MARKET REPORT 2021 Arosa-Lenzerheide

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Graubünden for Mountain Enthusiasts

Graubünden for mountain enthusiasts The Alpine Summer Switzerland’s No. 1 holiday destination. Welcome, Allegra, Benvenuti to Graubünden © Andrea Badrutt “Lake Flix”, above Savognin 2 Welcome, Allegra, Benvenuti to Graubünden 1000 peaks, 150 valleys and 615 lakes. Graubünden is a place where anyone can enjoy a summer holiday in pure and undisturbed harmony – “padschiifik” is the Romansh word we Bündner locals use – it means “peaceful”. Hiking access is made easy with a free cable car. Long distance bikers can take advantage of luggage transport facilities. Language lovers can enjoy the beautiful Romansh heard in the announcements on the Rhaetian Railway. With a total of 7,106 square kilometres, Graubünden is the biggest alpine playground in the world. Welcome, Allegra, Benvenuti to Graubünden. CCNR· 261110 3 With hiking and walking for all grades Hikers near the SAC lodge Tuoi © Andrea Badrutt 4 With hiking and walking for all grades www.graubunden.com/hiking 5 Heidi and Peter in Maienfeld, © Gaudenz Danuser Bündner Herrschaft 6 Heidi’s home www.graubunden.com 7 Bikers nears Brigels 8 Exhilarating mountain bike trails www.graubunden.com/biking 9 Host to the whole world © peterdonatsch.ch Cattle in the Prättigau. 10 Host to the whole world More about tradition in Graubünden www.graubunden.com/tradition 11 Rhaetian Railway on the Bernina Pass © Andrea Badrutt 12 Nature showcase www.graubunden.com/train-travel 13 Recommended for all ages © Engadin Scuol Tourismus www.graubunden.com/family 14 Scuol – a typical village of the Engadin 15 Graubünden Tourism Alexanderstrasse 24 CH-7001 Chur Tel. +41 (0)81 254 24 24 [email protected] www.graubunden.com Gross Furgga Discover Graubünden by train and bus. -

Switzerland 4Th Periodical Report

Strasbourg, 15 December 2009 MIN-LANG/PR (2010) 1 EUROPEAN CHARTER FOR REGIONAL OR MINORITY LANGUAGES Fourth Periodical Report presented to the Secretary General of the Council of Europe in accordance with Article 15 of the Charter SWITZERLAND Periodical report relating to the European Charter for Regional or Minority Languages Fourth report by Switzerland 4 December 2009 SUMMARY OF THE REPORT Switzerland ratified the European Charter for Regional or Minority Languages (Charter) in 1997. The Charter came into force on 1 April 1998. Article 15 of the Charter requires states to present a report to the Secretary General of the Council of Europe on the policy and measures adopted by them to implement its provisions. Switzerland‘s first report was submitted to the Secretary General of the Council of Europe in September 1999. Since then, Switzerland has submitted reports at three-yearly intervals (December 2002 and May 2006) on developments in the implementation of the Charter, with explanations relating to changes in the language situation in the country, new legal instruments and implementation of the recommendations of the Committee of Ministers and the Council of Europe committee of experts. This document is the fourth periodical report by Switzerland. The report is divided into a preliminary section and three main parts. The preliminary section presents the historical, economic, legal, political and demographic context as it affects the language situation in Switzerland. The main changes since the third report include the enactment of the federal law on national languages and understanding between linguistic communities (Languages Law) (FF 2007 6557) and the new model for teaching the national languages at school (—HarmoS“ intercantonal agreement). -

