Competition Issues in the Transport Sector in Lesotho

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Emergency Appeal Operation Update Lesotho: Food Insecurity

Emergency appeal operation update Lesotho: Food Insecurity Emergency Appeal n° MDRLS004 Glide n° OT-2016-000005-LSO Date of Issue: 19 July 2016 Expected end date: 31 July 2016 New end date: 31 December 2016 Operation manager (responsible for this EPoA): Point of contact: Prof Teboho Kitleli, Secretary General of Lesotho Red Cross Hung Ha Nguyen, Disaster Preparedness Delegate, IFRC, Southern Africa Operation start date: 22 January 2016 Expected timeframe: 6 months New timeframe: 11 months Appeal budget: CHF 735,735 Total number of people affected: 180,000 Number of people to be assisted: 9,000 individuals (1,800HH) Host National Society presence: Lesotho Red Cross Society, 9 staff members and 30 volunteers actively engage in emergency response in three districts of Qacha’s Nek, Thaba Tseka, and Mafeteng. Red Cross Red Crescent Movement partners actively involved in the operation: IFRC (Southern Africa Country Cluster Office), Monaco Red Cross, the Netherlands Red Cross, Norwegian Red Cross, Swedish Red Cross, Japanese Red Cross and British Red Cross Other partner organizations actively involved in the operation: Government of Lesotho (GoL) through the Disaster Management Authority is coordinating responses at country level. The UN-WFP plans to launch an appeal and will collaborate with government and other humanitarian partners. This Operations Update aims to provide the intervention progress up to date and request for a 5 months’ extension to complete the outstanding activities and call for additional contributions to further fulfil emerging needs from affected people and communities. Appeal History: This Emergency Appeal was launched on 22 January 2016 for CHF 669,160 Swiss francs to enable the IFRC to support the Lesotho Red Cross Society (LRCS) to respond to the food security needs of 4,500 drought affected beneficiaries for six months. -

Lesotho 2019 Human Rights Report

LESOTHO 2019 HUMAN RIGHTS REPORT EXECUTIVE SUMMARY Lesotho is a constitutional monarchy with a democratic parliamentary government. Under the constitution the king is head of state but does not actively participate in political activities. The prime minister is head of government and has executive authority. In 2017 former prime minister Pakalitha Mosisili of the Democratic Congress Party lost a vote of no confidence and a snap election. All major parties accepted the outcome, and Motsoahae Thomas Thabane of the All Basotho Convention Party (ABC) formed a coalition government and became prime minister. Mosisili transferred power peacefully to Thabane, and Mathibeli Mokhothu assumed leadership of the opposition. Local and international observers assessed the election as peaceful, credible, and transparent. The security forces consist of the Lesotho Defense Force (LDF), the Lesotho Mounted Police Service (LMPS), the National Security Service (NSS), and the Lesotho Correctional Service (LCS). The LMPS is responsible for internal security. The LDF maintains external security and may support police when the LMPS commissioner requests assistance. The NSS is an intelligence service that provides information on possible threats to internal and external security. The LDF and NSS report to the minister of defense; the LMPS, to the minister of police and public safety; and the LCS, to the minister of justice and correctional service. Civilian authorities generally maintained effective control over the security forces. The Southern African Development Community (SADC) Preventive Mission in Lesotho contingent of troops, deployed to foster stability as the government moved forward with SADC-recommended security-sector reforms, departed the country in November 2018. In May the government did not meet an SADC deadline for completion of constitutional and security reforms. -

