Fintech from Evolution to Revolution in MENA Region

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Enabling Commerce in the World's Most Under Penetrated Payments

Enabling Commerce In The World’s Most Under Penetrated Payments Market Network International Holdings Plc Annual Report and Accounts 2019 Network International Holdings Plc 01 Annual Report and Accounts 2019 We are Network International, the leading payment solutions provider in the Middle East and Africa. Our innovative solutions drive revenue and profitability for our customers. To read our Annual Report online go to www.network.ae Market opportunity Under penetrated payments markets R Read more on page 10 Business model A unique We are enabling and leading the transition from cash proposition to digital payments across the Middle East and Africa, one of the fastest growing payments markets in the world. R Read more on page 14 Strategic Report Governance Financial Statements 2019 Highlights 02 Corporate Governance Report 72 Independent Auditor’s Report 138 Our Industry 04 Board of Directors 74 Consolidated Statement Strategy in action Our Business at a Glance 06 Executive Management Team 76 of Financial Position 144 Chairman’s Statement 08 Audit and Risk Committee Report 88 Consolidated Statement of Profit or Loss 145 Market Overview 10 Nomination Committee Report 100 Market leading Consolidated Statement of Our Track Record 12 Directors’ Remuneration Report 102 other Comprehensive Income 146 Our Business Model 14 Directors’ Report 130 Consolidated Statement technology Chief Executive Officer’s Review 16 Going Concern Statement of Changes in Equity 147 Our Strategic Framework 20 and Viability Statement 136 Group Statement of Cash Flows -

Benefits of Open Payment Systems and the Role of Interchange

Benefits of Open Payment Systems and the Role of Interchange U.S. Version Delivering value through payment alternatives At MasterCard Worldwide, we take great pride in the many ways we advance com- merce. From the millions of consumers and businesses around the world who rely on our cards on a daily basis, to the retailers who accept them and institutions that issue them, it’s clear that the products and services we offer deliver extraordinary value. With demand for fast, convenient and safe payment alternatives rapidly accelerating, commerce is increasingly driven by blips on a screen, numbers punched on a keyboard, cards swiped through electronic readers and chip-activated cell phones. In fact, our products and services are so ingrained in everyday life that the value we deliver is all too often taken for granted. Perhaps the easiest way to grasp the true value of electronic payments is to envision a world without them. Clearly, if electronic payments came to a sudden halt, many facets of commerce—travel, trade and the Internet just to name a few—would face dire consequences. While cash and checks still have their place, they lack the speed, convenience and safety required by consumers, businesses and governments in today’s fast-paced, ever-shrinking world. To be sure, the widespread use of electronic payments and the sophisticated networks that seamlessly link millions of consumers, merchants and financial institutions around the globe are at the heart of commerce. Their importance is clear not only in industrialized nations, but in emerging markets as well, where we are making inroads in building a bridge to the modern economy. -

Financialreportpdf2020.Pdf

Finance chap 1.qxp_Layout 1 1/16/20 2:32 PM Page 1 Finance chap 1.qxp_Layout 1 1/16/20 2:32 PM Page 2 Industry Insight 4 MACROECONOMIC Set to soar: Momentum EGYPT’S FINANCE SECTOR acked by strong legislative reforms and an improving macroeconomy, Egypt’s financial sector holds a treasure chest of opportunities. The latest edition of BAmCham Egypt’s Financial Services Industry Insight looks 13 INSURANCE Still Untapped at all aspects of the sector from banks to insurance to the capital markets, and more. The issue starts with a look at the macroeconomic progress of the past three years, with the latest data from Egypt’s economic turnaround, an assessment of potential challenges and the reform plan going forward. This is followed by a chapter on the insurance sector’s growing potential and a BANKS BREWING 19 third chapter covering the key drivers behind the banking Business sector’s expanding investment. Chapters four and five offer updates on the closely related topics of financial inclusion and fintech, detailing the role of retail lending, e-banking and non-banking channels in drawing more consumers and SMEs into the financial system. Finally, chapter six has the latest on trends in the stock market, with a special look at 26 CRACKING private equity and Egypt’s new sovereign wealth fund. Consumer Credit Khaled Sewelam Director, Research and Publications FINTECH IS 34 Flourishing Amira Sheha Research Manager Fadila Noureldin Author and Senior Economic Researcher Kate Durham Editor and Head of Corporate Publications Nessim N. Hanna CAPITAL Senior Art Director 39 Crunch Emy Emile Senior Graphic Designer Verina Maher Graphic Designer Amany Kassem Advertising & Business Development Director Publications/Research EXPLOITING Lamia Seleit Sovereign Capital 45 Advertising Specialist Rowan Maamoun Advertising & Ad Traffic Coordinator Hani Elias Production Supervisor ©2019 AmCham Egypt’s Business Studies & Analysis Center. -

