Rihanna V Topshop & Passing Off: a Love/Hate Relationship

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retail Customer Experience Benchmarking

Google’s Omnichannel Customer Experience Review Creating seamless retail experiences Businesses that succeed in the future will be the ones that figure out how to meet consumer expectations for seamless omnichannel experiences. To help businesses understand the best examples of these types of experiences, Google partnered with Practicology to review 145 retailers across seven European countries. Here we summarise the findings for the UK, where we reviewed 40 retailers. 1 SEAMLESS CUSTOMER EXPERIENCES ARE CRITICAL 82% 60% 72% 82% of smartphone users 6 in 10 internet users check whether 72% of businesses name consult their phone on purchases a product is available in a local store improving customer they are about to make in-store1 before visiting a retail location2 experience their top priority3 2 EUROPEAN RESULTS 3 RETAIL PERFORMANCE BY VERTICAL Average omnichannel CX score - by country Average omnichannel CX score in the UK - by retail (% of CX principles and criteria passed) category (% of CX principles and criteria passed) Furniture Department 52% Homeware Stores 48% 48% 47% 44% 59% 45% Electronics 49% 54% DIY Telecoms Garden 52% 54% Specialities Fashion UK FR NL SE/NO/DK DE The UK is top of the list, with retailers scoring UK department store retailers offer the particularly well in terms of offering flexible best experiences, particularly by usaging fulfillment options and providing relevant in-store technology, providing flexible store details on their website. fulfilment options and running promotions across channels. 4 PERFORMANCE BY CX PRINCIPLE UK retailers excel in offering more flexible fulfilment options than retailers in other markets. In terms of offering omnichannel customer service, there is still room for improvement. -

Robyn Rihanna Fenty and Others -V- Arcadia Group Brands Limited And

Neutral Citation Number: [2015] EWCA Civ 3 Case No: A3/2013/2087 & A3/2013/2955 IN THE COURT OF APPEAL (CIVIL DIVISION) ON APPEAL FROM THE HIGH COURT OF JUSTICE CHANCERY DIVISION INTELLECTUAL PROPERTY The Hon Mr Justice Birss [2013] EWHC 2310 (Ch) Royal Courts of Justice Strand, London, WC2A 2LL Date: 22/01/2015 Before: LORD JUSTICE RICHARDS LORD JUSTICE KITCHIN and LORD JUSTICE UNDERHILL - - - - - - - - - - - - - - - - - - - - - Between: (1) Robyn Rihanna Fenty Claimants/ (2) Roraj Trade LLC Respond- (3) Combermere Entertainment Properties, LLC ents - and - (1) Arcadia Group Brands Limited Defendants/ (2) Topshop/Topman Limited Appellants - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Martin Howe QC and Andrew Norris (instructed by Reed Smith) for the Claimants/Respondents Geoffrey Hobbs QC and Hugo Cuddigan (instructed by Mishcon de Reya) for the Defendants/Appellants Hearing dates: 18/19 November 2014 - - - - - - - - - - - - - - - - - - - - - Approved Judgment Judgment Approved by the court for handing down. Fenty & Ors v Arcadia & Anr Lord Justice Kitchin: Introduction 1. These proceedings concern a complaint by Rihanna, the world famous pop star, about the sale of fashion garments bearing her image. 2. The appellants (collectively “Topshop”) own and operate the well known Topshop retail fashion stores. In 2012 Topshop began to sell in its stores and through its website a fashion t-shirt displaying a clearly recognisable image of Rihanna. The image was derived from a photograph of Rihanna which was taken when she was on a video shoot for a single from her “Talk That Talk” album. Rihanna is looking directly at the camera with her hair tied above her head with a headscarf. It is, as the judge thought, a striking image and similar images had been used by Rihanna in connection with the Talk That Talk album. -

