10 Industry Developments That Shaped the Decade

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retail Customer Experience Benchmarking

Google’s Omnichannel Customer Experience Review Creating seamless retail experiences Businesses that succeed in the future will be the ones that figure out how to meet consumer expectations for seamless omnichannel experiences. To help businesses understand the best examples of these types of experiences, Google partnered with Practicology to review 145 retailers across seven European countries. Here we summarise the findings for the UK, where we reviewed 40 retailers. 1 SEAMLESS CUSTOMER EXPERIENCES ARE CRITICAL 82% 60% 72% 82% of smartphone users 6 in 10 internet users check whether 72% of businesses name consult their phone on purchases a product is available in a local store improving customer they are about to make in-store1 before visiting a retail location2 experience their top priority3 2 EUROPEAN RESULTS 3 RETAIL PERFORMANCE BY VERTICAL Average omnichannel CX score - by country Average omnichannel CX score in the UK - by retail (% of CX principles and criteria passed) category (% of CX principles and criteria passed) Furniture Department 52% Homeware Stores 48% 48% 47% 44% 59% 45% Electronics 49% 54% DIY Telecoms Garden 52% 54% Specialities Fashion UK FR NL SE/NO/DK DE The UK is top of the list, with retailers scoring UK department store retailers offer the particularly well in terms of offering flexible best experiences, particularly by usaging fulfillment options and providing relevant in-store technology, providing flexible store details on their website. fulfilment options and running promotions across channels. 4 PERFORMANCE BY CX PRINCIPLE UK retailers excel in offering more flexible fulfilment options than retailers in other markets. In terms of offering omnichannel customer service, there is still room for improvement. -

Robyn Rihanna Fenty and Others -V- Arcadia Group Brands Limited And

Neutral Citation Number: [2015] EWCA Civ 3 Case No: A3/2013/2087 & A3/2013/2955 IN THE COURT OF APPEAL (CIVIL DIVISION) ON APPEAL FROM THE HIGH COURT OF JUSTICE CHANCERY DIVISION INTELLECTUAL PROPERTY The Hon Mr Justice Birss [2013] EWHC 2310 (Ch) Royal Courts of Justice Strand, London, WC2A 2LL Date: 22/01/2015 Before: LORD JUSTICE RICHARDS LORD JUSTICE KITCHIN and LORD JUSTICE UNDERHILL - - - - - - - - - - - - - - - - - - - - - Between: (1) Robyn Rihanna Fenty Claimants/ (2) Roraj Trade LLC Respond- (3) Combermere Entertainment Properties, LLC ents - and - (1) Arcadia Group Brands Limited Defendants/ (2) Topshop/Topman Limited Appellants - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Martin Howe QC and Andrew Norris (instructed by Reed Smith) for the Claimants/Respondents Geoffrey Hobbs QC and Hugo Cuddigan (instructed by Mishcon de Reya) for the Defendants/Appellants Hearing dates: 18/19 November 2014 - - - - - - - - - - - - - - - - - - - - - Approved Judgment Judgment Approved by the court for handing down. Fenty & Ors v Arcadia & Anr Lord Justice Kitchin: Introduction 1. These proceedings concern a complaint by Rihanna, the world famous pop star, about the sale of fashion garments bearing her image. 2. The appellants (collectively “Topshop”) own and operate the well known Topshop retail fashion stores. In 2012 Topshop began to sell in its stores and through its website a fashion t-shirt displaying a clearly recognisable image of Rihanna. The image was derived from a photograph of Rihanna which was taken when she was on a video shoot for a single from her “Talk That Talk” album. Rihanna is looking directly at the camera with her hair tied above her head with a headscarf. It is, as the judge thought, a striking image and similar images had been used by Rihanna in connection with the Talk That Talk album. -

