051820 Tractor Supply

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Williamson 101 - Nashville’S Suburban Office Market

WILLIAMSON 101 - NASHVILLE’S SUBURBAN OFFICE MARKET - Nashville Williamson County 2014 Easiest US County to Live in - Williamson County #10 2014 Fastest-growing American Cities - Franklin #14 New York Times Washington Post 2012, 2013 & 2014 Best High Schools in Tennessee 2014 Top 10 Best Cities for Kids - Brentwood #7 US News & World Report Livability.com 2012, 2013 & 2014 Most Business Friendly City in Tennessee 2013 Top Booming Suburbs in America - Brentwood #7 Beacon Center of Tennessee Coldwell Banker #1 in Land Trust Preservation in TN 2013 - Williamson County 2014 Greatest Southern Towns - Franklin #1 Land Trust for Tennessee Garden & Gun Where STRATEGIC Growth is the Point. With a highly educated workforce, an excellent public school system and a range of lifestyle choices, Williamson County is home to a diverse business community - from 40 corporate headquarters to thousands of small-shop entrepreneurs. Eleven of the largest 25 publicly traded companies in the Nashville region are located in the county, which also claims a third of the fastest-growing companies in the entire state. As a result of this dynamic business environment, Williamson County is a leader in the Southeast in population growth, employment growth and per capita income growth. More than 6,000 businesses span diverse industries, led by healthcare, technology, entertainment and manufacturing. Corporate headquarters include Nissan North America, Mars Petcare, Tractor Supply Company and Community Health Systems. Large, class A business parks provide an array of modern workspaces, and more major mixed-use development projects now are underway. Small-town and uniquely refurbished office options are popular in the historic downtown Franklin area and in the county’s other community-focused cities and towns of Brentwood, Fairview, Nolensville, Spring Hill and Thompson’s Station. -

Nashville's Tech Best Announced at 12Th Annual NTC

NTC PRESS RELEASE EMBARGOED UNTIL THE CONCLUSION OF NTC AWARDS ON THURSDAY, 7PM CDT ON APRIL 15, 2020 FOR IMMEDIATE RELEASE: THURSDAY, APRIL 15 at 7:00pm CST Nashville’s Tech Best Announced at 12th Annual NTC Awards The Greater Nashville Technology Council announced the winners of the 12th Annual NTC Awards, live broadcast from Stage Post Studios to hundreds of online attendees on Thursday evening. This was the first time the event was a hybrid in-person and virtually webcast program. The event, co-hosted by Brian Moyer, CEO and President of the Greater Nashville Technology Council, and Derek Young, corporate leader, community leader, and author, brought together more than 400 registered virtual attendees — representing more than 97 technology companies and related organizations in Middle Tennessee. All were present to celebrate this year’s technology champions in fifteen categories, including two new awards: Diversity and Inclusion Advocate of the Year and Technology Educator of the Year. “This past year presented challenges for our region and country that we never could have anticipated. And through it all, the greater Nashville tech community continued to shine by giving freely to assist those in need, by innovating to solve problems, and by protecting and supporting our local tech workforce,” said Brian Moyer. “For twelve years, the NTC Awards has recognized the people that make Nashville the destination for creative and innovative technology, and contributing to Middle Tennessee’s growth and prosperity. This year, it felt all the more important to celebrate our region’s tech leaders and their impactful work.” This year’s NTC Awards winners are listed below. -

