Annual Report 2007 63Rd Annual General Meeting Vancouver, June 2007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SAP Crystal Reports

GENERAL MITCHELL INTERNATIONAL AIRPORT MONTHLY DATA - March 2018 PASSENGERS LNDG WT MAIL FREIGHT AIRLINE ENP DEP TOTAL SHARELANDGS INT'L OLTS SCREENED LBS SHARE ENP DEP TOTAL ENP DEP TOTAL AER LINGUS CARGO 0 0 00.00% 1 0 0 0 407,8550.09% 0 0 0 0 0 0 AIR ALSIE 0 0 00.00% 1 0 0 0 62,4000.01% 0 0 0 0 0 0 AIR CANADA 1,335 1,321 2,6560.38% 52 2,656 0 1,335 2,444,0000.55% 0 0 0 0 0 0 AIR CARGO CARRIERS, IN 0 0 00.00% 25 0 0 0 660,3000.15% 0 0 0 0 0 0 AIR NET SYSTEMS 0 0 00.00% 0 0 0 0 00.00% 0 0 0 0 0 0 ALASKA AIRLINES, INC. 3,360 3,534 6,8941.00% 31 0 0 3,360 3,794,1700.85% 1,384 663 2,047 519 896 1,415 ALLEGIANT AIR, LLC 6,867 6,571 13,4381.95% 45 0 0 6,867 6,310,6861.42% 0 0 0 0 0 0 AMERICAN AIRLINES, INC 39,322 38,377 77,69911.25% 526 0 0 39,322 44,139,6429.94% 37,527 56,174 93,701 4,171 13,046 17,217 CARGOLUX AIRLINES INT 0 0 00.00% 1 0 0 0 763,0000.17% 0 0 0 0 0 0 COBALT AIR LLC 0 0 00.00% 1 0 0 0 15,7000.00% 0 0 0 0 0 0 CONCESIONARIA VUELA 800 917 1,7170.25% 8 1,717 0 800 1,137,5840.26% 0 0 0 0 0 0 CORPORATE AIR, LLC 0 0 00.00% 1 0 0 0 31,8000.01% 0 0 0 0 0 0 CSA AIR, INC. -

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

CDGS12 SOS Webcohor

Start of Season Report Paris - Charles de Gaulle Summer 2012 Source: SLOTIX Paris - Charles de Gaulle Airport CDG/LFPG Summer 2012 - Start Of Season Report Report data extraction date: Tuesday 27 March 2012 Last modification made on: Wednesday 28 March 2012 Table of contents Evolution of allocated slots at the Start Of Season (SOS) ............................................................................................2 Total slots by operator – TOP15 .......................................................................................................................................2 Slots distribution per alliance .............................................................................................................................................4 Size of aircraft ......................................................................................................................................................................5 Allocated slots per destination ...........................................................................................................................................6 Geographical distribution of allocated slots .....................................................................................................................8 Slots distribution per service type .....................................................................................................................................8 CDG Summer S12 capacities ...........................................................................................................................................9 -

