Industry Monitor

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Alte Bergstrasse 14 8303 Bassersdorf Fax +41 43 556 81 19 Switzerland [email protected]

Alte Bergstrasse 14 8303 Bassersdorf Fax +41 43 556 81 19 Switzerland [email protected] 2019-4 August 2019 Die Welt der Flugzeugpostkarten The World of Aviation Postcards Super Neuheiten für Ihre Sammlung – Great New Postcards for your Collection Bestellen Sie von unseren neuen Sammler-Postkarten Get some of our great new collector postcards Nouvelles cartes postales Neuheiten aus aller Welt, zum Beispiel New picture postcards from all over the world, for example Nouveautés de toutes les régions du monde, par exemple Neue Fluggesellschaften / New airline companies / Compagnies aériennes: Apollo Airways, Azimut, Bamboo Airways, Eastern Airlines (2018- / ex Dynamic), Gulf Aviation, Lao Air Llines (1967-1973), Nomad Aviation, Primera Air Nordic (Lettland/Latvia), Travel Service Poland, Wimbi Dira Airways – WDA Neuer Satz von jjPostcards, Mix von älteren und aktuellen Aufnahmen – new set published by jjPostcards with a mix of old and modern views (Seaboard 707, Azimut SSJ 100 etc.) Wimbi Dira Airways, in operation 2003 – ca. 2010/2014 – komplette Flotte / complete fleet: DC-3, DC-9, Boeing 727, Boeing 707 Schöne Auswahl von Thailand – Great selection from Thailand: Nok Air DHC-8 + Boeing 737, Thai Air Asia Airbus A320 www.jjpostcards.com Webshop mit bald 35.000 Flugzeugpostkarten – jede AK mit Scan der Vorder- und Rückseite Visit our web shop, nearly 35.000 aviation postcards – each card with scan of front and back boutique en ligne avec bientôt 35.000 cartes postales – chaque carte avec scan recto/verso Name ________________________ -

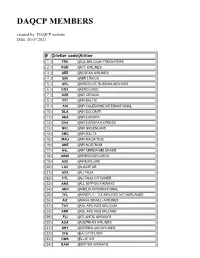

DAQCP MEMBERS Created By: DAQCP Website Date: 20.07.2021

DAQCP MEMBERS created by: DAQCP website Date: 20.07.2021 # 3-letter code Airline 1 FRH ACE BELGIUM FREIGHTERS 2 RUN ACT AIRLINES 3 AEE AEGEAN AIRLINES 4 EIN AER LINGUS 5 AFL AEROFLOT RUSSIAN AIRLINES 6 BOX AEROLOGIC 7 KZR AIR ASTANA 8 BTI AIR BALTIC 9 ACI AIR CALEDONIE INTERNATIONAL 10 DLA AIR DOLOMITI 11 AEA AIR EUROPA 12 OVA AIR EUROPA EXPRESS 13 GRL AIR GREENLAND 14 AMC AIR MALTA 15 MAU AIR MAURITIUS 16 ANE AIR NOSTRUM 17 ASL AIR SERBIA BELGRADE 18 ABW AIRBRIDGECARGO 19 AXE AIREXPLORE 20 LAV ALBASTAR 21 AZA ALITALIA 22 CYL ALITALIA CITYLINER 23 ANA ALL NIPPON AIRWAYS 24 AEH AMELIA INTERNATIONAL 25 TFL ARKEFLY - TUI AIRLINES NETHERLANDS 26 AIZ ARKIA ISRAELI AIRLINES 27 TAY ASL AIRLINES BELGIUM 28 ABR ASL AIRLINES IRELAND 29 FLI ATLANTIC AIRWAYS 30 AUA AUSTRIAN AIRLINES 31 AHY AZERBAIJAN AIRLINES 32 CFE BA CITYFLYER 33 BMS BLUE AIR 34 BAW BRITISH AIRWAYS 35 BEL BRUSSELS AIRLINES 36 GNE BUSINESS AVIATION SERVICES GUERNSEY LTD 37 CLU CARGOLOGICAIR 38 CLX CARGOLUX AIRLINES INTERNATIONAL S.A 39 ICV CARGOLUX ITALIA 40 CEB CEBU PACIFIC 41 BCY CITYJET 42 CFG CONDOR FLUGDIENST GMBH 43 CTN CROATIA AIRLINES 44 CSA CZECH AIRLINES 45 DLH DEUTSCHE LUFTHANSA 46 DHK DHL AIR LTD. 47 EZE EASTERN AIRWAYS 48 EJU EASYJET EUROPE 49 EZS EASYJET SWITZERLAND 50 EZY EASYJET UK 51 EDW EDELWEISS AIR 52 ELY EL AL 53 UAE EMIRATES 54 ETH ETHIOPIAN AIRLINES 55 ETD ETIHAD AIRWAYS 56 MMZ EUROATLANTIC 57 BCS EUROPEAN AIR TRANSPORT 58 EWG EUROWINGS 59 OCN EUROWINGS DISCOVER 60 EWE EUROWINGS EUROPE 61 EVE EVELOP AIRLINES 62 FIN FINNAIR 63 FHY FREEBIRD AIRLINES 64 GJT GETJET AIRLINES 65 GFA GULF AIR 66 OAW HELVETIC AIRWAYS 67 HFY HI FLY 68 HBN HIBERNIAN AIRLINES 69 HOP HOP! 70 IBE IBERIA 71 ICE ICELANDAIR 72 ISR ISRAIR AIRLINES 73 JAL JAPAN AIRLINES CO. -