Healthcare Transactions: Year in Review

HEALTHCARE TRANSACTIONS: YEAR IN REVIEW JANUARY 2019 bassberry.com OVERVIEW 2018 marked a year of continued robust healthcare merger and acquisition activity, with deal volume surpassing that of 2017. The dollar volume of healthcare deals also exceeded 2017, highlighted by CVS Health Corp. (NYSE: CVS) surviving regulatory scrutiny and finalizing its purchase of Aetna for $69 billion, and Cigna (NYSE: CI) closing its $67 billion merger with pharmacy benefit manager Express Scripts (Nasdaq: ESRX). Private equity firm KKR & Co. Inc. (NYSE: KKR) acquired Envision Healthcare Corporation (NYSE: EVHC) in a going private transaction for $9.9 billion; and in November, LifePoint Health, Inc. (Nasdaq: LPNT) merged with Apollo Global Management-owned RCCH HealthCare Partners for an estimated $5.6 billion. Not only do these deals show the energy of the industry, but they also represent a seismic shift in healthcare. Cross-sector transactions, such as the CVS-Aetna and Cigna-Express Scripts transactions, are becoming more frequent and disrupt traditional industry models. By seeking alliances across industry lines, healthcare companies aim both to reduce costs and improve care coordination as well as realign incentives to better meet consumer demands. As providers fight to stay profitable in the wake of value-based reimbursement, these cross-sector combinations may foreshadow the future of the healthcare industry. Many of these same drivers also have led to increasing private equity investment in the industry. The need for innovation and disruption via consolidation adds further appeal to investors. The injection of capital by private equity firms allows healthcare providers to cut costs and increase efficiencies, and the shift in reimbursement presents a unique opportunity for firms to help providers and systems reposition. -

Regional Economic Development Guide Tabletable of Contents

NASHVILLEREGIONAL ECONOMIC DEVELOPMENT GUIDE TABLETABLE OF CONTENTS Location 4 - 6 Economy 7 - 9 Accessibility & Transportation 10 - 11 International Business 12 - 15 Demographics 16 - 17 Talent & Workforce 18 - 25 Target Industries 26 - 27 Corporate Services 28 - 29 Health Care Management 30 - 32 Information Technology 33 - 35 Music & Entertainment 36 - 37 Advanced Manufacturing 38 - 39 Distribution & Trade 40 - 41 Livability 42 - 46 Contact Us 47 2 - TABLE OF CONTENTS TABLE OF CONTENTS - 3 LOCATIONLOCATION NASHVILLE Strategically located in the heart of the Tennessee Valley, the Nashville region is where businesses thrive and the creative spirit resonates across industries and communities. The Nashville economic market has 10 counties and a population of more than 1.9 million, making it the largest metro area in a five-state region. Many corporate headquarter giants call Nashville home, including Nissan North America, Bridgestone Americas, Dollar General, HCA Healthcare, AllianceBernstein, and Amazon. A national hub for the creative class, Nashville has the largest concentration of the music industry per capita in America. The Nashville region’s educated workforce not only provides an abundant talent pool for companies, but also bolsters the region’s vibrancy, artistic and musical essence, and Portland Springfield competitive edge in technology and Clarksville White Robertson House innovation. The Nashville region is Montgomery Sumner defined by a diverse economy, low Gallatin cost of living and doing business, a Goodlettsville Cheatham Hendersonville creative culture and a well-educated Ashland City population. Cultural diversity, unique neighborhoods, a variety of industries Charlotte Mt. Juliet Lebanon Davidson Wilson and a thriving creative community make Dickson Nashville Nashville’s economic market among the Dickson nation’s best locations for relocating, Brentwood La Vergne expanding and startup companies. -

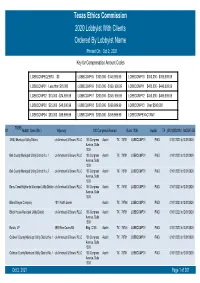

Texas Ethics Commission 2020 Lobbyist with Clients Ordered by Lobbyist Name Printed on Oct 2, 2021 Key for Compensation Amount Codes

