New York City Deferred Compensation Plan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Retrospective of Preservation Practice and the New York City Subway System

Under the Big Apple: a Retrospective of Preservation Practice and the New York City Subway System by Emma Marie Waterloo This thesis/dissertation document has been electronically approved by the following individuals: Tomlan,Michael Andrew (Chairperson) Chusid,Jeffrey M. (Minor Member) UNDER THE BIG APPLE: A RETROSPECTIVE OF PRESERVATION PRACTICE AND THE NEW YORK CITY SUBWAY SYSTEM A Thesis Presented to the Faculty of the Graduate School of Cornell University In Partial Fulfillment of the Requirements for the Degree of Master of Arts by Emma Marie Waterloo August 2010 © 2010 Emma Marie Waterloo ABSTRACT The New York City Subway system is one of the most iconic, most extensive, and most influential train networks in America. In operation for over 100 years, this engineering marvel dictated development patterns in upper Manhattan, Brooklyn, and the Bronx. The interior station designs of the different lines chronicle the changing architectural fashion of the aboveground world from the turn of the century through the 1940s. Many prominent architects have designed the stations over the years, including the earliest stations by Heins and LaFarge. However, the conversation about preservation surrounding the historic resource has only begun in earnest in the past twenty years. It is the system’s very heritage that creates its preservation controversies. After World War II, the rapid transit system suffered from several decades of neglect and deferred maintenance as ridership fell and violent crime rose. At the height of the subway’s degradation in 1979, the decision to celebrate the seventy-fifth anniversary of the opening of the subway with a local landmark designation was unusual. -

D. Rail Transit

Chapter 9: Transportation (Rail Transit) D. RAIL TRANSIT EXISTING CONDITIONS The subway lines in the study area are shown in Figures 9D-1 through 9D-5. As shown, most of the lines either serve only portions of the study area in the north-south direction or serve the study area in an east-west direction. Only one line, the Lexington Avenue line, serves the entire study area in the north-south direction. More importantly, subway service on the East Side of Manhattan is concentrated on Lexington Avenue and west of Allen Street, while most of the population on the East Side is concentrated east of Third Avenue. As a result, a large portion of the study area population is underserved by the current subway service. The following sections describe the study area's primary, secondary, and other subway service. SERVICE PROVIDED Primary Subway Service The Lexington Avenue line (Nos. 4, 5, and 6 routes) is the only rapid transit service that traverses the entire length of the East Side of Manhattan in the north-south direction. Within Manhattan, southbound service on the Nos. 4, 5 and 6 routes begins at 125th Street (fed from points in the Bronx). Local service on the southbound No. 6 route ends at the Brooklyn Bridge station and the last express stop within Manhattan on the Nos. 4 and 5 routes is at the Bowling Green station (service continues into Brooklyn). Nine of the 23 stations on the Lexington Avenue line within Manhattan are express stops. Five of these express stations also provide transfer opportunities to the other subway lines within the study area. -

Leisure Pass Group

Explorer Guidebook Empire State Building Attraction status as of Sep 18, 2020: Open Advanced reservations are required. You will not be able to enter the Observatory without a timed reservation. Please visit the Empire State Building's website to book a date and time. You will need to have your pass number to hand when making your reservation. Getting in: please arrive with both your Reservation Confirmation and your pass. To gain access to the building, you will be asked to present your Empire State Building reservation confirmation. Your reservation confirmation is not your admission ticket. To gain entry to the Observatory after entering the building, you will need to present your pass for scanning. Please note: In light of COVID-19, we recommend you read the Empire State Building's safety guidelines ahead of your visit. Good to knows: Free high-speed Wi-Fi Eight in-building dining options Signage available in nine languages - English, Spanish, French, German, Italian, Portuguese, Japanese, Korean, and Mandarin Hours of Operation From August: Daily - 11AM-11PM Closings & Holidays Open 365 days a year. Getting There Address 20 West 34th Street (between 5th & 6th Avenue) New York, NY 10118 US Closest Subway Stop 6 train to 33rd Street; R, N, Q, B, D, M, F trains to 34th Street/Herald Square; 1, 2, or 3 trains to 34th Street/Penn Station. The Empire State Building is walking distance from Penn Station, Herald Square, Grand Central Station, and Times Square, less than one block from 34th St subway stop. Top of the Rock Observatory Attraction status as of Sep 18, 2020: Open Getting In: Use the Rockefeller Plaza entrance on 50th Street (between 5th and 6th Avenues). -