Vea Un Ejemplo

3 To search aircraft in the registration index, go to page 178 Operator Page Operator Page Operator Page Operator Page 10 Tanker Air Carrier 8 Air Georgian 20 Amapola Flyg 32 Belavia 45 21 Air 8 Air Ghana 20 Amaszonas 32 Bering Air 45 2Excel Aviation 8 Air Greenland 20 Amaszonas Uruguay 32 Berjaya Air 45 748 Air Services 8 Air Guilin 20 AMC 32 Berkut Air 45 9 Air 8 Air Hamburg 21 Amelia 33 Berry Aviation 45 Abu Dhabi Aviation 8 Air Hong Kong 21 American Airlines 33 Bestfly 45 ABX Air 8 Air Horizont 21 American Jet 35 BH Air - Balkan Holidays 46 ACE Belgium Freighters 8 Air Iceland Connect 21 Ameriflight 35 Bhutan Airlines 46 Acropolis Aviation 8 Air India 21 Amerijet International 35 Bid Air Cargo 46 ACT Airlines 8 Air India Express 21 AMS Airlines 35 Biman Bangladesh 46 ADI Aerodynamics 9 Air India Regional 22 ANA Wings 35 Binter Canarias 46 Aegean Airlines 9 Air Inuit 22 AnadoluJet 36 Blue Air 46 Aer Lingus 9 Air KBZ 22 Anda Air 36 Blue Bird Airways 46 AerCaribe 9 Air Kenya 22 Andes Lineas Aereas 36 Blue Bird Aviation 46 Aereo Calafia 9 Air Kiribati 22 Angkasa Pura Logistics 36 Blue Dart Aviation 46 Aero Caribbean 9 Air Leap 22 Animawings 36 Blue Islands 47 Aero Flite 9 Air Libya 22 Apex Air 36 Blue Panorama Airlines 47 Aero K 9 Air Macau 22 Arab Wings 36 Blue Ridge Aero Services 47 Aero Mongolia 10 Air Madagascar 22 ARAMCO 36 Bluebird Nordic 47 Aero Transporte 10 Air Malta 23 Ariana Afghan Airlines 36 Boliviana de Aviacion 47 AeroContractors 10 Air Mandalay 23 Arik Air 36 BRA Braathens Regional 47 Aeroflot 10 Air Marshall Islands 23 -

