U Latest Projects Corporate News Sales Overview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Operator's Story Case Study: Guangzhou's Story

Railway and Transport Strategy Centre The Operator’s Story Case Study: Guangzhou’s Story © World Bank / Imperial College London Property of the World Bank and the RTSC at Imperial College London Community of Metros CoMET The Operator’s Story: Notes from Guangzhou Case Study Interviews February 2017 Purpose The purpose of this document is to provide a permanent record for the researchers of what was said by people interviewed for ‘The Operator’s Story’ in Guangzhou, China. These notes are based upon 3 meetings on the 11th March 2016. This document will ultimately form an appendix to the final report for ‘The Operator’s Story’ piece. Although the findings have been arranged and structured by Imperial College London, they remain a collation of thoughts and statements from interviewees, and continue to be the opinions of those interviewed, rather than of Imperial College London. Prefacing the notes is a summary of Imperial College’s key findings based on comments made, which will be drawn out further in the final report for ‘The Operator’s Story’. Method This content is a collation in note form of views expressed in the interviews that were conducted for this study. This mini case study does not attempt to provide a comprehensive picture of Guangzhou Metropolitan Corporation (GMC), but rather focuses on specific topics of interest to The Operators’ Story project. The research team thank GMC and its staff for their kind participation in this project. Comments are not attributed to specific individuals, as agreed with the interviewees and GMC. List of interviewees Meetings include the following GMC members: Mr. -

Travel Information

Travel Information 20th IEEE/ACIS International Conference on Computer and Information Science (ICIS 2021 Summer) June 23-24, 2021 Shanghai Development Center of Computer Software Technology Shanghai http://acisinternational.org/conferences/icis-2021/ Venue for the Conference Shanghai Development Center of Computer Software Technology (SSC) Full address: Technology Building, No. 1588 Lianhang Rd, Minhang District, 201112, Shanghai, China Host Contact: Ms. Yun Hu [email protected] Tel. 86-021-54325166-3313 Travel Information Taxi service: SSC is around 30 km (about 120 CNY) from Shanghai Hongqiao International Airport (SHA), Hongqiao Railway Station and 40 km (about 150 CNY) from Shanghai Pudong International Airport (PVG). Location of SSC from Shanghai Hongqiao International Airport Location of SSC from Shanghai Pudong International Airport Public Transportation: From Shanghai Hongqiao International Airport: From To Transportation Notes Hongqiao International Laoximeng Station Shanghai Metro Line 10 Airport Terminal 2 Direction: Jilong Road Laoximeng Station Lianhang Road Station Shanghai Metro Line 8 Transfer Direction: Shendu Highway inside the station Lianhang Road Station SSC Walk (about 10 min, 500m) From Hongqiao Railway Station: From To Transportation Notes Hongqiao Railway Laoximeng Station Shanghai Metro Line 10 Station Direction: Jilong Road Laoximeng Station Lianhang Road Station Shanghai Metro Line 8 Transfer Direction: Shendu Highway inside the station Lianhang Road Station SSC Walk (about 10 min, 500m) From Shanghai Pudong International Airport: From To Transportation Notes Pudong International Laoximeng Station Shanghai Maglev Airport Direction: Longyang Road Longyang Road Station Yaohua Road Station Shanghai Metro Line 7 Transfer out Direction: Meilan Road of the station Yaohua Road Station Lianhang Road Station Shanghai Metro Line 8 Transfer Direction: Shendu Highway inside the station Lianhang Road Station SSC Walk (about 10 min, 500m) Accommodation Ji Hotel (60~100 USD per night) Address: No. -

