Corporate Citizenship 2011 OUR / Purpose to Invest Wisely and Create Value OUR / Mission Generate Superior Investment Returns

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

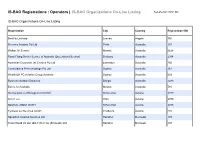

IS-BAO Registrations : Operators | IS-BAO Organizations On-Line Listing Sep-25-2021 09:51 AM

IS-BAO Registrations : Operators | IS-BAO Organizations On-Line Listing Sep-25-2021 09:51 AM IS-BAO Organizations On-Line Listing Organization City Country Registration ID# BestFly Limitada Luanda Angola 750 Revesco Aviation Pty Ltd Perth Australia 187 Walker Air Service Mascot Australia 2628 Royal Flying Doctor Service of Australia (Queensland Section) Brisbane Australia 2384 Australian Corporate Jet Centres Pty Ltd Essendon Australia 756 Consolidated Press Holdings Pty Ltd Sydney Australia 361 Westfield/LFG Aviation Group Australia Sydney Australia 339 Business Aviation Solutions Bilinga Australia 2283 ExecuJet Australia Mascot Australia 510 International Jet Management GmbH Schwechat Austria 2319 Avcon Jet Wien Austria 2290 Sparfell Luftfahrt GmbH Schwechat Austria 2385 Tyrolean Jet Services GmbH Innsbruck Austria 274 Squadron Aviation Services Ltd Hamilton Bermuda 189 Trans World Oil Ltd. dba T.W.O. Air (Bermuda) Ltd Hamilton Bermuda 197 S&K Bermuda Ltd. Pembroke Bermuda 45 Minera San Cristobal S.A. La Paz Bolivia 733 Vale SA Rio de Janeiro Brazil 560 AVANTTO Administração de Aeronaves Sao Paulo Brazil 654 PAIC Participacoes Ltda Sao Paulo Brazil 480 Lider Taxi Aereo S/A Brasil Belo Horizonte Brazil 48 EMAR Taxi Aereo Rio das Ostras Brazil 2615 ICON Taxi Aereo Ltda. São Paulo Brazil 2476 Banco Bradesco S/A Osasco Brazil 2527 M. Square Holding Ltd. Road Town British Virgin Islands 2309 London Air Services Limited dba London Air Services South Richmond Canada 2289 Chartright Air Group Mississauga Canada 432 ACASS Canada Ltd. Montreal Canada 102 Sunwest Aviation Ltd Calgary Canada 105 Air Partners Corporation Calgary Canada 764 Coulson Aviation (USA) Inc. -

FTSE Russell Factsheet | FTSE Goldman Sachs US High-Yield Corporate Bond Index | August 31, 2021

FTSE Russell Factsheet | FTSE Goldman Sachs US High-Yield Corporate Bond Index | August 31, 2021 INDEX CONSTITUENTS September 2021 Index Profile - Index data as of August 31, 2021 Coupon Maturity Index Weight Description (%) (YYYYMMDD) (%) 1011778 BC UNLTD LIABILITY CO 5.750 20250415 0.0250 1011778 BC UNLTD LIABILITY CO 3.875 20280115 0.2474 1011778 BC UNLTD LIABILITY CO 4.375 20280115 0.1197 1011778 BC UNLTD LIABILITY CO 3.500 20290215 0.0412 1011778 BC UNLTD LIABILITY CO 4.000 20301015 0.1614 99 ESCROW ISSUER INC 7.500 20260115 0.0154 AADVANTAGE LOYALTY IP LTD 5.500 20260420 0.1738 AADVANTAGE LOYALTY IP LTD 5.750 20290420 0.5089 ABERCROMBIE AND FITCH MGMT CO 8.750 20250715 0.0181 ACADEMY LTD 6.000 20271115 0.0675 ACADIA HEALTHCARE CO INC 5.500 20280701 0.0743 ACADIA HEALTHCARE CO INC 5.000 20290415 0.0278 ACCO BRANDS CORP 4.250 20290315 0.0323 ACI WORLDWIDE INC 5.750 20260815 0.0194 ACRISURE LLC 7.000 20251115 0.0445 ACRISURE LLC 10.125 20260801 0.0211 ACRISURE LLC 4.250 20290215 0.0383 ACRISURE LLC 6.000 20290801 0.0272 ACURIS FIN US INC 5.000 20280501 0.0549 ADIENT GLOBAL HLDGS LTD 4.875 20260815 0.0381 ADIENT US LLC 9.000 20250415 0.0314 ADT SECURITY CORP 4.125 20230615 0.0286 ADT SECURITY CORP 4.125 20290801 0.0552 ADT SECURITY CORP 4.875 20320715 0.0290 ADTALEM GLOBAL EDUCATION INC 5.500 20280301 0.1301 ADVANCED DRAINAGE SYSTEMS INC 5.000 20270930 0.0578 ADVISOR GROUP HLDGS INC 10.750 20270801 0.0713 AES ANDRES BV 5.700 20280504 0.0489 AES ARGENTINA GENERACION SA 7.750 20240202 0.0102 AETHON UNITED BR LP 8.250 20260215 0.0379 AFFINITY -

