EU Air Transport Liberalisation: Process, Impacts and Future Considerations

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

![Contents [Edit] Africa](https://docslib.b-cdn.net/cover/9562/contents-edit-africa-79562.webp)

Contents [Edit] Africa

Low cost carriers The following is a list of low cost carriers organized by home country. A low-cost carrier or low-cost airline (also known as a no-frills, discount or budget carrier or airline) is an airline that offers generally low fares in exchange for eliminating many traditional passenger services. See the low cost carrier article for more information. Regional airlines, which may compete with low-cost airlines on some routes are listed at the article 'List of regional airlines.' Contents [hide] y 1 Africa y 2 Americas y 3 Asia y 4 Europe y 5 Middle East y 6 Oceania y 7 Defunct low-cost carriers y 8 See also y 9 References [edit] Africa Egypt South Africa y Air Arabia Egypt y Kulula.com y 1Time Kenya y Mango y Velvet Sky y Fly540 Tunisia Nigeria y Karthago Airlines y Aero Contractors Morocco y Jet4you y Air Arabia Maroc [edit] Americas Mexico y Aviacsa y Interjet y VivaAerobus y Volaris Barbados Peru y REDjet (planned) y Peruvian Airlines Brazil United States y Azul Brazilian Airlines y AirTran Airways Domestic y Gol Airlines Routes, Caribbean Routes and y WebJet Linhas Aéreas Mexico Routes (in process of being acquired by Southwest) Canada y Allegiant Air Domestic Routes and International Charter y CanJet (chartered flights y Frontier Airlines Domestic, only) Mexico, and Central America y WestJet Domestic, United Routes [1] States and Caribbean y JetBlue Airways Domestic, Routes Caribbean, and South America Routes Colombia y Southwest Airlines Domestic Routes y Aires y Spirit Airlines Domestic, y EasyFly Caribbean, Central and -

SASCON'15 Program

SASCON `15 Swiss Aviation Safety Conference 2015 Location Tannwaldstrasse. From there follow the street and turn at the end of the street to the right SASCON ‘15 - Fatigue Risk Hotel ARTE, Kongresszentrum into Von-Roll-Strasse. Follow the street till you Riggenbachstrasse 10 see the hotel on your right. 4601 Olten Management Systems www.konferenzhotel.ch How to arrive by car You may park your car in the Sälipark P1 close 8th September 2015 to the hotel. Coming from Zurich, Bern, Basel How to arrive by train and Lucerne take the highway exit Rothrist and follow the signs for Olten/Aarburg. Pass The hotel ARTE is approx. 10 minutes on foot the tunnel and continue on until you see on away from the Olten train station. Use the rail- your right the sign Hotel Arte. Turn right and way underpass, where you find the Migrolino follow the sign. After 500m you will see the shop (near platform 12). On the right hand Hotel. side of the shop climb the stairs leading to Cover image by Mark Rabo: flic.kr/p/7HCbnR Federal Office of Civil Aviation 2015 www.foca.admin.ch Program 09:00 - 09:30 Registration 13:30 - 14:00 Fatigue Risk Management Stefan Becker, Head of Corporate Development 09:30 - 09:45 Opening of SASCON ’15, Welcome Address Swiss Air Ambulance Ltd., REGA Dr. Peter Müller, Director General FOCA 14:00 - 14:30 Fatigue Risk Management At Swiss Ph.D. Loukia Loukopoulou, Manager, Human 09:45 - 10:30 Things We Once Believed: A Reflection On The Performance & Systems Evolution of Fatigue Management Swiss International Airlines Ltd. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Austria 2020 440 Austrian Airlines AG 424300 19210 UIA-VB 3289 30323