Private Solutions for Infrastructure in Lesotho

A COUNTRY FRAMEWORK REPORT Private Solutions for Infrastructure in Lesotho PUBLIC-PRIVATE INFRASTRUCTURE ADVISORY FACILITY THE WORLD BANK A Country Framework Report Private Solutions for Infrastructure in Lesotho THE WORLD BANK Washington, D.C. Copyright © 2004 The findings, interpretations, and conclusions expressed in The International Bank for Reconstruction and Development/ this report are entirely those of the authors and should not be THE WORLD BANK attributed in any manner to the Public-Private Infrastructure 1818 H Street,NW Advisory Facility (PPIAF) or to the World Bank, to its affil- Washington, DC 20433, USA iated organizations, or to members of its Board of Executive Telephone 202-473-1000 Directors or the countries they represent. Internet www.worldbank.org Neither PPIAF nor the World Bank guarantees the accu- E-mail [email protected] racy of the data included in this publication or accepts All rights reserved responsibility for any consequence of their use. The bound- Manufactured in the aries, colors, denominations, and other information shown United States of America on any map in this report do not imply on the part of PPIAF or the World Bank Group any judgment on the legal status of any territory or the endorsement or acceptance of such boundaries. The material in this publication is copyrighted. Copyright is held by the World Bank on behalf of both the World Bank and PPIAF. Dissemination of this work is encouraged, and the World Bank will normally grant per- mission promptly and, when reproduction is for non-commercial purposes, without asking a fee. Permission to photocopy portions of this publication should be addressed to: Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, U.S.A., telephone 978-750-8400, fax 978-750-4470, or through the Internet at www.copyright.com For questions about this publication or information about ordering more copies, please refer to the PPIAF web- site or contact PPIAF c/o the World Bank, 1818 H. -

Mohale's Hoek District Council

MOHALE’S HOEK DISTRICT COUNCIL Information Handbook 2009 Handbook MOHALE’S HOEK DISTRICT COUNCIL LOCAL GOVERNMENT DISTRICT INFORMATION HANDBOOK June 2009 A COMPILATION OF CRUCIAL INFORMATION FOR THE DISTRICT (DISAGGREGATED COUNCIL-WISE) Ministry of local Government and Chieftainship German Technical Cooperation Department of Planning Kingdom of Lesotho Information Handbook 2009 1 handbook contents Prepared by: Department of Planning, Acronyms……………………………………………………………………………….............. 04 Ministry of Local Government and Chieftainship Mohale’s Hoek District Map………………………………………………………................. 05 Supported by: GTZ Lesotho Introduction………………………………………………………………………...........…….. 06 Background to Local Government in Lesotho……………………………............…………. 07 The Ministry of Local Government and Chieftainship Methodology…………………………………………………………………...........…………. 08 (MOLGC) through its Department of Planning, remains the owner of this handbook. However, there shall be no copy- 1. Profile of Community Councils……………………………………...……………… 09 right restrictions over the use or replication of the whole 2. Social Indicators……………………………………………………...……………… 10 or parts of this handbook. This is an approach for utiliza- 3. Gender Aspects……………………………………………………....………………. 11 tion by the interested parties and is entirely in the public domain. However, no changes shall be made 4. Agriculture………………………………………………………….………………… 12 to the handbook and reprinted thus without prior 5. Trade and Commerce…………………………………………………...…………… 13 permission of MOLGC. 6. Health…………………………………………………………………….…………… -

( 14 Zdthd" class="text-overflow-clamp2"> "TV D>( 14 Zdthd

( l ? 1 ) 0 MAFETENG TOWN : ITS ECONOMIC STRUCTURE AND REGIONAL FUNCTIONS INSTITUTE OPj£ 1 1 APR 1934 ■ MVtlOmiOT STUDIES U G iU ftY t J f m "TV d>( 14 ZdTHD ^ Durban and regional planning programme t> DEPARTMENT OF GEOGRAPHY N.U.L. ROMA LESOTHO AFRICA (RESEARCH REPORTj I Henk Huismpn 1S83 X t > u i Preface For the research programme undertaken in the context of the Urban and Regional Planning Programme, established at the National University of Lesotho in 1978, emphasis has been put on the spatial organization of develooment efforts and activities in the rural areas of Lesotho. This focus on the rural parts of the country also includes an assess ment of the role of urban centres in providing both agricultural and non-agricultursl services to the rural populati on. The present report focusses on the only urban centre in the Mafeteng District, viz. Mafeteng town. Services provided from the centre to the district's population are analysed in relation to the town 1s internal production structure. The information for this report was collected in 1981 by means of a sample survey of households and a number of special studies in which attention was paid to specific aspects of the urban economy and the town's population which were considered crucial for the analysis of structure and function of the town. The report should be seen as the urban counterpart to the URPP research report on households, production and resources in Mafeteng District, which was published in 1987. These reports will be followed by a planning survey of Mafeteng District, which contains an analysis of the district economy. -