Fif-I Q2 2019

Coupon Units Cost Market Value FIXED INCOME FUND-I Domestic Fixed Income Securities 73.32% U.S. Government & Federal Agency Obligations AMERICAN MUNI PWR-OHIO INC OH 5.9390 20,000 25,048 27,072 AMERICAN MUNI PWR-OHIO INC OH 7.8340 20,000 29,187 31,700 BAY AREA CA TOLL AUTH TOLL BRI 6.2630 20,000 27,161 29,987 BAY AREA CA TOLL AUTH TOLL BRI 6.9070 20,000 28,369 32,370 CALIFORNIA ST 7.3000 80,000 109,384 120,252 CALIFORNIA ST 7.3500 65,000 89,374 98,279 CALIFORNIA ST 7.5500 80,000 114,069 126,650 CALIFORNIA ST 7.6250 170,000 241,026 268,250 CALIFORNIA ST EARTHQUAKE AUTH 2.8050 109,200 109,200 109,200 CHICAGO IL TRANSIT AUTH SALES 6.2000 30,000 36,346 39,143 CLARK CNTY NV ARPT REVENUE 6.8810 30,000 30,000 30,000 COMMIT TO PUR FNMA SF MTG 3.5000 22,840,000 23,241,282 23,348,546 COMMIT TO PUR FNMA SF MTG 4.0000 20,400,000 21,059,813 21,077,742 DALLAS TX AREA RAPID TRANSIT S 5.0220 20,000 23,278 25,686 EAST BAY CA MUNI UTILITY DIST 5.8740 30,000 38,461 40,855 FEDERAL HOME LN BK CONS BD 2.6250 155,000 155,146 155,822 FEDERAL HOME LN BK CONS BD 3.0000 70,000 70,738 71,865 FEDERAL HOME LN BK CONS BD 2.2670 845,000 843,696 844,334 FEDERAL HOME LN BK CONS BD 2.1780 605,000 604,099 604,158 FEDERAL HOME LN MTG CORP 2.7500 145,000 145,758 150,132 FEDERAL HOME LN MTG CORP 6.2500 15,000 19,879 21,536 FEDERAL NATL MTG ASSN 1.6000 85,000 83,709 84,425 FEDERAL NATL MTG ASSN 2.1250 15,000 14,332 15,109 FEDERAL NATL MTG ASSN 2.5000 100,000 99,938 101,166 FEDERAL NATL MTG ASSN 2.8750 230,000 231,189 234,072 FEDERAL NATL MTG ASSN 6.6250 45,000 59,784 64,335 -