Debenhams: the Rise and Fall of a British Retail Institution Rupert Neate

Debenhams: the rise and fall of a British retail institution Rupert Neate The Gaurdian.com 1 December 2020 Founded in 1778, Debenhams was one of the largest and most historic department store chains in the world. The business was formed by William Clark as a single high end drapers store at 44 Wigmore Street in London’s West End. It rose to become one of the biggest retailers in the UK with, at one point, more than 200 large stores across 18 countries and exclusive partnerships with some of the world’s best-known designers including Jasper Conran and Julien Macdonald. But on Tuesday, the shutters finally came down as administrators announced the chain would be wound down and all of its remaining 124 stores shut, putting potentially all of its 12,000 employees out of work. The demise of Debenhams comes just a day after Sir Philip Green’s Arcadia Group retail empire collapsed into administration, putting a further 13,000 jobs at risk. In the 1980s and 1990s both retailers had been part of the vast Burton Group, founded by Sir Montague Maurice Burton. Clark’s business remained just the single shop on Wigmore Street until 1813 when he teamed up with Suffolk businessman William Debenham, and expanded into two stores on opposite sides of the street. One was known as Debenham & Clark and the other known as Clark & Debenham. The first store outside London – and an exact replica of the original Wigmore Street shop – was opened in Cheltenham in 1818. “In the ensuing years the firm prospered from the Victorian fashion for family mourning by which widows and other female relatives adhered to a strict code of clothing and etiquette,” the company says on its website. -

1 Court of Appeal Found No Love for Topshop Tank

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by CLoK Court of Appeal found no love for Topshop tank: theimage right that dare not speak its name Susan Fletcher Senior Lecturer in Law, University of Central Lancashire Justine Mitchell Associate Lecturer in Law, University of Central Lancashire Subject:Passing Off. Other related subjects: Torts. Image rights.Personalityrights.Publicityrights.Passing off. Tradeconnections.Intellectual property. Keywords:passing off, image rights, personality rights, publicity rights, trade marks, goodwill, misrepresentation, merchandising, endorsements, English law, comparative law, unfair competition, freeriding, unjust enrichment, dilution, monopoly, social media, photograph, Rihanna, Topshop, Fenty, Arcadia Abstract:This article contains an analysis of the first instance and appeal decisions of the “Rihanna case”.In particular, the authors consider the substantive law of passing off in the context of the unauthorised use of a celebrity's image on a Topshop tank vest top. This is followed by a discussionof the consequences of the caseforcelebrities, consumers and stakeholders in theentertainmentand fashion industries. Every time you see me it's a different colour, a different shape, a different style. ....because it really...I/we just go off of instinct. Whatever we feel that very moment, we just go for it. Creatively, fashion is another world for me to get my creativity out.12 1Rihanna quote from the Talk That Talk music video available at www.youtube.com/watch?v=cVTKxwO2UnU -

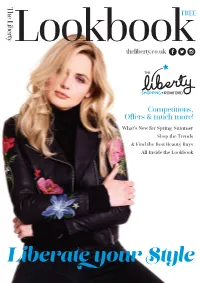

Iberate Our Style

The Liberty The FREE the theliberty.co.uk Competitions, Offers & much more! What's New for Spring/Summer Shop the Trends & Find the Best Beauty Buys All Inside the Lookbook iberate our Style The Liberty Lookbook | Spring/Summer 2017 The Liberty Store List the Accessories River Island Holland & Barrett Music Liberty The Liberty Claire’s Select Hot Shots Barbers HMV the Children Super 25 & Hairdressers Services theliberty.co.uk Abacus Superdry Kiko Milano Boots Opticians Topman Lush Euro Change Competitions, BASE Offers & much more! Topshop MET – Rx Liberty Flowers What's New for Spring/Summer Department Stores Shop the Trends & Find the Best Beauty Buys Debenhams Food & Drink Naturally Unique Post Oce (in WHSmith) All Inside the Lookbook WELCOME to The Liberty Lookbook 2017, your one-stop Marks & Spencer Beleaf Paul Falltrick Hair & Beauty Shopmobility Primark Café Liberty The Perfume Shop Sky guide to what to wear and where to shop. In the following Electrical & Phones Cake Box Purple Valentine Timpson Shoe Repair TSB BASEO Costa Coee Supercuts iberate our Style Carphone Warehouse (in Debenhams & Waterstones) Jewellery Shoes pages, you’ll find the latest looks from The Liberty stores, Clarks Chitter Chatter Debenhams Beaverbrooks Foot Locker EE El Mexicana The Diamond Shop COVER: style and beauty advice, news, exclusive offers and much more. Gingham Kitchen Ernest Jones Hotter Embroidered Jacket, New Look Fone Fusion Linzi Liberty Mobile Greggs H. Samuel Italianissimo Pandora Oce Mobile Bitz Schuh Liberty Wok Swarovski O2 Shoe Zone Stormfront -