Annex I EN Changes to National allocation table for the year 2020 pursuant to the Agreement between the European Union and the Swiss Confederation on the linking of their greenhouse emissions trading systems, and to the Commission Delegated Decision C(2020) 3107 Note: The values for 2020 are total. They include the initial allocation for the flights between EEA Aerodromes and the additional allocation for the flights to and within Switzerland. These values need to be inserted as updates in the National Aviation Allocation Tables XML file. Member State: Austria ETSID Operator name 2020 440 Austrian Airlines AG 424300 19210 UIA-VB 3289 30323 International Jet Management GmbH 157 33061 AVCON JET AG 83 28567 Tupack Verpackungen Gesellschaft m.b.H. 17 25989 The Flying Bulls 16 45083 easyJet Europe Airline GmbH 1823642 Member State: Belgium ETSID Operator name 2020 908 BRUSSELS AIRLINES 285422 27011 ASL Airlines Belgium 110688 2344 SAUDI ARABIAN AIRLINES CORPORATION 3031 32432 EgyptAir 315 29427 Flying Service 271 13457 EXCLU Flying Partners CVBA 81 36269 EXCLU VF International SAGL 22 28582 EXCLU Inter-Wetail c/o Jet Aviation Business Jets AG 14 Member State: Bulgaria ETSID Operator name 2020 29056 Bulgaria Air 81265 28445 BH AIR 41204 Member State: Croatia ETSID Operator name 2020 12495 Croatia Airlines hrvatska zrakoplovna tvrtka d.d. 88551 Member State: Cyprus ETSID Operator name 2020 7132 Joannou & Paraskevaides (Aviation) Limited 30 Member State: Czechia ETSID Operator name 2020 859 České aerolinie a.s. 256608 24903 Smartwings, a.s. 119819 -

1 Determinants for Seat Capacity Distribution in EU and US, 1990-2009

Determinants for seat capacity distribution in EU and US, 1990-2009. Pere SUAU-SANCHEZ*1; Guillaume BURGHOUWT 2; Xavier FAGEDA 3 1Department of Geography, Universitat Autònoma de Barcelona, Edifici B – Campus de la UAB, 08193 Bellaterra, Spain E-mail: [email protected] 2Airneth, SEO Economic Research, Roetersstraat 29, 1018 WB Amsterdam, The Netherlands E-mail: [email protected] 3Department of Economic Policy, Universitat de Barcelona, Av.Diagonal 690, 08034 Barcelona, Spain E-mail: [email protected] *Correspondance to: Pere SUAU-SANCHEZ Department of Geography, Universitat Autònoma de Barcelona, Edifici B – Campus de la UAB, 08193 Bellaterra, Spain E-mail: [email protected] Telephone: +34 935814805 Fax: +34 935812100 1 Determinants for seat capacity distribution in EU and US, 1990-2009. Abstract Keywords: 2 1. Introduction Air traffic is one of the factors influencing and, at the same time, showing the position of a city in the world-city hierarchy. There is a positive correlation between higher volumes of air passenger and cargo flows, urban growth and the position in the urban hierarchy of the knowledge economy (Goetz, 1992; Rodrigue, 2004; Taylor, 2004; Derudder and Witlox, 2005, 2008; Bel and Fageda, 2008). In relation to the configuration of mega-city regions, Hall (2009) remarks that it is key to understand how information moves in order to achieve face-to-face communication and, over long distances, it will continue to move by air, through the big international airports (Shin and Timberlake, 2000). This paper deals with the allocation of seat capacity among all EU and US airports over a period of 20 years. -

