Determine What Payment Prices (Costs) Are and Who Bears Them

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Benefits of Open Payment Systems and the Role of Interchange

Benefits of Open Payment Systems and the Role of Interchange U.S. Version Delivering value through payment alternatives At MasterCard Worldwide, we take great pride in the many ways we advance com- merce. From the millions of consumers and businesses around the world who rely on our cards on a daily basis, to the retailers who accept them and institutions that issue them, it’s clear that the products and services we offer deliver extraordinary value. With demand for fast, convenient and safe payment alternatives rapidly accelerating, commerce is increasingly driven by blips on a screen, numbers punched on a keyboard, cards swiped through electronic readers and chip-activated cell phones. In fact, our products and services are so ingrained in everyday life that the value we deliver is all too often taken for granted. Perhaps the easiest way to grasp the true value of electronic payments is to envision a world without them. Clearly, if electronic payments came to a sudden halt, many facets of commerce—travel, trade and the Internet just to name a few—would face dire consequences. While cash and checks still have their place, they lack the speed, convenience and safety required by consumers, businesses and governments in today’s fast-paced, ever-shrinking world. To be sure, the widespread use of electronic payments and the sophisticated networks that seamlessly link millions of consumers, merchants and financial institutions around the globe are at the heart of commerce. Their importance is clear not only in industrialized nations, but in emerging markets as well, where we are making inroads in building a bridge to the modern economy. -

View Annual Report

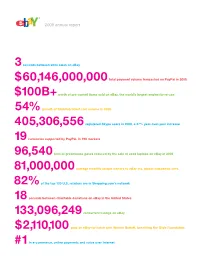

To Our Stockholders, In 2008, we embraced a tremendous amount of fundamental change against the backdrop of a deteriorating external market and economy. Even with the challenges, we exited the year a stronger company and remain a leader in e-commerce, payments and Internet voice communications. Our performance for the full year not only reflects the strength of our portfolio, but also the operating discipline, strategic clarity and focus with which our management team is leading the company going forward. Financially, the company had a good year, marked by strong revenue growth, stronger EPS growth and excellent free cash flow. Despite the extremely challenging economic environment in 2008 – including a slowdown in global e-commerce, a strengthening dollar, and declining interest rates – we delivered $8.5 billion in revenues, an 11 percent increase from the prior year, and $1.36 of diluted EPS. We also delivered a solid operating margin of 24 percent. The size of the eBay marketplace continues to be the largest in the world with nearly $60 billion of gross merchandise volume (the total value of goods sold in all of our Marketplaces) in 2008. PayPal continues to experience strong growth, both on eBay and across e-commerce, and Skype had a great year, growing both revenues and user base. In addition, we strengthened our portfolio by investing in the growth of our emerging businesses and through key acquisitions. In 2008, advertising, global classifieds and StubHub, the leading online tickets marketplace, all gained momentum in terms of revenues. Key acquisitions we made during the year will help us build on our strengths. -

American Express Company Earnings Conference Call Q3'12

American Express Company Financial Community Meeting Kenneth Chenault Chairman and Chief Executive Officer Dan Schulman Group President, Enterprise Growth John Hayes Executive Vice President and Chief Marketing Officer August 8, 2013 Agenda Year-to-Date Financial and Business Performance Growth Opportunities Enterprise Growth Update The Brand Q&A 2 Financial Performance $ in billions; except per share amounts Q2'12 Q3'12 Q4'12 Q1'13 Q2'13 Total Revenues Net of Interest $8.0 $7.9 $8.1 $7.9 $8.2 Expense Growth vs. Prior Year 5% 4% 5% 4% 4% FX Adjusted Growth vs. Prior Year† 7% 5% 5% 5% 4% Net Income $1.3 $1.3 $0.6 $1.3 $1.4 Diluted EPS* $1.15 $1.09 $0.56 $1.15 $1.27 Adjusted Diluted EPS** $1.09 Adjusted Growth vs. Prior Year** 7% 6% 8%** 7% 10% Return on Average Equity 27% 26% 23% 23% 24% *Attributable to common shareholders. Represents net income less earnings allocated to participating share awards and other items of $14MM in Q2’12, $14MM in Q3’12, $7MM in Q4’12, $11MM in Q1’13 and $13MM in Q2’13. **Adjusted diluted earnings per share and the adjusted growth rate, non-GAAP measures, are calculated by excluding from diluted EPS the Q4’12 restructuring charges, Membership Rewards expense and cardmember reimbursements. See Annex 1 for a breakdown of the adjustments and a reconciliation. †This is a non-GAAP measure. FX adjusted information assumes a constant exchange rate between the periods being compared for purposes of currency translation into U.S. -

