Spice-Report.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1. Introduction Spices Constitute an Important Group of Agricultural Produce. They Are Used in Manufactures of Medicines, Cosmet

2 1. Introduction Spices constitute an important group of agricultural produce. They are used in manufactures of medicines, cosmetics, condiments, sweets, beverages and preservatives. Many value added products such as oils and oleoresins, curry powders, beverages, pickles etc. are also produced from them. Almost all countries in the world including those which do not produce consume spices or spice products. Thus they have an important place in international market. India is one of the largest producers and exporters of spices in the world. According to the Spices Board of India, there are fifty two varieties of spices cultivated in India. Pepper, cardamom, ginger, turmeric, nutmeg, clove, tamarind etc. are important among them. There is a total area of 2.3 million hectares of land under spices cultivation in India. Its annual production is estimated at 27 lakh tonnes valued at Rs. 1300 crores. More than 2.5 lakh farmers in rural areas of India are dependent on spices cultivation for livelihood and employment. The country has a share of about 44 per cent in quantity and 36 per cent in value in world spices trade. The state of Kerala, situated on the south western tip of India, is also noted for the cultivation of spices. A large variety of spices such as pepper, cardamom, turmeric, ginger, tamarind, clove, cinnamon, vanilla etc are grown in the state in most of its districts. Among the spices cultivated in Kerala, black pepper popularly known as ‘black gold’ and cardamom, the ‘queen of spices’ are the two major ones. Kerala accounted for 95 per cent of the total pepper production in India in the year 2009-10 and its share in the cardamom production of the country during this period was as high as 78 per cent. -

Sustainable Strategies of Small Scale Pepper Processing Industries – a Case Study in Wayanad, Kerala

International Journal of Mechanical Engineering and Technology (IJMET) Volume 9, Issue 1, January 2018, pp. 348–355, Article ID: IJMET_09_01_037 Available online at http://iaeme.com/Home/issue/IJMET?Volume=9&Issue=1 ISSN Print: 0976-6340 and ISSN Online: 0976-6359 © IAEME Publication Scopus Indexed SUSTAINABLE STRATEGIES OF SMALL SCALE PEPPER PROCESSING INDUSTRIES – A CASE STUDY IN WAYANAD, KERALA Vijay K Rajan M.Com 4th Semester, Department of Management and Commerce, Amrita School of Arts and Sciences, Mysuru, Amrita Vishwa Vidyapeetham, Karnataka, India Dr. S. RanjithKumar, Assistant Professor, Department of Management and Commerce, Amrita School of Arts and Sciences, Mysuru, Amrita Vishwa Vidyapeetham, Karnataka, India ABSTRACT Agriculture plays a vital role in Indian economy, about 54.6% of the population is engaged in agriculture and allied pepper processing activities. Agriculture contributes 17% towards the nation’s Gross Value Added (GVA). Kerala has the 13th largest economy in India with the GDP of 7.48 lakh crore per annum. Although service industry is the predominant industry in Kerala, agriculture also having equal importance for the development of the state welfare as 12% of the GDP is derived from agriculture and allied activities. Natural rubber, coconut, tea, coffee, cashew and spices including cardamom, vanilla, cinnamon and nutmeg comprises a critical contribution to agricultural sector along with state produces 97% of pepper out of national output of India. District of Idukki and Wayanad are the two major pepper producers in Kerala. Idukki as the leading producer contributes 30,424 tons of pepper production from 43755 hectors. Wayanad contributes 3706 tons from8945 hectors. -

Given an Overview of the System of Rice Intensification

Published: February 11, 2012 00:00 IST | Updated: February 11, 2012 04:24 IST Orissa farmers get a taste of local cultivation practices Special Correspondent Given an overview of the system of rice intensification beyond borders:The farmers team from Orissa inspecting an oil palm farm near Lalgudi. Picking up inputs on latest agricultural practices from the region, a group of 15 farmers from Orissa undertook an exposure visit to the district over the past four days. Farmers from Ganjam, Koraput and Malkangiri districts in Orissa were part of the team that was on the visit organised under the Integrated Scheme of Oilseeds, Pulses, Oil Palm and Maize (ISOPOM) that concluded on Thursday. The team was accompanied by S.P.Samantaray, Agronomist, and Mahes Kumar Padhy, Agriculture Officer, from Orissa. Agriculture Department officials, led by J.Sekar, Joint Director of Agriculture, Tiruchi, briefed the team on agricultural practices adopted in the district, the different crops and the productivity trends. The farmers were also given an overview of the system of rice intensification technique in paddy cultivation. First hand account The team visited oil palm plantation of Naryanan, a farmer at L.Abisekapuram village near Lalgudi to get a first hand account of cultivation methods. They were also briefed on oil palm cultivation methods, taxonomy, yield prospects, the price and profitability to farmers by R.Chandrasekaran, Deputy Director of Agriculture (Central schemes), Tiruchi. The team also visited an oil extraction unit at Varanavasi village and the oil palm plantation maintained by the Cauvery Oil Palm Ltd, where they were briefed on the oil extraction methods and by-products of oil palm. -

