Wuliangye Yibin

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

China Consumer Close-Up

January 13, 2015 The Asian Consumer: A new series Equity Research China Consumer Close-up The who, what and why of China’s true consumer class Few investing challenges have proven more elusive than understanding the Chinese consumer. Efforts to translate the promise of an emerging middle class into steady corporate earnings have been uneven. In the first of a new series on the Asian consumer, we seek to strip the problem back to the basics: Who are the consumers with spending power, what drives their consumption and how will that shift over time? The result is a new approach that yields surprising results. Joshua Lu Goldman Sachs does and seeks to do business with +852-2978-1024 [email protected] companies covered in its research reports. As a result, Goldman Sachs (Asia) L.L.C. investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Sho Kawano Investors should consider this report as only a single factor +81(3)6437-9905 [email protected] Goldman Sachs Japan Co., Ltd. in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Becky Lu Appendix, or go to www.gs.com/research/hedge.html. +852-2978-0953 [email protected] Analysts employed by non- US affiliates are not registered/ Goldman Sachs (Asia) L.L.C. qualified as research analysts with FINRA in the U.S. January 13, 2015 Asia Pacific: Retail Table of contents PM Summary: A holistic view of the Asian consumer 3 China’s cohort in a regional context (a preview of India and Indonesia) 8 What they are buying and what they will buy next: Tracking 7 consumption desires 11 Seven consumption desires in focus 14 1. -

Le Chevalier Errant

期 49 总第 JUILLET 2018 | MAGAZINE CULTUREL EN CHINOIS ET FRANÇAIS ISSN : 16749715 CN115961/C N°49 二零一八年七月刊 《孔子学院》中法文对照版 武侠 Le chevalier errant Le chevalier 孔 子 学 院 INSTITUT CONFUCIUS N.49 | JUILLET 2018 WWW.CIM.CHINESECIO.COM RMB 16 / EURO 5,99 NEOMA CONFUCIUS INSTITUTE FOR BUSINESS Le seul centre accrédité par Hanban en France et dans les pays francophones pour la formation et l’examen de CTCSOL (Certificate for Teachers of Chinese to Speakers of Other Languages). Le CTCSOL est un certificat international, délivré par Hanban, aux candidats ayant réussi l’examen de qualification professionnelle en tant que professeurs de chinois internationaux. PROCHAINES SESSIONS DE FORMATION ET D’EXAMEN L’INSTITUT CONFUCIUS DE Examen oral Formation à l’examen oral • Session 2018 : • 1re session : 2–4 janv. 2019 L’UNIVERSITÉ DE LORRAINE 5–6 janv. ; 13–14 janv. 2019 • 2e session : 3–5 juil. 2019 Situé à Metz, chef-lieu de l’ancienne région de Lorraine, • 1re session 2019 : • 3e session : 11–13 déc. 2019 l’institut Confucius de l’Université de Lorraine est une structure 6–7 juil. ; 13–14 juil. 2019 universitaire de coopération franco-chinoise (Université de Lorraine, e • 2 session 2019 : Formation à l’examen écrit Université de Technologie de Wuhan et Hanban). Il est également re 14–15 déc. ; 21–22 déc. 2019 • 1 session : 5–8 janv. 2019 soutenu par les autorités territoriales. Depuis sa création en 2011, • 2e session : 6–9 juil. 2019 il reste fidèle à sa vocation d’être un lieu d’échange et de découverte Examen écrit • 3e session : 14–17 déc. -

“Eight-Point Regulation” and “Chinese

vv Clinical Group Archives of Nursing Practice and Care DOI http://dx.doi.org/10.17352/anpc.000016 CC By Xianglong Xu1-3, Runzhi Zhu1-3, Sha Deng1-3, Sheng Liu1-3, Dengyuan Liu1-3, Research Article Cesar Reis4, Manoj Sharma5 and Yong Effects of “Eight-Point Regulation” Zhao1-3* 1School of Public Health and Management, and “Chinese Military Bans Luxury Chongqing Medical University, Chongqing 400016, China 2Research Center for Medicine and Social Banquets” on Price, Sale, and Development, Chongqing Medical University, Chongqing 400016, China Consumption of High-End Alcohol 3The Innovation Center for Social Risk Governance in Health, Chongqing Medical University, Chongqing Products in China 400016, China 4Loma Linda University Medical Center, Department of Preventive Medicine 24785 Stewart Street, Suite 204 Loma Linda, CA 92354 5Department of Behavioral and Environmental Health, Abstract Jackson State University, Jackson 39213, USA Background: Alcohol use disorder was linked to corruption, abuse of power, and bureaucratic Dates: Received: 20 June, 2016; Accepted: 02 ineffi ciency in mainland China. The Communist Party of China issued the “Eight-Point Regulation” and December, 2016; Published: 05 December, 2016 “Luxury Banquets Ban for Chinese Military” in December 2012 to eliminate extravagance and corruption. This study aimed to probe the effects of “Eight-point regulation” and “Chinese military bans luxury *Corresponding author: Yong Zhao, Department banquets” on price, sale, and consumption of high-end alcohol products in China. of Nutrition and Food Hygiene, School of public health and management, Chongqing Medical Methods: We collected and analyzed secondary data to derive refl ections on the infl uence of the University. -