The New York City Waterfalls

THE NEW YORK CITY WATERFALLS GUIDE FOR CHILDREN AND ADULTS WELCOME PLAnnING YOUR TRIP The New York City Waterfalls are sited in four locations, and can be viewed from many places. They provide different experiences at each site, and the artist hopes you will visit all of the Waterfalls and see the various parts of New York City they have temporarily become part of. You can get closest to the Welcome to THE NEW YORK CIty WATERFALLS! Waterfalls at Empire-Fulton Ferry State Park in DUMBO; along the Manhattan Waterfront Greenway, north of the Manhattan Bridge; along the Brooklyn The New York City Waterfalls is a work of public art comprised of four Heights Promenade; at Governors Island; and by boat in the New York Harbor. man-made waterfalls in the New York Harbor. Presented by Public Art Fund in collaboration with the City of New York, they are situated along A great place to go with a large group is Empire-Fulton Ferry State Park in Brooklyn, which is comprised of 12 acres of green space, a playground, the shorelines of Lower Manhattan, Brooklyn and Governors Island. picnic benches, as well as great views of The New York City Waterfalls. These Waterfalls range from 90 to 120-feet tall and are on view from Please see the map on page 18 for other locations. June 26 through October 13, 2008. They operate seven days a week, You can listen to comments by the artist about the Waterfalls before your from 7 am to 10 pm, except on Tuesdays and Thursdays, when the visit at www.nycwaterfalls.org (in the podcast section), or during your visit hours are 9 am to 10 pm. -

1981 FINAL REPORT Development of UNDE R CONTRACT: DOT-OS-50233

DOT/RSPA/DPB/-50/81/19 Planning and JANUA RY 1981 FINAL REPORT Development of UNDE R CONTRACT: DOT-OS-50233 Public Transportation Conference Proceedings Terminals Pre pa red for: Office of University Research Washingt on, D.C. 20590 U.S. Deportment of Transportation S.G.,t.I.u. LtdttARV Research and Special Programs Administration tiJ J :) 3 T,:'1 :I;:))'.''; f ... f\l?;)' NOTICE This document is disseminated tmder the sponsorship of the Department of Trans portation in the interest of information exchange. The United States Government assumes no liability for its contents or use thereof. Technical Report Documentation Page I , Roporr No. 2. GoYe Mt,\~f"'lt At~e!s1on No. J. Rec1p1enf s Cotalog No, DOT/RSPA/DPB-50/81/19 4 . T itle end Subr1de 5. Report D ote Planning and Development of Public Transportation January 1981 Terminals 6. Pe,fo,m,ng 0,9,on, zotion Code 8. Pe,fo,m1ng O,gon110t1on Report ,....,o . I 7. Atori sJ ester A. Hoel, Larry G . Richards UVA/529036/CEBl/107 /i:-nitnr~'l 9. P e ,lorm 1n9Or9on1 1ot 1on Nome ond Address 10. 'Nork Un,t No. (TRAISJ Department of Civil Engineering School of Engineering and Applied Science 11. Controct or G,ont No, Univer sity of Virginia, Thornton Hall DOT-OS-50233 Charlottesville, VA 22901 13. Type of Repo, r ond Period Cove red 12. Sponsoring Agency Nome ond A ddre ss Office of University Research Final Report Research and Special Programs Administration u . S . Department of Transportation 14. Sponsoring Agency Code Washington, D. -