Langwies Abfahrt Partenza Departure Départ Live-Anzeige 13

Langwies Abfahrt Partenza Departure Départ Live-Anzeige 13. Dezember 2020 - 11. Dezember 2021 05:00 12:00 19:00 01:00 Zeit Linie Zielort Zeit Linie Zielort Zeit Linie Zielort Zeit Linie Zielort R 05:06 B a Chur, Bahnhofplatz 12:05 R , Chur 19:05 R Chur 01:17 B / 0 Chur, Bahnhofplatz Peist,Schulhaus 05:12 - St. Peter,Caflies 05:15 - Peist 12:13 - St. Peter-M. 12:17 - Lüen-C. 12:26 - Peist 19:13 - St. Peter-M. 19:17 - Lüen-C. 19:26 - a Peist,Schulhaus 01:25 - St. Peter, Gufa 01:26 - Pagig, Abzw. 05:18 - Castiel, Dorf 05:24 - Altstadt 12:44 - Chur 12:53 Altstadt 19:44 - Chur 19:53 £ n St. Peter,Caflies 01:30 - St. Peter,Rath. 01:30 - Maladers, alte Post 05:34 - Chur, Malteser 05:43 - 12:50 Arosa 19:50 Arosa Pagig, Abzw. 01:32 - Pagig, Pudanal 01:32 - Chur, Bahnhofpl. 05:48 R R Tura 01:33 - Castiel, Galgenbühl 01:37 - Litzirüti 12:56 - Arosa 13:09 Litzirüti 19:56 - Arosa 20:09 U 05:50 Arosa Castiel, Dorf 01:37 - Calfreisen, Abzw. 01:37 - R Calfreisen, Dorf 01:38 - Sax (Maladers) 01:42 - Litzirüti 05:56 - Arosa 06:09 13:00 20:00 Maladers, Dorf 01:46 - Maladers, Schule 01:46 - 06:00 Zeit Linie Zielort Zeit Linie Zielort Maladers, alte Post 01:48 - Maladers, Chisgruob 01:48 - Zeit Linie Zielort 13:05 R Chur 20:04 R Chur Maladers, Tumma 01:48 - Peist 13:13 - St. Peter-M. 13:17 - Lüen-C. 13:26 - Peist 20:11 - St. -

Mediendokumentation Skigebietsverbindung Arosa Lenzerheide

Mediendokumentation Skigebietsverbindung Arosa Lenzerheide Inhalt Baubericht Arosa Lenzerheide................................................................................................................... 2 Projektbeschrieb: Verbindungsbahn Hörnli-Urdenfürggli .......................................................................... 4 Projektbeschrieb: Erschliessungsbahnen Lenzerheide ................................................................................ 5 Wintermarke Arosa Lenzerheide (Marketingkonzept)............................................................................... 7 Wirtschaftliche Bedeutung der Skigebietsverbindung................................................................................ 8 Geschichte der Skigebietsverbindung........................................................................................................ 9 Tschiertschen............................................................................................................................................ 9 Baubericht Arosa Lenzerheide Die Idee einer Verbindung der beiden Skigebiete Arosa und Lenzerheide besteht seit den frühen 70er Jahren. Die geografisch eng beieinander liegenden Schneesportgebiete sind nur durch das Urdental von- einander getrennt. Die Distanz beträgt lediglich 2 km Luftlinie. Bereits am 1. Juni 2008 haben die Stimm- berechtigten der Gemeinde Arosa an der Urnenabstimmung mit 613 Ja zu 114 Nein der Skigebietsver- bindung Arosa Lenzerheide mit einem Ja-Anteil von 84.3% zugestimmt. Am 27. November 2011 ist -

Loipenplan Ansicht West Nordic Loipen-Höhenprofile Langlaufen

www.lenzerheide.com Piz Danis Stätzerhorn Faulberg LoipenplanLanglaufenAnsicht West 2497 m 2574 m 2572 m Fulbergegg 2449 m Piz Scalottas 2322 m Nordic Windegga Crap la Pala 2230 m 2151 m Dreibündenstein Langlauf, Winterwandern, Schneeschuh 2160 m June Hütte Tgantieni 1793 m Alp Lavoz Muldain Alp Stätz Lain Spoina Sporz Pradaschier Zorten Alvaschein La Pala Sartons Malix 1120m Bual Churwalden 1229m Valbella 1500m Fastatsch 1560 m Chur Golfplatz 1407 m i i Wintersportbericht/ Parpan 1493m Lantsch/Lenz 1328m See Loipenhotline i i Informationen zu Wetter,Temperaturen, Foppa 1387 m St. Cassian 1415 m Winterwanderwege, Eisfelder,Schlittelwege, Tiefencastel Julier Lenzerheide 1475m Gruoben Rodelbahn Pradaschier,Loipen- und i Mittelberg 1512 m Capfeders Pistenzustand, Schneequalität und -höhe sowie die Parpaner Höhe 1560m Transportanlagen: Triangel 1495 m Telefon +41 (0)81 385 11 33 Lenzerhorn Parpaner Rothorn 2906 m Scharmoin 2863 m Joch 2020m www.lenzerheide.com Oberberg Erfahren Sie mehr zum Loipenzustand: Drei Webcams und den detaillierten Wintersportbericht finden Sie unter www.lenzerheide.com/langlauf Blau Loipen für Einsteiger Rot Loipen für Fortgeschrittene Schwarz Loipen für Könner Duschen/Garderoben Restaurationsbetriebe Langlaufpass Langlaufzentren Wachsraum Loipenbenutzung nur mit gültigem Langlaufpass Valbella, Canols (direkt am See): Die 5kmlange Golfrunde ist ideal für Einsteiger. Die beiden Loipenabschnitte Capfeders und Bual Ideal für konditionell und technisch versierte Läufer Langlaufschulen nur Garderoben Verpflegungsmöglichkeit, WC/Dusche, Gratis Sportbus Zum Ausgangspunkt St.Cassian gelangen Sie führen Sie zu den schönsten Plätzen im Hochtal eignet sich die Rennloipe La Pala. Ein echter Prüfstein Schweizerischer Langlaufpass CHF 120.00 * Schliessfächer,Wachsraum bequem mit dem Postauto. Lenzerheide. Am äussersten Punkt Capfeders für jeden Langläufer. -