Hunan Sanhong Pharmaceutical Company Limited “True Tiger Wine” Project

Hunan Sanhong Pharmaceutical Company Limited “True Tiger Wine” Project Feasibility Studies Report December 2005 Table of Content Chapter 1 General Introduction ................................................................................................................................................................................... 7 1.1 Project Summary ......................................................................................................................................................................................... 7 1.1.1 Project Title ....................................................................................................................................................................................... 7 1.1.2 Project Construction Contractor and Corporation ............................................................................................................................. 7 1.1.3 General Competent Authority of Project ............................................................................................................................................ 7 1.1.4 Nature of Project ................................................................................................................................................................................ 7 1.1.5 Specific Competent Authority of Project ............................................................................................................................................ 7 1.1.6 Project Construction Location and Area -

Research and Analysis Report of Kweichow Moutai Company

Academic Journal of Business & Management ISSN 2616-5902 Vol. 3, Issue 7: 1-5, DOI: 10.25236/AJBM.2021.030701 Research and Analysis Report of Kweichow Moutai Company Yinglin Qian School of Economics, Northwest University for Nationalities, Qujing, Yunnan 655000, China Abstract: Fiedler mentioned "does not exist a kind of is suitable for various situation of universal principles and methods of management, management can only act according to the circumstances of the specific", moutai company is the most influential brand in China and to achieve a monopoly in the competition and development, based on the fundamental analysis and technical analysis, maotai company for the industry analysis, company analysis and technical analysis, This paper probes into the development prospect of Maotai Company, obtains some problems existing in the development and puts forward corresponding investment suggestions for investors. Keywords: industry analysis, technical analysis, investment advice 1. Overview of Kweichow Moutai Company 1)Company business summary and analysis of capital ownership structure Since its establishment, the company has been engaged in a variety of businesses, including the production, sales and service of Maotai liquor, the production and sales of beverage, food and packaging materials, the development of anti-counterfeiting technology and the research and development of related products of the information industry. It belongs to the beverage manufacturing industry in the food and beverage industry, and is the typical representative of maotai-flavor liquor in China. It wants to have a famous reputation both at home and abroad, and it is the only liquor industry in China that has won the title of "green food" and "organic food". -

A Viga Ting Hin A

December 11, 2018 Food & Beverages Gan Bei: low inventory to support growth HINA C ■ We believe the China baijiu sector’s short-term slowdown has been priced in, and we consider the sector’s current valuation to be attractive. ■ Positive on the long-term outlook on product mix upgrades and channel reforms. Current tight channel inventory supports volume growth in 1H19F ■ We initiate coverage on China’s baijiu sector with an Overweight rating. Our top pick is Moutai. We have an Add call on Yanghe and Hold on Wuliangye. AVIGATING AVIGATING N Analyst(s) Lei YANG, CFA T (86) 21 6162 9676 E [email protected] FeiFei SUN T (86) 21 6162 5750 E [email protected] IMPORTANT DISCLOSURES, INCLUDING ANY REQUIRED RESEARCH CERTIFICATIONS, ARE PROVIDED AT THE Powered by END OF THIS REPORT. IF THIS REPORT IS DISTRIBUTED IN THE UNITED STATES IT IS DISTRIBUTED BY CGS-CIMB the EFA SECURITIES (USA), INC. AND IS CONSIDERED THIRD-PARTY AFFILIATED RESEARCH. Platform Navigating China Consumer Staples │Food & Beverages │December 11, 2018 TABLE OF CONTENTS Sector summary ............................................................................................................................. 5 Our market survey finds younger generation has started to drink baijiu ....................................... 9 China Baijiu sector overview ....................................................................................................... 13 Comparison of major baijiu players ............................................................................................ -