March 31, 2021

Coupon Units Cost Market Value EXTENDED TERM FIXED INCOME FUND Domestic Fixed Income Securities 77.35% U.S. Government & Federal Agency Obligations ALABAMA ECON SETTLEMENT AUTH B 4.2630 80,000 79,996 92,502 AMERICAN MUNI PWR-OHIO INC OH 8.0840 650,000 939,886 1,221,726 BAY AREA CA TOLL AUTH TOLL BRI 7.0430 715,000 957,245 1,241,011 BAY AREA CA TOLL AUTH TOLL BRI 2.5740 690,000 690,002 727,778 CALIFORNIA ST 5.7000 1,000,000 1,175,700 1,018,171 CALIFORNIA ST 7.5500 1,300,000 1,809,993 2,216,499 COMMIT TO PUR FNMA SF MTG 2.5000 14,328,000 14,783,344 14,801,966 COMMIT TO PUR GNMA II JUMBOS 3.0000 8,000,000 8,349,500 8,345,703 FEDERAL HOME LN MTG CORP 6.2500 475,000 608,841 697,775 FEDERAL HOME LN MTG CORP 6.7500 250,000 324,699 367,397 FEDERAL NATL MTG ASSN 6.2500 105,000 136,302 142,980 FEDERAL NATL MTG ASSN 7.1250 750,000 978,263 1,095,644 FEDERAL NATL MTG ASSN 7.2500 1,375,000 1,816,377 2,038,276 FHLMC POOL #2B-4443 2.7790 193,813 198,077 202,669 FHLMC POOL #2B-5468 2.8000 252,216 259,169 262,524 FHLMC POOL #84-9278 1.9940 401,652 413,856 418,631 FHLMC POOL #84-9625 2.6350 131,000 135,566 136,513 FHLMC POOL #84-9626 3.3640 155,681 161,684 162,578 FHLMC POOL #G0-6625 4.5000 418,840 454,680 467,409 FHLMC POOL #G0-7892 4.5000 179,264 192,789 198,973 FHLMC POOL #G6-0764 4.5000 152,786 166,154 170,393 FHLMC POOL #RA-3404 2.0000 3,996,948 4,156,651 4,051,417 FHLMC POOL #SD-7526 2.5000 6,146,961 6,369,603 6,427,999 FHLMC POOL #SD-7530 2.5000 2,642,814 2,804,812 2,754,023 FHLMC POOL #V8-3204 4.5000 163,024 174,217 176,141 FHLMC MULTICLASS MT 0.8830 -

Pax Large Cap Fund Microsoft Corporation 69,102,772.38 5.7 Apple Inc. 47,294,037.00 3.9 Applied Materials, Inc. 38,956,958.40 3

Pax Large Cap Fund USD 3/31/2021 Port. Ending Market Value Portfolio Weight Microsoft Corporation 69,102,772.38 5.7 Apple Inc. 47,294,037.00 3.9 Applied Materials, Inc. 38,956,958.40 3.2 Amazon.com, Inc. 37,215,594.24 3.1 Procter & Gamble Company 36,350,360.01 3.0 United Parcel Service, Inc. Class B 34,964,903.12 2.9 Alphabet Inc. Class A 34,574,022.76 2.9 Bristol-Myers Squibb Company 33,191,165.67 2.7 Voya Financial, Inc. 32,355,403.32 2.7 T-Mobile US, Inc. 32,112,829.32 2.7 Lowe's Companies, Inc. 31,885,959.16 2.6 Trane Technologies plc 29,602,624.68 2.4 Alphabet Inc. Class C 28,522,270.44 2.4 BlackRock, Inc. 27,785,687.88 2.3 Dell Technologies Inc Class C 27,666,670.85 2.3 JPMorgan Chase & Co. 26,908,174.80 2.2 Fiserv, Inc. 25,811,800.32 2.1 Medtronic Plc 25,303,918.52 2.1 Aptiv PLC 24,835,790.00 2.1 salesforce.com, inc. 24,474,798.66 2.0 Sysco Corporation 24,370,423.70 2.0 CVS Health Corporation 23,817,592.31 2.0 Becton, Dickinson and Company 23,658,495.00 2.0 Citizens Financial Group, Inc. 23,479,853.00 1.9 Merck & Co., Inc. 22,584,903.12 1.9 Target Corporation 22,477,379.74 1.9 PTC Inc. 22,216,710.00 1.8 Prologis, Inc. -