Texas Ethics Commission 2020 Lobbyist With Clients Ordered By Lobbyist Name Printed On Oct 2, 2021 Key for Compensation Amount Codes LOBBCOMPEQZERO $0 LOBBCOMP05 $100,000 - $149,999.99 LOBBCOMP10 $350,000 - $399,999.99 LOBBCOMP01 Less than $10,000 LOBBCOMP06 $150,000 - $199, 999.99 LOBBCOMP11 $400,000 - $449,999.99 LOBBCOMP02 $10,000 - $24,999.99 LOBBCOMP07 $200,000 - $249, 999.99 LOBBCOMP12 $450,000 - $499,999.99 LOBBCOMP03 $25,000 - $49,000.99 LOBBCOMP08 $250,000 - $299,999.99 LOBBCOMP13 Over $500,000 LOBBCOMP04 $50,000 - $99,999.99 LOBBCOMP09 $300,000 - $349,999.99 LOBBCOMPEXACTAMT 70358 #1 Abbott, Sean (Mr.) Attorney 100 Congress Avenue Suite 1300 Austin TX (512)4352334 MODIFIED 3 B&J Municipal Utility District c/o Armbrust & Brown, PLLC 100 Congress Austin TX 78701 LOBBCOMP01 PAID 01/01/2020 to12/31/2020 Avenue, Suite 1300 Bell County Municipal Utility District No. 1 c/o Armbrust & Brown, PLLC 100 Congress Austin TX 78701 LOBBCOMP01 PAID 01/01/2020 to12/31/2020 Avenue, Suite 1300 Bell County Municipal Utility District No. 2 c/o Armbrust & Brown, PLLC 100 Congress Austin TX 78701 LOBBCOMP01 PAID 01/01/2020 to12/31/2020 Avenue, Suite 1300 Berry Creek Highlands Municipal Utility District c/o Armbrust & Brown, PLLC 100 Congress Austin TX 78701 LOBBCOMP01 PAID 01/01/2020 to12/31/2020 Avenue, Suite 1300 Blake Magee Company 1011 North Lamar Austin TX 78704 LOBBCOMP01 PAID 01/01/2020 to12/31/2020 Block House Municipal Utility District c/o Armbrust & Brown, PLLC 100 Congress Austin TX 78701 LOBBCOMP01 PAID 01/01/2020 to12/31/2020 Avenue, Suite 1300 Bonzo, LP 3939 Bee Caves Rd. -

Private Equity Buyouts in Healthcare: Who Wins, Who Loses? Eileen Appelbaum and Rosemary Batt Working Paper No

Private Equity Buyouts in Healthcare: Who Wins, Who Loses? Eileen Appelbaum* and Rosemary Batt† Working Paper No. 118 March 15, 2020 ABSTRACT Private equity firms have become major players in the healthcare industry. How has this happened and what are the results? What is private equity’s ‘value proposition’ to the industry and to the American people -- at a time when healthcare is under constant pressure to cut costs and prices? How can PE firms use their classic leveraged buyout model to ‘save healthcare’ while delivering ‘outsized returns’ to investors? In this paper, we bring together a wide range of sources and empirical evidence to answer these questions. Given the complexity of the sector, we focus on four segments where private equity firms have been particularly active: hospitals, outpatient care (urgent care and ambulatory surgery centers), physician staffing and emergency * Co-Director and Senior Economist, Center for Economic and Policy Research. [email protected] † Alice H. Cook Professor of Women and Work, HR Studies and Intl. & Comparative Labor ILR School, Cornell University. [email protected]. We thank Andrea Beaty, Aimee La France, and Kellie Franzblau for able research assistance. room services (surprise medical billing), and revenue cycle management (medical debt collecting). In each of these segments, private equity has taken the lead in consolidating small providers, loading them with debt, and rolling them up into large powerhouses with substantial market power before exiting with handsome returns. https://doi.org/10.36687/inetwp118 JEL Codes: I11 G23 G34 Keywords: Private Equity, Leveraged Buyouts, health care industry, financial engineering, surprise medical billing revenue cycle management, urgent care, ambulatory care. -