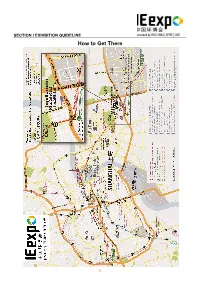

How to Get There

SECTION I EXHIBITION GUIDELINE How to Get There 12 SECTION I EXHIBITION GUIDELINE How to Get There (cont’d) Shanghai Metro Map 13 SECTION I EXHIBITION GUIDELINE How to Get There (cont’d) SNIEC is strategically located in Pudong‘s key economic development zone. There is a public traffic interchange for bus and metro, , one named “Longyang Road Station“ about 10-min walk from the station to fairground, and one named “Huamu Road Station“ about 1-min walk from the station to fairground. By flight The expo centre is located half way between Pudong International Airport and Hongqiao Airport, 35 km away from Pudong International Airport to the east, and 32 km away from Hongqiao Airport to the west. You can take the airport bus, maglev or metro directly to the expo center. From Pudong International Airport By taxi By Transrapid Maglev: from Pudong International Airport to Longyang Road Take metro line 2 to Longyang Road Station to change line 7 to Huamu Road Station, 60 min. By Airport Line Bus No. 3: from Pudong Int’l Airport to Longyang Road, 40 min, ca. RMB 20. From Hongqiao Airport By taxi Take metro line 2 to Longyang Road Station to change line 7 to Huamu Road Station, 60 min. By train From Shanghai Railway Station or Shanghai South Railway Station please take metro line1 to People’s Square, then take metro line 2 toward Pudong International Airport Station and get off at Longyang Road Station to change line7 to Huamu Road Station. From Hongqiao Railway Station, please take metro line 2 to Longyang Road Station and change line 7 to Huamu Road Station. -

Development of High-Speed Rail in the People's Republic of China

ADBI Working Paper Series DEVELOPMENT OF HIGH-SPEED RAIL IN THE PEOPLE’S REPUBLIC OF CHINA Pan Haixiao and Gao Ya No. 959 May 2019 Asian Development Bank Institute Pan Haixiao is a professor at the Department of Urban Planning of Tongji University. Gao Ya is a PhD candidate at the Department of Urban Planning of Tongji University. The views expressed in this paper are the views of the author and do not necessarily reflect the views or policies of ADBI, ADB, its Board of Directors, or the governments they represent. ADBI does not guarantee the accuracy of the data included in this paper and accepts no responsibility for any consequences of their use. Terminology used may not necessarily be consistent with ADB official terms. Working papers are subject to formal revision and correction before they are finalized and considered published. The Working Paper series is a continuation of the formerly named Discussion Paper series; the numbering of the papers continued without interruption or change. ADBI’s working papers reflect initial ideas on a topic and are posted online for discussion. Some working papers may develop into other forms of publication. Suggested citation: Haixiao, P. and G. Ya. 2019. Development of High-Speed Rail in the People’s Republic of China. ADBI Working Paper 959. Tokyo: Asian Development Bank Institute. Available: https://www.adb.org/publications/development-high-speed-rail-prc Please contact the authors for information about this paper. Email: [email protected] Asian Development Bank Institute Kasumigaseki Building, 8th Floor 3-2-5 Kasumigaseki, Chiyoda-ku Tokyo 100-6008, Japan Tel: +81-3-3593-5500 Fax: +81-3-3593-5571 URL: www.adbi.org E-mail: [email protected] © 2019 Asian Development Bank Institute ADBI Working Paper 959 Haixiao and Ya Abstract High-speed rail (HSR) construction is continuing at a rapid pace in the People’s Republic of China (PRC) to improve rail’s competitiveness in the passenger market and facilitate inter-city accessibility. -

Directions Shanghai Office

Address & Map Shanghai, China Our Address CMS China Shanghai Representative Office, 3108 Plaza 66, Tower 2, 1266 Nanjing Road West, Shanghai, 200040, China T +86 21 6289 6363 F +86 21 6289 0731 Directions Shanghai office From the Airport By car In the city by train — Shuttle bus – take airport shuttle bus no. 2 to — From Pudong Airport: Take Waihuan Road and ‒ From Puxi: Take Metro Line 2 or Line 7 to Jing’an Jing’an Temple, from there it is a 10-minute walk to turn right into Jiyang Road. Turn into North-South Temple, from there it is a 10-minute walk east our office along Nanjing Road West. Shuttle bus Elevated Road and continue along this road until along Nanjing Road West. Turn left into Xikang service: departs daily from 6.30 a.m. to 11 p.m. at you reach HuaiHai Road. Take a left, and then turn Road and the first office building on the right is around 30-minute intervals. right into Shimen Road (No.1). Turn left into Plaza 66, Tower 2. Nanjing Road West, then right into Xikang Road; — Taxi – the journey to our office takes around 30 the first office building on the right is Plaza 66, ‒ From Pudong: Take Metro Line 2 to Nanjing Road minutes from Hongqiao Airport and 90 minutes Tower 2. West, from there it is an 8-minute walk west along from Pudong Airport. Nanjing Road West. Turn right into Xikang Road — From Hongqiao Airport: Take Yingbinyi Road to and the first office building on the right is Plaza 66, — By Metro – take Metro Line 2 to Jing’an Temple, Yan’an Elevated Road. -