The Economics of Payment Card Interchange Fees and the Limits of Regulation

ICLE Financial Regulatory Program White Paper Series June 2, 2010 THE ECONOMICS OF PAYMENT CARD INTERCHANGE FEES AND THE LIMITS OF REGULATION By Todd J. Zywicki ICLE | 2910 NE 42nd Ave., Portland, OR 97213 | www.laweconcenter.org | [email protected] | 503.770.0650 THE ECONOMICS OF PAYMENT CARD INTERCHANGE FEES AND THE LIMITS OF REGULATION 1 Todd J. Zywicki Fresh off of the most substantial national liquidity crisis of the last generation and the enactment of sweeping credit card regulation in the form of the Credit CARD Act, Congress continues to deliberate, with a continuing drumbeat of support from lobbyists, a set of new regulations for credit card companies. These proposals, offered in the name of consumer protection, seek to constrain the setting of “interchange fees”— transaction charges integral to payment card systems—through a range of proposed political interventions. This article identifies both the theoretical and actual failings of such regulation. Payment cards are a secure, inexpensive, welfare-increasing payment mechanism largely unlike any other in history. Rather than increasing consumer welfare in any meaningful sense, interchange fee legislation represents an attempt by some merchants to shift costs away from their businesses and onto card issuing banks and cardholders. In particular, bank-issued credit cards offer a dramatic improvement in the efficiency and availability of consumer credit by shifting credit risk from merchants onto banks in exchange for the cost of the interchange fee—currently averaging less than 2% of purchase value. Merchants’ efforts to cabin these fees would harm not only consumers but also the merchants themselves as commerce would depend more heavily on less-efficient paper- based payment systems. -

Canadian Payments Revolution

News July 28, 2008 • Issue 08:07:02 Industry Update .......................................14 HR 5546 is in the House ..........................49 Canadian payments Shopit starts Revolution .............................50 Agreement keeps Frontier fl ying .................51 revolution – eh! PCI SSC adds new payment device types ...........................52 By Adam Atlas New webinars target PCI education ...........53 Attorney at Law Gas stations nixing plastic ........................54 he Canadian payments industry, like Canada itself, is often underappreci- ated in the United States. Chances are the average U.S. ISO or merchant Features level salesperson (MLS) knows little to nothing about the payments sphere up north. ISOpinion: T Brewer taps payments market ................40 It may come as a surprise, then, to many readers of The Green Sheet that Canadian payments is largely controlled by a handful of financial institutions many believe Views constitute a monopoly that stifles competition – the very lifeblood of American commerce. Approaching a crossroads By Patti Murphy But Canada may have just taken a significant step toward breaking that strangle- hold. On July 12, 2008, myself, along with 49 colleagues from Canada and the The Takoma Group ...............................26 United States participated in the inaugural event of the Canadian Acquirers Education Association. The three-hour founding cocktail, sponsored by ISOs VersaPay Corp. and Pivotal Payments, took place at the Hilton Toronto Airport in Toronto, the business capital -

American Express February 9, 2011 Financial Community Presentation Ken Chenault

American Express February 9, 2011 Financial Community Presentation Ken Chenault Good afternoon. And welcome to our first Financial Community meeting of the year. AGENDA Here’s today’s agenda. I’ll begin by covering our 2010 financial performance, including the strong business metrics that made it such a successful year for us. I’ll then spend time reviewing an area of interest for many of you – our multi-year investment strategy, a strategy that includes the transformation of the company for the digital environment. I’ll cover the performance of some of our major 2010 initiatives and also review our investment focus over the short to moderate-term, with a particular emphasis on how we’re capitalizing on opportunities in the digital space. Since many of our investments are made outside of the United States, I thought the timing was right to give you a deep drill on our progress across international. Doug Buckminster, President of International Consumer and Small Business Services, will take you through our progress over the last several years, along with the opportunities we’re pursuing for future growth. As you’ll see, we already have a strong foundation in many parts of the world, but the potential for future growth is substantial and our initiatives to capture that potential are already underway. So let me get right to our financial performance. HISTORICAL FINANCIAL PERFORMANCE For 2010 we generated $4.1 billion of net income, EPS growth of 117%, managed revenue growth of 2%1 and a Return on Equity of 27%. Given the continuing softness and uncertainty across the global economy during the year, I’m very proud of our performance. -