Guest Information

Guest information PRÄTSCHLI Alpine Spa Hotel • Prätschlistrasse 64 • CH-7050 Arosa Tel. +41 (0) 81 378 80 80 • [email protected] • www.praetschli.ch 1 Dear Guests We are happy to welcome in our unique Alpine spa in Arosa. The PRÄTSCHLI Alpine Spa Hotel is located high above the roofs of Arosa. Enjoy the panoramic views over the snowy mountains and observe the mythical nature while your body, soul and mind can take time out and rediscover an inner equilibrium. The PRÄTSCHLI Alpine Spa offers a wellness area of 650 m2. Take a rest in the sauna or the steam bath, or enjoy the mountain views in the relaxation room. We provide several wellness and massage treatments. You will also find a gym with modern fitness devices. Find your silence and peace in our relaxing pool, which is equipped with massage showers and whirlpool beds. The perfect setting to indulge your senses after a day of winter sports. The following information provides a summary of our services. If you require additional information, do not hesitate to contact us at any time. We wish you a pleasant stay at our PRÄTSCHLI Alpine Spa Hotel Arosa. PRÄTSCHLI Alpine Spa Hotel Arosa Brigitte und Christian Menet PRÄTSCHLI Alpine Spa Hotel • Prätschlistrasse 64 • CH-7050 Arosa Tel. +41 (0) 81 378 80 80 • [email protected] • www.praetschli.ch 2 CONTENTS COVID-19 PROTECTION CONCEPT ………………………………………………………………page 4 PRÄTSCHLI ALPINE SPA Wellness area ..................................................................................................... page 7 Treatments ........................................................................................................ -

Hiking in Lenzerheide, Switzerland - KÜHL Blog

Trip Report: Hiking in Lenzerheide, Switzerland - KÜHL Blog Trip Report: Hiking in Lenzerheide, Switzerland HIKING TRAVEL TRIP REPORTS By Kühl Editor on October 4, 2019 When I arrived at the Swiss ski area, Arosa Lenzerheide, in the canton of Graubünden, in early September, I embarked on a memorable Grison Alps adventure. I explored the lush green valley and its pristine alpine lake and also trekked down from the rocky surface of the Rothorn Summit to the midpoint at Scharmoin. Arosa Lenzerheide A Room with a View Checking in at the modern Revier Mountain Lodge was done electronically at a high tech computer console. I had to guess at some of the required responses since the prompts were in German. All of the rooms are arranged on one side of each floor’s corridor and are accessed by a multiple digit code obtained during check-in. Each doorway entrance has a whimsical English saying. Two of my favorites were Follow Your Dreams and Tonight is https://www.kuhl.com/borninthemountains/trip-report-hiking-lenzerheide-switzerland/[10/7/19, 3:59:32 PM] Trip Report: Hiking in Lenzerheide, Switzerland - KÜHL Blog the Night. The focal point of my simple wood-paneled room was an oversized picture window with an incredible view of the fertile valley. The turquoise colored Lake Heidsee glistened against the backdrop of dark green foliage and surrounding mountains. Off in the distance, I could see the telltale sign of ski runs carved into the slopes. View from Revier Mountain Lodge Few hotel accommodations offer an unobstructed view of Mother Nature’s handiwork. -

