcomed attendees to the meeting. She indicated that tires were one of ten priority materials in CT and emphasized the collaborative process as essential to the success of recycling programs. Meeting Overview Scott Cassel of the Product Stewardship Institute (PSI) thanked meeting sponsors and reported that the size of the group was the largest ever for a PSI dialogue meeting, reflecting significant interest in the issue of scrap tire management. Scott reported that 90 percent of the 65 respondents to a 2014 PSI survey of state/local governments and watershed protection groups said that they had a scrap tire dumping problem. He outlined the contents of PSI’s briefing document and asked for comments and suggested revisions by January 30. Scott also laid out the expected meeting outcomes and provided an overview of the meeting agenda. Scott highlighted three basic problems mentioned by those from government, industry, and environmental groups whom PSI interviewed prior to the meeting: illegal dumping, market challenges for higher end uses, and lack of sustainable funding. -

City of San Marcos Sales Tax Update Q22018 Third Quarter Receipts for Second Quarter Sales (April - June 2018)

City of San Marcos Sales Tax Update Q22018 Third Quarter Receipts for Second Quarter Sales (April - June 2018) San Marcos SALES TAX BY MAJOR BUSINESS GROUP In Brief $1,400,000 2nd Quarter 2017 $1,200,000 San Marcos’ receipts from April 2nd Quarter 2018 through June were 3.9% below the $1,000,000 second sales period in 2017 though the decline was the result of the State’s transition to a new software $800,000 and reporting system that caused a delay in processing thousands of $600,000 payments statewide. Sizeable local allocations remain outstanding, par- $400,000 ticularly for home furnishings, build- ing materials, service stations and $200,000 casual dining restaurants. Partial- ly offsetting these impacts, the City received an extra department store $0 catch-up payment that had been General Building County Restaurants Business Autos Fuel and Food delayed from last quarter due to the Consumer and and State and and and Service and Goods Construction Pools Hotels Industry Transportation Stations Drugs same software conversion issue. Excluding reporting aberrations, ac- tual sales were up 3.0%. Progress was led by higher re- TOP 25 PRODUCERS ceipts at local service stations. The IN ALPHABETICAL ORDER REVENUE COMPARISON price of gas has been driven high- ABC Supply Co Hughes Water & Four Quarters – Fiscal Year To Date (Q3 to Q2) Sewer er over the past year by simmering Albertsons Hunter Industries global political tension and robust Ashley Furniture 2016-17 2017-18 economic growth that has lifted de- Homestore Jeromes Furniture mand. Best Buy Kohls Point-of-Sale $14,377,888 $14,692,328 The City also received a 12% larg- Biggs Harley KRC Rock Davidson County Pool er allocation from the countywide Landsberg Orora 2,217,780 2,261,825 use tax pool. -

Alternative Approaches to Designing Financial Incentives

OECD PROJECT ON FINANCIAL INCENTIVES AND RETIREMENT SAVINGS POLICY BRIEF N°3 DECEMBER 2018 Alternative approaches to designing financial incentives The most common type of financial incentive savings are taxed upon withdrawal. In contrast, used by governments to promote savings for individuals would be better-off paying taxes retirement, is to defer taxation by taxing upfront when they expect tax rates during individuals only on their pension benefits retirement will be greater than when they are (“EET”). Governments are alternatively using working. other approaches to providing financial In the long run, upfront taxation may translate incentives, either through the tax system (e.g. into a higher fiscal cost than taxation upon upfront taxation or tax credits) or outside the tax withdrawal. Figure 2 compares the yearly fiscal system (e.g. matching contributions and fixed effects of the two tax regimes. It shows that, in nominal subsidies). the short term, upfront taxation leads to a lower Taxing retirement savings upfront or upon fiscal cost than taxation upon withdrawal. Taxing withdrawal only withdrawals and thus deferring tax collection, brings the full cost of tax revenues Taxing retirement savings upfront (i.e. taxing forgone on contributions upfront. With upfront only contributions, “TEE”) is often seen as an taxation, the fiscal cost is just equal to tax equivalent approach to taxing retirement savings revenues forgone on returns. In the long term, upon withdrawal (“EET”). Both tax regimes do once the two systems reach maturity, the fiscal indeed provide the same overall tax advantage to impact is reversed with taxation upon withdrawal individuals when their income is subject to the leading to a lower annual fiscal cost than upfront same marginal tax rate throughout working and taxation. -

SHOULD WE TAX UNHEALTHY FOODS and DRINKS? Donald Marron, Maeve Gearing, and John Iselin December 2015

