Austin Office Marketbeat Cushman & Wakefield

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

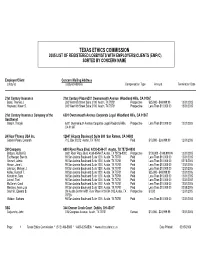

Texas Ethics Commission 2008 List of Registered Lobbyists with Employers/Clients (Emp/C) Sorted by Concern Name

TEXAS ETHICS COMMISSION 2008 LIST OF REGISTERED LOBBYISTS WITH EMPLOYERS/CLIENTS (EMP/C) SORTED BY CONCERN NAME Employer/Client Concern Mailing Address Lobbyist Lobbyist Address Compensation Type Amount Termination Date 0S Consulting LLC 3232 McKinney Avenue Suite 1400 Dallas, TX 75204 Saenz, Luis J. 1115 San Jacinto Blvd. Suite 275 Austin, TX 78701 Prospective $25,000 - $49.999.99 12/31/2008 24 Hour Fitness USA Inc. 12647 Alcosta Boulevard Suite 500 San Ramon, CA 94583 Bascombe, Bennett E. P.O. Box 50272 Austin, TX 78763 Paid Less Than $10,000.00 12/10/2008 Goodell-Polan, Deborah P.O. Box 50272 Austin, TX 78763 Paid Less Than $10,000.00 12/31/2008 2428 Partners L.P. 1406 Camp Craft Road Suite 222 Austin, TX 78746 Collins, Sharlene N. 100 Congress Avenue Suite 1300 Austin, TX 78701 Paid $10,000 - $24,999.99 12/31/2008 3 Pickwick LLC Three Pickwick Plaza Suite 400 Greenwich, CT 06830 Goodell-Polan, Deborah P.O. Box 50272 Austin, TX 78763 Paid Less Than $10,000.00 04/10/2008 3M Company 3M Center Building 225-5S-08 St. Paul, MN 55144-1000 Cariveau, Lisa 919 Congress Avenue Suite 950 Austin, TX 78701 Paid Less Than $10,000.00 10/10/2008 Eschberger, Brenda 919 Congress Avenue Suite 950 Austin, TX 78701 Paid Less Than $10,000.00 12/31/2008 Johnson, Michael J. 919 Congress Avenue Suite 950 Austin, TX 78701 Paid Less Than $10,000.00 12/31/2008 Kelley, Russell T. 919 Congress Avenue Suite 950 Austin, TX 78701 Paid $10,000 - $24,999.99 12/31/2008 Kemptner, Sara 919 Congress Avenue Suite 950 Austin, TX 78701 Paid Less Than $10,000.00 12/31/2008 Luttrell, Toni 919 Congress Avenue Suite 950 Austin, TX 78701 Paid Less Than $10,000.00 12/31/2008 McGarah, Carol 919 Congress Avenue Suite 950 Austin, TX 78701 Paid $25,000 - $49.999.99 12/31/2008 Waldon, Barbara 919 Congress Avenue Suite 950 Austin, TX 78701 Paid Less Than $10,000.00 12/31/2008 4600 Texas Group Inc. -

Aarhus Business College - OAAP Fall 2019 Global Learning Program

Aarhus Business College - OAAP Fall 2019 Global Learning Program Texas Longhorns with elite genetics can often fetch $40,000 or more at auction with the record of $170,000 in recent history for a cow. Table of Contents Welcome to Texas Pg 3 Laws in a Foreign Country Pg 5 Important Information Pg 6 Campus Map Pg 7 Your Home Away from Home Pg 8 – 10 What’s Nearby/Areas of Interest Pg 11 – 15 Course Outlines/Instructor Bios Pg 18 – 26 Guest Speaker Series/Speaker Bios Pg 27 – 31 Corporate Site Visits, Excursions and Tours Pg 32 – 36 Handy Texas Phrases Pg 41 – 42 Notes Pg 43 Program Schedule Pg 44 - 45 Welcome to Texas! People QuickFacts Texas USA Population, 2016 estimate 28,304,596 325,719,178 Persons under 18 years, percent, 2016 26.0% 22.6% Persons 65 years and over, percent, 2016 12.3% 15.6% Female persons, percent, 2016 50.3% 50.8% White alone, percent, 2016 79.2% 76.6% Black or African American alone, percent, 2016 12.7% 13.4% American Indian and Alaska Native alone, percent, 2014 1.0% 1.3% Asian alone, percent, 2016 5.0% 5.8% Native Hawaiian and Other Pacific Islander alone, percent, 2016 0.1% 0.2% Hispanic or Latino, percent, 2016 38.8% 17.6% You Are Here Language other than English spoken at home, pct age 5+, 2012-2016 35.2% 21.1% High school graduate or higher, percent of persons age 25+, 2012-2016 82.3% 87.0% Bachelor's degree or higher, percent of persons age 25+, See how Texas 2012-2016 28.1% 30.3% compares to the US Median household income, 2012-2016 $54,727 $55,322 Persons below poverty level, percent, 2012-2016 14.7% 12.3% United States Census Bureau - census.gov Enjoy Austin! Hike and Bike Trail at Lady Bird Lake And… Please follow the rules! Texas State Capitol Building Austin, Texas LAWS IN A FOREIGN COUNTRY WHILE VISITING AUSTIN, TEXAS, YOU ARE SUBJECT TO ITS LAWS AND REGULATIONS. -