Fintech from Evolution to Revolution in MENA Region

FinTech: From Evolution to Revolution MENA Region Prepared By: Yasmine Osama Anwar Donia Mostafa Salama Abstract: Financial innovation has been revolutionizing the traditional banking throughout the financial history. However, a newly concept known as “FinTech” has been rapidly changing the pace and the elements of competition in the industry, exponentially, during the last seven recent years. Such an inevitable change is known to be a disruptive one. The disruptive power of finTech applications is even stronger when applied to address the needs of the populations in developing economies with substantial numbers of unbanked population, like that of the MENA region. Accordingly, the evaluation of the concurrent development and the maturation of finTech is vital to draw the future roadmap of the banking and financial sectors in MENA region. The evaluation is executed through comparing the dominance and prevalence of the finTech products and the coordination of the stakeholders of the finTech ecosystem, among seven Arab countries in the MENA region. The countries are; United Arab of Emirates, Egypt, Jordan, Lebanon, Morocco, Kuwait and Saudi Arabia. The selection of those countries is attributed to the fact that they account for almost 92% of the total number of startups in 12 Arab Countries in MENA (Wamada, 2017). The paper concluded that massive efforts and initiations had been introduced to the mentioned Arab countries and are still on going, however, more is still needed in the near future. Such required efforts are paramount in order to boost the digitalization pace in the financial systems, surge the percentages of financial inclusion and overcome the existing deterrents while maintaining financial stability. -

Banking Automation BULLETIN

IssueIssue 228 401 | September | October 20042020 Banking Automation BULLETIN Self-service more important than ever in challenging times Cards and contactless curtail cash usage in CEE Could cashback make a comeback? Egyptian banking and payments making headway Central bank digital currencies – can cash go virtual? Country profile: Nigeria Published by RBR since 1979 www.rbrlondon.com/bulletin Built to Connect. Built for More.TM The way people bank is changing, and the ATM is a critical digital channel in a modern connected journey. DN Series™ delivers a more personalized experience in a more integrated solution. Discover DN Series The most advanced solutions available today. The most functionality in the smallest footprint. The most connected ATM we’ve ever built. DieboldNixdorf.com/DNseries Issue 401 | October 2020 First published in December 1979 Banking Automation BULLETIN 2 GLOBAL CARDS UnionPay still represents largest share of card spend Could cashback make 3 ECO‑CONSCIOUS CARDS Fintechs breathe new life into eco friendly card a comeback? concepts 5 UK CASH Cashback at UK retailers plays important role in Cashback may have originated in the UK in the payments 1980s, but its popularity has been falling in the 6 LITHUANIA PAYMENTS country since 2012. Could it make a comeback? Lithuania continues move away from cash I am not talking here about the rebates that some 8 SELF‑SERVICE BANKING ASIA issuers give cardholders when they spend on their cards (although that type of Self-service more important than ever in cashback is also on the decline as a result of reduced interchange fees), but the type challenging times of cashback where a customer makes a purchase with a card in a store and obtains 10 CEE PAYMENTS Cards and contactless curtail cash usage in CEE cash at the checkout which is then added to the purchase amount. -

Person-To-Person Payments

SINCE 1994, THE EXCLUSIVE MONTHLY REPORT ON INTERNET BANKING PRODUCTS & MARKETS . Number 174/175 Dec. 10, 2009 STRATEGIES FOR Person-to-Person Payments 2.0 FINANCIAL Does mobility provide the tipping point for bank-branded P2P? INSTITUTIONS ____________________________ erson-to-person payments received much attention at November’s BAI Retail Delivery conference with four Internet banking Pcompanies making big announcements: First Data, FIS, S1, and PayPal (see pp. 38-39). Marketing When we first wrote about this area 10 years ago (OBR 54, Nov. Security 1999), three major U.S. banks had P2P systems in the works: Wells Fargo, Bank of America and Bank One. By 2002, all Mobile were shuttered; knocked out cold by the biggest financial- services success story of the dot-com era, PayPal. Payments PayPal now dominates eBay commerce and has become a force at Innovations other online merchants as well. But still, PayPal’s volume of pure P2P, casual payments between non-commercial parties, hasn’t taken Personal finance any material share away from paper-based solutions. For the most part, people still pay each other in old-fashioned ways: cash, checks, and IOUs. Because electronic transactions are often more expensive, INSIDE they won’t catch on until their convenience solidly trumps paper. P2P Payments Mobile banking may be that path to ultra-convenience. Gartner seems Overview ......................................... 4 to think so. The research company put money transfer as the number- Market size..................................... 6 one most important application for smartphones in 2012 (see p. 8). 15-year forecast ......................... 10 So what exactly is driving the rekindled interest in P2P? ........................... -