Exhibitor Manual Global Sourcing Fair: Electronics & Components English | | June 26-28, 2012 Shanghai World Expo Exhibition and Convention Center Shanghai, China

Exhibitor Manual Global Sourcing Fair: Electronics & Components English | | June 26-28, 2012 Shanghai World Expo Exhibition And Convention Center Shanghai, China 1. General information 2. Rules and regulations 3. Exhibition stands styles and regulations 4. Intellectual property compliance policy 5. Fair security 6. Publicity 7. Services for exhibitors 8. Liability 9. Information about Shanghai 10. Order Forms 11. Exhibitor eNews Download Exhibitor Manual (printer-friendly version) Download Official Service Providers Contact Lists (printer-friendly version) Copyright © 2012 Trade Media Holdings Ltd. Copyright © 2012 Trade Media Ltd. All rights reserved. Terms of Use Privacy Policy Security Measures IP Policy More manufacturers Shanghai Official Service Providers Jun 2012 Contractor (for any inquiry regarding booth setup and contractor related issues) Pico IES Group (China) Co. Ltd No. 188 XinChen Road, BeiCai Town, Pudong Area, Shanghai 201204, China Tel: (86-21) 5196 0990 ext. 8275 / 8278 Fax: (86-21) 5190 8290 E-mail: [email protected] / [email protected] Contact: Jayz Ni / Tony Gu Freight Forwarder Bondex Logistics Co. Ltd Room 2407-2408, International Capital Plaza, No. 1318 North Sichuan Road, Shanghai 200080, China Mobile: (86) 1381 8209 204 Tel: (86-21) 5107 8887 ext. 836 Fax: (86-21) 6876 0433 E-mail: [email protected] Contact: Kiki Xu Mobile: (86) 1381 7105 339 Tel: (86-21) 5107 8887 ext. 891 Fax: (86-21) 6876 0433 E-mail: [email protected] Contact: Kerry Teng Hotel Reservation Agent The Fair Management has appointed Shenzhen KCMICE Service Co. Ltd as the official hotel reservation agent for the Fair and can help you with your hotel reservations and provide you with special room rates on selected hotels near Shanghai World Expo Exhibition And Convention Center. -

Shanghai Metro Case Study

TDSi Provides EXpert Solution for Shanghai Metro With successful installations already in full operation The Project: Shanghai Metro on Shanghai Metro's Line 6 and Line 9, access control specialist TDSi, in partnership with a distribution Type of Site: Railway Station partner in China, later completed work on the system installation for the Metro's Line 7. Number of Users / Doors: 2,000 doors per line Shanghai Metro is one of the newest and fastest growing transit systems in the world, with 162 Solution Required: An integrated system stations and over 225 km of track running both above that caters for high volumes of users passing and underground. On average, well over two million through multiple access points passengers use the system every day - with the future expansion plans set to see that number Solutions Used: TDSi EXpert Controllers, increase to over three million. MIFARE Readers and EXgarde Enterprise Software The latest addition to the network... W: www.tdsi.co.uk T: 01202 723 535 E: [email protected] Line 7 was commissioned into service at the end of 2008, connecting the Baoshan District with the city centre and Pudong District. Significantly, it provided a vita link to the site of the World Expo, which was hosted by Shanghai in 2010. Over the years, TDSi and its distribution partner have developed and supplied fully integrated access control solutions for Lines 6 and 9. Each Line is served by over 40 stations as well as its own Operational Control Centre (OCC), with around 2,000 doors secured and controlled by TDSi's systems on each line. -