View Annual Report

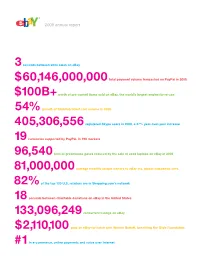

To Our Stockholders, In 2008, we embraced a tremendous amount of fundamental change against the backdrop of a deteriorating external market and economy. Even with the challenges, we exited the year a stronger company and remain a leader in e-commerce, payments and Internet voice communications. Our performance for the full year not only reflects the strength of our portfolio, but also the operating discipline, strategic clarity and focus with which our management team is leading the company going forward. Financially, the company had a good year, marked by strong revenue growth, stronger EPS growth and excellent free cash flow. Despite the extremely challenging economic environment in 2008 – including a slowdown in global e-commerce, a strengthening dollar, and declining interest rates – we delivered $8.5 billion in revenues, an 11 percent increase from the prior year, and $1.36 of diluted EPS. We also delivered a solid operating margin of 24 percent. The size of the eBay marketplace continues to be the largest in the world with nearly $60 billion of gross merchandise volume (the total value of goods sold in all of our Marketplaces) in 2008. PayPal continues to experience strong growth, both on eBay and across e-commerce, and Skype had a great year, growing both revenues and user base. In addition, we strengthened our portfolio by investing in the growth of our emerging businesses and through key acquisitions. In 2008, advertising, global classifieds and StubHub, the leading online tickets marketplace, all gained momentum in terms of revenues. Key acquisitions we made during the year will help us build on our strengths. -

2021 Prime Time for Real-Time Report from ACI Worldwide And

March 2021 Prime Time For Real-Time Contents Welcome 3 Country Insights 8 Foreword by Jeremy Wilmot 3 North America 8 Introduction 3 Asia 12 Methodology 3 Europe 24 Middle East, Africa and South Asia 46 Global Real-Time Pacific 56 Payments Adoption 4 Latin America 60 Thematic Insights 5 Glossary 68 Request to Pay Couples Convenience with the Control that Consumers Demand 5 The Acquiring Outlook 5 The Impact of COVID-19 on Real-Time Payments 6 Payment Networks 6 Consumer Payments Modernization 7 2 Prime Time For Real-Time 2021 Welcome Foreword Spurred by a year of unprecedented disruption, 2020 saw real-time payments grow larger—in terms of both volumes and values—and faster than anyone could have anticipated. Changes to business models and consumer behavior, prompted by the COVID-19 pandemic, have compressed many years’ worth of transformation and digitization into the space of several months. More people and more businesses around the world have access to real-time payments in more forms than ever before. Real-time payments have been truly democratized, several years earlier than previously expected. Central infrastructures were already making swift For consumers, low-value real-time payments mean Regardless of whether real-time schemes are initially progress towards this goal before the pandemic immediate funds availability when sending and conceived to cater to consumer or business needs, intervened, having established and enhanced real- receiving money. For merchants or billers, it can mean the global picture is one in which heavily localized use time rails at record pace. But now, in response to instant confirmation, settlement finality and real-time cases are “the last mile” in the journey to successfully COVID’s unique challenges, the pace has increased information about the payment. -

American Express Company Earnings Conference Call Q3'12

American Express Company Financial Community Meeting Kenneth Chenault Chairman and Chief Executive Officer Dan Schulman Group President, Enterprise Growth John Hayes Executive Vice President and Chief Marketing Officer August 8, 2013 Agenda Year-to-Date Financial and Business Performance Growth Opportunities Enterprise Growth Update The Brand Q&A 2 Financial Performance $ in billions; except per share amounts Q2'12 Q3'12 Q4'12 Q1'13 Q2'13 Total Revenues Net of Interest $8.0 $7.9 $8.1 $7.9 $8.2 Expense Growth vs. Prior Year 5% 4% 5% 4% 4% FX Adjusted Growth vs. Prior Year† 7% 5% 5% 5% 4% Net Income $1.3 $1.3 $0.6 $1.3 $1.4 Diluted EPS* $1.15 $1.09 $0.56 $1.15 $1.27 Adjusted Diluted EPS** $1.09 Adjusted Growth vs. Prior Year** 7% 6% 8%** 7% 10% Return on Average Equity 27% 26% 23% 23% 24% *Attributable to common shareholders. Represents net income less earnings allocated to participating share awards and other items of $14MM in Q2’12, $14MM in Q3’12, $7MM in Q4’12, $11MM in Q1’13 and $13MM in Q2’13. **Adjusted diluted earnings per share and the adjusted growth rate, non-GAAP measures, are calculated by excluding from diluted EPS the Q4’12 restructuring charges, Membership Rewards expense and cardmember reimbursements. See Annex 1 for a breakdown of the adjustments and a reconciliation. †This is a non-GAAP measure. FX adjusted information assumes a constant exchange rate between the periods being compared for purposes of currency translation into U.S. -

