Fif-I Q2 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sumter, SC 29150

IN SPORTS: Lady Barons to face CN in 3A state tourney B1 PANORAMA Step Off! Performers from 3 states will compete in the 5th annual SERVING SOUTH CAROLINA SINCE OCTOBER 15, 1894 Lemira Golden Steppers show WEDNESDAY, FEBRUARY 22, 2017 75 CENTS C1 Family, puppy survive blaze Council approves parkway rezoning BY JIM HILLEY [email protected] Sumter City Council ap- proved an ordinance to allow multi-family apartments on the south side of Patriot Park- way near Deschamps Road at Tuesday’s regular meeting. Some residents of the area led a coordinated campaign against the proposal, and members of the public who at- tended the meeting were asked by opponents to hold up signs during council’s vote urging council to vote against the or- dinance. Martin Graf, an Air Force retiree, was one of the people passing out signs. Graf said he and other area residents were promised the area would remain agricultur- al and single dwellings when he purchased a house there. Members of council pointed SAMMY WAY / THE SUMTER ITEM out they could find no record Flames engulf a home at 104 Church St. on Tuesday morning. of any such promises and that the city would not have been involved in any agreement Tuesday morning fire guts Victorian-era Church Street home when that area was still in Sumter County. Councilman David Mer- BY ADRIENNE SARVIS inside the structure to put chant said he reached out to [email protected] out more flames. former councilmen and was He said one resident was told no such promises were After thinking everything inside the house when the made. -

Department of Consumer Credit State of Oklahoma

Department of Consumer Credit State of Oklahoma Helping protect Oklahoma Consumers through the regulation of consumer credit sales and consumer loans. 2015 Annual Report Scott Lesher Mary Fallin Administrator Governor Ruben Tornini Todd Lamb Deputy Administrator Lt. Governor STATE OF OKLAHOMA DEPARTMENT OF CONSUMER CREDIT November 18, 2015 The Honorable Mary Fallin Governor, State of Oklahoma 2300 N. Lincoln Blvd., Room 212 Oklahoma City, Oklahoma 73105 The Honorable Brian Bingman President Pro Tempore Oklahoma State Senate 2300 N. Lincoln Blvd., Room 422 Oklahoma City, Oklahoma 73105 The Honorable Jeffrey Hickman Speaker of the Oklahoma House of Representatives 2300 N. Lincoln Blvd., Room 401 Oklahoma City, Oklahoma 73105 Dear Governor Fallin, President Pro Tempore Bingman, and Speaker Hickman: On behalf of the Oklahoma Commission on Consumer Credit and the staff, we are pleased to submit the 2015 Annual Report for the Oklahoma Department of Consumer Credit and the Oklahoma Commission on Consumer Credit. This report contains information regarding the activities of the Department, the Commission, and the industries regulated by the Department. The Department of Consumer Credit annually licenses or registers over 10,000 credit-related organizations including supervised lenders, mortgage brokers/loan originators, mortgage lenders, deferred deposit lenders, credit service organizations, consumer litigation funders, pawn brokers, rent-to-own dealers, health spas, precious metal dealers, acceptance companies and businesses that finance goods -

Schedule of Investments December 31, 2020 (Unaudited)

Schedule of Investments December 31, 2020 (Unaudited) City National Rochdale Government Money Market Fund Description Face Amount (000) Value (000) Description Face Amount (000) Value (000) U.S. Government Agency Obligations [44.9%] 0.135%, VAR United States FFCB Secured Overnight 0.183%, VAR ICE LIBOR Financing Rate+0.025%, 02/26/21 $ 25,000 $ 25,000 USD 1 Month+0.035%, 01/26/21 $ 25,000 $ 25,000 0.180%, VAR United States 0.213%, VAR ICE LIBOR Secured Overnight USD 1 Month+0.070%, Financing Rate+0.070%, 08/12/22 50,000 50,000 06/24/21 50,000 49,998 0.200%, VAR United States FNMA Secured Overnight 0.470%, VAR United States Financing Rate+0.090%, Secured Overnight 07/15/21 50,000 50,000 Financing Rate+0.360%, 01/20/22 50,000 50,000 FHLB 0.130%, 06/17/21 25,000 24,999 0.500%, VAR United States 0.169%, VAR ICE LIBOR Secured Overnight USD 1 Month+0.015%, Financing Rate+0.390%, 04/15/22 50,000 50,000 07/13/21 50,000 50,000 0.160%, VAR United States 0.350%, VAR United States Secured Overnight Secured Overnight Financing Rate+0.050%, Financing Rate+0.240%, 05/05/22 25,000 25,000 07/16/21 25,000 25,000 0.420%, VAR United States 0.310%, VAR United States Secured Overnight Secured Overnight Financing Rate+0.310%, Financing Rate+0.200%, 05/09/22 50,000 50,000 09/24/21 50,000 50,000 0.280%, VAR United States Total U.S. -

