(Reciprocal Agreement) (United Kingdom) Order 2016 Article1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Red Tape Robin Ellison Frontmatter More Information

Cambridge University Press 978-1-108-42695-4 — Red Tape Robin Ellison Frontmatter More Information RED TAPE Red Tape tells the sometimes astonishing story of the making of laws, both good and bad, the recent explosion in rule making and the failure of repeated attempts to rationalise the statute books – even governments themselves are concerned about the increasing number and complexity of our laws. Society requires the rule of law, but the rule of too much law means that the general public faces frustrating excesses created by overzeal- ous regulators and lawmakers. Robin Ellison reveals the failure of repeated attempts to limit the number and complexity of new laws, and the expan- sion of regulators. He challenges the legislature to introduce fewer yet bet- ter laws and regulators by encouraging lawmakers to adopt practices that improve the eiciency of the law and the lives of everyone. Too much law leads to frustration for all – Red Tape is a long overdue exposé of our legal system for practitioners and consumers alike. robin ellison is a solicitor, a consultant with an international law irm, Pinsent Masons, where he specialises in the development of pensions and related inancial services products for insurers and other providers, and is the Cass Business School Professor of Pensions Law and Economics, City, University of London. He acts for a number of governments and govern- ment agencies and has been an adviser to the House of Commons Select Committee on Work and Pensions. © in this web service Cambridge University Press www.cambridge.org -

![A5-2801 [New File].Pmd](https://docslib.b-cdn.net/cover/3407/a5-2801-new-file-pmd-4413407.webp)

A5-2801 [New File].Pmd

PENSIONS ACT 2014 (c. 19) Pensions Act 2014 CHAPTER 19 CONTENTS PART 1 STATE PENSION Introduction 1. State pension State pension at the full or reduced rate 2. Entitlement to state pension at full or reduced rate 3. Full and reduced rates of state pension State pension at the transitional rate 4. Entitlement to state pension at transitional rate 5. Transitional rate of state pension 6. Recalculation and backdating of transitional rate in special cases Transitional entitlement based on contributions of others 7. Survivor’s pension based on inheritance of additional old state pension 8. Choice of lump sum or survivor’s pension under section 9 in certain cases 9. Survivor’s pension based on inheritance of deferred old state pension 10. Inheritance of graduated retirement benefit Transition: women who have had a reduced rate election 11. Reduced rate elections: effect on section 4 pensions 12. Reduced rate elections: pension for women with no section 4 pension Transition: pension sharing on divorce etc 13. Shared state pension on divorce etc 14. Pension sharing: reduction in the sharer’s section 4 pension 15. Pension sharing: amendments Postponing or suspending state pension 16. Pensioner’s option to suspend state pension 17. Effect of pensioner postponing or suspending state pension 18. Section 17 supplementary: calculating weeks, overseas residents, etc Prisoners and overseas residents 19. Prisoners 20. Overseas residents Definitions 21. “Old state pension” 22. General definitions etc Supplement No. 108 [Sept 2014] The Law Relating to Social Security 5.2801 PENSIONS ACT 2014 (c. 19) Consequential and other amendments 23. Amendments 24. Abolition of contracting-out for salary related schemes etc PART 2 OPTION TO BOOST OLD RETIREMENT PENSIONS 25. -

PENSIONS ACT 2004 (C

PENSIONS ACT 2004 (c. 35) Pensions Act 2004 CHAPTER 35 ARRANGEMENT OF SECTIONS PART 1 THE PENSIONS REGULATOR Establishment Section 1. The Pensions Regulator 2. Membership of the Regulator 3. Further provision about the Regulator General provisions about functions 4. Regulator’s functions 5. Regulator’s objectives 6. Supplementary powers 7. Transfer of OPRA’s functions to the Regulator Non-executive functions 8. Non-executive functions The Determinations Panel 9. The Determinations Panel 10. Functions exercisable by the Determinations Panel Annual report 11. Annual reports to Secretary of State Provision of information, education and assistance 12. Provision of information, education and assistance New powers in respect of occupational and personal pension schemes 13. Improvement notices 14. Third party notices 15. Injunctions and interdicts 16. Restitution 17. Power of the Regulator to recover unpaid contributions 18. Pension liberation: interpretation 19. Pension liberation: court’s power to order restitution 20. Pension liberation: restraining orders 21. Pension liberation: repatriation orders Supplement No. 97 [Dec 2011] The Law Relating to Social Security 5.3201 PENSIONS ACT 2004 (c. 35) Powers in relation to winding up of occupational pension schemes 22. Powers to wind up occupational pension schemes 23. Freezing orders 24. Consequences of freezing order 25. Period of effect etc of freezing order 26. Validation of action in contravention of freezing order 27. Effect of determination to wind up scheme on freezing order 28. Effect of winding up order on freezing order 29. Effect of assessment period under Part 2 on freezing order 30. Power to give a direction where freezing order ceases to have effect 31. -