1 Court of Appeal Found No Love for Topshop Tank

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by CLoK Court of Appeal found no love for Topshop tank: theimage right that dare not speak its name Susan Fletcher Senior Lecturer in Law, University of Central Lancashire Justine Mitchell Associate Lecturer in Law, University of Central Lancashire Subject:Passing Off. Other related subjects: Torts. Image rights.Personalityrights.Publicityrights.Passing off. Tradeconnections.Intellectual property. Keywords:passing off, image rights, personality rights, publicity rights, trade marks, goodwill, misrepresentation, merchandising, endorsements, English law, comparative law, unfair competition, freeriding, unjust enrichment, dilution, monopoly, social media, photograph, Rihanna, Topshop, Fenty, Arcadia Abstract:This article contains an analysis of the first instance and appeal decisions of the “Rihanna case”.In particular, the authors consider the substantive law of passing off in the context of the unauthorised use of a celebrity's image on a Topshop tank vest top. This is followed by a discussionof the consequences of the caseforcelebrities, consumers and stakeholders in theentertainmentand fashion industries. Every time you see me it's a different colour, a different shape, a different style. ....because it really...I/we just go off of instinct. Whatever we feel that very moment, we just go for it. Creatively, fashion is another world for me to get my creativity out.12 1Rihanna quote from the Talk That Talk music video available at www.youtube.com/watch?v=cVTKxwO2UnU -

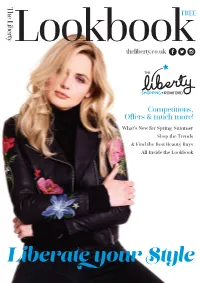

Iberate Our Style

The Liberty The FREE the theliberty.co.uk Competitions, Offers & much more! What's New for Spring/Summer Shop the Trends & Find the Best Beauty Buys All Inside the Lookbook iberate our Style The Liberty Lookbook | Spring/Summer 2017 The Liberty Store List the Accessories River Island Holland & Barrett Music Liberty The Liberty Claire’s Select Hot Shots Barbers HMV the Children Super 25 & Hairdressers Services theliberty.co.uk Abacus Superdry Kiko Milano Boots Opticians Topman Lush Euro Change Competitions, BASE Offers & much more! Topshop MET – Rx Liberty Flowers What's New for Spring/Summer Department Stores Shop the Trends & Find the Best Beauty Buys Debenhams Food & Drink Naturally Unique Post Oce (in WHSmith) All Inside the Lookbook WELCOME to The Liberty Lookbook 2017, your one-stop Marks & Spencer Beleaf Paul Falltrick Hair & Beauty Shopmobility Primark Café Liberty The Perfume Shop Sky guide to what to wear and where to shop. In the following Electrical & Phones Cake Box Purple Valentine Timpson Shoe Repair TSB BASEO Costa Coee Supercuts iberate our Style Carphone Warehouse (in Debenhams & Waterstones) Jewellery Shoes pages, you’ll find the latest looks from The Liberty stores, Clarks Chitter Chatter Debenhams Beaverbrooks Foot Locker EE El Mexicana The Diamond Shop COVER: style and beauty advice, news, exclusive offers and much more. Gingham Kitchen Ernest Jones Hotter Embroidered Jacket, New Look Fone Fusion Linzi Liberty Mobile Greggs H. Samuel Italianissimo Pandora Oce Mobile Bitz Schuh Liberty Wok Swarovski O2 Shoe Zone Stormfront -

The Aesthetics of Mainstream Androgyny

The Aesthetics of Mainstream Androgyny: A Feminist Analysis of a Fashion Trend Rosa Crepax Goldsmiths, University of London Thesis submitted for the degree of Ph.D. in Sociology May 2016 1 I confirm that the work presented in this thesis is my own. Rosa Crepax Acknowledgements I would like to thank Bev Skeggs for making me fall in love with sociology as an undergraduate student, for supervising my MA dissertation and encouraging me to pursue a PhD. For her illuminating guidance over the years, her infectious enthusiasm and the constant inspiration. Beckie Coleman for her ongoing intellectual and moral support, all the suggestions, advice and the many invaluable insights. Nirmal Puwar, my upgrade examiner, for the helpful feedback. All the women who participated in my fieldwork for their time, patience and interest. Francesca Mazzucchi for joining me during my fieldwork and helping me shape my methodology. Silvia Pezzati for always providing me with sunshine. Laura Martinelli for always being there when I needed, and Martina Galli, Laura Satta and Miriam Barbato for their friendship, despite the distance. My family, and, in particular, my mum for the support and the unpaid editorial services. And finally, Goldsmiths and everyone I met there for creating an engaging and stimulating environment. Thank you. Abstract Since 2010, androgyny has entered the mainstream to become one of the most widespread trends in Western fashion. Contemporary androgynous fashion is generally regarded as giving a new positive visibility to alternative identities, and signalling their wider acceptance. But what is its significance for our understanding of gender relations and living configurations of gender and sexuality? And how does it affect ordinary people's relationship with style in everyday life? Combining feminist theory and an aesthetics that contrasts Kantian notions of beauty to bridge matters of ideology and affect, my research investigates the sociological implications of this phenomenon. -

