Banking Automation BULLETIN

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Enabling Commerce in the World's Most Under Penetrated Payments

Enabling Commerce In The World’s Most Under Penetrated Payments Market Network International Holdings Plc Annual Report and Accounts 2019 Network International Holdings Plc 01 Annual Report and Accounts 2019 We are Network International, the leading payment solutions provider in the Middle East and Africa. Our innovative solutions drive revenue and profitability for our customers. To read our Annual Report online go to www.network.ae Market opportunity Under penetrated payments markets R Read more on page 10 Business model A unique We are enabling and leading the transition from cash proposition to digital payments across the Middle East and Africa, one of the fastest growing payments markets in the world. R Read more on page 14 Strategic Report Governance Financial Statements 2019 Highlights 02 Corporate Governance Report 72 Independent Auditor’s Report 138 Our Industry 04 Board of Directors 74 Consolidated Statement Strategy in action Our Business at a Glance 06 Executive Management Team 76 of Financial Position 144 Chairman’s Statement 08 Audit and Risk Committee Report 88 Consolidated Statement of Profit or Loss 145 Market Overview 10 Nomination Committee Report 100 Market leading Consolidated Statement of Our Track Record 12 Directors’ Remuneration Report 102 other Comprehensive Income 146 Our Business Model 14 Directors’ Report 130 Consolidated Statement technology Chief Executive Officer’s Review 16 Going Concern Statement of Changes in Equity 147 Our Strategic Framework 20 and Viability Statement 136 Group Statement of Cash Flows -

Card Processing Guide Merchant Operating Instructions

Card Processing Guide Merchant Operating Instructions © 2019 GPUK LLP. All Rights Reserved. CONTENTS SECTION PAGE Welcome 1 Global Payments 1 About This Document 1 An Introduction To Card Processing 3 The Anatomy Of A Card Payment 3 Transaction Types 4 Risk Awareness 4 Card Present (CP) Transactions 9 Cardholder Verified By PIN 9 Cardholder Verified By Signature 9 Cardholder Verified By PIN And Signature 9 Contactless Card Payments 10 Checking Cards 10 Examples Of Card Logos 13 Examples Of Cards And Card Features 14 Accepting Cards Using An Electronic Terminal 18 Authorisation 19 ‘Code 10’ Calls 24 Account Verification/Status Checks 25 Recovered Cards 25 Refunds 26 How To Submit Your Electronic Terminal Transactions 28 Using Fallback Paper Vouchers 29 Card Not Present (CNP) Transactions 32 Accepting Mail And Telephone Orders 32 Accepting Internet Orders 33 Authorisation Of CNP Transactions 35 Confirming CNP Orders 37 Delivering Goods 37 Collection Of Goods 38 Special Transaction Types 39 Bureau de Change 39 Dynamic Currency Conversion (DCC) 40 Foreign Currency Transactions 40 Gratuities 41 Hotel And Car Rental Transactions 41 Prepayments/Deposits/Instalments 43 Purchase With Cashback 43 Recurring Transactions 44 Card Processing Guide © 2019 GPUK LLP. All Rights Reserved. SECTION PAGE Global Iris 47 HomeCurrencyPay 49 An Introduction To HomeCurrencyPay 49 Card Present (CP) HomeCurrencyPay Transactions 50 Mail Order And Telephone Order (MOTO) HomeCurrencyPay Transactions 52 Ecommerce HomeCurrencyPay Transactions 55 Mastercard And Visa Regulations -

Benefits of Open Payment Systems and the Role of Interchange

Benefits of Open Payment Systems and the Role of Interchange U.S. Version Delivering value through payment alternatives At MasterCard Worldwide, we take great pride in the many ways we advance com- merce. From the millions of consumers and businesses around the world who rely on our cards on a daily basis, to the retailers who accept them and institutions that issue them, it’s clear that the products and services we offer deliver extraordinary value. With demand for fast, convenient and safe payment alternatives rapidly accelerating, commerce is increasingly driven by blips on a screen, numbers punched on a keyboard, cards swiped through electronic readers and chip-activated cell phones. In fact, our products and services are so ingrained in everyday life that the value we deliver is all too often taken for granted. Perhaps the easiest way to grasp the true value of electronic payments is to envision a world without them. Clearly, if electronic payments came to a sudden halt, many facets of commerce—travel, trade and the Internet just to name a few—would face dire consequences. While cash and checks still have their place, they lack the speed, convenience and safety required by consumers, businesses and governments in today’s fast-paced, ever-shrinking world. To be sure, the widespread use of electronic payments and the sophisticated networks that seamlessly link millions of consumers, merchants and financial institutions around the globe are at the heart of commerce. Their importance is clear not only in industrialized nations, but in emerging markets as well, where we are making inroads in building a bridge to the modern economy. -