Hawaiian Holdings, Inc. 2017 Annual Report Map Not Drawn to Scale

Hawaiian Holdings, Inc. 2017 Annual Report Map not drawn to scale. CANADA Seattle Harbin Asahikawa Portland NORTH Burlington Memanbetsu Portland Sapporo/Chitose Kushiro AMERICA Rochester Shenyang Obihiro Buffalo Boston Hakodate Salt Lake City Syracuse Nantucket Misawa JAPAN Martha’s Vineyard Beijing Aomori Akita Morioka Sacramento New York/Kennedy Yamagata CHINA Niigata Oakland Seoul/Incheon Komatsu Sendai San Francisco Osaka/Itami Izumo Tokyo/Narita San Jose SOUTH Busan Hiroshima Nagoya Ube Tokyo/Haneda Las Vegas Raleigh-Durham KOREA Kitakyushu Osaka/Kansai Los Angeles Charlotte Fukuoka Nanki Shirahama Atlanta Nagasaki Okayama Long Beach Phoenix Shanghai/Hongqiao Kumamoto Tokushima Savannah Kagoshima Takamatsu San Diego Kochi Austin Oita Matsuyama Jacksonville Hangzhou Shanghai/Pudong Chengdu Chongqing Amami Miyazaki Daytona Beach Tampa Orlando To New Delhi, India Okinawa L¯ıhu‘e Fort Myers West Palm Beach MEXICO Fort Lauderdale Xiamen Taipei Guangzhou Honolulu Kahului Shenzhen Kaohsiung Hong Kong* TAIWAN Kailua-Kona Hanoi HAWAI‘I THAILAND Manila Bangkok* PHILIPPINES VIETNAM Guam Phnom Penh Ho Chi Minh City CAMBODIA MALAYSIA Kuala Lumpur Singapore PAPUA KAUA‘I NEW GUINEA Lıhu‘e O‘AHU INDONESIA NI‘IHAU Jakarta MOLOKA‘I Honolulu Kapalua Ho‘olehua Kahului MAUI Pago Pago La¯na‘i City AMERICAN LANA‘I SAMOA KAHO‘OLAWE Cairns Papeete Townsville Hilo Mackay TAHITI Kailua-Kona Rockhampton AUSTRALIA Gladstone HAWAI‘I ISLAND Brisbane Perth Sydney Adelaide Canberra Auckland New Plymouth Melbourne Napier Palmerston North Wellington NEW Nelson ZEALAND Christchurch Queenstown Dunedin Codeshare Partners: Honolulu – Long Beach Starting May 2018 Future Routes Kahului – San Diego Starting May 2018 Lı¯hu‘e – Oakland Interline Partners: Starting July 2018 OPERATED BY EMPIRE AIRLINES *Some international routes behind and beyond Japan pending receipt of government operating authority. -

Aero Ae 45 & Ae

This production list is presented to you by the editorial team of "Soviet Transports" - current to the beginning of January 2021. Additions and corrections are welcome at [email protected] Aero Ae 45 & Ae 145 181 Ae 45 built by Aero at Prague-Vysocany from 1947 to 1951 The c/n consisted of the year of manufacture and a sequential number. 1 OK-BCA Ae 45 Aero f/f 21jul47 the first prototype; rgd 11sep47; underwent trials with the SVZÚ sep47 OK-BCA Ae 45 Ministers. dopravy trf unknown Ministry of Transport OK-BCA Ae 45 CSA trf unknown canx 1953 2 OK-CCA Ae 45 Aero rgd 09apr48 the second prototype; f/f 12mar48 OK-CCA Ae 45 Celulozka Bratisl. trf unknown Celulozka Bratislava; canx 1958 not known Ae 45 Czechoslovak AF trf unknown 49 003 G-007 (1) Ae 45 Hungarian AF d/d 15may49 HA-AEB Ae 45 MÉM Rep. Szolgálat trf 06apr52 Hungarian Flying Association; damaged 29apr52 when the landing gear broke HA-AEB Ae 45 OMSZ trf 18jun57 Hungarian Air Ambulance; w/o (or canx ?) 22nov62 49 004 OK-DCB Ae 45 rgd 21apr49 canx to Italy I-CRES Ae 45 Aero Club Milano rgd 18jul59 Aero Club Milano of Linate; owner also reported as Franco Rol; based at Torino; canx 1970 F-GFYA Ae 45 Pierre Cavassilas res aug88 Pierre Cavassilas of Chavenay; possibly never fully registered F-AZJX Ae 45 Pierre Cavassilas rgd 08jul94 seen Chavenay 20may94 with a 'W' taped over the 'A' of the registration; still current in 2007; under restoration near Paris in 2008; was to be reflown jan09; seen Compiègne 19jun09 and 27jun09 in all-grey c/s with large blue registration, in great condition; seen Soissons-Courmelles 28may12 with smaller black registration; l/n Compiègne 15jun13, active 49 005 OK-DCA Ae 45 rgd 23apr49 I-AERA Ae 45 Luigi Leone rgd 11oct61 based at Torino 49 006 HB-EKF Ae 45 Mr. -