Employment Tribunals at a Final Hearing Reserved

Case number: 2602342/2018 Reserved EMPLOYMENT TRIBUNALS BETWEEN: Claimant Respondent And Mr P Kibble Arcadia Group Limited AT A FINAL HEARING Held at: Nottingham On: 16 & 17 December 2019 and in chambers on 13 January 2020 Before: Employment Judge R Clark REPRESENTATION For the Claimant: Mr B Henry of Counsel For the Respondent: Mr S Wyeth of Counsel RESERVED JUDGMENT The judgment of the tribunal is that: - 1. The claim of breach of contract fails and is dismissed. REASONS 1. Introduction 1.1 This is a claim for damages alleging breach of contract. With effect from 9 June 2018, the claimant’s long period of employment with the respondent came to an end by reason of redundancy. He received the statutory redundancy entitlement and notice to which he was entitled under the Employment Rights Act 1996. 1 Case number: 2602342/2018 Reserved 1.2 The claimant’s claim is that those payments did not reflect the enhanced contractual entitlement he enjoyed as a result of two collective agreements made between his employer and his union, the Union of Shop, Distributive and Allied Workers (“USDAW”). The first agreement dates back to 1976 (“the 1976 agreement”). This was subject to a more recent variation in the second agreement signed off in 1996 (“the 1996 agreement”). 1.3 There is no dispute that those agreements applied to the claimant when his employment commenced in 1981 as they still did when the 1996 agreement was reached. There is no dispute that they provide for enhanced severance terms in case of redundancy and, to that extent, quantum is agreed. -

Arcadia Group Ltd

Arcadia Group Ltd Modern Slavery Act – Transparency Statement 2015/16 About this statement We are committed to sourcing our products in an ethical, legal and responsible manner. We do not tolerate forced, bonded or involuntary labour, human trafficking or any forms of slavery and are committed to taking the necessary steps to prevent it within our operations and supply chain. Our Fashion Footprint programme continues to monitor and manage the ethical, social and environmental impacts of our business. Arcadia’s Code of Conduct clearly communicates our minimum expectations to our suppliers, and our Ethical Trading programmes monitor and improve working conditions in the factories that our suppliers use to manufacture goods for us. This statement has been published in accordance with the Modern Slavery Act 2015. It sets out the steps taken by Arcadia Group Limited and its subsidiaries, during their financial year September 2015 – August 2016, to prevent modern slavery in their business operations and supply chains. It has been approved by the Board of Arcadia Group Limited and signed by Ian Grabiner, CEO of Arcadia Group Limited. About Arcadia The Arcadia Group began life in the early 1900s and is now an international business comprising of eight high street brands; Burton, Dorothy Perkins, Evans, Miss Selfridge, Outfit, Topshop, Topman and Wallis. We have 2766 outlets across the globe, consisting of owned stores, concessions and international franchise stores, as well as all our various e-commerce websites. We employ over 24,000 people globally and have three main distribution centres in the UK. We are proud of the improvements to working conditions that our Ethical Trading programme has achieved. -