Healthcare Real Estate

VALUE FOCUS REAL ESTATE Sector Focus: Healthcare Real Estate Second Quarter 2017 Healthcare Facilities 1 Macro Indicators 3 Industry Performance and M&A Activity 6 Publicly Traded Companies Hospitality 9 Residential 11 Healthcare 12 Commercial Real Estate 16 About Mercer Capital 22 www.mercercapital.com Mercer Capital’s Value Focus: Real Estate Industry Second Quarter 2017 Healthcare Facilities As of the most recent data in 2015, healthcare spending in the United States was $3.2 trillion. Average annual growth in national healthcare expenditures from 2015 to 2025 is expected to be approximately 5.6%. As a share of gross domestic product, national healthcare expenditure is expected to increase from 17.8% in 2015 to 19.9% by 2025. Demand for medical office buildings (MOBs) is driven primarily by demographic characteristics, rather than economic trends. This has contributed to more stable performance for the medical office building segment during a period when office space in general has underperformed. Consolidation continued in the industry during 2016, spurred by efforts to cut costs and offset lower insurance reimbursement rates. This trend has encouraged demand for larger office space and weakened the market for smaller, individual healthcare facilities, although ambulatory centers associated with larger hospitals are an exception. Merger and acquisition activity is expected to pick up in 2017, following an 8.0% increase in transactions in the first quarter. Of 27 transactions during the first quarter, three included organizations with revenues of $1 billion or greater. Average rents in the medical office space were $24.00 per square foot in 2016, which represents an 8.0% increase over the prior year and 8.3% above the $22.16 low observed in early 2013. -

2018 Annual Report CELEBRATING 80 YEARS of LIFE out HERE About Tractor Supply

2018 Annual Report CELEBRATING 80 YEARS OF LIFE OUT HERE About Tractor Supply Tractor Supply is the largest rural Our Focus lifestyle retailer in the United States. At December 29, 2018, the Company operated Tractor Supply is focused on being the 1,940 stores in 49 states, including 1,765 most dependable supplier of relevant Tractor Supply stores and 175 Petsense pet products and services for the lifestyle specialty stores and e-commerce websites needs of recreational farmers and ranchers at TractorSupply.com and Petsense.com. and all others who live the rural lifestyle. Tractor Supply customers are home, Our Mission land, pet and livestock owners that live a conservative and self-reliant lifestyle. They and Values depend on us to have the products they need for Life Out Here. Our mission is to work hard, have fun and make money by providing legendary service Our ONETractor Strategy is designed to and great products at everyday low prices. provide a convenient shopping experience anytime, anywhere and any way our This mission is supported by a key set of customers choose. To learn more or values – ethics, respect, balance, winning shop online, visit TractorSupply.com attitude, communication, development, and Petsense.com. teamwork, change, initiative and accountability – that are the foundation of our culture and the guiding principles for how we conduct business. Message from Our CEO GREG SANDFORT CHIEF EXECUTIVE OFFICER To Our Stakeholders, depend on Tractor Supply for their everyday and quarterly cash dividends. 2018 basic needs in living the rural lifestyle. marked the eighth consecutive year we As we celebrated our 80th anniversary in Additionally, Tractor Supply’s Stewardship increased our quarterly cash dividend 2018, Tractor Supply has grown from a Program has been a natural extension of for shareholders. -