31295010060639.Pdf (4.945Mb)

ADAPTIVE REUSE PROJECT OF THE TIPS IRON AN STEEL BUILDING FOR A CULTURAL CENTER Presented to: Professor W. Lawrence Garvin Division of Architecture Texas Tech University In part i a 1 fu1f i11ment of the requirements for the degree of Bachelor of Architecture by: Catherine Nored Schaffer June 24, 1985 DEDICATION I wish to dedicate this program to my husband, Tony. Thank you, Tony, for your loving support, prayers, and under stand i ng. ACKNOWLEOQHENTS I wish to thank all of my family for their support and guidance. To my father and mother a special thanks for making my goals and dreams possible and also to my sisters for their love and faith in me. n TABLE OF CONTENTS Page Ded i cat i on ,- Acknow1edgments 1 1 GOALS AND OBJECTIVES 1 BACKGROUND 3 Project Statement 4 Project Justification 6 Definition of Conservation - Techniques .... 8 Cultural Malls in Historical Environments ... 10 Background and Location of Austin 11 History of the Tips Iron and Steel Building . 20 The Existing BuiIding 22 New Growth and Its Effects 26 Conclusion 34 Endnotes 36 m IV Eaa» ACTIVITY ANALYSIS 38 Introduction 39 The Retai1 Environment 39 The Office Environment 43 Museum Environment 44 Social Environment 45 Conclusion 49 Reference List 50 Public Activities 5 1 Retai1 Activities 64 Office Activities (Administrative) 79 Leasable Office Activities 85 Museum Activities 89 Endnotes 96 SITE ANALYSIS 97 Introduction 98 Images 103 Zoning 103 Utilities 103 Soil 103 CI imate 107 Topography 109 Conclusion 109 Endnotes 112 SPACE SUMMARY 113 Reference List 114 Leasable Retail Space 116 Office Spaces 120 Museum Spaces 123 Public Spaces 126 Net to Gross Conversions 127 Total Existing Building Net Square Footage . -

Austin's Office Market Is Fast, Competitive and Expensive

Research & Forecast Report AUSTIN | OFFICE Q2 2018 Austin’s office market is fast, competitive and expensive Kaitlin Holm Research and Marketing Coordinator | Austin Boots On The Ground Commentary by David Bremer Future Forecast Our “Boots on the Ground” viewpoint is the voice of our experts, who If the rumor mill is correct, there are some more big deals coming have broken down the market data and compared it to what they are down the pipeline. Our market has been waiting patiently for new seeing for themselves. This is their take on what the numbers actually product to come to market in order to provide some breathing mean for the Austin office market. room, but as we get closer to buildings being delivered (Domain, North, East) and beginning construction (CBD), we’re hearing about Austin’s current office market can be summed up in three words: big corporate users preleasing space. We’ll give you a hint: Look at fast, competitive and expensive. While absorption decreased and the big users that have been taking down space for the past 3 years vacancy went up slightly in the second quarter, the market has and expect more of the same. We don’t think much of the space been extremely busy in comparison to past summer slowdowns. that is set to deliver over the next two years will deliver free and Rates and operating expenses have continued to trend upward, clear. As long as we don’t see a tech bust, we feel that the market primarily due to skyrocketing taxes. We are seeing competition is going to remain fast, competitive and expensive. -