SHOULD WE TAX UNHEALTHY FOODS AND DRINKS? Donald Marron, Maeve Gearing, and John Iselin December 2015 Donald Marron is director of economic policy initiatives and Institute fellow at the Urban Institute, Maeve Gearing is a research associate at the Urban Institute, and John Iselin is a research assistant at the Urban-Brookings Tax Policy Center. The authors thank Laudan Aron, Kyle Caswell, Philip Cook, Stan Dorn, Lisa Dubay, William Gale, Genevieve Kenney, Adele Morris, Eric Toder, and Elaine Waxman for helpful comments and conversations; Joseph Rosenberg for running the Tax Policy Center model; Cindy Zheng for research assistance; Elizabeth Forney for editing; and Joanna Teitelbaum for formatting. This report was funded by the Laura and John Arnold Foundation. We thank our funders, who make it possible for Urban to advance its mission. The views expressed are those of the authors and should not be attributed to our funders, the Urban-Brookings Tax Policy Center, the Urban Institute, or its trustees. Funders do not determine our research findings or the insights and recommendations of our experts. For more information on our funding principles, go to urban.org/support. TAX POLICY CENTER | URBAN INSTITUTE & BROOKINGS INSTITUTION EXECUTIVE SUMMARY A healthy diet is essential to a long and vibrant life. But there is increasing evidence that our diets are not as healthy as we would like. Obesity, diabetes, hypertension, and other conditions linked to what we eat and drink are major challenges globally. By some estimates, obesity alone may be responsible for almost 3 million deaths each year and some $2 trillion in medical costs and lost productivity (Dobbs et al. -

Nonprofit Analysis of the Final Tax Bill

Tax Cuts and Jobs Act, H.R. 1 Nonprofit Analysis of the Final Tax Law* UPDATED April 5, 2018 ISSUE LEGISLATIVE CHANGE IMPACT ON CHARITABLE NONPROFITS • Preserves nonprofit nonpartisanship by • The House-passed tax bill and several leaving longstanding law intact. bills pending in Congress would repeal or • House-passed version would have weaken the Johnson Amendment. weakened existing law, which for 60+ • More than 5,600 organizations JOHNSON years has protected charitable nonprofits, nationwide, along with thousands of AMENDMENT houses of worship, and foundations so religious leaders, faith organizations, law (NONPROFIT they can work in communities free from enforcement officials, and the vast NONPARTISANSHIP) partisan pressures, divisions, and majority of the general public oppose interference. weakening the 1954 Johnson Amendment. • Visit www.GiveVoice.org for more information. • Increases the standard deduction for • As a result of the change, the charitable individuals (to $12,000), couples (to deduction would be out of reach of more $24,000), and heads of households (to than 87% of taxpayers. The Joint $18,000). Committee on Taxation (JCT) estimates • Raises the limit on cash donations for that itemized deductions will drop by $95 those who itemize deductions to 60% of billion in 2018. Not all of this would adjusted gross income (AGI), up from the disappear; the change is estimated to STANDARD current 50% of AGI. shrink giving to the work of charitable DEDUCTION AND • Repeals the “Pease limitation” on nonprofits by $13 billion or more each INCENTIVES FOR itemized deductions that limits year. Estimates are that this drop in giving would cost 220,000 to 264,000 nonprofit CHARITABLE GIVING deductions for upper-income individuals. -

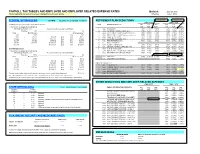

PAYROLL TAX TABLES and EMPLOYEE and EMPLOYER RELATED EXPENSE RATES Updated: June 27, 2012 *Items Highlighted in Yellow Have Been Changed Since the Last Update