Deposits Service Guide

DEPOSITS SERVICE GUIDE JUNE 17, 2021 DTCC Public (White) Copyright IMPORTANT LEGAL INFORMATION The contents of all Service Guides constitute "Procedures" of The Depository Trust Company ("DTC") as defined in the Rules of DTC. If Participants or other authorized users of DTC's services fail to follow these Procedures precisely, DTC shall bear no responsibility for any losses associated with such failures. From time to time, DTC receives from outside sources notices, other documents, and communications concerning financial assets. Although DTC may make certain of such documents and communications, or extracts therefrom, ("Information") available to Participants and other authorized users, it shall be under no obligation to do so nor, having once or more done so, shall DTC have a continuing obligation to make available Information of a certain type. Information is not independently verified by DTC and is not intended to be a substitute for obtaining advice from an appropriate professional advisor. Therefore, Participants and other authorized users are advised to obtain and monitor Information independently. In addition, nothing contained in Information made available to Participants and other authorized users shall relieve them of their responsibility under DTC's Rules and Procedures or other applicable contractual obligations to check the accuracy, where applicable, of Participant Daily Activity Statements and all other statements and reports received from DTC and to notify DTC of any discrepancies. DTC DOES NOT REPRESENT THE ACCURACY, ADEQUACY, TIMELINESS, COMPLETENESS, OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY INFORMATION (AS DEFINED ABOVE) PROVIDED TO PARTICIPANTS AND OTHER AUTHORIZED USERS, WHICH IS PROVIDED AS-IS. DTC SHALL NOT BE LIABLE FOR ANY LOSS RELATED TO SUCH INFORMATION (OR THE ACT OR PROCESS OF PROVIDING SUCH INFORMATION) RESULTING DIRECTLY OR INDIRECTLY FROM MISTAKES, ERRORS, OR OMISSIONS, OTHER THAN THOSE CAUSED DIRECTLY BY GROSS NEGLIGENCE OR WILLFUL MISCONDUCT ON THE PART OF DTC. -

March 2019 from Astoria to Lower Manhattan and Back

100Days and 100Nights From Astoria to Lower Manhattan and Back March 2019 NEW YORK CITY TRANSIT RIDERS COUNCIL 1 2 NEW YORK CITY TRANSIT RIDERS COUNCIL Acknowledgments PCAC report producers Ellyn Shannon, Associate Director Bradley Brashears, Planning Manager Sheila Binesh, Transportation Planner Shaun Wong, Data Intern Uday Schultz, Field Intern Special thanks to Lisa Daglian, Executive Director William Henderson, Executive Director Emeritus Andrew Albert, NYCTRC Chair Angela Bellisio Kyle Wong Candy Chan NYC Transit staff NYCTRC Council Members: Burton M. Strauss Jr., Stuart Goldstein, Christopher Greif, William K. Guild, Marisol Halpern, Sharon King Hoge, Trudy L. Mason, Scott R. Nicolls, and Edith M. Prentiss 4 TABLE OF CONTENTS EXECUTIVE SUMMARY....................................................................................................... ii INTRODUCTION................................................................................................................ 1 METHODOLOGY................................................................................................................ 3 AM/PM PEAK FINDINGS.................................................................................................... 7 AM RIDER EXPERIENCE..................................................................................................... 8 AM RIDER EXPERIENCE: REAL-TIME DATA.......................................................................... 19 PM RIDER EXPERIENCE.................................................................................................... -