COVID-19 Office Impact Report: Downtown Austin, Texas

September 2020 COVID-19 Office Impact Report Downtown Austin, Texas Introduction COVID-19 has temporarily changed almost every aspect This report has identified three important trends to our lives, including how we work, but it remains to be watch in the coming year or so that could impact our seen how much will change permanently. The primary office market. First, will the office market downtown purpose of this report is to lay the research groundwork absorb the record amount of office space currently necessary to understand the potential impact COVID-19 under construction and scheduled to deliver in the next will have on the downtown office market. The report will twelve months? Second, when will leasing activity in be updated periodically and may evolve to include new downtown rebound and return to pre-COVID-19 levels? trends should they arise. Finally, how will the sublease market evolve as all of this unfolds? While these questions remain unanswered, it is It's important to note that prior to the pandemic our important to monitor the trends to better understand downtown office market boasted extremely strong levels of impact and possible paths to recovery. market fundamentals. This will undoubtedly help. At the end of 2019 (Q4) our office space vacancy rate stood at 5.4% and had remained below 10% since the second quarter of 2011. The pandemic has already ticked that up to 8.2% and is expected to increase in the near future. With consistent occupancy rates and steadily growing rents, no one is surprised that developers have responded with project after project producing new inventory year after year. -

Texas Ethics Commission 2006 List of Registered Lobbyists with Employers/Clients (Emp/C) Sorted by Concern Name

TEXAS ETHICS COMMISSION 2006 LIST OF REGISTERED LOBBYISTS WITH EMPLOYERS/CLIENTS (EMP/C) SORTED BY CONCERN NAME Employer/Client Concern Mailing Address Lobbyist Lobbyist Address Compensation Type Amount Termination Date (OSI) EYETECH Inc 3 Times Square 12th Floor New York, NY 10036 Catron, Marsha 1001 Congress Ave Suite 100 Austin, TX 78701 Prospective Less Than $10,000.00 12/31/2006 Gonzalez, Luis E. 1001 Congress Avenue Suite 100 Austin, TX 78701 Prospective $50,000 - $99,999.99 12/31/2006 McPartland Matz, Laura 1001 Congress Avenue Suite 100 Austin, TX 78701 Prospective $50,000 - $99,999.99 12/31/2006 Santos, Frank R. 1001 Congress Avenue Suite 100 Austin, TX 78701 Prospective $50,000 - $99,999.99 12/31/2006 21st Century Insurance Company of the , TX Southwest Sandin, Tracyle 6301 Owensmouth Avenue Corporate Legal Woodland Hills, Prospective Less Than $10,000.00 12/31/2006 CA 91367 24 Hour Fitness USA Inc. 12647 Alcosta Boulevard Suite 500 San Ramon, CA 94583 Goodell-Polan, Deborah P.O. Box 50272 Austin, TX 78763 Paid Less Than $10,000.00 12/31/2006 2428 Partners L. P. 5400 LBJ Freeway Suite 1560 Dallas, TX 75240 Brown, J. E. Buster P.O. Box 426 Austin, TX 78767 Prospective $25,000 - $49.999.99 12/31/2006 2428 Partners LP 5400 LBJ Freeway Suite 1560 Dallas, TX 75240 Phenix, William G. P.O. Box 684551 Austin, TX 78768-4551 Prospective Less Than $10,000.00 12/31/2006 3M Company 3M Center Building 225-5S-08 St. Paul, MN 55144-1000 Eschberger, Brenda 98 San Jacinto Boulevard Suite 1200 Austin, TX 78701 Paid Less Than $10,000.00 12/31/2006 Johnson, Michael J. -

Austin's Office Market Starts the Year Slow, but Steady

Research & Forecast Report AUSTIN | OFFICE Q1 2018 Austin’s office market starts the year slow, but steady Kaitlin Holm Research and Marketing Coordinator | Austin Boots On The Ground Commentary by David Bremer Future Forecast Our “Boots on the Ground” view point is the voice of our experts, who Our recent forecasts have been correct and remain the same for have broken down the market data and compared it to what they are the next quarter; relatively flat rates with small increases only in seeing for themselves. This is their take on what the numbers actually prime markets, no meaningful over-delivery to help solve demand mean for the Austin office market. issues, etc. We’ve started to see some taxes come in for 2018 and unfortunately it seems the City of Austin is keeping the pedal to When you look at the numbers, the office market was relatively the metal. This may actually force some Landlords to lower rates flat in Q1 2018. Absorption was negligible, vacancy trended up to be competitive, but won’t actually help tenants’ bottom lines. slightly and rates increased. Our team believes that this “lack of Construction pricing seems to have leveled out which should hold activity” was based primarily on standard cyclical activity (i.e. improvement allowances steady. Lastly, we expect competition for lack of moves and deal-push over the holidays). On the ground, prime central space to remain strong as more and more national however, we’ve seen an uptick of activity and are tracking a large credit worthy tenants (without the same pricing sensitivities) grow. -

Austin Office MARKETWATCH Report Is a Monthly Report Prepared by Transwestern That Tracks Market Statistics for the Austin MSA