PAYROLL TAX TABLES AND EMPLOYEE AND EMPLOYER RELATED EXPENSE RATES Updated: June 27, 2012 *items highlighted in yellow have been changed since the last update. Effective: July 1, 2012 FEDERAL WITHHOLDING 26 PAYS FEDERAL TAX ID NUMBER 86-6004791 RETIREMENT PLAN DEDUCTIONS 10.5% AT 50/50 10.5% AT 50/50 EMPLOYEE EMPLOYER (a) SINGLE person (including head of household) - CODE RETIREMENT PLAN DED OLD NEW DED OLD NEW If the amount of wages (after subtracting CODE RATE RATE CODE RATE RATE withholding allowances) is: The amount of income tax to withhold is: 1 ASRS PLAN-ASRS 7903 11.13% 10.90% 7904 9.87% 10.90% Not Over $83 ............................................................................................. $0 2 CORP JUVENILE CORRECTIONS (501) 7905 8.41% 8.41% 7906 9.92% 12.30% Over But not over - of excess over - 3 EORP ELECTED OFFICIALS & JUDGES (415) 7907 10.00% 11.50% 7908 17.96% 20.87% $83 - $417 10% $83 4 PSRS PUBLIC SAFETY (007) (ER pays 5% EE share) 7909 3.65% 4.55% 7910 38.30% 48.71% $417 - $1,442 $33.40 plus 15% $417 5 PSRS GAME & FISH (035) 7911 8.65% 9.55% 7912 43.35% 50.54% $1,442 - $3,377 $187.15 plus 25% $1,442 6 PSRS AG INVESTIGATORS (151) 7913 8.65% 9.55% 7914 90.08% 136.04% $3,377 - $6,954 $670.90 plus 28% $3,377 7 PSRS FIRE FIGHTERS (119) 7915 8.65% 9.55% 7916 17.76% 20.54% $6,954 - $15,019 $1,672.46 plus 33% $6,954 9 N/A NO RETIREMENT $15,019 ………………………………………………………$4,333.91 plus 35% $15,019 0 CORP CORRECTIONS (500) 7901 8.41% 8.41% 7902 9.15% 11.14% B PSRS LIQUOR CONTROL OFFICER (164) 7923 8.65% 9.55% 7924 38.77% 46.99% (b) MARRIED person F PSRS STATE PARKS (204) 7931 8.65% 9.55% 7932 18.50% 25.16% If the amount of wages (after subtracting G CORP PUBLIC SAFETY DISPATCHERS (563) 7933 7.96% 7.96% 7934 7.50% 7.90% withholding allowances) is: The amount of income tax to withhold is: H PSRS DEFERRED RET OPTION (DROP) 7957 8.65% 9.55% 0.24% AT 50/50 Not Over $312 ............................................................................................ -

Saleh Poll Tax December 2011

On the Road to Heaven: Poll tax, Religion, and Human Capital in Medieval and Modern Egypt Mohamed Saleh* University of Southern California (Preliminary and Incomplete: December 1, 2011) Abstract In the Middle East, non-Muslims are, on average, better off than the Muslim majority. I trace the origins of the phenomenon in Egypt to the imposition of the poll tax on non- Muslims upon the Islamic Conquest of the then-Coptic Christian Egypt in 640. The tax, which remained until 1855, led to the conversion of poor Copts to Islam to avoid paying the tax, and to the shrinking of Copts to a better off minority. Using new data sources that I digitized, including the 1848 and 1868 census manuscripts, I provide empirical evidence to support the hypothesis. I find that the spatial variation in poll tax enforcement and tax elasticity of conversion, measured by four historical factors, predicts the variation in the Coptic population share in the 19th century, which is, in turn, inversely related to the magnitude of the Coptic-Muslim gap, as predicted by the hypothesis. The four factors are: (i) the 8th and 9th centuries tax revolts, (ii) the Arab immigration waves to Egypt in the 7th to 9th centuries, (iii) the Coptic churches and monasteries in the 12th and 15th centuries, and (iv) the route of the Holy Family in Egypt. I draw on a wide range of qualitative evidence to support these findings. Keywords: Islamic poll tax; Copts, Islamic Conquest; Conversion; Middle East JEL Classification: N35 * The author is a PhD candidate at the Department of Economics, University of Southern California (E- mail: [email protected]). -

Denmark Ecotax Rates Green Budget Germany (Gbg)

DENMARK ECOTAX RATES GREEN BUDGET GERMANY (GBG) EFR in Denmark: General Tax- Tax rate national cur- Tax rate – Name Typ Specific Tax-Base Base rency Euro € Denmark Waste manage- Charge on batte- ment - individual Lead batteries - car 1.61 € per ries Fee/Charge products batteries < 100 Ah 12.00 DKK per unit. unit. Waste manage- Charge on batte- ment - individual Lead batteries - car 3.23 € per ries Fee/Charge products batteries > 100 Ah 24.00 DKK per unit. unit. Waste manage- Charge on batte- ment - individual 2.42 € per ries Fee/Charge products Lead batteries - other 18.00 DKK per unit. unit. Waste manage- 33.6 - Charge on ha- ment - individual 250 - 88,000 DKK 11828 € zardous waste Fee/Charge products Hazardous waste per tonne per tonne. 185.20 € per Charge on mu- household nicipal waste 1378.00 DKK per per year collection / Waste manage- household per year on aver- treatment Fee/Charge ment - in general Municipal waste on average age. 2.20 € per Charge on sewa- Management of 16.40 DKK per m3 m3 on a- ge discharge Fee/Charge water resources Water consumption on average verage Duty on carrier Waste manage- bags made of pa- ment - individual Carrier bags made of 1.34 € pr per, plastics, etc. Tax products paper 10.00 DKK pr kg kg. Duty on carrier Waste manage- bags made of pa- ment - individual Carrier bags made of 2.96 € pr per, plastics, etc. Tax products plastics 22.00 DKK pr kg kg. 0.27 € per kg net Duty on certain 2.00 DKK per kg net weight of chlorinated sol- Hazardous che- weight of the sub- the sub- vents Tax micals Dichloromethane stance. -

