Annual Report 2007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Plastic Omnium's Manufacturing Businesses

Levallois, January 2, 2020, * Two new President & CEOs to lead Plastic Omnium's manufacturing businesses On January 1, 2020, Stéphane Noël has been appointed President and CEO of Intelligent Exterior Systems, and Christian Kopp has also been appointed President and CEO of Clean Energy Systems. The Intelligent Exterior Systems business, which generates revenue of approximately €4 billion, is the global leader in exterior systems. The Clean Energy Systems business, the world leader in storage and pollution reduction solutions, takes in around €3 billion in revenue. Stéphane Noël, 49, started his career at Hutchinson, working in quality and operations, and later became a subsidiary CEO in Asia. He joined Plastic Omnium in 2012 as President and CEO for Asia for the Clean Energy Systems business. In October 2017 he took on the role of President and CEO of Clean Energy Systems. Stéphane Noël graduated from Polytech Angers and holds a Master's degree from the EM LYON business school. Christian Kopp is now taking the helm of Clean Energy Systems. Christian Kopp, 53, came to Plastic Omnium in 2007 after starting his career at Thomson CSF and Valeo. He held several positions in the Intelligent Exterior Systems business in the areas of programs, sales and business development, before becoming CEO of the Chinese joint venture YFPO. Most recently, he served as president and CEO of the Asia region for Clean Energy Systems. Christian Kopp graduated from MINES Paris Tech and earned a Master's degree at Stanford University. Plastic Omnium Chairman Laurent Burelle and CEO Laurent Favre said, "We congratulate Stéphane Noël and Christian Kopp on their promotions. -

Investor Presentation April 2020 (Fact Book 2019)

Bitte decken Sie die schraffierte Fläche mit einem Bild ab. Please cover the shaded area with a picture. (24.4 x 7.6 cm) Investor Presentation April 2020 (Fact Book 2019) www.continental.com Investor Relations Agenda 1 Continental at a Glance 2 2 Strategy 13 3 Automotive Group 24 3.1 Chassis & Safety → Autonomous Mobility and Safety 34 3.2 Interior → Vehicle Networking and Information 48 3.3 Powertrain → Vitesco Technologies 60 4 Rubber Group 63 4.1 Tires 69 4.2 ContiTech 83 5 Corporate Governance 91 6 Sustainability 101 7 Shares and Bonds 113 8 Glossary 120 2 Investor Presentation, April 2020 © Continental AG 1 | Continental at a Glance One of the World’s Leading Technology Companies for Mobility › Continental develops pioneering technologies and services for sustainable and €44.5 billion connected mobility of people and their goods. 2019 sales › We offer safe, efficient, intelligent, and affordable solutions for vehicles, machines, traffic and transportation. › Continental was founded in 1871 and is headquartered in Hanover, Germany. 241,458 employees (December 31, 2019) 2019 sales by group Rubber Group 595 Locations 40% in 59 countries and markets (December 31, 2019) Automotive Group 60% 3 Investor Presentation, April 2020 © Continental AG 1 | Continental at a Glance Founded in 1871, Expanding into Automotive Electronics Since 1998 Continental-Caoutchouc- and Continental expands its activities in telematics Continental expands Gutta-Percha Compagnie is and other fields by acquiring the automotive Continental expands its expertise in founded in Hanover, Germany. electronics business from Motorola. software and systems vehicle antennas by expertise through the acquiring Kathrein Acquisition of a US Continental reinforces its acquisition of Elektrobit. -

P 01.Qxd 6/30/2005 2:00 PM Page 1

p 01.qxd 6/30/2005 2:00 PM Page 1 June 27, 2005 © 2005 Crain Communications GmbH. All rights reserved. €14.95; or equivalent 20052005 GlobalGlobal MarketMarket DataData BookBook Global Vehicle Production and Sales Regional Vehicle Production and Sales History and Forecast Regional Vehicle Production and Sales by Model Regional Assembly Plant Maps Top 100 Global Suppliers Contents Global vehicle production and sales...............................................4-8 2005 Western Europe production and sales..........................................10-18 North America production and sales..........................................19-29 Global Japan production and sales .............30-37 India production and sales ..............39-40 Korea production and sales .............39-40 China production and sales..............39-40 Market Australia production and sales..........................................39-40 Argentina production and sales.............45 Brazil production and sales ....................45 Data Book Top 100 global suppliers...................46-50 Mary Raetz Anne Wright Curtis Dorota Kowalski, Debi Domby Senior Statistician Global Market Data Book Editor Researchers [email protected] [email protected] [email protected], [email protected] Paul McVeigh, News Editor e-mail: [email protected] Irina Heiligensetzer, Production/Sales Support Tel: (49) 8153 907503 CZECH REPUBLIC: Lyle Frink, Tel: (49) 8153 907521 Fax: (49) 8153 907425 e-mail: [email protected] Tel: (420) 606-486729 e-mail: [email protected] Georgia Bootiman, Production Editor e-mail: [email protected] USA: 1155 Gratiot Avenue, Detroit, MI 48207 Tel: (49) 8153 907511 SPAIN, PORTUGAL: Paulo Soares de Oliveira, Tony Merpi, Group Advertising Director e-mail: [email protected] Tel: (35) 1919-767-459 Larry Schlagheck, US Advertising Director www.automotivenewseurope.com Douglas A. Bolduc, Reporter e-mail: [email protected] Tel: (1) 313 446-6030 Fax: (1) 313 446-8030 Tel: (49) 8153 907504 Keith E. -