RASG-PA ESC/29 — WP/04 14/11/17 Twenty

RASG‐PA ESC/29 — WP/04 14/11/17 Twenty ‐ Ninth Regional Aviation Safety Group — Pan America Executive Steering Committee Meeting (RASG‐PA ESC/29) ICAO NACC Regional Office, Mexico City, Mexico, 29‐30 November 2017 Agenda Item 3: Items/Briefings of interest to the RASG‐PA ESC PROPOSAL TO AMEND ICAO FLIGHT DATA ANALYSIS PROGRAMME (FDAP) RECOMMENDATION AND STANDARD TO EXPAND AEROPLANES´ WEIGHT THRESHOLD (Presented by Flight Safety Foundation and supported by Airbus, ATR, Embraer, IATA, Brazil ANAC, ICAO SAM Office, and SRVSOP) EXECUTIVE SUMMARY The Flight Data Analysis Program (FDAP) working group comprised by representatives of Airbus, ATR, Embraer, IATA, Brazil ANAC, ICAO SAM Office, and SRVSOP, is in the process of preparing a proposal to expand the number of functional flight data analysis programs. It is anticipated that a greater number of Flight Data Analysis Programs will lead to significantly greater safety levels through analysis of critical event sets and incidents. Action: The FDAP working group is requesting support for greater implementation of FDAP/FDMP throughout the Pan American Regions and consideration of new ICAO standards through the actions outlined in Section 4 of this working paper. Strategic Safety Objectives: References: Annex 6 ‐ Operation of Aircraft, Part 1 sections as mentioned in this working paper RASG‐PA ESC/28 ‐ WP/09 presented at the ICAO SAM Regional Office, 4 to 5 May 2017. 1. Introduction 1.1 Flight Data Recorders have long been used as one of the most important tools for accident investigations such that the term “black box” and its recovery is well known beyond the aviation industry. -

Listado De Certificados De Operador Aéreo (AOC) De Avión Y Helicóptero

Listado de Certificados de Operador Aéreo (AOC) de avión y helicóptero. Fecha de generación: 27-09-2021 Operador DBA Número AOC Flotas ATR 72-200 SERIES AERONOVA, S.L. AIR EUROPA EXPRESS ES.AOC.020 BOEING 737-800 SERIES EMBRAER ERJ 190-200 LR AIRBUS A330-200 AIRBUS A330-300 (RR) AIR EUROPA LINEAS AEREAS, S.A. AIR EUROPA ES.AOC.004 BOEING 737-800 SERIES BOEING 787-8 BOEING 787-9 ATR 72-212 A AIR NOSTRUM LINEAS AEREAS DEL AIR NOSTRUM LINEAS AEREAS DEL BOMBARDIER CL-600-2B19 ES.AOC.002 MEDITERRANEO, S.A. MEDITERRANEO BOMBARDIER CL-600-2D24 BOMBARDIER CL-600-2E25 AIR TAXI & CHARTER AIR TAXI & CHARTER CESSNA 525 ES.AOC.088 INTERNATIONAL, S.L INTERNATIONAL CESSNA 525A BOEING 737-400 SERIES ALBASTAR, S.A. ALBASTAR ES.AOC.106 BOEING 737-800 SERIES ANA MARIA ALEGRE GALINDO PIRIVUELO ES.AOC.148 ROBIN DR 400/180 R AURA AIRLINES, S.L. GOWAIR Vacation Airlines ES.AOC.146 AIRBUS A320-200 BABCOCK MISSION CRITICAL BABCOCK MISSION CRITICAL ES.AOC.046 BEECHCRAFT B200 SERVICES ESPAÑA, S.A. SERVICES ESPAÑA AGUSTA 139 AGUSTA A109E AGUSTA A109S AGUSTA-BELL AB 412 BABCOCK MISSION CRITICAL BABCOCK MISSION CRITICAL ES.AOC.129 BELL 412 SERVICES ESPAÑA, S.A. SERVICES ESPAÑA BELL 412EP EUROCOPTER EC135 P2 EUROCOPTER EC135 T2 EUROCOPTER EC135 T2+ EUROCOPTER EC135 T3 EUROCOPTER MBB-BK 117 C-2 EUROCOPTER MBB-BK117 D-2 BARON 58, S.L.U. BARON 58, S.L.U. ES.AOC.132 EUROCOPTER AS355F2 AGUSTA A109A II AGUSTA-BELL AB 206 B BELL 206B BIGAS GRUP HELICOPTERS SL ES.AOC.136 EUROCOPTER AS 350 B EUROCOPTER EC 130B4 ROBINSON R44 ROBINSON R44 II ATR 72-212 A BINTER CANARIAS, S.A. -