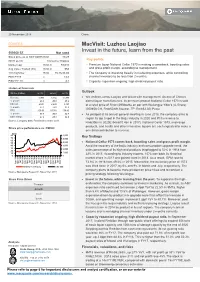

Macvisit: Luzhou Laojiao Invest in the Future, Learn from the Past

20 November 2018 China EQUITIES MacVisit: Luzhou Laojiao 000568 SZ Not rated Invest in the future, learn from the past Stock price as of 16/11/2018 Rmb 40.29 Key points GICS sector Consumer Staples Market cap Rmb m 59,015 Premium liquor National Cellar 1573 is making a comeback, boosting sales Avg Value Traded (3m) Rmb m 553 and gross profit margin, according to management. 12m high/low Rmb 75.26/35.05 The company is investing heavily in marketing expenses, while controlling PER FY19 x 13.8 channel inventory to be less than 2 months. P/BV FY 19 x 3.1 Capacity expansion ongoing; high dividend payout ratio. Historical financials Outlook YE Dec (RMBm) 2015A 2016A 2017A Revenue 6,900 8,304 10,395 We visited Luzhou Laojiao and talked with management. As one of China’s % growth 28.9 20.3 25.2 oldest liquor manufacturers, its premium product National Cellar 1573 is sold EBITDA 2,037 2,639 3,491 at a retail price of Rmb1,099/bottle on par with Wuliangye Yibin’s (A-Share) % growth 62.2 29.5 32.3 (000858 CH, Rmb50.69, Neutral, TP: Rmb52.30) Puwu. EPS 105.00 137.50 179.80 % growth 67.4 30.9 32.7 As pledged at its annual general meeting in June 2018, the company aims to EBIT Margin 27.2 29.9 32.0 regain its top 3 spot in the Baiju industry in 2020 and lift its revenue to Source: Company data, FactSet,November 2018 Rmb30bn in 2020E (Rmb10.4bn in 2017). -

Cocktails Mocktails Beer & Cider

COCKTAILS Jasmine Lychee Martini 22 House infused Jasmine Tea Vodka, Paraiso Lychee Liqueur and Pineapple juice Mango Campari Spritz 22 Campari, Mango juice, sparkling wine and soda Guava Margarita 22 el Jimador Reposado Tequila, Guava juice, fresh lime juice Amaretto Sour 22 Disaronno amaretto, fresh lemon juice, egg white Chrysanthemum Old Fashioned 22 House infused Chrysanthemum Rum, bitters and syrup Cinnamon Apple Martini 22 House infused cinnamon Vodka, Schnapps apple pucker, apple juice, cinnamon syrup The Dragon's Eye 26 Paraiso Lychee Liqueur, Kweichow Moutai Chinese spirit, lychee, fresh lemon Oolong Mojito 22 Bacardi Superior White Rum, fresh lime, fresh mints, Oolong syrup Strawberry Daiquiri 22 Bacardi Superior White Rum, Suntory Rubis Strawberry, fresh strawberry Espresso Martini 22 Ketel One Vodka, Kahlua, Espresso MOCKTAILS Seasonal Fruit Cup 13 Seasonal fresh fruit, fruit juice (Please ask our friendly staff) Traditional Lemonade 13 Fresh lemon juice, honey, soda water Virgin Oolong Mojito 17 Fresh lime, fresh mints, Oolong syrup Virgin Strawberry Caipirinha 17 Fresh strawberry, fresh lime, apple juice BEER & CIDER Cascade 'Premium Light' Tasmania 9 James Boag’s 'Premium' Tasmania 11 Crown Lager Victoria 11 Tsing Tao China 11 Corona 'Extra' Mexico 12 Heineken Holland (locally brewed under license) 12 Stella Artois Belgium (locally brewed under license) 12 Kirin 'Ichiban' Japan 13 Little Creatures 'Pipsqueak' Apple Cider Adelaide Hills 12 1 WINE BY THE GLASS SPARKLING - 120ml NV Chandon Brut Yarra Valley, Victoria 17 2016 -

A PEDAGOGY of CULTURE BASED on CHINESE STORYTELLING TRADITIONS DISSERTATION Presented in Partial Fulfillment of the Requirement

A PEDAGOGY OF CULTURE BASED ON CHINESE STORYTELLING TRADITIONS DISSERTATION Presented in Partial Fulfillment of the Requirements for the Doctor of Philosophy in the Graduate School of The Ohio State University By Eric Todd Shepherd MA, East Asian Languages and Literatures The Ohio State University 2007 Dissertation Committee: Approved by Galal Walker, Advisor _______________________ Mark Bender Advisor Mari Noda Graduate Program in Dorothy Noyes East Asian Languages and Literatures Copyright by Eric Todd Shepherd 2007 ABSTRACT This dissertation is an historical ethnographic study of the Shandong kuaishu (山东快书) storytelling tradition and an ethnographic account of the folk pedagogy of Wu Yanguo, one professional practitioner of the tradition. At times, the intention is to record, describe and analyze the oral tradition of Shandong kuaishu, which has not been recorded in detail in English language scholarly literature. At other times, the purpose is to develop a pedagogical model informed by the experiences and transmission techniques of the community of study. The ultimate goal is to use the knowledge and experience gained in this study to advance our understanding of and ability to achieve advanced levels of Chinese language proficiency and cultural competence. Through a combination of the knowledge gained from written sources, participant observation, and first-hand performance of Shandong kuaishu, this dissertation shows that complex performances of segments of Chinese culture drawn from everyday life can be constructed through a regimen of performance based training. It is intended to serve as one training model that leads to the development of sophisticated cultural competence. ii Dedicated to Chih-Hsin Annie Tai iii ACKNOWLEDGMENTS Any dissertation is a collaborative effort. -

