EDA LAVOSAR Workshop #2 "Industry Workshop" (Brussels, 25Th June 2013) Dr

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Autumn Assembly 2008 Delegate List Delegates Name Title Company Mr David Chetwynd MR SARWAR AHMAD DE&S MOD Mr

Autumn Assembly 2008 Delegate List Delegates Name Title Company Mr David Chetwynd MR SARWAR AHMAD DE&S MOD Mr. Richard Allen-Shalless DAE UK Design Authority & Safety Manager Thales Aerospce Mr Stuart Aplin BAE systems Mr Stephen Armitage Mr David Baddeley Systems Engineer Thales Mr. Adrian Barnes Sr. Systems Engineer QinetiQ Mr. Roger Barrett Technical Consultant Thales Underwater Systems Ltd Colin Bates Director Seframe Limited Mr David Battersby Systems Engineering researcher BAE Systems Mr Richard Beasley Systems Engineering specialist and skill owner Rolls-Royce plc Mr Sidney Birch Software Manager BAE Systems Mr Duncan Bourne Research Engineer Loughborough University/Goodrich Grant Bremer Consultant Aldpartners Mr Ron Brittain Engineering Manager - Systems BVT Surface Fleet (BAE Systems and VT Joint Venture) Mr Simon Brooks Business Engineering Manager Thales Dr Anne Bruseberg Systems Engineering & Assessment Ltd Simon Campbell SELEX Sensors & Airborne Systems Ltd Andrew Campbell Sula Systems Limited Mr Derek Cass Engineering Manager Selex Galileo Mr. Michael Coussens Principal Consultant System Consultant Services Ltd Mr Ian Cox Systems Engineer MBDA Mr Malcolm Currie Head of Systems Engineering Parsons Brinckerhoff Ltd Robert Dale Systems Engineer MBDA Mr M Daley Design Assurance Engineer BVT Surface Fleet Michelle Ellis ERTMS Customer RequirementsTeam Leader Westinghouse Rail Systems Ltd Dr. Michael Emes Senior Research Fellow University College London Mr David Evans Mr BMT Sigma Limited Mr. Stephen Fielding Principal Systems -

Behind a Veil of Secrecy:Military Small Arms and Light Weapons

16 Behind a Veil of Secrecy: Military Small Arms and Light Weapons Production in Western Europe By Reinhilde Weidacher An Occasional Paper of the Small Arms Survey Copyright The Small Arms Survey Published in Switzerland by the Small Arms Survey The Small Arms Survey is an independent research project located at the Grad © Small Arms Survey, Graduate Institute of International Studies, Geneva 2005 uate Institute of International Studies in Geneva, Switzerland. It is also linked to the Graduate Institute’s Programme for Strategic and International Security First published in November 2005 Studies. All rights reserved. No part of this publication may be reproduced, stored in Established in 1999, the project is supported by the Swiss Federal Depart a retrieval system, or transmitted, in any form or by any means, without the ment of Foreign Affairs, and by contributions from the Governments of Australia, prior permission in writing of the Small Arms Survey, or as expressly permit Belgium, Canada, Denmark, Finland, France, the Netherlands, New Zealand, ted by law, or under terms agreed with the appropriate reprographics rights Norway, Sweden, and the United Kingdom. It collaborates with research insti organization. Enquiries concerning reproduction outside the scope of the above tutes and nongovernmental organizations in many countries including Brazil, should be sent to the Publications Manager, Small Arms Survey, at the address Canada, Georgia, Germany, India, Israel, Jordan, Norway, the Russian Federation, below. South Africa, Sri Lanka, Sweden, Thailand, the United Kingdom, and the United States. Small Arms Survey The Small Arms Survey occasional paper series presents new and substan Graduate Institute of International Studies tial research findings by project staff and commissioned researchers on data, 47 Avenue Blanc, 1202 Geneva, Switzerland methodological, and conceptual issues related to small arms, or detailed Copyedited by Alex Potter country and regional case studies. -