Annual Report

2017 ANNUAL REPORT STATE OF OKLAHOMA DEPARTMENT OF CONSUMER CREDIT CONTENTS MISSION STATEMENT 1 ADMINISTRATOR’S REPORT 2 COMMISSION ON CONSUMER CREDIT 8 DEPARTMENT STAFF 9 ORGANIZATIONAL STRUCTURE 10 MORTGAGE LENDERS 11 MORTGAGE BROKERS 23 MORTGAGE LOAN ORIGINATORS 31 SUPERVISED LENDERS 213 DEFERRED DEPOSIT LENDERS 228 RENT-TO-OWN 231 PAWNBROKER’S 235 PRECIOUS METAL & GEM DEALERS 247 CREDIT SERVICE ORGANIZATIONS 252 HEALTH SPAS 255 NOTIFICATIONS 262 CONSUMER LITIGATION FUNDERS 331 COMMISSION MEETING MINUTES 333 Scott Lesher Administrator Email: [email protected] Telephone: (405)-521-3653 Department of Consumer Credit 3613 N.W. 56th Street, Suite 240 · Oklahoma City, OK 73112 Telephone: (405)-521-3653 · Fax: (405)-521-6740 Statewide Consumer Line: (800)-448-4904 Website: https://www.ok.gov/okdocc MISSION STATEMENT We protect and educate consumer buyers, lessees and borrowers against unfair practices, and are fair and impartial in the regulation of consumer credit transactions in Oklahoma. 1 ADMINISTRATOR’S REPORT THE ADMINISTRATOR’S REPORT INCLUDES INFORMATION PURSUANT TO TITLE 14A O.S. § 6-104 (5), AND IS EXPANDED TO INCLUDE OTHER RESPONSIBILITIES AND ACCOMPLISHMENTS OF THE DEPARTMENT OF CONSUMER CREDIT. The Department of Consumer Credit annually licenses or registers over 13,051 credit-related organizations including mortgage lenders, mortgage brokers, mortgage loan originators, supervised lenders, deferred deposit lenders, rent-to-own dealers, pawnbroker’s, precious metal and gem dealers, credit service organizations, health spas, consumer litigation funders, and notifications in relation to acceptance companies and businesses that finance goods and services for Oklahoma consumers. There are 6,355 licensee offices which are periodically investigated or examined. -

Ally Financial Inc.(GOM) 10-K

Ally Financial Inc. (GOM) 10-K Annual report pursuant to section 13 and 15(d) Filed on 02/25/2011 Filed Period 12/31/2010 Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2010, or ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number: 1-3754 ALLY FINANCIAL INC. (Exact name of registrant as specified in its charter) Delaware 38-0572512 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 200 Renaissance Center P.O. Box 200 Detroit, Michigan 48265-2000 (Address of principal executive offices) (Zip Code) (866) 710-4623 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act (all listed on the New York Stock Exchange): Title of each class 6.00% Debentures due April 1, 2011 7.35% Notes due August 8, 2032 10.00% Deferred Interest Debentures due December 1, 2012 7.25% Notes due February 7, 2033 10.30% Deferred Interest Debentures due June 15, 2015 7.375% Notes due December 16, 2044 7.30% Public Income Notes (PINES) due March 9, 2031 Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

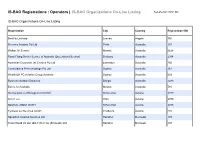

IS-BAO Registrations : Operators | IS-BAO Organizations On-Line Listing Sep-25-2021 09:51 AM