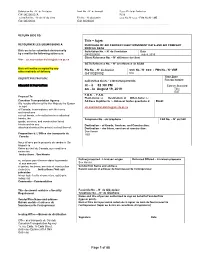

G410020002/A N/A Client Ref

Solicitation No. - N° de l'invitation Amd. No. - N° de la modif. Buyer ID - Id de l'acheteur G410020002/A N/A Client Ref. No. - N° de réf. du client File No. - N° du dossier CCC No./N° CCC - FMS No./N° VME G410020002 G410020002 RETURN BIDS TO: Title – Sujet: RETOURNER LES SOUMISSIONS À: PURCHASE OF AIR CARRIER FLIGHT MOVEMENT DATA AND AIR COMPANY PROFILE DATA Bids are to be submitted electronically Solicitation No. – N° de l’invitation Date by e-mail to the following addresses: G410020002 July 8, 2019 Client Reference No. – N° référence du client Attn : [email protected] GETS Reference No. – N° de reference de SEAG Bids will not be accepted by any File No. – N° de dossier CCC No. / N° CCC - FMS No. / N° VME other methods of delivery. G410020002 N/A Time Zone REQUEST FOR PROPOSAL Sollicitation Closes – L’invitation prend fin Fuseau horaire DEMANDE DE PROPOSITION at – à 02 :00 PM Eastern Standard on – le August 19, 2019 Time EST F.O.B. - F.A.B. Proposal To: Plant-Usine: Destination: Other-Autre: Canadian Transportation Agency Address Inquiries to : - Adresser toutes questions à: Email: We hereby offer to sell to Her Majesty the Queen in right [email protected] of Canada, in accordance with the terms and conditions set out herein, referred to herein or attached hereto, the Telephone No. –de téléphone : FAX No. – N° de FAX goods, services, and construction listed herein and on any Destination – of Goods, Services, and Construction: attached sheets at the price(s) set out thereof. -

Nigeria's Infrastructure: a Continental Perspective

COUNTRY REPORT Nigeria’s Infrastructure: A Continental Perspective Vivien Foster and Nataliya Pushak FEBRUARY 2011 © 2011 The International Bank for Reconstruction and Development / The World Bank 1818 H Street, NW Washington, DC 20433 USA Telephone: 202-473-1000 Internet: www.worldbank.org E-mail: [email protected] All rights reserved A publication of the World Bank. The World Bank 1818 H Street, NW Washington, DC 20433 USA The findings, interpretations, and conclusions expressed herein are those of the author(s) and do not necessarily reflect the views of the Executive Directors of the International Bank for Reconstruction and Development / The World Bank or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Rights and permissions The material in this publication is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. The International Bank for Reconstruction and Development / The World Bank encourages dissemination of its work and will normally grant permission to reproduce portions of the work promptly. For permission to photocopy or reprint any part of this work, please send a request with complete information to the Copyright Clearance Center Inc., 222 Rosewood Drive, Danvers, MA 01923 USA; telephone: 978-750-8400; fax: 978-750-4470; Internet: www.copyright.com. -

An Infrastructure Action Plan for Nigeria

Copyright c African Development Bank Group Rights and Permissions Angle des l’avenue du Ghana et des Rues Peirre de Coubertin et Hedi Nouira All rights reserved. BP 323 -1002 TUNIS Belvedere (Tunisia) Tel : +216 71 333 511/71 103 450 The text and data in this publication may be repro- Fax: +216 71 351 933 duced as long as the source is cited. Reproduction Email: [email protected] for commercial purposes is forbidden. This document may be ordered from: Legal Disclaimer The Knowledge & Information Center (KVRC), African Development Bank The findings, interpretations and conclusions in Address: BP 323 -1002 TUNIS Belvedere (Tunisia) this report are those of the author/s and not neces- Telephone: +216 711103402 sarily those of the African Development Bank. In Telefax: +216 71833248 preparation of this document, every effort was E-mail: [email protected] made to source data and information from formal internal sources including the National Bureau of Cover design : KeyKoncepts Statistics (NBS). Cover Photo : AfDB Finance Projects Typesetting and interior design: KeyKoncepts In preparation of this document, every effort has Maps: Kroll Maps also been made to offer the most current, correct Photography: AfDB and clearly expressed information and analysis. Nonetheless, inadvertent errors can occur, and ap- plicable laws, rules and regulations may change. The African Development Bank makes its docu- mentation available without warranty of any kind and accepts no responsibility for its accuracy or for any consequences of its use. For more information about this report and other information on Nigeria, please visit http://www. afdb.org/en/countries/Western-africa/Nigeria/infra- structure-and-growth-in-Nigeria-an-action-plan-for- strengthened-recovery/ Foreword On his official visit to Nigeria from November 23-24, 2010, the President of the African Development Bank Group, Dr. -