Who's Who at Europe's Supplier Parks

AN_070319_23.qxd 15.03.2007 11:19 Uhr Page 23 March 19, 2007 www.autonewseurope.com · PAGE 23 2007 Guide to purchasing Who’s who at Europe’s supplier parks AUDI VOLKSWAGEN 1. Ingolstadt 23. Autoeuropa Supplier Park opened in 1995 Supplier Park opened in 1995 Ingolstadt Logistics Center (GVZ) Palmela, Quinta da Marquesa, 85057 Ingolstadt, Germany Quinta do Anjo, Portugal Tel :(49) 841-890 Tel: (351) 1-321-2541/2601 Carcoustics: door sound proofing; Delphi: interior ArvinMeritor, Benteler, Edscha, Faurecia, Tenneco; wiring harness; Dräxlmaier: wiring, instrument panels; Hayes Lemmerz: wheels; Kautex; Magna Donnelly; Pal- Faurecia: front-end modules; Montes: air filters and metal: Logistics; PPG; Vanpro (joint venture JCI-Faurecia) filtration equipment; Preymesser: consolidation tasks Rehau: bumpers; Scherm: logistics; Röchling Auto- 24. Brussels 30 motive: door trim; Siemens VDO: fuel tanks; Tenneco: Supplier Park opened in 2001 emission control systems; Venture/Peguform: door trim Blvd. De la 2eme Armee, Britannique 201, 201, Britse Tweedelegerlaan, 2a. Neckarsulm 1190 Brussels, Belgium Supplier Park opened in 1996 15 Tel: (32) 2-348-2111 Bad Friedrichshall Industry and Commerce Park ArvinMeritor: door mechanisms, fittings; Expert: 28 NSU Str. 24-32 13 4 bumpers; Inergy: fuel tanks; Hayes Lemmerz: wheels; 74172 Neckarsulm, Germany Siemens VDO: fuel tanks; Sumitomo Electric Indus- 26 Tel: (49) 7132-310 12 24 11 tries: electrical cables AFL Michels: wiring; Plastal: bumpers; Faurecia: floor- 19 29 8 ing; Fritz Logistik: logistics; Grammer: central consoles; 2a 3 25. Pamplona 5 2b HP Pelzer: roofs; Johnson Controls: instrument panels, 18 1 16 Supplier Park opened in 1999 6 27 pillars; Rhenus: logistics; Siemens VDO: fuel tanks; 9 Pol. -

Who Supplies Whom in Europe

20080317-GTP_who_supplies.qxd 3/14/08 5:58 PM Page 2 2008 Guide to purchasing Who supplies whom in Europe Audi BMW Fiat Ford GM Europe Jaguar-Land RoverMercedes/Smart Air conditioning Behr, Denso, Valeo Behr, Denso, Valeo Denso, Valeo Behr, Visteon Behr, Delphi, Valeo Behr, Denso, Visteon Behr, Denso, Eberspächer, Valeo Airbags Autoliv, Key Safety Systems, Alcoa, Autoliv, Takata Petri, Autoliv, Key Safety Systems, Autoliv, Takata-Petri, Autoliv, Key Safety Systems, Autoliv Alcoa , Autoliv, Takata-Petri, Takata-Petri, TRW TRW Automotive TRW Automotive TRW Automotive Takata-Petri, TRW Automotive TRW Automotive Antilock brakes Bosch, Continental Bosch, Continental Bosch, TRW Automotive Continental, TRW Automotive Bosch, Continental, Bosch, Continental Bosch TRW Automotive Automatic Aisin AW, Magneti Marelli, ZF Friedrichshafen Aisin AW, Magneti Marelli Jatco, Magneti Marelli Aisin AW, Magneti Marelli ZF Friedrichshafen Getrag, Magneti Marelli, ZF Friedrichshafen transmissions ZF Friedrichshafen, ZF Sachs Axles Volkswagen Braunschweig Alcoa, ThyssenKrupp, Johnson Controls, Magneti Marelli, Benteler Delphi, Magneti Marelli Dana, Visteon Benteler, ThyssenKrupp, TMD Friction ZF Friedrichshafen TRW Automotive, Varta Batteries Johnson Controls, Moll, Varta Johnson Controls, Seeber, Varta, n/a Johnson Controls, Benteler Delphi, Johnson Controls, Delphi, Johnson Controls, Varta Johnson Controls, Varta, Voestalpine Vb Autobatterie Varta, Vb Autobatterie Brake lines/ Continental, Cooper-Standard, Continental, Freudenburg, FTE, Bosch, CF Gomma, Continental, -