Arosa Lenzerheide Piste Map 2019

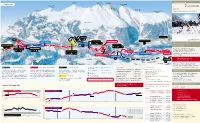

ACHTUNG Der Pisten- und Rettungsdienst überwacht Luftseilbahn und kontrolliert nur die markierten und geöffneten Pisten! Ausserhalb der Bahnbetriebszeiten sind S Gondelbahn Luftseilbahn die Abfahrten geschlossen und vor keinen Erzhorn 2924m Aroser Rothorn 2980m Parpaner Rothorn 2865m Lenzerhorn 2906m Piz Scalottas 2323m Arosa Lenzerheide 144 6er Sesselbahn Gefahren wie Lawinensprengungen oder Rothorngipfel Piz Scalottas Gondelbahn Pistenmaschinen mit Seilwinden gesichert! S WO Erzhorn 2924m Aroser Rothorn 2980m Parpaner Rothorn 2865m Lenzerhorn 2906m Piz Scalottas 2323m 4er Sesselbahn LEBENSGEFAHR! Arosa Lenzerheide 144 6er Sesselbahn Rothorngipfel 40 Piz Scalottas 21 WO 3er Sesselbahn 4er Sesselbahn SICHERHEITSHINWEIS 42 N 40 Das Gebiet ausserhalb der markierten und s 2er Sesselbahn 21 ta 3er Sesselbahn ot June Hütte präparierten Pisten gilt als freies Schnee- al 42 N Sc Skilift sportgelände. Es wird weder markiert noch Tiefencastel s 2er Sesselbahn Parpaner Weisshorn 2824m Alp Fops ta vor alpinen Gefahren gesichert. ot June Hütte Lantsch/Lenz 40 al Tiefencastel Marola Hütte Sc ÜbungsliftSkilift Rothor Alp Fops Parpaner Weisshorn 2824m Galerie Tgantieni 50a INFORMATION Lantsch/Lenz 40 Piz Danis 2497 m 42a ZauberteppichÜbungslift n Lain Muldain Zorten Marola Hütte Sämtliche Pisten sind am Pistenrand 2 Rothor 50a 50 Galerie Sporz Tgantieni Piz Danis 2497 m beidseitig mit orangen Markierungspfosten, 42a 1 LeichteZauberteppichPiste n Lain Muldain Zorten 55a den Schwierigkeitsgraden und Nummern 2 44 Acla Grischuna rud 50 Sporz rt signalisiert. -

VAZEROL Lenzerheide – Davos/ St.Moritz/ Engadin

Ihr zukünftiger Wohn- und Ferienort ... befindet sich im Herzen Graubündens, im Schnitt- punkt der Verbindungen VAZEROL Lenzerheide – Davos/ St.Moritz/ Engadin. Brienz / Brinzauls Lenzerheide/Graubünden Vazerol bietet ein gesundes Höhenklima (1170m ü. M.). Der Weiler Vazerol liegt auf einer weiten, windgeschützten Sonnen- terrasse hoch über dem Albulatal. Das unvergleichliche Panorama erstreckt sich von den Bergünerstöcken über die Gipfel des Ober- halbsteins bis weit in die Schinschlucht. FL Vazerol liegt in unmittelbarer Nähe der Skigebiete Lenzerheide, Davos und Savognin, und nur 5 Autominuten vom Golfplatz sowie SG Landquart Samnaun Kur- und Badehotel Alvaneu Bad entfernt. Im Sommer bietet Vazerol Ruhe, ein herrliches Wandergebiet in GL AUSTRIA Klosters schönster Landschaft. Chur Davos Die Wohnsiedlung Vazerol liegt in der Nähe des Dorfes Brienz in ei- Flims Scuol UR Laax Susch nem reizvollen Gelände mit altem Baumbestand. Die Zufahrt erfolgt Arosa auch im Winter mühelos über gut ausgebaute Strassen. Lenzerheide Zernez Thusis Bergün Disentis 0 km 0 1 VAZEROL Vals Zuoz Sta. Maria 20 km 20 Savognin 30 km 30 40 km 40 St. Moritz Samedan San Bernardino Bivio TI Poschiavo ITALIA Ski- und Wandergebiet Tennis-Plätze Golf-Plätze namaste vision ag, 15. Januar 2014 19 Überbauung Vazerol: Kurzbeschrieb Öffentliche Verkehrsmittel Lenzerheide Der Weiler Vazerol ist bequem mit öffentlichen Verkehrsmitteln zu Lantsch/Lenz erreichen. Mit dem Zug via Chur oder Davos nach Tiefencastel, und kurze Weiterfahrt mit dem Postauto. Wohn- und Ferienort Brienz/Brinzauls Mit dem Postauto ab Chur über die Lenzerheide Richtung Tiefen- VAZEROL castel. Vazerol Davos Lenzerheide bietet in nur 7 km Entfernung interessante Möglichkeiten: Chur • diverse Bergbahnen und Skilifte • viele Einkaufsmöglichkeiten und Restaurants • Banken und Post Tiefencastel St. -