International Civil Aviation Organization Aviation Data and Analysis Seminar (Tehran, Iran I.R, 20

International Civil Aviation Organization Aviation Data and Analysis Seminar (Tehran, Iran I.R, 20 - 23 February 2017) LIST OF PARTICIPANTS 20 February 2017 NAME TITLE & ADDRESS STATES ALGERIA Ms. Kahina Loucif Commercial Director Airport Services Management Establishment ALGERIA Ms. Lamia Ouali Technical Framework Airport Services Management Establishment ALGERIA INDIA Mr. Praveen Kumar Srivastava Deputy Director (ISS) Directorate general of Civil Aviation (DGCA) New Delhi, INDIA ISLAMIC REPUBLIC OF IRAN Mr. Mortaza Dehghan Vice President of Aeronautical and International Affairs Civil Aviation Organization Tehran - ISLAMIC REPUBLIC OF IRAN Mr. Arash Khodai Vice President Civil Aviation Organization Tehran - ISLAMIC REPUBLIC OF IRAN Mr. Vahid Ezoji Vice President of Administrative Department Civil Aviation Organization Tehran - ISLAMIC REPUBLIC OF IRAN Mr. Hassanali Shahbazilar Representative of I.R. of Iran to the ICAO ICAO HQ Montreal - CANADA Mr. Morad Esmaili Director General for Legal and International Affairs Tehran - ISLAMIC REPUBLIC OF IRAN Mr. Mohammad Saeed Sharafi General Director for Aerodrome and ANS oversight Civil Aviation Organization Tehran - ISALAMIC REPUBLIC OF IRAN - 2 - NAME TITLE & ADDRESS Rahmatoolah Firoozipour Director General Civil Aviation Organization Tehran - ISALAMIC REPUBLIC OF IRAN Mr. Meisam Shaker Arani Assistance Director for Aerodrome and ANS Oversight Civil Aviation Organization Tehran - ISLAMIC REPUBLIC OF IRAN Mrs. Fahimeh Sarhadi Deputy Director for International Affairs Civil Aviation Organization Tehran - ISALAMIC REPUBLIC OF IRAN Mr. Mehdi Zand Senior Expert for International Affairs Civil Aviation Organization Tehran - ISLAMIC REPUBLIC OF IRAN Mr. Ramin Amintinat Senior Expert for International Affairs Assurance Manager Tehran - ISLAMIC REPUBLIC OF IRAN Ms. Yasaman Allameh Senior Expert for International Affairs Civil Aviation Organization Tehran - ISLAMIC REPUBLIC OF IRAN Mr. -

Oneworld Visit Europe 1Aug18

Valid effective from 01 August 2018 Amendments: • Add additional cities permitted for Russia in Europe (RU) and excluded for Russia in Asia (XU) OW VISIT EUROPE 1. Application/Fares and Expenses A. Application Valid for travel within Europe. RT, CT, SOJ, DOJ Economy travel On AY/BA/IB/LA/QR/S7-operated direct flights and through plane services. Applicable to Industry discount international fares /Travel agent fares - passengers must have proof of industry/travel agent employment. Travel on the last international sector in to Europe and the first international sector from Europe must be operated and marketed, or marketed AA/AY/BA/CX/EC/IB/JJ/JL/LA/KA/LP/MH/ QF/QR/RJ/S7/UL/XL/4M. For the purposes of this fare, the definition of Europe is as follows: Albania Algeria Armenia Austria Azerbaijan Belarus Belgium Bosnia & Herzegovina Bulgaria Croatia Cyprus Czech Republic Denmark Estonia Finland France Georgia Germany Gibraltar Greece Hungary Iceland Ireland Israel Italy Latvia Lithuania Luxembourg Macedonia Malta Moldova Montenegro Morocco Netherlands Norway Poland Portugal Romania Russia in Europe Slovakia Slovenia Spain Sweden Switzerland Tunisia Turkey Ukraine United Kingdom For the purpose of this fare, Europe can be considered as one country. Note: For the purpose of this fare, flights between Russia in Europe and Russia in Asia are considered intercontinental sectors. Russia in Europe (RU), Russian cities to the West of the Ural Mountains. RU cities are: AAQ/AER/ASF/BZK/EGO/GOJ/IAR/KGD/KLF/KRR/KUF/KZN/LED/LPK/MMK/MOW/MRV/NBC/ OGZ/PEE/PES/PEZ/ROV/SKX/STW/UFA/VOG/VOZ Russia in Asia (XU), Russian cities to the East of the Ural Mountains. -

