Worldwide Estate and Inheritance Tax Guide

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tax Appeals Rules Procedures

Tax Appeals Tribunal Rules & Procedures The rules of the game February 2017 Glossary of terms KRA Kenya Revenue Authority TAT Tax Appeals Tribunal TATA Tax Appeals Tribunal Act TPA Tax Procedures Act VAT Value Added Tax 2 © Deloitte & Touche 2017 Definition of terms Tax decision means: a) An assessment; Tax law means: b) A determination of tax payable made to a a) The Tax Procedures Act; trustee-in-bankruptcy, receiver, or b) The Income Tax Act, Value Added liquidator; Tax Act, and Excise Duty Act; and c) A determination of the amount that a tax c) Any Regulations or other subsidiary representative, appointed person, legislation made under the Tax director or controlling member is liable Procedures Act or the Income Tax for under specified sections in the TPA; Act, Value Added Tax Act, and Excise d) A decision on an application by a Duty Act. taxpayer to amend their self-assessment return; Objection decision means: e) A refund decision; f) A decision requiring repayment of a The Commissioner’s decision either to refund; or allow an objection in whole or in part, or g) A demand for a penalty. disallow it. Appealable decision means: a) An objection decision; and b) Any other decision made under a tax law but excludes– • A tax decision; or • A decision made in the course of making a tax decision. 3 © Deloitte & Touche 2017 Pre-objection process; management of KRA Audit KRA Audit Notes The TPA allows the Commissioner to issue to • The KRA Audits are a tax payer a default assessment, amended undertaken by different assessment or an advance assessment departments of the KRA that (Section 29 to 31 TPA). -

Manual for the Negotiation of Bilateral Tax Treaties

United Nations United Nations Manual for the Negotiation of Bilateral Tax Treaties Treaties Tax the Negotiation of Bilateral for Manual Manual for the Negotiation of Bilateral Tax Treaties between Developed and Developing Countries between Developed and Developing Countries United Nations Manual for the Negotiation of Bilateral Tax Treaties between Developed and Developing Countries asdf United Nations New York, 2016 Copyright © June 2016 For further information, please contact: United Nations United Nations All rights reserved Department of Economic and Social Affairs Financing for Development Office United Nations Secretariat Two UN Plaza, Room DC2-2170 New York, N.Y. 10017, USA Tel: (1-212) 963-7633 • Fax: (1-212) 963-0443 E-mail: [email protected] Preface Domestic resource mobilization, including tax revenues, is central to achieving sustainable development. Taxes represent a stable source of finance that, complemented by other sources, is critical to financing the 2030 Agenda for Sustainable Development, including the Sustainable Development Goals (SDGs). Taxation is essential to providing public goods and services, increasing equity and helping manage macroeco- nomic stability. SDG 17 on the means of implementation and global partnership for sustainable development calls on the international community to strengthen domestic resource mobilization, including through international support to developing countries, to improve domestic capacity for tax and other revenue collection. Mobilizing domestic public revenue for investment in sus- tainable development has featured prominently on the financing for development agenda since the 1990s. The Addis Ababa Action Agenda (AAAA) of the Third International Conference on Financing for Development (Addis Ababa, 13 – 16 July 2015) provides a new global framework for financing sustainable development by aligning all financial flows and policies with economic, social and environmental priorities. -

An Analysis of the Graded Property Tax Robert M

TaxingTaxing Simply Simply District of Columbia Tax Revision Commission TaxingTaxing FairlyFairly Full Report District of Columbia Tax Revision Commission 1755 Massachusetts Avenue, NW, Suite 550 Washington, DC 20036 Tel: (202) 518-7275 Fax: (202) 466-7967 www.dctrc.org The Authors Robert M. Schwab Professor, Department of Economics University of Maryland College Park, Md. Amy Rehder Harris Graduate Assistant, Department of Economics University of Maryland College Park, Md. Authors’ Acknowledgments We thank Kim Coleman for providing us with the assessment data discussed in the section “The Incidence of a Graded Property Tax in the District of Columbia.” We also thank Joan Youngman and Rick Rybeck for their help with this project. CHAPTER G An Analysis of the Graded Property Tax Robert M. Schwab and Amy Rehder Harris Introduction In most jurisdictions, land and improvements are taxed at the same rate. The District of Columbia is no exception to this general rule. Consider two homes in the District, each valued at $100,000. Home A is a modest home on a large lot; suppose the land and structures are each worth $50,000. Home B is a more sub- stantial home on a smaller lot; in this case, suppose the land is valued at $20,000 and the improvements at $80,000. Under current District law, both homes would be taxed at a rate of 0.96 percent on the total value and thus, as Figure 1 shows, the owners of both homes would face property taxes of $960.1 But property can be taxed in many ways. Under a graded, or split-rate, tax, land is taxed more heavily than structures. -