M E M O R a N D U M

County of Caroline Michael A. Finchum, Director Department of Planning & Community Development 233 West Broaddus Avenue Bowling Green, Virginia 22427 (804) 633-4303 E-mail: [email protected] M E M O R A N D U M TO: Caroline County Planning Commission FROM: Michael A. Finchum Director of Planning & Community Development SUBJECT: Capital Improvements Program Fiscal Year 18 to Fiscal Year 22 Public Hearing DATE: February 14, 2017 Enclosed is the FY 18-22 Capital Improvements Program (CIP) with departmental requests together with the recommendations of the County Administrator. The CIP process begins in September when departments and agencies are directed to assess their infrastructure and equipment needs for the next five years. The process used by County Administration/Planning is designed to better integrate the budgeting and CIP processes and to incorporate review and recommendations by the County Administrator earlier in the process. A capital project or expenditure must be valued at $50,000 or greater to be included in the CIP. Any item(s) under $50,000 are included in the department’s operational budget request. You will note there are no school requests included in the CIP due to the requests not meeting the threshold of a capital project. The County Administrator is preparing a list of similar projects for schools and other departments that focus on maintenance and operation requests that will not be part of the formal CIP. MAF:lz Att: Packet CAPITAL IMPROVEMENTS PROGRAM FISCAL YEAR 2018- 2022 Beyond FY18 FY19 FY20 FY21 FY22 FY18-22 2022 Admin./Finance Request Infrastructure Replace Accounting System 300,000 300,000 DEPARTMENT TOTAL 300,000 0 0 0 0 300,000 County Administrators Recommendation Infrastructure Replace Accounting System 300,000 300,000 TOTAL C.A. -

William C. Thompson, Jr

WILLIAM C. THOMPSON, JR. NEW YORK CITY COMPTROLLER Lesbian Gay Bisexual Transgender DIRECTORY OF SERVICES AND RESOURCES NEW YORK METROPOLITAN AREA JUNE 2005 www.comptroller.nyc.gov June 2005 Dear Friend, I am proud to present the 2005 edition of our annual Lesbian, Gay, Bisexual and Transgender Directory of Services and Resources. I know it will continue to serve you well as an invaluable guide to all the New York metropolitan area has to offer the LGBT community, family and friends. Several hundred up-to-date listings, most with websites and e-mail addresses, are included in this year’s Directory. You’ll find a wide range of community organizations, health care facilities, counseling and support groups, recreational and cultural opportunities, houses of worship, and many other useful resources and contacts throughout the five boroughs and beyond. My thanks to the community leaders, activists and organizers who worked with my staff to produce this year’s Directory. Whether you consult it in book form or online at www.comptroller.nyc.gov, I am sure you’ll return many times to this popular and comprehensive resource. If you have questions or comments, please contact Alan Fleishman in my Office of Research and Special Projects at (212) 669-2697, or send us an email at [email protected]. I look forward to working together with you as we continue to make New York City an even better place to live, work and visit. Very truly yours, William C. Thompson, Jr. PHONE FAX E-MAIL WEB LINK * THE CENTER, 208 WEST 13TH STREET, NEW YORK, NY 10011 National gay/lesbian newsmagazine. -

United States Bankruptcy Court

UNITED STATES BANKRUPTCY COURT PROOF OF CLAIM SOUTHERN DISTRICT OF NEW YORK THIS SPACE IS FOR COURT USE ONLY (Manhattan Division) Specific Debtor against which this claim is asserted: NOTE: This form should not be used to make a claim for an administrative expense arising after the commencement of the case. A "request" for payment of an administrative expense may be filed pursuant to 11 U.S.C. § 503. Name of Creditor (The person or other entity to whom the debtor owes money or property): Name and address where notices should be sent: Check box if you are aware that anyone else has filed a proof of claim relating to your claim. Attach copy of statement giving particulars. Check box if you have never received any notices from the bankruptcy court in this case. TEL: ( ) - Carefully read instructions included with this Proof of Claim before completing. In order to have your claim considered for payment and/or voting purposes, complete ALL applicable questions. The original of this Proof of Claim must be mailed to: United States Bankruptcy Court, Southern District of New York, Attn: Refco Inc. Claims Docketing Center, Bowling Green Station, P.O. Box 5175, New York, New York 10274-5175 or hand delivered to: United States Bankruptcy Court, Southern District of New York, Attn: Refco Inc. Claims Docketing Center, One Bowling Green, Room 534, New York, New York 10004-1408. This Proof of Claim must be received no later than July 17, 2006, at 5:00 p.m. prevailing Eastern Time. No facsimiles will be accepted. Last four digits of account or other number by which creditor Check here Replaces A previously filed claim, dated: identifies debtor: if this claim Amends Number: 1. -