1 Determinants for Seat Capacity Distribution in EU and US, 1990-2009

Determinants for seat capacity distribution in EU and US, 1990-2009. Pere SUAU-SANCHEZ*1; Guillaume BURGHOUWT 2; Xavier FAGEDA 3 1Department of Geography, Universitat Autònoma de Barcelona, Edifici B – Campus de la UAB, 08193 Bellaterra, Spain E-mail: [email protected] 2Airneth, SEO Economic Research, Roetersstraat 29, 1018 WB Amsterdam, The Netherlands E-mail: [email protected] 3Department of Economic Policy, Universitat de Barcelona, Av.Diagonal 690, 08034 Barcelona, Spain E-mail: [email protected] *Correspondance to: Pere SUAU-SANCHEZ Department of Geography, Universitat Autònoma de Barcelona, Edifici B – Campus de la UAB, 08193 Bellaterra, Spain E-mail: [email protected] Telephone: +34 935814805 Fax: +34 935812100 1 Determinants for seat capacity distribution in EU and US, 1990-2009. Abstract Keywords: 2 1. Introduction Air traffic is one of the factors influencing and, at the same time, showing the position of a city in the world-city hierarchy. There is a positive correlation between higher volumes of air passenger and cargo flows, urban growth and the position in the urban hierarchy of the knowledge economy (Goetz, 1992; Rodrigue, 2004; Taylor, 2004; Derudder and Witlox, 2005, 2008; Bel and Fageda, 2008). In relation to the configuration of mega-city regions, Hall (2009) remarks that it is key to understand how information moves in order to achieve face-to-face communication and, over long distances, it will continue to move by air, through the big international airports (Shin and Timberlake, 2000). This paper deals with the allocation of seat capacity among all EU and US airports over a period of 20 years. -

World Timetable KLM & Partners

World timetable KLM & partners Book on line at klm.com or call KLM Amsterdam + 31 20 4 747 747 24 hours a days, 7 days a week Important This timetable presents schedule data available on Feb. 04, 2005. Schedule changes are likely to occur after this date. We recommend that you obtain confirmation of all flight details when making reservations for your personal itinerary. Book online at www.klm.com or call KLM Amsterdam +31 20 4 747 747 24 hours a day, 7 days a week. Printing To print the page you are viewing, do NOT press the print button but go to the PRINT dialogue and select the page(s) you wish to print. If you do not do this, then the whole timetable will print out. Decoding Airline codes USA Two letter state codes AF Air France TU Tunis Air AK Alaska AM Aeromexico UX Air Europa AL Alabama AS Alaska Airlines VN Vietnam Airlines Corporation AR Arkansas AT Royal Air Maroc VO Tyrolean Airways AZ Arizona AY Finnair Oyj WA KLM Cityhopper B.V. CA California AZ Alitalia WB Rwandair Express CO Colorado A5 Air Linair WX Cityjet dba Air France CT Connecticut A6 Air Alps Aviation XJ Mesaba Airlines (Northwest Airlink) DC District of Columbia BA British Airways XK Compagnie Aerienne Corse Mediterranee DE Delaware BD British Midland Airways Ltd XM Alitalia Express FL Florida BE British European XT Air Exel GA Georgia Bus Bus service YS Regional Airlines dba Air France HI Hawaii CJ China Northern Airlines ZV Air Midwest IA Iowa CO Continental Airlines Z2 Styrian Airways ID Idaho COe Continental Express 2H Thalys International IL Illinois CY Cyprus Airways 9E Pinnacle Airlines (Northwest Airlink) IN Indiana CZ China Southern Airlines 9W Jet Airways KS Kansas DB Brit Air dba Air France KY Kentucky DL Delta Air Lines LA Louisiana DM Maersk Air MA Massachusetts EE Aero Airlines A.S. -