2014 Registration Document 1 CONTENTS

PEUGEOT S.A. Incorporated in France with issued capital of €786,588,648 Governed by a Managing Board and a Supervisory Board Registered Offi ce: 75, avenue de la Grande-Armée DOCUMENT REGISTRATION 75116 Paris – France R.C.S. Paris B 552 100 554 – Siret 552 100 554 00021 Phone: + 33 (0)1 40 66 55 11 – Fax: + 33 (0)1 40 66 54 14 REGISTRATION DOCUMENT psa-peugeot-citroen.com 2014 2014 REGISTRATION2014 DOCUMENT The original French version of this Registration Document, which contains all of the information in the Management Report, was filed with the French securities regulator (Autorité des Marchés Financiers – AMF) on 27 March 2015, in accordance with the provisions of Article 212-13 of the AMF General Regulations. It may be used in connection with a financial transaction in conjunction with an Offering Memorandum approved by the AMF. It was prepared by the issuer and is the responsibility of the person whose Signature appears therein. It contains all of the information concerning the Annual Financial Report. PSA PEUGEOT CITROËN 2014 Registration Document 1 CONTENTS CONSOLIDATED FINANCIAL 1 PSA PEUGEOT CITROËN 3 5 STATEMENTS AT 31 DECEMBER 2014 AFR 169 1.1. Key fi gures 4 1.2. History and highlights of the Company’s business 6 5.1. Consolidated statements of income 170 1.3. Organisational structure 7 5.2. Consolidated statements of income and expenses recognised in equity 172 1.4. Business activities and strategy 11 5.3. Consolidated balance sheets 174 1.5. Risk factors AFR 22 5.4. Consolidated statements of cash fl ows 176 5.5. -

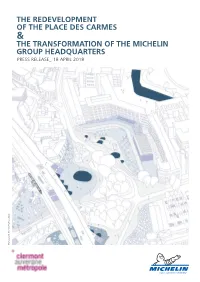

The Redevelopment of the Place Des Carmes the Transformation of the Michelin Group Headquarters

THE REDEVELOPMENT OF THE PLACE DES CARMES & THE TRANSFORMATION OF THE MICHELIN GROUP HEADQUARTERS PRESS RELEASE_ 18 APRIL 2018 © Construire, Encore Heureux, BASE. Press Contacts: Perrine Dijoux: + 33 6 82 79 10 23 - [email protected] Florence Marchand: + 33 6 08 01 16 35 - fl[email protected] EDITORIAL_ IBRINGING THE CARMES SITE INTO A NEW ERA: A VISION SHARED BY CLERMONT-AUVERGNE-MÉTROPOLE AND MICHELIN The crucible in which Michelin was forged and A new stage in the urban transformation of dynamic hub of Clermont-Ferrand, the Carmes site Clermont-Ferrand, indicative of the progressive has symbolic resonance. Its urban transformation outlook of a metropolitan area with international today reflects how the ambitions of Métropole and scope, and with innovation in its DNA, this project Michelin are converging, pointing toward a shared also underlines the solid place of Michelin in the future vision. Clermont landscape. This once rural zone, situated on the historic city outskirts, was initially a In both the architecture and the running of the project, the transformation of the Carmes site place of industry. Service activities expresses the new way in which Michelin is opening then gradually began to predominate, up to the town and to the world. making it the ideal location for the Jean-Dominique Senard, CEO of Michelin Group Group’s head office. In terms of town planning and architecture, this long process has culminated in a somewhat disparate complex, The trust built up over many years between the suffering from a lack of identity. Michelin Group and Clermont-Auvergne-Métropole has once again made it possible to establish a Conceived in the round, the metamorphosis of public-private partnership for developing a large- Carmes seeks to reflect the extensive influence of scale project which embodies a true community of the headquarters of this global group that Michelin purpose. -