A Leading Multi-Channel, International Retailer 2011 Highlights

Debenhams Annual Report and Accounts 2011 A leading multi-channel, international retailer 2011 highlights Financial highlights* Gross transaction value £2.7bn +4.5% Revenue £2.2bn +4.2% Headline profit before tax £166.1m +10.0% Basic earnings per share 9.1p +21 . 3% Dividend per share 3.0p *All numbers calculated on 53 week basis Operational highlights • Market share growth in most key categories: women’s casualwear, menswear, childrenswear and premium health & beauty • Strong multi-channel growth; online GTV up 73.8% to £180.4 million1 • Excellent performance from Magasin du Nord: EBITDA up 141.1% to £13.5m2 • Sales in international franchise stores up 16.5% to £77.0m1 • Three new UK stores opened, creating 350 new jobs • Eleven store modernisations undertaken • New ranges including Edition, Diamond by Julien Macdonald and J Jeans for Men by Jasper Conran • “Life Made Fabulous” marketing campaign introduced 1 53 weeks to 3 September 2011 2 53 weeks to 3 September 2011 vs 42 weeks to 28 August 2010 Welcome Overview Overview p2 2 Chairman’s statement 4 Market overview 6 2011 performance Chief Executive’s review New Chief Executive p8 Michael Sharp reviews the past year and sets the Strategic review strategy going forward Strategic review p8 8 Chief Executive’s review 11 Setting a clear strategy for growth 12 Focusing on UK retail 16 Delivering a compelling customer proposition 20 Multi-channel Focusing on UK retail 24 International Improving and widening Finance review p12 the brand in the UK Finance review p28 28 Finance Director’s review -

Can Arcadia Stop the Rot? As Sir Philip Green's Fashion Empire Faces Tough Times, Gemma Goldiingle and George Macdonald Analyse How It Can Turn the Corner

14 Retail Week June 16, 2017 Can Arcadia stop the rot? As Sir Philip Green's fashion empire faces tough times, Gemma Goldiingle and George MacDonald analyse how it can turn the corner ashion giant Arcadia, owner of famous One of the Arcadia brands facing the fascias such as Topshop, Evans and most competition is the jewel in its Dorothy Perkins, suffered a steep fall in crown - Topshop. profits last year. The retailer was once a haven for FThe retailer's annual report and accounts, fashion-forward young shoppers and filed at Companies House this week, showed exuded cool. that earnings took a£129.2m hit from excep- However, over the past decade tionals as onerous lease provisions and costs Zara, H&M and Primark have surged relating to the now defunct BHS had an impact. in popularity while pureplay rivals But even before such items were taken such as Asos and Boohoo are also rivalling into account, operating profit slid 16% from Topshop in the style stakes. £252.9m to £211.2m on sales down from Some industry observers believe it is no £2.07bnto£2.02bn. longer the automatic first-choice shopping Arcadia faces many of the same problems destination for its young customers. as its peers, such as changes to consumer GlobalData analyst Kate Ormrod says: spending habits and currency volatihty, as well "Online pureplays are now the first port of as some particular challenges of its own. call. They are dominating in terms of customer Arcadia said: "The retail industry continues engagement. Shoppers are on there first thing Has Topshop(above, to experience a period of major change as in the morning and last thing at night." right) lost its cool customers become ever more selective and Ormrod says that Topshop needs to do more despite attempts to value-conscious and advances in technology to engage its customers online and connect remain current? open up more diverse, fast-changing and more with popular culture. -