House of Lords Official Report

Vol. 757 Monday No. 62 24 November 2014 PARLIAMENTARY DEBATES (HANSARD) HOUSE OF LORDS OFFICIAL REPORT ORDER OF BUSINESS Introduction: Baroness Helic............................................................................................669 Questions Sri Lanka.......................................................................................................................669 Universal Credit ............................................................................................................671 Children and the Police................................................................................................674 Commonwealth: Young Entrepreneurs.........................................................................677 Pensions Act 2014 (Consequential Amendments) (Units of Additional Pension) Order 2014 Motion to Approve ........................................................................................................679 Social Security Class 3A Contributions (Units of Additional Pension) Regulations 2014 Motion to Approve ........................................................................................................679 Representation of the People (Scotland) (Amendment No. 2) Regulations 2014 Motion to Approve ........................................................................................................679 Electoral Registration Pilot Scheme Order 2014 Motion to Approve ........................................................................................................679 Representation -

House of Lords Official Report

Vol. 774 Thursday No. 36 8 September 2016 PARLIAMENTARYDEBATES (HANSARD) HOUSE OF LORDS OFFICIAL REPORT ORDEROFBUSINESS Questions Brexit: Belfast Agreement.............................................................................................1123 Employment: Remuneration.........................................................................................1125 Zimbabwe .....................................................................................................................1128 Brexit: Constitutional Reform and Governance Act 2010............................................1131 Business of the House Motion on Standing Orders ...........................................................................................1133 Business of the House Timing of Debates.........................................................................................................1133 Civil Society and Lobbying Motion to Take Note.....................................................................................................1133 Grammar Schools Statement......................................................................................................................1177 NHS: Health and Social Care Act 2012 Motion to Take Note.....................................................................................................1180 National Minimum Wage (Amendment) (No. 2) Regulations 2016 Motion to Approve ........................................................................................................1209 Pensions Act 2014 -

The Social Security (Reciprocal Agreement) (Isle of Man) Order 2016

STATUTORY INSTRUMENTS 2016 No. 157 SOCIAL SECURITY The Social Security (Reciprocal Agreement) (Isle of Man) Order 2016 Made - - - - 10th February 2016 Coming into force - - 6th April 2016 At the Court at Buckingham Palace, the 10th day of February 2016 Present, The Queen’s Most Excellent Majesty in Council Section 179(1)(a), (2), (3), (4) and (5) of the Social Security Administration Act 1992(a) provides that for the purpose of giving effect to any agreement with the government of a country outside the United Kingdom providing for reciprocity in matters relating to payments for purposes similar or comparable to the purposes of legislation to which that section applies, Her Majesty may by Order in Council make provision for modifying or adapting the Social Security Administration Act 1992, the Social Security Contributions and Benefits Act 1992(b) and Part 1 of the Pensions Act 2014(c), and any regulations made under those Acts or that Part, in their application to cases affected by the agreement. Accordingly, Her Majesty is pleased by and with the advice of Her Privy Council, in exercise of the powers conferred by section 179(1)(a), (2), (3) and (5) and section 189(4), (5) and (6)(d) of the Social Security Administration Act 1992, to order as follows. Citation and commencement 1. This Order may be cited as the Social Security (Reciprocal Agreement) (Isle of Man) Order 2016 and shall come into force on 6th April 2016. Modification of legislation 2. The Social Security Administration Act 1992, the Social Security Contributions and Benefits Act 1992, Part 1 of the Pensions Act 2014 and regulations made under those Acts or that Part, shall be modified to such extent as may be required to give effect to the provisions contained in (a) 1992 c.5. -