Contract Number

Contract Number Contract Title Contract Current Contract Current Total Vendor Name Start Date End Date Contract Value 22A/2132/0210 PROVISION OF ESTABLISHMENT SUPPORT AND TRAINING SERVICES TO (FORMER) NRTA ESTABLISHMENTS 16 Mar 2007 30 Jun 2011 439,664,890.47 VT FLAGSHIP LTD AARC1A/00024 CONTRACTOR LOGISTIC SUPPORT SERVICE FOR ALL MARKS FOR ALL MARKS OF THE VC10 AIRCRAFT PROJECT 18 Dec 2003 31 Mar 2011 463,471,133.00 BAE SYSTEMS (OPERATIONS) LIMITED AARC1B/00188 TRISTAR INTEGRATED OPERATIONAL SUPPORT 20 Oct 2008 31 Dec 2015 118,177,227.00 MARSHALL OF CAMBRIDGE AEROSPACE LIMITED ACT/01397 PROVISION OF AIRCRAFT, INSTRUCTORS & SERVICES TO SUPPORT UAS & EFT, YRS 5 & 6 7 Jan 2009 31 Mar 2019 163,910,977.00 BABCOCK AEROSPACE LIMITED ACT/03528 CATERING (INCLUDING FOOD SUPPLY) RETAIL AND LEISURE SERVICES AND MESS AND HOTEL SERVICES TO VARIOUS RAF 5 Jan 2011 31 May 2018 145,198,692.00 ISS MEDICLEAN LIMITED STATIONS ACROSS THE UNITED KINGDOM AFSUP/0004 SHIP CLUSTER OWNER CONTRACT 23 Jun 2008 23 Jun 2013 180,962,000.00 CAMMELL LAIRD SHIPREPAIRERS & SHIPBUILDERS LIMITED AHCOMM1/00035 APACHE MTADS 11 May 2005 6 Mar 2011 188,407,408.00 WESTLAND HELICOPTERS LIMITED AHCOMM2/2030 APACHE INTEGRATED OPERATIONAL SUPPORT 29 Sep 2009 31 Dec 2030 957,949,173.09 WESTLAND HELICOPTERS LIMITED AHCOMM2/2042 APACHE SUSTAINMENT SPARES 27 Apr 2005 1 May 2009 165,516,251.00 WESTLAND HELICOPTERS LIMITED AHCOMM2/2064 INTERIM SUPPORT ARRANGEMENT 1 Apr 2007 30 Nov 2014 130,884,574.89 WESTLAND HELICOPTERS LIMITED AHCOMM2/2064/1 INTERIM SUPPORT ARRANGEMENT 1 Apr 2007 31 Mar -