BLACKROCK INVESTMENT STEWARDSHIP 2018 ANNUAL REPORT 1 Our Mission in Context: 2017-2018 Highlights

BlackRock Investment Stewardship 2018 Annual Report August 30, 2018 The Investment Stewardship Annual Report reviews BlackRock’s approach to corporate governance and stewardship in support of long- Contents term value creation for our clients. In this report we Annual Report provide practical examples of the Investment Stewardship team’s work over the year, distilling Our global and local focus 1 some of the trends and company-specific Our mission in context: situations reported in our regional quarterly 2017-2018 highlights 2 reports. We emphasize the outcome of our Our achievements over the past year 3 engagements with companies, including some which have spanned several years. We also Our principles, priorities and engagement commentaries 5 provide examples of where we have contributed to the public discourse on corporate governance and Engagement and voting case studies 7 investment stewardship. Engagement and voting statistics 20 Investor perspective and public policy 21 Appendix List of companies engaged 25 Our Annual Report reporting period is July 1, 2017 to June 30, 2018, representing the Securities and Exchange Commission’s (SEC) 12-month reporting period for U.S. mutual funds, including iShares. Our global and local focus BlackRock’s number one focus, as a fiduciary investor, is on generating the long-term sustainable financial returns on which our clients depend to meet their financial goals. Investment Stewardship is focused on assessing the quality of management, board leadership and standards of operational excellence – in aggregate, corporate governance – at the public companies in which we invest on behalf of our clients. We see this responsibility as part of our fiduciary duty, through which we contribute to BlackRock’s mission to create a better financial future for our clients. -

Annual Report

WEISS ALTERNATIVE BALANCED RISK FUND CLASS K – WEIKX INVESTOR CLASS – WEIZX Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website www.weissfunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 866-530-2690 or by sending an email request to [email protected]. You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 866-530-2690 or send an email request to [email protected] to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary. -

Sealed Air Corp. Advance Auto Parts Inc. Honeywell

MARKET VALUE PRICE AND EARNINGS REVENUE NET INCOME 6/30/19 CHANGE 6/30/19 EARN- 5-YEAR 1-YEAR LATEST CHANGE LATEST CHANGE LATEST VALUE FROM STOCK INGS PER TOTAL TOTAL FISCAL YEAR FROM YEAR FISCAL YEAR FROM YEAR FISCAL ’19 ’18 RANKED BY 6/30/19 MARKET VALUE INDUSTRY (BILLION) 6/30/18 PRICE SHARE RETURN RETURN (BILLION) BEFORE (MILLION) BEFORE YEAR END 1 1 BANK OF AMERICA CORP. BAC CHARLOTTE Financial services $275.26 (3.5)% $28.95 $2.61 99.9% 9.0% $110.58 10.3% $28,147.0 54% Dec-2018 Industrial and defense 2 - HONEYWELL INTERNATIONAL INC. HON CHARLOTTE equipment 127.06 19.4 174.59 8.98 106.5 32.4 41.8 3.1 6,765.0 338 Jan-2019 3 2 LOWE'S COS. INC. LOW MOORESVILLE Hardware stores 79 0.1 100.91 2.84 124.9 12.9 71.31 3.9 2,314.0 (33) Jan-2019 4 3 DUKE ENERGY CORP. DUK CHARLOTTE Utilities 64.24 15.9 88.24 3.76 42.1 33.3 24.52 4.1 2,666.0 (13) Dec-2018 5 4 BB&T CORP. BBT WINSTON-SALEM Financial services 37.63 (4.3) 49.13 3.91 40.6 9.9 12.99 6.9 3,237.0 35 Dec-2018 6 6 RED HAT INC. RHT RALEIGH Software 33.44 57.8 187.76 2.33 239.7 39.7 3.36 15.1 434.0 68 Feb-2019 HONEYWELL 7 7 IQVIA HOLDINGS INC. IQV DURHAM Pharmaceutical services 31.74 53.5 160.90 1.24 201.9 61.2 10.41 7.3 259.0 (80) Dec-2018 INTERNATIONAL INC. -