Middle East & Africa

FOR 46 YEARS, THE LEADING PUBLICATION COVERING PAYMENT SYSTEMS WORLDWIDE AUGUST 2017 / ISSUE 1115 Latin America’s Largest Acquirers See page 11 for a ranking of the 46 largest merchant acquirers in Middle East & Africa Latin America and the Caribbean based on transactions handled in 2016. This group processed 19.44 billion Mastercard and > see p. 10 MARKET SHARES InComm to Buy Amex’s Prepaid Platform OF PURCHASE VOLUME Prepaid card payment processor InComm will be the exclusive 2016 distributor in the U.S. of American Express prepaid card products as part of a transaction that involves its acquisition of Amex’s > see p. 5 U.S. General Purpose Card Brands—Midyear 2017 56% 40% 3% 1% Visa, Mastercard, American Express, and Discover credit, debit, Visa Mastercard Amex Diners and prepaid cards generated 46.07 billion purchase transactions –82 bps +70 bps +13 bps –1 bps from January 1 through June 30, 2017—up 2.25 billion or 5.1% > see p. 7 PURCHASE VOLUME ($BIL.) 2015 VS. 2016 QR Code Payment Global Interoperability ‘15 167.34 Visa• ‘16 184.59 EMVCo, the global technical body that manages specifications ‘15 113.03 for contact and contactless EMV card transactions, has released Mastercard• ‘16 130.62 specifications for QR (quick response) code-based mobile ‘15 8.06 > see p. 12 Amex• ‘16 8.72 Alternative Credit for Online Payments ‘15 3.24 Diners• ‘16 3.94 Providing consumers with credit for big-ticket retail purchases © 2017 The Nilson Report from online merchants is the business of U.S.-based Bread, a start–up that recently received $126 million in Series B equity > see p. -

A2A (Account-To-Account): the Automatic Transfer of Funds from One Account to Another

Encyclopedia of Terminology for the Acquiring Industry A A2A (Account-to-Account): The automatic transfer of funds from one account to another. An example is the Fedwire or wire transfer transaction. AAV: See Accountholder Authentication Value. ABA: See American Bankers Association. ABA Transit Routing Number: The unique number devised by the American Bankers Association (ABA) in 1910 that identifies the bank issuer of depository accounts. It is a 10‐digit number (nine digits and a verification digit) issued by the Federal Reserve Bank to identify each bank by a bank identification number. This number (also called the ABA number and the routing transit number) has changed over the years to accommodate such things as the Federal Reserve System, the advent of MICR, and the implementation of the Expedited Funds Availability Act (EFAA). It is used both in check processing and in the ACH (Automated Clearing House) routing of electronic checking account debits. The number is usually the first sequence of numbers preceding an account number at the bottom of a check. Acceptance Criteria: The parameters, procedures, and requirements set up by a risk management and underwriting department that must be met before entering into a contract or arrangement. These criteria apply to the merchant as well as the ISO/MSPs. Typical criteria include financial statements, background checks, site visits, credit checks, product review, and web site review. Acceptance Mark: A word, name, symbol, logo, or other device or any combination of devices that identifies the goods or services of one entity from the goods and services of another. A mark that identifies goods is commonly called a trademark. -

AND a DIGITAL FUTURE Kenneth I. Chenault Chair

AMERICAN EXPRESS CEO KENNETH CHENAULT TALKS OF PASSION, INTEGRITY, LEADERSHIP — AND A DIGITAL FUTURE Kenneth I. Chenault Chairman and Chief Executive Officer American Express Company April 15, 2013 Excerpts from Mr. Chenault’s Remarks What about the U.S. economy? Consumer confidence has held up pretty well….Economic recovery is going to be relatively slow….What we’ve got to hope for is that it will stay stable. How do you make your money? Two principle ways. The discount rate that we charge merchants, which generally averages around 2.5 percent on the purchase….Fees to be a member and to have a card. Future of your business? We are the most diversified payments company in the world. That’s very important in that we are a one-stop-shop. What’s also critical in the way the world is going, is that we have data and information on both sides of the street, and the ability, in fact, to use that data is going to position us very well for the digital transformation that’s taking place. What kind of card do you have? All the cards. I really believe you’ve got to eat what you cook. Do you have a bank credit card? I really don’t. But I analyze the competition extensively. Do you sell a lot of traveler’s checks? We are the leader by far in the traveler’s check business. But it’s not a growth market…. So what we’ve done is, we’ve taken the infrastructure that we’ve used with the traveler’s check business and we’re entering an opportunity that I think is fantastic, which is reloadable prepaid, which is increasingly an alternative for cash, checks, and debit.