Financialreportpdf2020.Pdf

Finance chap 1.qxp_Layout 1 1/16/20 2:32 PM Page 1 Finance chap 1.qxp_Layout 1 1/16/20 2:32 PM Page 2 Industry Insight 4 MACROECONOMIC Set to soar: Momentum EGYPT’S FINANCE SECTOR acked by strong legislative reforms and an improving macroeconomy, Egypt’s financial sector holds a treasure chest of opportunities. The latest edition of BAmCham Egypt’s Financial Services Industry Insight looks 13 INSURANCE Still Untapped at all aspects of the sector from banks to insurance to the capital markets, and more. The issue starts with a look at the macroeconomic progress of the past three years, with the latest data from Egypt’s economic turnaround, an assessment of potential challenges and the reform plan going forward. This is followed by a chapter on the insurance sector’s growing potential and a BANKS BREWING 19 third chapter covering the key drivers behind the banking Business sector’s expanding investment. Chapters four and five offer updates on the closely related topics of financial inclusion and fintech, detailing the role of retail lending, e-banking and non-banking channels in drawing more consumers and SMEs into the financial system. Finally, chapter six has the latest on trends in the stock market, with a special look at 26 CRACKING private equity and Egypt’s new sovereign wealth fund. Consumer Credit Khaled Sewelam Director, Research and Publications FINTECH IS 34 Flourishing Amira Sheha Research Manager Fadila Noureldin Author and Senior Economic Researcher Kate Durham Editor and Head of Corporate Publications Nessim N. Hanna CAPITAL Senior Art Director 39 Crunch Emy Emile Senior Graphic Designer Verina Maher Graphic Designer Amany Kassem Advertising & Business Development Director Publications/Research EXPLOITING Lamia Seleit Sovereign Capital 45 Advertising Specialist Rowan Maamoun Advertising & Ad Traffic Coordinator Hani Elias Production Supervisor ©2019 AmCham Egypt’s Business Studies & Analysis Center. -

EMF Implementing EMV at The

Implementing EMV®at the ATM: Requirements and Recommendations for the U.S. ATM Community Version 2.0 Date: June 2015 Implementing EMV at the ATM: Requirements and Recommendations for the U.S. ATM Community About the EMV Migration Forum The EMV Migration Forum is a cross-industry body focused on supporting the EMV implementation steps required for global and regional payment networks, issuers, processors, merchants, and consumers to help ensure a successful introduction of more secure EMV chip technology in the United States. The focus of the Forum is to address topics that require some level of industry cooperation and/or coordination to migrate successfully to EMV technology in the United States. For more information on the EMV Migration Forum, please visit http://www.emv- connection.com/emv-migration-forum/. EMV is a trademark owned by EMVCo LLC. Copyright ©2015 EMV Migration Forum and Smart Card Alliance. All rights reserved. The EMV Migration Forum has used best efforts to ensure, but cannot guarantee, that the information described in this document is accurate as of the publication date. The EMV Migration Forum disclaims all warranties as to the accuracy, completeness or adequacy of information in this document. Comments or recommendations for edits or additions to this document should be submitted to: ATM- [email protected]. __________________________________________________________________________________ Page 2 Implementing EMV at the ATM: Requirements and Recommendations for the U.S. ATM Community TABLE OF CONTENTS -

Financial Infrastructure

CONFIDENTIAL FOR RESTRICTED USE ONLY (NOT FOR USE BY THIRD PARTIES) Public Disclosure Authorized FINANCIAL SECTOR ASSESSMENT PROGRAM Public Disclosure Authorized RUSSIAN FEDERATION FINANCIAL INFRASTRUCTURE TECHNICAL NOTE JULY 2016 Public Disclosure Authorized This Technical Note was prepared in the context of a joint World Bank-IMF Financial Sector Assessment Program mission in the Russian Federation during April, 2016, led by Aurora Ferrari, World Bank and Karl Habermeier, IMF, and overseen by Finance & Markets Global Practice, World Bank and the Monetary and Capital Markets Department, IMF. The note contains technical analysis and detailed information underpinning the FSAP assessment’s findings and recommendations. Further information on the FSAP program can be found at www.worldbank.org/fsap. THE WORLD BANK GROUP FINANCE & MARKETS GLOBAL PRACTICE Public Disclosure Authorized i TABLE OF CONTENT Page I. Executive Summary ........................................................................................................ 1 II. Introduction ................................................................................................................... 15 III. Payment and Settlement Systems ............................................................................. 16 A. Legal and regulatory framework .......................................................................... 16 B. Payment system landscape .................................................................................... 18 C. Systemically important payment systems -