Mcc Lesotho Compact 2008-2013 Evaluation Design

MCC LESOTHO COMPACT 2008-2013 MCA HEALTH PROJECT LESOTHO FINAL EVALUATION MCC-15-PO-0074 EVALUATION DESIGN June 16, 2017 HEALTHMATCH consultancies Pim de Graaf The Netherlands Page 1 of 96 Content CONTENT .......................................................................................................................................................... 2 ABBREVIATIONS AND ACRONYMS ................................................................................................................... 4 I INTRODUCTION AND BACKGROUND ........................................................................................................ 5 COUNTRY CONTEXT .................................................................................................................................................. 5 HEALTH PROFILE ...................................................................................................................................................... 6 HEALTH SYSTEM ...................................................................................................................................................... 7 OBJECTIVES OF THIS REPORT .................................................................................................................................... 12 2 OVERVIEW OF THE COMPACT ................................................................................................................ 13 THE HEALTH PROJECT AND IMPLEMENTATION PLAN ...................................................................................................... -

Highlights Contents

LESOTHO METEOROLOGICAL SERVICES (LEKALA LA TSA BOLEPI) Ten-Day Agrometeorological Bulletin 21st – 31st January 2005 Issue No.10/2004-05 Date of Issue: 4 February 2005 Vol. 3 …dedicated to the agricultural community … aimed at harmonizing agricultural activities with weather and climate Contents Highlights Weather Summary Page 1 q Below normal rains recorded. Rainfall Situation q Cumulative rainfall normal countrywide. Page 1 q Temperature Crops conditions good at few localities. Page 1 q Infestation of insects at some places. Crop Stage and Condition Page 1 q Low rainfall expected for next dekad. Dekadal Outlook Page 1 Rainfall and Temperature Summaries Page 2 Glossary Page 3 The Director TEL: (+266) 22324374/22324425 Lesotho Meteorological Services FAX: (+266) 22325057/22350325 Agrometeorological Section E-mail:[email protected] P.O. Box 14515 http://www.lesmet.org.ls Maseru 100, Lesotho Issue No. 10/2004-05 Vol.3 21st –31st January 2005 WEATHER SUMMARY The percentage departure from normal cumulative 11th – 20 th January 2005 rainfall ranges from -12% to 32% (Table 1). The highest cumulative rainfalls of 721.5mm, The last dekad of January was dominated by 543.9mm and 509.4mm are recorded at Oxbow, surface trough. However, there was insufficient Leribe and Qacha’s Nek (Table 1 and Fig. 3). moisture over the interior as a result only partly Mafeteng, Maseru Airport, Moshoeshoe I and cloudy and warm conditions with few Phuthiatsana stations are the only stations which thundershowers occurred. have received cumulative rainfall of less than 400mm. RAINFALL SITUATION TEMPERATURE The last ten days of January received relatively low rainfall compared to the previous dekad (11th th The country experienced near normal – 20 January 2005) which was very wet. -

(LECSA)/Paris Evangelical Missionary Society (PEMS) in Meadowlands, Soweto, In

THE STRUGGLE OF THE LESOTHO EVANGELICAL CHURCH IN SOUTHERN AFRICA (LECSA)/PARIS EVANGELICAL MISSIONARY SOCIETY (PEMS) IN MEADOWLANDS, SOWETO, IN BECOMING A MISSIONAL ECCLESIA IN A LOCAL CONTEXT BY L.T. KGANYAPA SUBMITTED IN FULFILLMENT OF MASTER OF ARTS IN THEOLOGY IN MISSIOLOGY UNIVERSITY OF PRETORIA SUPERVISOR: PROF. S.T. KGATLA 29 APRIL 2016 1 © University of Pretoria DECLARATION I declare that ‘The Struggle of the Lesotho Evangelical Church in Southern Africa (LECSA)/Paris Evangelical Missionary Society (PEMS) in Meadowlands, Soweto, in becoming a missional ecclesia in a local context’ is indeed my original work and all sources employed are duly indicated and acknowledged by means of references and a bibliography. Date: …………………………………………….2016 Signature: ……………………………………………. Leonard Tsidiso Kganyapa 2 © University of Pretoria ACKNOWLEDGEMENTS My sincere gratitude goes to Prof. S.T. Kgatla, my supervisor at the University of Pretoria (UP), for the supportive role he played throughout this research endeavour. I also extend a big thank you to the UP Bursary Fund for the bursary they awarded to me to study at the University. I would also like to thank Ms Brenda Nsanzya, faculty librarian at UP, for helping me obtain information from the library and search for books and articles pertaining to my research topic. Thanks also go to Ms Doris Mokgokolo, faculty administration at UP, for her assistance and patience with all of the changing dates and delays regarding the final submission of my dissertation. Thanks to Ms Mirriam Mabalane, faculty librarian at the University of Johannesburg (UJ) Soweto Campus, for helping me with access and space in the Research Commons. -