Vol. 25 No. 2 February 2012

Annual subscription Rs. 50/- Vol. 25 No. 2 February 2012 SPICES BOARD Ministry of Commerce & Industry SPICE Government of India Sugandha Bhavan INDIA P.B. No. 2277 A JOURNAL DEVOTED Palarivattom P.O. TO THE PROMOTION OF Cochin - 682 025 INDIAN SPICE INDUSTRY Chairman : Dr. A. Jayathilak IAS Chief Editor : Dr. P. S. Sreekantan Thampi Deputy Director (Publicity) Editor : S. Palanichamy Publisher : P.M. Suresh Kumar ISSUE Secretary & Director (Mktg) i/c IN FEBRUARY Editorial Committee C A. K.C. Babu, ACA WORLD SPICE CONGRESS Director (Finance) INITIATES MAJOR ACTIONS TO EMPOWER SPICE FARMERS 4 S. Siddaramappa Director (Development) Dr. M. R. Sudharshan ENCOUNTER WITH A YOUNG Director (Research) i/c MAIDEN - JUNGFRAU 11 Hugh & Colleen Gantzer SPICE INDIA PUBLISHED SIMULTANEOUSLY IN ENGLISH, MALAYALAM, TAMIL, KANNADA TELUGU, HINDI AND NEPALI AJOWAIN : A UNDER- UTILIZED SEED SPICE 15 Anoop A. Shetty, SUBSCRIPTION RATES Tanuja Buckseth & Naresh V.S. 1 year - Rs. 50/- 5 years - Rs. 200/- EMPOWERING FARMER GROUPS Subscription may be sent either by M.O. or 19 PAYS THE DIVIDENT Bank Draft drawn in favour of Dr. S. Varadarasan the Secretary, Spices Board, Cochin The views expressed by the contributors are not EVENTS necessarily those of the Spices Board 21 SPICE INDIA Tel : 0484-2333610-616, 2347965 Fax : 0484-2331429-2334429 CALENDAR OF OPERATIONS FOR E-mail : [email protected] IMPORTANT SPICES - Website : www.indianspices.com 25 MARCH 2012 Printed at : Niseema Printers & Publishers, Kochi-18 SPICES STATISTICS - Tel: 0484-2403760 DECEMBER 2011 29 Vol. XXV FEBRUARY-2012 No. 2 FEBRUARY 2012 3 WORLD SPICE CONGRESS INITIATES MAJOR ACTIONS TO EMPOWER SPICE FARMERS he Indian Spice Industry will take Tup a quality capacity building exercise jointly with USFDA [United States Food Drug Administration] enabling every segment of the spice industry to face the challenges of international trade and commerce in spices. -

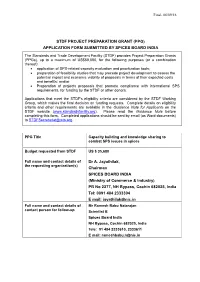

STDF/PPG/517- Application (2016)

Final- 06/09/16 STDF PROJECT PREPARATION GRANT (PPG) APPLICATION FORM SUBMITTED BY SPICES BOARD INDIA The Standards and Trade Development Facility (STDF) provides Project Preparation Grants (PPGs), up to a maximum of US$50,000, for the following purposes (or a combination thereof): application of SPS-related capacity evaluation and prioritization tools; preparation of feasibility studies that may precede project development to assess the potential impact and economic viability of proposals in terms of their expected costs and benefits; and/or Preparation of projects proposals that promote compliance with international SPS requirements, for funding by the STDF or other donors. Applications that meet the STDF's eligibility criteria are considered by the STDF Working Group, which makes the final decision on funding requests. Complete details on eligibility criteria and other requirements are available in the Guidance Note for Applicants on the STDF website (www.standardsfacility.org). Please read the Guidance Note before completing this form. Completed applications should be sent by email (as Word documents) to [email protected]. PPG Title Capacity building and knowledge sharing to combat SPS issues in spices Budget requested from STDF US $ 35,680 Full name and contact details of Dr A. Jayathilak, the requesting organization(s) Chairman SPICES BOARD INDIA (Ministry of Commerce & Industry) PB No 2277, NH Bypass, Cochin 682025, India Tel: 0091 484 2333304 E mail: [email protected] Full name and contact details of Mr Ramesh Babu Natarajan contact person for follow-up Scientist B Spices Board India NH Bypass, Cochin 682025, India Tele: 91 484 2333610, 2333611 E mail: [email protected] Final- 06/09/16 I. -