Reform of Credit Card Schemes in Australia

CHAPTER 5: PROMOTING EFFICIENCY AND COMPETITION 5.1 Introduction The main regulations in the Bankcard, MasterCard and Visa credit card schemes in Australia – dealing with the collective setting of interchange fees, restrictions on merchant pricing and restrictions on entry – have been assessed in previous Chapters on public interest grounds. Each of these regulations represents significant departures from the normal workings of the market. This final Chapter draws the previous analyses together by reviewing the regulations and their consequences against the benchmarks that underpin the public interest test, and summarising the public interest concerns. These concerns provide the background for the use of the Reserve Bank’s payments system powers to promote reform of the designated credit card schemes, in the interests of promoting efficiency and competition in the Australian payments system. The Chapter outlines the reform measures and their likely impact. It then analyses the main objections to reform that have been raised and concludes that they are not a persuasive defence of the status quo. The last section outlines the next steps in the Reserve Bank’s consultation process before its proposed standards and access regime are finalised. 5.2 Scheme regulations and competition benchmarks To meet the broad objectives of public policy, the payments system in Australia would be expected to be responsive to competitive pressures, including freedom of entry into the markets for different payment instruments, provided the safety of the system is not compromised. There is likely to be a role for private-sector regulations to ensure the safety, technical consistency and orderly operation of any payment system, but such regulations should not be so binding or widespread as to compromise the market process. -

Debit Card Interchange

Payments the way we see it Debit Card Interchange The impact of debit interchange regulation and what financial services institutions can do to support a positive outcome Contents 1 Highlights 3 2 Overview of the U.S. Debit Card Interchange Regulation 4 2.1 Durbin Amendment of the Dodd-Frank Act 4 2.2 Interchange Fee in a Debit Card Transaction 5 2.3 Debit Card Usage in the United States 6 2.4 Drivers for U.S. Debit Interchange Regulation 7 2.5 Viewpoints and Estimated Impact for Key Stakeholders 8 3 Debit and Credit Interchange Interventions around the World 9 3.1 Australia 9 3.2 Canada 9 3.3 European Union 10 3.4 New Zealand 10 4 Implications for Stakeholders 11 4.1 Implications for Issuers 12 4.2 Implications for Merchants 12 4.3 Implications for Customers 12 4.4 Implications for Networks 13 4.5 Implications for the Economy 13 5 Recommendations for Financial Services Institutions 14 5.1 Political 14 5.2 Economic 14 5.3 Social 16 5.4 Technological 16 6 Conclusion 18 References 19 2 the way we see it 1 Highlights In 2010, the U.S. Congress passed the Dodd-Frank Wall Street and Consumer Protection Act, a sweeping change to financial regulation in the United States. The Durbin amendment, part of the Dodd-Frank Act, allows the Federal Reserve board to implement a comprehensive system of debit card interchange. The amendment establishes standards for an interchange fee1, and prohibits issuers and networks from restricting the number of networks over which an electronic debit transaction may be processed. -

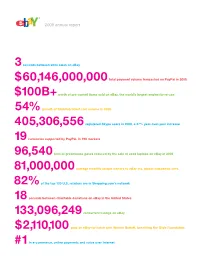

View Annual Report

To Our Stockholders, In 2008, we embraced a tremendous amount of fundamental change against the backdrop of a deteriorating external market and economy. Even with the challenges, we exited the year a stronger company and remain a leader in e-commerce, payments and Internet voice communications. Our performance for the full year not only reflects the strength of our portfolio, but also the operating discipline, strategic clarity and focus with which our management team is leading the company going forward. Financially, the company had a good year, marked by strong revenue growth, stronger EPS growth and excellent free cash flow. Despite the extremely challenging economic environment in 2008 – including a slowdown in global e-commerce, a strengthening dollar, and declining interest rates – we delivered $8.5 billion in revenues, an 11 percent increase from the prior year, and $1.36 of diluted EPS. We also delivered a solid operating margin of 24 percent. The size of the eBay marketplace continues to be the largest in the world with nearly $60 billion of gross merchandise volume (the total value of goods sold in all of our Marketplaces) in 2008. PayPal continues to experience strong growth, both on eBay and across e-commerce, and Skype had a great year, growing both revenues and user base. In addition, we strengthened our portfolio by investing in the growth of our emerging businesses and through key acquisitions. In 2008, advertising, global classifieds and StubHub, the leading online tickets marketplace, all gained momentum in terms of revenues. Key acquisitions we made during the year will help us build on our strengths. -