4 Psa Peugeot Citroën

20 CORPORATE SOCIAL RESPONSIBILITY STRATEGIC GUIDELINES, COMMITMENTS AND INDICATORS CORPORATE SOCIALSO RESPONSIBILITY STRATEGIC GUIDELINES, COMMITMENTS AND INDICATORS 2011 In addition to the 2011 Sustainable Development and Annual Report and its website (www.annualreport.psa-peugeot- citroen.com), this document covers the economic, environmental, social, societal and governance aspects of the corporate social responsibility performance of PSA Peugeot Citroën companies. It is designed to provide a deeper understanding of the Group’s sustainable development challenges and impacts and explain more about its policies, programmes and 2011 accomplishments. Together, these publications make up PSA Peugeot Citroën’s sustainable development reporting for 2011 and are available on the corporate website (www.psa-peugeot-citroen.com) Global Reporting Initiative (GRI) Guidelines For the ninth straight year, the Group’s sustainable development reporting follows the Sustainability Reporting Guidelines issued by the Global Reporting Initiative, using the G3 version for the fifth year. According to the criteria recommended in the “G3 Guidelines, Application Levels”, the Group’s own assessment of its 2011 sustainable development reporting results in an A+ application level (the GRI application level check statement is available at the end of this report). Audit In its capacity as outside auditor, Grant Thornton has performed the necessary verifications aimed at expressing moderate assurance on: | The Group’s procedures for compiling i) the environmental data from PCA, PCI and PMTC production plants, Peugeot and Citroën dealerships, Gefco and Faurecia, and ii) the employee relations data from the Automotive Division, Peugeot and Citroën dealerships and Gefco published in this Report, which are indicated by this symbol: P | Certain PCA environmental indicators and certain Automotive Division employee relations indicators. -

![[Encode Sans 47 Pt Light] on Several Lines LOREM](https://docslib.b-cdn.net/cover/6403/encode-sans-47-pt-light-on-several-lines-lorem-1876403.webp)

[Encode Sans 47 Pt Light] on Several Lines LOREM

CHIEF EXECUTIVE OFFICER Carlos TAVARES Carlos Tavares held various positions within the Renault Group between 1981 and 2004, before joining the Nissan Group. Carlos Tavares was appointed Executive Vice President, Chairman of the Management Committee Americas and President of Nissan North America in 2009, before being appointed as Chief Operating Officer of Renault, a position he held until 2013. Carlos Tavares served as Chairman of the PSA Managing Board from March 31, 2014, having joined the PSA Managing Board on January 1, 2014. He also serves as a director of Airbus Holding S.A., and is a member of the board of directors of the European Automobile Manufacturers’ Association (ACEA). Carlos Tavares was appointed Executive Director of Stellantis with effect from January 17, 2021 and Chief Executive Officer on January 17, 2021. Born in Portugal, Carlos Tavares graduated from École Centrale de Paris. 2021/01/19 Communication Department HEAD OF AMERICAS Mike MANLEY Michael Manley has a deep background in all aspects of global business operations including strategy, business development, commercial, brand, product planning and operational activities. Bringing extensive experience in the international automobile business, Manley joined DaimlerChrysler in 2000 as Director - Network Development (United Kingdom). He was responsible for product planning and all sales activities outside North America, appointed to this position in December 2008. He later served as Executive Vice President - International Sales and Global Product Planning Operations. Manley was the lead executive for the international activities of Chrysler Group outside of North America, where he was responsible for implementing the co-operation agreements for distribution of Chrysler Group products through Fiat’s international distribution network. -