IS-BAO Registrations : Operators | IS-BAO Organizations On-Line Listing Sep-25-2021 09:51 AM IS-BAO Organizations On-Line Listing Organization City Country Registration ID# BestFly Limitada Luanda Angola 750 Revesco Aviation Pty Ltd Perth Australia 187 Walker Air Service Mascot Australia 2628 Royal Flying Doctor Service of Australia (Queensland Section) Brisbane Australia 2384 Australian Corporate Jet Centres Pty Ltd Essendon Australia 756 Consolidated Press Holdings Pty Ltd Sydney Australia 361 Westfield/LFG Aviation Group Australia Sydney Australia 339 Business Aviation Solutions Bilinga Australia 2283 ExecuJet Australia Mascot Australia 510 International Jet Management GmbH Schwechat Austria 2319 Avcon Jet Wien Austria 2290 Sparfell Luftfahrt GmbH Schwechat Austria 2385 Tyrolean Jet Services GmbH Innsbruck Austria 274 Squadron Aviation Services Ltd Hamilton Bermuda 189 Trans World Oil Ltd. dba T.W.O. Air (Bermuda) Ltd Hamilton Bermuda 197 S&K Bermuda Ltd. Pembroke Bermuda 45 Minera San Cristobal S.A. La Paz Bolivia 733 Vale SA Rio de Janeiro Brazil 560 AVANTTO Administração de Aeronaves Sao Paulo Brazil 654 PAIC Participacoes Ltda Sao Paulo Brazil 480 Lider Taxi Aereo S/A Brasil Belo Horizonte Brazil 48 EMAR Taxi Aereo Rio das Ostras Brazil 2615 ICON Taxi Aereo Ltda. São Paulo Brazil 2476 Banco Bradesco S/A Osasco Brazil 2527 M. Square Holding Ltd. Road Town British Virgin Islands 2309 London Air Services Limited dba London Air Services South Richmond Canada 2289 Chartright Air Group Mississauga Canada 432 ACASS Canada Ltd. Montreal Canada 102 Sunwest Aviation Ltd Calgary Canada 105 Air Partners Corporation Calgary Canada 764 Coulson Aviation (USA) Inc. -

State of Illinois State Universities Retirement System

State of Illinois State Universities Retirement System Compliance Examination For the Year Ended June 30, 2018 Performed as Special Assistant Auditors for the Auditor General, State of Illinois State Universities Retirement System of the State of Illinois Compliance Examination For the Year Ended June 30, 2018 Table of Contents Schedule Page(s) State Universities Retirement System Officials 1 Management Assertion Letter 2 Compliance Report Summary 3 Independent Accountant’s Report on State Compliance, on Internal Control Over Compliance, and on Supplementary Information for State Compliance Purposes 5 Independent Auditors’ Report on Internal Control over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards 9 Schedule of Findings Current Findings – State Compliance 11 Prior Findings Not Repeated 14 Financial Statement Report The System’s financial statement report for the year ended June 30, 2018, which includes the Independent Auditor’s Report, Management Discussion and Analysis, Basic Financial Statements and Notes to the Basic Financial Statements, Required Supplementary Information Other than Management Discussion and Analysis, Supplementary Information, and the Independent Auditor’s Report on Internal Control over Financial Reporting and on Compliance and Other Matters Based on an Audit of Basic Financial Statements performed in accordance with Government Auditing Standards has been issued separately. Supplementary Information for -

Ally Financial Inc. ( GOM ) 10−K

Ally Financial Inc. ( GOM ) 10−K Annual report pursuant to section 13 and 15(d) Filed on 2/28/2012 Filed Period 12/31/2011 Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10−K þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011 or ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number: 1−3754 ALLY FINANCIAL INC. (Exact name of registrant as specified in its charter) Delaware 38−0572512 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 200 Renaissance Center P.O. Box 200 Detroit, Michigan 48265−2000 (Address of principal executive offices) (Zip Code) (866) 710−4623 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act (all listed on the New York Stock Exchange): Title of each class 10.00% Deferred Interest Debentures due December 1, 2012 7.25% Notes due February 7, 2033 10.30% Deferred Interest Debentures due June 15, 2015 7.375% Notes due December 16, 2044 7.30% Public Income Notes (PINES) due March 9, 2031 Fixed Rate/Floating Rate Perpetual Preferred Stock, Series A 7.35% Notes due August 8, 2032 8.125% Fixed Rate/Floating Rate Trust Preferred Securities, Series 2 of GMAC Capital Trust I Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well−known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Investment Holdings As of June 30, 2019