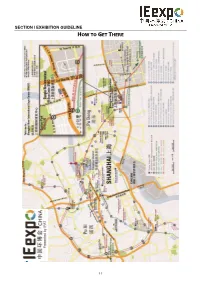

How to Get There

SECTION I EXHIBITION GUIDELINE HOW TO GET THERE 11 SECTION I EXHIBITION GUIDELINE HOW TO GET THERE (CONT’D) SHANGHAI METRO MAP 12 SECTION I EXHIBITION GUIDELINE HOW TO GET THERE (CONT’D) SNIEC is strategically located in Pudong‘s key economic development zone. There is a public traffic interchange for bus and metro, , one named “Longyang Road Station“ about 10-min walk from the station to fairground, and one named “Huamu Road Station“ about 1-min walk from the station to fairground. By flight The expo centre is located half way between Pudong International Airport and Hongqiao Airport, 35 km away from Pudong International Airport to the east, and 32 km away from Hongqiao Airport to the west. You can take the airport bus, maglev or metro directly to the expo center. From Pudong International Airport By taxi By Transrapid Maglev: from Pudong International Airport to Longyang Road Take metro line 2 to Longyang Road Station to change line 7 to Huamu Road Station, 100 min. By Airport Line Bus No. 3: from Pudong Int’l Airport to Longyang Road, 40 min, ca. RMB 20. From Hongqiao Airport By taxi Take metro line 2 to Longyang Road Station to change line 7 to Huamu Road Station, 60 min. By train From Shanghai Railway Station or Shanghai South Railway Station please take metro line1 to People’s Square, then take metro line 2 toward Pudong International Airport Station and get off at Longyang Road Station to change line7 to Huamu Road Station. From Hongqiao Railway Station, please take metro line 2 to Longyang Road Station and change line 7 to Huamu Road Station. -

2019-Shanghai Basic Facts

SHANGHAI BASIC FACTS 2019 Editorial Board Adviser: Zhou Huilin, Zhu Yonglei Editors-in-Chief: Xu Wei, Zhou Ya, Tang Huihao Deputy Editors-in-Chief: Yin Xin, Chen Yongqi, Qian Fei Editor: Cao Meifang SHANGHAI BASIC FACTS 2019 Compiled by: Information Office of Shanghai Municipality Shanghai Municipal Statistics Bureau ZHONGXI BOOK COMPANY SHANGHAI Located at the estuary of the Yangtze River in eastern China and facing the Pacific Ocean, Shanghai sprawls across an area of over 6,340.5 square kilometers with a population of 24.2378 million in 2018. Shanghai is China’s most thriving economic center, with GDP per capita climbing to US$20,398 by the end of 2018. Shanghai is a pioneer in China’s reform and opening- up, as well as innovation. A total of 670 multinational enterprises have set up regional headquarters in the city, and 441 foreign- invested R&D centers have also been established here. Shanghai is one of the world’s financial centers with its financial markets generating a total transaction volume of 1,645.78 trillion yuan and trading volumes of several products ranked top among global markets. An RMB products center, which matches the currency’s international status, has taken form in the city. Shanghai is an important shipping center, handling 730.4794 million tons of goods in 2018. On top of that, its international container volume reached 42.0102 million TEUs, the highest in the world for nine straight years. When it comes to the number of cruise ship passengers, the city ranked fourth in the world. Some 771,600 flights were processed at Shanghai Pudong and Hongqiao international airports, reaching 117.6343 million inbound and outbound trips. -

Swissmem Division Photonics

We are looking forward to welcoming you at our booth. Laser World of Photonics 15 – 17 March 2016 Shanghai New International Expo Centre Swiss Competencies in Photonics At the Swiss Pavilion, Booth 3122, Hall W3 Swissmem Division Photonics Swissmem‘s Photonics division is an industry network for Swiss Map Swiss Pavilion developers, manufacturers and suppliers of photonic and optical Visit the Swiss Pavilion at SNIEC Shanghai New International Booth 3122, Hall W3 systems and system components. It brings together 36 Swiss Expo Center, 2345 Long Yang Road, Pudong New Area, companies and six universities and research institutes. Shanghai 201204, P.R. China. Swissmem 的光电部门是针对瑞士的光子,光学系统以及系 Exhibition Hours 统组件的开发商,制造商以及供应商的一个行业网络。这 15 –16 March 2016 (Tue-Wed) 9.00 –17.00 里汇集了36个瑞士公司以及6所大学和研究机构。 17 March 2016 (Thu) 9.00 –16.00 Last year, the value of the photonic products manufactured in Switzerland amounted to CHF 3 billion, with laser materials processing accounting for the lion‘s share of this volume. Switzerland‘s photonics industry employs around 9,500 people. The majority of these (26%) work in optical measuring technology and image processing. 去年,瑞士光电行业产值在大约30亿瑞士法郎,其中激光 材料加工占有最大份额。瑞士的光电行业从业人员有大约 9500人。这其中大部人员(26%)从业在光学测量以及图像处 理行业。 With 90% of its sales generated abroad, the Swiss photonics industry is heavily export driven. The Swiss companies operating in this sector are distinguished by their strong technologies and components, by their innovativeness and by the fact that they have been supplying the international market with How to -

How to Get There?