*** Sky Is the Limit Stocks with All Time Highs

Scan date: 27-03-2021-04_43 | Week number: 12 *** Sky is the limit Stocks with All Time Highs Weekly interval The Nasdaq Stock Market Foto by Bill Jelen _______________________________________________________________________________________________________________ *** COPYRIGHT © 2021 SKY IS THE LIMIT | *** Data analytics by https://PragmatycznaSowa.pl/ *** Disclaimer: This is not a financial advice | this report should be treated as a educational content | Please do backtest & research before trade Scan date: 27-03-2021-04_43 | Week number: 12 All tickers with ATH sorted by total traded: Close * Volume, in descending order: AMAT,UPST,ASML,TXN,SBUX,CSX,ADP,ORLY,WLTW,WAFU,TROW,GWPH,TSCO,ODFL,QRVO,PAYX,CDW,PRAH,NDAQ,FIVE,TRMB,JBHT,GNMK, EXPD,BOWX,VTIP,TXRH,PNFP,BLMN,VONV,CASY,CNXC,OMCL,LGIH,LOB,IUSV,RDVY,LSTR,PKW,ENSG,SAIA,UCTT,ROCH,FTCS,CCMP,UFPI,CO LM,ESGD,UHAL,ICHR AMAT.US,UPST.US,ASML.US,TXN.US,SBUX.US,CSX.US,ADP.US,ORLY.US,WLTW.US,WAFU.US,TROW.US,GWPH.US,TSCO.US,ODFL.US,QRVO.US, PAYX.US,CDW.US,PRAH.US,NDAQ.US,FIVE.US,TRMB.US,JBHT.US,GNMK.US,EXPD.US,BOWX.US,VTIP.US,TXRH.US,PNFP.US,BLMN.US,VONV.US, CASY.US,CNXC.US,OMCL.US,LGIH.US,LOB.US,IUSV.US,RDVY.US,LSTR.US,PKW.US,ENSG.US,SAIA.US,UCTT.US,ROCH.US,FTCS.US,CCMP.US,UFP I.US,COLM.US,ESGD.US,UHAL.US,ICHR.US All tickers with ATH sorted alphabetically ADP,AMAT,ASML,BLMN,BOWX,CASY,CCMP,CDW,CNXC,COLM,CSX,ENSG,ESGD,EXPD,FIVE,FTCS,GNMK,GWPH,ICHR,IUSV,JBHT,LGIH,LOB,LST R,NDAQ,ODFL,OMCL,ORLY,PAYX,PKW,PNFP,PRAH,QRVO,RDVY,ROCH,SAIA,SBUX,TRMB,TROW,TSCO,TXN,TXRH,UCTT,UFPI,UHAL,UPST,VON V,VTIP,WAFU,WLTW -

Nashville Healthcare Fraud Conference

Bass, Berry & Sims The Pinnacle at Symphony Place NASHVILLE 150 Third Avenue South, Suite 2800 Nashville, Tennessee 37201 HEALTHCARE FRAUD CONFERENCE THURSDAY DECEMBER 7, 2017 SCHEDULE 7:30 – 8:30 Registration and Breakfast 8:30 – 8:40 Welcome 8:40 – 9:20 Healthcare Fraud Year in Review: Where Do We Go From Here? Lindsey Fetzer, Associate, Bass, Berry & Sims PLC Brian Roark, Member, Bass, Berry & Sims PLC 9:25 – 9:55 Effectively Handling Employment Decisions Involving Whistleblowers (Ethics CLE) Justin Page, Deputy General Counsel, Ambulatory Services, Envision Healthcare Corporation Taylor Chenery, Member, Bass, Berry & Sims PLC 9:55 – 10:10 Break 10:10 – 10:45 What Every Healthcare Compliance Officer Wishes the Legal Department Knew LeToia Crozier, Chief Compliance Officer, Change Healthcare Amy Garner, Vice President and Chief Compliance Officer, West Tennessee Healthcare Steve Hinkle, Vice President and Chief Compliance Officer, Ardent Health Services Moderated by: Anna Grizzle, Member, Bass, Berry & Sims PLC 10:50 – 11:25 Mine Your Own Data: The Role of Data in Dealing with Healthcare Fraud Issues Greg Russo, Managing Director, Berkeley Research Group Jeff Gibson, Associate, Bass, Berry & Sims PLC 11:25 – 12:00 Revisiting Parallel Proceedings in Healthcare Fraud Cases Stuart Canale, Assistant U.S. Attorney, U.S. Attorney’s Office for the Western District of Tennessee Mary Jane Stewart, First Assistant U.S. Attorney, U.S. Attorney’s Office for the Middle District of Tennessee Lisa Rivera, Member, Bass, Berry & Sims PLC 12:00 – 12:30 Lunch Buffet 12:30 – 1:30 Keynote Presentation: A View from the U.S. Attorneys Hon. Donald Q. -