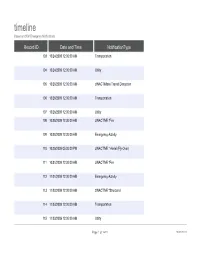

Timeline Based on OEM Emergency Notifications

timeline Based on OEM Emergency Notifications Record ID Date and Time NotificationType 103 10/24/2009 12:00:00 AM Transportation 104 10/24/2009 12:00:00 AM Utility 105 10/26/2009 12:00:00 AM zINACTIMass Transit Disruption 106 10/26/2009 12:00:00 AM Transportation 107 10/26/2009 12:00:00 AM Utility 108 10/28/2009 12:00:00 AM zINACTIVE *Fire 109 10/28/2009 12:00:00 AM Emergency Activity 110 10/29/2009 05:00:00 PM zINACTIVE * Aerial (Fly-Over) 111 10/31/2009 12:00:00 AM zINACTIVE *Fire 112 11/01/2009 12:00:00 AM Emergency Activity 113 11/02/2009 12:00:00 AM zINACTIVE *Structural 114 11/03/2009 12:00:00 AM Transportation 115 11/03/2009 12:00:00 AM Utility Page 1 of 1419 10/02/2021 timeline Based on OEM Emergency Notifications Notification Title [blank] [blank] [blank] [blank] Major Gas Explosion 32-25 Leavitt St. [blank] [blank] [blank] [blank] [blank] [blank] [blank] [blank] Page 2 of 1419 10/02/2021 timeline Based on OEM Emergency Notifications Email Body Notification 1 issued on 10/24/09 at 11:15 AM. Emergency personnel are on the scene of a motor vehicle accident involving FDNY apparatus on Ashford Street and Hegeman Avenue in Brooklyn. Ashford St is closed between New Lots Ave and Linden Blvd. Hegeman Ave is closed from Warwick St to Cleveland St. Notification 1 issued 10/24/2009 at 6:30 AM. Emergency personnel are on scene at a water main break in the Fresh Meadows section of Queens. -

Your Guidebook

New York Pass Guidebook 1929 Shearwater – Statue of Liberty Sail Getting In: Please arrive 30 minutes prior to sail located at the North Cove Yacht Harbor in front of the glass atrium of the winter garden at Brookfield Place (World Financial Center). Hours of Operation Sailing: April 26 – October 31 Daytime Sail: Monday – Friday – 12.30PM, 2.15PM City Lights Sail: May 31 – September 7 Friday & Saturday – 9:30PM Closings & Holidays N/A Reservations required Reservations must be made in advance online. A credit card pre-authorization is required to guarantee your reservation, however, your card will not be charged if valid pass(es) are presented upon scheduled check-in. Reservations cannot be made by phone. If you do not wish to provide credit card authorization, please arrive at dockside service desk at least 30 minutes prior to departure to be admitted on a first-come-first-served basis. Please Note: If you do not wish to provide credit card authorization, please arrive at the dockside service desk at least 30 minutes prior to departure to be admitted on a first-come-first-served basis. Website: https://www.manhattanbysail.com/nypass/ Getting There Address North Cove Marina at Brookfield PlaceWorld Financial New York, NY 10280 US Closest Bus Stop Stop 12 on Downtown route Closest Subway Stop Chambers Street / Park Place / Fulton Street 9/11 Memorial & Museum Getting In: Please present your pass at the ticket window to receive a timed ticket for entry. We suggest that you visit the Museum early in the day for the shortest lines and greatest access to your preferred entry time.