S/C/W/163 3 August 2000 ORGANIZATION (00-3257)

WORLD TRADE RESTRICTED S/C/W/163 3 August 2000 ORGANIZATION (00-3257) Council for Trade in Services DEVELOPMENTS IN THE AIR TRANSPORT SECTOR SINCE THE CONCLUSION OF THE URUGUAY ROUND PART ONE Note by the Secretariat This Note has been produced at the request of the Council for Trade in Services in the framework of the review of the Air Transport Annex which stipulates in paragraph 5 that "The Council for Trade in Services shall review periodically, and at least every five years, developments in the air transport sector and the operation of this Annex with a view to considering the possible further application of the Agreement in this sector.". The Secretariat has been asked through the Council for Trade in Services to update document S/C/W/59, dated 5 November 1998 and document S/C/W/129, dated 15 October 1999. This Note addresses both the economic and regulatory developments in the sector, in both a historical (1993) and contemporary (1999) framework. Since the Annex provides no definition of the sector, the paper tries to encompass all aspects of air transport and air transport-related services following the model of the former Secretariat document S/C/W/59 on the same subject examined during the exchange of information program in 1998. It largely draws on this document as well as on ICAO publications and in particular, the annual report "The World of Civil Aviation" (first edition, 1992). Additional professional sources such as IATA documents and press sources have also been used. As indicated during the Council session held on July 2000, the Council requested due to time constraints, that the document be in three parts. -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010. -

Airlines Codes

Airlines codes Sorted by Airlines Sorted by Code Airline Code Airline Code Aces VX Deutsche Bahn AG 2A Action Airlines XQ Aerocondor Trans Aereos 2B Acvilla Air WZ Denim Air 2D ADA Air ZY Ireland Airways 2E Adria Airways JP Frontier Flying Service 2F Aea International Pte 7X Debonair Airways 2G AER Lingus Limited EI European Airlines 2H Aero Asia International E4 Air Burkina 2J Aero California JR Kitty Hawk Airlines Inc 2K Aero Continente N6 Karlog Air 2L Aero Costa Rica Acori ML Moldavian Airlines 2M Aero Lineas Sosa P4 Haiti Aviation 2N Aero Lloyd Flugreisen YP Air Philippines Corp 2P Aero Service 5R Millenium Air Corp 2Q Aero Services Executive W4 Island Express 2S Aero Zambia Z9 Canada Three Thousand 2T Aerocaribe QA Western Pacific Air 2U Aerocondor Trans Aereos 2B Amtrak 2V Aeroejecutivo SA de CV SX Pacific Midland Airlines 2W Aeroflot Russian SU Helenair Corporation Ltd 2Y Aeroleasing SA FP Changan Airlines 2Z Aeroline Gmbh 7E Mafira Air 3A Aerolineas Argentinas AR Avior 3B Aerolineas Dominicanas YU Corporate Express Airline 3C Aerolineas Internacional N2 Palair Macedonian Air 3D Aerolineas Paraguayas A8 Northwestern Air Lease 3E Aerolineas Santo Domingo EX Air Inuit Ltd 3H Aeromar Airlines VW Air Alliance 3J Aeromexico AM Tatonduk Flying Service 3K Aeromexpress QO Gulfstream International 3M Aeronautica de Cancun RE Air Urga 3N Aeroperlas WL Georgian Airlines 3P Aeroperu PL China Yunnan Airlines 3Q Aeropostal Alas VH Avia Air Nv 3R Aerorepublica P5 Shuswap Air 3S Aerosanta Airlines UJ Turan Air Airline Company 3T Aeroservicios -