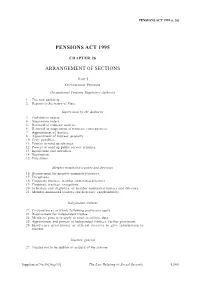

PENSIONS ACT 1995 (C

PENSIONS ACT 1995 (c. 26) PENSIONS ACT 1995 CHAPTER 26 ARRANGEMENT OF SECTIONS PART I OCCUPATIONAL PENSIONS Occupational Pensions Regulatory Authority 1. The new authority.. 2. Reports to Secretary of State. Supervision by the Authority 3. Prohibition orders. 4. Suspension orders. 5. Removal of trustees: notices. 6. Removal or suspension of trustees: consequences. 7. Appointment of trustees. 8. Appointment of trustees: property. 10. Civil penalties. 11. Powers to wind up schemes. 12. Powers to wind up public service schemes. 13. Injunctions and interdicts. 14. Restitution. 15. Directions. Member-nominated trustees and directors 16. Requirement for member-nominated trustees. 17. Exceptions. 18. Corporate trustees: member-nominated directors. 19. Corporate trustees: exceptions. 20. Selection, and eligibility, of member-nominated trustees and directors. 21. Member-nominated trustees and directors: supplementary. Independent trustees 22. Circumstances in which following provisions apply. 23. Requirement for independent trustee. 24. Members’ powers to apply to court to enforce duty. 25. Appointment and powers of independent trustees: further provisions. 26. Insolvency practitioner or official receiver to give information to trustees. Trustees: general 27. Trustee not to be auditor or actuary of the scheme Supplement No.36 [Aug 95] The Law Relating to Social Security 5.1801 PENSIONS ACT 1995 (c. 26) Section 28. Section 27: consequences. 29. Persons disqualified for being trustees. 30. Persons disqualified: consequences. 31. Trustees not to be indemnified for fines or civil penalties. Functions of trustees 32. Decisions by majority. 33. Investment powers: duty of care. 34. Power of investment and delegation. 35. Investment principles. 36. Choosing investments. 37. Payment of surplus to employer. 38. -

LGPC Bulletin 139 – January 2016

Local Government Pensions Committee Secretary, Jeff Houston LGPC Bulletin 139 – January 2016 This month’s Bulletin contains a number of general items of information. Please contact Con Hargrave with any comments on the contents of this Bulletin or with suggestions for other items that might be included in future Bulletins. LGPC contacts can be found at the end of this Bulletin. Contents LGPS England and Wales Exit payment recovery consultation response LGPS Scotland Amendment Regulations 2016/32 Revision to LGPS 2015 ill health certificate Scheme Advisory Board England and Wales Opinion on status of local pension boards in local authorities New State Pension Special bulletin on ending of contracting out HM Treasury contracting out working group - decisions required HMRC Cut off date for expressions of interest in the Scheme Reconciliation Service (SRS) – 5th April 2016 HMRC Pensions Schemes Newsletter no. 75 Countdown Bulletin 13 – January 2016 Fixed Protection 2016 Other News and Updates Employee contribution bandings 2016/17 Commutation and revaluation of benefits Tell Us Once Public service pensions history LGPC fund contacts Updates to LGPC documents Training Legislation Local Government House, Smith Square, London SW1P 3HZ T 020 7664 3000 F 020 7664 3030 E [email protected] www.local.gov.uk LGPS England and Wales Exit payment recovery consultation response In Bulletin 138, we referred to the short consultation period that the Government had commenced on the recovery of exit payments (as opposed to the cap on exit payments). We have since responded to the consultation outlining our concerns on the revised proposals, which as reported in the last bulletin, have been significantly changed from those originally consulted on in 2014. -

Isle of Man Social Security and Pensions Legislation Contents

Isle of Man Social Security and Pensions Legislation Contents The Social Security Legislation files, subject to a few exceptions, do not reproduce provisions superseded at or before its latest supplement. Generally the text represents those provisions which are in force on the day the file is accessed, or were due to come into force very shortly afterwards. Provisions and amendments which have been repealed or revoked or otherwise superseded, and provisions which simply amend an earlier measure without special savings, are not normally reproduced. Amendments are explained in footnotes. The new provision or new words are enclosed in square brackets with a figure referring to the footnote, so that amendments can be clearly seen. After a row of dots a footnote will explain the deletion. In an Act there may be a list of the Act's commencement dates at the end of the document The work aims to reflect all textual amendments which have come into force. It does not however purport to reflect all blanket amendments (e.g., amendments required by Transfer of Functions Orders, etc.), or amendments to references in Statutory Instruments to provisions which are affected by a consolidation of an Act or of another Statutory Instrument. We aim to upload updated files as soon after any changes effected by new provisions commence. We aim to do this within 8 weeks from the commencement of the amendments. New provisions which have been passed or made but which have not yet come into force may also be included in a supplement where, for example, there is a need for practitioners to consult them for implementation or planning purposes. -