A Leading Multi-Channel, International Retailer 2011 Highlights

Debenhams Annual Report and Accounts 2011 A leading multi-channel, international retailer 2011 highlights Financial highlights* Gross transaction value £2.7bn +4.5% Revenue £2.2bn +4.2% Headline profit before tax £166.1m +10.0% Basic earnings per share 9.1p +21 . 3% Dividend per share 3.0p *All numbers calculated on 53 week basis Operational highlights • Market share growth in most key categories: women’s casualwear, menswear, childrenswear and premium health & beauty • Strong multi-channel growth; online GTV up 73.8% to £180.4 million1 • Excellent performance from Magasin du Nord: EBITDA up 141.1% to £13.5m2 • Sales in international franchise stores up 16.5% to £77.0m1 • Three new UK stores opened, creating 350 new jobs • Eleven store modernisations undertaken • New ranges including Edition, Diamond by Julien Macdonald and J Jeans for Men by Jasper Conran • “Life Made Fabulous” marketing campaign introduced 1 53 weeks to 3 September 2011 2 53 weeks to 3 September 2011 vs 42 weeks to 28 August 2010 Welcome Overview Overview p2 2 Chairman’s statement 4 Market overview 6 2011 performance Chief Executive’s review New Chief Executive p8 Michael Sharp reviews the past year and sets the Strategic review strategy going forward Strategic review p8 8 Chief Executive’s review 11 Setting a clear strategy for growth 12 Focusing on UK retail 16 Delivering a compelling customer proposition 20 Multi-channel Focusing on UK retail 24 International Improving and widening Finance review p12 the brand in the UK Finance review p28 28 Finance Director’s review -

Can Arcadia Stop the Rot? As Sir Philip Green's Fashion Empire Faces Tough Times, Gemma Goldiingle and George Macdonald Analyse How It Can Turn the Corner

14 Retail Week June 16, 2017 Can Arcadia stop the rot? As Sir Philip Green's fashion empire faces tough times, Gemma Goldiingle and George MacDonald analyse how it can turn the corner ashion giant Arcadia, owner of famous One of the Arcadia brands facing the fascias such as Topshop, Evans and most competition is the jewel in its Dorothy Perkins, suffered a steep fall in crown - Topshop. profits last year. The retailer was once a haven for FThe retailer's annual report and accounts, fashion-forward young shoppers and filed at Companies House this week, showed exuded cool. that earnings took a£129.2m hit from excep- However, over the past decade tionals as onerous lease provisions and costs Zara, H&M and Primark have surged relating to the now defunct BHS had an impact. in popularity while pureplay rivals But even before such items were taken such as Asos and Boohoo are also rivalling into account, operating profit slid 16% from Topshop in the style stakes. £252.9m to £211.2m on sales down from Some industry observers believe it is no £2.07bnto£2.02bn. longer the automatic first-choice shopping Arcadia faces many of the same problems destination for its young customers. as its peers, such as changes to consumer GlobalData analyst Kate Ormrod says: spending habits and currency volatihty, as well "Online pureplays are now the first port of as some particular challenges of its own. call. They are dominating in terms of customer Arcadia said: "The retail industry continues engagement. Shoppers are on there first thing Has Topshop(above, to experience a period of major change as in the morning and last thing at night." right) lost its cool customers become ever more selective and Ormrod says that Topshop needs to do more despite attempts to value-conscious and advances in technology to engage its customers online and connect remain current? open up more diverse, fast-changing and more with popular culture. -