22/02/2021 Asos Launches Expanded Topshop & Topman Range

ASOS LAUNCHES EXPANDED TOPSHOP & TOPMAN RANGE WITH TARGETED CUSTOMER AWARENESS CAMPAIGN LONDON, 22nd February 2021: ASOS, one of the world’s leading online fashion retailers, has today launched a multi-million-pound campaign targeted at Topshop and Topman customers, letting them know that they can shop their favourite brands on ASOS following their acquisition at the start of the month. The social-led campaign will run across YouTube, TikTok, Snapchat, Facebook and Instagram for two weeks from today and is targeted at driving awareness among customers in the UK, US and Germany. It coincides with the first major drops of new product from the brands on ASOS since the acquisition and marks the first moment that customers will be able to access a wider range of items on the ASOS platform. Available product has already doubled since early February, with plans in place to double it again over the next few weeks. José Antonio Ramos, Chief Commercial Officer at ASOS, said: “Topshop and Topman were well-established, strong-performing brands on ASOS prior to the acquisition, and we know our customers loved them just as much as us. Their integration with ASOS is going well, and our long-term plans to revitalise the brands and inject new life into them will translate into more new, exciting and fashion-led products launching in the months ahead.” Alongside activations and new customer discount codes in the UK and Germany, ASOS will be running 25%-off promotions for each of the brands across Europe, Australia and the US today and Tuesday, as a way of welcoming new and returning customers and inviting them to reexperience the brands. -

Silver Belle NEW YORK — Hollywood Glamour Is Always in Style

THE NEW NORTHPARK/9 FASHION’S STARRING ROLE/13 WWDWomen’s Wear DailyWEDNESDAY • The Retailers’ Daily Newspaper • May 3, 2006 • $2.00 Sportswear Silver Belle NEW YORK — Hollywood glamour is always in style. Simple, sassy and elegant party frocks are sure to liven up the coming holiday season. Here, Nanette Lepore’s silk and metallic halter dress, a Head Dress headband and Stuart Weitzman shoes. The British Invasion: Topshop Aims to Open Flagship in New York By David Moin M FRIDAY M FRIDAY NEW YORK — Get ready America: Topshop is on its way. British retail tycoon Philip Green wants to make his mark in the U.S. and SON MAKEUP; STYLED BY KI SON MAKEUP; STYLED BY a Topshop flagship could open in New York as soon as next spring. He already has his eyes on a site, but declined to reveal details beyond saying it is 60,000 to 90,000 square feet in size. “If we enter here, we’re not going to be TZ/KRAMER + KRAMER/HAKANS TZ/KRAMER low-key,” assured Green, the flamboyant billionaire owner of Arcadia, parent of Topshop, Dorothy Perkins, Burton, Miss Selfridge and department store British Home Stores. Topshop 12 E; HAIR AND MAKEUP BY SUZANNE KA E; HAIR AND MAKEUP BY See , Page PHOTO BY TALAYA CENTENO; MODEL: CECILIA/SUPREM TALAYA PHOTO BY 2 WWD, WEDNESDAY, MAY 3, 2006 WWD.COM Maria D. Lopez Resigns at St. John WWDWEDNESDAY Sportswear NEW YORK — Maria D. Lopez, who was second on a mission the past 18 months to reach a young- in command to Tim Gardner, head designer at er clientele and started experimenting with new St. -