Unitarian Universalist Common Endowment Fund, LLC "Top 50" Holdings and Summary Report As of September 30, 2020

Unitarian Universalist Common Endowment Fund, LLC "Top 50" Holdings and Summary Report as of September 30, 2020 Asset Name Shares Market Value SEA LTD ADR 11,330 1,745,273.20 AMAZON COM INC 540 1,700,314.20 NETFLIX COM INC 2,915 1,457,587.45 SERVICENOW INC 2,835 1,374,975.00 SQUARE INC A 8,195 1,332,097.25 VISA INC CLASS A SHARES 6,500 1,299,805.00 MATCH GROUP INC NEW 9,867 1,091,783.55 ADOBE INC 2,075 1,017,642.25 ZOETIS INC 5,303 876,957.11 MICROSOFT CORP 3,860 811,873.80 INTUIT INC 2,310 753,545.10 FACEBOOK INC CLASS A 2,874 752,700.60 COSTAR GROUP INC 862 731,415.62 TWILIO INC A 2,772 684,933.48 CHARTER COMMUNICATIONS INC NEW 869 542,551.46 ALIGN TECHNOLOGY INC 1,620 530,323.20 ZILLOW GROUP INC C 5,130 521,156.70 BERKSHIRE HATHAWAY INC CL B 2,348 499,983.12 FLOOR DECOR HOLDINGS INC A 6,475 484,330.00 J P MORGAN CHASE CO 4,953 476,825.31 ILLUMINA INC 1,510 466,710.80 ALPHABET INC CL A 285 417,696.00 PFIZER INC 11,239 412,471.30 EDWARDS LIFESCIENCES CORP 5,130 409,476.60 UNILEVER N V N Y SHS NEW 6,655 401,962.00 ROCHE HLDG LTD SPONSORED ADR 9,145 392,115.65 ATLASSIAN CORP PLC CLASS A 2,090 379,941.10 BANK OF AMERICA CORP 14,865 358,097.85 VERIZON COMMUNICATIONS INC 5,947 353,787.03 WARNER MUSIC GROUP CORP COM CL A 12,085 347,322.90 WALMART INC 2,300 321,793.00 UBER TECHNOLOGIES INC 8,820 321,753.60 SAMPO PLC 8,075 319,962.54 DEXCOM INC 770 317,417.10 VONOVIA SE 4,590 315,304.71 WALT DISNEY CO THE 2,541 315,287.28 GROCERY OUTLET HOLDING CORP 8,005 314,756.60 DAIKIN INDUSTRIES 1,700 310,906.85 PROCTER & GAMBLE CO 2,230 309,947.70 MONSTER -

Loomis Sayles Global Allocation Fund Investments As of June 30, 2021 (Unaudited)

Loomis Sayles Global Allocation Fund Investments as of July 31, 2021 (Unaudited) Shares/ Currency Interest Maturity Principal Amount Security Description Code Rate Date Market Value ($) % of Fund Common Stocks 304,417 Accenture PLC, Class A 96,707,193 1.95% 2,897,800 AIA Group Ltd. 34,674,381 0.70% 964,539 Airbnb, Inc., Class A 138,903,261 2.80% 370,904 Alibaba Group Holding Ltd., Sponsored ADR 72,396,752 1.46% 48,554 Alphabet, Inc., Class A 130,830,210 2.63% 6,126 Alphabet, Inc., Class C 16,567,277 0.33% 43,209 Amazon.com, Inc. 143,781,836 2.90% 239,207 ASML Holding NV 182,845,945 3.68% 937,303 Atlas Copco AB, Class A 63,478,852 1.28% 910,249 Canada Goose Holdings, Inc. 38,639,618 0.78% 264,875 Copart, Inc. 38,936,625 0.78% 219,514 Costco Wholesale Corp. 94,329,556 1.90% 332,591 Cummins, Inc. 77,194,371 1.55% 549,624 Danaher Corp. 163,507,644 3.29% 722,665 Dassault Systemes SE 39,863,788 0.80% 362,864 Descartes Systems Group, Inc. (The) 26,318,983 0.53% 1,708,131 Dropbox, Inc., Class A 53,789,045 1.08% 284,340 Estee Lauder Cos., Inc. (The), Class A 94,921,222 1.91% 325,252 Facebook, Inc., Class A 115,887,288 2.33% 1,112,366 Farfetch Ltd., Class A 55,751,784 1.12% 91,345 Goldman Sachs Group, Inc. (The) 34,243,414 0.69% 869,554 Halma PLC 34,904,752 0.70% 2,201,959 HDFC Bank Ltd. -