Merchant Integration Guide

PAYFORT Merchant Integration Guide Document Version: 10.0 July, 2019 PayFort PayFort Merchant Integration Guide Copyright Statement All rights reserved. No part of this document may be reproduced in any form or by any means or used to make any derivative such as translation, transformation, or adaptation without the prior written permission from PayFort Corporation. Trademark 2014-2019 PayFort ©, all rights reserved. Contents are subject to change without prior notice. Contact Us [email protected] www.PayFort.com 2014-2019 PayFort ©, all rights reserved 2 PayFort PayFort Merchant Integration Guide Contents 1. FORT in a Glimpse .......................................................................................................................... 11 2. About this Document ........................................................................................................................ 12 2.1 Intended Audience .................................................................................................................... 12 3. Request/ Response Value Type ....................................................................................................... 13 4. Before Starting the Integration with FORT........................................................................................ 14 5. Redirection ....................................................................................................................................... 15 Authorization/ Purchase URLs ................................................................................................. -

Credit Cards (VISA & Mastercard)

Banque Misr payment cards Fees , Limits and commission. Credit Cards (VISA & MasterCard) Dear Customer, Kindly find the below card Fees, usage limits, commission and interest rates for Banque Misr payment cards. 1-Fees and charges Islamic Platinum Islamic Gold- BM Islamic Titanium Platinum World EL ARABY- Card Type Classic Gold Business Corporate Titanium BM/Egypt World Classic / Egypt Gold Elite ASATHA Post Post Card validity 3 years 2 years 1 year 3 years 400 EGP 300 EGP 150 EGP Issuance fees 150 200 EGP included I- 250 EGP included I- included I- included I- 2,000 (ASATHA) for the first 150 EGP 200 EGP 150 EGP 200 EGP 1,500 EGP EGP SCORE fees SCORE fees SCORE SCORE EGP 100 EGP (EL year fees fees ARABY) 75 2,000 EGP(ASATHA) Renewal fees 75 EGP 75 EGP 100 EGP 100 EGP 100 EGP 150 EGP 150 EGP 300 EGP 200 EGP 1,500 EGP EGP 50 EGP (EL ARABY) Free with a Free with a maximum maximum Issuance and Free with a maximum of 3 of 4 cards of 4 cards renewal of the Exempted with a maximum 2 cards and 75 EGP 75 EGP N/A cards and 150 EGP for and 300 and 100 Free 50 EGP Supplementary 100 EGP for more than 2 cards more than 3 cards EGP for EGP for cards more than more than 4 cards 4 cards Reissuance of a replacement for 75 EGP Free Free 75 EGP lost/damaged cards 1- Usage Limits inside and abroad : Gold Platinum EL Islamic Gold Islamic Islamic Platinum Card Type Classic BM/Egypt Business Corporate Titanium BM/Egypt World World Elite ARABY- Classic Gold Titanium Post Post ASATHA Purchases Inside Egypt Within the credit card limit Purchases Abroad Daily limit -

The Economics of Payment Card Interchange Fees and the Limits of Regulation

ICLE Financial Regulatory Program White Paper Series June 2, 2010 THE ECONOMICS OF PAYMENT CARD INTERCHANGE FEES AND THE LIMITS OF REGULATION By Todd J. Zywicki ICLE | 2910 NE 42nd Ave., Portland, OR 97213 | www.laweconcenter.org | [email protected] | 503.770.0650 THE ECONOMICS OF PAYMENT CARD INTERCHANGE FEES AND THE LIMITS OF REGULATION 1 Todd J. Zywicki Fresh off of the most substantial national liquidity crisis of the last generation and the enactment of sweeping credit card regulation in the form of the Credit CARD Act, Congress continues to deliberate, with a continuing drumbeat of support from lobbyists, a set of new regulations for credit card companies. These proposals, offered in the name of consumer protection, seek to constrain the setting of “interchange fees”— transaction charges integral to payment card systems—through a range of proposed political interventions. This article identifies both the theoretical and actual failings of such regulation. Payment cards are a secure, inexpensive, welfare-increasing payment mechanism largely unlike any other in history. Rather than increasing consumer welfare in any meaningful sense, interchange fee legislation represents an attempt by some merchants to shift costs away from their businesses and onto card issuing banks and cardholders. In particular, bank-issued credit cards offer a dramatic improvement in the efficiency and availability of consumer credit by shifting credit risk from merchants onto banks in exchange for the cost of the interchange fee—currently averaging less than 2% of purchase value. Merchants’ efforts to cabin these fees would harm not only consumers but also the merchants themselves as commerce would depend more heavily on less-efficient paper- based payment systems. -