Investment Holdings As of June 30, 2019 Montana Board of Investments | Portfolio as of June 30, 2019 Transparency of the Montana Investment Holdings The Montana Board of Investment’s holdings file is a comprehensive listing of all manager funds, separately managed and commingled, and aggregated security positions. Securities are organized across common categories: Pension Pool, Asset Class, Manager Fund, Aggregated Individual Holdings, and Non-Pension Pools. Market values shown are in U.S. dollars. The market values shown in this document are for the individual investment holdings only and do not include any information on accounts for receivables or payables. Aggregated Individual Holdings represent securities held at our custodian bank and individual commingled accounts. The Investment Holdings Report is unaudited and may be subject to change. The audited Unified Investment Program Financial Statements, prepared on a June 30th fiscal year-end basis, will be made available once the Legislative Audit Division issues the Audit Opinion. Once issued, the Legislative Audit Division will have the Audit Opinion available online at https://www.leg.mt.gov/publications/audit/agency-search-report and the complete audited financial statements will also be available on the Board’s website http://investmentmt.com/AnnualReportsAudits. Additional information can be found at www.investmentmt.com Montana Board of Investments | Portfolio as of June 30, 2019 2 Table of Contents Consolidated Asset Pension Pool (CAPP) 4 CAPP - Domestic Equities 5 CAPP - International -

FTSE Russell Factsheet | FTSE Goldman Sachs US High-Yield Corporate Bond Index | August 31, 2021

FTSE Russell Factsheet | FTSE Goldman Sachs US High-Yield Corporate Bond Index | August 31, 2021 INDEX CONSTITUENTS September 2021 Index Profile - Index data as of August 31, 2021 Coupon Maturity Index Weight Description (%) (YYYYMMDD) (%) 1011778 BC UNLTD LIABILITY CO 5.750 20250415 0.0250 1011778 BC UNLTD LIABILITY CO 3.875 20280115 0.2474 1011778 BC UNLTD LIABILITY CO 4.375 20280115 0.1197 1011778 BC UNLTD LIABILITY CO 3.500 20290215 0.0412 1011778 BC UNLTD LIABILITY CO 4.000 20301015 0.1614 99 ESCROW ISSUER INC 7.500 20260115 0.0154 AADVANTAGE LOYALTY IP LTD 5.500 20260420 0.1738 AADVANTAGE LOYALTY IP LTD 5.750 20290420 0.5089 ABERCROMBIE AND FITCH MGMT CO 8.750 20250715 0.0181 ACADEMY LTD 6.000 20271115 0.0675 ACADIA HEALTHCARE CO INC 5.500 20280701 0.0743 ACADIA HEALTHCARE CO INC 5.000 20290415 0.0278 ACCO BRANDS CORP 4.250 20290315 0.0323 ACI WORLDWIDE INC 5.750 20260815 0.0194 ACRISURE LLC 7.000 20251115 0.0445 ACRISURE LLC 10.125 20260801 0.0211 ACRISURE LLC 4.250 20290215 0.0383 ACRISURE LLC 6.000 20290801 0.0272 ACURIS FIN US INC 5.000 20280501 0.0549 ADIENT GLOBAL HLDGS LTD 4.875 20260815 0.0381 ADIENT US LLC 9.000 20250415 0.0314 ADT SECURITY CORP 4.125 20230615 0.0286 ADT SECURITY CORP 4.125 20290801 0.0552 ADT SECURITY CORP 4.875 20320715 0.0290 ADTALEM GLOBAL EDUCATION INC 5.500 20280301 0.1301 ADVANCED DRAINAGE SYSTEMS INC 5.000 20270930 0.0578 ADVISOR GROUP HLDGS INC 10.750 20270801 0.0713 AES ANDRES BV 5.700 20280504 0.0489 AES ARGENTINA GENERACION SA 7.750 20240202 0.0102 AETHON UNITED BR LP 8.250 20260215 0.0379 AFFINITY -