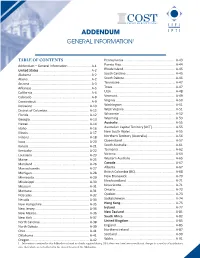

Addendum General Information1

ADDENDUM GENERAL INFORMATION1 TABLE OF CONTENTS Pennsylvania ......................................................... A-43 Addendum – General Information ......................... A-1 Puerto Rico ........................................................... A-44 United States ......................................................... A-2 Rhode Island ......................................................... A-45 Alabama ................................................................. A-2 South Carolina ...................................................... A-45 Alaska ..................................................................... A-2 South Dakota ........................................................ A-46 Arizona ................................................................... A-3 Tennessee ............................................................. A-47 Arkansas ................................................................. A-5 Texas ..................................................................... A-47 California ................................................................ A-6 Utah ...................................................................... A-48 Colorado ................................................................. A-8 Vermont................................................................ A-49 Connecticut ............................................................ A-9 Virginia ................................................................. A-50 Delaware ............................................................. -

Download Article (PDF)

5th International Conference on Accounting, Auditing, and Taxation (ICAAT 2016) TAX TRANSPARENCY – AN ANALYSIS OF THE LUXLEAKS FIRMS Johannes Manthey University of Würzburg, Würzburg, Germany Dirk Kiesewetter University of Würzburg, Würzburg, Germany Abstract This paper finds that the firms involved in the Luxembourg Leaks (‘LuxLeaks’) scandal are less transparent measured by the engagement in earnings management, analyst coverage, analyst accuracy, accounting standards and auditor choice. The analysis is based on the LuxLeaks sample and compared to a control group of large multinational companies. The panel dataset covers the years from 2001 to 2015 and comprises 19,109 observations. The LuxLeaks firms appear to engage in higher levels of discretionary earnings management measured by the variability of net income to cash flows from operations and the correlation between cash flows from operations and accruals. The LuxLeaks sample shows a lower analyst coverage, lower willingness to switch to IFRS and a lower Big4 auditor rate. The difference in difference design supports these findings regarding earnings management and the analyst coverage. The analysis concludes that the LuxLeaks firms are less transparent and infers a relation between corporate transparency and the engagement in tax avoidance. The paper aims to establish the relationship between tax avoidance and transparency in order to give guidance for future policy. The research highlights the complex causes and effects of tax management and supports a cost benefit analysis of future tax regulation. Keywords: Tax Avoidance, Transparency, Earnings Management JEL Classification: H20, H25, H26 1. Introduction The Luxembourg Leaks (’LuxLeaks’) scandal made public some of the tax strategies used by multinational companies. -

Environmental Taxes and Subsidies: What Is the Appropriate Fiscal Policy for Dealing with Modern Environmental Problems?

William & Mary Environmental Law and Policy Review Volume 24 (2000) Issue 1 Environmental Justice Article 6 February 2000 Environmental Taxes and Subsidies: What is the Appropriate Fiscal Policy for Dealing with Modern Environmental Problems? Charles D. Patterson III Follow this and additional works at: https://scholarship.law.wm.edu/wmelpr Part of the Environmental Law Commons, and the Tax Law Commons Repository Citation Charles D. Patterson III, Environmental Taxes and Subsidies: What is the Appropriate Fiscal Policy for Dealing with Modern Environmental Problems?, 24 Wm. & Mary Envtl. L. & Pol'y Rev. 121 (2000), https://scholarship.law.wm.edu/wmelpr/vol24/iss1/6 Copyright c 2000 by the authors. This article is brought to you by the William & Mary Law School Scholarship Repository. https://scholarship.law.wm.edu/wmelpr ENVIRONMENTAL TAXES AND SUBSIDIES: WHAT IS THE APPROPRIATE FISCAL POLICY FOR DEALING WITH MODERN ENVIRONMENTAL PROBLEMS? CHARLES D. PATTERSON, III* 1 Oil spills and over-fishing threaten the lives of Pacific sea otters. Unusually warm temperatures are responsible for an Arctic ice-cap meltdown. 2 Contaminated drinking water is blamed for the spread of avian influenza from wild waterfowl to domestic chickens.' Higher incidences of skin cancer are projected, due to a reduction in the ozone layer. Our environment, an essential and irreplaceable resource, has been under attack since the industrial age began. Although we have harnessed nuclear energy, made space travel commonplace, and developed elaborate communications technology, we have been unable to effectively eliminate the erosion and decay of our environment. How can we deal with these and other environmental problems? Legislators have many methods to encourage or discourage individual or corporate conduct. -