Cabin Repairs

April 2019 - www.avitrader.com Cabin Expendable repairs inventory strategies Q&A: People on the Move Beach Aviation Group latest appointments Company profile: MRO News Farsound Aviation from around the world Editor‘s Page 2 Cabin fever he aviation interiors industry once again to exceed $2bn for narrowbody and widebody converged on the German city of Hamburg aircraft by 2026 – double the amount spent at in April for another riveting installation of a peak in 2016 . Aircraft Interiors Expo - the world’s leading T The show had several new pieces of innovation event for airlines and the supply chain to source the latest innovations, technologies, and products on display, notably, the brand new half-size for the cabin interiors, in-flight entertainment, and thermally insulated inflight service cart able to passenger comfort industries . maintain food safely chilled for more than 20 Published monthly by hours without dry-ice or air chillers, it was pre- AviTrader Publications Corp. Since its inaugural event in 2000 the aviation sented to the public for the very first time . Suite 305, South Tower industry has evolved beyond expectations, with a new generation of aircraft, such as the Air- In this edition, we home in on cabins and ex- 5811 Cooney Road bus A350 and Boeing 787 and 777X, enabling plore how cabin maintenance strategies can Richmond, British Columbia airlines to redefine the onboard experience . keep costs lower and boost cabin efficiency . V6X 3M1 And as demand for air travel continues to grow, Canada Keith Mwanalushi thanks to -

IATA Dangerous Goods Regulations 58Th Edition ADDENDUM Posted 20 June 2017 � 58 � IATA ������ ��� 2017 � 6 � 20

KINOSHITA AVIATION CONSULTANTS Website: http://www. airtransport-tozai.com IATA Dangerous Goods Regulations 58th Edition ADDENDUM Posted 20 June 2017 58 IATA 2017 6 20 58 IATA (Addendum) ( 23 ) 2017 6 20 USG-13 JL—08 Page 1/23 Australia AUG-03 Page 1/233/23 Belgium BEG-01, BEG-02, BEG-04, BEG-05 Page 4/23 Germany DEG-04 Italy ITG-05 Saudi Arabia SAG-04 Page 5/23 U.S.A. USG-13 UN3166 Vehicles Engine Machinery (UN3528 Class 3 UN3529 Div. 2.1) 25kg USG-13 (d) articles of UN 3528 or UN 3529 (UN3528 UN3529 ) USG-13 (d) 2. (v) Articles of UN 3528 or UN 3529 (UN3528 UN3529 ) IATA DGR 9.3.4 Loading on Cargo Aircraft () Page 5/23 2.8.3.4 Air Europa Air Europa Express (X5) flydubai Frenchblue (BF) Middle East Airlines Niki (HG) Page 6/23 3K (Jet Asia) 3K-05 Page 6/239/23 5X (United Parcel Service) 5X-01, 5X-02, 5X-03, 5X-04, 5X-05, 5X-06, 5X-07, 5X-08 Page 9/23 AI (Air India) AI-08 AZ (Alitalia Airlines) AZ-02 BF (Frenchblue) BF-01 Page 10/23 BR (EVA Airways) BR-19 CA (Air China) CA-14 CA-15 CX (Cathay Pacific Airways) CX-08 Page 11/23 FX (Federal Express) FX-04, FX-05 GF (Gulf Air) GF-14 Page 12/23 GH (Lic GloBus) GH-02 HG (Niki) HG-01, HG-02, HG-03, HG-04, HG-05, HG-06 JL (Japan Airlines) JL-08 JL-08 I I JU (Air Serbia) JU-06, JU-07, JU-13 KA (Hong Kong Dragon Airlines (Cathay Dragon)) KA-08 Page 13/23 LD (Air Hong Kong) LD-08 LX (Swiss International) LX-07 ME (Middle East Airlines) ME-02 MN (Comair Pty Ltd) MN-01, MN-02 MP (Martinair Holland) MP-07 OK (Czech Airlines) -