Mastercard International

CODE OF PRACTICE FOR PAYMENT CARD SCHEME OPERATORS Background The Code of Practice for Payment Card Scheme Operators (“the Code”) has been drawn up and observed by eight payment card scheme operators1 (“scheme operators”) in Hong Kong since 2007. The introduction of the Payment Systems and Stored Value Facilities Ordinance (“the Ordinance”) on 13 November 2015 has necessitated certain modifications of the Code, which are now incorporated in this version. The scheme operators remain committed to observe this updated version of the Code in providing services to the general public. Purpose This Code specifies general principles for the scheme operators to observe in order to promote the general safety and efficiency of payment cards in Hong Kong and to foster public confidence in them. Classification This is a non-statutory Code drawn up by the scheme operators in Hong Kong. New scheme operators entering the Hong Kong market should also adhere to the general principles in this Code. Application To the scheme operators in Hong Kong. This Code applies only to their operations in Hong Kong and is not intended to have extra-territorial effect. 1 “Payment card scheme operators” means, for the purposes of this Code, multi-purpose payment card schemes which provide credit and /or debit function through a payment network for making payment of goods or services. It excludes multi-purpose stored-value cards, which are dealt with separately by the regulatory regime for stored value facilities under the Ordinance. Structure INTRODUCTION 1. Status of the Code 2. Objectives 3. Enquiries SAFETY 4. Legal Basis of the System 5. -

National Payment System Development Strategy for 2021 – 2023

NATIONAL PAYMENT SYSTEM DEVELOPMENT STRATEGY FOR 2021 – 2023 Moscow 2021 CONTENTS Introduction .......................................................................................................................... 2 1. Current status of the NPS ............................................................................................... 4 1.1. Regulation ..................................................................................................................................................................................4 1.2. NPS infrastructure .................................................................................................................................................................5 1.3. Payment service providers ................................................................................................................................................9 1.4. Payment service consumers ..........................................................................................................................................10 2. Global and domestic trends and challenges of the payment market ......................13 2.1. Transformation of client experience and consumption models .....................................................................13 2.2. New payment technologies ...........................................................................................................................................13 2.3. New payment market participants .............................................................................................................................14 -

2021 Prime Time for Real-Time Report from ACI Worldwide And

March 2021 Prime Time For Real-Time Contents Welcome 3 Country Insights 8 Foreword by Jeremy Wilmot 3 North America 8 Introduction 3 Asia 12 Methodology 3 Europe 24 Middle East, Africa and South Asia 46 Global Real-Time Pacific 56 Payments Adoption 4 Latin America 60 Thematic Insights 5 Glossary 68 Request to Pay Couples Convenience with the Control that Consumers Demand 5 The Acquiring Outlook 5 The Impact of COVID-19 on Real-Time Payments 6 Payment Networks 6 Consumer Payments Modernization 7 2 Prime Time For Real-Time 2021 Welcome Foreword Spurred by a year of unprecedented disruption, 2020 saw real-time payments grow larger—in terms of both volumes and values—and faster than anyone could have anticipated. Changes to business models and consumer behavior, prompted by the COVID-19 pandemic, have compressed many years’ worth of transformation and digitization into the space of several months. More people and more businesses around the world have access to real-time payments in more forms than ever before. Real-time payments have been truly democratized, several years earlier than previously expected. Central infrastructures were already making swift For consumers, low-value real-time payments mean Regardless of whether real-time schemes are initially progress towards this goal before the pandemic immediate funds availability when sending and conceived to cater to consumer or business needs, intervened, having established and enhanced real- receiving money. For merchants or billers, it can mean the global picture is one in which heavily localized use time rails at record pace. But now, in response to instant confirmation, settlement finality and real-time cases are “the last mile” in the journey to successfully COVID’s unique challenges, the pace has increased information about the payment.