Financial Transaction Taxes

FINANCIAL MM TRANSACTION TAXES: A tax on investors, taxpayers, and consumers Center for Capital Markets Competitiveness 1 FINANCIAL TRANSACTION TAXES: A tax on investors, taxpayers, and consumers James J. Angel, Ph.D., CFA Associate Professor of Finance Georgetown University [email protected] McDonough School of Business Hariri Building Washington, DC 20057 202-687-3765 Twitter: @GUFinProf The author gratefully acknowledges financial support for this project from the U.S. Chamber of Commerce. All opinions are those of the author and do not necessarily reflect those of the Chamber or Georgetown University. 2 Financial Transaction Taxes: A tax on investors, taxpayers, and consumers FINANCIAL TRANSACTIN TAES: Table of Contents A tax on investors, taxpayers, and Executive Summary .........................................................................................4 consumers Introduction .....................................................................................................6 The direct tax burden .......................................................................................7 The indirect tax burden ....................................................................................8 The derivatives market and risk management .............................................. 14 Economic impact of an FTT ............................................................................17 The U.S. experience ..................................................................................... 23 International experience -

Taxation of Individuals 2020

Taxation of individuals Luxembourg 2020 kpmg.lu Tax year The tax year corresponds to the calendar year. Tax rates Progressive tax rates ranging from 0% to 45.78% apply to taxable income not exceeding €200,004 (€400,008 for couples taxed jointly). The excess is subject to 45.78%. The calculation of Luxembourg income taxes depends on the taxable income and the individual’s family status, i.e. the tax class. Tax classes - residents Without With Aged at least children dependent 65 years children on 1 January 2020 Single 1 1a 1a Married / Partners * 1 1/1a 1 Married/Partners - joint 2 2 2 taxation ** Separated / Divorced*** 2 / 1 2 / 1a 2 / 1a Widow(er)*** 2 / 1a 2 / 1a 2 / 1a * Joint application before 31 March of the following year for separate tax filing ** Married taxpayers file jointly: mandatory joint taxation Taxpayers who have entered into a registered partnership agreement and who shared a common residence during the whole tax year can elect to be taxed jointly *** Residents who separated (legal separation), divorced or were widowed during a specific tax year are granted tax class 2 for the next 3 tax years 2 Taxation of individuals – Luxembourg 2020 3 Tax classes - non-residents Without With Aged at least children dependent 65 years children on 1 January 2020 Single 1 1a 1a Married * / Partners 1 1 1 Married/Partners filing 2 2 2 jointly** Separated / Divorced*** 2 / 1 2 / 1a 2 / 1a Widow(er)*** 2 / 1a 2 / 1a 2 / 1a * Tax class 1a maintained for partners with dependent children or aged at least 65 years ** Specific requests before -

International Tax Cooperation and Capital Mobility

CEPAL CEPALREVIEW REVIEW 77 • AUGUST 77 2002 65 International tax cooperation and capital mobility Valpy FitzGerald University of Oxford The international mobility of capital and the geographical edmond.fitzgerald @st-antonys.oxford.ac.uk dispersion of firms have clear advantages for the growth and modernization of Latin America and the Caribbean, but they also pose great challenges. Modern principles of capital taxation for open developing economies indicate the need to find the correct balance between the encouragement of private investment and the financing of social infrastructure, both of which are necessary for sustainable growth. This balance can be sub-optimal when countries compete for foreign investment by granting tax incentives or applying conflicting principles in determining the tax base. The fiscal authorities of the region could obtain a more equitable share of capital tax revenue, without depressing investment and growth, through more effective regional tax rules, double taxation treaties, information sharing and treatment of offshore financial centres along the lines already promoted for OECD members. INTERNATIONAL TAX COOPERATIONAUGUST AND CAPITAL 2002 MOBILITY • VALPY FITZGERALD 66 CEPAL REVIEW 77 • AUGUST 2002 I Introduction Globalization involves increasing freedom of capital for developing as well as developed countries. Latin movement: both for firms from industrialized countries America and the Caribbean have been at the forefront investing in developing countries, and for financial asset of the liberalization -