Super-Rich Get Richer by David Teather the Rich Keep Getting Richer

Super-rich get richer by David Teather The rich keep getting richer. According to the latest Forbes ranking of the world’s richest people, there are now a record 946 dollar billionaires around the world. They have made their money from everything from telecoms to steel to Chinese food. For the 13th year in a row, Microsoft co-founder Bill Gates was the richest person in the world. His personal fortune rose $6bn last year to $56bn (£29bn). His friend, the investment expert Warren Buffett, was the second richest. His fortune increased by $10bn during the year to reach $52bn. Both Mr Gates and Mr Buffett give a percentage of their fortunes to charity. Third richest is the Mexican telecoms entrepreneur Carlos Slim Helu, who added $19bn to his wealth, and now has $49bn. The total wealth of all the people on the list grew by 35% during the year to $3.5 trillion as a result of rising property prices, commodities and stock markets. Luisa Kroll who helped to compile the list at Forbes said it was “an extraordinary year”. On the previous list there were just 793 billionaires. The richest Briton on the list is the Duke of Westminster, Gerald Cavendish Grosvenor, at number 55. Grosvenor inherited much of his wealth and is one of the UK’s wealthiest landowners. He is said to be worth $11bn. Sir Philip Green, the retail entrepreneur who controls British Home Stores and Topshop owner Arcadia is the second richest Briton at number 104 on the list. Sir Philip, 55, has $7bn. -

The More Things Change, the More They Stay the Same

YEARS 2003-2013 Issue 15 × 2013 September 28 - October 10 YOUR FREE COPY THE ESSENTIAL GUIDE TO LIFE, TRAVEL & ENTERTAINMENT IN ICELAND NEWS POLITICS FILM MUSIC TRAVEL Jóhanna The gender-based Lots and lots of Bam brings us We let fish suck on Sigurðardóttir wage gap widens :( RIFF! “Random Hero” our toes… SPEAKS! 5 year anniversary of the collapse 2008- 2013 THE MORE THINGS CHANGE, THE MORE THEY STAY THE SAME... Complete Lots of Download the FREE Grapevine Appy Hour app! Reykjavík Listings cool events Every happy hour in town in your pocket. + Available on the App store and on Android Market. The Reykjavík Grapevine Issue 15 — 2013 2 Editorial | Anna Andersen TRACK OF THE ISSUE ICELANDISTAN 5.0 Anna’s 32nd Editorial have wreaked more havoc on this country than land in the foreign media. anything that’s not directly caused by a natural So much emphasis has been put on this (only disaster. Our economy has been reduced to the possible) course of action that Icelanders them- standards of Eastern Europe at end of the Cold selves have perhaps forgotten what else the new War. As a nation, we are more or less bankrupt.” government has done to stem the rippling effects Almost overnight, our tiny island nation in the of the crash, not to mention all of the events that middle of the North Atlantic became the poster- led up to it. This would at least explain why Ice- child for the global economic crisis—a shiny ex- landers recently returned to power the very same ample of how to do everything wrong. -

Next / / Visualthinking.Co.Uk

Research Briefing Winter 2018 Transforming the Department Store New. Updated. / Back Next visualthinking.co.uk / 1 About The very definition of the department store is in flux. Since we published our first report on mainstream department stores, the sector has seen acquisitions, restructuring and hundreds of store closures. Visual Thinking knows a thing or two about the department store What department stores will look like in the next five years is one sector. With 25 years of experience, we’ve enabled some of its question; but what about the here and now? The hard truth is that biggest names to see real and immediate breakthroughs in store retailers must balance the need for long-term strategy with the more performance. Our team of retail transformation specialists are immediate reality of poor store performance. Many do not have the dedicated to helping retailers take stores from the everyday to the luxury of time to get it right; with individual stores and even the very exceptional. Whether your focus is on game-changing methods existence of the retailer themselves under continued threat. or continuous improvement, we turn big strategy into meaningful In this report, Visual Thinking has set out to explore the current action – informing policy, embedding change, empowering teams challenges and opportunities facing our mainstream department stores and engaging shoppers. No one delivers visible change instore if they are to turnaround their commercial fortunes. Not at some point better and faster. in time, but today. For more information visit: We hope this report, supported by exclusive research conducted by www.visualthinking.co.uk Roamler and expert opinion and analysis, goes some way to answering the key questions facing the sector.