Media Documentation

Media Documentation Contents 1 Winter Universiade 2021 ......................................................................................... 4 1.1 Organisations Involved ..................................................................................... 5 1.2 History .............................................................................................................. 5 2 Venues .................................................................................................................... 7 2.1 Andermatt-Realp UR ........................................................................................ 8 2.2 Engelberg OW .................................................................................................. 9 2.3 Lenzerheide GR ............................................................................................. 10 2.4 Lucerne LU ..................................................................................................... 11 2.5 Stoos SZ ......................................................................................................... 12 2.6 Sursee LU ...................................................................................................... 13 2.7 Zug ZG ........................................................................................................... 14 3 Sport ...................................................................................................................... 15 3.1 Sports ............................................................................................................ -

Stratospheric Ozone Measurements at Arosa (Switzerland): History and Scientific Relevance

Atmos. Chem. Phys., 18, 6567–6584, 2018 https://doi.org/10.5194/acp-18-6567-2018 © Author(s) 2018. This work is distributed under the Creative Commons Attribution 4.0 License. Stratospheric ozone measurements at Arosa (Switzerland): history and scientific relevance Johannes Staehelin1, Pierre Viatte2, Rene Stübi2, Fiona Tummon1, and Thomas Peter1 1Institute for Atmospheric and Climate Science, ETHZ, Zürich, Switzerland 2Federal Office of Meteorology and Climatology MeteoSwiss, Payerne, Switzerland Correspondence: Johannes Staehelin ([email protected]) Received: 20 November 2017 – Discussion started: 29 November 2017 Revised: 15 March 2018 – Accepted: 22 March 2018 – Published: 8 May 2018 Abstract. In 1926 stratospheric ozone measurements began identifying potentially unexpected stratospheric responses to at the Light Climatic Observatory (LKO) in Arosa (Switzer- climate change, support the continued need to document land), marking the beginning of the world’s longest series stratospheric ozone changes. This is particularly valuable at of total (or column) ozone measurements. They were driven the Arosa site, due to the unique length of the observational by the recognition that atmospheric ozone is important for record. This paper presents the evolution of the ozone layer, human health, as well as by scientific curiosity about what the history of international ozone research, and discusses the was, at the time, an ill characterised atmospheric trace gas. justification for the measurements in the past, present and From around the mid-1950s to the beginning of the 1970s into future. studies of high atmosphere circulation patterns that could improve weather forecasting was justification for studying stratospheric ozone. In the mid-1970s, a paradigm shift oc- curred when it became clear that the damaging effects of 1 Introduction anthropogenic ozone-depleting substances (ODSs), such as long-lived chlorofluorocarbons, needed to be documented. -

Amtliches Gemeindeverzeichnis Der Schweiz Angekündigte

Eidgenössisches Departement des Innern EDI Bundesamt für Statistik BFS Abteilung Register 0 Statistische Grundlagen und Übersichten November 2016 Amtliches Gemeindeverzeichnis der Schweiz Angekündigte Änderungen 2016 Ausgabe vom 03.11.2016 (ersetzt Ausgabe vom 22.06.2016) 1 Allgemeines 1.1 Kurzbeschreibung Nach Art. 19, Abs. 3 der Verordnung vom 21. Mai 2008 über die geographischen Namen (GeoNV - SR 510.625) sind die Gemeindenamen und Gemeindenummern des amtlichen Gemeindeverzeichnis- ses behördenverbindlich. Das Bundesamt für Statistik vergibt für jede Gemeinde eine Nummer und erstellt, verwaltet und veröffentlicht das amtliche Gemeindeverzeichnis der Schweiz (GeoNV - Art. 19, Abs. 1). Im amtlichen Gemeindeverzeichnis werden alle von der Eidgenössischen Vermessungsdirek- tion (swisstopo) genehmigten Änderungen von Gemeindenamen sowie weitere von den zuständigen kantonalen Stellen gemeldeten Änderungen (Aufhebung von Gemeinden, Gebietsveränderungen und Änderungen in den Bezirken oder einer vergleichbaren administrativen Einheit des Kantons) nachge- führt. 1.2 Struktur Das amtliche Gemeindeverzeichnis ist nach Kantonen sowie nach Bezirken oder einer vergleichbaren administrativen Einheit des Kantons gegliedert (GeoNV - Art. 19, Abs. 2). 1.3 Wichtigste Anwendungen Das amtliche Gemeindeverzeichnis wird als definitorische Grundlage zur Gemeindeidentifikation und Gemeindenamen in zahlreichen Verwaltungsapplikationen auf Stufe Bund, Kantone und Gemeinden sowie in der Privatwirtschaft eingesetzt. Espace de l'Europe 10 CH-2010 Neuchâtel www.statistik.admin.ch