Emergent Global Marketing Challenges for Kerala Cardamom

Volume 1, 2017 EMERGENT GLOBAL MARKETING CHALLENGES FOR KERALA CARDAMOM PRODUCERS VIS-À-VIS ROLE OF THE SPICE BOARD OF INDIA Majo George * RMIT University, Ho Chi Minh City, [email protected] Vietnam Elsa Cherian Centre for Management Studies, North [email protected] Eastern Regional Institute of Science and Technology, Itanagar, India * Corresponding author ABSTRACT Aim/Purpose This research paper attempts to deeply and rationally probe into the present situation, discussing the expected role of the Spices Board of India, which in 1987 started to function replacing the erstwhile Cardamom Board, where the focus was only on the Cardamom plantation sector and export development. Background Cardamom, the “Queen of Spices” is the third most expensive of the spices, next only to saffron and vanilla. The Cardamom Plantation and export devel- opment sector is now just one of the many focal points of expected action of promotional endeavors of the Spices Board of India. The cardinal problem is the 1990s market threat from Guatemala, which floods the market with Carda- mom with cheaper prices, though it is qualitatively inferior to Indian green Car- damom. The second problem for Indian exports is that the higher cost of pro- duction coupled with increasing domestic market demand causes lower quanti- ties for exports. Apart from the functional insufficiency of the Spices Board of India, in the view of the Cardamom farmers and secondary and tertiary market intermediaries, the present auction system, the scattered unorganized farming community at large, and other governmental promotional deficiencies together make the complexity of the present situation confounded. -

Dehydrated Spices Industry of India and Positioning It in Uganda”

A GLOBAL / COUNTRY STUDY AND REPORT ON “Dehydrated spices industry of India and positioning it in Uganda” Submitted to Gujarat Technological University IN PARTIAL FULFILLMENT OF THE REQUIREMENT OF THE AWARD FOR THE DEGREE OF MASTER OF BUSINESS ASMINISTRATION UNDER THE GUIDANCE OF Nirav Vyas Assistant Professor Submitted by MBA SEMESTER IV STUDENTS ---------------------------------------------------------------------------------------- Shree Jaysukhalal Vadhar Institute of Management Studies, Jamnagar MBA PROGRAMME Affiliated to Gujarat Technological University 1 Preface Uganda, the country which has been in existence since very long but still not very well known to most part of the world. The country is still looked as a ―third world country‖ and when it comes to business opportunities world-wide, then absolutely no one or very less entrepreneurs show real interest in Uganda. This is very orthodox and conventional way of looking towards any country for business. Uganda is ranked among the 20 top fastest development economies of the world and is the 4th fastest developing economy of Africa. It is situated in Western Africa and is improving and strengthening its economical and urbanization position slowly but very steadily. This project is an attempt to explore the country as a market place and to position a specific Indian industry to do business with it and also it is an attempt to find out opportunities for Gujarati Enterprises to position themselves in that country as entrepreneurs. The first part of the project enlightens on factors like the overview of economy, demography, topography, prevailing industries and their contribution to GDP of Uganda. In the last section of the first part of the project we have tried to find out certain business in which the Indian enterprises can really look into for business The second part of the project enlightens the opportunities of doing business and positioning a particular Indian industry in Uganda. -

370560In0spices0standards01p

Agriculture and Rural Development Discussion Paper 19 Cost of Compliance with SPS Standards Public Disclosure Authorized The World Bank Delivering and Taking the Heat Indian Spices and Evolving Product and Process Standards Public Disclosure Authorized Public Disclosure Authorized Steven Jaffee Public Disclosure Authorized First printing or web posting: 2005 © 2004 The International Bank for Reconstruction and Development / The World Bank 1818 H Street, NW Washington, DC 20433 Telephone 202-473-1000 Internet www.worldbank.org E-mail [email protected] All rights reserved. Agriculture and Rural Development Discussion Papers is an informal series produced by the Agriculture and Rural Development Department of the World Bank. These papers raise concepts and issues for discussion in the broader development community and describe ongoing research and/or implementation experiences from the Bank. The findings, interpretations, and conclusions expressed herein are those of the author(s) and do not necessarily reflect the views of the Board of Executive Directors of the World Bank, the governments they represent, or the organizations of contributing authors. The World Bank does not guarantee the accuracy of the data included in this work. Rights and Permissions The material in this work is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. The World Bank encourages dissemination of its work and will normally grant permission promptly. For permission to photocopy or reprint any part of this work, please send a request with complete information to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, USA, telephone 978-750-8400, fax 978-750-4470, www.copyright.com. -