Isle of Man Social Security Legislation Volumes Contents

Isle of Man Social Security Legislation Volumes Contents The electronic version of the Social Security Legislation Volumes are made up of links to the original documents used for the former paper-based Volume files or, where the legislation has not been amended since it was made, to the original document that was approved by Tynwald (more than one Statutory Instrument may be applied by that document). Consolidated documents from the volume files will have “socsec/ss/” before the name of the pdf in the hyperlink. Some of the PDFs contain bookmarks, these can be used to see the contents of, and navigate within, the PDFs. Some of the documents contain more than one Order or Regulations and the bookmarks may be used to navigate to the different Orders or Regulations within that document. To find out when Social Security Legislation was last amended please see Social Security News which provides details of our Orders approved by Tynwald. Those Orders can be viewed within the Order paper for the relevant Tynwald sitting. The latest supplement incorporates amendments made at the May and November 2018 Tynwald sittings. The amendments give effect to the following statutory documents. May 2018 SD2018/0124 Social Security Legislation (Benefits) (Application) Order 2018 (except those provisions that have effect from 6 April 2019) November 2018 SD2018/0268 Equality Act 2017 (Sex Equality Rule) (Exceptions) Regulations 2018 SD2018/0269 Budgeting Loans (Recovery by Deductions from Benefits) (Amendment) Regulations 2018 (except those provisions that have effect from 6 April 2019) SD2018/0272 Child Benefit (Rates) (Amendment) Regulations 2018 The following statutory documents approved at the following Tynwald sittings have amendments that come into operation on 6 April 2019 or later that have not been included in the Volume files. -

Tax Dictionary S

Leach’s Tax Dictionary. Version 9 as at 5 June 2016. Page 1 S S Tax code The letter S before a PAYE tax code indicates that the employee is regarded as subject to the Scottish rate of income tax (SRIT) from 6 April 2016. National insurance Contribution letter for an employee who is in a money purchase occupational pension scheme but who does not pay national insurance. The letter is replaced by C from 6 April 2012. Other meanings (1) Shaw, Scottish law reports of Session Cases, published between 1821 and 1838. (2) Old Roman numeral for 7. (3) US dollar, more popularly represented by the symbol $. This was first used in 1785. It is believed to be a corruption of the figure 8. (4) South. (5) CFI code for an ordinary share. (6) For pool betting duty, this denotes the total of stakes. (7) Amount surrendered, as used in the formula in Corporation Tax Act 2009 s1201. (8) For capital allowance on an assured tenancy, the starting expenditure attributable to the dwelling-house (Capital Allowances Act 2001 s522). s (1) Section, particularly of an Act of Parliament. (2) Shilling, pre-decimal unit of currency worth 5p, so 4s = 20p. S£ Abbreviation: Syrian pound. S$ (1) Abbreviation: Singapore dollar (2) Abbreviation: tala, currency of Samoa. SA (1) Self-assessment. (2) Abbreviation used in Income and Corporation Taxes Act 1988 s444AJ(5) to mean “surplus arising” in relation to life assurance business. S & L Savings and loans. S2P State Second Pension. [The abbreviation SSP is used for statutory sick pay.] SA South Africa, including its law reports published from 1948. -

Revised Version 31/8/2015

WELFARE REFORM AND PENSIONS ACT 1999 (C. 30) Welfare Reform and Pensions Act 1999 Chapter 30 ARRANGEMENT OF SECTIONS PART I STAKEHOLDER PENSION SCHEMES SECTION 1. Meaning of “stakeholder pension scheme” 2. Registration of stakeholder pension scheme. 3. Duty of employers to facilitate access to stakeholder pension schemes. 4. Obtaining information with respect to compliance with section 3 and corresponding Northern Ireland legislation. 5. Powers of inspection for securing compliance with section 3 and corresponding Northern Ireland legislation. 6. Application of certain enactments. 7. Reduced rates of contributions etc: power to specify different percentages. 8 Interpretation and application of Part I. PART II PENSIONS: GENERAL Payments by employers to pension schemes 9. Monitoring of employers’ payments to personal pensionschemes. 10. Late payments by employers to occupational pension schemes. Pensions and bankruptcy 11. Effect of bankruptcy on pension rights: approved arrangements. 12. Effect of bankruptcy on pension rights: unapproved arrangements. 13. Sections 11 and 12 application to Scotland. 14. No forfeiture on bankruptcy of rights under pension schemes. 15. Excessive pension contributions made by persons who have become bankrupt. 16. Excessive pension contributions made by persons who have become bankrupt: Scotland. Miscellaneous 17. Compensating occupational pension schemes. 18. Miscellaneous amendments. PART III PENSIONS ON DIVORCE ETC Pension sharing orders 19. Orders in England and Wales. 20. Orders in Scotland. Supplement No. 50 [March 2000] The Law Relating to Social Security 2.6001 WELFARE REFORM AND PENSIONS ACT 1999 (C. 30) Sections 25B to 25D of the Matrimonial Causes Act 1973 21. Amendments. 22. Extension to overseas divorces etc. Miscellaneous 23. Supply of pension information in connection with divorce etc.