20091201-Je New Contracts Jan 2009-Final

In answer to PQ 303350 MOD Contracts entered into between 1 January 2009 and 31 October 2009 by Broad Value Range, Contractor Name, Start Date and Broad Industrial Heading. In answer to PQ Number 303350, dated 27 November 2009. Value Contractor Code Contract Start Date SIC Description Over £500m BAE SYSTEMS (OPERATIONS) LIMITED 01-Apr-09 Unknown Over £500m WESTLAND HELICOPTERS LIMITED 29-Sep-09 Gas £250m-£500m BAE SYSTEMS (OPERATIONS) LIMITED 01-Apr-09 Aircraft & Spacecraft £250m-£500m BAE SYSTEMS ELECTRONICS LIMITED 15-Jul-09 Weapons & Ammunition £250m-£500m BAE SYSTEMS SURFACE SHIPS SUPPORT LIMITED 10-Sep-09 Electricity £250m-£500m DEVONPORT ROYAL DOCKYARD LIMITED 05-Feb-09 Ship Building & Maintenance £100m-£250m BAE SYSTEMS SURFACE SHIPS LIMITED 21-Jul-09 Ship Building & Maintenance £100m-£250m DEVONPORT ROYAL DOCKYARD LIMITED 01-Apr-09 Ship Building & Maintenance £100m-£250m E D S DEFENCE LTD 13-May-09 Sewage and Refuse Disposal £100m-£250m EUROCOPTER UK LIMITED 18-Sep-09 Aircraft & Spacecraft £100m-£250m NAVISTAR DEFENSE LLC 20-Feb-09 Weapons & Ammunition £100m-£250m SKANSKA UK PLC 24-Apr-09 Construction £100m-£250m THALES OPTRONICS LTD 29-Jul-09 Instrument Engineering £100m-£250m VT AEROSPACE LIMITED 07-Jan-09 Education £100m-£250m WESTLAND HELICOPTERS LIMITED 01-Apr-09 Aircraft & Spacecraft £50m-£100m BP INTERNATIONAL LIMITED 01-Feb-09 Petroleum & Nuclear Fuel £50m-£100m EUROCOPTER 01-Jan-09 Aircraft & Spacecraft £50m-£100m INTEGRATED SURVIVABILITY TECHNOLOGIES LIMITED 01-Apr-09 Weapons & Ammunition £50m-£100m TURNER FACILITIES MANAGEMENT LTD 08-Jun-09 Legal Activities, Accounting, Business Management & Consultancy £25m-£50m AAH PHARMACEUTICALS LTD 09-Jan-09 Sale, Maintenance, & Repair of Motor Vehicles/Cycles £25m-£50m ANTEON LIMITED 12-Feb-09 Instrument Engineering £25m-£50m COMPASS CONTRACT SERVICES (U K)LIMITED 09-Jul-09 Hotels & Restaurants £25m-£50m DAF TRUCKS N.V. -

RELEASE 2 2009/10 2010/11 2011/12 Departmental Expenditure Limits (DEL) 46 994 2008/09 2009/10 2010/11 2011/12 Total Gross Expenditure on R&D 2 074 1 839 1 782

A NATIONAL STATISTICS PUBLICATION UK DEFENCE STATISTICS F 1.2 Public Expenditure by F 1.3b Defence Expenditure by F 1.4 Estimated MOD Equipment F 1.7 MOD Research & Development Commodity Block Symbols FACTSHEET 2012 EDITION Departmental Grouping Expenditure Expenditure Outturn } Categories merged for some years Inclusive of non-recoverable VAT at Current Prices (£ million) Current Prices (£ billion) || Discontinuity in time series Provisional Outturn 2011/12 Inclusive of non-recoverable VAT at Current Prices (£ million) Inclusive of non-recoverable VAT at Current Prices (£ million) Outturn Outturn Defence Spending 37 169 * Not applicable Outturn Research & Development 2008/09 2009/10 2010/11 RELEASE 2 2009/10 2010/11 2011/12 Departmental Expenditure Limits (DEL) 46 994 2008/09 2009/10 2010/11 2011/12 Total Gross Expenditure on R&D 2 074 1 839 1 782 .. Not available r r Total Gov’t Resource DEL 333.2 345.8 340.7 Of which: p Provisional Of which: Cash Resource DEL 37 980 Intramural 262 288 226 of which Estimated MOD Equipment r Revised Education 49.6 51.4 r 51.4 13 386 ll 13 174 ll 13 994 ll 15 251 Extramural 1 812 1 551 1 556 Personnel Costs 12 846 Expenditure NHS (Health) 95.8 99.0 101.6 p r Revised but still provisional Service Personnel Costs 10 101 Communities Local Government 25.5 26.0 26.6 Civilian Personnel Costs 2 745 Receipts 83 87 89 e Estimate Home Office 9.5 9.3 r 8.8 Of which: Of which used: r Infrastructure Costs 4 580 Defence 34.9 39.0 37.7 Intramurally 75 80 72 - Zero or rounded to zero Inventory Consumption 2 535 Work and Pensions 8.8 8.8 7.5 Extramurally 8 7 16 Equipment Support Costs 6 256 Capital Expenditure on Equip. -