Chemistry of Spices This Page Intentionally Left Blank Chemistry of Spices

Chemistry of Spices This page intentionally left blank Chemistry of Spices Edited by Villupanoor A. Parthasarathy Indian Institute of Spices Research Calicut, Kerala, India Bhageerathy Chempakam Indian Institute of Spices Research Calicut, Kerala, India and T. John Zachariah Indian Institute of Spices Research Calicut, Kerala, India CABI is a trading name of CAB International CABI Head Offi ce CABI North American Offi ce Nosworthy Way 875 Massachusetts Avenue Wallingford 7th Floor Oxfordshire OX10 8DE Cambridge, MA 02139 UK USA Tel: +44 (0)1491 832111 Tel: +1 617 395 4056 Fax: +44 (0)1491 833508 Fax: +1 617 354 6875 E-mail: [email protected] E-mail: [email protected] Website: www.cabi.org ©CAB International 2008. All rights reserved. No part of this publication may be reproduced in any form or by any means, electronically, mechanically, by photocopying, recording or otherwise, without the prior permission of the copyright owners. A catalogue record for this book is available from the British Library, London, UK. Library of Congress Cataloging-in-Publication Data Chemistry of spices / [edited by] V.A. Parthasarathy, B. Chempakam, T. John Zachariah. p. cm. Includes bibliographical references and index. ISBN 978-1-84593-405-7 (alk. paper) 1. Spices--Analysis. 2. Spice plants--Composition. I. Parthasarathy, V.A. II. Chempakam, B., Dr. III. Zachariah, T. John. IV. Title. SB305.C44 2008 641.3'383--dc22 2007043551 ISBN-13: 978 1 84593 405 7 Typeset by Spi, Pondicherry, India. Printed and bound in the UK by Biddles Ltd, King’s Lynn. Contents Contributors vii Preface ix 1 Introduction 1 V.A. -

Spices Board

Notification No.2 SPICES BOARD (Ministry of Commerce & Industry, Govt.of India) Sugandha Bhavan, N.H. By Pass, P.B. No.2277, Palarivattom. P.O., KOCHI– 682025 Invites applications for the following posts: 1. Scientist B (Entomology) Number of Post : 1 (One) Category : General Qualifications : a) Essential : 1) Post Graduate Degree in Agriculture/ Horticulture with specialization in Entomology/Nematology or Post Graduate Degree in Entomology/ Nematology from a recognized University 2) Should have a minimum 7 OGPA out of 10 or 70% marks in Post Graduation. b) Desirable : Doctorate Degree in Entomology/Nematology OR Three years research experience in Entomology/Nematology as supported by Certificates/documents. Place of Posting : Anywhere in India Age : Not more than 35 years as on 01.12.2013. Scale of Pay : PB-3: Rs.15600-39100 + GP Rs.5400 2. Scientist B (Microbiology) Number of Post : 1 (One) Category : OBC Qualifications : a) Essential : 1. Post Graduate Degree in Microbiology/ General Microbiology/Food Microbiology or Applied Microbiology from a recognized University with minimum 7 OGPA out of 10 or 70% marks. b) Desirable : Doctorate Degree in Microbiology in any of the above discipline OR Three years' research experience in the field of quality control of agricultural products. Place of Posting : Anywhere in India Age : Not more than 30 years as on 01.12.2013 Relaxation in upper age limit will be applicable for OBC candidates as per rules. Scale of Pay : PB-3: Rs.15600-39100 + GP Rs.5400 3. Assistant Director (Accounts) Number of Post : 1 (One) Category : ST Qualifications : Essential : 1. CA/ICWA/CFA/A.C.S/MBA (First Class) with specialization in Financial Management from a recognized University. -