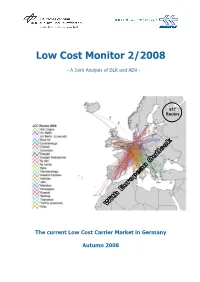

Low Cost Monitor 2/2008

Low Cost Monitor 2/2008 - A Joint Analysis of DLR and ADV - 617 Routes The current Low Cost Carrier Market in Germany Autumn 2008 The current Low Cost Carrier Market in Germany (2008) Since several years the low cost carrier (LCC) market is an essential part of the German air transport market. The Low Cost Monitor, jointly issued by ADV and DLR, twice a year informs on LCC’s essential features and current developments in this market segment, particularly as to the number and relative importance of low cost carriers, their offers including the air fare, and the passenger demand. The offers reflected by the current Monitor are based on one reference week of the summer flight schedule 2008. The passenger traffic indicated relates to the half year total of 2008. Airlines 4 The airlines involved in the Low Cost business, design their flight services quite differently. Due to this inhomogeneity, only a few clear distinctive criteria can be defined, for example low fares and direct sale via the Internet. Thus, in some cases a certain scope of discretion arises when allocating an airline to the LCC-segment. Furthermore, for several airlines amalgamations of business models are seen, which additionally complicate the accurate allocation of airlines to the Low Cost Market. The authors of this Monitor currently classify 23 airlines operating on German airports as low cost carriers. These are in detail (see also Table 1): Aer Lingus (EI) (www.aerlingus.com), Fleet: 33 Aircraft (A320: 27/A321: 6) Air Baltic (BT) (www.airbaltic.com), Fleet: 25 Aircraft -

European Air Law Association 23Rd Annual Conference Palazzo Spada Piazza Capo Di Ferro 13, Rome

European Air Law Association 23rd Annual Conference Palazzo Spada Piazza Capo di Ferro 13, Rome “Airline bankruptcy, focus on passenger rights” Laura Pierallini Studio Legale Pierallini e Associati, Rome LUISS University of Rome, Rome Rome, 4th November 2011 Airline bankruptcy, focus on passenger rights Laura Pierallini Air transport and insolvencies of air carriers: an introduction According to a Study carried out in 2011 by Steer Davies Gleave for the European Commission (entitled Impact assessment of passenger protection in the event of airline insolvency), between 2000 and 2010 there were 96 insolvencies of European airlines operating scheduled services. Of these insolvencies, some were of small airlines, but some were of larger scheduled airlines and caused significant issues for passengers (Air Madrid, SkyEurope and Sterling). Airline bankruptcy, focus on passenger rights Laura Pierallini The Italian market This trend has significantly affected the Italian market, where over the last eight years, a number of domestic air carriers have experienced insolvencies: ¾Minerva Airlines ¾Gandalf Airlines ¾Alpi Eagles ¾Volare Airlines ¾Air Europe ¾Alitalia ¾Myair ¾Livingston An overall, since 2003 the Italian air transport market has witnessed one insolvency per year. Airline bankruptcy, focus on passenger rights Laura Pierallini The Italian Air Transport sector and the Italian bankruptcy legal framework. ¾A remedy like Chapter 11 in force in the US legal system does not exist in Italy, where since 1979 special bankruptcy procedures (Amministrazione Straordinaria) have been introduced to face the insolvency of large enterprises (Law. No. 95/1979, s.c. Prodi Law, Legislative Decree No. 270/1999, s.c. Prodi-bis, Law Decree No. 347/2003 enacted into Law No. -