Annual Report

Annual20 ////////////////////////////////////////////////////////// report 07 Financial report Business review Shareholder information 2007 Annual report Thales 45 rue de Villiers 92200 Neuilly-sur-Seine – FRANCE Tél.: + 33 (0)1 57 77 80 00 www.thalesgroup.com www.thalesgroup.com WorldReginfo - 31f96d7b-6321-44dc-9b56-5ddcb02cd173 The Corporate brochure is available at www.thalesgroup.com WorldReginfo - 31f96d7b-6321-44dc-9b56-5ddcb02cd173 2007 ANNUAL REPORT CONTENTS Overview ........................................................................................................................................................................................................2 Timeline ...........................................................................................................................................................................................................4 Key figures .....................................................................................................................................................................................................6 Governance and auditors ...................................................................................................................................................................8 1 . 2007 FINANCIAL REPORT 1. Directors’ report ............................................................................................................................................................................. 12 2. Consolidated financial statements ............................................................................................................................. -

Defence Diversification Revisited

Defence Diversification Revisited A history of defence diversification in the UK and elsewhere – lessons learned and ways forward. May 2016 Foreword by Len McCluskey, General Secretary of Unite Unite the Union represents tens of thousands of workers in the UK Defence industry. Our members work at the cutting edge of technology in highly skilled, high value jobs. Their contribution to the economy of the U.K. is vital and for many communities is essential for their survival. Defence is a complex industry with a world class supply chain, largely based onshore in the UK due to the security involved in the manufacturing process. The current UK footprint is responsible for globally recognised products and capabilities and presents a link with a proud heritage of manufacturing across the country. Iconic aircraft, ships, submarines and weapons have been produced by the UK across the decades and the country is still producing world class equipment such as the Queen Elizabeth class Carriers, Astute submarines, Typhoon fighter, Hawk trainer and Wildcat helicopters. Radar, sensors and weapons systems are also produced here in the UK and the industry generates billions of pounds in tax and national insurance payments as well as billions in exports. However, the defence industry has also suffered huge cuts in jobs in recent decades, with tens of thousands of workers being made redundant. There are further challenges facing the industry and Unite is calling for a new Defence Industrial Strategy allied to a broader Manufacturing Strategy to defend those jobs. A critical component could and should be an agency to identify potential job losses far enough in advance for a legally binding programme of diversification to kick in, retaining critical skills and finding new work for existing workers. -

Table 7A.2. the 100 Largest Arms-Producing Companies

Table 7A.2. The 100 largest arms-producing companies in the OECD and developing countries, 2000 Figures in columns 6, 7, 8 and 10 are in US$ million. Figures in italics are percentages. 1 2 3 4 5 6 7 8 9 10 11 a Rank Arms sales Total sales Col. 6 as Profit Employment 2000 1999 Company (parent company) Country Sectorb 2000 1999 2000 % of col. 8 2000 2000 1 1 Lockheed Martin USA Ac El Mi 18 610 19 790 25 329 73 – 519 130 000 2 2 Boeing USA Ac El Mi 16 900 16 000 51 521 33 2 128 198 000 3 3 BAE SYSTEMS UK A Ac El Mi SA/A 14 400 15 470 18 473 78 1 440 84 900 Sh 4 4 Raytheon USA El Mi 10 100 11 530 16 895 60 141 93 700 5 5 Northrop Grumman USA Ac El Mi SA/A 6 660 7 070 7 618 87 608 39 300 6 6 General Dynamics USA El MV Sh 6 520 5 550 10 356 63 901 43 300 7 – EADSc France/ Ac El Mi 5 340 0 22 303 24 – 832 88 880 FRG/ Spain 8 7 Thalesd France El Mi SA/A 5 160 4 450 8 476 61 . 57 230 9 8 Litton USA El Sh 3 950 3 910 5 588 71 218 40 300 ARMS PRODUCTION357 10 13 TRW USA El Oth 3 370 2 990 17 231 20 438 102 880 11 9 United Technologies USA El Eng 2 880 3 480 26 583 11 1 808 153 800 12 14 Mitsubishi Heavy Industriese Japan Ac MV Mi Sh 2 850 2 460 28 255 10 – 189 . -