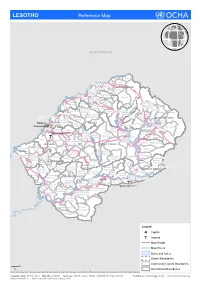

LESOTHO Reference Map

LESOTHO Reference Map SOUTH AFRICA Makhunoane Liqobong Likila Ntelle n Maisa-Phoka Ts'a-le- o d Moleka le BUTHA BUTHE a Lipelaneng C Nqechane/ Moteng Sephokong Linakeng Maputsoe Leribe Menkhoaneng Sekhobe Litjotjela Likhotola/ LERIBE Hleoheng Malaoaneng Manka/ Likhakeng Matlameng Mapholaneng/ Fobane Koeneng/ Phuthiatsana Kolojane Lipetu/ Kao Pae-la-itlhatsoa -Leribe Fenyane Litsilo -Pae-la-itlhatsoa Mokhachane/ Mamathe/Bulara Mphorosane Molika-liko Makhoroana Limamarela Tlhakanyu/Motsitseng Teyateyaneng Seshote Mapholaneng/ Majoe-Matso/ Meno/ Lekokoaneng/Maqhaka Mohatlane/ Sebetia/Khokhoba Pae-la-itlhatsoa Matsoku -Mapholaneng MOKHOTLONG Lipohong Thuapa-Kubu/ Moremoholo/ Katse Popa Senekane BEREA Moshemong Maseru Thuathe Koali/ Taung/Khubelu Mejametalana p Mokhameleli Semenanyane Mokhotlong S Maluba-lube/ Mateanong e Maseru Suoane/ m Rafolatsane Thaba-Bosiu g Ratau e Liphakoeng n Bokong n e a Ihlo-Letso/ Mazenod Maseru Moshoeshoe l Setibing/ Khotso-Ntso Sehong-hong e Tsoelike/ Moeketsane h Pontseng/ Makopoi/ k Mantsonyane Bobete p Popa_MSU a Likalaneng Mahlong Linakaneng M Thaba-Tseka/ Rothe Mofoka Nyakosoba/Makhaleng Maboloka Linakeng/Bokhoasa/Manamaneng THABA TSEKA Kolo/ MASERU Setleketseng/ Tebang/ Matsieng Tsakholo/Mapotu Seroeneg S Mashai e Boleka n Tsa-Kholo Ramabanta/ q Methalaneng/ Tajane Moeaneng u Rapo-le-boea n Khutlo-se-metsi Litsoeneng/Qalabane Maboloka/ y Sehonghong Thaba-Tsoeu/ Monyake a Lesobeng/ Mohlanapeng Mathebe/ n Sehlaba-thebe/ Thabaneng Ribaneng e Takalatsa Likhoele Moshebi/ Kokome/ MAFETENG Semonkong Leseling/ -

Hiog-OOOO-G1 62

________________________'FNMR 122 hIOG-OOOO-G1 62 Quantitative analyses of Lesotho's offici1,,yteId data for maize and sorghum 4. ERSONPAL AUTHOU (100) Eckertt Jerry 5. )RPORATEAUTHORS (101) Ooloo State Univ. Dept. of Economics 6. DOCUMENT DATE (110) =7. NUMBER OF PAGES (120) . ARC NUMBER (170) 1980 35p. LT633.1.E19 9. REFERENCE ORGANIZATION (130) Colo. State 10. SUPPLEMENTARY NOTES (500) (In LASA research rpt.no.8) (Financial support rendered under AID cooperative agreement no.: AID/ta-CA-I under AID basic memorandum no.: AID/ta-BMA-6) 11. ABSTRACT (950) 12.DESCRIPTORS (920) 13. PROJECT NUMBER (ISO) Maize Data collection Lesotho Methodology Sorghum Statistics 14. ONTRACT NO.(I4 ) 1. ONTRACT Yield Productivity TYPE (140) Rainfall Analysis AID/ta-BMA-6 16. 1YPE OF DOCUMENT (160) AM) 90,7 (10,79) LESOTHO AGRICULTURAL SECTOR ANALYSIS PROJECT Ministry of Agriculture Kingdom of Lesotho Department of Economics Colorado State University QUANTITATIVE ANALYSES OF LESOTHO'S OFFICIAL YIELD DATA FOR MAIZE AND SORGHUM Research Report No. 8 Lesotho Agricultural Sector Analysis Project by Jerry Eckert Agricultural Economist QUANTITATIVE ANALYSES OF LESOTHO'S OFFICIAL YIELD DATA FOR MAIZE AND SORGHUM Research Report No. 8 Lesotho Agricultural Sector Analysis Project by Jerry Eckert Agricultural Economist Prepared with support of the United States Agency for International Development, Cooperative Agreement AID/ta-CA-l. All expressed opinions, conclusions or recommendations are those of the author and not of the funding agency, the United States Government -