REAL ESTATE OUTLOOK AUSTIN OFFICE MARKET WATCH JUNE 2017 Recent Office Leases OFFICE LEASE STATISTICS :: VACANCY & RENTAL RATE 25.0%25.0% $36.00$36.00 Northwest :: Hays Software (renew) GROSS RENT PSF ($) VACANCY (%) 11,110 SF at Riata Gateway 20.0%20.0% $32.00$32.00 Northwest :: Fathom Water Mgmt (subls) 15.0%15.0% $28.00 14,053 SF at Riata Corporate Park 7 $28.00 10.0%10.0% $24.00 CBD :: Dykema Gosset $24.00 5.0%5.0% 10,891 SF at One Eleven Congress 0.0% $20.00 0.0% QTD $20.00 10 11 12 13 14 15 16 17 Central :: Cobb Fendley & Assoc. 16,444 SF at Centennial Towers All office buildings larger than 25,000 SF excluding government, medical, user campuses and office condos. Office Sales Statistics Recent Office Sales AUSTIN AUSTIN U.S. TRAILING AUSTIN QUARTER TRAILING U.S. 12 MO. Q1 2017 TO DATE 12 MO. Q1 2017 Southwest :: Capital Ridge Volume ($ Mil) $2,842.3 $539.9 $123.5 $139,691 $28,758.5 320 S. Capital of Texas Highway No. of Properties 77 14 5 5,769 1,428 217,000 SF 7 story Class A office building Buyer: GLL Real Estate Partners Total SF 9,849,227 2,036,349 354,064 583,995,689 124,764,923 Seller: Miller Global JV Riverside Resources Average Price/SF $299 $341 $382 $253 $246 Average Cap Rate (Yield) 6.3% 5.4% N/A 6.6% 6.7% SOURCE: Real Capital Analytics Monthly Office Lease Statistics By Submarket NO. -

Austin Fire Department Subject Guide

Austin Fire Department Subject Guide Sources of Information Relating to Austin Fire Department Austin History Center Austin Public Library Compiled by Rusty Heckaman, Bob Rescola, and Toni Cirilli, 2019 The purpose of the Austin History Center is to provide customers with information about the history and current events of Austin and Travis County by collecting, organizing, and preserving research materials and assisting in their use. INTRODUCTION The collections of the Austin History Center contain valuable research materials that document the Austin Fire Department. The materials in this resource guide are arranged by format, including textual and photographic items as well as audio and video. Austin Fire Department Subject Guide 1 Table of Contents INTRODUCTION ........................................................................................................................................... 1 BRIEF OVERVIEW OF AUSTIN FIRE DEPARTMENT .................................................................... 3 ARCHITECTURAL ARCHIVES COLLECTION .................................................................................... 4 ARCHIVES AND MANUSCRIPTS COLLECTION ............................................................................... 6 OVERSIZE ARCHIVES ................................................................................................................................. 8 AUSTIN FILES – SUBJECT: TEXT AND PHOTOGRAPHS ............................................................ 10 AUSTIN FILES – BIOGRAPHY: TEXT AND -

Northwest Austin

Spring :: 1Q 2013 Austin Publication Date: April 2013 Office Market Overview The Austin Office Market Overview is a quarterly publication prepared by Transwestern Austin for our clients. If you would like receive copies of this publication on a quarterly basis, please contact any of our senior team members below, or send an email request to [email protected]. Transwestern Austin 901 South MoPac Expressway Building 4, Suite 250 Austin, Texas 78746 512.328.5600 www.transwestern.net/austin Transwestern Austin Kevin Roberts, President | Southwest (713) 270.3347 [email protected] Robert Gaston, Executive Vice President | Central Texas (512) 314.3554 [email protected] Becky Doolin, CPA, Senior Vice President | Financial Services (512) 314.3575 [email protected] Agency Leasing and Tenant Advisory Mike Brown, Senior Vice President (512) 314.3552 [email protected] Britt Reed, Senior Vice President (512) 314.3577 [email protected] Greg Johnson, Vice President (512) 314.3570 [email protected] Luke Wheeler, Vice President (512) 314.3553 [email protected] Brandon Lester, Associate Vice President (512) 314.3576 [email protected] Will Stewart, Senior Associate (512) 314.3574 [email protected] Central Texas Multifamily Services Jeff Rogers, Managing Director (512) 314.5207 [email protected] Chris Stutzman, Managing Director (512) 314.5203 [email protected] Development Services Ty Puckett, Executive Vice -