Frequently Asked Questions About Oneworld, Codeshare and Other Partner Airlines

FREQUENTLY ASKED QUESTIONS ABOUT ONEWORLD, CODESHARE AND OTHER PARTNER AIRLINES 1. What will happen to AA’s participation in the oneworld Alliance and its relationships with its codeshare partners or other partner airlines? We expect our participation in oneworld and our relationships with our other partners to remain unchanged. 2. Can I still accrue miles and redeem mileage awards through oneworld and American's frequent flyer air partners? Yes, we expect our partnerships with airlines such as British Airways, Cathay Pacific, Finnair, Iberia, Japan Airlines (JAL), LAN, Malév, Qantas, Royal Jordanian and S7 Airlines and others remain unchanged as a result of the Chapter 11 filing. 3. Will my elite status with AAdvantage still be recognized by oneworld Alliance partners? Yes, we expect that your elite status with AAdvantage will continue to be recognized by our oneworld partners, and that the benefits you receive when flying with them will not change as a result of the Chapter 11 filing. 4. Will there be a reduction of routes that AA currently offers through oneworld and its codeshare partners? We remain deeply committed to meeting your travel needs with the same standards of safe, secure and reliable service, and intend to maintain a strong presence in domestic and international markets. As we and all airlines routinely do, we will continue to evaluate our operations and service, assuring that our network is as efficient and productive as possible. 5. Will AA’s airline partners continue to honor their ticket reservation and baggage transfer commitments? Yes. We expect that all benefits with partner airlines will remain intact. -

European Air Law Association 23Rd Annual Conference Palazzo Spada Piazza Capo Di Ferro 13, Rome

European Air Law Association 23rd Annual Conference Palazzo Spada Piazza Capo di Ferro 13, Rome “Airline bankruptcy, focus on passenger rights” Laura Pierallini Studio Legale Pierallini e Associati, Rome LUISS University of Rome, Rome Rome, 4th November 2011 Airline bankruptcy, focus on passenger rights Laura Pierallini Air transport and insolvencies of air carriers: an introduction According to a Study carried out in 2011 by Steer Davies Gleave for the European Commission (entitled Impact assessment of passenger protection in the event of airline insolvency), between 2000 and 2010 there were 96 insolvencies of European airlines operating scheduled services. Of these insolvencies, some were of small airlines, but some were of larger scheduled airlines and caused significant issues for passengers (Air Madrid, SkyEurope and Sterling). Airline bankruptcy, focus on passenger rights Laura Pierallini The Italian market This trend has significantly affected the Italian market, where over the last eight years, a number of domestic air carriers have experienced insolvencies: ¾Minerva Airlines ¾Gandalf Airlines ¾Alpi Eagles ¾Volare Airlines ¾Air Europe ¾Alitalia ¾Myair ¾Livingston An overall, since 2003 the Italian air transport market has witnessed one insolvency per year. Airline bankruptcy, focus on passenger rights Laura Pierallini The Italian Air Transport sector and the Italian bankruptcy legal framework. ¾A remedy like Chapter 11 in force in the US legal system does not exist in Italy, where since 1979 special bankruptcy procedures (Amministrazione Straordinaria) have been introduced to face the insolvency of large enterprises (Law. No. 95/1979, s.c. Prodi Law, Legislative Decree No. 270/1999, s.c. Prodi-bis, Law Decree No. 347/2003 enacted into Law No.