State of Delaware OFFICE of the STATE BANK COMMISSIONER

State of Delaware OFFICE OF THE STATE BANK COMMISSIONER Licensees and Existing Branches PDT: 12/6/2018 12:02PM Check Casher, Drafts, or Money Orders 011862 ACME Markets, Inc. 100 Suburban Drive Newark, DE 19711 Contact: Ms. Shea Spencer - (623) 869-4470 Filing Status: Current - Licensed Expires Date: 12/31/2018 Branches / Locations: License # Address 011863 1401 North DuPont Street Wilmington, DE 19806 Filing Status: Current - Licensed Expires Date: 12/31/2018 011864 2098 Naamans Road Wilmington, DE 19810 Filing Status: Current - Licensed Expires Date: 12/31/2018 011865 460 East Main Street Middletown, DE 19709 Filing Status: Current - Licensed Expires Date: 12/31/2018 011866 146 Fox Hunt Drive Bear, DE 19701 Filing Status: Current - Licensed Expires Date: 12/31/2018 011867 1001 North DuPont Highway Dover, DE 19901 Filing Status: Current - Licensed Expires Date: 12/31/2018 011868 4720 Limestone Road Wilmington, DE 19808 Filing Status: Current - Licensed Expires Date: 12/31/2018 011869 128 Lantana Drive Hockessin, DE 19707 Filing Status: Current - Licensed Expires Date: 12/31/2018 011870 236 East Glenwood Avenue Smyrna, DE 19977 Filing Status: Current - Licensed Expires Date: 12/31/2018 011871 1 University Plaza Newark, DE 19702 Filing Status: Current - Licensed Expires Date: 12/31/2018 011872 1308 Centerville Road Wilmington, DE 19808 Filing Status: Current - Licensed Expires Date: 12/31/2018 011873 1901 Concord Pike Wilmington, DE 19803 Filing Status: Current - Licensed Expires Date: 12/31/2018 023755 18578 Coastal Highway Unit 13 Rehoboth -

March 31, 2021

Coupon Units Cost Market Value EXTENDED TERM FIXED INCOME FUND Domestic Fixed Income Securities 77.35% U.S. Government & Federal Agency Obligations ALABAMA ECON SETTLEMENT AUTH B 4.2630 80,000 79,996 92,502 AMERICAN MUNI PWR-OHIO INC OH 8.0840 650,000 939,886 1,221,726 BAY AREA CA TOLL AUTH TOLL BRI 7.0430 715,000 957,245 1,241,011 BAY AREA CA TOLL AUTH TOLL BRI 2.5740 690,000 690,002 727,778 CALIFORNIA ST 5.7000 1,000,000 1,175,700 1,018,171 CALIFORNIA ST 7.5500 1,300,000 1,809,993 2,216,499 COMMIT TO PUR FNMA SF MTG 2.5000 14,328,000 14,783,344 14,801,966 COMMIT TO PUR GNMA II JUMBOS 3.0000 8,000,000 8,349,500 8,345,703 FEDERAL HOME LN MTG CORP 6.2500 475,000 608,841 697,775 FEDERAL HOME LN MTG CORP 6.7500 250,000 324,699 367,397 FEDERAL NATL MTG ASSN 6.2500 105,000 136,302 142,980 FEDERAL NATL MTG ASSN 7.1250 750,000 978,263 1,095,644 FEDERAL NATL MTG ASSN 7.2500 1,375,000 1,816,377 2,038,276 FHLMC POOL #2B-4443 2.7790 193,813 198,077 202,669 FHLMC POOL #2B-5468 2.8000 252,216 259,169 262,524 FHLMC POOL #84-9278 1.9940 401,652 413,856 418,631 FHLMC POOL #84-9625 2.6350 131,000 135,566 136,513 FHLMC POOL #84-9626 3.3640 155,681 161,684 162,578 FHLMC POOL #G0-6625 4.5000 418,840 454,680 467,409 FHLMC POOL #G0-7892 4.5000 179,264 192,789 198,973 FHLMC POOL #G6-0764 4.5000 152,786 166,154 170,393 FHLMC POOL #RA-3404 2.0000 3,996,948 4,156,651 4,051,417 FHLMC POOL #SD-7526 2.5000 6,146,961 6,369,603 6,427,999 FHLMC POOL #SD-7530 2.5000 2,642,814 2,804,812 2,754,023 FHLMC POOL #V8-3204 4.5000 163,024 174,217 176,141 FHLMC MULTICLASS MT 0.8830