Austin Sublease Report

For More Information, Matt Watson 512 699 2104 1 500 W 2nd St Location: CBD Cluster Building Type: Class A Office CBD Submarket Travis County Status: Built 2017 Austin, TX 78701 Stories: 29 RBA: 509,376 SF Typical Floor: 17,414 SF Developer: The Beck Group Total Avail: 46,187 SF % Leased: 100% Management: CBRE Recorded Owner: Gw Block 23 Office Llc Expenses: 2019 Tax @ $13.26/sf; 2019 Ops @ $14.86/sf, 2015 Est Ops @ $14.89/sf Parcel Number: 01050010010000 Parking: 800 Covered Spaces are available; Ratio of 2.00/1,000 SF Amenities: Balcony, Conferencing Facility, Fitness Center, Property Manager on Site, Shower Facilities Floor SF Avail Floor Contig Bldg Contig Rent/SF/Yr + Svs Occupancy Term Type P 17th / Suite 1750 10,135 10,135 10,135 Withheld Vacant Negotiable Sublet For more information contact Matt Watson @ 512 699 2104 [email protected] Copyrighted report licensed to Austin Office Space, Inc - 84170. Page 1 For More Information, Matt Watson 512 699 2104 2 515 Congress Ave - 515 Congress - 6th & Congress Location: 515 Congress Building Type: Class A Office CBD Cluster CBD Submarket Status: Built 1974 Travis County Stories: 26 Austin, TX 78701 RBA: 263,058 SF Typical Floor: 14,000 SF Developer: - Total Avail: 49,554 SF % Leased: 84.9% Management: Stream Realty Partners, LP Recorded Owner: - Expenses: 2019 Tax @ $12.11/sf; 2014 Combined Est Tax/Ops @ $15.14/sf Parcel Number: 02060306160000 Parking: 340 Covered Spaces @ $195.00/mo; Ratio of 1.77/1,000 SF Amenities: 24 Hour Access, Banking, Bicycle Storage, Conferencing Facility, Fitness Center, Property Manager on Site, Restaurant, Shower Facilities Floor SF Avail Floor Contig Bldg Contig Rent/SF/Yr + Svs Occupancy Term Type P 19th / Suite 1900 5,568 5,568 5,568 $33.60/n Vacant Thru Mar 2022 Sublet For more information contact Matt Watson @ 512 699 2104 [email protected] Copyrighted report licensed to Austin Office Space, Inc - 84170. -

C:\Lobby Reports to Post on Web Page\Latest 2005 Reports

TEXAS ETHICS COMMISSION 2005 LIST OF REGISTERED LOBBYISTS WITH EMPLOYERS/CLIENTS (EMP/C) SORTED BY CONCERN NAME Employer/Client Concern Mailing Address Lobbyist Lobbyist Address Compensation Type Amount Termination Date 21st Century Insurance 21st Century Plaza 6301 Owensmouth Avenue Woodland Hills, CA 91367 Bond, Thomas J. 300 West 6th Street Suite 2100 Austin, TX 78701 Prospective $25,000 - $49.999.99 12/31/2005 Haywood, Karen S. 300 West 6th Street Suite 2100 Austin, TX 78701 Prospective Less Than $10,000.00 12/31/2005 21st Century Insurance Company of the 6301 Owensmouth Avenue Corporate Legal Woodland Hills, CA 91367 Southwest Sandin, Tracyle 6301 Owensmouth Avenue Corporate Legal Woodland Hills, Prospective Less Than $10,000.00 12/31/2005 CA 91367 24 Hour Fitness USA Inc. 12647 Alcosta Boulevard Suite 500 San Ramon, CA 94583 Goodell-Polan, Deborah P.O. Box 50272 Austin, TX 78763 Paid $10,000 - $24,999.99 12/31/2006 3M Company 6801 River Place Blvd. A130-05-N-07 Austin, TX 78726-9000 Bridges, Russell B. 6801 River Place Blvd. A130-05-N-07 Austin, TX 78726-9000 Prospective $100,000 - $149,999.99 12/31/2005 Eschberger, Brenda 98 San Jacinto Boulevard Suite 1200 Austin, TX 78701 Paid Less Than $10,000.00 12/31/2005 Grunert, Jaimie 98 San Jacinto Boulevard Suite 1200 Austin, TX 78701 Paid Less Than $10,000.00 02/18/2005 Hixson, Jana L. 98 San Jacinto Boulevard Suite 1200 Austin, TX 78701 Paid Less Than $10,000.00 12/31/2005 Johnson, Michael J. 98 San Jacinto Boulevard Suite 1200 Austin, TX 78701 Paid Less Than $10,000.00 12/31/2005 Kelley, Russell T.