Board of Directors' Pay up from Last Year

Published By 200 Business Park Drive Armonk, NY 10504 Phone: 914.730.7300 Fax: 914.730.7303 www.total-comp.com 2017 / 2018 BOARD OF DIRECTORS COMPENSATION REPORT January 2018 All rights reserved. © 2018 Total Compensation Solutions, LLC. Printed in the United States of America. This publication of the 2017/2018 Board of Directors Compensation Report may not be reproduced, stored in a retrieval system, or transmitted in whole or in part, in any form or by any means (electronic, mechanical, photocopying, recording or otherwise) without the prior written permission of Total Compensation Solutions, LLC. 200 Business Park Drive, Armonk, NY 10504. The information provided in this report is confidential and for the use of the subscribing organization only. By accepting this material, you agree that it will not be reproduced, copied, transmitted or disclosed to organizations or persons outside of your organization. Table of Contents Section Page I. Executive Summary Introduction ------------------------------------------------------------------- 2 Company Demographics -------------------------------------------------- 5 Findings and Observations ----------------------------------------------- 8 II. Data Analysis Board Structure -------------------------------------------------------------- 13 Committee Structure ------------------------------------------------------- 16 Board Compensation ------------------------------------------------------ 19 III. Board Compensation All Companies -------------------------------------------------------------- -

FTSE Russell Factsheet | FTSE Goldman Sachs US High-Yield Corporate Bond Index | August 31, 2021

FTSE Russell Factsheet | FTSE Goldman Sachs US High-Yield Corporate Bond Index | August 31, 2021 INDEX CONSTITUENTS September 2021 Index Profile - Index data as of August 31, 2021 Coupon Maturity Index Weight Description (%) (YYYYMMDD) (%) 1011778 BC UNLTD LIABILITY CO 5.750 20250415 0.0250 1011778 BC UNLTD LIABILITY CO 3.875 20280115 0.2474 1011778 BC UNLTD LIABILITY CO 4.375 20280115 0.1197 1011778 BC UNLTD LIABILITY CO 3.500 20290215 0.0412 1011778 BC UNLTD LIABILITY CO 4.000 20301015 0.1614 99 ESCROW ISSUER INC 7.500 20260115 0.0154 AADVANTAGE LOYALTY IP LTD 5.500 20260420 0.1738 AADVANTAGE LOYALTY IP LTD 5.750 20290420 0.5089 ABERCROMBIE AND FITCH MGMT CO 8.750 20250715 0.0181 ACADEMY LTD 6.000 20271115 0.0675 ACADIA HEALTHCARE CO INC 5.500 20280701 0.0743 ACADIA HEALTHCARE CO INC 5.000 20290415 0.0278 ACCO BRANDS CORP 4.250 20290315 0.0323 ACI WORLDWIDE INC 5.750 20260815 0.0194 ACRISURE LLC 7.000 20251115 0.0445 ACRISURE LLC 10.125 20260801 0.0211 ACRISURE LLC 4.250 20290215 0.0383 ACRISURE LLC 6.000 20290801 0.0272 ACURIS FIN US INC 5.000 20280501 0.0549 ADIENT GLOBAL HLDGS LTD 4.875 20260815 0.0381 ADIENT US LLC 9.000 20250415 0.0314 ADT SECURITY CORP 4.125 20230615 0.0286 ADT SECURITY CORP 4.125 20290801 0.0552 ADT SECURITY CORP 4.875 20320715 0.0290 ADTALEM GLOBAL EDUCATION INC 5.500 20280301 0.1301 ADVANCED DRAINAGE SYSTEMS INC 5.000 20270930 0.0578 ADVISOR GROUP HLDGS INC 10.750 20270801 0.0713 AES ANDRES BV 5.700 20280504 0.0489 AES ARGENTINA GENERACION SA 7.750 20240202 0.0102 AETHON UNITED BR LP 8.250 20260215 0.0379 AFFINITY