The Role of Security and Defence Companies in EU Migration And

The role of security and defence companies in EU migration and border control and the impact on the protection of the rights of refugees, migrants and asylum seekers 1 Contemporary border control and migration management policies and practices of the European Union are structured within a framework characterised by an intimate collaboration between public and private interests, with public interests broadly represented by EU agencies and member states, and private interests by security and defence companies, lobbying consultancies, law firms, universities and research institutes. Particularly defining about the public-private collaboration is the increased reliance on advanced and innovative border technologies which are developed and deployed with the dual aim of controlling irregular migration, and simultaneously, sealing off and securing the European borders. These advanced and innovative border technologies range from pre-screening technologies like biometrics comprising of facial features and fingerprints, to land and maritime surveillance by technologically advanced systems like early warning radar systems and unmanned aerial vehicles (UAVs) that can detect suspicious movements or vessels from a certain distance. This has created a market for technologically advanced software, technologies and equipment that is shaped, supported and provided primarily by major security and defence companies such as Airbus (formerly known as EADS and henceforth Airbus/EADS), Finmeccanica (now known as Leonardo), Thales, BAE Systems, and Safran, in collaboration with software companies, universities, research centres and think-tanks making migration control a profitable and viable option. With the War on Terror having translated into a War on Immigrants there is a conflation of security with migration and border control. -

Army Guide Monthly • Issue #7

Army G uide monthly # 7 (82) July 2011 British Army Warriors get protection and mobility upgrade JSC Plant Leninskaya Kuznitsa Starts Production Of UAG-40 Automatic Grenade Launcher Thales creates Thales Communications & Security Patria`s mortar systems have not been used to fire cluster ammunition in Libya DTM to showcase Springbuck Six APC at DSEI 2011 MTL Group official opening by HRH The Duke of Kent General Dynamics UK selects Thales sights for Scout SV ATK Receives $77 Million Contract to Develop Next-Generation Ammunition for U.S. Army Abrams Main Battle Tank LMT to deliver armoured cabs to German Army BAE Providing 519 Gunner Protection Systems for USMC Oshkosh Defense to Supply 400 Additional M-ATVs to U.S. Forces Navistar Defense To Produce Second Round Of MRAP Recovery Vehicles General Dynamics European Land Systems presents the new Medium Trackway Bridge (MTB), the PIRANHA 3 and the EAGLE at DSEi 2011 U.S. Army Selects Oshkosh Defense to Recapitalize Heavy Tactical Vehicles Australian Defence Minister accepts 800th Bushmaster to roll off the production line $12 M Bradley Blast-Resistant Fuel Bladder Win Elbit Systems Awarded an Israeli Ministry of Defense Follow-on Order for the Digital Army Program BAE Systems Awarded $53 Million From U.S. Marine Corps for MRAP Work U.S. Army Selects Lockheed Martin`s SMSS Autonomous Vehicle for Afghanistan Deployment www.army-guide.com Army Guide Monthly • #7 (82) • July 2011 Defence Industry planning between DE&S, DSG, ourselves and our supply British Army Warriors get protection and network to ensure that these vehicles were ready for the mobility upgrade front line as quickly as possible." TES(H) includes: A modular armour system to allow quick and easy fitment of "mix and match" armour packages to meet changing threats. -