TO SURVIVE OR THRIVE? Domestic Payments Innovation in the Pandemic DOMESTICCONTENTS SCHEMES PROSPECTS

DOMESTIC PAYMENT SCHEMES JURY 2021 TO SURVIVE OR THRIVE? Domestic Payments Innovation in the Pandemic DOMESTICCONTENTS SCHEMES PROSPECTS Forewords 03 Executive Summary 04 The Jury 06 The Changing World of Domestic Payments 07 Systemic Innovation 13 The Pandemic Strikes 15 Effect on Innovation 18 Future Prospects 20 Additional information 25 3 Domestic Payments Schemes Jury 2021 FOREWORDS It is great to see John Chaplin Many domestic payment systems are embracing these continuing to dedicate time innovations and setting themselves on a new trajectory. and effort to the Payment The recently issued G20 cross-border payments roadmap Innovation Jury and Chris also refers to the role that well-functioning domestic Hamilton now joining this effort. payment systems and their international linkages can have on improving cross-border payments. At the same This pandemic brought out in time this crisis has also challenged the domestic payment stark relief the fundamental systems in their ability to handle a rapid surge in usage, the role of digital payments in the effectiveness of their business continuity plans and ability functioning of the economy. A to handle increasing sophistication of cyber threats and recent McKinsey report showed social engineering attacks. that countries with greater adoption of digital payments, a well-functioning payments This edition discusses the dual theme of how the domestic market and good ID infrastructure were able to respond payment systems are handling the crisis and how they are to the crisis faster and with greater ambition. Regulators navigating the rapid shifts underway. I am sure the insights across the world took several measures to enable presented in this report will be useful for the various the smooth functioning and fostering usage of digital stakeholders following the developments in the domestic payments. -

Canadian Payments Revolution

News July 28, 2008 • Issue 08:07:02 Industry Update .......................................14 HR 5546 is in the House ..........................49 Canadian payments Shopit starts Revolution .............................50 Agreement keeps Frontier fl ying .................51 revolution – eh! PCI SSC adds new payment device types ...........................52 By Adam Atlas New webinars target PCI education ...........53 Attorney at Law Gas stations nixing plastic ........................54 he Canadian payments industry, like Canada itself, is often underappreci- ated in the United States. Chances are the average U.S. ISO or merchant Features level salesperson (MLS) knows little to nothing about the payments sphere up north. ISOpinion: T Brewer taps payments market ................40 It may come as a surprise, then, to many readers of The Green Sheet that Canadian payments is largely controlled by a handful of financial institutions many believe Views constitute a monopoly that stifles competition – the very lifeblood of American commerce. Approaching a crossroads By Patti Murphy But Canada may have just taken a significant step toward breaking that strangle- hold. On July 12, 2008, myself, along with 49 colleagues from Canada and the The Takoma Group ...............................26 United States participated in the inaugural event of the Canadian Acquirers Education Association. The three-hour founding cocktail, sponsored by ISOs VersaPay Corp. and Pivotal Payments, took place at the Hilton Toronto Airport in Toronto, the business capital -

American Express February 9, 2011 Financial Community Presentation Ken Chenault

American Express February 9, 2011 Financial Community Presentation Ken Chenault Good afternoon. And welcome to our first Financial Community meeting of the year. AGENDA Here’s today’s agenda. I’ll begin by covering our 2010 financial performance, including the strong business metrics that made it such a successful year for us. I’ll then spend time reviewing an area of interest for many of you – our multi-year investment strategy, a strategy that includes the transformation of the company for the digital environment. I’ll cover the performance of some of our major 2010 initiatives and also review our investment focus over the short to moderate-term, with a particular emphasis on how we’re capitalizing on opportunities in the digital space. Since many of our investments are made outside of the United States, I thought the timing was right to give you a deep drill on our progress across international. Doug Buckminster, President of International Consumer and Small Business Services, will take you through our progress over the last several years, along with the opportunities we’re pursuing for future growth. As you’ll see, we already have a strong foundation in many parts of the world, but the potential for future growth is substantial and our initiatives to capture that potential are already underway. So let me get right to our financial performance. HISTORICAL FINANCIAL PERFORMANCE For 2010 we generated $4.1 billion of net income, EPS growth of 117%, managed revenue growth of 2%1 and a Return on Equity of 27%. Given the continuing softness and uncertainty across the global economy during the year, I’m very proud of our performance.