HOW TO GET THERE? BY PLANE Pudong International Airport --- SWEECC > Taxi: about 50 minutes > Subway: Line 2, stop at Longyang Road Station, transfer to line 7 direction SWEECC (about 40 minutes) > Airport Shuttle: take line 5, stop at Dongfang Hospital Station, transfer to bus line 82, direction SWEECC (about 70 minutes) > Airport bus: Line 3, stop at Longyang Road Station, transfer to line 7 direction SWEECC (about 60 minutes) Hongqiao Airport --- SWEECC > Taxi: about 35 minutes > Subway: Line 10 from Terminal 1, stop at Laoximen Station, transfer to line 8, direction SWEECC (about 40 minutes) Pudong International Airport Hotline: 021-38484500 Hongqiao Airport Hotline: 021-62688918 BY TRAIN BY TAXI Shanghai Railway Station --- SWEECC Da zhong taxi 96822 > Taxi: 2 stations, at 13km from SWEECC Ba Shi taxi 96840 > Subway: Line 1 to People’s Square, transfer to line 8, stop Jing Jiang taxi 96961 at Yaohua Road Station. 7min walk to SWEECC (south gate); Qiang Sheng taxi 62580000 about 40 minutes. Hai Bo taxi 96933 > Subway: Line 1 to People’s Square, transfer to line 8, stop at China Art Museum. 7min walk to SWEECC (north gate); about 40 minutes. Shanghai South Railway Station --- SWEECC > Taxi: 2 stations, at 9km from SWEECC > Subway: Line 1 stop at People’s Square, transfer to line 8, BY PUBLIC TRANSPORTATION stop at Yaohua Road Station. 7min walk to SWEECC (south WITH THE SUBWAY gate); about 50 minutes. Line 8 Yaohua Road or China Art Museum > Subway: Line 1 stop to People’s Square, transfer to line 8, stop at China Art Museum. -

EXHIBITOR WELCOME LETTER Dear Exhibitor

EXHIBITOR WELCOME LETTER Dear Exhibitor, Welcome to MWC Shanghai 2019, 26 – 28 June, at the Shanghai New International Expo Centre in Shanghai. We would like to extend our thanks to you for exhibiting at the show. This year’s event is set to be bigger and better than ever before as it gathers global industry leaders and facilitates business. CONTENT Enclosed you will find some useful information to ensure that your presence at the event runs smoothly and successfully. Included in this pack you will find: Venue and Transport Information Registration & Opening Times Build-up and Dismantling Schedule Networking Event Shuttle Bus Schedule Exhibitor Services Health & Safety Rules Useful Information about Shanghai 4YFN Event 1 VENUE AND TRANSPORT INFORMATION MWC19 Shanghai will be held from Wednesday 26 to Friday 28 June 2019 at the Shanghai New International Expo Centre (SNIEC), Kerry Hotel Pudong and Jumeirah Himalayas Hotel Shanghai. 2345 Longyang Road Pudong District, Shanghai People’s Republic of China *Please note the exhibition is going to be held in Halls N1-N5 and E6-E7 with the main registration and badge collection area at Entrance 2 and 3 (express access) of SNIEC. The map below should give you a clear idea on the most convenient way to get to the site. 2 How do I get from the airport to the venue? SNIEC is located half way between Pudong International Airport and Hongqiao Airport, 33 km away from Pudong International Airport to the east, and 32 km away from Hongqiao Airport to the west. A) Pudong International Airport --- SNIEC By taxi: about 35 minutes; around RMB 120 By Maglev line: Take the Maglev Train at the Waiting Hall of Pudong International Airport to the LongYang Road Station -> Change Metro Line 7 to Huamu Road Station (exit from Gate 2);Maglev price is RMB50 for single ticket; RMB80 for round- trip ticket By airport bus line: take lines No.