Locally-Stored Version

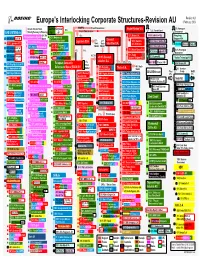

Revision AU Europe's Interlocking Corporate Structures-Revision AU 3 February 2003 32.32% / Golden Share DaimlerChrysler SOGEPA French Government Alcatel-Alstom S.A. 51% Norwegian 30% Pacte D'Actionnaires 73.2% Finnish Govt BAE SYSTEMS plc Ministry Economy & Financing 54% 46% Government 66% Stk 15% 50% Alstom S.A. Patria Industries Oyj Kongsberg 50% Sika Intl (w/ LM) Finmeccanica S.p.A Market 100% Motoren und Gruppen ASA Turbinen-Union GmbH 17% 4.3% Dassault 100% Patria Finavitec Oy 100% WASS (Whitehead) SpA Lagardere SCA 100% Chantiers 2.5% Lagardere SCA Stock Stock Industries S.A. de L'Atlantique 33% Viking Submarine Corp. AB 33% MTU Turbomeca Market Market 100% Patria Vehicles Oy 50% Team Lancer (w/ 50% Agusta Westland, Ltd. Rolls-Royce (MTR) GmbH 51% Alcatel Space S.A. 50.3% Norwegian Alvis; Raytheon;UDLP) 15% 11% 50% Patria–Hagglunds Oy 32% NH Industries Government 33% Eurojet Turbo GmbH 51% Thales 40% Tanker Transport 45.76% 27% Nammo AS 45% Bell Agusta A/C Ltd. 12% Intl Aero Engines AG 49.9% Dassault Systems Belgium NV Raufoss Technology A/S Support Co. Ltd. 35% Aviation S.A. 50% ATIL (w/ Boeing) European Aeronautic 6% 34% 9.7% 40% NEXPLO Indust. AB 45% Nammo A/S 50% Flagship, Ltd. (w/ VT) Stock 100% Alenia Aeronautica S.p.A Defence and Space (EADS) BV 50% European 46% Stock 50% Aerosystems Intl Market Aerosystems Ltd Thales S.A. Market 36% Investor 20% Eurofighter GmbH 42.5% Eurofighter GmbH AB LM Ericsson Float Group BAES 100% Royal Ordnance 45.76% Dassault 100% Sogitec Industrie 99% Thales Nederland BV 29% 35% Aviation S.A. -

Liste Des Societes Hors De France Au 31 Decembre 2016

LIST OF NON-FRENCH COMPANIES HELD BY THALES AS OF 31 DECEMBER 2016 * For the sake of transparency, Thales publishes the list of its non-French participations on its website. These foreign entities aim at the development of the company and they all address operational requirements. Thales complies with applicable tax regulations in the various countries where it operates PERCENTAGE OF COMPANY NAME COUNTRY INTEREST BLACKSTONETEK (PTY) LTD 13 SOUTH AFRICA BUSINESS VENTURE INVESTMENTS (PROPRIETARY) LIMITED 100 SOUTH AFRICA EVERTRADE MEDICAL 10 SOUTH AFRICA THALES CORPORATE SOUTH AFRICA (PROPRIETARY) LIMITED 64 SOUTH AFRICA THALES SOUTH AFRICA (PROPRIETARY) LIMITED 47 SOUTH AFRICA THALES SOUTH AFRICA SYSTEMS (PROPRIETARY) LIMITED 47 SOUTH AFRICA THALES INTERNATIONAL ALGERIE SARL 100 ALGERIA AVIONIC EMBEDDED SOFTWARE GmbH i.L. 47 GERMANY DIEHL AEROSPACE GmbH 49 GERMANY ELECTRONIC SIGNALLING SERVICES (ESS) GmbH 100 GERMANY ET MARINESYSTEME GmbH 50 GERMANY EURO-ART ADVANCED RADAR TECHNOLOGY GmbH 50 GERMANY EURO-ART INTERNATIONAL EWIV 50 GERMANY EUROFIGHTER SIMULATION SYSTEMS GmbH 26 GERMANY EUROPEAN SATELLITE NAVIGATION INDUSTRIES GMBH 31 GERMANY HELICOPTER TRAINING MEDIA INTERNATIONAL GmbH 50 GERMANY HELM'ARABIA GmbH & Co KG 38 GERMANY HFTS HELICOPTER FLIGHT TRAINING SERVICES GmbH 25 GERMANY IFB INSTITUT FUR BAHNTECHNIK GmbH 7 GERMANY JUNGHANS MICROTEC GmbH 45 GERMANY MELA GmbH 9 GERMANY SYSGO AG 96 GERMANY THALES ALENIA SPACE DEUTSCHLAND GmbH 67 GERMANY THALES DEUTSCHLAND GmbH 100 GERMANY THALES ELECTRONIC SYSTEMS GmbH 100 GERMANY THALES IMMOBILIEN