Wuliangye Yibin Co., Ltd. Annual Report 2020 (Full Text)

Wuliangye Yibin Co., Ltd. Annual Report 2020 President Zeng Congqin (Signature) April 28, 2021 Wuliangye Yibin Co., Ltd. Annual Report 2020 (Full Text) Contents Section I Important Notice and Interpretations .................................................................................... 3 Section II Company Profile and Main Financial Highlights .................................................................. 5 Section III Summary of Company Business ........................................................................................ 10 Section IV Discussion and Analysis of Operation ................................................................................. 11 Section V Significant Matters .............................................................................................................. 35 Section VI Changes in Shares and Shareholders ............................................................................... 50 Section VII Preferred Share .................................................................................................................. 56 Section VIII Convertible Corporate Bonds............................................................................................. 56 Section IX Directors, Supervisors, Senior Management and Employees ........................................... 57 Section X Corporate Governance ....................................................................................................... 68 Section XI Corporate Bonds ............................................................................................................... -

Tsingtao Brewery Because We Expect CR Beer Albert Yip to Deliver Stronger Adj

9 Nov 2020 CMB International Securities | Equity Research | Sector Initiation China Beer and White Wine Sector Leaders to benefit from ASP growth and sector OUTPERFORM (Initiation) consolidation; top picks are Moutai and CR Beer We initiate coverage of China beer and white wine sectors with Outperform rating. China beer and white wine sector Premiumization and production efficiency improvement are key growth drivers of beer sector. We prefer CR Beer to Tsingtao Brewery because we expect CR Beer Albert Yip to deliver stronger adj. EPS CAGR through the partnership with Heineken. High- (852) 3900 0838 end white wine segment has a favorable competitive landscape. Its limited supply [email protected] has supported price appreciation. We prefer Moutai to Wuliangye because we expect Moutai to raise ex-factory price earlier than Wuliangye. China’s premium and super Premiumization and production efficiency improvement are key growth premium beer sales value to grow drivers of beer sector. (1) Premiumization: China’s market share of the at 8.5% CAGR from 2018 to 2023E premium and super premium categories was 16.4% by volume in 2018, which (US$ bn) was significantly lower than the US/Korea (42.1%/25%). Value of premium and 70 super premium categories is estimated to increase by 8.5% CAGR from 2018 60 to 2023E. (2) Production efficiency: Plant closures, optimization of capacity 50 and sales mix increase of canned beer and bottled beer with returnable bottles 40 concept can enhance efficiency. (3) Industry consolidation: We expect sector 30 leaders to lower SG&A expenses ratio suggested by US market history. -

Luzhou Laojiao

INITIATION Company Note Food & Beverages│China│October 17, 2019 Insert Insert China Luzhou Laojiao ADD Successful channel reforms Consensus ratings*: Buy 26 Hold 5 Sell 0 ■ We like Luzhou Laojiao for its successful distribution channel reforms, strong Current price: Rmb86.12 profitability improvement and potential ASP hike for its star brand – Cellar 1573. Target price: Rmb122.0 ■ We forecast a 27% EPS CAGR in FY18–21F, driven by a 23%/24% sales CAGR from its high-end and mid-range product segments, respectively. Previous target: Rmb ■ We initiate with an Add rating and DCF-based TP of Rmb122 (WACC:9.6%) Up/downside: 41.7% CGS-CIMB / Consensus: 21.4% New distribution network starting to reap benefits Since 2015, Laojiao has taken four years to restructure its distribution network, providing Reuters: 000568.SZ stronger market support for its distributors and restoring its high-end brand image. Now Bloomberg: 000568 CH Laojiao has around 3,000 distributors with over 8,000 of its own salespeople. Its brand Market cap: US$17,826m value rose by 40% yoy to US$5.3bn in 2019, according to Brand Finance. Backed with Rmb126,144m this strong distribution network, we expect Laojiao’s channel reforms to start to bear fruit Average daily turnover: US$129.7m and its sales to grow at a 19% CAGR in FY18–21F. We also expect its high S&D Rmb916.1m expenses ratio of 26% in 2018 to gradually fall back by 5%pts to 21% in 2021F, leading Current shares o/s: 1,465m to OPM expansion of 8.4%pts from 34.2% in FY18 to 42.4% in FY21F.