MANAGING STRESS & STAYING HEALTHY How to Stay Fit & Healthy During Coronavirus (COVID-19) Pandemic

In follow up to our previous communications regarding COVID-19 Global Talent Resources and Opportunities, we wanted to provide you with some additional resources and updated information. Furthermore, we are pleased to announce that we are in the process of forging a national partnership with NFI! NFI is a leading international provider of transportation logistics, warehousing, and distribution services. Through this partnership our two organizations will work together to streamline available job opportunities within NFI for our ASM team members, and their loved ones, who may be looking for work during these challenging times. More details regarding the NFI / ASM partnership will be provided in the coming days. We will continue to provide updates as we source additional information. MANAGING STRESS & STAYING HEALTHY On Demand Webcasts – EAP (Employee Assistance Webcasts) Can be accessed on Hyperlink: www.cigna.com/EAPWebcasts Below are some of the options that have been created in response to Covid-19: • Navigating Back-To-School Challenges • Managing Anxiety: Corona Virus Fears & Concerns • Supporting Employees (for managers) Corona Virus Fears & Concerns • Life @ Home: Managing the Stressors • Experiencing Mindfulness - Part I: An Introduction • Experiencing Mindfulness - Part II: How Can It Help Managing Stress Toolkit: Available at Hyperlink: Stress Tool Kit Disaster Resource Center: Specific Coronavirus content available on the Disaster Resource Center Hyperlink: Disaster Resource Center How to Stay Fit & Healthy During Coronavirus (COVID-19) Pandemic https://nutrition.org/how-to-stay-fit-and-healthy-during-coronavirus-covid-19- pandemic/ ADDITIONAL JOB SEARCH RESOURCES The opportunities below were sourced from LinkedIn. For your convenience we have added links for easy access to these employment websites. -

Companies from Industries Spanning from Technology to Retail Are Hiring to Meet Increased Demand Caused by the Coronavirus Pandemic

Companies Are Still Hiring During COVID-19 Companies from industries spanning from technology to retail are hiring to meet increased demand caused by the coronavirus pandemic. Below is a regularly updated list of companies hiring right now. Last Updated: November 13, 2020 • Target plans to hire approximately 130,000 seasonal team members for 2020. • Amazon says it’s hiring more than 100,000 people. • UPS is hiring more than 100,000 people for open positions. • FedEx is hiring people for more than 70,000 roles, including seasonal. • McDonald's is hiring people for more than 50,000 roles. • Albertsons Companies is hiring 50,000 people across their companies for open roles. • The Department of Veterans Affairs hires people to fill more than 45,000 positions each year. • Walmart is hiring people for about 35,000 positions, including seasonal. • CVS Health is hiring people for more than 34,000 roles. • Taco Bell is hiring 30,000 people to work at its restaurants. • Ace Hardware is hiring 30,000 people to work in its stores nationwide. • Allied Universal is hiring more than 25,000 people for open positions. • Dollar Tree, which is also the parent company of Family Dollar, is hiring 25,000 workers for its stores and distribution centers. • Walgreens is hiring 25,000 employees for permanent and temporary roles. • Jackson Hewitt Tax Service expects to hire 22,000 seasonal workers. • Lowe’s is hiring people for more than 20,000 positions. • The Home Depot is hiring people to fill about 20,000 jobs. • Instawork is hiring 20,000 workers over the next two months.