Before the U.S. Department of Transportation Washington, D.C

BEFORE THE U.S. DEPARTMENT OF TRANSPORTATION WASHINGTON, D.C. Application of AMERICAN AIRLINES, INC. BRITISH AIRWAYS PLC OPENSKIES SAS IBERIA LÍNEAS AÉREAS DE ESPAÑA, S.A. Docket DOT-OST-2008-0252- FINNAIR OYJ AER LINGUS GROUP DAC under 49 U.S.C. §§ 41308 and 41309 for approval of and antitrust immunity for proposed joint business agreement JOINT MOTION TO AMEND ORDER 2010-7-8 FOR APPROVAL OF AND ANTITRUST IMMUNITY FOR AMENDED JOINT BUSINESS AGREEMENT Communications about this document should be addressed to: For American Airlines: For Aer Lingus, British Airways, and Stephen L. Johnson Iberia: Executive Vice President – Corporate Kenneth P. Quinn Affairs Jennifer E. Trock R. Bruce Wark Graham C. Keithley Vice President and Deputy General BAKER MCKENZIE LLP Counsel 815 Connecticut Ave. NW Robert A. Wirick Washington, DC 20006 Managing Director – Regulatory and [email protected] International Affairs [email protected] James K. Kaleigh [email protected] Senior Antitrust Attorney AMERICAN AIRLINES, INC. Laurence Gourley 4333 Amon Carter Blvd. General Counsel Fort Worth, Texas 76155 AER LINGUS GROUP DESIGNATED [email protected] ACTIVITY COMPANY (DAC) [email protected] Dublin Airport [email protected] P.O. Box 180 Dublin, Ireland Daniel M. Wall Richard Mendles Michael G. Egge General Counsel, Americas Farrell J. Malone James B. Blaney LATHAM & WATKINS LLP Senior Counsel, Americas 555 11th St., NW BRITISH AIRWAYS PLC Washington, D.C. 20004 2 Park Avenue, Suite 1100 [email protected] New York, NY 10016 [email protected] [email protected] Antonio Pimentel Alliances Director For Finnair: IBERIA LÍNEAS AÉREAS DE ESPAÑA, Sami Sareleius S.A. -

Annual Report 2007 63Rd Annual General Meeting Vancouver, June 2007

INTERNATIONAL AIR TRANSPORT ASSOCIATION ANNUAL ANNUAL REPORT REPORT 07 20 07 Contents IAtA Board of Governors 03 Director General’s Message 04 01 the state of the Industry 06 02 simplifying the Business 12 03 safety 18 04 security 24 05 Regulatory & Public Policy 30 06 environment 34 07 Cost-efficiency 40 08 Industry Financial 44 & shared services 09 Aviation solutions 50 10 IAtA Membership 52 11 IAtA Worldwide 54 Giovanni Bisignani Director General & CEO International Air transport Association Annual Report 2007 63rd Annual General Meeting Vancouver, June 2007 Promoting sustainable forest management. This paper is certified by FSC (Forest Stewardship Council) and PEFC (Programme for the endorsement of Forest Certification schemes). IATA has become more relevant to its members; and is a strong and respected voice on behalf of our industry. But while airline fortunes may have improved, many challenges remain. Chew Choon Seng IATA Board of Governors Report, 2006 03 IATA Board of Governorsas at 1 May 2007 Khalid Abdullah Almolhem Temel Kotil Fernando Pinto SAUDI ARABIAN AIRLINES TURKISH AIRLINES TAP PORTUGAL Gerard Arpey Liu Shaoyong Toshiyuki Shinmachi AMERICAN AIRLINES CHINA SOUTHERN AIRLINES JAPAN AIRLINES David Bronczek Samer A. Majali Jean-Cyril Spinetta FEDEX EXPRESS ROYAL JORDANIAN AIR FRANCE Philip Chen Wolfgang Mayrhuber Douglas Steenland CATHAY PACIFIC LUFTHANSA NORTHWEST AIRLINES Chew Choon Seng – Chairman Robert Milton Vasudevan Thulasidas SINGAPORE AIRLINES AIR CANADA AIR INDIA Yang Ho Cho Atef Abdel Hamid Mostafa Glenn F. Tilton KOREAN AIR EGYPTAIR UNITED AIRLINES Fernando Conte Titus Naikuni Leo M. van Wijk IBERIA KENYA AIRWAYS KLM ROYAL DUTCH AIRLINES Enrique Cueto Valery M.