FINANCE Offshore Finance.Pdf

This page intentionally left blank OFFSHORE FINANCE It is estimated that up to 60 per cent of the world’s money may be located oVshore, where half of all financial transactions are said to take place. Meanwhile, there is a perception that secrecy about oVshore is encouraged to obfuscate tax evasion and money laundering. Depending upon the criteria used to identify them, there are between forty and eighty oVshore finance centres spread around the world. The tax rules that apply in these jurisdictions are determined by the jurisdictions themselves and often are more benign than comparative rules that apply in the larger financial centres globally. This gives rise to potential for the development of tax mitigation strategies. McCann provides a detailed analysis of the global oVshore environment, outlining the extent of the information available and how that information might be used in assessing the quality of individual jurisdictions, as well as examining whether some of the perceptions about ‘OVshore’ are valid. He analyses the ongoing work of what have become known as the ‘standard setters’ – including the Financial Stability Forum, the Financial Action Task Force, the International Monetary Fund, the World Bank and the Organization for Economic Co-operation and Development. The book also oVers some suggestions as to what the future might hold for oVshore finance. HILTON Mc CANN was the Acting Chief Executive of the Financial Services Commission, Mauritius. He has held senior positions in the respective regulatory authorities in the Isle of Man, Malta and Mauritius. Having trained as a banker, he began his regulatory career supervising banks in the Isle of Man. -

Note on Taxation System

Note on Taxation system Introduction Today an important problem against each government is that how to get income temporarily by debt also, but they have to return it after some time. Some government income is received from government enterprises, administrative and judicial tasks and other such sources, but a big part of government income is received from taxation. Taxes: - Taxes are those compulsory payments which are used without any such hope towards government by tax payers that they will get direct benefit in return of them. According to Prof. Seligman, ‘’ Tax is that compulsory contribution given to Government by individuals which is paid in the payment of expenses in all general favours and no special benefit is given in lieu of that.’’ According to Trussing, ‘’The special thing is that in regard of tax in comparison to all amounts taken by government, quid pro quo is not found directly between taxpayer and government administration in it.’’ Characteristics of a Tax It is clear by above mentioned definitions that some specialties are found in tax which are as follows: - (1) Compulsory Contribution—Tax is a contribution given to state by people living within the premises of country due to residence and property etc. or by citizens and this contribution is given for general use only. Though it is a compulsory contribution, therefore, no individual can deny from the payment of tax. For example, no person can say that he is not getting benefit from some services provided by that state or he didn’t get the right to vote, therefore, he is not bound to pay tax. -

Country Update: Australia

www.pwc.com Country update: Australia Anthony Klein Partner, PwC Australia Liam Collins Partner, PwC Singapore Agenda 1. Economic and social challenges 2. Tax and politics 3. Recent developments 4. 2015 Federal Budget – key announcements 5. Regulatory environment – changes at the ATO 6. Q&A Global Tax Symposium – Asia 2015 PwC 2 Economic and social challenges Global Tax Symposium – Asia 2015 PwC 3 $ billion 10,000 12,000 14,000 ‐ 2,000 4,000 6,000 8,000 2,000 PwC Tax – Symposium Global 2015 Asia Economic outlook 0 Australia’s net debt levels, A$ billion net debt levels, Australia’s 2002‐03 2003‐04 2004‐05 2005‐06 2006‐07 2007‐08 2008‐09 2009‐10 2010‐11 2011‐12 2012‐13 2013‐14 2014‐15 2015‐16 Commonwealth 2016‐17 2017‐18 2018‐19 2019‐20 Current year 2020‐21 2021‐22 2022‐23 States 2023‐24 2024‐25 and 2025‐26 territories 2026‐27 2027‐28 2028‐29 2029‐30 2030‐31 Federation 2031‐32 2032‐33 2033‐34 2034‐35 2035‐36 2036‐37 2037‐38 2038‐39 2039‐40 2040‐41 2041‐42 2042‐43 2043‐44 2044‐45 2045‐46 2046‐47 2047‐48 2048‐49 2049‐50 4 Impact of iron ore prices and AUD 1980 to 2015 200.00 1.5000 180.00 1.3000 160.00 140.00 1.1000 120.00 0.9000 Iron Ore Price 100.00 AUD:USD 0.7000 80.00 60.00 0.5000 40.00 0.3000 20.00 0.00 0.1000 Global Tax Symposium – Asia 2015 PwC 5 Domestic challenges Domestic economy • Declining per capita income • Government spending previously underpinned by resources boom – now less affordable • As a consequence, deficits ‘as far as the eye can see’ • A Government short on political capital Demographic challenges • Ageing population