Air Travel Consumer Report

Air Travel Consumer Report A Product Of THE OFFICE OF AVIATION CONSUMER PROTECTION Issued: August 2021 Flight Delays1 June 2021 January - June 2021 Mishandled Baggage, Wheelchairs, and Scooters 1 June 2021 January -June 2021 Oversales1 2nd Quarter 2021 Consumer Complaints2 June 2021 (Includes Disability and January - June 2021 Discrimination Complaints) Airline Animal Incident Reports4 June 2021 Customer Service Reports to 3 the Dept. of Homeland Security June 2021 1 Data collected by the Bureau of Transportation Statistics. Website: http://www.bts.gov 2 Data compiled by the Office of Aviation Consumer Protection. Website: http://www.transportation.gov/airconsumer 3 Data provided by the Department of Homeland Security, Transportation Security Administration 4 Data collected by the Office of Aviation Consumer Protection. TABLE OF CONTENTS Section Page Section Page Flight Delays Flight Delays (continued) Introduction 3 Table 8 35 Explanation 4 List of Regularly Scheduled Domestic Flights with Tarmac Delays Over 3 Hours, By Marketing/Operating Carrier Branded Codeshare Partners 5 Table 8A Table 1 6 List of Regularly Scheduled International Flights with 36 Overall Percentage of Reported Flight Tarmac Delays Over 4 Hours, By Marketing/Operating Carrier Operations Arriving On-Time, by Reporting Marketing Carrier Appendix 37 Table 1A 7 Mishandled Baggage Overall Percentage of Reported Flight Ranking- by Marketing Carrier (Monthly) 39 Operations Arriving On-Time, by Reporting Operating Carrier Ranking- by Marketing Carrier (YTD) 40 Table 1B 8 -

Make Business Trips Easier with These 4 Travel Hacks

MAY 2016 NEWSLETTER American and United Will Soon Offer PAGE 3 No-Frills Fares Southwest Raises EarlyBird Check-In PAGE 4 Make Business Trips Easier With These 4 Travel Hacks 1 INFocusPAGEPAGE Newsletter 22 Make Business Trips Easier With These 4 Travel Hacks By Brit Tulloch Travelling frequently for work can be 2. Stress less with a travel stick the bag to the back of the seat in draining, on you and your wallet. But it checklist front of you. You can watch what you want doesn’t have to be that way. without straining your neck. It may seem obsessive, but creating There are a few travel tips you can use a travel checklist before you jet off will 4. Save time with the rolling to save money on business trips, making do wonders for your stress levels. You technique your travel experience a little more no longer have to worry about packing pleasant. enough socks or a spare laptop charger. Ever wondered how soldiers fit all their provisions into one backpack? They have 1. Feel more at home with a Use this free app to organise your a special technique for rolling and folding serviced apartment packing, scheduling and other details. their clothes, to allow for maximum space. Staying in hotels every time you travel 3. Create your own inflight With this technique, you can save time can be a downer. The sterile surrounds entertainment at the baggage carousel by travelling with lack the warmth and character of home. only one suitcase. Instead, find the next best thing by staying Smartphones and iPads offer better in a serviced apartment. -

Advanced Seat Reservation

Advanced Seat Reservation Iberia, Iberia Express and Iberia Regional Air Nostrum extend to all fares the possibility of advanced seat reservation from the moment of ticket purchase • The advanced seat reservation is only applicable on flights operated by Iberia, Iberia Express and Iberia Regional Air Nostrum , is only applicable to individual passengers with previously issued flight tickets and, is subject to the availability of seats at the moment of request. • This service is free of charge for passengers travelling in Business class . • For passengers in Economy class this service is voluntary and subject to charges , except for those passengers on Economy Full Fare (Y), fares B, H, K, M, Z, L, A , Club Fiesta passengers, Iberia Plus Platinum and Gold card holders and their equivalents in oneworld Emerald and Sapphire, for whom it's free of charge . • Passengers can choose their seat in the Economy cabin before checking-in online or in person at the airport, provided they have previously issued tickets. • For security reasons, the use of emergency seats, including Economy XL , continue to be subject to certain requirements. • For check-in at the airport, or through on-line check-in unreserved seats are free for all passengers. Flights which can sell paid seats Only Iberia flights operated by Iberia, Iberia Expess and Air Nostrum Flights which do not sell paid seats • Code-share marketing other airlines - flights operated by Iberia - • Code-share IB4000-4999 // IB7000-7999 - flights operated by other airlines - If free assignation is allowed, the conditions applied will be determined by the operating airline. Code-share IB5000-5999 -flights operated by Vueling - There is no seat assignation • Air Shuttle flights • Charter flights TERMS AND CONDITIONS: Terms and Conditions of paid seats The prior reservation of paid seats is optional, is subject to the availability of seats at the moment of request and is only applicable on flights operated by Iberia and Iberia Regional Air Nostrum to individual passengers with previously issued flight tickets.