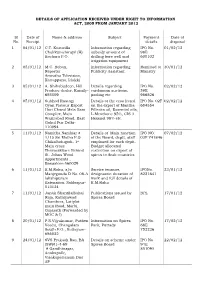

RTI Details February 2012

DETAILS OF APPLICATION RECEIVED UNDER RIGHT TO INFORMATION ACT, 2005 FROM JANUARY 2012 Sl Date of Name & address Subject Payment Date of No. Receipt details disposal 1 04/01/12 C.T. Kuruvilla Information regarding IPO No. 01/02/12 Chakkumchirayil (H) subsidy amount of 98E Kochara P.O. drilling bore well and 600102 irrigation equipment 2 05/01/12 M.C. Boban, Information regarding Remitted to 30/01/12 Reporter Publicity Assistant Ministry Amrutha Television, Kattappana, Idukki 3 05/01/12 A. Shihabudeen, Hill Details regarding IPO No. 02/02/12 Produce dealer, Kumily- cardamom auctions, 58E 685509 pooling etc 986826 4 05/01/12 Subhod Rustogi Details of the cess levied IPO No. 02F 02/02/12 Gyan Flavour Export on the export of Mantha 684554 Hari Chand Mela Ram Pillerita oil, Essential oils, Complex, Main L-Menthone 95%, CIS 3 Wazirabad Road, East Hexenol 98% etc. Gokul Pur Delhi- 110094 5 11/01/12 Namitha Nambiar # Details of Main function IPO NO. 07/02/12 1/15 Sri Matha P.G of the Board, deptt, staff 03F 741846 Chika0adugodi- 1st emploued for each deptt. Main cross Budget allocated Thavarakkare Behind restriction on export of St. Johns Wood spices to Arab countries Appartments , Bangalore-560029 6 11/01/12 K.M.Rahu, s/o Service tennure, IPONo. 23/01/12 Manjegouda D No. 08-A designastin duration of 8221641 lakshipuram work and full details of Extensiion, Saklespur- K.M.Rahu 513134 7 11/01/12 Janak Shantilalbahai Publications issued by BPL 17/01/12 Raja, Kathiyawad Spices Board Chambers, Latiplot main Road, Morbi, Gujarath (Forwarded by MOC & I) 8 20/01/12 P.S.Vijyakumar, Puthen Information on Spices IPO No. -

Vol. 25 No. 4 April 2012

Annual subscription Rs. 50/- Vol. 25 No. 4 April 2012 SPICES BOARD Ministry of Commerce & Industry Government of India Sugandha Bhavan SPICE P.B. No. 2277 Palarivattom P.O. INDIA Cochin - 682 025 A JOURNAL DEVOTED TO THE PROMOTION OF Chairman : Dr. A. Jayathilak IAS INDIAN SPICE INDUSTRY Chief Editor : Dr. P. S. Sreekantan Thampi Deputy Director (Publicity) Editor : S. Palanichamy Publisher : P.M. Suresh Kumar Secretary & Director (Research) i/c Editorial Committee IN APRIL ISSUE C A. K.C. Babu, ACA Director (Finance) S. Siddaramappa JODHPUR SPICES PARK Director (Development) COMMISSIONED 4 Dr. M. R. Sudharshan Director (Marketing) i/c CULTIVATION OF FENUGREEK SPICE INDIA FOR SPICE AND QUALITY SEED PUBLISHED SIMULTANEOUSLY IN 7 Raj Pal Meena, ENGLISH, MALAYALAM, TAMIL, KANNADA P. R. Kumar and R. P. Meena TELUGU, HINDI AND NEPALI SUBSCRIPTION RATES CITY OF MOSAICS 1 year - Rs. 50/- MADABA 17 5 years - Rs. 200/- Hugh & Colleen Gantzer Subscription may be sent either by M.O. or Bank Draft drawn in favour of WORLD SPICE the Secretary, Spices Board, Cochin CONGRESS SKIT 20 The views expressed by the contributors are not necessarily those of the Spices Board EVENTS 22 SPICE INDIA Tel : 0484-2333610-616, 2347965 Fax : 0484-2331429-2334429 E-mail : [email protected] CALENDAR OF OPERATIONS FOR Website : www.indianspices.com 29 IMPORTANT SPICES - MAY 2012 Printed at : Niseema Printers & Publishers, Kochi-18 Tel: 0484-2403760 SPICES STATISTICS - MARCH 2012 33 Vol. XXV APRIL-2012 No. 4 APRIL 2012 3 Spices Board of India to establish 10 Spice Parks by end of 2012 JODHPUR SPICES PARK COMMISSIONED pices Board of India, the nodal G With an investment of more than Rs.