Hand & Lock Launch New Design at Topshop Concession

For Immediate release – March 2017 Contact: Sasha Danker [email protected] 0207 580 7488 Hand & Lock 86 Margaret Street London, W1W 8TE Hand & Lock Launch New Design at Topshop Concession -Introducing The Flora Jacket- London, United Kingdom- Hand & Lock will be launching a new embroidery design at the Hand & Lock concession in Topshop, Oxford Circus in March 2017. Featuring a silver embroidered swallow and a cluster of roses in two colour variations for both dark and light denim, the design is perfectly in tune with the current trend of floral embroidery as seen on the high street and the runways of Fashion Week. Coinciding with the launch of a new line of Topshop denim, the Hand & Lock design features an element of customisation with an embroidered name in an exclusive new silver thread font thus creating a statement design ideal for the back of a denim, bomber or faux leather jacket. Hand & Lock have been producing the world’s finest hand embroidery since 1767 and specialise in embroidery and monogramming for the military, the Royal Family and fashion houses as well as creating bespoke commissions. Aptly named The Flora Jacket, the new embroidery design will feature on denim jackets to be worn by various press and bloggers to promote both the design and the new font as well the Hand & Lock Topshop Concession. Team Manager and Events Coordinator, Ella Yeoman says “We’ve created this beautiful new embroidery design in the hopes of encouraging fashion embroidery and personalisation. The Flora Jacket shows how you can really make a garment your own and having your name embroidered certainly makes a statement about you” With the expansion of design offerings, Hand & Lock are gaining popularity amongst the younger customers. -

Nordstrom and ASOS: a Game-Changing Joint-Venture

Nordstrom and ASOS: A Game-Changing Joint-Venture July 12, 2021 We're excited to announce a new joint venture with ASOS, an online retailer for fashion-loving 20-somethings around the world with a purpose to give its customers the confidence to be whoever they want to be. What the venture entails: We're acquiring a minority interest in ASOS Holdings, which holds the Topshop, Topman, Miss Selfridge and HIIT brands to help drive the growth of these brands and sit alongside a new wider strategic partnership. ASOS will retain operational and creative control of Topshop, Topman, Miss Selfridge and HIIT brands. A shared ownership model with a Nordstrom seat on the ASOS Holdings board will ensure close collaboration between us and ASOS, driving a stronger future for the iconic Topshop, Topman, Miss Selfridge and HIIT brands worldwide. We will now have the exclusive multi-channel retail rights for Topshop and Topman in all of North America, including Canada and own a minority stake globally. We will also become the only brick-and-mortar presence for these brands worldwide. Why this is a big deal: President and Chief Brand Officer Pete Nordstrom said it best, "We could not have found a better partner in ASOS, the world leader in fashion for the 20-something customer, and are thrilled to have the opportunity to work with them to reimagine the wholesale/retail partnership. Bringing the ASOS brands, including Topshop and Topman, to our customers allows us to create newness and excitement and offer more relevant products to this dynamic customer segment so we can continue to deliver on our commitment to help them feel good and look their best." This investment will help drive the growth of these brands globally, setting the stage for us and ASOS to sit alongside a new wider strategic partnership. -

Zalando Brand Diaries with Polo Ralph Lauren, Topshop, Levi's

PRESS RELEASE // BRAND DIARIES ZALANDO BRAND DIARIES WITH POLO RALPH LAUREN, TOPSHOP, LEVI’S BERLIN, 22ND OCTOBER 2015 // Zalando launches Brand Diaries: three brands, three ambassadors and three stories. Following in the footsteps of the Share Your Style campaign, where influencers such as Lucky Blue Smith and Caroline de Maigret shared their style insights, Zalando launches Brand Diaries - a video series featuring Polo Ralph Lauren, TOPSHOP and Levi's®. Europe’s biggest online platform for fashion invited key representatives of these three iconic fashion brands to talk about their style in the context of a different city: New York, London and San Francisco. From left to right: Adam Gallagher (Polo Ralph Lauren), Jacqui Markham (TOPSHOP), Jonathan Cheung (Levi´s®) To portrait Polo Ralph Lauren, the American heritage brand selected international men’s influencer Adam Gallagher. Exclusively for the Brand Diaries, Adam talks about his career, style evolution as well as the influence New York has on his lifestyle. Working out in Washington Square Park, admiring the Flatiron building or getting a quick coffee at Ralph’s Café are just a few of the things that contribute to Adam’s style. His modern gentleman and dapper looks, in photoshoots taken next to iconic NYC landmarks, accentuate the current Polo Ralph Lauren collection for men. TOPSHOP Global Design Director, Jacqui Markham, reveals how London and British style inspires the brand’s collections, what her exciting job entails, whose style she admires and how she’d describe her own personal style. In her closing words Jacqui says: “fashion should not be serious. It is about having fun, just experiment”.