Oklahoma Oil and Gas Industry Taxation

OKLAHOMA OIL AND GAS INDUSTRY TAXATION Comparative Effective Tax Rates in the Major Producing States January 11, 2018 Oklahoma Oil and Gas Industry Taxation Contents I. Introduction .......................................................................................................................................... 2 II. Severance Taxes .................................................................................................................................... 4 Recent Tax Law Changes .................................................................................................................. 4 Oklahoma Severance Tax Payments ................................................................................................ 4 Oklahoma Effective Severance Tax Rate.......................................................................................... 7 Oklahoma Versus Other Producing States ....................................................................................... 8 State Trends in Severance Tax Rates ............................................................................................. 10 III. Ad Valorem Taxes ............................................................................................................................... 11 IV. Measuring the Broader Tax Contribution of Oil & Gas ....................................................................... 16 Personal Income Taxes and Oil and Gas Earnings ......................................................................... 17 Oil and Gas-Related -

Environmental Taxes and Subsidies: What Is the Appropriate Fiscal Policy for Dealing with Modern Environmental Problems?

William & Mary Environmental Law and Policy Review Volume 24 (2000) Issue 1 Environmental Justice Article 6 February 2000 Environmental Taxes and Subsidies: What is the Appropriate Fiscal Policy for Dealing with Modern Environmental Problems? Charles D. Patterson III Follow this and additional works at: https://scholarship.law.wm.edu/wmelpr Part of the Environmental Law Commons, and the Tax Law Commons Repository Citation Charles D. Patterson III, Environmental Taxes and Subsidies: What is the Appropriate Fiscal Policy for Dealing with Modern Environmental Problems?, 24 Wm. & Mary Envtl. L. & Pol'y Rev. 121 (2000), https://scholarship.law.wm.edu/wmelpr/vol24/iss1/6 Copyright c 2000 by the authors. This article is brought to you by the William & Mary Law School Scholarship Repository. https://scholarship.law.wm.edu/wmelpr ENVIRONMENTAL TAXES AND SUBSIDIES: WHAT IS THE APPROPRIATE FISCAL POLICY FOR DEALING WITH MODERN ENVIRONMENTAL PROBLEMS? CHARLES D. PATTERSON, III* 1 Oil spills and over-fishing threaten the lives of Pacific sea otters. Unusually warm temperatures are responsible for an Arctic ice-cap meltdown. 2 Contaminated drinking water is blamed for the spread of avian influenza from wild waterfowl to domestic chickens.' Higher incidences of skin cancer are projected, due to a reduction in the ozone layer. Our environment, an essential and irreplaceable resource, has been under attack since the industrial age began. Although we have harnessed nuclear energy, made space travel commonplace, and developed elaborate communications technology, we have been unable to effectively eliminate the erosion and decay of our environment. How can we deal with these and other environmental problems? Legislators have many methods to encourage or discourage individual or corporate conduct. -

Financial Transaction Taxes

FINANCIAL MM TRANSACTION TAXES: A tax on investors, taxpayers, and consumers Center for Capital Markets Competitiveness 1 FINANCIAL TRANSACTION TAXES: A tax on investors, taxpayers, and consumers James J. Angel, Ph.D., CFA Associate Professor of Finance Georgetown University [email protected] McDonough School of Business Hariri Building Washington, DC 20057 202-687-3765 Twitter: @GUFinProf The author gratefully acknowledges financial support for this project from the U.S. Chamber of Commerce. All opinions are those of the author and do not necessarily reflect those of the Chamber or Georgetown University. 2 Financial Transaction Taxes: A tax on investors, taxpayers, and consumers FINANCIAL TRANSACTIN TAES: Table of Contents A tax on investors, taxpayers, and Executive Summary .........................................................................................4 consumers Introduction .....................................................................................................6 The direct tax burden .......................................................................................7 The indirect tax burden ....................................................................................8 The derivatives market and risk management .............................................. 14 Economic impact of an FTT ............................................................................17 The U.S. experience ..................................................................................... 23 International experience