Hybrids Electric Vehicles Slides Revue Chris

Hybrids & Electric Vehicles Challenges and Opportunities Pascal Colombani Chairman, Valeo Sharing Knowledge Conference Mövenpick Hotel by the Dead Sea, Jordan, March 1, 2010 Context and customer attitude Hybrid worlds and technical considerations Industrialization and markets Infrastructures and new business models Environmental concerns, Security of Supply, CO2 Regulations L/ 100 km - g CO2/km 11 260 USA 10 240 9 220 200 8 JAPAN 180 Federal 7 160 6 140 EUROPE California ? 5 120 100 4 Source: International Energy Agency 80 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 CO2 Reductions driven by regulations AND enduser expectations March, 1 2010 © Valeo 2009 3 I Millions of electric vehicles ? EV / PHEV / HEV experimentations in Europe "The future belongs to the electric Amsterdam Denmark vehicle – using electricity from the power plug" Martin Winterkorn, CEO Volkswagen, 2008 London Berlin "The Obama-Biden comprehensive New Energy for America plan will put 1 million plug-in hybrid electric cars on the road by 2015" Strasbourg Munich Barack Obama, President of the United States "Millions of electric vehicles will be rolling on German roads within the next Portugal Bregenz 20 years" Jürgen Gromann, CEO RWE Spain Monaco Milan, Pisa "Americans need one electric car per & Roma household. That's 100 million cars right there. And it can be done" Shai Agassi, CEO Better Plance Nice to have or must have? Source: A.T. Kearney March, 1 2010 © Valeo 2009 4 I Automotive demand 2007 - 2008 Alternative Drive in the Future* 2007 2008 Europe -

Automotive Industry & Innovation

AUTOMOTIVE KEY INFO IN INDUSTRY 10POINTS & INNOVATION HIGH-TECH INDUSTRIES A M S TO ARK ES ET C O C F A M A S N IL R TS D LI E E A G ON SUM RK AT CON MA EUROPE’S EWAY TO EMEA #2 (INSEE) AUTOMOTIVE INDUSTRY (EUROSTAT) FRENCH AUTOMOTIVE #1 INDUSTRY: HOST COUNTRY FOR FOREIGN INVESTMENT 4.2% PROJECTS IN INDUSTRY INCREASE IN EXPORTS IN EUROPE IN 2018 (EY) (DOUANES) BUSINESS FRANCE 77, boulevard Saint-Jacques 75680 Paris Cedex 14 Tel. : +33 1 40 73 30 00 A DRIVING FORCE With 2.2 million passenger cars registered in France in 2018 1 (up 3%), France is ranked third in Europe (European Automobile Manufacturers’ Association, ACEA). In 2016, there were 1,925 companies operating and more than 197,000 people employed in the automobile industry (made up of automakers and equipment manufacturers). In 2018, French exports of vehicles and automotive equipment amounted to €50.5 billion, up 4.2% compared with 2017. (French Customs Authorities) #2 MARKET IN EUROPE In 2016, the French automotive industry was the second largest in 2 Europe in terms of revenues after Germany (€482 million) (Eurostat). France is the continent’s third largest producer of passenger cars (1.7 million in 2018), after Germany (4.9 million), and Spain (2.2 million), with production having increased for the fifth year in a row. (European Automobile Manufacturers’ Association, ACEA) GLOBAL BRANDS France has two companies among the world’s top 10 car 3 manufacturers (Renault, 9th, and PSA, 10th) and two among the top 10 equipment manufacturers (Faurecia, 8th, and Valeo, 9th). -

Groupe Psagroupe - 2018 Registration Document

20 REGISTRATION DOCUMENT Including the annual financial report 18 GROUPE PSA - 2018 REGISTRATION DOCUMENT -1 CONTENTS MESSAGE OF THE PRESIDENT 2 KEY FIGURES 3 CONSOLIDATED FINANCIAL GROUPE PSA 5 STATEMENTS AT 31 DECEMBER 2018 143 1.1. History and highlights of the Company’s business 6 5.1. Consolidated statements of income 144 1.2. Organisational structure 7 5.2. Consolidated comprehensive income 146 1.3. Activities and strategy 9 5.3. Consolidated statements of financial position 148 1.4. Risk management and internal control procedures 20 5.4. Consolidated statements of cash flows 150 1.5. Risk factors DPEF.B 23 5.5. Consolidated statements of changes in equity 152 1.6. Vigilance plan 34 5.6. Notes to the consolidated financial statements at 31 December 2018 153 5.7. Report of the Supervisory Board: DECLARATION ON observations of the Supervisory Board EXTRA-FINANCIAL PERFORMANCE 37 on the Report of the Managing Board 2.1. Social responsibility: an integral part of and on the 2018 consolidated financial the Group’s strategy 38 statements 221 2.2. Embracing environmental issues 41 5.8. Statutory Auditors' Report on the 2018 consolidated financial statements 222 2.3. Societal commitment to sustainable development 57 PEUGEOT S.A. FINANCIAL 2.4. Human resources: driving Groupe PSA STATEMENTS FOR THE YEAR transformation 65 ENDED 31 DECEMBER 2018 227 2.5. Groupe PSA CSR performance 78 6.1. Income statement for the year ended 2.6. Report by the independent third party, 31 December 2018 228 on the consolidated non-financial statement included in the group 6.2.