Qacha's Nek District Council

QACHA’S NEK DISTRICT COUNCIL Information Handbook 2009 0 Handbook QACHA’S NEK DISTRICT COUNCIL LOCAL GOVERNMENT DISTRICT INFORMATION HANDBOOK June 2009 A COMPILATION OF CRUCIAL INFORMATION FOR THE DISTRICT (DISAGGREGATED COUNCIL-WISE) Ministry of local Government and Chieftainship German Technical Cooperation Department of Planning Kingdom of Lesotho Kingdom of Lesotho Information Handbook 2009 1 Handbook Prepared by: Department of Planning, Ministry of Local Government and Chieftainship Supported by: GTZ Lesotho The Ministry of Local Government and Chieftainship (MOLGC) through its Department of Planning, remains the owner of this handbook. However, there shall be no copy- right restrictions over the use or replication of the whole or parts of this handbook. This is an approach for utiliza- tion by the interested parties and is entirely in the public domain. However, no changes shall be made to the handbook and reprinted thus without prior permission of MOLGC. Version dated: June 2009 Pictures provided by: The Age Multimedia Publishers Design/Layout by: The Age Multimedia Publishers Printed by: Qacha’s nek Publisher’s contact details, Maseru: District Council Ministry of Local Government, P.O. Box 686, Maseru 100, Lesotho. Tel.: +266 22 325331 Fax: +266 22 311269 Contact details, Qacha’s Nek: District Council, P.O. Box 1, Qacha’s Nek 600, Lesotho. 2009 Tel.: +266 22 950216/950261 Fax: +266 22 950524 2 Qacha’s Nek District Council Contents Acronyms……………………………………………………………………………….............. 04 Qacha’s Nek District Map…………………………………………………………................. 05 Introduction………………………………………………………………………...........…….. 06 Background to Local Government in Lesotho……………………………............…………. 07 Methodology…………………………………………………………………...........…………. 08 1. Profile of Community Councils……………………………………...……………… 09 2. Social Indicators……………………………………………………...……………… 10 3. Gender Aspects……………………………………………………....………………. -

Second State Of

Second State of the Environment 2002 Report Lesotho Lesotho Second State of the Environment Report 2002 Authors: Chaba Mokuku, Tsepo Lepono, Motlatsi Mokhothu Thabo Khasipe and Tsepo Mokuku Reviewer: Motebang Emmanuel Pomela Published by National Environment Secretariat Ministry of Tourism, Environment & Culture Government of Lesotho P.O. Box 10993, Maseru 100, Lesotho ISBN 99911-632-6-0 This document should be cited as Lesotho Second State of the Environment Report for 2002. Copyright © 2004 National Environment Secretariat. All rights reserved. No parts of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior permission of the publisher. Design and production by Pheko Mathibeli, graphic designer, media practitioner & chartered public relations practitioner Set in Century Gothic, Premium True Type and Optima Lesotho, 2002 3 Contents List of Tables 8 Industrial Structure: Sectoral Composition 34 List of Figures 9 Industrial Structure: Growth Rates 36 List of Plates 10 Population Growth 37 Acknowledgements 11 Rural to Urban Migration 37 Foreword 12 Incidence of Poverty 38 Executive Summary 14 Inappropriate Technologies 38 State and impacts: trends 38 Introduction 24 Human Development Trends 38 Poverty and Income Distribution 44 Socio-Economic and Cultural Environment. 26 Agriculture and Food Security 45 People, Economy and Development Ensuring Long and Healthy Lives 46 Socio-Economic Dimension 26 Ensuring